Академический Документы

Профессиональный Документы

Культура Документы

NCB Case Study

Загружено:

Danish QueuИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

NCB Case Study

Загружено:

Danish QueuАвторское право:

Доступные форматы

NCB Introduction: The National Commercial Bank was the first Saudi bank to be licensed and the biggest

in the Kingdom and a leading financial institution in the Region. NCB provides the highest standards in Islamic banking, with a customer-focused approach that emphasizes service, quality convenience, and innovation. The Bank initiated business in the name of The National Commercial Bank under Royal Decree on 20 Rabi Thani 1373H (26 December 1953). The National Commercial Bank owns 90.424% of NCB Capital, the Premier Investment bank in the Kingdom, and owns 64.68% of Turkiye Finans Katilim Bankasti (TFKB), the leading bank in Islamic Banking in Turkey.

Key Facts & Figures: The Banker ranked NCB as # 1 in the Middle East & # 126 in the World according to its Tier 1 Capital. Best Private Banking in KSA by Euromoney. The NCB is the largest Bank in the Arab world. The Banks paid-up capital is SR 15,000 million (US$ 4,000 million). At year-end 2010, the Bank has operated 284 branches throughout the Kingdom, dedicated exclusively to Islamic Banking services. At year-end 2010, the Banks customers had surpassed 2.3 million clients. At year-end 2010, the Bank employees throughout the Kingdom had reached a total manpower of 5,443 of which 89.4% are Saudis. At year-end 2010, the Bank has operated 1626 Automated Teller Machines throughout the Kingdom. Over 89% of customer transactions had been successfully executed through alternative delivery channels during fiscal year 2010.

Business Need NCB IT department has more than 30 in-house projects with approx. 150 developers and testers. To increase the efficiency of the IT Department, minimize bugs, reduce time to production and improve the quality of the development process. NCB needed to establish more effective communication and collaboration between development teams, which were spread out on three different floors of NCB IT building. The company also needed a global solution for testing and quality management that would provide a central focal point for all testing documentation, test scripts and information. Challenge As a result of several projects, NCB development efforts were spread out among different teams and vendors. It was having difficulty combining components from different teams to create its applications, delaying product releases and driving up development costs. Solution Royal Cyber Inc. implemented IBM Rational Team Concert which is one of the main CLM Rational Jazz application. Based on the IBM Jazz platform, the RTC application supports distributed teams by providing communication in context, event feeds, integrated chat and automated traceability. Facilitating communication between the companys development teams and vendors, helps reduce inconsistencies between different platform components. In addition to providing a more modern, intuitive interface for the companys developers, Rational Team Concert delivers dashboards and reports to help projects stay on track, work items to help track changes through the development lifecycle and advanced source control functionality that supports component-based development. To meet the QA teams testing requirements, Royal Cyber Inc. implemented IBM Rational Quality Manager another application of CLM, built on the Rational Jazz platform. The CLM Rational Jazz platform enables collaboration amongst business stakeholders and software developers while Rational Quality Manager software supports a geographically distributed team by executing Rational Functional Tester Scripts from anywhere via Jazz and other Internet technologies. Benefits Improves communication and collaboration between development teams, resulting in greater productivity and reduced costs. Increase the efficiency of the NCB IT department, reduce time to market and improve the quality of the development process. Reduces the time required to debug applications through a common communication platform, improving operational efficiency. Centralized and organized system for testing documents and central scripts repository have helped the bank reduce development and the reuse of frequently used scripts.

Вам также может понравиться

- Building Business Apps in C A Step-by-Step Guide to Enterprise Application DevelopmentОт EverandBuilding Business Apps in C A Step-by-Step Guide to Enterprise Application DevelopmentОценок пока нет

- Infosys Finacle Client Innovation Booklet 2019Документ40 страницInfosys Finacle Client Innovation Booklet 2019MomoОценок пока нет

- Blockchain Technology for Paperless Trade Facilitation in MaldivesОт EverandBlockchain Technology for Paperless Trade Facilitation in MaldivesОценок пока нет

- Barclays Case Study.Документ2 страницыBarclays Case Study.ReemaОценок пока нет

- Enabling Globalization- a Guide to Using Localization to Penetrate International MarketsОт EverandEnabling Globalization- a Guide to Using Localization to Penetrate International MarketsРейтинг: 5 из 5 звезд5/5 (1)

- Discover The Digital Banking Evolution - From Legacy To Cutting-Edge Download Now!Документ6 страницDiscover The Digital Banking Evolution - From Legacy To Cutting-Edge Download Now!gaikwadswapna5Оценок пока нет

- FinacleДокумент28 страницFinacleshanthi rajesh100% (1)

- Usama CVДокумент4 страницыUsama CVusama.islam100Оценок пока нет

- 3.process MGMT at Celestica LTDДокумент4 страницы3.process MGMT at Celestica LTDDevspringОценок пока нет

- Gvs BankingДокумент4 страницыGvs BankingGayatriThotakuraОценок пока нет

- Audit in CBS Environment: CA. Kuntal P. Shah BackgroundДокумент28 страницAudit in CBS Environment: CA. Kuntal P. Shah BackgroundPatricia UkemОценок пока нет

- China Trust Commercial Case Study 076961Документ4 страницыChina Trust Commercial Case Study 076961conglyhuynhОценок пока нет

- Working Capital ReportДокумент61 страницаWorking Capital ReportNikhil SharmaОценок пока нет

- Oracle Banking Platform BR 1841108Документ8 страницOracle Banking Platform BR 1841108Nicolae Lungu0% (1)

- Supply Chain of Reval: (Indian Institute of Foreign Trade)Документ17 страницSupply Chain of Reval: (Indian Institute of Foreign Trade)Shaveta_Khuran_5978100% (1)

- FinacleДокумент28 страницFinaclePayal Harshil Shah100% (4)

- Oracle Banking Platform: Enabling Transformation of Retail BankingДокумент8 страницOracle Banking Platform: Enabling Transformation of Retail BankingGajendra KanseОценок пока нет

- Pibas Core Business Solution (A Software Proposal To HBL)Документ26 страницPibas Core Business Solution (A Software Proposal To HBL)m78654321Оценок пока нет

- Islamic Banking Solution by OracleДокумент30 страницIslamic Banking Solution by OracleAlHuda Centre of Islamic Banking & Economics (CIBE)Оценок пока нет

- Rajshahi Krishi Unnayan Bank: Terms of Reference (TOR) ForДокумент15 страницRajshahi Krishi Unnayan Bank: Terms of Reference (TOR) ForImran HasanОценок пока нет

- TCS BaNCS Brochure Core Banking 1212-1Документ8 страницTCS BaNCS Brochure Core Banking 1212-1Muktheshwar ReddyОценок пока нет

- Global Workforce Solutions and Professional Services Rock Star Consulting GroupДокумент15 страницGlobal Workforce Solutions and Professional Services Rock Star Consulting Groupbob panicОценок пока нет

- Pre and Post Merger AnalysisДокумент84 страницыPre and Post Merger AnalysisMano BernardОценок пока нет

- Shri Shambhubhai V. Patel College of Computer Science & Business Management Affiliated To Veer Narmad South Gujarat University, SuratДокумент29 страницShri Shambhubhai V. Patel College of Computer Science & Business Management Affiliated To Veer Narmad South Gujarat University, Surat241 Dhruvi ShiyaniОценок пока нет

- Case Study Deutsche Bank Compas Banking Luxoft For Risk Management AdvisoryДокумент5 страницCase Study Deutsche Bank Compas Banking Luxoft For Risk Management AdvisoryluxoftОценок пока нет

- Opentext Celent c2b Integration Hybrid Approach ReportДокумент28 страницOpentext Celent c2b Integration Hybrid Approach ReportArpit AgarwalОценок пока нет

- Ruchi Kashyap Profile-2Документ4 страницыRuchi Kashyap Profile-2probal.silОценок пока нет

- Suman Mondal Resume 2504Документ3 страницыSuman Mondal Resume 2504sanjib paridaОценок пока нет

- Quicken LoansДокумент3 страницыQuicken LoanshellowodОценок пока нет

- Suresh 7.9YrsExp AutomationTestEngineerДокумент5 страницSuresh 7.9YrsExp AutomationTestEngineervenkat reddyОценок пока нет

- Credit Management System (LEADING INDIAN BANK) (Java-Oracle9i)Документ117 страницCredit Management System (LEADING INDIAN BANK) (Java-Oracle9i)Manish Sharma0% (1)

- Assignment No 2Документ8 страницAssignment No 2samarОценок пока нет

- Overview of Banks in PakistanДокумент3 страницыOverview of Banks in PakistanHaroon KhanОценок пока нет

- A Fresh Start: Core Systems ModernizationДокумент15 страницA Fresh Start: Core Systems Modernizationvij_in2006Оценок пока нет

- Implementing FLEXCUBE: A Case StudyДокумент4 страницыImplementing FLEXCUBE: A Case StudySenathipathi RamkumarОценок пока нет

- SAP Manage Offering Newsletter: GreetingsДокумент9 страницSAP Manage Offering Newsletter: Greetingsanirban.bit5406Оценок пока нет

- OracleДокумент144 страницыOracleBhaveen JoshiОценок пока нет

- NSE's MarketsДокумент5 страницNSE's MarketsvikashotcoolОценок пока нет

- Financial Management: Pakistan Telecommunication LimitedДокумент23 страницыFinancial Management: Pakistan Telecommunication LimitedmdsonuОценок пока нет

- Resume Ashwani MishraДокумент8 страницResume Ashwani Mishramdkamal0% (1)

- K04844 - PCF - Banking - Vers - 6.1.0 - April 2023Документ27 страницK04844 - PCF - Banking - Vers - 6.1.0 - April 2023estefanibearroyoОценок пока нет

- Extranet ProjДокумент11 страницExtranet ProjDexter KamalОценок пока нет

- TEMENOS CoreBanking BrochureДокумент12 страницTEMENOS CoreBanking BrochureRahul Tripathi100% (1)

- Aber Report 2020 - en - 4Документ92 страницыAber Report 2020 - en - 4ForkLogОценок пока нет

- Mis 305 Assignment 2Документ20 страницMis 305 Assignment 2Fahim AhmedОценок пока нет

- Tcs Bancs DigitalДокумент4 страницыTcs Bancs Digitalspiritual pfiОценок пока нет

- Pitchaiah - 4 Years - 1.8 Years RPAДокумент4 страницыPitchaiah - 4 Years - 1.8 Years RPAhimijain347Оценок пока нет

- Ma Him Naji ShuklaДокумент6 страницMa Him Naji Shuklaabu1882Оценок пока нет

- Allied Bank Limited: DetailsДокумент11 страницAllied Bank Limited: DetailsRida ZehraОценок пока нет

- Timeless BlackДокумент2 страницыTimeless BlackjaneisgoodcatОценок пока нет

- Resume 4Документ4 страницыResume 4KishoreОценок пока нет

- Project Report of DISA 2.0 CourseДокумент12 страницProject Report of DISA 2.0 CourseCA Nikhil BazariОценок пока нет

- Rizwan KhanДокумент95 страницRizwan KhanAshutoshSharmaОценок пока нет

- SUNAINA GUPTA For Quality Center Admin With ALM, MumbaiДокумент4 страницыSUNAINA GUPTA For Quality Center Admin With ALM, MumbaiAndrewOberoiОценок пока нет

- Finacle: Detailed Solution DescriptionДокумент4 страницыFinacle: Detailed Solution DescriptionVibhor JoshiОценок пока нет

- Design of Study: ObjectiveДокумент48 страницDesign of Study: ObjectiveHitesh MoreОценок пока нет

- Core Banking Con SOAДокумент13 страницCore Banking Con SOAPatricio SilvaОценок пока нет

- Bank Islami: Management Information SystemsДокумент11 страницBank Islami: Management Information SystemsSaad AfridiОценок пока нет

- Group NO 11 Confarance PaperДокумент5 страницGroup NO 11 Confarance PaperTejaswini UpadhyeОценок пока нет

- Finacle Core Banking Brochure 2022Документ24 страницыFinacle Core Banking Brochure 2022Prashant YadavОценок пока нет

- Fundamentals of Accounting II AssignmentДокумент2 страницыFundamentals of Accounting II Assignmentbirukandualem946Оценок пока нет

- Atestat Pagau Maria XII-E CNPCB CorectatДокумент5 страницAtestat Pagau Maria XII-E CNPCB CorectatMaria ItuОценок пока нет

- 1LPS 3 BoQ TemplateДокумент369 страниц1LPS 3 BoQ TemplateAbdulrahman AlkilaniОценок пока нет

- Persona Based Identity and Access ManagementДокумент39 страницPersona Based Identity and Access Managementsneha sureshbabuОценок пока нет

- Six Sigma Control PDFДокумент74 страницыSix Sigma Control PDFnaacha457Оценок пока нет

- Bony IauДокумент572 страницыBony IauTommy HectorОценок пока нет

- Company Profile of Tradexcel Graphics LTDДокумент19 страницCompany Profile of Tradexcel Graphics LTDDewan ShuvoОценок пока нет

- Din 11864 / Din 11853: Armaturenwerk Hötensleben GMBHДокумент70 страницDin 11864 / Din 11853: Armaturenwerk Hötensleben GMBHkrisОценок пока нет

- English 8 - Q3 - Las 1 RTP PDFДокумент4 страницыEnglish 8 - Q3 - Las 1 RTP PDFKim Elyssa SalamatОценок пока нет

- Uber Final PPT - Targeting and Positioning MissingДокумент14 страницUber Final PPT - Targeting and Positioning MissingAquarius Anum0% (1)

- BBA Semester III Project (Marketing Strategy) BritanniaДокумент65 страницBBA Semester III Project (Marketing Strategy) BritanniaWe Rocks100% (1)

- Practicum ReportДокумент30 страницPracticum ReportCharlie Jhake Gray0% (2)

- Tax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJДокумент1 страницаTax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJMrugesh Joshi50% (2)

- 01 Pengantar SCMДокумент46 страниц01 Pengantar SCMAdit K. BagaskoroОценок пока нет

- Walmart GRRДокумент174 страницыWalmart GRRPatricia DillonОценок пока нет

- Q4M1Документ54 страницыQ4M1Klyn AgananОценок пока нет

- Organization Chart UpdatedДокумент1 страницаOrganization Chart UpdatedganrashОценок пока нет

- DSE Assignment SummaryДокумент14 страницDSE Assignment SummaryDipongkorPaulОценок пока нет

- Chapter 15 PartnershipДокумент56 страницChapter 15 PartnershipNurullita KartikaОценок пока нет

- Retail Store Operations Reliance Retail LTD: Summer Project/Internship ReportДокумент48 страницRetail Store Operations Reliance Retail LTD: Summer Project/Internship ReportRaviRamchandaniОценок пока нет

- Coi D00387Документ101 страницаCoi D00387Fazila KhanОценок пока нет

- Ccs (Conduct) RulesДокумент3 страницыCcs (Conduct) RulesKawaljeetОценок пока нет

- Lean Production SystemДокумент8 страницLean Production SystemRoni Komarul HayatОценок пока нет

- 703 07s 05 SCMДокумент12 страниц703 07s 05 SCMDiana Leonita FajriОценок пока нет

- Heller - Sues - GT Heller V Greenberg TraurigДокумент45 страницHeller - Sues - GT Heller V Greenberg TraurigRandy PotterОценок пока нет

- Alok Kumar Singh Section C WAC I 3Документ7 страницAlok Kumar Singh Section C WAC I 3Alok SinghОценок пока нет

- MKT 566 Quiz 2Документ16 страницMKT 566 Quiz 2kaz92Оценок пока нет

- Black Book PDFДокумент69 страницBlack Book PDFManjodh Singh BassiОценок пока нет

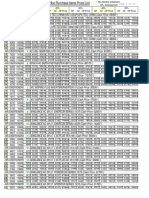

- PriceListHirePurchase Normal6thNov2019Документ56 страницPriceListHirePurchase Normal6thNov2019Jamil AhmedОценок пока нет

- Fundamentals of Data Engineering: Plan and Build Robust Data SystemsОт EverandFundamentals of Data Engineering: Plan and Build Robust Data SystemsРейтинг: 5 из 5 звезд5/5 (1)

- Product Operations: How successful companies build better products at scaleОт EverandProduct Operations: How successful companies build better products at scaleОценок пока нет

- Business Intelligence Strategy and Big Data Analytics: A General Management PerspectiveОт EverandBusiness Intelligence Strategy and Big Data Analytics: A General Management PerspectiveРейтинг: 5 из 5 звезд5/5 (5)

- The Non-Technical Founder: How a 16-Year Old Built a Six Figure Software Company Without Writing Any CodeОт EverandThe Non-Technical Founder: How a 16-Year Old Built a Six Figure Software Company Without Writing Any CodeРейтинг: 4 из 5 звезд4/5 (1)

- ChatGPT Millionaire 2024 - Bot-Driven Side Hustles, Prompt Engineering Shortcut Secrets, and Automated Income Streams that Print Money While You Sleep. The Ultimate Beginner’s Guide for AI BusinessОт EverandChatGPT Millionaire 2024 - Bot-Driven Side Hustles, Prompt Engineering Shortcut Secrets, and Automated Income Streams that Print Money While You Sleep. The Ultimate Beginner’s Guide for AI BusinessОценок пока нет

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveОт EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveОценок пока нет

- Designing Data-Intensive Applications: The Big Ideas Behind Reliable, Scalable, and Maintainable SystemsОт EverandDesigning Data-Intensive Applications: The Big Ideas Behind Reliable, Scalable, and Maintainable SystemsРейтинг: 5 из 5 звезд5/5 (6)

- Design and Build Modern Datacentres, A to Z practical guideОт EverandDesign and Build Modern Datacentres, A to Z practical guideРейтинг: 3 из 5 звезд3/5 (2)

- Notion for Beginners: Notion for Work, Play, and ProductivityОт EverandNotion for Beginners: Notion for Work, Play, and ProductivityРейтинг: 4 из 5 звезд4/5 (8)

- Change Management for Beginners: Understanding Change Processes and Actively Shaping ThemОт EverandChange Management for Beginners: Understanding Change Processes and Actively Shaping ThemРейтинг: 4.5 из 5 звезд4.5/5 (3)

- Creating Online Courses with ChatGPT | A Step-by-Step Guide with Prompt TemplatesОт EverandCreating Online Courses with ChatGPT | A Step-by-Step Guide with Prompt TemplatesРейтинг: 4 из 5 звезд4/5 (4)

- Learn Power BI: A beginner's guide to developing interactive business intelligence solutions using Microsoft Power BIОт EverandLearn Power BI: A beginner's guide to developing interactive business intelligence solutions using Microsoft Power BIРейтинг: 5 из 5 звезд5/5 (1)

- Managing Humans: Biting and Humorous Tales of a Software Engineering ManagerОт EverandManaging Humans: Biting and Humorous Tales of a Software Engineering ManagerРейтинг: 4 из 5 звезд4/5 (90)

- Python for Beginners: A Crash Course Guide to Learn Python in 1 WeekОт EverandPython for Beginners: A Crash Course Guide to Learn Python in 1 WeekРейтинг: 4.5 из 5 звезд4.5/5 (7)

- The Complete Business Process Handbook: Body of Knowledge from Process Modeling to BPM, Volume 1От EverandThe Complete Business Process Handbook: Body of Knowledge from Process Modeling to BPM, Volume 1Рейтинг: 4.5 из 5 звезд4.5/5 (7)

- Artificial Intelligence in Practice: How 50 Successful Companies Used AI and Machine Learning to Solve ProblemsОт EverandArtificial Intelligence in Practice: How 50 Successful Companies Used AI and Machine Learning to Solve ProblemsРейтинг: 4.5 из 5 звезд4.5/5 (38)

- Excel Formulas That Automate Tasks You No Longer Have Time ForОт EverandExcel Formulas That Automate Tasks You No Longer Have Time ForРейтинг: 5 из 5 звезд5/5 (1)

- The Ultimate Excel VBA Master: A Complete, Step-by-Step Guide to Becoming Excel VBA Master from ScratchОт EverandThe Ultimate Excel VBA Master: A Complete, Step-by-Step Guide to Becoming Excel VBA Master from ScratchОценок пока нет