Академический Документы

Профессиональный Документы

Культура Документы

SEB Report: US Growth To Rebound After Weakness in Q1

Загружено:

SEB Group0 оценок0% нашли этот документ полезным (0 голосов)

268 просмотров4 страницыSEB’s economists project the US economy will rebound later in 2012 after GDP growth slows to 2 per cent in the first quarter. They say many soft indicators point to a strengthening final demand and therefore keep their 2012 GDP growth forecast at 2.5 per cent. The economists, led by Mattias Bruér, forecast unemployment gradually declining tow 7.4 per cent at the end of 2013.

Оригинальное название

SEB report: US growth to rebound after weakness in Q1

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документSEB’s economists project the US economy will rebound later in 2012 after GDP growth slows to 2 per cent in the first quarter. They say many soft indicators point to a strengthening final demand and therefore keep their 2012 GDP growth forecast at 2.5 per cent. The economists, led by Mattias Bruér, forecast unemployment gradually declining tow 7.4 per cent at the end of 2013.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

268 просмотров4 страницыSEB Report: US Growth To Rebound After Weakness in Q1

Загружено:

SEB GroupSEB’s economists project the US economy will rebound later in 2012 after GDP growth slows to 2 per cent in the first quarter. They say many soft indicators point to a strengthening final demand and therefore keep their 2012 GDP growth forecast at 2.5 per cent. The economists, led by Mattias Bruér, forecast unemployment gradually declining tow 7.4 per cent at the end of 2013.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

U.S.

economy on a firmer footing

A slowdown in real GDP growth seems increasingly likely in Q1 and we estimate that real GDP grew at a 2 percent annualized rate in the first quarter, compared to 3.0 percent in Q4. But the weaker first-quarter growth wouldnt rule out stronger performance in subsequent quarters, and since many soft indicators of final demand is strengthening our 2012 and 2013 GDP forecasts remain unchanged at 2.5 percent. The unemployment rate is sliding gradually to 7.4 percent at the end of 2013. Although we believe that the recovery is on a firmer footing it is not going to be a straight line up by any means. Unseasonably warm weather may have boosted activity while high oil and gasoline prices are beginning to cut into consumers purchasing power and growth prospects in general. Fortunately there are offsets: the looming credit squeeze was averted and the tail risk of a severe recession in Europe is decidedly lower. Financial conditions are much easier compared to a few months ago. Employment growth has been stronger than expected as well, but wage growth remains subdued. Arguably too much fiscal tightening too fast is the biggest risk in 2013. Under current law the fiscal tightening is around 4.5 percent of GDP easily enough to break any recovery. Even if only 2 percentage points of tightening actually occurs, its still the second largest in modern history. Dont look for any clarity until after the November election when action is needed on a smorgasbord of contentious economic issues, among others the expiring Bush era tax cuts and the sequester which automatically slash federal outlays. This is why Fed chairman Bernanke is talking about a fiscal cliff at years end. Our assumption is that the fiscal headwind will be little more than 1 percent in 2013 which is not enough to break the recovery. But expect a messy process with possible macroeconomic as well as debt rating related concerns along the way. Our inflation forecasts are revised higher this year on oil. But the upturn is judged to be temporary and in 2013 both headline and core inflation will be running well below the target. Consequently, we stick with our forecast of additional QE although it is a close call.

TUESDAY 20 MARCH 2012

Mattias Brur

SEB Economic Research +46 8 763 85 06

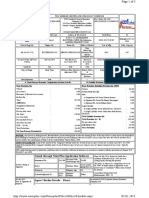

Key data Percentage change

2010 2011 2012 2013 GDP Unemployment* Inflation Core inflation

Source: SEB

3.0 9.6 1.6 1.0

1.7 9.0 3.1 1.7

2.5 8.2 2.2 1.9

2.5 7.6 1.3 1.3

* Per cent of labour force, yearly averages

Economic Insight

THE BIG PICTURE

Currently there is a huge split between the demand side and supply side in the U.S. economy. The supply side is all good: employment growth is around 250k a month and aggregate hours worked is 3.5 percent above the Q4 average. So what the supply side is suggesting is that growth is running above 4 percent at an annualized rate. The demand side is a different story: real consumer spending has practically no momentum and both capital spending and net exports are tracking negative GDP contributions. According to the demand side data alone real GDP growth could be closer to zero right now. But the housing market is in better shape which is one reason why the recovery may end up being more sustainable than last year. The glass half full group would point out that housing only is 2 percent of the U.S. economy, however. Soaring oil and gasoline prices are advancing on the worry list. It is not the level but the change in prices that influences growth, and the rule of thumb we use is that a persistent USD 10 dollar increase in the oil price lowers real GDP growth by 0.2 percent year one as well as year two. So compared to the October lows we may be looking at a 0.8 percent drag on real GDP growth in 2011 if oil prices stay where they are for a year all else being equal (somewhat smaller effects when using yearly averages). Fortunately there are offsets since financial conditions are much easier today compared to a few months ago and should no longer hurt growth. Higher oil prices will push up inflation temporary but further out inflation is expected to run below the level the Fed is shooting for. As long as inflation expectations are behaving well the Fed will probably look through any oil-related bounce in inflation. Remember that in January the Fed said that the funds rate is going to be held to the floor at least through late 2014 and six of the 17 Fed officials dont believe they will raise rates until 2015-16. So we remain of the view that the available policy options are 1) an unchanged accommodative monetary policy stance or 2) additional easing. Higher inflation is making more asset purchases a harder sell but more easing may come, especially if the economy starts fraying at the edges. Since Q1 real GDP growth is poised to disappoint we are reluctant to change our forecast of additional policy easing. What has been floating around recently is sterilized QE which could have the potential to stimulate the economy while at the same time subdue worries about future inflation. As an aside, Bernanke again described U.S. growth as frustratingly slow last week. Meanwhile markets may be in the process of pricing out QE and pricing in an early tightening cycle.

Economic Insight

CONSUMER SPENDING / CAPITAL EXPENDITURES

The trend in real consumer spending is running at a low level and our models do not suggest much improvement over the near term. Despite faster employment growth and the long and generous arm of Uncle Sam, who contributes 20 percent of the income pie, weak income growth is holding down consumer spending. Whilst growth in real disposable income has trended below real consumption growth since the beginning of 2011, the drop in the savings rate and the fading fuel shock supported consumption last year. But these tailwinds may be turning: driven in part by the ratio of household net worth to personal income falling from 650 percent at the bubble heights to 500 today, our savings model suggests that an uptrend in the savings rate is fundamentally motivated. When this ratio was at current levels in the past, the savings rate was within the 7-10 percent band with near consistency. The labor market is the key; stronger employment growth should ultimately fuel income and spending. A signpost of the current hardship: the number of Americans receiving food stamps is above 46 million. Usually the unseasonably warm weather is an argument that the bears are pushing, arguing that the economy has been artificially strong as a result. But the flip side is that excluding energy, real consumption growth is above 2 percent. In our view what is driving consumption right now is almost exclusively auto related where fleet sales represent most of the buying. Meanwhile 89 percent of the consumption pie is shrinking and we would like to see a more broad-based expansion in any event.

millions

millions

Economic Insight

THE LABOR MARKET

The unemployment rate has fallen by 0.8 percentage points since August, to 8.3 percent. More private jobs have been created since November than in any three-month period since 2006. Aggregate hours worked are up 3.6 percent at an annual rate over the last three months. As a standalone number this is suggesting real GDP growth at around 4.5 percent in Q1. But real GDP growth is tracking around 2 percent in Q1 so productivity must be contracting in the current quarter just as it did a year ago. Whenever this happens, companies move to protect their squeezed profit margins and respond the following quarter by slowing hiring. Looking back over the past decade this happened every time, and monthly payrolls, on average, come in 70k lower the following quarter. This is why we caution against extrapolating current employment trends into the future. The progress on the unemployment front has been much faster than justified by the classic Okuns law, but that is implicitly assuming that trend GDP growth rate has not changed much. But remember that trend GDP growth is the sum of labor force growth and productivity growth. While the growth in the labor force has recently picked up, the productivity trend is running slightly above zero right now. Putting these numbers together they are suggesting that trend GDP growth has been running below 1 percent for a year now. That can explain the better labor market outcomes even with frustratingly slow growth. Going forward, however, what the pick up in labor force growth is suggesting is that the lower speed limit is only temporary. Thus, going forward we expect much slower progress against unemployment even if real GDP growth will be better than last years 1.7 percent.

Person (millions)

millions

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Investment Banking Deal ProcessДокумент25 страницInvestment Banking Deal Processdkgrinder100% (1)

- GW Law Faculty Analyzes Holder in Due Course DoctrineДокумент41 страницаGW Law Faculty Analyzes Holder in Due Course DoctrineRussel SirotОценок пока нет

- Resume - Bharati Desai Senior Accounting PositionsДокумент4 страницыResume - Bharati Desai Senior Accounting PositionsJeremy SmithОценок пока нет

- Firm Case AnalysisДокумент10 страницFirm Case Analysis411hhapОценок пока нет

- ESG Handbook - FCA UKДокумент20 страницESG Handbook - FCA UKEmdad YusufОценок пока нет

- Your Statement: Account SummaryДокумент5 страницYour Statement: Account SummaryVictor PopaОценок пока нет

- The Warehouse Annual Report 2016Документ96 страницThe Warehouse Annual Report 2016Ngan PhamОценок пока нет

- Retirement Planning Calculator - MR Money TVДокумент6 страницRetirement Planning Calculator - MR Money TVCath CОценок пока нет

- Insights From 2014 of Significance For 2015Документ5 страницInsights From 2014 of Significance For 2015SEB GroupОценок пока нет

- Eastern European Outlook 1503: Baltics and Central Europe Showing ResilienceДокумент23 страницыEastern European Outlook 1503: Baltics and Central Europe Showing ResilienceSEB GroupОценок пока нет

- Nordic Outlook 1502: Central Banks and Oil Help Sustain GrowthДокумент52 страницыNordic Outlook 1502: Central Banks and Oil Help Sustain GrowthSEB GroupОценок пока нет

- Economic Insights:"Sanctions War" Will Have Little Direct Impact On GrowthДокумент3 страницыEconomic Insights:"Sanctions War" Will Have Little Direct Impact On GrowthSEB GroupОценок пока нет

- Nordic Outlook 1411: Increased Stress Squeezing Global GrowthДокумент40 страницNordic Outlook 1411: Increased Stress Squeezing Global GrowthSEB GroupОценок пока нет

- Investment Outlook 1405: The Road To Reasonable ExpectationsДокумент37 страницInvestment Outlook 1405: The Road To Reasonable ExpectationsSEB GroupОценок пока нет

- Nordic Outlook 1408: Continued Recovery - Greater Downside RisksДокумент53 страницыNordic Outlook 1408: Continued Recovery - Greater Downside RisksSEB GroupОценок пока нет

- Investment Outlook 1412: Slowly, But in The Right DirectionДокумент38 страницInvestment Outlook 1412: Slowly, But in The Right DirectionSEB GroupОценок пока нет

- Economic Insights: Riksbank To Lower Key Rate, While Seeking New RoleДокумент3 страницыEconomic Insights: Riksbank To Lower Key Rate, While Seeking New RoleSEB GroupОценок пока нет

- CFO Survey 1409: More Cautious View On Business ClimateДокумент16 страницCFO Survey 1409: More Cautious View On Business ClimateSEB GroupОценок пока нет

- SEB Report: Brazil - Back To Grey Economic Reality After The World CupДокумент2 страницыSEB Report: Brazil - Back To Grey Economic Reality After The World CupSEB GroupОценок пока нет

- China Financial Index 1403: Better Business Climate AheadДокумент6 страницChina Financial Index 1403: Better Business Climate AheadSEB GroupОценок пока нет

- SEB Report: Change of Government in India Creates Reform HopesДокумент2 страницыSEB Report: Change of Government in India Creates Reform HopesSEB GroupОценок пока нет

- Investment Outlook 1409: Bright Outlook For Those Who Dare To Take RisksДокумент39 страницInvestment Outlook 1409: Bright Outlook For Those Who Dare To Take RisksSEB GroupОценок пока нет

- Deloitte/SEB CFO Survey Finland 1405: Closing The GapДокумент12 страницDeloitte/SEB CFO Survey Finland 1405: Closing The GapSEB GroupОценок пока нет

- Asia Strategy Focus:Is The Indonesia Rally Over?Документ17 страницAsia Strategy Focus:Is The Indonesia Rally Over?SEB GroupОценок пока нет

- Nordic Outlook 1405: Recovery and Monetary Policy DivergenceДокумент48 страницNordic Outlook 1405: Recovery and Monetary Policy DivergenceSEB GroupОценок пока нет

- Economic Insights: Subtle Signs of Firmer Momentum in NorwayДокумент4 страницыEconomic Insights: Subtle Signs of Firmer Momentum in NorwaySEB GroupОценок пока нет

- Eastern European Outlook 1403: Continued Recovery in Eastern Europe Despite TurmoilДокумент24 страницыEastern European Outlook 1403: Continued Recovery in Eastern Europe Despite TurmoilSEB GroupОценок пока нет

- Economic Insights: The Middle East - Politically Hobbled But With Major PotentialДокумент5 страницEconomic Insights: The Middle East - Politically Hobbled But With Major PotentialSEB GroupОценок пока нет

- SEB Report: More Emergency Actions Needed in UkraineДокумент2 страницыSEB Report: More Emergency Actions Needed in UkraineSEB GroupОценок пока нет

- Investment Outlook 1403: Markets Waiting For Earnings ConfirmationДокумент39 страницInvestment Outlook 1403: Markets Waiting For Earnings ConfirmationSEB GroupОценок пока нет

- Economic Insights: Global Economy Resilient To Geopolitical UncertaintyДокумент31 страницаEconomic Insights: Global Economy Resilient To Geopolitical UncertaintySEB GroupОценок пока нет

- Swedish Housing Price Indicator Signals Rising PricesДокумент1 страницаSwedish Housing Price Indicator Signals Rising PricesSEB GroupОценок пока нет

- CFO Survey 1403: Improving Swedish Business Climate and HiringДокумент12 страницCFO Survey 1403: Improving Swedish Business Climate and HiringSEB GroupОценок пока нет

- Optimism On Swedish Home Prices Fading A LittleДокумент1 страницаOptimism On Swedish Home Prices Fading A LittleSEB GroupОценок пока нет

- Asia Strategy Comment: Tokyo Election May Affect YenДокумент3 страницыAsia Strategy Comment: Tokyo Election May Affect YenSEB GroupОценок пока нет

- Nordic Outlook 1402: Recovery With Shift in Global Growth EnginesДокумент49 страницNordic Outlook 1402: Recovery With Shift in Global Growth EnginesSEB GroupОценок пока нет

- SEB's China Tracker: Top 7 FAQ On China's SlowdownДокумент11 страницSEB's China Tracker: Top 7 FAQ On China's SlowdownSEB GroupОценок пока нет

- Alternative Investment Funds in Luxembourg - NomiluxДокумент4 страницыAlternative Investment Funds in Luxembourg - NomiluxAnonymous 76ezj7Q9bОценок пока нет

- Corporate Financial Accounting 14th Edition Warren Solutions ManualДокумент14 страницCorporate Financial Accounting 14th Edition Warren Solutions ManualRobertMurphyjgwo100% (59)

- Irfan Malik 01Документ2 страницыIrfan Malik 01Irfan AliОценок пока нет

- SARFAESI (Central Registry) Amendment Rules, 2016Документ6 страницSARFAESI (Central Registry) Amendment Rules, 2016Latest Laws Team100% (1)

- Additional Performance Measurement 123Документ7 страницAdditional Performance Measurement 123Aditi AggarwalОценок пока нет

- Issued Through Nsureplus Application SoftwareДокумент1 страницаIssued Through Nsureplus Application SoftwaresureshОценок пока нет

- Peranggaran - Materi 2Документ42 страницыPeranggaran - Materi 2citra kurniaОценок пока нет

- Capitaltwo RISHABHДокумент36 страницCapitaltwo RISHABHSaloni SharmaОценок пока нет

- Getting Paid Math 2.3.9.A1Документ3 страницыGetting Paid Math 2.3.9.A1Aethan King AveОценок пока нет

- New BankДокумент13 страницNew BankVelayudhan SunkaraОценок пока нет

- Full 2012 2013Документ275 страницFull 2012 2013DeshiPolaОценок пока нет

- Financial Management HomeworkДокумент33 страницыFinancial Management HomeworkShielaОценок пока нет

- Assignment 1 Business & FinanceДокумент4 страницыAssignment 1 Business & FinanceSan Lizas AirenОценок пока нет

- Vendor-Form Sakchham KarkiДокумент4 страницыVendor-Form Sakchham KarkiMijuna RukihaОценок пока нет

- Poonawalla-backed Wellness Forever Plans $160 Million ListingДокумент4 страницыPoonawalla-backed Wellness Forever Plans $160 Million ListingAryan KapoorОценок пока нет

- Quick Check-Chapter 6: Skechers Famous FootwearДокумент2 страницыQuick Check-Chapter 6: Skechers Famous FootwearJannette Treviño RamosОценок пока нет

- GROUP 8 - Australia - COUNTRY RISK ANALYSISДокумент28 страницGROUP 8 - Australia - COUNTRY RISK ANALYSISvishnu sehrawatОценок пока нет

- The influence of capital structure on firm valueДокумент51 страницаThe influence of capital structure on firm valueDevikaОценок пока нет

- LiabilitiesДокумент2 страницыLiabilitiesFrederick AbellaОценок пока нет

- Latihan Soal Analysis of Financial StatementДокумент7 страницLatihan Soal Analysis of Financial StatementCaroline H24Оценок пока нет

- Tax Invoice / Bill of SupplyДокумент1 страницаTax Invoice / Bill of SupplyabhimanyuОценок пока нет

- Account Statement From 1 Nov 2020 To 9 Nov 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент2 страницыAccount Statement From 1 Nov 2020 To 9 Nov 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancevinod reddyОценок пока нет