Академический Документы

Профессиональный Документы

Культура Документы

120320

Загружено:

Vinh NguyenИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

120320

Загружено:

Vinh NguyenАвторское право:

Доступные форматы

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Econ 203 Lect A, Tut C - Tutorial 9

Tutor: Vinh Nguyen1 (vinhcit@gmail.com)

1 Concordia

University

Mar 20, 2012

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Monetary Policy Targets and Instrument in Canada

Targets:

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Monetary Policy Targets and Instrument in Canada

Targets: Foreign exchange rate (1960s)

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Monetary Policy Targets and Instrument in Canada

Targets: Foreign exchange rate (1960s) Money supply (1970s early 1990s)

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Monetary Policy Targets and Instrument in Canada

Targets: Foreign exchange rate (1960s) Money supply (1970s early 1990s) Ination rate (early 1990s present)

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Monetary Policy Targets and Instrument in Canada

Targets: Foreign exchange rate (1960s) Money supply (1970s early 1990s) Ination rate (early 1990s present) Instrument: interest rate. In Canada: overnight rate (the

interest rate large nancial institutions receive or pay on loans from one day until the next)

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Monetary Policy Targets and Instrument in Canada

Targets: Foreign exchange rate (1960s) Money supply (1970s early 1990s) Ination rate (early 1990s present) Instrument: interest rate. In Canada: overnight rate (the

interest rate large nancial institutions receive or pay on loans from one day until the next)

A relationship:

bank rate overnight rate + 0.25%

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Monetary Policy Targets and Instrument in Canada

Targets: Foreign exchange rate (1960s) Money supply (1970s early 1990s) Ination rate (early 1990s present) Instrument: interest rate. In Canada: overnight rate (the

interest rate large nancial institutions receive or pay on loans from one day until the next)

A relationship:

bank rate overnight rate + 0.25%

Overnight rate commercial bank lending rates

expansion in the money supply

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Taylor Rule

Taylor Rule:

i = i0 + a ( ) + b (Y Yp )

>0 >0

where is the banks target ination rate and i0 is the target nominal interest

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Taylor Rule

Taylor Rule:

i = i0 + a ( ) + b (Y Yp )

>0 >0

where is the banks target ination rate and i0 is the target nominal interest

Long-run change: change in i0

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Taylor Rule

Taylor Rule:

i = i0 + a ( ) + b (Y Yp )

>0 >0

where is the banks target ination rate and i0 is the target nominal interest

Long-run change: change in i0 Short-run change: temporarily set the nominal rate to i

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(i)(iv)

Were given:

i = i0 + ( ) + (Y Yp )

where

= 2%

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(i)(iv)

Were given:

i = i0 + ( ) + (Y Yp )

where

= 2%

(i) With i0 = 9%, = , Y = Yp , it must be that

i = i0 = 9%.

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(i)(iv)

Were given:

i = i0 + ( ) + (Y Yp )

where

= 2%

(i) With i0 = 9%, = , Y = Yp , it must be that

i = i0 = 9%.

(ii) Now, we have Y Yp = 5% and = . Then,

i = i0 5% = 4%.

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(i)(iv)

Were given:

i = i0 + ( ) + (Y Yp )

where

= 2%

(i) With i0 = 9%, = , Y = Yp , it must be that

i = i0 = 9%.

(ii) Now, we have Y Yp = 5% and = . Then,

i = i0 5% = 4%.

(iii) i dropping shifts the AD and AS curves up (see

Figure 10.8 on page 260)

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(i)(iv)

Were given:

i = i0 + ( ) + (Y Yp )

where

= 2%

(i) With i0 = 9%, = , Y = Yp , it must be that

i = i0 = 9%.

(ii) Now, we have Y Yp = 5% and = . Then,

i = i0 5% = 4%.

(iii) i dropping shifts the AD and AS curves up (see

Figure 10.8 on page 260)

(iv) i was 9% and now i = 4%, so i = 5%. Thus,

= 1.5i = 2% 1.5(5%) = 9.5%

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(v),(vi)

Again:

i = i0 + ( ) + (Y Yp )

where

= 2%

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(v),(vi)

Again:

i = i0 + ( ) + (Y Yp )

where

= 2%

(v) Now = 1.5i, so = 1.5i. First,

notice: inew = i0 1.5i + (Y Yp ) = iold 1.5i + (Y Yp )

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(v),(vi)

Again:

i = i0 + ( ) + (Y Yp )

where

= 2%

(v) Now = 1.5i, so = 1.5i. First,

notice: inew = i0 1.5i + (Y Yp ) = iold 1.5i + (Y Yp )

It follows that

i = 1.5i + (Y Yp )

2.5i = (Y Yp )

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(v),(vi)

Again:

i = i0 + ( ) + (Y Yp )

where

= 2%

(v) Now = 1.5i, so = 1.5i. First,

notice: inew = i0 1.5i + (Y Yp ) = iold 1.5i + (Y Yp )

It follows that

i = 1.5i + (Y Yp )

2.5i = (Y Yp )

With Y Yp = 5%, it must be that i = 2%. So

inew = iold + i = 9% 2% = 7%

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(v),(vi)

Again:

i = i0 + ( ) + (Y Yp )

where

= 2%

(v) Now = 1.5i, so = 1.5i. First,

notice: inew = i0 1.5i + (Y Yp ) = iold 1.5i + (Y Yp )

It follows that

i = 1.5i + (Y Yp )

2.5i = (Y Yp )

With Y Yp = 5%, it must be that i = 2%. So

inew = iold + i = 9% 2% = 7%

(vi) We have = 1.5i = 2% 1.5(2%) = 5%.

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(vii) and MC 6 from Tut 8

(vii) Lowering interest rate creates an upward pressure on

ination.

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(vii) and MC 6 from Tut 8

(vii) Lowering interest rate creates an upward pressure on

ination.

When is taken into account, the BoC is more careful

with lowering the interest so as to not raising too high. Thus, i (part (v)) is higher than i (part (ii)).

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(vii) and MC 6 from Tut 8

(vii) Lowering interest rate creates an upward pressure on

ination.

When is taken into account, the BoC is more careful

with lowering the interest so as to not raising too high. Thus, i (part (v)) is higher than i (part (ii)). MC 6 from Tut 8. Long term eects allude to change in potential output, so (C) is a right choice.

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(vii) and MC 6 from Tut 8

(vii) Lowering interest rate creates an upward pressure on

ination.

When is taken into account, the BoC is more careful

with lowering the interest so as to not raising too high. Thus, i (part (v)) is higher than i (part (ii)). MC 6 from Tut 8. Long term eects allude to change in potential output, so (C) is a right choice.

SRAS is a temporary measure to maintain the overnight

rate so (A) is wrong. Correction: [I misread SRAS into SPRA] In any case, SRAS = short-run aggregate supply, which has little to do with long term potential output, so (A) is not the right choice.

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(vii) and MC 6 from Tut 8

(vii) Lowering interest rate creates an upward pressure on

ination.

When is taken into account, the BoC is more careful

with lowering the interest so as to not raising too high. Thus, i (part (v)) is higher than i (part (ii)). MC 6 from Tut 8. Long term eects allude to change in potential output, so (C) is a right choice.

SRAS is a temporary measure to maintain the overnight

rate so (A) is wrong. Correction: [I misread SRAS into SPRA] In any case, SRAS = short-run aggregate supply, which has little to do with long term potential output, so (A) is not the right choice. AD can be shifted without any change to potential output (see Figure 10.8, page 260). (B) is also wrong.

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 1(vii) and MC 6 from Tut 8

(vii) Lowering interest rate creates an upward pressure on

ination.

When is taken into account, the BoC is more careful

with lowering the interest so as to not raising too high. Thus, i (part (v)) is higher than i (part (ii)). MC 6 from Tut 8. Long term eects allude to change in potential output, so (C) is a right choice.

SRAS is a temporary measure to maintain the overnight

rate so (A) is wrong. Correction: [I misread SRAS into SPRA] In any case, SRAS = short-run aggregate supply, which has little to do with long term potential output, so (A) is not the right choice. AD can be shifted without any change to potential output (see Figure 10.8, page 260). (B) is also wrong. (D) refers to temporary techniques. (D) is not correct.

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 3(i)(iv)

(i) At equilibrium, M s = M d so i = 0.05. As such, I = 95

and Y = 1375. (Note: C = 100 + 0.8(Y 150)).

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 3(i)(iv)

(i) At equilibrium, M s = M d so i = 0.05. As such, I = 95

and Y = 1375. (Note: C = 100 + 0.8(Y 150)).

(ii) C = 1080, and S = Y T C = 145.

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 3(i)(iv)

(i) At equilibrium, M s = M d so i = 0.05. As such, I = 95

and Y = 1375. (Note: C = 100 + 0.8(Y 150)).

(ii) C = 1080, and S = Y T C = 145. (iii) Note that

Y =C +I +G

Y C T I =G T

Note that Y C T = S so we have S I = G T . This means the government decit can be nanced by borrowing from private savings.

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 3(i)(iv)

(i) At equilibrium, M s = M d so i = 0.05. As such, I = 95

and Y = 1375. (Note: C = 100 + 0.8(Y 150)).

(ii) C = 1080, and S = Y T C = 145. (iii) Note that

Y =C +I +G

Y C T I =G T

Note that Y C T = S so we have S I = G T . This means the government decit can be nanced by borrowing from private savings.

1 (iv) Multiplier 1c = 5. So with G = 50, Y = 250,

thus new Y = 1375 + 250 = 1625.

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 3(v)(vii)

(v) Solve the system

Y = 100 + 0.8(Y 150) + 120 500i + 200 100 = 200 2000i + 0.1Y We get i = 0.111111 and Y = 1222.22.

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 3(v)(vii)

(v) Solve the system

Y = 100 + 0.8(Y 150) + 120 500i + 200 100 = 200 2000i + 0.1Y We get i = 0.111111 and Y = 1222.22. (vi) Solve the system Y = 100 + 0.8(Y 150) + 120 500i + 250 100 = 200 2000i + 0.1Y Answers: i = 0.122222 and Y = 1444.44

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 3(v)(vii)

(v) Solve the system

Y = 100 + 0.8(Y 150) + 120 500i + 200 100 = 200 2000i + 0.1Y We get i = 0.111111 and Y = 1222.22. (vi) Solve the system Y = 100 + 0.8(Y 150) + 120 500i + 250 100 = 200 2000i + 0.1Y Answers: i = 0.122222 and Y = 1444.44 (vii) Note that from (v) to (vi), i has gone up, so I has gone down. Specically, I = 5.55. Note also that before (in (iv)), G = 50 leads to Y = 250. Now (in (v), (vi)), G = 50 leads to Y = 222.22. So the scal policy is now less eective in aecting Y .

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 3(viii)

(viii) We have

Y = 100 + 0.8(Y 150) + I + G = 20 + 0.8Y + I + G

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

Question 3(viii)

(viii) We have

Y = 100 + 0.8(Y 150) + I + G = 20 + 0.8Y + I + G

Therefore,

Y = 100 + 5(I + G )

Y = 5(I + G )

Econ203-Tut9 Vinh Nguyen Taylor Rule Question 3 Reference(s)

References

Curtis, Douglas; Irvine, Ian and Begg, David. Macroeconomics. 2nd Canadian edition, USA: McGraw-Hill Ryerson, 2010.

Вам также может понравиться

- Levin + Perez + Markov + Wilmer (2008) - Markov Chains and Mixing TimesДокумент388 страницLevin + Perez + Markov + Wilmer (2008) - Markov Chains and Mixing TimesVinh NguyenОценок пока нет

- Organizational Stuffs: Typed by Vinh Nguyen. Date May 18, 2011Документ7 страницOrganizational Stuffs: Typed by Vinh Nguyen. Date May 18, 2011Vinh NguyenОценок пока нет

- Summary of Topic and Material For Winter 2011Документ1 страницаSummary of Topic and Material For Winter 2011Vinh NguyenОценок пока нет

- DepartДокумент2 страницыDepartVinh NguyenОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

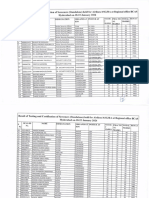

- Section 1: 1. Ofosu, George Nelson 2. OBENG, Kevin Kofi 3.OBENG-OFORI, Afrifa KwameДокумент17 страницSection 1: 1. Ofosu, George Nelson 2. OBENG, Kevin Kofi 3.OBENG-OFORI, Afrifa KwameTony JamesОценок пока нет

- Reterta V MoresДокумент13 страницReterta V MoresRam Migue SaintОценок пока нет

- Basics Stats Ti NspireДокумент7 страницBasics Stats Ti NspirePanagiotis SotiropoulosОценок пока нет

- A88438-23 Critical Procedure 11-01 - Pipeline Cut Outs - A5X9W9Документ7 страницA88438-23 Critical Procedure 11-01 - Pipeline Cut Outs - A5X9W9mahmoudОценок пока нет

- UNECE-Turkey-TCDO-Rail Freight Traffic in Euro-Asian LinksДокумент20 страницUNECE-Turkey-TCDO-Rail Freight Traffic in Euro-Asian LinksArseneОценок пока нет

- Oil Refinery OpsДокумент3 страницыOil Refinery OpsPhiPhiОценок пока нет

- SWOT Analysis Microtel by WyndhamДокумент10 страницSWOT Analysis Microtel by WyndhamAllyza Krizchelle Rosales BukidОценок пока нет

- AET Assignment C Kate ThomsonДокумент12 страницAET Assignment C Kate ThomsonaymenmoatazОценок пока нет

- Scout Activities On The Indian Railways - Original Order: MC No. SubjectДокумент4 страницыScout Activities On The Indian Railways - Original Order: MC No. SubjectVikasvijay SinghОценок пока нет

- Charts & Publications: Recommended Retail Prices (UK RRP)Документ3 страницыCharts & Publications: Recommended Retail Prices (UK RRP)KishanKashyapОценок пока нет

- Wiring DiagramsДокумент69 страницWiring DiagramsMahdiОценок пока нет

- Cap. 1Документ34 страницыCap. 1Paola Medina GarnicaОценок пока нет

- Dorks List For Sql2019 PDFДокумент50 страницDorks List For Sql2019 PDFVittorio De RosaОценок пока нет

- Energia Eolica Nordex N90 2500 enДокумент20 страницEnergia Eolica Nordex N90 2500 enNardo Antonio Llanos MatusОценок пока нет

- Induction-Llgd 2022Документ11 страницInduction-Llgd 2022Phạm Trúc QuỳnhОценок пока нет

- Risk-Based IA Planning - Important ConsiderationsДокумент14 страницRisk-Based IA Planning - Important ConsiderationsRajitha LakmalОценок пока нет

- 04.CNOOC Engages With Canadian Stakeholders PDFДокумент14 страниц04.CNOOC Engages With Canadian Stakeholders PDFAdilОценок пока нет

- Problems of Spun Concrete Piles Constructed in Soft Soil in HCMC and Mekong Delta - VietnamДокумент6 страницProblems of Spun Concrete Piles Constructed in Soft Soil in HCMC and Mekong Delta - VietnamThaoОценок пока нет

- Sparse ArrayДокумент2 страницыSparse ArrayzulkoОценок пока нет

- INSURANCE BROKER POLICIES Erna SuryawatiДокумент7 страницINSURANCE BROKER POLICIES Erna SuryawatiKehidupan DuniawiОценок пока нет

- Steris Amsco Century v120Документ2 страницыSteris Amsco Century v120Juan OrtizОценок пока нет

- Radix Sort - Wikipedia, The Free EncyclopediaДокумент13 страницRadix Sort - Wikipedia, The Free EncyclopediasbaikunjeОценок пока нет

- Basic Details: Government Eprocurement SystemДокумент4 страницыBasic Details: Government Eprocurement SystemNhai VijayawadaОценок пока нет

- 14 DETEMINANTS & MATRICES PART 3 of 6 PDFДокумент10 страниц14 DETEMINANTS & MATRICES PART 3 of 6 PDFsabhari_ramОценок пока нет

- Hyflow: Submersible PumpsДокумент28 страницHyflow: Submersible PumpsmanoОценок пока нет

- Solar Power Plant in Iit HyderabadДокумент9 страницSolar Power Plant in Iit HyderabadHimanshu VermaОценок пока нет

- 671 - BP Well Control Tool Kit 2002Документ19 страниц671 - BP Well Control Tool Kit 2002Ibama MirillaОценок пока нет

- HyderabadДокумент3 страницыHyderabadChristoОценок пока нет

- Burberry Annual Report 2019-20 PDFДокумент277 страницBurberry Annual Report 2019-20 PDFSatya PhaneendraОценок пока нет

- Psychological Attitude Towards SafetyДокумент17 страницPsychological Attitude Towards SafetyAMOL RASTOGI 19BCM0012Оценок пока нет