Академический Документы

Профессиональный Документы

Культура Документы

Case Analysis Embraer

Загружено:

fossacecaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Case Analysis Embraer

Загружено:

fossacecaАвторское право:

Доступные форматы

Global Strategic Management December, 2006 Case Analysis Embraer: The Global Leader in Regional Jets

Introduction This case analysis examines the major issues and ideas from the HBS case Embraer: The Global Leader in Regional Jets1 and identifies the key attributes and characteristics of a successful international aircraft company from Brazil. Despite many challenges and the fact that Embraer is based in a developing country, Embraer has grown into one of the worlds most successful airplane manufacturers. This paper discusses the nature of the aircraft industry and competition, the key elements of Embraers strategy, how Embraer is adapting to address future market changes. Finally, the paper analyzes the paradox of Embraers rise and explores what that may imply about its home country.

Overview of the Commercial Aircraft Industry Porters Five Forces framework2 provides a convenient way to analyze the dynamics of the commercial aircraft industry. The figure below shows a high level view of the key forces, barriers to entry, supplier power, buyer power, rivalry and the threat of substitution. This brief analysis does not take into account the military jet, corporate jet and the emerging tiny jet markets that also impact the strategies of aircraft manufacturers.

Barriers to Entry are extremely high with large initial capital investments required along with extremely high fixed costs. Additionally, highly skilled workers are required and learning curves for workers and companies are long. Because the value chain is highly integrated, that is partners and suppliers work very closely with the incumbent manufacturers, a new entrant is at a distinct disadvantage. There is a high degree of customer loyalty, coupled with very high switching costs for customers. Supplier Power is variable. Suppliers with proprietary technology or extremely specialized expertise have high power. Suppliers of certain special materials and coatings also have high power. Some commodity suppliers of materials and services have relatively low power. Buyer Power is extremely high causing severe pricing pressure on aircraft manufacturers. The industry often experiences periods of over capacity which puts further downward pressure on prices. Customer preference and flying trends may help bolster the power of buyers in negotiating with manufacturers who have long development cycles and may have inventory which may not meet the current trends and needs of the buyers. On the other hand, switching costs for buyers are very high and have a fairly long time horizon .

Page 2 of 14

Threat of Substitutes are low with no cost effective alternatives available for commercial jets. Industry Rivalry is very high with two major duopolies dominating the industry: Airbus vs. Boeing in large jets and Embraer vs. Bombardier in regional jets. Long development lead times mean that every new model is critical to the success of the vendor and any misstep could spell disaster. Long development lead times mean rivals can plan counter-moves well in advance and catch an emerging trend while a competitor may already be committed to a certain direction.

SUPPLIER POWER

Specialized Suppliers Importance of supplier partnerships Impact of inputs on cost or differentiation Lack of substitute inputs Some Threat of forward integration Ample set of technology providers

BARRIERS TO ENTRY

Very High Costs of Entry Initial Capital Investment High Fixed Costs Long Learning curve Government support required Skilled Engineers/Technical Brand Loyalty Customer Switching Costs Access to technology partners (Integrated Value Chain) Incumbent Retaliation Proprietary Products

RIVALRY

THREAT OF

Strong rivalry between players SUBSTITUTES Duopolies in 2 segments No compelling or adequate (Boeing vs. Airbus Large Jets substitutes for commercial jets: Embraer vs. Bombardier Trains Regional Jets) Automobiles Cyclical Industry Ships Intermittent Overcapacity Helicopters High Switching Costs Brand identity Customer Switching Costs are very high Long Development Cycle Times (Rivals can plan countermoves)

BUYER POWER

Customers - Bargaining leverage Buyer Power is High Buyer has transparent information Brand identity Price sensitivity Require Product differentiation Buyer concentration vs. industry Buyers' incentives(option)

Diagram of Porter's Five Forces for the Commercial Aircraft Industry

Page 3 of 14

Core Elements of Embraers Strategy Embraers core strategy can be summarized by the following bullets:

Interdependence with Brazilian Government Focus on Regional Jet Market Family Approach to Product Development Cultivate relationships and risk share with technology partners and parts suppliers Focus on Intelligent Systems, Engineering Project Management Risk Partner and Supplier Strategy Intelligent Systems Interdependence with Brazilian Government Embraer was founded by the Brazilian government and the company is a source of national pride. In 1994, after privatization, the Brazilian government continued to

provide subsidies in the form of loans to Embraer to provide capital funds to start new initiatives. As quoted by Embraer CEO Botelho, We want to keep on being the

technological and industrial arm of the Brazilian government, although of course, we have to make profits.1 Embraer recognizes the role its home country plays and the fact the United States, home country to its largest customers, is not going to offer the type of the support that the Brazilian government will provide.

Focus on Regional Jet Market

In the commercial aircraft market, Embraer produces planes exclusively for the Regional Jet market. Embraer provides aircraft that are less expensive to produce and operate than its main competitor, Bombardier. Airbus and Boeing make larger aircraft and do not compete in the regional jet market. In the past few years, Embraer has expanded its strategy to also focus on the 70 to 110 seat market as portrayed on their website: www.ruleof70to110.com/main/index.html. Embraers campaign points out the

Page 4 of 14

inefficiencies of flying planes that are too large for regional flights or too small to handle increasing demand. Their claim is that the 70 to 110 seat plane fills a void for customers. Embraer not only provides less expensive planes, they have developed roomier planes with innovations such as the double-bubble design8 that allows more head room and larger cabin space for passengers. Another part of Embraers strategy is to use larger regional jet aircraft to replace the aging fleet of planes that may be too large to operate on the increasing number of short-haul routes. In a sense, Embraer is preparing to compete with Airbus and Boeing, but their approach is subtle: create/identify the market, fill a void and replace aging aircraft that are going to be retired.

Product Families Embraers method of managing its product lines is based around families of aircraft. Rather than developing a single model, Embraer designs it products based on platforms than can be scaled to larger or smaller capacities allowing for parts reuse and reduction of learning curves for its staff and the staff of its customers. This strategy keeps costs low and improves time to market. The platform or family approach to product management reduced time to market by two to three years, allowing Embraer aircraft to be introduced in less than half the industry standard time that new plane projects require6. The platform approach to product management works hand in hand with Embraers strategic partnership strategy. Embraers strategy can be broken into three parts6:

Choose Technology Areas aimed at product innovation and fulfilling the needs/requirements of customers

Page 5 of 14

Identification of risk partners for supply of parts and subsystems (technology packages) Cultivation of local subcontractors for engineering services, chemical coatings, milling and other specialized aircraft technologies

Strategic Partnerships For key technology areas, it is not important that Embraer manufacture every key technology, but rather the company leverages its core capabilities in systems integration, marketing and technical services coordinating the risk partnerships. The risk partners are enlisted to supply key components of the aircraft and are required to invest their own funds for development, thereby taking on some of the risk of the project. Partners are rewarded if the project is successful in supplying primary components and spares for the life of the new aircraft line. Most of the risk partners are located outside of Brazil, but co-locate engineers in So Jos dos Campos. Local subcontractors are used extensively for engineering services, milling, and coatings. Many of the local firms were founded by former Embraer employees, resulting in an aircraft industry cluster.

Intelligent Systems

Instead of attempting to build an entire aircraft and develop all technologies within Brazil, Embraer has chosen to focus on key aircraft technologies while building core expertise in aerodynamics, fuselage and systems integration.6 The decision to focus on the fuselage was driven partly because this technology could not be easily sourced outside of Brazil and thus it provided a good area for Embraer to develop its own expertise. This became part of Embraers determination not to outsource the aircraft

Page 6 of 14

cockpit nor anything that was not integral to its longer term strategy of concentrating on the provision of intelligent systems1. Embraers recognition of the fact that increasing its competency in systems integration is more important than the ability to create or manufacture all of the technologies in an aircraft, provided it with a realistic approach to competing globally.

Disruptive Innovation?

Another useful framework for analyzing the commercial aircraft industry and Embraers strategy is from the point of view of disruptive technology described by Clayton Christensen4. The commercial aircraft industry is dynamic and subject to the effects of Porters five forces as described earlier. Vendors in this industry need to be cognizant not only of economic factors that impact buyers (airlines) but also of passenger preference trends. A keen awareness of passenger trends allows vendors to understand market dynamics and sustain or improve their current position. Furthermore, an appreciation of the role disruptive innovation may lead manufacturers to discover new opportunities and grow future sales. As applied to the aircraft industry, Christensens model could be represented as in the graph below:

Page 7 of 14

From the analysis, Embraer could choose to compete with the Airbus 320 and Boeing 737 in some sectors. With superior operating margins, Embraer presents a compelling case for airlines to consider Embraer aircraft to assemble lighter and more fuel-efficient fleets. Based on the previous Porter analysis, the reaction of the incumbent vendors must be considered. Although one would expect them to defend their turf, the Airbus 320 and Boeing 737 are larger aircraft and more expensive to operate. One could argue that Embraer has already eaten into some of the market share that would have been been attained by Airbus or Boeing by filling the 70 to 110 seat void with lower cost aircraft. However, according to Embraer CEO Botelho, entering the 135 seat aircraft market is not in the cards for Embraer as this would mean jumping into the big dogs market, a

Page 8 of 14

reference to Airbus and Boeing8. Rather, he would prefer to diversify into the defense market and expand in the business jet market. Alliances and Partnerships A new strategic direction or logical outgrowth? From their founding, Embraer formed strategic relationships with technology partners. The first Embraer jet trainer licensed technology from the Italian firm

Aermacchi for a product to be used by the Brazilian Air Force. Other technology came from the Brazilian Aeronautical Technical Centers (CTA) Institute of Research and Development (IPD). Embraer learned to incorporate technology from different sources while strengthening core competencies in intelligent systems, systems integration and project engineering. The use of risk partners not only benefits Embraer from a

technological point of view, but also from a financial and capital structure point of view. Based on Embraers past with the turbulent Brazilian economy of the early 1990s to Botelhos restructuring in the middle 1990s, to the WTO dispute, Embraer has always faced difficulties with respect to funding projects. In addition to the regional jet market, Embraer participates in competition for defense business in Brazil and globally. While Botelho would like to expand Brazils share of the defense business, his success has been limited.

The 1999 announcement of a strategic alliance with a group of French aerospace companies was a logical outgrowth of Embraers overall strategy of risk partnerships. Embraer had already embarked on an effort to work with fewer key suppliers on the ERJ170/190 (only 26 vendors vs. 45 for the ERJ-145)6. The US defense market had proven difficult to break into. An alliance could provide extra capital funding, technological resources and credible partners to bolster business in this important sector not subject to

Page 9 of 14

WTO restrictions. Also, this move was consistent with Embraers core strategy to develop Intelligence Systems. Defense Systems1. In the defense context, this translates to Intelligent

The new alliance provides the capability for Embraer to transfer in technological know-how for supersonic aircraft, and allows expansion into defense systems for naval and ground support1. An alliance is also a good alternative to being acquired which would most likely be defeated by government veto. Overall, in terms of diversification in product lines, capital funding sources, and acquisition of new technological capabilities, the alliance is a good fit and is consistent with Embraers core strategy.

A Global Leader from an Emerging Economy According to Porter, Government cannot create competitive industries; only companies can do that.7 In the case of Embraer, the role of government is to act as "a catalyst and challenge. Embraer can credit part of its success to government-

sponsored institutional and technological developments dating back to the 1950s6. Embraer implemented much of the IPD technology to its advantage but created its own methods of technological innovation and internal learning to carry it forward. Embraer is responsible for increasing the size and capabilities of the So Jos dos Campos region and creating a local aircraft design cluster for Brazil.

Even with government help, the appearance of Embraer in a developing country such as Brazil appears to be an anomaly. However, in the context of Porters analysis of the Competitive Advantage of Nations, some of Brazils lack of endowments actually created

Page 10 of 14

the necessity out of which Embraer was born. For example, Brazil has large amounts of land through difficult terrain and wide rivers but limited surface transportation infrastructure. Aircraft are a natural way to overcome these challenges. In applying Porters Diamond Framework to Embraer, we can analyze the success of the company and attempt to understand the reasons for this success.

1. Firm Strategy, Structure and Rivalry

Embraer has no domestic rivals in the aircraft business. Embraer was founded by the government and later was privatized. There is an active aircraft industry in the local

Page 11 of 14

suppliers to Embraer in So Jos dos Campos which mirrors the technology cluster that the United States has in the area surrounding MIT.

2. Demand Conditions

Embraer has very demanding local and global customers. Locally, the Brazilian Defense Force and Brazilian Airlines do not automatically choose Embraer. They must compete and win on a level playing field. Brazils domestic buyers are just as discerning as global buyers.

3. Related Supporting Industries

In So Jos dos Campos, Embraer enjoys geographic proximity to upstream and downstream industries. This facilitates the exchange of information and promotes a continuous exchange of ideas and innovations. These local suppliers are also free to compete globally.

4. Factor Conditions

Brazil did not inherit any key factors to help them enter the aerospace business. After World War II, highly skilled and specialized labor was cultivated. Embraer never had easy access to capital or benefited from a strong Brazilian infrastructure. Over time, Embraer has developed core competencies and has helped So Jos dos Campos to grow, creating specialized factors and conditions helping to foster sustained innovation and investment from overseas. These factors are difficult to duplicate and have created competitive advantage.

Page 12 of 14

Implications for Brazil Embraers success demonstrates that with the proper mix of government support, strong corporate leadership and sound strategy, Brazilian companies can succeed globally. Embraer is a great source of national pride for Brazil and serves as a shining example of how a Brazilian company can compete on a global basis. However, the company faced adversity and was able to overcome it through strong leadership, partnerships with and incentives from the government, along with global risk partnerships structured to allow technology and capital to flow into Embraer. By adding value and leveraging technologies from other countries, Embraer was able to build its own core competencies and achieve global leadership in the regional jet market. Other businesses in Brazil are equal candidates for success, specifically satellite and fuel technologies. As Porter points out, the government may act as a catalyst, but only companies can create sustained competitive industries.

Managers that recognize the fact that their home nation is integral to their success will promote continuous innovation while welcoming the formation of clusters of like competitors to create national centers of excellence. These clusters will lead to what Porter calls the Diamond of National Advantage which is a self-reinforcing construct that is difficult for other nations to imitate. Ultimately, nations that wish to be

competitive effectively on a global basis need to realize that only companies can achieve and sustain competitive advantage and that the capacity of its industry to innovate and upgrade is essential. Armed with this knowledge, national policy makers can make decisions to foster an environment conducive to supporting industries that will be able to take advantage of the lessons described above.

Page 13 of 14

References

1. Embraer: The Global Leader in Regional Jets, Pankaj Ghemawat, Gustavo A. Herrero, Luis Felipe Monteiro, Harvard Business School, 9-701-006, October 20, 2000 2. How Competitive Forces Shape Strategy, Michael E. Porter, HBR Article, MarchApril 1979. 3. Designing and Implementing a New Supply Chain Paradigm for Airplane Development, Yun Yee Ruby Lam, MIT, June 2005, https://dspace.mit.edu/handle/1721.1/34854 4. Global Collaboration and Implementation World Aerospace Symposium-2005, Tim Bowler, www.aviationweek.com/conferences 5. The Innovators Dilemma, Clayton M. Christensen, Harper Business, 2000, New York 6. Transfer of Technology for Successful Integration into the Global Economy, A case study of Embraer in Brazil, Jos E. Cassiolato, Roberto Bernardes and Helena Lastres, UNCTAD, United Nations, New York and Geneva, 2002, http://www.unctad.org/en/docs/iteipcmisc20_en.pdf 7. The Competitive Advantage of Nations, Michael E. Porter, HBR 90211, 1990 8. The Little Aircraft Company that Could, Russ Mitchell, Fortune Magazine, November 14, 2005 9. Airbus vs. Boeing Revisted: international competition in the aircraft market, Douglas A. Irwin, Nina Pavcnik, Journal of International Economics, 28 August 2003, http://www.dartmouth.edu/~dirwin/airbus3.pdf

Page 14 of 14

Вам также может понравиться

- Airbus A3XX: Developing The World's Largest Commercial JetДокумент31 страницаAirbus A3XX: Developing The World's Largest Commercial JetRishi Bajaj100% (1)

- Financial Management CalculationsДокумент35 страницFinancial Management CalculationsfossacecaОценок пока нет

- IB Physics Data and FormulasДокумент5 страницIB Physics Data and FormulasfossacecaОценок пока нет

- AirbusДокумент23 страницыAirbusSharad Sharu100% (1)

- Study of Price, Product and Promotion of BoeingДокумент29 страницStudy of Price, Product and Promotion of BoeingNeha GoyelОценок пока нет

- Flyht Case SolutionДокумент2 страницыFlyht Case SolutionkarthikawarrierОценок пока нет

- Boeing 7e7Документ7 страницBoeing 7e7kaye100% (2)

- Case Study 1Документ5 страницCase Study 1PrincessОценок пока нет

- Flyaudio in An 08 Is250 With Factory Nav InstructionsДокумент2 страницыFlyaudio in An 08 Is250 With Factory Nav InstructionsAndrewTalfordScottSr.Оценок пока нет

- International Entry Strategies (Report)Документ5 страницInternational Entry Strategies (Report)Asrulnor_Hazno_7100100% (3)

- David Sm15 Case Im 22 EmbraerДокумент16 страницDavid Sm15 Case Im 22 Embraernoura0% (1)

- Six Thinking Hats TrainingДокумент34 страницыSix Thinking Hats TrainingNishanthan100% (1)

- Embraer: Global StrategyДокумент14 страницEmbraer: Global StrategyJesse Kedy100% (10)

- Executive SummaryДокумент3 страницыExecutive Summaryapi-532683276Оценок пока нет

- Taxing Situations Two Cases On Income Taxes - An Accounting Case StudyДокумент5 страницTaxing Situations Two Cases On Income Taxes - An Accounting Case Studyfossaceca80% (5)

- Manage Hospital Records with HMSДокумент16 страницManage Hospital Records with HMSDev SoniОценок пока нет

- Honda Atlas CarsДокумент100 страницHonda Atlas CarsShery AwanОценок пока нет

- EIA GuidelineДокумент224 страницыEIA GuidelineAjlaa RahimОценок пока нет

- Boeing Vs AirbusДокумент6 страницBoeing Vs AirbusAanchal VirmaniОценок пока нет

- Porter's FiveForces - VN Airline IndustryДокумент3 страницыPorter's FiveForces - VN Airline IndustryNgọc QuỳnhОценок пока нет

- Competition Strategies SamsungДокумент12 страницCompetition Strategies SamsungLuis NashОценок пока нет

- Environmental Analysis of Emirates Airline IndustryДокумент9 страницEnvironmental Analysis of Emirates Airline IndustryAbraham50% (2)

- Boeing Strategic FailuresДокумент2 страницыBoeing Strategic FailuresPat0% (1)

- Challenges and opportunities for high-temperature materials developmentДокумент7 страницChallenges and opportunities for high-temperature materials developmentraharjoitbОценок пока нет

- Airbus vs Boeing: Competing in Commercial AviationДокумент30 страницAirbus vs Boeing: Competing in Commercial AviationJamar JohnsonОценок пока нет

- AIRBUS & BOEING: A COMPARATIVE ANALYSIS OF THE COMMERCIAL AIRCRAFT INDUSTRY GIANTSДокумент35 страницAIRBUS & BOEING: A COMPARATIVE ANALYSIS OF THE COMMERCIAL AIRCRAFT INDUSTRY GIANTSdeepakОценок пока нет

- Case Study Analysis Commercial Airline Industry: Airbus & BoeingДокумент17 страницCase Study Analysis Commercial Airline Industry: Airbus & BoeingShone ThattilОценок пока нет

- Verizon Case Study Mgmt5984Документ11 страницVerizon Case Study Mgmt5984fossacecaОценок пока нет

- Embraer Strategic ManagementДокумент10 страницEmbraer Strategic Managementsampuran.das67% (3)

- AirTran Airways Case Study AnalysisДокумент18 страницAirTran Airways Case Study AnalysisSaima Ali50% (2)

- Iglesia Ni Cristo v. Court of AppealsДокумент2 страницыIglesia Ni Cristo v. Court of AppealsNoreen NombsОценок пока нет

- BCG MatrixДокумент2 страницыBCG MatrixDean Martin0% (1)

- Swot and Porter Analysis of Spice JetДокумент3 страницыSwot and Porter Analysis of Spice Jethemanth_kumar_800% (1)

- Case Analysis Embraer FinalДокумент17 страницCase Analysis Embraer Finalfossaceca67% (3)

- Xiaomi: From Wikipedia, The Free EncyclopediaДокумент18 страницXiaomi: From Wikipedia, The Free EncyclopediaCris EzechialОценок пока нет

- Hyundai Distribution ChannelДокумент2 страницыHyundai Distribution ChannelLakshay Arora100% (1)

- Toyota MotorsДокумент19 страницToyota MotorsPakassignmentОценок пока нет

- Embraer Vs BombardierДокумент1 страницаEmbraer Vs BombardierJose luis Martinez GarzaОценок пока нет

- Airbus 2020 Vision, Strategy, EtcДокумент4 страницыAirbus 2020 Vision, Strategy, Etczipzap123Оценок пока нет

- HP Swot & Space MatrixДокумент5 страницHP Swot & Space MatrixTeacherSOSОценок пока нет

- PrefaceДокумент16 страницPrefaceNavaneeth RameshОценок пока нет

- Huawei Technologies Philippines IncДокумент85 страницHuawei Technologies Philippines IncJanna IbrahimОценок пока нет

- Perception of Product Attribute Nike Reebok AddidasДокумент68 страницPerception of Product Attribute Nike Reebok Addidasrajan029100% (2)

- 5 Forces SamsungДокумент8 страниц5 Forces SamsungVy DangОценок пока нет

- LG Mission, Vision & Values LG Mission StatementДокумент9 страницLG Mission, Vision & Values LG Mission StatementQasim MughalОценок пока нет

- CC C CCCCCC CДокумент4 страницыCC C CCCCCC CZoe Yilin WangОценок пока нет

- Airbus PortersFF RuheeДокумент2 страницыAirbus PortersFF RuheeNabila TabassumОценок пока нет

- Marketing Report SampleДокумент16 страницMarketing Report SampleSasanka BalasuriyaОценок пока нет

- CourseworkДокумент5 страницCourseworkJijoo Jacob VargheseОценок пока нет

- BB309 - Sme - Asm - Assignment Case Study - Jan11Документ5 страницBB309 - Sme - Asm - Assignment Case Study - Jan11Tony LinОценок пока нет

- Cherry Airbus, MC Donnell Doughlas, United Contingental Holdings, Inc.Документ7 страницCherry Airbus, MC Donnell Doughlas, United Contingental Holdings, Inc.dinysulisОценок пока нет

- Embrear 2013Документ11 страницEmbrear 2013Jhun Albert AmbataliОценок пока нет

- Case01 JetBlue Airways TNДокумент16 страницCase01 JetBlue Airways TNSajid AnothersonОценок пока нет

- Airbus A3XX PowerpointДокумент31 страницаAirbus A3XX PowerpointRashidОценок пока нет

- Airbus A3XX Development Plan/TITLEДокумент31 страницаAirbus A3XX Development Plan/TITLEHarsh AgrawalОценок пока нет

- Product Ready InnovationДокумент11 страницProduct Ready Innovationsork93Оценок пока нет

- Research Paper On Airline IndustryДокумент6 страницResearch Paper On Airline Industryhyxjmyhkf100% (1)

- Minglana, Mitch T. BSA 201: Activity 5: Rolls-Royce Case (Porter'S Five Forces Analysis)Документ2 страницыMinglana, Mitch T. BSA 201: Activity 5: Rolls-Royce Case (Porter'S Five Forces Analysis)Mitch Tokong MinglanaОценок пока нет

- Jaipuria Institute of Management, Indore. BATCH 2020-2022 B2BДокумент8 страницJaipuria Institute of Management, Indore. BATCH 2020-2022 B2BVikas PatelОценок пока нет

- Industry AnalysisДокумент18 страницIndustry AnalysisTushar BallabhОценок пока нет

- Ch4. Airline Business and Marketing StrategiesДокумент29 страницCh4. Airline Business and Marketing StrategiesHammad RajpootОценок пока нет

- Case 5Документ8 страницCase 5Thuy Tien NguyenОценок пока нет

- Marketing Management Case: Boeing: Lincoln UniversityДокумент10 страницMarketing Management Case: Boeing: Lincoln Universitymihajlo88Оценок пока нет

- Airbus A3XX: Developing The World's Largest Commercial JetДокумент31 страницаAirbus A3XX: Developing The World's Largest Commercial JetAshish JainОценок пока нет

- AirTran Airways Case StudyДокумент16 страницAirTran Airways Case StudyslipperinoОценок пока нет

- Jetblue Airlines: Monica Agrippa MARCH 18, 2013 Jetblue Case Study AnalysisДокумент48 страницJetblue Airlines: Monica Agrippa MARCH 18, 2013 Jetblue Case Study AnalysisVishal Kumar SinghОценок пока нет

- Boeing vs. AirbusДокумент17 страницBoeing vs. AirbusInez Rosario Amante50% (2)

- Tutorial3 Case AircraftДокумент3 страницыTutorial3 Case AircraftQiu yii0% (1)

- Bombardier: The C-Series Dilemma: OpportunityДокумент8 страницBombardier: The C-Series Dilemma: OpportunityAtsushiОценок пока нет

- EMSE 6850 Syllabus - FossacecaДокумент6 страницEMSE 6850 Syllabus - FossacecafossacecaОценок пока нет

- Linear ProgrammingДокумент66 страницLinear ProgrammingsagarbolisettiОценок пока нет

- Master Syllabus Qant405: Management ScienceДокумент9 страницMaster Syllabus Qant405: Management SciencefossacecaОценок пока нет

- Week 3 - "What-If" Analysis For Linear Programming and Intro To Network Optimization ProblemsДокумент62 страницыWeek 3 - "What-If" Analysis For Linear Programming and Intro To Network Optimization ProblemsfossacecaОценок пока нет

- MGMT 101: Introduction To Management Science: Fall (October - December) 2012Документ4 страницыMGMT 101: Introduction To Management Science: Fall (October - December) 2012fossacecaОценок пока нет

- MGMT 101: Introduction To Management Science: Fall (October - December) 2012Документ4 страницыMGMT 101: Introduction To Management Science: Fall (October - December) 2012fossacecaОценок пока нет

- Week 2 - Linear Programming: Formulation and Applications & "What-If" AnalysisДокумент95 страницWeek 2 - Linear Programming: Formulation and Applications & "What-If" AnalysisfossacecaОценок пока нет

- Lecture 1 EMSE 6850 - Quantitative Models For Systems EngineersДокумент89 страницLecture 1 EMSE 6850 - Quantitative Models For Systems EngineersfossacecaОценок пока нет

- Ultra 3eTI CyberFence WhitePaperДокумент14 страницUltra 3eTI CyberFence WhitePaperfossacecaОценок пока нет

- Week 2 - Linear Programming: Formulation and Applications & "What-If" AnalysisДокумент95 страницWeek 2 - Linear Programming: Formulation and Applications & "What-If" AnalysisfossacecaОценок пока нет

- Priceline Case 1 AnalysisДокумент3 страницыPriceline Case 1 AnalysisfossacecaОценок пока нет

- Branding and Analysis of Romania v1Документ6 страницBranding and Analysis of Romania v1fossacecaОценок пока нет

- Final Paper - Double ClickДокумент14 страницFinal Paper - Double ClickfossacecaОценок пока нет

- Harley Davidson Case StudyДокумент8 страницHarley Davidson Case StudyfossacecaОценок пока нет

- Xerox CorporationДокумент10 страницXerox CorporationfossacecaОценок пока нет

- Ibguide 06Документ5 страницIbguide 06fossacecaОценок пока нет

- Interpretation 1Документ17 страницInterpretation 1ysunnyОценок пока нет

- Learn About Intensifiers and How to Use Them Effectively in WritingДокумент3 страницыLearn About Intensifiers and How to Use Them Effectively in WritingCheryl CheowОценок пока нет

- Creating Rapid Prototype Metal CastingsДокумент10 страницCreating Rapid Prototype Metal CastingsShri JalihalОценок пока нет

- Ed TechДокумент19 страницEd TechAlexie AlmohallasОценок пока нет

- Management principles and quantitative techniquesДокумент7 страницManagement principles and quantitative techniquesLakshmi Devi LakshmiОценок пока нет

- Tối Ưu Hóa Cho Khoa Học Dữ LiệuДокумент64 страницыTối Ưu Hóa Cho Khoa Học Dữ Liệuminhpc2911Оценок пока нет

- Customer Channel Migration in Omnichannel RetailingДокумент80 страницCustomer Channel Migration in Omnichannel RetailingAlberto Martín JiménezОценок пока нет

- POLS219 Lecture Notes 7Документ7 страницPOLS219 Lecture Notes 7Muhammad Zainal AbidinОценок пока нет

- Ap22 FRQ World History ModernДокумент13 страницAp22 FRQ World History ModernDylan DanovОценок пока нет

- Edgevpldt Legazpi - Ee As-Built 121922Документ10 страницEdgevpldt Legazpi - Ee As-Built 121922Debussy PanganibanОценок пока нет

- Company BackgroundДокумент17 страницCompany Backgroundzayna faizaОценок пока нет

- 47-Article Text-201-1-10-20180825Документ12 страниц47-Article Text-201-1-10-20180825kevin21790Оценок пока нет

- How To Block Facebook in Mikrotik Using L7 Protocols (Layer 7) - Lazy Geek - )Документ11 страницHow To Block Facebook in Mikrotik Using L7 Protocols (Layer 7) - Lazy Geek - )oscar_198810Оценок пока нет

- Lfa Sop 00067Документ6 страницLfa Sop 00067Ahmed IsmaillОценок пока нет

- Solar Winds OrionAPM DatasheetДокумент4 страницыSolar Winds OrionAPM DatasheetArun J D'SouzaОценок пока нет

- Keystone - Contractors - Book 16 05 12 FinalДокумент9 страницKeystone - Contractors - Book 16 05 12 Finalfb8120Оценок пока нет

- Affidavit To Use Surname of The Father - MarquezДокумент2 страницыAffidavit To Use Surname of The Father - MarquezReyjohn LodiasОценок пока нет

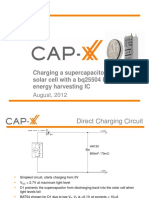

- 1208 CAP XX Charging A Supercapacitor From A Solar Cell PDFДокумент12 страниц1208 CAP XX Charging A Supercapacitor From A Solar Cell PDFmehralsmenschОценок пока нет

- Circuit Project Electronic: Simple Pulse Generator by IC 555 TimerДокумент1 страницаCircuit Project Electronic: Simple Pulse Generator by IC 555 TimerM Usman RiazОценок пока нет

- Daa M-4Документ28 страницDaa M-4Vairavel ChenniyappanОценок пока нет

- Fiber Optics Splicing Procedures: Your Source To Fiber Optics, Industrial Datacomm & Fieldbus Products-Solutions-ServicesДокумент7 страницFiber Optics Splicing Procedures: Your Source To Fiber Optics, Industrial Datacomm & Fieldbus Products-Solutions-ServicesHafis Aikal AmranОценок пока нет

- Pumping Station Modification PDFДокумент15 страницPumping Station Modification PDFcarlosnavalmaster100% (1)

- GA 7 Parts ManualДокумент565 страницGA 7 Parts ManualDave SchallОценок пока нет

- Marantz CD4000 PDFДокумент28 страницMarantz CD4000 PDFboroda2410Оценок пока нет

- Rheomix 141Документ5 страницRheomix 141Haresh BhavnaniОценок пока нет