Академический Документы

Профессиональный Документы

Культура Документы

Insurance - A Brief Overview: Chapter-1

Загружено:

Sreeja SahadevanИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Insurance - A Brief Overview: Chapter-1

Загружено:

Sreeja SahadevanАвторское право:

Доступные форматы

WEDDING INSURANCE

Chapter-1

Insurance - A Brief Overview

In law and economics insurance is a form of risk management. Insurance is used to compensate irreparable loss. In economic terminology, insurance is defined as an equitable transfer of the risk of loss. The transfer is done from one entity to other, in exchange for a specific amount, also known as premium. The entity which takes upon itself, the burden of compensating the loss is called as the insurer or in more precise terms the insurance company. The entity which is likely to suffer from a loss be compensated in case of a loss is called as the insured. The insurer is usually a company that sells insurance. The amount that is paid as a consideration to cover the likelihood of a loss is known as the premium. The premium differs according to the amount insured and the nature of insurance. In today's world, risk management has come up as a major activity or field with principles based on practice and research. It is an integral part of Insurance. It is a study which is involved with appraising and managing risk. It applies the rule of Law of Large Numbers. When applied to Risk Management, this rule implies that as the number of exposure units' increase, the actual results are more likely to match the probable, anticipated or forecasted results. INDIAN INSURANCE SECTOR

1

WEDDING INSURANCE

India insurance is a flourishing industry, with several national and international players competing and growing at rapid rates. Thanks to reforms and the easing of policy regulations, the Indian insurance sector been allowed to flourish, and as Indians become more familiar with different insurance products, this growth can only increase, with the period from 2010 - 2015 projected to be the 'Golden Age' for the Indian insurance industry. India Insurance Policies at a Glance Indian insurance companies offer a comprehensive range of insurance plans, a range that is growing as the economy matures and the wealth of the middle classes increases. The most common types include: term life policies, endowment policies, joint life policies, whole life policies, loan cover term assurance policies, unit-linked insurance plans, group insurance policies, pension plans, and annuities. General insurance plans are also available to cover motor insurance, home insurance, travel insurance and health insurance. Due to the growing demand for insurance, more and more insurance companies are now emerging in the Indian insurance sector. With the opening up of the economy, several international leaders in the insurance sector are trying to venture into the India insurance industry. India Insurance: History The history of the Indian insurance sector dates back to 1818, when the Oriental Life Insurance Company was formed in Kolkata. A new era began in the India insurance sector, with the passing of the Life Insurance Act of 1912.

2

WEDDING INSURANCE

The Indian Insurance Companies Act was passed in 1928. This act empowered the government of India to gather necessary information about the life insurance and non-life insurance organizations operating in the Indian financial markets. The Triton Insurance Company Ltd formed in 1850 and was the first of its kind in the general insurance sector in India. Established in 1907, Indian Mercantile Insurance Limited was the first company to handle all forms of India insurance. Indian Insurance: Sector Reform The formation of the Malhotra Committee in 1993 initiated reforms in the Indian insurance sector. The aim of the Malhotra Committee was to assess the functionality of the Indian insurance sector. This committee was also in charge of recommending the future path of insurance in India. The Malhotra Committee attempted to improve various aspects of the insurance sector, making them more appropriate and effective for the Indian market. The recommendations of the committee put stress on offering operational autonomy to the insurance service providers and also suggested forming an independent regulatory body. The Insurance Regulatory and Development Authority Act of 1999 brought about several crucial policy changes in the insurance sector of India. It led to the formation of the Insurance Regulatory and Development Authority (IRDA) in 2000.

WEDDING INSURANCE

The goals of the IRDA are to safeguard the interests of insurance policyholders, as well as to initiate different policy measures to help sustain growth in the Indian insurance sector. The Authority has notified 27 Regulations on various issues which include Registration of Insurers, Regulation on insurance agents, Solvency Margin, Re-insurance, Obligation of Insurers to Rural and Social sector, Investment and Accounting Procedure, Protection of policy holders' interest etc. Applications were invited by the Authority with effect from 15th August, 2000 for issue of the Certificate of Registration to both life and non-life insurers. The Authority has its Head Quarter at Hyderabad. Detailed information on IRDA is available at their Protection of the interest of policy holders: IRDA has the responsibility of protecting the interest of insurance policyholders. Towards achieving this objective, the Authority has taken the following steps: IRDA has notified Protection of Policyholders Interest Regulations 2001 to provide for: policy proposal documents in easily understandable language; claims procedure in both life and non-life; setting up of grievance redressal machinery; speedy settlement of claims; and policyholders' servicing. The Regulation also provides for payment of interest by insurers for the delay in settlement of claim. The insurers are required to maintain solvency margins so that they are in a position to meet their obligations towards policyholders with regard to payment of claims.

4

WEDDING INSURANCE

It is obligatory on the part of the insurance companies to disclose clearly the benefits, terms and conditions under the policy. The advertisements issued by the insurers should not mislead the insuring public. All insurers are required to set up proper grievance redress machinery in their head office and at their other offices. The Authority takes up with the insurers any complaint received from the policyholders in connection with services provided by them under the insurance contract. General insurance products and services are being offered as package policies offering a combination of the covers mentioned above in various permutations and combinations. There are package policies specially designed for householders, shopkeepers, industrialists, agriculturists, entrepreneurs, employees and for professionals such as doctors, engineers, chartered accountants etc. Apart from standard covers, General insurance companies also offer customized or tailor-made policies based on the personal requirements of the customer. A suitable general insurance cover is an absolute essential for every family. This is a necessity to overcome uncertainties and risks prevalent in life. It is also necessary to protect ones property against risks as a loss or damage to ones property can leave one in doldrums. It is important for prospective customers to read and understand the terms and conditions of a policy before they enter into an insurance contract. The proposal form needs to be filled in correctly and completely with all factual and relevant data by the customer. He must also ensure that the insurance cover is adequate and an appropriate one, as desired.

5

WEDDING INSURANCE

CHAPTER 2

Impact of Liberalization, Privatization And Globalization

6

WEDDING INSURANCE

POLICIES AFTER LIBERALISATION: Under the recommendation of Malhotra Committee the Insurance Regulatory and Development Authority was set up to monitor and control the Insurance industry some of the initiatives taken by the government after Insurance sector reforms are: Government to have not more than 50 per cent stake in insurance companies. Insurance sector to be opened up for private companies and any number of insurance enterprises can operate.

Private players with minimum paid up capital of Rs.1 billion should be given opportunity to do business.

Foreign companies can enter Indian market through joint ventures with Indian companies. IMPACT OF LIBERALISATION AND PRIVATISATION: The state controlled Insurance companies like LIC and GIC faced stiff competition from private insurance companies post reforms. The monopoly of the national Insurance companies came to an end. The private Insurance companies were able to exploit the shortcomings in the state run Insurance companies. The private insurance companies launched a variety of new insurance products like health care, pension plans, annuity plans, income protection, market linked products, which were welcomed by the end customers. The business for the private sector boomed in both urban and rural sector alike. IMPACT OF GLOBALISATION AND PRIVATISATION: While nationalized insurance companies have done a commendable job in extending the volume of the business, opening up insurance sector to private

7

WEDDING INSURANCE

players was a necessity in the context of globalization of financial sector. If traditional infrastructural and semipublic goods industries such as banking, airlines, telecom, power etc., have significant private sector presence, continuing a state of monopoly in provision of insurance was indefensible and therefore, the globalization of insurance has been done as discussed earlier. Its impact has to be seen in the form of creating various opportunities and challenges. The introduction of private players in the industry has added colours to the dull industry. The initiatives taken by the private players are very competitive and have given immense competition to the on time monopoly of the market LIC. Since the advent of the private players in the market the industry has seen new and innovative steps taken by the players in the sector. The new players have improved the service quality of the insurance. As a result LIC down the years have seen the declining in its career. The market share was distributed among the private players. Though LIC still holds 75% of the insurance sector the upcoming nature of these private players is enough to give more competition to LIC in the near future. LIC market share has decreased from 95 %( 2002-03) to 81% (2004-05). The following company holds the rest of the market share of the insurance industry. The life insurance of India added 4.1% to the GDP of the economy in 2009, an immense growth since 1999, when the gates were opened for the private company in the market. IMPACT OF GLOBALISATION: While nationalized insurance

companies have done a commendable job in extending the volume of the

8

WEDDING INSURANCE

business, opening up insurance sector to private players was a necessity in the context of globalization of financial sector. If traditional infrastructural and semipublic goods industries such as banking, airlines, telecom, power etc., have significant private sector presence, continuing a state of monopoly in provision of insurance was indefensible and therefore, the globalization of insurance has been done as discussed earlier. Its impact has to be seen in the form of creating various opportunities and challenges. The introduction of private players in the industry has added colours to the dull industry. The initiatives taken by the private players are very competitive and have given immense competition to the on time monopoly of the market LIC. Since the advent of the private players in the market the industry has seen new and innovative steps taken by the players in the sector. The new players have improved the service quality of the insurance. As a result LIC down the years have seen the declining in its career. The market share was distributed among the private players. Though LIC still holds 75% of the insurance sector the upcoming nature of these private players is enough to give more competition to LIC in the near future. LIC market share has decreased from 95% (2002-03) to 81% (2004-05). The following company holds the rest of the market share of the insurance industry.

IMPACT

OF

GLOBALISATION

ON

INDIAN

INSURANCE

COMPANIES

WEDDING INSURANCE

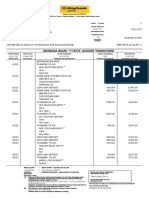

NAME OF THE PLAYER

MARKET SHARE (%)

LIC

82.3

ICICI PRUDENTIAL BIRLA SUN LIFE BAJA ALLIANZ SBI LIFE HDFC STANDARD TATA AIG

5.63

2.56 2.03 1.80 1.36 1.29

MAX YORK AVIVA

NEW

0.90

0.79

KOTAK MAHINDRA ING VYASA

0.51

0.37

10

WEDDING INSURANCE

AMP SANMAR

0.26

METLIFE

0.21

PRESENT SCENARIO OF GLOBALISATION In a tough battle to expand market shares the private sector life insurance industry consisting of 14 life insurance companies at 26% have lost 3% of market share to the state owned Life Insurance Corporation (LIC) in the domestic life insurance industry in 2006-07. According to the figures released by Insurance Regulatory & Development Authority, the total premium of these 14 companies have shot up by 90% to Rs 19,471.83 crore in 2006-07 from Rs 10, 252 crore. LIC with a total premium mobilization of Rs 55,934 crore has been able to retain a market share of 74.26 % during the reporting period. In total the life insurance industry in first year premium has grown by 110% to Rs 75, 406 crore during 2006-07. The 2006-07 performance has thrown a few surprises in the ranking among the private sector life insurance companies. New entrants like Reliance Life and SBI Life had shown a huge growth of over 381% and 210% respectively during the year. Reliance Life which has become one of the top five companies ended the year with a premium of Rs 930 crore during the year. ICICI Prudential Life Insurance remained as the No1 private sector life insurance company during the year. Bajaj Allianz overtook ICICI Prudential

11

WEDDING INSURANCE

in terms of monthly market share in March, for the first time ever. Bajaj's market share among private players in non-single premium for March stood at 29.1% vs. ICICI Prudential's 23.8%. Bajaj gained 4.6 percentage point market share among private sector players for FY07. Among other private players, SBI Life and Reliance Life continued to do well, each gaining 4% market share in FY07. SBI Life's growth was driven by increasing contribution from ULIP premiums. Another notable development of the 2006-07 performance has been the expansion of retail markets by the life insurance companies. Bajaj Allianz Life insurance has added 20 lakh policies while ICICI Prudential has expanded over 19 lakh policies during the year. With the largest number of life insurance policies in force in the world, Insurance happens to be a mega opportunity in India. It's a business growing at the rate of 15-20 per cent annually and presently is of the order of Rs 450 billion. Together with banking services, it adds about 7 per cent to the country's GDP. Gross premium collection is nearly 2 per cent of GDP and funds available with LIC for investments are 8 per cent of GDP. Yet, nearly 80 per cent of Indian population is without life insurance cover while health insurance and non-life insurance continues to be below international standards. And this part of the population is also subject to weak social security and pension systems with hardly any old age income security. This it is an indicator that growth potential for the insurance sector is immense. A well-developed and evolved insurance sector is needed for economic development as it provides long term funds for infrastructure development

12

WEDDING INSURANCE

and at the same time strengthens the risk taking ability. It is estimated that over the next ten years India would require investments of the order of one trillion US dollar. The Insurance sector, to some extent, can enable investments in infrastructure development to sustain economic growth of the country. Insurance is a federal subject in India. There are two legislations that govern the sector- The Insurance Act- 1938 and the IRDA Act- 1999. The insurance sector in India has become a full circle from being an open competitive market to nationalization and back to a liberalized market again. Tracing the developments in the Indian insurance sector reveals the 360 degree turn witnessed over a period of almost two centuries. Important milestones in the life insurance business in India 1912: The Indian Life Assurance Companies Act enacted as the first statute to regulate the life insurance business. 1928: The Indian Insurance Companies Act enacted to enable the government to collect statistical information about both life and non-life insurance businesses. 1938: Earlier legislation consolidated and amended to by the Insurance Act with the objective of protecting the interests of the insuring public. 1956: 245 Indian and foreign insurers and provident societies taken over by the central government and was nationalized. LIC formed by an Act of Parliament- LIC Act 1956- with a capital contribution of Rs. 5 crore from the Government of India.

13

WEDDING INSURANCE

In a tough battle to expand market shares the private sector life insurance industry consisting 14 life insurance companies at 26% have lost 3% of market share to the state owned Life Insurance Corporation (LIC) in the domestic life insurance industry in 2006-07. According to the figures released by Insurance Regulatory & Development Authority the total premium these 14 companies have shot up by 90% to Rs 19,471.83 crore in 2006-07 from Rs 10, 252 crore. LIC with a total premium mobilization of Rs 55,934 crore has been able retain a market share of 74.26 % during the reporting period. In total the life insurance industry in first year premium has grown by 110% to Rs 75, 406 crore during 2006-07. The 2006-07 performance has thrown a few surprises in the ranking among the private sector life insurance companies. New entrants like Reliance Life and SBI Life had shown a huge growth of over 381% and 210% respectively during the year. Reliance Life which has become one of the top five companies ended the year with a premium of Rs 930 crore during the year. Though ICICI Prudential Life Insurance remained as the No 1 private sector life insurance Company during the year Bajaj Allianz overtook ICICI Prudential in terms of monthly market share in March, for the first time ever. Bajaj's market share among private players in non-single premium for March stood at 29.1% vs. ICICI Prudential's 23.8%. Bajaj gained 4.6 percentage point market share among private sector players for FY07. Among other private players, SBI Life and Reliance Life continued to do well, each gaining 4% market share in FY07. SBI Life's growth was driven by increasing the contribution from ULIP premiums. Another notable

14

WEDDING INSURANCE

development of the 2006-07 performance has been the expansion of retail markets by the life insurance companies. Bajaj Allianz Life insurance has added 20 lakh policies while ICICI Prudential has expanded over 19 lakh policies during the year. OPPORTUNITES FOR INSURANCE SECTOR A state monopoly has little incentive to innovative or offers a wide

range of products. It can be seen by a lack of certain products from LIC's portfolio and lack of extensive risk categorization in several GIC products such as health insurance. More competition in this business will spur firms to offer several new products and more complex and extensive risk categorization. It would also result in better customer services and help improve the

variety and price of insurance products. The entry of new players would speed up the spread of both life and

general insurance. Spread of insurance will be measured in terms of insurance penetration and measure of density.

With the entry of private players, it is expected that insurance business

roughly 400 billion rupees per year now, more than 20 per cent per year even leaving aside the relatively under developed sectors of health insurance, pen More importantly, it will also ensure a great mobilization of funds that can be utilized for purpose of infrastructure development that was a factor considered for globalization of insurance.

15

WEDDING INSURANCE

More importantly, it will also ensure a great mobilization of funds that

can be utilized for purpose of infrastructure development that was a factor considered for globalization of insurance. With allowing of holding of equity shares by foreign company either

itself or through its subsidiary company or nominee not exceeding 26% of paid up capital of Indian partners will be operated resulting into supplementing domestic savings and increasing economic progress of nation. Agreements of various ventures have already been made to be discussed later on in this paper. It has been estimated that insurance sector growth more than 3 times

the growth of economy in India. So business or domestic firms will attempt to invest in insurance sector. Moreover, growth of insurance business in India is 13 times the growth insurance in developed countries. So it is natural, that foreign companies would be fostering a very strong desire to invest something in Indian insurance business. Most important not the least tremendous employment opportunities

will be created in the field of insurance which is burning problem of the present day today issues. CHALLENGES BEFORE THE INDUSTRY New age companies have started their business as discussed earlier. Some of these companies have been able to float 3 or 4 products only and some have targeted to achieve the level of 8 or 10 products. At present, these companies are not in a position to pose any challenge to LIC and all other four companies operating in general insurance sector, but if we see the quality

16

WEDDING INSURANCE

and standards of the products which they issued, they can certainly be a challenge in future. Because the challenge in the entire environment caused by globalization and liberalization the industry is facing the following challenges:

The existing insurer, LIC and GIC, have created a large group of dis satisfied customers due to the poor quality of service. Hence there will be shift of large number of customers from LIC and GIC to the private insurers.

LIC may face problem of surrender of a large number of policies, as new insurers will woo them by offer of innovative products at lower prices. The corporate clients under group schemes and salary savings schemes may shift their loyalty from LIC to the private insurers. There is a likelihood of exit of young dynamic managers from LIC to the private insurer, as they will get higher package of remuneration. LIC has overstaffing and with the introduction of full computerization, a large number of the employees will be surplus. However they cannot be retrenched. Hence the operating costs of LIC will not be reduced. This will be a disadvantage in the competitive market, as the new insurers will operate with lean office and high technology to reduce the operating costs. GIC and its four subsidiary companies are going to face more challenges, because their management expenses are very high due to surplus staff. They can't reduce their number due to service rules.

17

WEDDING INSURANCE

Management of claims will put strain on the financial resources, GIC and its subsidiaries since it is not up the mark. LIC has more than to 60 products and GLC has more than 180 products in their kitty, which are outdated in the present context as they are not suitable to the changing needs of the customers. Not only that they are not competent enough to complete with the new products offered by foreign companies in the market. Reaching the consumer expectations on par with foreign companies such as better yield and much improved quality of service particularly in the area of settlement of claims, issue of new policies, transfer of the policies and revival of policies in the liberalized market is very difficult to LIC and GIC. Intense competition from new insurers in winning the consumers by multi-distribution channels, which will include agents, brokers, corporate intermediaries, bank branches, affinity groups and direct marketing through telesales and interest. The market very soon will be flooded by a large number of products by fairly large number of insurers operating in the Indian market. Even with limited range of products offered by LIC and GIC, the consumers are confused in the market. Their confusion will further increase in the face for large number of products in the market. The existing level of awareness of the consumers for insurance products is very low. It is so because only 62% of the Indian population is literate and less than 10% educated. Even the educated consumers are ignorant about the various products of the insurance.

18

WEDDING INSURANCE

The insurers will have to face an acute problem of the redressal of the consumers, grievances for deficiency in products and services. Increasing awareness will bring number of legal cases filled by the consumers against insurers is likely to increase substantially in future. Major challenges in canalizing the growth of insurance sector are product innovation, distribution network, investment management, customer service and education.

ESSENTIALS TO MEET THE CHALLENGES Indian insurance industry needs the following to meet the global

challenges Understanding the customer better will enable insurance companies to

design appropriate products, determine price correctly and increase profitability.

Selection of right type of distribution channel mix along with prudent

and efficient FOS [Fleet on Street] management. An efficient CRM system, which would eventually create sustainable

competitive advantages and build a long-lasting relationship Insurers must follow best investment practices and must have a strong

asset management company to maximize returns. Insurers should increase the customer base in semi urban and rural

areas, which offer a huge potential.

19

WEDDING INSURANCE

Promoting health insurance and using e-broking to increase the

business.

CHAPTER 3

Introduction to wedding insurance

The wedding day is considered by many people to be the happiest and most momentous day in ones life. It can be easy to get carried away planning this day, and ensuring that everything from the dress to the table decorations is

20

WEDDING INSURANCE

prepared. However, along with those commitments vowed in the ceremony, a wedding can require a huge financial commitment. As wedding become more and more expensive, so the wedding insurance becomes more popular. It makes sense to ensure that you are covered, both to protect the financial investment, and to offer compensation should something go wrong on this special day. The average wedding insurance policy covers for cancellation expenses, damage to wedding attire and public liability, but can find insurance which covers far more. One can consider wedding insurance an unnecessary expense, but it makes sense to protect your big day. If something goes wrong, wedding insurance offers peace of mind and provides some financial compensation for the entire family. Whenever a person wish to purchase an insurance policy, it is important to compare a range of different insurance providers. Comparing policies enables to assess the type and extent of cover a persons need, and gives you the chance to compare policy prices. When assessing different policies, consider the areas of cover which are most important such as: Transport cover Wedding dress cover Wedding attire cover Wedding ring cover Wedding flower cover Marquee cover

21

WEDDING INSURANCE

Catering cover Cake cover Wedding photograph cover Wedding gift cover Foreign travel cover

Consider also how much a person willing to pay for the insurance the best insurance policies are those which offer comprehensive protection at an affordable price. Remember that the cheapest policies may not provide with much financial cover, whilst a very expensive policy might be charging for unnecessary cover. The internet is a good place to begin your search for wedding insurance; the majority of insurance providers have their own website, whilst online wedding forums are a good place to pick up tips from other people getting married. Simply by entering the keywords ('wedding' 'insurance' 'UK') into a search engine one will find a range of insurance providers, and other websites offering advice. Insurance providers usually publish their policy details on their website it is easy to check the terms and conditions before you buy and ensure that the policy offers the cover ones need. Some sites also offer a free estimate service, tailored to the specific details of ones wedding. If you go on to purchase a wedding insurance online, one may be entitled to a discount on the price of the policy.

22

WEDDING INSURANCE

If a person is employing a wedding planner, they should be able to advice on finding a suitable insurance provider and may be able to negotiate a discount on the price of the policy. One can also ask any friends and family if they can recommend an insurance provider, or know someone getting married who has found an inexpensive policy. If one has other insurance, such as home insurance, with a particular provider, ask if they also offer wedding insurance. One may even be entitled to a discount for taking out more than one policy with them. Wedding insurance helps make things right when something goes wrong. A person always dreamed of planning the perfect wedding, but no matter how carefully you plan it, there are many things that can go wrong things that are beyond your control. What if ones reception venue goes out of business a month before the wedding, and one lost their deposit and have to find another location? Or a hurricane causes your wedding to be postponed? What if your bridal shop closes, leaving you without a gown? Then wedding insurance is a good option. A wedding is an investment, and as the average cost of weddings rises, now up to $27,000, wedding insurance is needed more than ever. After all, one wouldnt buy a new car that costs that much without insuring it against damage. For as little as $160, your wedding insurance policy can cover a variety of situations, such as: No Dress. One can get repair or replacement cost if the brides wedding gown or grooms tuxedo is lost or damaged.

23

WEDDING INSURANCE

up.

Lost Deposits. One can reimburse your deposit if a vendor goes out of

business, declares bankruptcy before their wedding, or simply fails to show

Lost Rings. One can receive repair or replacement cost if the bride or

grooms wedding bands are lost or damaged.

Severe Weather. If severe weather (such as a hurricane) forces one to

postpone your wedding, wedding insurance provide reimbursement for nonrecoverable expenses. Transportation Shutdown. If one has to postpone the wedding because a commercial transportation shutdown prevents the bride, groom or their parents from getting there, they can receive reimbursement for nonrecoverable expenses.

24

WEDDING INSURANCE

Ruined Photos. If ones photographers film is defective, or negatives are lost or damaged, wedding insurance help cover the cost to re-take new photos. Call to Duty. If the bride or groom is unexpectedly called up to active duty, or has her or his military service leave revoked, forcing them to postpone the event, wedding insurance provide reimbursement for nonrecoverable expenses. Damaged Gifts. One can get repair or replacement cost if their wedding gifts are damaged. Sudden Illness. If the wedding needs to be postponed because sudden

illness prevents the bride, groom or their parents from attending, they can receive reimbursement for non-recoverable expenses. Venue Requires Insurance. As an additional option to ones policy, one can add liability coverage to protect themselves in case a guest is injured or causes damage to property. Liquor Liability. As an individual liability option to policy, one can add this coverage to protect them against liability arising from alcohol-related occurrences (subject to policy conditions and exclusions). Additional Expense. If a vendor suddenly becomes unavailable for ones event but one can find a last-minute replacement, wedding insurance can reimburse this for the difference in cost. COST OF WEDDING INSURANCE

25

WEDDING INSURANCE

As with any other type of insurance, the cost of wedding insurance varies. The price of ones policy will depend on factors such as the type of wedding one choose and the extent of cover they need. Each insurance provider will usually have a range of cover packages on offer. Basic cover can be purchased for around 25, which would pay out around 6,000 if your wedding is cancelled. For a high level of cover, which would pay out around 50,000 for a cancelled wedding, policy prices range between 250 and 350? In between, a range of cover levels are available to suit ones wedding plans and budget. Essentially, the more one pay the greater the cover that one has, should anything go wrong. The cover level one chooses will indicate the maximum possible payout, not the amount that they are entitled to receive. If one have a policy which offers 50,000 of cancellation cover, and their wedding is cancelled, their insurance provider will assess ones claim and compensate them accordingly: if the cancellation resulted in costs of 18,000 this will be the amount one receive. It is worth paying more for a policy if one is planning an expensive wedding, but will not always need the highest level of cover. Remember that the cheapest policies may not provide with enough financial cover, whilst expensive policies might charge for unnecessary cover.

26

WEDDING INSURANCE

Let wedding budget to calculate the level of cover one requires. For example, if ones estimated wedding costs are: Wedding dress - 2,000 Wedding attire - 1,500 Wedding rings - 1,750 Flowers - 800 Wedding cake - 350 Transport - 1,000 Caterer - 1,750 Photographer - 1,000 Total = 10,150 A person may wish to consider a policy which offers cancellation insurance of up to ten or fifteen thousand pounds. Currently, a policy offering 15,000 of cover costs around 60. Make sure that one compare policies, and prices, to find the best deal: a wedding insurance policy offering roughly 10,000 of cancellation cover currently costs 55 from one provider, but 99 from another: a difference of 44. It is advisable to purchase wedding insurance when one has an exact date for the wedding in mind. Many policies are designed to cover for one year, and some insurance providers will increase the cost of policy if you require the insurance for longer than twelve months. WEDDING INSURANCE COVER

27

WEDDING INSURANCE

Different wedding insurance policies will cover different aspects of ones wedding, and typically offer different levels of cover. The policy that is right is usually the one which offers the correct amount of cover for the most important aspects of your wedding. What these most important aspects are will vary from couple to couple. The majority of wedding insurance policies will cover: Cancellation of the wedding Refund of deposits made to suppliers no longer able to provide the service they promised Damage / loss of wedding clothes Damage / loss of wedding flowers Damage / loss of wedding invitations Problems with wedding photography / photographs / photographer Damage / loss of wedding gifts Damage / loss of wedding rings Damage / loss of wedding cake Problems with wedding video / video team Problems with wedding transport Damage / loss of luggage Damage / loss of wedding documentation

28

WEDDING INSURANCE

Transport delays Personal accident resulting in death or disability Legal expenses, should a claim arise relating to the wedding or reception Public liability, should someone, or their possessions, be injured as a result of your wedding or reception A policy will detail the level of cover given for each of these aspects. A policy offering 12,000 worth of wedding cancellation cover might offer 6,000 of wedding clothes cover, 4,500 of cake cover and 10,000 personal accident cover. The amount of cover a policy provides will vary; typically, the more expensive the policy, the higher the individual levels of cover will be. However, some insurers charge more than others for the same level of cover: it is important to do a research. Some policies include cover for other aspects of the wedding, such as professional counseling in the event that someone dies, or the wedding is called off by one party. If one needs specific items to be covered by the wedding insurance policy, they will usually be able to arrange the cover by paying an extra premium. For example, if one is planning to have your wedding reception in a marquee, they can insure the marquee itself for an extra sum: currently, 20,000 of cover will cost around 30. Wedding insurance will not cover every aspect of your big day: consider Wedding Cover Exclusions and Weddings Abroad before you buy. MAKING A CLAIM

29

WEDDING INSURANCE

If one has purchased wedding insurance and later need to make a claim, they will need to contact their insurance provider. When insurance provider sends your policy documents they will usually include details of the claims procedure. One may need to telephone the company when one realize and will have to make a claim, to inform them of ones intention and check which documents one will need to provide. There may even be a hotline which one can contact if there is urgent need of advice or assistance. They may ask one to complete a claims form and return it with the relevant documents. Remember that one may need to register your claim within a certain number of days of the incident occurring. Failing to make a claim for several months may affect the claims procedure, or even ones entitlement to compensation. When one register their claim, they will need to describe what happened and provide a rough estimate of the costs involved. If there is an urgent need for repair or replacement of an item, for example, if their wedding dress has been stained the day before the wedding, they will usually have to pay to fix the problem with their own money, and claim back the amount they spend at a later date. If they spend any money on repairs or replacements which are covered by their insurance, make sure that keep any receipts: without these one may not entitled to a refund. Once a person has given the insurance company details of the claim, they will have to wait for them to assess the situation and make a decision. This process can take some time, but one should contact their insurance provider if they have still heard nothing one month after making the claim. BENEFITS OF WEDDING INSURANCE

30

WEDDING INSURANCE

Wedding insurance is not obligatory, but it can offer peace of mind for a relatively small investment. When deciding whether or not to purchase cover for ones wedding day, remember that even if one do not purchase insurance will need a contingency plan to cover unexpected costs. It is not uncommon for accidents to occur, or for unforeseen incidents to disrupt plans. Consider the following pros and cons of wedding insurance: Pros Peace of mind - if something should go wrong on the day, one is insured. Cost - weddings are notoriously expensive, but a basic wedding insurance policy is typically inexpensive. Cons Cover - no policy will cover one for all eventualities, and one may not be able to claim for every incident. Cost - a wedding is an expensive commitment, and may consider insurance to be an unnecessary extra cost. Example Scenarios The main benefit of wedding insurance is that one is protected in the event that something goes wrong. The following scenarios highlight typical advantages of purchasing wedding insurance: Flooding leads to public transport strikes and closed roads. Guests are unable to attend: wedding cancellation insurance pays the costs involved in rearranging ones day.

31

WEDDING INSURANCE

Cake maker goes out of business. Wedding cake cannot be made. Cake insurance refunds ones deposits. Guests damage carpet and chairs at reception. Hotel demands compensation. Liability insurance covers the cost of damages. Bride tears hem of dress when trying it on. He must be repaired: dress insurance covers cost of repairs. Bride and bridesmaids struck down with severe food poisoning after hen night. Wedding cancellation insurance pays the costs involved in rearranging this day. If one decides wedding insurance is unnecessary, make sure that one puts money aside in a contingency fund, to cover costs if the unexpected does happen. Some more advantages of wedding insurance 1) Formal wear-you repair or replace, if the bride or groom tuxedo wedding dress is lost or damaged. 2.) Lost deposits-reimbursement of the deposit if a vendor goes out of business declared bankruptcy before the wedding, or simply not show up. 3.) Get Lost Rings one can repair or replacement cost is the bride or groom Engagement rings are lost or damaged. 4.) Severe Weather-If a natural disaster forces one to postpone your wedding; they cannot provide reimbursement for eligible costs.

32

WEDDING INSURANCE

5). Transportation Shutdown- If ones wedding because of the commercial transportation shutdown and the bride, groom or both parents will move set, then get out there to reimburse non-refundable expenses. 6) Ruined Pictures-If photographer movie is defective, or negatives are lost or damaged, the cost to re-take the photos is covered. 7.) Call to Duty-If the bride or groom, it is mandatory, or unexpectedly called his / her military leave revoked, forcing Event shift their expenses are not reimbursable covered. With under your insurance, you may be covered, rest easy. The weeks before ones wedding can be very emotional and stressful. Purchasing an insurance policy is to calm ones mind and help to relax and sleep peacefully at their wedding weeks before hand. CANCELLING YOUR WEDDING INSURANCE POLICY If one wishes to cancel your wedding insurance, one may find it a difficult process. By agreeing to purchase the insurance one has agreed to a legally binding contract, valid until the end of the insurance term. Some companies will allow canceling but will typically need to give them a certain amount of notice, and may need to pay a fee to cover the administration costs of the cancellation. However, if one decides within fourteen days of purchasing a policy that they wish to cancel the insurance, they are entitled to do so. It is their statutory right to cancel their policy within two weeks of its purchase, its renewal, or the receipt of policy documents in the post. One should be

33

WEDDING INSURANCE

entitled to a refund of any policy payments they have already made if one cancels it within this period. Make sure that one contacts their wedding insurer as soon as possible when they have decided to cancel the policy. Many providers will have a hotline that one can call: take the time to call and tell the company that will be returning one policy documents. If one do not call, and the cancellation deadline expires before documents arrive, they may refuse to cancel the insurance and/or refund the payment. If one believes that policy was mis-sold, or that the insurer has acted unfairly, one may wish to complain. What isn't covered? Be sure to read the exclusions in the policy carefully; one may think that they are insured for something that they're actually not when one reads the small print. Most policies won't reimburse the wedding costs if the bride and groom decide not to get married for personal reasons. They also won't usually pay to rearrange a wedding that has been cancelled due to a preexisting medical condition. When should a person take a wedding insurance? Ideally ones wedding insurance should be the first item on things to do list when one is planning their wedding. If possible one should take out a policy before one spends anything on the wedding, and certainly before one pay any large deposits. Sit down with the finance and work out for the wedding budget before one start checking out insurance policies so that to have an idea of the level of cover one will need.

34

WEDDING INSURANCE

Some insurance companies won't allow taking out a policy more than one year before the wedding, but shopping around if one wants to take out insurance sooner as many providers will offer this. Top Three Wedding Insurance Providers With so much choice when it comes to buying a wedding insurance policy, it can often be hard to know where to start. Heres a guide to three of the best providers on the market for wedding insurance to give you a head start. Quality matters. If one is looking for the cheapest wedding insurance, its not something one would recommend at Dolce Sposa. One can find that cheap wedding insurance is cheap for a reason, i.e. when it comes to making a claim one may have difficulty making a successful claim which makes it rather pointless in paying for wedding insurance. They recommend that one do it right and go for a reputable wedding insurance provider. And make sure one read the fine print to understand the circumstances under which an insurer will pay out. 1. E and L Insurance E&L has a selection of cover levels, all of which provide comprehensive cover for every eventuality. It covers weddings both in the UK and overseas and also offers the same cover for civil partnerships. Premiums There are eight separate bands of cover at E&L, meaning one have a lot of choice when it comes to choosing your level. The basic premium for Band 1 without any extras is 19.50, going up to 56.25 for Band 4 and 172.50 for

35

WEDDING INSURANCE

Band 8. The premiums are the same for both overseas weddings and civil partnerships.

Example Cover Because there are so many cover bands, the level of cover differs greatly. As an example, Cancellation & Expenses cover for Band 1 goes up to 6,000, and for Band 8 it goes up to 50,000, meaning the vast majority of weddings will be covered. Pros E&L does not charge excess on anything apart from Public Liability and Marquees, where it is 99. It can be purchased up to two years before the wedding, and the wide choice of cover levels makes it suitable for most weddings. Cons Premiums for all types of weddings are the same, including civil partnerships and weddings abroad, whereas they could be different to provide better value.

2. Ecclesiastical Wedding Insurance Ecclesiastical is one of the best wedding insurance providers in the UK, offering a wide choice of cover levels and the unique feature that allows one to pick and choose your own cover for each event.

36

WEDDING INSURANCE

Premiums There are five tiers of cover available, and the basic premiums are: 30, 56, 82, 152 and 282. Extra marquee cover is available on all tiers for either 75 or 105 depending on the type of marquee. Example Cover Cancellation or Curtailment cover ranges from 5,000 on Tier 1 to 50,000 on Tier 2. Public Liability cover is also comprehensive, covering anything up to 5 million. Pros The wide choice of cover is what makes Ecclesiastical one of the best providers around. The Mix & Match features also allow one to choose from each cover level to make their policy even more specialized for the wedding. Cons Cheapest package does not include many of the basics, including rings, wedding attire, gifts and failure of suppliers.

3. Cover My Wedding Cover My Wedding is dedicated to providing wedding insurance, which gives it a slight edge in the specialist stakes. The choice of cover is wide, and the premiums are also affordable.

37

WEDDING INSURANCE

Premiums Cover My Wedding has four levels of cover, from 2 Star to 4 Star. The premiums are as follows: 18.99, 39.99, 79, 139. Example Cover Cancellation & Rearrangement cover ranges from 5,000 to 40,000, and Ceremonial Attire cover ranges from 1,500 to 10,000. Most of the other levels of cover also provide a wide choice for any type of wedding. Pros There is the option of an excess waiver available for which one will have to pay a slightly higher premium. There is also a full range of optional extras available to cover every eventuality. Cons No noticeable disadvantages, although it could have more levels of cover to provide extra choice.

38

WEDDING INSURANCE

CHAPTER 4

SWOT ANALYSIS

A SWOT Analysis is a helpful tool in which examine key characteristics of a business. This is a strategic analysis that is done in all businesses of all sizes: small sole proprietorships on up to Fortune 500 organizations. This encourages all businesses in the wedding industry to do this twice a year. It is great for quickly assessing: Whether one is moving in the right direction or not What is AWESOME about ones business? What needs to be changed and improved? What external factors (trends, economics, and politics) affect the business? SWOT Analysis The SWOT breaks down into two components, of two parts each (four parts total): Internal Factors: Strengths the strengths of the business. Weaknesses the weaknesses of your business.

39

WEDDING INSURANCE

External Factors: Opportunities and opportunities for the business. Threats and threats for the business. SWOT is all about? One final step is necessary in putting the SWOT information together. An analysis is only valuable if one put a plan into place. In this last step you will create a list of strategies for the business. Maximize our strengths to take advantage of opportunities: StrengthOpportunity Strategies (SO Strategies) Use our strengths to minimize the threats to our business: Strength-Threat Strategies (ST Strategies) Use opportunities to lessen weaknesses: Weakness-Opportunity Strategies (WO Strategies) Mitigate the weaknesses in light of impending threats: Weakness-Threat Strategies (WT Strategies) Wedding Cancellation Cover Damage of the wedding venue due to fire & allied perils. Riot or curfew near the wedding venue. Death or injury to the bride, groom or the family members.

40

WEDDING INSURANCE

Insured Property Protection cover This can cover ones house or a wedding venue. Personal accident cover This is for the bride, groom and immediate family. Money Cover Keeping in mind large sums of money kept in the house during this wedding this can cover theft. Valuables Cover This can cover all jewelery kept at the house during the wedding. Public Liability Cover This can cover the legal liability that can arise incase third party property is damaged during the wedding or third party bodily injury caused due to accidents/ damage to the venue and food poisoning during the wedding. Its very important to buy one wedding insurance policy in advance and not last minute so that it covers all the details and you have understood the policy well. Once you have taken a policy, remember to keep a proof of all expenses, bills, booking receipts, jewellery valuation certificates etc. Do contact us for help with wedding insurance policies in India.

CHAPTER 5

41

WEDDING INSURANCE

WEDDING INSURANCE IN INDIA AND ABROAD

Wedding Insurance now gaining popularity in India!

Not many families here in India, inquire or know much about wedding insurance available. Similar to general, automobile or health insurance, wedding insurance policies is designed to offer financial protection to couples and families from any unforeseen circumstances on their wedding day. Many of us have heard of many things going wrong at weddings, a theft or electrical mishap at the wedding venue or the residence of one of the families is often heard of. Considering the amount of money spent on Indian weddings it might make sense to spend a small amount on a wedding insurance policy. Every country has their own guidelines for their policies and policies in India are offering the following mentioned below. In addition there are various plans for the same cover that allow one to choose the premium for the maximum sum assured and proportionate to your total wedding budget. There are also customized insurance packages for big weddings that are tailor made to meet various clients needs.

42

WEDDING INSURANCE

Wedding Insurance in India and the U.S.A

While buying insurance is the most un-marriage like thing one could be thinking of while planning their wedding, it could just be one of the most important things one do. Marriages today have evolved from being just a ceremony uniting two people in holy matrimony to a large production, where people often end up spending a large chunk if not most of their savings. Wedding insurance is becoming a very common practice and a safety net for many couples in India and around the world. Insurance companies are cashing in on the countrys increasing affinity toward purchasing insurance and numerous insurers have come out with wedding insurance policies with widespread policies covering everything from damages to your wedding outfit to weather calamities. While policies in India and countries like the U.S.A cover many similar mishaps, there are some differences and the diversity is more evident when it comes to the popular coverage options purchased in each country.

43

WEDDING INSURANCE

A typical wedding insurance policy in the U.S.A and India offers financial protection to the insurer from losses due to unforeseen events that hamper the wedding proceedings or lead to its cancellation. Generally policies in India cover losses arising from the postponement and cancellation of the wedding due to causes like natural calamities, injury to the bride or groom or an accident, injury to a family member, riots etc. One can also purchase coverage to insure their wedding venue, valuables or liability arising due to third party property damage or bodily injuries. With the amount of jewellery and cash gifts present in most Indian weddings, protecting your valuables can be a good idea and is one of the more common coverage options requested. One of the most important aspects some insurers offer, especially in a country like India where transportation hassles abound, is the protection against problems arising when either the bride or groom is stuck or delayed due to problematic transportation or road safety issues. One the other hand in the U.S.A the availability of liability coverage is a godsend. In a country where suing and law suits are so common a practice, protection against third party damage and injuries can quite possibly save the insured major moolah. Another popular option is wedding insurance coverage in the case of either spouse having to move due to corporate reasons or military deployment. People who live in cities where the weather and commonly occurring natural disasters can create a problem like in the hurricane belt or earthquake prone areas, can also take advantage of polices that cover these calamities. While wedding insurance in India and the United Sates both offer options like protection against losses due to failure of service by vendors, wedding decorators, wedding photographers etc. there is one area that the U.S. has an

44

WEDDING INSURANCE

advantage easing your heartbreak. Some insurance providers are actually offering wedding insurance in the case of the bride or groom getting cold feet no such luck here though one will have to deal with the emotional turmoil along with the financial burden!

CHAPTER 6 CASE STUDIES

Bajaj Allianz Wedding Insurance

45

WEDDING INSURANCE

Bajaj Allianz is offering wedding insurance with premium payments of as low as below Rs 4,000, and as high as close to Rs 15,000. As per its website, it has four insurance options -- Rs two lakh, Rs four lakh, Rs six lakh and Rs eight lakh and the indicative premiums for these four options range from Rs 3770 to Rs 14276. Wedding Insurance package is a customized Event Insurance package to cover specific risks related to weddings. Bajaj Allianz is the first company to launch such a unique and comprehensive cover for wedding cancellation or postponement, where the insurance package covers for the monetary loss following the cancellation or postponement of wedding due to fire and allied perils, accident to bride/groom, accident to blood relatives resulting in hospitalization within 7 days prior to the printed / declared wedding date, damage to property, money in safe, burglary and public liability, etc. Weddings have become quite an expensive and elaborate affair. People do take care to make this once in a life time event a memorable one. This is a comprehensive product that covers all the specific risks related to weddings .The product has four Sum Insured options starting with coverage of Rs. 2,000,000 and going upto Rs. 7,000,000.One can also choose among 6 types of risk coverages with varying Sum Insured options. The premium would range from Rs. 3,770 to Rs. 14,276. There is a wide scope for such

46

WEDDING INSURANCE

customized package products but the Indian market is still in its nascent stages.

Bajaj Allianz launches insurance cover for weddings

Bajaj Allianz General Insurance, the leading private general insurance company in India, is the first company to launch an insurance coverage for weddings cancellation or postponement. Bajaj Allianz's profits grew by 52 percent in the first half-year of 2004-2005. Bajaj Allianz General Insurance Company Ahmedabad, India, Dec 2, 2004 The insurance package covers for the monetary loss if a wedding must be canceled of postponed due to incidents such as fire, accidents before the wedding, property damage or burglary. Mr. Kamesh Goyal, CEO of Bajaj Allianz General Insurance, said, "These days, weddings have become quite an expensive and elaborate affair. People take care to make this once-in-a-lifetime event a memorable one. In case of any postponement or cancellations, there is a certain risk of monetary loss. The wedding insurance package can compensate the monetary loss. This unique package product covers the specific risks related to weddings." Premiums and profits Bajaj Allianz's premium income grew by 84 percent to 4,050 million rupees (68 million euros) in the first half of the 2004-2005 business years. Its profits grew by 52 percent to 200 million rupees (3.4 million euros). Bajaj

47

WEDDING INSURANCE

Allianz has set a target of raising a premium income of 7,500 million rupees (126 million euros) in the current fiscal. In the year 2003-2004, the company garnered a premium income of approximately 4,800 million rupees (81 million euros) with a profit after tax of 217 million rupees (3.4 million euros), a growth of 125 percent in net profits. Bajaj Allianz sold over 1.2 million policies for the year. The company has settled over 100,000 claims worth 1,500 million rupees (25 million euros). Scope for customized package products This is the first time that any insurance company in India has come out with a wedding coverage. The company believes that there is a large scope for such customized package products. Bajaj Allianz is one of the few insurance companies who have entered the event insurance market, offering customized solutions. Bajaj Allianz is focused on sports, films and entertainment; it has insured events like golf tournaments, cricket matches, award nights, product launches. Bajaj Allianz General Insurance Company Limited is a joint venture company between Bajaj Auto Limited, India's leading manufacturer of twoand three-wheeler vehicles and the Allianz Group.

ICICI Lombard Wedding Insurance

48

WEDDING INSURANCE

ICICI Lombard, on its part, provides insurance cover for the wedding cancellation, material damage to the property such as wedding venue, personal accident cover for insured person (bride or the groom) and any public liability arising out of the cancellation. It covers cancellation or postponement of the wedding ceremonies due to factors ranging from fire, earthquake or burglary and theft at the venue. It also covers for "sudden, unexplained, uninitiated failure" of the bride or the groom to appear for the wedding ceremonies due to reasons like, death, personal injury or any major illness. Price of your policy will depend on factors such as the type of wedding you choose and the extent of cover you need. Each insurance provider will usually have a range of cover packages on offer. Basic cover can be purchased for around 25, which would pay out around 6,000 if your wedding is cancelled. For a high level of cover, this would pay out around 50,000 for a cancelled wedding, policy prices range between 250 and 350. In between, a range of cover levels are available to suit your wedding plans and the budget. Essentially, the more you pay the greater the cover that you have, should anything go wrong. The cover level you choose will indicate the maximum possible payout, not the amount that one is entitled to receive. If one has a policy which offers 50,000 of cancellation cover, and ones wedding is cancelled, their insurance provider will assess their claim and compensate accordingly: if the cancellation resulted in costs of 18,000 this will be the

49

WEDDING INSURANCE

amount you receive. It is worth paying more for a policy if one is planning an expensive wedding, but will not always need the highest level of cover. Remember that the cheapest policies may not provide you with enough financial cover, whilst expensive policies might charge you for unnecessary cover.

Wedding Insurance

Wedding is an auspicious event that marks a beginning of a new chapter in ones life. It is the starting point of creating a family of own. It is a once in a lifetime event that continues to bring you joy for the rest of your life. However, even such an event can be affected with uncertainties. But the good news is that they provide one with the peace of mind and security for all those uncertainties, on the most memorable day. Insure one of the happiest days in the life with ICICI Lombard General Insurance Co Ltd and get covered against substantial risks. We cover you for Wedding Cancellation, Material Damage to the Property, Personal Accident cover for Insured Person and Public Liability Section I Wedding Cancellation Scope of Cover: Cancellation or postponement of the wedding ceremonies due to: Fire & Allied perils including Earthquake at the Venue. Burglary & Theft at the Venue Sudden, unexplained, un intimated failure of the Named Person (s) to appear for the wedding ceremonies on account of any of the following contingencies:

50

WEDDING INSURANCE

Death of such Named Person(s) Personal injury, either temporary or permanent, which renders the Named Person(s) incapable of appearing at the insured event. Illness resulting in hospitalization of the Named person 10 days prior to the printed declared wedding date. Basis of Sum insured for Wedding Cancellation: Expenses on the following things will be covered: A) Printing of Cards B) Advances given to venue C) Advances given to caterer D) Advances to Decorations, music etc E) Advance given to hotel room bookings / travel bookings. Subject to a max of Sum insured Main Exclusions: The Company shall not be liable for cancellation of the wedding event due to: Bandh/Civil unrest Any act of terrorism Kidnapping of the named person. Complete breakdown of transportation services which prevent the Named Person(s) from reaching the venue.

51

WEDDING INSURANCE

The non-appearance of any Named Person(s) due to such Named Person(s) being a part of an air flight, other than as a passenger in a duly licensed commercial aircraft, without the knowledge and consent of the Company. Any consequential loss due to cancellation of the insured event. Unexplained or mysterious disappearance or shortage in respect of the property to be utilized for the insured event discovered upon taking of inventory. Damage to, or destruction of, property caused intentionally by the Insured or at Insured's direction. Section II Damage to Property Scope of Cover: Direct physical loss/ damage caused to property insured due to Std. Fire & Allied Perils including Earthquake Burglary & Theft Basis of Sum insured for Material Damage: Cost of decoration & Shamiana, hired sets, jewelry, precious metals & stones, appliances - given by Blood Relations & In-laws Sum insured breakup will be required, & Valuation certificates, bills etc. will be needed for jewellery, precious metals & stones to be covered.

Main Exclusions: The Company shall not be liable for material damage due to:

52

WEDDING INSURANCE

Any damage caused to any property to be utilized for the insured event caused by wear & tear, gradual deterioration, depreciation, mechanical or electrical breakdown. Unexplained or mysterious disappearance or shortage in respect of the property to be utilized for the insured event discovered upon taking of inventory. Loss or damage to property stored outdoors without due attendance or supervision. Damage to, or destruction of, property caused intentionally by the Insured or at Insured's direction. Any act of terrorism For complete details, please read the Policy document Section III Personal Accident Scope of Cover: Named person including Blood relation & relatives are covered against Accidental death Permanent partial Disablement Permanent Total Disablement (Names to be declared) Main Exclusions: The Company shall not be liable for:

53

WEDDING INSURANCE

Compensation under more than one of the foregoing sub-clauses in respect of the same period of disablement of the insured person. Compensation in respect of death or bodily injury or any disease or illness to the insured person directly or indirectly caused by or contributed to by nuclear weapons, arising from ionizing radiations or nuclear contamination by radioactivity from any nuclear fuel or from any nuclear waste from the combustion of nuclear fuel. Compensation in respect of death, injury or disablement of the insured person due to or arising out of or directly or indirectly connected with or traceable to War, Invasion, Act of foreign enemy, Hostilities (whether war be declared or not), Civil War, Rebellion, Revolution, Insurrection, Mutiny, Military or Usurped Power, Seizure, Capture, Arrests, Restraint and Detainment of whatever nature. Compensation in respect of death, injury or disablement of the insured person from: (a) Intentional self-injury, suicide or attempted suicide, (b) Whilst under the influence of intoxicating liquor or drugs, Section IV Public Liability Scope of Cover: Liability towards third parties for any accidents resulting in injury or damage occurring at the venue of the wedding, in connection with the wedding, during the policy period. Main Exclusions: The Company shall not be liable for any liability arising due to:

54

WEDDING INSURANCE

Pollution Acts of God, earthquake, earth-tremor, volcanic eruption, flood, storm, tempest, typhoon, hurricane, tornado, cyclone or other similar acts or convulsions of nature and atmospheric disturbances. Deliberate, willful or intentional non-compliance of any statutory requirements. Fines, penalties, punitive or exemplary damages or any other damages resulting from the multiplication of compensatory damages, or arising out of any criminal liabilities Consequence of war, invasion, act of foreign enemy, hostilities (whether war be declared or not), civil war, rebellion, revolution, terrorism, insurrection or military or usurped power; Ionizing radiation or contamination by radioactivity from any nuclear fuel or from any nuclear waste from the combustion of nuclear fuel. The radioactive, toxic, explosive or other hazardous properties of any explosive nuclear assembly or nuclear component thereof. Claims arising out of any motor vehicle or trailer temporarily in the Insured's custody or control for the purpose of parking. Damage to property owned, leased or hired or under hire purchase or on loan to the Insured or otherwise in the Insured's care, custody or control other than:

55

WEDDING INSURANCE

Premises (or the contents thereof) temporarily occupied by the Insured for work thereon or other property temporarily in the Insured's possession for work Loss or damage to the Visitors' clothing and personal effects.

CHAPTER 7

CONCLUSION

The big fat Indian wedding just gets bigger and fatter. As politicians, actors and industrialist make news with the childrens multi-crore rupee wedding. But, the bigger the wedding the harder it is to manage and God forbid, if something goes wrong, each carefully made plan could come undone in more time. Insuring the wedding might be the answer.

56

WEDDING INSURANCE

Different wedding insurance policies will cover different aspects of ones wedding and typically offer different levels of cover. The policy that is right for one is usually the one which offers the correct amount of cover for the most important aspect of the wedding. The concept of wedding insurance is much popular abroad and hardly any marriages take place without getting insurance cover. The concept of wedding insurance is fast becoming a popular subject amongst couples. Wedding plan is useful as it helps and cover for problems disasters or mistakes on your wedding day, from a broken down wedding car to a problem at the wedding venue or just about anything. Wedding insurance is new in India. People are reluctant to go for wedding insurance as they dont want to think anything negative in the auspicious day, since two of the private companies i.e. Bajaj Allianz And ICICI Lombard have started offering this cover with exclusive premium and hope that the concept will slowly start growing in Indi

CHAPTER 8

BIBILOGRAPHY

www.bajajallianz.com www.icicilombard.com www.protectmywedding.com

www.wedsafe.com

57

WEDDING INSURANCE

58

Вам также может понравиться

- Section I: Knowledge of The Insurance Industry: Service Sector Management Financial Services - InsuranceДокумент27 страницSection I: Knowledge of The Insurance Industry: Service Sector Management Financial Services - InsuranceYugandhar SivaОценок пока нет

- United India Insurance Co REPORT 22.07.19Документ53 страницыUnited India Insurance Co REPORT 22.07.19Trilok SamtaniОценок пока нет

- MOTOR Insurance-3Документ46 страницMOTOR Insurance-3m_dattaias100% (1)

- Miscellaneous InsuranceДокумент82 страницыMiscellaneous Insurancem_dattaias100% (6)

- Royal Sundaram General InsuranceДокумент22 страницыRoyal Sundaram General InsuranceVinayak BhardwajОценок пока нет

- GMC, Gpa RFQДокумент8 страницGMC, Gpa RFQRushil Gupta100% (1)

- Motor InsuranceДокумент35 страницMotor InsuranceS1626Оценок пока нет

- Introduction On Motor Insurance: TH STДокумент32 страницыIntroduction On Motor Insurance: TH STRahil Khan100% (1)

- 88 - IC-Marketing-and-Public-RelationsДокумент1 страница88 - IC-Marketing-and-Public-RelationsVINAY S N33% (3)

- Insurance Law in IndiaДокумент44 страницыInsurance Law in IndiaVaibhav AhujaОценок пока нет

- AD 003 033 Your Car Insurance GuideДокумент37 страницAD 003 033 Your Car Insurance GuideDhar RakulОценок пока нет

- Bharti Axa ProjectДокумент59 страницBharti Axa ProjectChirag NathaniОценок пока нет

- Motor Tariff Gist - Study MaterialДокумент9 страницMotor Tariff Gist - Study MaterialSadasivuni007Оценок пока нет

- Chapter 1-History of Life InsuranceДокумент9 страницChapter 1-History of Life InsuranceGanesh Sadaphal44% (9)

- InsuranceДокумент29 страницInsuranceAzifОценок пока нет

- HDFC LifeДокумент66 страницHDFC LifeChetan PahwaОценок пока нет

- Motor Insurance - FinalДокумент23 страницыMotor Insurance - FinalAlexОценок пока нет

- Miscellaneous InsuranceДокумент27 страницMiscellaneous InsuranceRavneet KaurОценок пока нет

- New India Assurance Company LTDДокумент63 страницыNew India Assurance Company LTDkevalcool25050% (2)

- Fire & Consequential Loss Insurance 57Документ15 страницFire & Consequential Loss Insurance 57surjith rОценок пока нет

- Claim Procedure and Terms & Conditions For Personal Accident InsuranceДокумент11 страницClaim Procedure and Terms & Conditions For Personal Accident InsuranceMayur AbhinavОценок пока нет

- Comprehensive Template For Contributor Services Agreement Telus & Security Standards - Oct2022Документ11 страницComprehensive Template For Contributor Services Agreement Telus & Security Standards - Oct2022Salma AkilОценок пока нет

- Claim Management For Life Insurance-Mr. Zain IbrahimДокумент35 страницClaim Management For Life Insurance-Mr. Zain IbrahimAsad HamidОценок пока нет

- Industrial Project On Reliance Life Insurance Company LimitedДокумент116 страницIndustrial Project On Reliance Life Insurance Company LimitedTimothy Brown100% (1)

- Motor OD Manual - Underwriting & Calims PDFДокумент201 страницаMotor OD Manual - Underwriting & Calims PDFMani Rathinam100% (1)

- Insurance Documents: Module - 3Документ13 страницInsurance Documents: Module - 3SasiОценок пока нет

- Insurance - Subrogation, Contribution, Re-InsuranceДокумент26 страницInsurance - Subrogation, Contribution, Re-InsuranceShivam kumar YadavОценок пока нет

- De TariffingДокумент16 страницDe TariffingpankajguptaОценок пока нет

- Insurance Industry ChetanДокумент50 страницInsurance Industry ChetanUjjwal Joseph fernandedОценок пока нет

- LICДокумент8 страницLICCharmi Joshi100% (1)

- Free Irda Ic 38 Insurance Agents GeneralДокумент12 страницFree Irda Ic 38 Insurance Agents GeneralShabaz AliОценок пока нет

- "PROFITABILITY OF LIFE INSURANCE" Shailesh Kumar Singh and Prof. Peeyush Kumar PandeyДокумент9 страниц"PROFITABILITY OF LIFE INSURANCE" Shailesh Kumar Singh and Prof. Peeyush Kumar PandeySourya Pratap SinghОценок пока нет

- Impact of COVID-19 On Insurance SectorДокумент2 страницыImpact of COVID-19 On Insurance SectorMahbubur RahmanОценок пока нет

- Liability InsuranceДокумент13 страницLiability InsuranceThoom Srideep Rao100% (1)

- Insurance SectorДокумент45 страницInsurance Sectorverma786786100% (1)

- Motor Insurance Claims in IndiaДокумент13 страницMotor Insurance Claims in IndiaNagavyas KanugoviОценок пока нет

- Life InsuranceДокумент39 страницLife Insurancearjunmba11962450% (2)

- Insurance and Risk ManagementДокумент140 страницInsurance and Risk Managementgg100% (1)

- Final Project Fire InsuranceДокумент22 страницыFinal Project Fire InsuranceDeep Lath50% (2)

- Team 3 Group InsuranceДокумент42 страницыTeam 3 Group InsuranceAnonymous Ua8mvPkОценок пока нет

- Frudulent ClaimsДокумент23 страницыFrudulent ClaimsNaishadh J Desai AnD'sОценок пока нет

- General InsuranceДокумент65 страницGeneral InsurancePaul MeshramОценок пока нет

- IC-24 - Legal Aspects of Life AssuranceДокумент1 страницаIC-24 - Legal Aspects of Life Assuranceaman vermaОценок пока нет

- Birla Sun Life InsuranceДокумент71 страницаBirla Sun Life Insurancemamata prasadОценок пока нет

- Rural InsuranceДокумент45 страницRural InsuranceVirendra Jha60% (5)

- Birla SunlifeДокумент27 страницBirla SunlifeVinney KumarОценок пока нет

- Reliance Nippon Life Insurance AkhileshДокумент63 страницыReliance Nippon Life Insurance AkhileshAkhilesh JadhavОценок пока нет

- Zenice Field ReportДокумент23 страницыZenice Field ReportDeogratius Mcoka100% (1)

- IrdaДокумент10 страницIrdafundoo16Оценок пока нет

- An Internship Project Report OnДокумент19 страницAn Internship Project Report OnMadhav RajbanshiОценок пока нет

- HRM Paper (Ic-90)Документ8 страницHRM Paper (Ic-90)anon-917692100% (2)

- AlopДокумент39 страницAlopabhishekmantri100% (1)

- Consequential Loss PolicyДокумент34 страницыConsequential Loss PolicyAnmol GulatiОценок пока нет

- Practice QuestionsДокумент109 страницPractice QuestionsDc Maxx37% (19)

- YashkharatblackbookДокумент46 страницYashkharatblackbookJATIN PUJARIОценок пока нет

- IC 78 Miscellaneous InsuranceДокумент306 страницIC 78 Miscellaneous InsuranceKrishna GowdaОценок пока нет

- Project Report On Field Study in Insurance SectorДокумент86 страницProject Report On Field Study in Insurance Sectorsunny_choudhary@hotmail.com100% (1)

- Claims Management in Life InsuranceДокумент53 страницыClaims Management in Life InsuranceJitesh100% (3)

- Summer Training Report-Max New York LifeДокумент40 страницSummer Training Report-Max New York LifeAbhishek LaghateОценок пока нет

- Project On Claims Management in Life InsuranceДокумент69 страницProject On Claims Management in Life InsuranceAnand ChavanОценок пока нет

- Microsoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSДокумент8 страницMicrosoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDuy Trần TấnОценок пока нет

- Sample Business ProposalДокумент10 страницSample Business Proposalvladimir_kolessov100% (8)

- Accounting CycleДокумент6 страницAccounting CycleElla Acosta0% (1)

- Report of The Committee On Regulatory Regime For Trees Grown On Private Land Nov 2012Документ42 страницыReport of The Committee On Regulatory Regime For Trees Grown On Private Land Nov 2012Ravi Shankar KolluruОценок пока нет

- Use CaseДокумент4 страницыUse CasemeriiОценок пока нет

- Table 1. Different Modules of Training Proposed On Mushroom Cultivation Technology DetailsДокумент11 страницTable 1. Different Modules of Training Proposed On Mushroom Cultivation Technology DetailsDeepak SharmaОценок пока нет

- De Mgginimis Benefit in The PhilippinesДокумент3 страницыDe Mgginimis Benefit in The PhilippinesSlardarRadralsОценок пока нет

- © 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenДокумент62 страницы© 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenHIỀN LÊ THỊОценок пока нет

- Correlations in Forex Pairs SHEET by - YouthFXRisingДокумент2 страницыCorrelations in Forex Pairs SHEET by - YouthFXRisingprathamgamer147Оценок пока нет

- Forex Fluctuations On Imports and ExportsДокумент33 страницыForex Fluctuations On Imports and Exportskushaal subramonyОценок пока нет