Академический Документы

Профессиональный Документы

Культура Документы

11 Frenchppps

Загружено:

dahoune4728Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

11 Frenchppps

Загружено:

dahoune4728Авторское право:

Доступные форматы

French PPPs

Did 2005 see their coming of age?

Bruno Cantier

fter several years of expectation, 2005 has been an extremely busy year for French project finance teams and has fulfilled expectations in terms of development of the PPP market in France, even though most of the projects which have emerged were granted or tendered either on the basis of sectorial, availability-based PFI legislation (for prisons and hospitals) or through classic demand-based concession projects (for road projects), rather than on the basis of the new PPP on the basis of legislation enacted by the June 2004 PPP Ordinance. 2005 has also seen the creation or the announcement, by several important financial institutions, of heavily funded PPP-dedicated investment funds, in particular that of the CNCE, who could become important players in these projects in the years to come. As of October 2005, more than 30 PPP projects were launched in the healthcare sector on the basis of the 2003 hospital PFI sectorial legislation, including 4 major projects valued between h100 and 300 million each. In addition to this, 2005 saw the closing of Frances first demand-based rail concession since the Eurotunnel (the h1,200 million Perpignan Figueras HSL concession, concluded in February 2005), and of Frances biggest private financing ever in the motorway sector, the A 41 toll motorway project (concluded in November 2005 on a project-financed basis, with a private sector investment amounting to h940 million). The importance of the projects tendered, awarded or concluded, in a wide variety of sector ranging from hospitals to roads, and from prisons to

HSL projects has also helped the French market to forge what should be the main features of a French market practice for the next few years. 2005 has seen the development of new sets of contracts and standards, in particular in terms of risk allocation between the public and private sector, and in terms of liability caps between the project sponsors and the SPV. Even though some players and in particular EGF-BTP, representing the major French construction contractors have initially voiced some concerns regarding the relatively slow development of the non-sectorial PPP projects, it is important to note that 2005 has also seen an unprecedented move by the new French government, in the framework of its national macro-economic policies aimed at fostering domestic consumption through public sector spending, to enhance the recourse to the new legal framework set out by the June 2004 PPP Ordinance. In October 2005, the French government announced that it had identified more than 35 government projects of a value in excess of h9 billion which should be tendered out under this new legislation. As of January 2006, more than 4 major PPP rail projects and 2 road PPP projects were subject to the valuation pralable procedure1, and it is likely that a significant number of them will be tendered out in 2006. The local authorities seem to remain somehow reluctant towards PPP so far, but this should not necessarily be a surprise, in particular given the complexity of project-financed PPP projects and their lack of background experience with this structure.

2005 main developments, sector by sector Hospitals

If the motorway sector remains the reference, in terms of market standards and practices as far as demand-based, traffic risk concessions are concerned, the hospital sector has become in the past two years the key reference for French availability-based PPPs, in particular in terms of risk allocation, competitive dialogue procedure, payment mechanisms and termination provisions. As is generally the case in France, these PPP projects are mainly focused on construction and maintenance, and include relatively few services (with the exception of the supply of utilities such as heat, water and electricity). Services such as catering or laundry remain excluded from the scope of these contracts, and the main project sponsors are therefore mainly composed of construction contractors such as Bouygues, Eiffage and Vinci, utilities such as Dalkia or Gaz de France (Cofathec), or financial institutions such as Dexia, Calyon, ABN AMRO, SocGen, CDC or Ixis. Although they are eligible benefit from the June 2004 PPP Ordinance, French hospital PPP projects (BEH, acronym for long-term administrative lease, or Bail emphytotique hospitalier) have been, with almost no exceptions, tendered and granted on the basis of a sectorial, availabilitybased PFI legislation. The main advantage of this sectorial PPP legislation, which is based on similar features as those of the PPP Ordinance, consists in the absence of formal requirements for the public sector to enter into the long, costly and complex preliminary valuation pralable procedure imposed by the June 2004 PPP Ordinance.

40

www.infrastructurejournal.com

The most notable of the 30 projects (of varying sizes) which have emerged under this sectorial legislation consist of the big 4 projects, namely those of the hospitals of Caen, Saint Nazaire, Southern Ile de France and Bourgoin-Jallieu, which should represent an aggregated value of more than h700 million. The current status of these projects, as of 31 December 2005, is as follows: the h100 million Caen Hospital PPP has been awarded to a Bouygues-led consortium, in association with ABN Amro; the most important French hospital PPP ever, the h250/300 million Southern Ile de France Hospital PPP was at the BAFO stage; the h150/200 million Saint Nazaire and the h120million Bourgoin-Jallieu Hospital PPPs were at the initial competitive dialogue phase.

Roads

Motorway projects are traditionally in France the cutting edge sector, as far as project finance and PPP are concerned. As was 2004, 2005 has been particularly active in the road sector, as it has seen: the signing and approval of the h618 million A19 toll motorway concession to Vinci (on a corporate finance basis), the tendering and submission of a BAFO on the h900 million A65 toll motorway concession between Pau and Bordeaux, the award and conclusion of the record-breaking A41 toll motorway concession between Annecy and Geneva (on a project finance basis) to Bouygues and AREA (a subsidiary of the recently privatised French motorway giant APRR). With more than h940million of private sector investment based on a project-financed mini-perm debt, the A41 project outnumbers both A28 toll Motorway and Perpignan Figueras HSL concessions in terms of the amount of project financed senior debt.

Prisons

In the prisons sector, the Ministry of Justice has awarded to an Eiffage-led consortium in November 2005 its first wave of prison PPPs, consisting of an availabilitybased PFI concerning the construction and maintenance of 4 prisons located in eastern France, with estimated investment costs in the vicinity of h300million for 2800 inmates. The second wave of prison PPPs, with a similar scope and contractual structure, and consisting of 3 prisons located in western France, was tendered during the year 2005 and is currently at the competitive dialogue stage. As is the case for hospitals, and for the time being, the prison PPP projects have been granted on the basis of a sectorial PFI legislation and have excluded services (other than maintenance and utilities), such as catering and laundry. The French Ministry of Justice has however announced that the third wave of prison PPPs, due to be launched in early 2006, would be based on the June 2004 PPP Ordinance and would include a wider range of services, which may attract new types of project sponsors.

The second significant development of 2005 in terms of road PPPs (usually a stronghold of traditional French demandbased toll motorway concession), was the decision of the Government to launch, at the very end of this year, an valuation pralable procedure for several availability-based PPP contracts concerning important toll-free motorways, on the basis of the June 2004 PPP ordinance. One of the most advanced of the 4 availability-based road PFI projects currently being considered by the French Government is the A4/A86 freeway extension project, of an estimated amount of more than h600million.

In spite of the traditional reluctance of lenders to finance rail projects including substantial demand risk, the h1,200 million Perpignan Figueras HSL concession, a demand-based, traffic risk concession with a contract structure similar to those of French motorway concessions, reached financial close in February 2005 on a project finance basis. Awarded to an Eiffage/ACS consortium, and with a mini perm senior debt of more than h400million, it is one of the rare examples of this kind of structure. Furthermore, 2005 has seen an unprecedented move by the French Government to open up French domestic rail projects to PPP, which were before excluded by law from the scope of private finance, except for cross-border projects such as the Perpignan Figueras or Lyon Turin projects. A reform of the French legislation (finally approved by law 2006-10 of 5 January 2006) has lifted the prohibition of either demand-based and availabilitybased PPP structures for rail projects. The French Government decided in October 2005 to launch (either in 2006 or 2007) 5 major rail PPP projects (of a value exceeding h8000 million) under either a demand-based concession structure, or an availability-based PFI structure. The projects in question, some of which have already been submitted to the valuation pralable phase, are mainly composed of: the gigantic, 300 kilometre-long HSL between Tours and Bordeaux (the estimated value of which is comprised between 4 and 5 billion euros, and which should be tendered out in 2006 either under the form of a demandbased concession or of an availability based PFI), and also of four other rail projects of a value comprised for each between h600 million and h1200 million, namely: the h2200 million HSL Rhine Rhne East, which is planned to be tendered out on a contractual structure similar to that of

Rail

2005 has seen a tremendous evolution of both prospects and legal framework for French rail PPPs.

www.infrastructurejournal.com

41

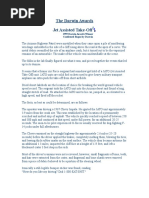

Summary of the main French PPP projects tendered out, awarded, closed or subject to a preliminary assessment procedure in 2005 N 1. Project A19 toll motorway Estimated value 618 million Type of contract demand-based, risk traffic concession Main bidding sponsors Vinci Eiffage / APRR Bouygues / ASF Bilfinger / SANEF Vinci/Ferrovial/ASF Eiffage Bouygues/APRR ASF/Acesa Eiffage/SANEF Bilfinger/APRR Bouygues N/A Status Awarded to Viinci and signed on January 2005

2.

A41 toll motorway

940 million

demand-based, risk traffic concession

Awarded to Bouygues/APRR in June 2005 Financial close reached in November 2005 BAFO submitted in December 2005

3.

A65 toll motorway

900 million

demand-based, risk traffic concession

4.

A4/A86 million motorway Perpignan Figueras HSL

650 million

availability-based PFI, based on the June 2004 PPP Ordinance demand-based, risk traffic concession

Evaluation pralable Tendering in 2006 Awarded to Eiffage/ACS in early 2004 Financial Close reached on February 2005 Evaluation pralable Tendering in 2006 Evaluation pralable Tendering in 2006

5.

1200 million

Vinci/Ferrovial Eiffage/ACS Bouygues.Acciona RFF/GIF N/A

6.

Tours Bordeaux HSL Rhine Rhone East (Dijon Mulhouse) HSL GSmillion Rail PPP Reims Light Rail First wave of prisons PPP Second wave of prisons PPP Caen Hospital PPP Saint Nazaire Hospital PPP Bourgoin-Jallieu Hospital PPP

4500 million

either demand-based, risk traffic concession or availability-based PFI availability-based PFI (based on the June 2004 PPP Ordinance) for the rail equipment, traditional procurement for civil works availability-based PFI, based on the June 2004 PPP Ordinance demand-based, traffic risk concession availability-based PFI, based on sectorial PFI legislation availability-based PFI, based on sectorial PFI legislation availability-based PFI, based on sectorial PFI legislation availability-based PFI, based on sectorial PFI legislation availability-based PFI, based on sectorial PFI legislation

7.

2200 million (including around 700 million for the rail equipment) 700 million

N/A

8.

N/A

Evaluation pralable Tendering in 2006

9.

300 million

Vinci/Bombardier/Keolis Tendered in 2005, award Alstom/Bouygues/Transdev projected in 2006 Eiffage/ Ansaldo/Connex Vinci/Ixis/GDF Eiffage Bouygues/Dexia Vinci/Ixis/GDF Eiffage Bouygues/Dexia Bouygues/ABN Amro CDC/Dexia/Icade/Eiffage Vinci/Calyon Eiffage Bouygues Vinci/Dexia Eiffage Bouygues Dalkia Vinci/Dexia/SG/Dalkia Eiffage Bouygues N/A Awarded to Eiffage on November 2005 Competitive dialogue phase BAFO to be submitted in the first half of 2006 Awarded to Bouygues/ABN Amro Competitive dialogue

10.

300 million

11.

250 million

12. 13.

100 million 50/200 million

14.

120 million _

Competitive dialogue

15.

Southern Ile de France Hospital PPP (CHSF) Annemasse Hospital PPP INSEP PPP

250/300 million

availability-based PFI, based on sectorial PFI legislation availability-based PFI, based on sectorial PFI legislation availability-based PFI, based on the June 2004 PPP Ordinance

BAFO to be submitted in midJanuary 2006 Preliminary studies Tendering projected in the first quarter of 2006 Evaluation pralable completed Tendered in September 2005

16.

100 to 150 million 60 million

17.

N/A

42

www.infrastructurejournal.com

Netherlands HSL Zuid (civil works under traditional procurement, and an estimated h700 million rail equipment under a PPP structure), the h1200 million Nmes Montpellier HSL, the h700 million GSM Rail PPP, the h650 million Roissy Express Link.

structure discussed during the competitive dialogue. The option, left open by the French PPP Ordinance, to enter into separate discussions with the bidders regarding the contractual aspects has seen little success, as it is widely viewed by the public sector as rendering more difficult the comparison between the various offers.

Given the importance of the investment and risks at stake, the feasibility of this ambitious agenda remains to be confirmed in the months to come.

Payment mechanism

The Payment mechanism is generally comprised of 2 distinct elements, the investment fee, on the one hand, and the operation and maintenance fee, on the other hand. In order to keep the financing costs as low as possible, most of the first French accommodation projects have provided that a substantial amount of the remuneration, in particular the investment fee, would not be impacted (or would not be significantly impacted) by penalties in case of poor performance. In some projects, penalties were limited to the operation and maintenance fee, and were generally not to affect the investment fee significantly in excess of 20 per cent of its amount. In addition to this, the French public sector has increasingly accepted to guarantee, after the completion date, a substantial part of the private sector debt (generally comprised between 65 and 80 per cent of the initial investment costs), in order to reduce further the private sector's financing costs.

Other

Other sectors have remained largely exempt from significant PPP activity. As was foreseeable given the institutional and political landscape of the Education sector, France has seen few if any projects launched or even considered in the education sector, traditionally amongst the most active sectors for PPP elsewhere in Europe. One of the few notable exceptions is the relatively small, h15 million School PPP planned by the Dpartement of Loiret, and which may be tendered out in 2006. The Defense sector, initially thought as a potential goldmine for availabilitybased PPPs has seen few significant projects proposed for the preliminary valuation pralable procedure, with the exception of some accommodation projects (such as the h60 million Dax Helicopter school, and the h60 million National Army Sports School of Fontainebleau), and of the h130 million Airforce IP Network project.

Termination provisions

Termination provisions are similar to those of traditional French demand-risk concession. Most of the contracts provide that the private sector will be entitled to recover, in case of forfeiture, a termination compensation from the public sector generally comprised between 75 per cent and 85 per cent of the net accounting value of the assets.

Specific features of French availability-based PPPs Approach to competitive dialogue

The current French market trend, as far as procedural aspects are concerned, is to consider the competitive dialogue phase as a way to finalise a unique contract structure for all bidders at BAFO stage. Bidders have few, if any, margin at BAFO stage to amend the contractual

concerns about the private sector's capacity to follow the move, in particular after the sale of the French motorway concessionaires to French and Spanish construction contractors. A reshuffle of the cards between the traditional sponsors and players of these projects (and more specifically a more significant role for the investment funds) would be a rather credible scenario if the infrastructure sector, which gets the bulk of the projected investment amounts, fulfils expectations in 2006. In the infrastructure sector, 2006 is expected to see the tendering of some of the major rail and road PPP projects evoked earlier, as well as the award of the A65 toll motorway concession. It may in addition see the tendering of the h1,000 million Reunion Island Mass Transit System PPP, as well as the award of the h300 million Reims light rail demandbased concession. In the accommodation sector, 2006 is expected to see the award and financial close of some of the currently most important French accommodation PPPs at the moment, and in particular of the second wave of prisons, and of the Southern Ile de France, Saint Nazaire and Bourgoin-Jallieu hospital PFI projects. 2006 should also see the tendering out of the h150 million Annemasse Hospital PPP, and of the third wave of prison PPPs. In addition to this already busy agenda, the French PPP market may also see, in 2006, the launching of valuation pralable procedures or even the tendering out of some of the 35 pilot PPP projects identified by the French Government. Bruno Cantier, Lovells

1 The Evaluation pralable procedure, a requirement of the June 2004 PPP Ordinance, provides that a prior assessment procedure aimed at demonstrating, through a public sector compartor, the opportunity to launch an availability-based PFI, should be put in place before the tendering out of a PFI project. This procedure generally takes between 3 to 6 months and requires the participation of high level financial and technical consultants.

Prospects for 2006/2007

Expectations are running high in the French PPP sector for 2006 and 2007, with the expected explosion of the projects tendered out under PPP structures, both in terms of numbers and in terms of value. This raises

www.infrastructurejournal.com

43

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- United States v. Stanley Baltrunas, 416 F.2d 401, 10th Cir. (1969)Документ3 страницыUnited States v. Stanley Baltrunas, 416 F.2d 401, 10th Cir. (1969)Scribd Government DocsОценок пока нет

- March 27, 2014Документ10 страницMarch 27, 2014The Delphos HeraldОценок пока нет

- Adjectives To Nouns: General VocabularyДокумент4 страницыAdjectives To Nouns: General VocabularyZoe78Оценок пока нет

- TOEFL READING COMPREHENSION STRATEGIESДокумент24 страницыTOEFL READING COMPREHENSION STRATEGIESGeoidy Stich80% (5)

- Not PrecedentialДокумент6 страницNot PrecedentialScribd Government DocsОценок пока нет

- 12-07-01 Imprisoned Court Watcher David Schied - The Judicial House of Cards and How It Is Falling Down at The Expense of The PeopleДокумент5 страниц12-07-01 Imprisoned Court Watcher David Schied - The Judicial House of Cards and How It Is Falling Down at The Expense of The PeopleHuman Rights Alert - NGO (RA)Оценок пока нет

- Unit 23Документ4 страницыUnit 23Andrea FieldsОценок пока нет

- Capili Vs CAДокумент6 страницCapili Vs CAKGTorresОценок пока нет

- Measures of Social Defense: Cornell Law ReviewДокумент23 страницыMeasures of Social Defense: Cornell Law ReviewPASION Jovelyn M.Оценок пока нет

- Conditional SentencesДокумент5 страницConditional SentencesHadiОценок пока нет

- People Vs Espidol VilluanuevaДокумент9 страницPeople Vs Espidol VilluanuevarhinaОценок пока нет

- Learning English March 2011 Advanced WorksheetsДокумент4 страницыLearning English March 2011 Advanced WorksheetsThe GuardianОценок пока нет

- United States v. Rivera-Rosario, 352 F.3d 1, 1st Cir. (2003)Документ18 страницUnited States v. Rivera-Rosario, 352 F.3d 1, 1st Cir. (2003)Scribd Government DocsОценок пока нет

- Curse of Strahd Backgrounds v1.1Документ10 страницCurse of Strahd Backgrounds v1.1Matheus Prado100% (2)

- Roads of Destiny: O. Henry Essay - O. Henry Short Fiction AnalysisДокумент4 страницыRoads of Destiny: O. Henry Essay - O. Henry Short Fiction AnalysisLivia TarlapanОценок пока нет

- Robert James Pitts v. State of North Carolina, 395 F.2d 182, 4th Cir. (1968)Документ9 страницRobert James Pitts v. State of North Carolina, 395 F.2d 182, 4th Cir. (1968)Scribd Government DocsОценок пока нет

- Capital Punishment in Pakistan LLBДокумент2 страницыCapital Punishment in Pakistan LLBAtifОценок пока нет

- Second Chances - Report by The ACLU of Michigan About Juvenile Life Without Parole Sentences in MichiganДокумент32 страницыSecond Chances - Report by The ACLU of Michigan About Juvenile Life Without Parole Sentences in MichiganTlecoz Huitzil100% (7)

- Bài Tập Đại Từ Quan Hệ Tiếng Anh Lớp 11Документ5 страницBài Tập Đại Từ Quan Hệ Tiếng Anh Lớp 11nguyentrang111Оценок пока нет

- The Seventh Tower - 3 AenirДокумент103 страницыThe Seventh Tower - 3 AenirsiciliadarianeОценок пока нет

- The Darwin Awards: Stories of accidental deaths through stupidityДокумент9 страницThe Darwin Awards: Stories of accidental deaths through stupidityJohn100% (1)

- Beard Head v. STAT - ComplaintДокумент116 страницBeard Head v. STAT - ComplaintSarah BursteinОценок пока нет

- Handbook For Prison LeadersДокумент150 страницHandbook For Prison LeadersAlfredo Cruz100% (1)

- UNITED STATES of America, Plaintiff-Appellee-Cross-Appellant, v. Robert Clay MEDLOCK, Defendant-Appellant-Cross - AppelleeДокумент7 страницUNITED STATES of America, Plaintiff-Appellee-Cross-Appellant, v. Robert Clay MEDLOCK, Defendant-Appellant-Cross - AppelleeScribd Government DocsОценок пока нет

- Mandalay in 1885-1888: The Letters of James Alfred Colbeck, Originally Selected and Edited by George H. Colbeck in 1892, ContinuedДокумент30 страницMandalay in 1885-1888: The Letters of James Alfred Colbeck, Originally Selected and Edited by George H. Colbeck in 1892, ContinuedapalamgОценок пока нет

- Psychopathy Is The Unified Theory of CrimeДокумент18 страницPsychopathy Is The Unified Theory of Crimebıind jonnОценок пока нет

- Eng. - 5 Complex SentencesДокумент22 страницыEng. - 5 Complex SentencesAiza ConchadaОценок пока нет

- Call of Cthulhu d20 Where Madness DwellsДокумент52 страницыCall of Cthulhu d20 Where Madness DwellsJosh N Oregonia100% (8)

- DDOPEN2018 - Gangs of WaterdeepДокумент77 страницDDOPEN2018 - Gangs of WaterdeepΜιχάλης Τερζάκης75% (4)

- Amit Lodha - Bihar DiariesДокумент249 страницAmit Lodha - Bihar DiariesMohammed Daniyal89% (37)