Академический Документы

Профессиональный Документы

Культура Документы

Table of Contents

Загружено:

William HarrisИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Table of Contents

Загружено:

William HarrisАвторское право:

Доступные форматы

Table of Contents Stock option awards under our equity incentive plans are granted at the fair market

value per share of our common stock on the date the option is granted as determined by reference to the closing price for shares of our common stock on the Nasdaq Global Select Market on the last market trading day prior to the date the option is granted. The options granted to our named executive officers typically vest ratably over a four-year period, commencing one year from the date of grant, and expire after 10 years. The restricted stock units granted by our Compensation Committee cliff vest either after a set period of time or upon the achievement of specified goals for our performance over a period of time. Awards of restricted stock with time-based vesting provide our named executive officers with a minimum level of value while also providing an additional incentive for such individuals to remain in their positions with us. Awards of restricted stock with performance-based vesting provide an additional incentive for our named executive officers to remain in their positions with us in order to realize the benefit of such award and also focus them on a performance parameter which the Compensation Committee considers beneficial to increasing the value of our stock, and consequently, stockholder value. The Compensation Committee determines the timing of the annual grants of stock options and restricted stock units to our named executive officers as well as the terms and restrictions applicable to such grants. The Compensation Committee approves generally in January of each year the annual grant to our executive officers after the Compensation Committee has reviewed the information set forth in the tally sheets. Grants may also be made in connection with commencement of employment, promotions, or tenure. The Compensation Committee adjusted the aggregate amount of the long-term incentive compensation awards for 2011 to increase the size of the award to an amount commensurate with the 50th percentile of similarly-situated companies, including the Peer Group. Consistent with prior years, the long-term incentive compensation awards for 2011 were comprised of three vehicles, weighted as follows: (i) 35% of the value of the award issued in stock options, (ii) 25% of the value of the award issued in time based restricted stock units and (iii) 40% of the value of the award issued in performance-based restricted stock units. Accordingly, on January 31, 2011, the Compensation Committee granted awards under the long-term incentive plan to our named executive officers, targeting grant values by type of award, as follows:

Restricted Stock Units Time-Based PerformanceVesting Based Vesting

Name

Cash

Stock Options1

Total

Mark E. Speese Robert D. Davis Mitchell E. Fadel Theodore V. DeMarino Christopher A. Korst

(1)

$ 1,298,550

$ $ $ $

120,260 205,660 86,074 97,440

$ 85,900 $146,900 $ 61,481 $ 69,600

$ $ $ $

137,440 235,040 98,370 111,360

$ 1,298,550 $ 343,600 $ 587,600 $ 245,925 $ 278,400

Tenure grants of 10,000 options made to each of Mr. Speese and Mr. Fadel on January 3, 2011 are not included in these amounts.

Consistent with prior long-term incentive awards years, the awards of restricted stock with performance-based vesting to our named executive officers (and performance-based cash, with respect to Mr. Speeses award) in January 2011 contained provisions with respect to our achievement of EBITDA. The Compensation Committee established a three-year EBITDA target as the appropriate basis upon which to measure our performance in this context. The Compensation Committee believes EBITDA represents an accurate indicator of our performance over an extended period of time, as an EBITDA measure incorporates certain factors which the Compensation Committee believes are important to an understanding of our performance over such period, such as an increase in revenue as well as the management of our expenses, while not incorporating other factors which the Compensation Committee does not believe are important to an understanding of our performance over such period, such as any repurchases of our outstanding

shares which would affect an earnings per share measurement. The Compensation Committee selected a three-year period over which to measure EBITDA based upon the time-period utilized with respect to awards made by similarly-situated public companies in the retail industry, as well as upon its belief that a three-year measurement period was appropriate to place an emphasis on our operating results over an extended period of time, as opposed to the single year measure which is utilized in our annual cash incentive program. In setting the target amount of EBITDA over such three-year period, the Compensation Committee reviewed with Mr. Speese our financial projections as well as the markets expectations with respect to our financial performance over such period. The three-year EBITDA target for the 2011 performance-based awards was set at $1.361 billion.

Вам также может понравиться

- Understanding Financial Statements (Review and Analysis of Straub's Book)От EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Рейтинг: 5 из 5 звезд5/5 (5)

- Remuneration Policy 2015Документ5 страницRemuneration Policy 2015Shahzad SalimОценок пока нет

- HSBC Remuneration Practices and GovernanceДокумент11 страницHSBC Remuneration Practices and GovernanceBhaktiОценок пока нет

- Based On Compensation & Benefits ManualДокумент7 страницBased On Compensation & Benefits ManualbapigangОценок пока нет

- HW 2-SolnДокумент9 страницHW 2-SolnZhaohui ChenОценок пока нет

- Alliance Concrete ForecastingДокумент7 страницAlliance Concrete ForecastingS r kОценок пока нет

- Employee Stock Option PlanДокумент7 страницEmployee Stock Option Plankrupalee100% (1)

- Esop Case StudyДокумент28 страницEsop Case Studyhareshms100% (2)

- KPMG Esop SurveyДокумент28 страницKPMG Esop Surveykunal2301Оценок пока нет

- Compensation and BenefitsДокумент28 страницCompensation and BenefitssubhidraОценок пока нет

- Test Bank - Chapter14 Capital BudgetingДокумент35 страницTest Bank - Chapter14 Capital BudgetingAiko E. Lara100% (8)

- Fortis Policy On Compensation & BenefitsДокумент7 страницFortis Policy On Compensation & BenefitsSomya TewariОценок пока нет

- Presented To:-Presented By: - Roll No #Документ25 страницPresented To:-Presented By: - Roll No #Aamir AttariОценок пока нет

- Linear Inequality Word ProblemsДокумент10 страницLinear Inequality Word ProblemsHao Lu100% (2)

- Employee Compensation and Benefits ProgramДокумент11 страницEmployee Compensation and Benefits ProgramAanchal chopraОценок пока нет

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionОт EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionОценок пока нет

- 2023 Fast 500 Winners List v1.1Документ16 страниц2023 Fast 500 Winners List v1.1William HarrisОценок пока нет

- Financial System and Financial MarketДокумент10 страницFinancial System and Financial MarketPulkit PareekОценок пока нет

- BDO V Republic DigestДокумент3 страницыBDO V Republic DigestTrem Gallente100% (2)

- Esop Process & Faq'sДокумент10 страницEsop Process & Faq'ssaurabhsarafОценок пока нет

- Bonus Shares and EsopДокумент4 страницыBonus Shares and EsopRon FlemingОценок пока нет

- GJU MBA 4th Sem NotesДокумент41 страницаGJU MBA 4th Sem NotesKapil Vats100% (3)

- Esop FinalДокумент31 страницаEsop Finalansh384100% (2)

- Q1 2023 AcquisitionsДокумент28 страницQ1 2023 AcquisitionsWilliam HarrisОценок пока нет

- Cost Accounting MCQ - S For End TermДокумент9 страницCost Accounting MCQ - S For End TermPRASANNA100% (1)

- Cost II CH 6 Pricing DecisionДокумент17 страницCost II CH 6 Pricing DecisionAshuОценок пока нет

- FOREX - Trading With Clouds - Ichimoku PDFДокумент5 страницFOREX - Trading With Clouds - Ichimoku PDFfmicrosoft9164Оценок пока нет

- E-Commerce Website: Final Year Project Short ProposalДокумент2 страницыE-Commerce Website: Final Year Project Short ProposalMobassar Khan100% (2)

- Porter's Generic StrategiesДокумент22 страницыPorter's Generic StrategiesChristian GuerОценок пока нет

- OCI NV Remuneration PolicyДокумент7 страницOCI NV Remuneration PolicyxymaanОценок пока нет

- Remuneration Policy and Senior Managers' Compensation: Stock Option PlanДокумент1 страницаRemuneration Policy and Senior Managers' Compensation: Stock Option PlanEr Tarun KumarОценок пока нет

- Case AnalysisДокумент8 страницCase AnalysisAnish GuptaОценок пока нет

- SC 2007Документ13 страницSC 2007chrisn87Оценок пока нет

- Total CompensationДокумент2 страницыTotal CompensationMahalaxmi SoojiОценок пока нет

- Roz BrewerДокумент4 страницыRoz BrewerCrainsChicagoBusinessОценок пока нет

- Board ManualДокумент3 страницыBoard ManualStuti GuptaОценок пока нет

- GE Executive CmpensationДокумент4 страницыGE Executive CmpensationRutwickОценок пока нет

- CHAPTER 17-scmДокумент15 страницCHAPTER 17-scmZsisum Meroo1Оценок пока нет

- R14 - Lesson 5 - Share-Based CompensationДокумент8 страницR14 - Lesson 5 - Share-Based CompensationDhar CHanОценок пока нет

- Compensation: Definition: Compensation Is What Employees Receive in Exchange For Their Contribution To The OrganisationДокумент36 страницCompensation: Definition: Compensation Is What Employees Receive in Exchange For Their Contribution To The OrganisationChandra Prakash JangidОценок пока нет

- Nota 8Документ6 страницNota 8Mariana PelinОценок пока нет

- Zoom Assignment PDFДокумент6 страницZoom Assignment PDFSibika GadiaОценок пока нет

- RT Annual Report Remuneration PolicyДокумент16 страницRT Annual Report Remuneration PolicyJohn KalvinОценок пока нет

- Analysis of Financial Statements: Analysis For The InvestorДокумент21 страницаAnalysis of Financial Statements: Analysis For The InvestorAnonymous BJRnKsОценок пока нет

- Dinda Putri Novanti 1910533004 - Summary Management Performance CompensationДокумент5 страницDinda Putri Novanti 1910533004 - Summary Management Performance CompensationDinda Putri NovantiОценок пока нет

- Employee Stock Option Plan 264Документ21 страницаEmployee Stock Option Plan 264TejalTamboliОценок пока нет

- Management CompensationДокумент15 страницManagement CompensationNikhil KhobragadeОценок пока нет

- IFRS 2 Share Based Payment Final Revision ChecklistДокумент17 страницIFRS 2 Share Based Payment Final Revision ChecklistEmezi Francis ObisikeОценок пока нет

- The Challenges in Compensation Decision For Special Groups W.R.T " "Документ18 страницThe Challenges in Compensation Decision For Special Groups W.R.T " "swt786Оценок пока нет

- Directors Report Year End: Mar '11Документ20 страницDirectors Report Year End: Mar '11Nirali ShahОценок пока нет

- Executive CompensationДокумент2 страницыExecutive Compensationricha928Оценок пока нет

- Lecture 9 Incentive Pay SystemДокумент15 страницLecture 9 Incentive Pay SystemAysha NavinaОценок пока нет

- TCFSL Remuneration PolicyДокумент4 страницыTCFSL Remuneration PolicyNISHA BANSALОценок пока нет

- Components of Directors' Remuneration PackageДокумент6 страницComponents of Directors' Remuneration PackageFidas RoyОценок пока нет

- Compensation Practices of Ashok Leyland: by Arjun and PriyankaДокумент15 страницCompensation Practices of Ashok Leyland: by Arjun and PriyankaAnonymous UP5RC6JpGОценок пока нет

- Performance EvaluationДокумент5 страницPerformance Evaluationrinto OdegawaОценок пока нет

- Mergers and Acquisitions: Sanjay Mehrotra FCA, MBAДокумент23 страницыMergers and Acquisitions: Sanjay Mehrotra FCA, MBAChinmay KhetanОценок пока нет

- PFRS2 - CFAS Group 2Документ3 страницыPFRS2 - CFAS Group 2Shivon Lazuli Lets playОценок пока нет

- Lar CkerДокумент28 страницLar CkerJobberdОценок пока нет

- This Plan Is To Align The Interest of Executives and Shareholders To Maximize The Shareholder Value UltimatelyДокумент5 страницThis Plan Is To Align The Interest of Executives and Shareholders To Maximize The Shareholder Value UltimatelySoumithra BiswasОценок пока нет

- REWARDS AND COMPENSATION MANAGEMENT-unit 4Документ9 страницREWARDS AND COMPENSATION MANAGEMENT-unit 4Poovarasan KarnanОценок пока нет

- 5share OptionsДокумент21 страница5share OptionsnengОценок пока нет

- Dividend Distibution Policy 05.08.2022Документ6 страницDividend Distibution Policy 05.08.2022Anshul GuptaОценок пока нет

- TCL RemunerationPolicyДокумент3 страницыTCL RemunerationPolicyPratyush KumarОценок пока нет

- CM Unit - IIIДокумент24 страницыCM Unit - IIIsunilkumarmswa22Оценок пока нет

- Remuneration PolicyДокумент4 страницыRemuneration PolicyKritika GargОценок пока нет

- Remuneration PolicyДокумент3 страницыRemuneration PolicyMahalaxmi SoojiОценок пока нет

- Executive Compensation-Class SlidesДокумент25 страницExecutive Compensation-Class SlidesSoni MainaliОценок пока нет

- Compensation For The Named Executive Officers in 2011 and 2010Документ1 страницаCompensation For The Named Executive Officers in 2011 and 2010GeorgeBessenyeiОценок пока нет

- Dilutive Securities and Earnings Per ShareДокумент11 страницDilutive Securities and Earnings Per ShareAdhiyanto PLОценок пока нет

- Analysis of Dividend PolicyДокумент6 страницAnalysis of Dividend PolicyShubhangi GargОценок пока нет

- ICAI Guidance Note - Employee Share-Based PaymentsДокумент66 страницICAI Guidance Note - Employee Share-Based PaymentssagarganuОценок пока нет

- 2023 ASI Impact ReportДокумент43 страницы2023 ASI Impact ReportWilliam HarrisОценок пока нет

- April 2024 CPRA Board Simoneaux 20240415 CompressedДокумент37 страницApril 2024 CPRA Board Simoneaux 20240415 CompressedWilliam HarrisОценок пока нет

- Market Report 2023 Q1 Full ReportДокумент17 страницMarket Report 2023 Q1 Full ReportKevin ParkerОценок пока нет

- Development: Washington, DCДокумент96 страницDevelopment: Washington, DCWilliam HarrisОценок пока нет

- QR 3 - FinalДокумент20 страницQR 3 - FinalWilliam HarrisОценок пока нет

- Copt 2021Документ44 страницыCopt 2021William HarrisОценок пока нет

- Atlanta 2022 Multifamily Investment Forecast ReportДокумент1 страницаAtlanta 2022 Multifamily Investment Forecast ReportWilliam HarrisОценок пока нет

- Pebblebrook Update On Recent Operating TrendsДокумент10 страницPebblebrook Update On Recent Operating TrendsWilliam HarrisОценок пока нет

- Regional Surveys of Business ActivityДокумент2 страницыRegional Surveys of Business ActivityWilliam HarrisОценок пока нет

- 2022 Abell Foundation Short Form Report 8yrДокумент36 страниц2022 Abell Foundation Short Form Report 8yrWilliam HarrisОценок пока нет

- Industry Update H2 2021 in Review: Fairmount PartnersДокумент13 страницIndustry Update H2 2021 in Review: Fairmount PartnersWilliam HarrisОценок пока нет

- FP Pharmaceutical Outsourcing Monitor 08.30.21Документ30 страницFP Pharmaceutical Outsourcing Monitor 08.30.21William HarrisОценок пока нет

- 3Q21 I81 78 Industrial MarketДокумент5 страниц3Q21 I81 78 Industrial MarketWilliam HarrisОценок пока нет

- FP - CTS Report Q3.20Документ13 страницFP - CTS Report Q3.20William HarrisОценок пока нет

- Manhattan RetailДокумент9 страницManhattan RetailWilliam HarrisОценок пока нет

- DSB Q3Документ8 страницDSB Q3William HarrisОценок пока нет

- FP - CTS Report H1.21Документ13 страницFP - CTS Report H1.21William HarrisОценок пока нет

- TROW Q3 2020 Earnings ReleaseДокумент15 страницTROW Q3 2020 Earnings ReleaseWilliam HarrisОценок пока нет

- 2020 Q3 Industrial Houston Report ColliersДокумент7 страниц2020 Q3 Industrial Houston Report ColliersWilliam HarrisОценок пока нет

- For Important Information, Please See The Important Disclosures Beginning On Page 2 of This DocumentДокумент5 страницFor Important Information, Please See The Important Disclosures Beginning On Page 2 of This DocumentWilliam HarrisОценок пока нет

- Gun Stocks: Fear Fires Up Investors To Purchase Gun StocksДокумент14 страницGun Stocks: Fear Fires Up Investors To Purchase Gun StocksWilliam HarrisОценок пока нет

- Richmond Office Performance in DownturnsДокумент1 страницаRichmond Office Performance in DownturnsWilliam HarrisОценок пока нет

- Healthcare Technology Mailer v14Документ4 страницыHealthcare Technology Mailer v14William HarrisОценок пока нет

- Comms Toolkit For MD Clean Energy Town HallДокумент4 страницыComms Toolkit For MD Clean Energy Town HallWilliam HarrisОценок пока нет

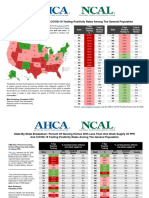

- State-By-State Breakdown: COVID-19 Testing Positivity Rates Among The General PopulationДокумент2 страницыState-By-State Breakdown: COVID-19 Testing Positivity Rates Among The General PopulationWilliam HarrisОценок пока нет

- Techbid PT212 PDFДокумент160 страницTechbid PT212 PDFSomeshОценок пока нет

- Wa0001Документ12 страницWa0001Sudip Issac SamОценок пока нет

- Warehouse Financing What Does Warehouse Financing Mean?Документ7 страницWarehouse Financing What Does Warehouse Financing Mean?swaati_uОценок пока нет

- Product Quote Template InstructionsДокумент6 страницProduct Quote Template InstructionsNakata Lintong SiagianОценок пока нет

- Marginal Utility in Class ExerciseДокумент1 страницаMarginal Utility in Class ExerciseVanish StarОценок пока нет

- 1.1 Energy Scenario - Revised (Table Format)Документ8 страниц1.1 Energy Scenario - Revised (Table Format)Gajanan JagtapОценок пока нет

- Right of Accession With Respect To Immovable PropertyДокумент4 страницыRight of Accession With Respect To Immovable PropertyAnonymous rf30olОценок пока нет

- Store RecordsДокумент10 страницStore RecordsKavitha ReddyОценок пока нет

- Virtonomics Data Collection FormДокумент8 страницVirtonomics Data Collection Formapi-410426030Оценок пока нет

- NET PRESENT VALUE (NPV) PwrpointДокумент42 страницыNET PRESENT VALUE (NPV) Pwrpointjumar_loocОценок пока нет

- VALUATION METHOD 1 Part 1Документ5 страницVALUATION METHOD 1 Part 1Lloyd AniñonОценок пока нет

- Electricity Facts Label: StarTex Power - 12 Month Usage Bill CreditДокумент3 страницыElectricity Facts Label: StarTex Power - 12 Month Usage Bill CreditElectricity RatingsОценок пока нет

- Strategy Comprehensive MMДокумент286 страницStrategy Comprehensive MMf318480Оценок пока нет

- Materi BPK Wisnu Wardana Indonesia Econ Outlook-Cfo Forum 2023Документ21 страницаMateri BPK Wisnu Wardana Indonesia Econ Outlook-Cfo Forum 2023anggara.mastangiОценок пока нет

- Global Insurance Trends Analysis 2016Документ29 страницGlobal Insurance Trends Analysis 2016Rahul MandalОценок пока нет

- Inventory Management, Supply Contracts and Risk PoolingДокумент96 страницInventory Management, Supply Contracts and Risk PoolingdhiarОценок пока нет

- Gebauer2017 PDFДокумент10 страницGebauer2017 PDFSHIVAM TOMAR MBA 2019-21 (Delhi)Оценок пока нет

- IBIG 06 01 Three Statements 30 Minutes CompleteДокумент12 страницIBIG 06 01 Three Statements 30 Minutes CompletedarylchanОценок пока нет