Академический Документы

Профессиональный Документы

Культура Документы

How An SIP Works: Mutual Funds Post Office Bank

Загружено:

Abhishek BansalИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

How An SIP Works: Mutual Funds Post Office Bank

Загружено:

Abhishek BansalАвторское право:

Доступные форматы

Wikipedia A Systematic Investment Plan (SIP) is a vehicle offered by mutual funds to help you save regularly.

It is just like a recurring deposit with the post office or bank where you put in a small amount every month. The difference here is that the amount is invested in a mutual fund. The minimum amount to be invested can be as small as monthly or quarterly. [edit]How 100 and the frequency of investment is usually

an SIP works

An SIP allows you to take part in the stock market without trying to second-guess its movements. It is also known as Dollar Cost Averaging. An SIP means you commit yourself to investing a fixed amount every month. Let's say it is 1,000.

When the Market price of shares fall, the investor benefits by purchasing more units; and is protected by purchasing less when the price rises. Thus the average cost of units is always closer to the lower end[see Dollar cost averaging].) { NAV : Net Asset Value , or the price of one unit of a fund. Can be computed as follows : NAV = [ market value of all the investments in the fund + current assets + deposits - liabilities ] divided by the number of units outstanding.}

Date NAV Approx number of units you will get at

1000

Jan 1 10

100

Feb 1 10.5 95.23

Mar 1 11

90.90

Apr 1 9.5

105.26

May 1 9

111.11

Jun 1 11.5 86.95

Within six months, you would have 5,89.45 units by investing just

1,000 every month.

Over the long run, you may make money or lose Let's say you invested in a Mutual Fund unit during the dotcom and tech boom. Say you began with Investment period Mar 2000 Mar 2005 1,000 and kept investing 1,000 every month. This would be the result:

Monthly investment 1,000

Total amount invested 61,000

Value of investment of Mar 7, 2005 1,09,315

Return on investment 23.87%

Had you bought the units on March 13, 2000 at 10.88 per unit (that was the NAV then), you would have lost because the NAV was just 7.04 on March 7, 2005. But because you spaced out your investment, you won. Conversely if the market had trended higher from the day you decided to start investing, you would lose out on an opportunity. This would happen as your subsequent purchases will get you less number of units for the same amount. Systematic Investment Plan can help you to be disciplined (if you need discipline) but not solve your market timing issues. The Investment advisor or the Mutual Fund has a vested interest in pitching this idea to you as once you invest all your future investment would also accrue to them effortlessly. [edit]How

an SIP scores

It makes you disciplined in your savings. Every month you are forced to keep aside a fixed amount. This could either be debited directly from your account or you could give the mutual fund post-dated cheques. As you see above, it helps you make money over the long term. Since you get more units when the NAV drops and fewer when it rises, the cost averages out over time. So you tide over all the ups and downs of the market without any drastic losses. Also, a number of mutual funds do not charge an entry load if you opt for an SIP. This fee is a percentage of the amount you are investing. And if you do not exit (sell your units) within a year of buying the units, you do not have to pay an exit load (same as an entry load, except this is charged when you sell your units).

If, however, you do sell your units within a year, you would be charged an exit load. So it pays to stay invested for the long-run. The best way to enter a mutual fund is via an SIP. But to get the benefit of an SIP, think of at least a three-year time frame when you won't touch your money. Of course you would lose money if your units lost value over time. What most SIP Mutual funds don't tell you is that they recover their fees as monthly charges by selling your units, so while you are buying more units when the market is down, more of your units are also being sold to fund the monthly charges of the Mutual fund. Also the Bid and Offer of the Mutual Fund is around 7% and this is the front load or expense you pay for buying the units each month. Also sometimes the Mutual fund will have annual fee charges. In spite of the above drawbacks the retail investors' benefit in the long term horizon of 58 years is enormous. Only make sure that you can switch your funds from stock market to money market at short notice when the markets are really in a correction phase to safeguard the profits which you have made when the market was in a booming phase. This is easier said than done. Wikipedia

What is Systematic Investment Plan or SIP?

SIP works on the principle of regular investments. It is like your recurring deposit where you put in a small amount every month. It allows you to invest in a MF by making smaller periodic investments (monthly or quarterly) in place of a heavy one-time investment i.e. SIP allows you to pay 10 periodic investments of Rs 500 each in place of a one-time investment of Rs 5,000 in an MF. Thus, you can invest in an MF without altering your other financial liabilities. It is imperative to understand the concept of rupee cost averaging and the power of compounding to better appreciate the working of SIPs. SIP has brought mutual funds within the reach of an average person as it enables even those with tight budgets to invest Rs 500 or Rs 1,000 on a regular basis in place of making a heavy, one-time investment. While making small investments through SIP may not seem appealing at first, it enables investors to get into the habit of saving. And over the years, it can really add up and give you handsome returns. A monthly SIP of Rs 1000 at the rate of 9% would grow to Rs 6.69 lakh in 10 years, Rs 17.83 lakh in 30 years and Rs 44.20 lakh in 40 years. Even for the cash-rich, SIPs reduces the chance of investing at the wrong time and losing their sleep over a wrong investment decision. However, the true benefit of an SIP is derived by investing at lower levels. Other benefits include: 1. Discipline

The cardinal rule of building your corpus is to stay focused, invest regularly and maintain discipline in your investing pattern. A few hundreds set aside every month will not affect your monthly disposable income. You will also find it easier to part with a few hundreds every month, rather than set aside a large sum for investing in one shot. 2. Power of compounding Investment gurus always recommend that one must start investing early in life. One of the main reasons for doing that is the benefit of compounding. Let's explain this with an example. Person A started investing Rs 10,000 per year at the age of 30. Person B started investing the same amount every year at the age of 35. When they attained the age of 60 respectively, A had built a corpus of Rs 12.23 lakh while person B's corpus was only Rs 7.89 lakh. For this example, a rate of return of 8% compounded has been assumed. So the difference of Rs 50,000 in amount invested made a difference of more than Rs 4 lakh to their end-corpus. That difference is due to the effect of compounding. The longer the (compounding) period, the higher the returns. Now, instead of investing Rs 10,000 each year, suppose A invested Rs 50,000 after every five years, starting at the age of 35. The total amount invested, thus remains the same -- Rs 3 lakh. However, when he is 60, his corpus will be Rs 10.43 lakh. Again, he loses the advantage of compounding in the early years. 3. Rupee cost averaging This is especially true for investments in equities. When you invest the same amount in a fund at regular intervals over time, you buy more units when the price is lower. Thus, you would reduce your average cost per share (or per unit) over time. This strategy is called 'rupee cost averaging'. With a sensible and long-term investment approach, rupee cost averaging can smoothen out the market's ups and downs and reduce the risks of investing in volatile markets. People who invest through SIPs capture the lows as well as the highs of the market. In an SIP, your average cost of investing comes down since you will go through all phases of the market, bull or bear. 4. Convenience This is a very convenient way of investing. You have to just submit cheques along with the filled up enrolment form. The mutual fund will deposit the cheques on the requested date and credit the units to one's account and will send the confirmation for the same. 5. Other advantages

There are no entry or exit loads on SIP investments. Capital gains, wherever applicable, are taxed on a first-in, first-out basis. Disclaimer: While we have made efforts to ensure the accuracy of our content (consisting of articles and information), neither this website nor the author shall be held responsible for any losses/ incidents suffered by people accessing, using or is supplied with the content.

agic of Mutual Fund Systematic Investment Plan (SIP) Systematic Investment Plan in Mutual Fund is commonly named SIP is really getting popular in India. Systematic Investment Plan is such a beautiful tool, which if used properly can help you to achieve all your financial goals. Some time back we wrote Do you really understand Systematic Investment Plan which is one of the most popular article of TFL, but readers requested that they want to read more about basics of Mutual Fund SIP. So here it is..

This Article will cover

Magic of SIP What is Systematic Investment Plan (SIP) Advantage & Benefit of Systematic Investment Plan Best Systematic Investment Plan in India Systematic Investment Plan Presentation with Facts & Figures SIP Presentation with Examples & Analogies (I like this one Systematic Investment Plan (SIP) Calculator Must Use )

What is Systematic Investment Plan?

We all have various financial obligations. Some of them like daily needs, school fees, etc involve the major outgo of your cash. Others like trip for your family or buying a fancy gizmo entails a one time payments for which money can be relatively easily collected. But for long term goals like retirement or purchasing a home require you to save and invest for many years. Yet irrespective of the amount involved and the time horizon, planning and investing money systematically and regularly enables you to sail through these obligations. A SIP could prove to be a simple and effective solution toward achieving these goals. A SIP is a method of investing in mutual funds, by investing a fixed sum at a regular frequency, to buy units of a mutual fund schemes. It is quite similar to a recurring

deposit of a bank or post office. For the convenience, an investor could start a SIP with as low as Rs 500; however this amount may differ from one fund house to other.

Benefits of Systematic Investment Plan

1) What is your equation to investments: EARN->SPEND->SAVE OR EARN->SAVE->SPEND

The first is a wrong way of investing. You should be saving in a disciplined manner and SIP enables you to follow the second, which is the correct equation of investments. 2) Power of compounding: SIP make sure that you are not only benefited on your investment but you also get returns over the interest which in overall will result generating greater returns. 3) Easy, Flexibility and Liquidity: SIP is easy to start, manage and stop. It gives you flexibility to choose a desired scheme or to with draw in parts. And with conditions you have the money for contingency and emergency use. 4) You can also do SIP in ELSS (Equity Linked Saving Scheme) to save tax under section 80 C. To check complete list of benefits you must read this article Benefits of Investing Systematically.

Best Systematic Investment Plans in India

Mutual Fund 3 5 10 12 YearsInvestment YearsInvestment YearsInvestment YearsInvestment 36000 60000 120000 144000 % Amount % Amount % Amount % Amount

Scheme Name

Birla Sunlife Equity Fund DSP BR Equity Fund

26

51990

17

92033

29

570925

27

847695

30

55142

22

103852

32

656368

28

890730

Franklin India 28 Blue Chip Fund HDFC Equity Fund HDFC Top 200 Fund 39

54785

20

98935

29

549491

27

860441

61979

26

112626

34

721916

32

1142897

34

57909

24

109045

33

706670

ICICI Prudential 25 Growth Fund Reliance Growth 29 Fund Reliance Vision 25 Fund SBIMagnum Global Fund Sundaram Growth Fund 29

51186

16

90158

25

437115

22

616589

54014

21

100716

38

901404

35

1407815

51789

17

91941

33

677154

31

1078457

54249

16

88337

31

607379

26

793162

24

50576

15

88069

25

458342

22

617858

Tata Pure Equity 27 Fund

52625

19

95385

29

554004

25

727228

*Calculations are done on 1st day of 2011 Monthly Investment of Rs 1000 I will again say Best comes after postmortem report you should see them as Top Systematic Investment Plans in Last 10 Years or just Systematic Investment PlanComparison. Calculations are done on Rs 1000 per month investment to keep things simple. If you would like to calculate for Rs

5000 or Rs 10000 you can multiply the amount by 5 or 10.

Вам также может понравиться

- Systematic Investment PlanДокумент8 страницSystematic Investment PlanMelissa D'silvaОценок пока нет

- What Is Systematic Investment Plan or SIP?: Investment Avenue Mutual FundДокумент7 страницWhat Is Systematic Investment Plan or SIP?: Investment Avenue Mutual FundCheruv SoniyaОценок пока нет

- Systematic Investment Plan - A Better Way To Build Wealth Over The Long TermДокумент5 страницSystematic Investment Plan - A Better Way To Build Wealth Over The Long Termginig69Оценок пока нет

- SIP Write Up - v2Документ1 страницаSIP Write Up - v2Chandan MishraОценок пока нет

- Systematic Investment Plan (Sip) : Mutual Funds Post Office BankДокумент34 страницыSystematic Investment Plan (Sip) : Mutual Funds Post Office BankKonarPriyaОценок пока нет

- To Study The Systematic Investment Plan As An Investment OptionДокумент7 страницTo Study The Systematic Investment Plan As An Investment OptionumachinchaneОценок пока нет

- The Fidelity SIP Guide: We're Here To HelpДокумент12 страницThe Fidelity SIP Guide: We're Here To HelpkrishchellaОценок пока нет

- Intorduction Final 150922Документ66 страницIntorduction Final 150922Shyam SundarОценок пока нет

- The Best Funds To Invest In: How You Can Invest in A Mutual FundДокумент23 страницыThe Best Funds To Invest In: How You Can Invest in A Mutual FundsakifakiОценок пока нет

- Systematic Investment PlanДокумент28 страницSystematic Investment PlansangnaguОценок пока нет

- Systematic Investment PlanДокумент27 страницSystematic Investment PlanVishal Sonawane0% (1)

- SIP: Start Early, Save Regularly: DisclaimerДокумент2 страницыSIP: Start Early, Save Regularly: DisclaimerWhiteFlintoffОценок пока нет

- SIP Returns On MF Ready Reckoner Schemes: Retail ResearchДокумент6 страницSIP Returns On MF Ready Reckoner Schemes: Retail ResearchumaganОценок пока нет

- Cost of DelayДокумент3 страницыCost of DelayajiskpОценок пока нет

- A Long-Term Investment Strategy (Misunderstood of SIP)Документ3 страницыA Long-Term Investment Strategy (Misunderstood of SIP)anuraghosh9227Оценок пока нет

- Systematic Investment Planning: Task - 6Документ3 страницыSystematic Investment Planning: Task - 6shubhamОценок пока нет

- Systematic Investment Plans Mba ProjectДокумент69 страницSystematic Investment Plans Mba ProjectMaheshwari Stephen Pinto87% (150)

- Systematic Investment Plan (SIP) - An Investment Mantra For Growth of Your WealthДокумент2 страницыSystematic Investment Plan (SIP) - An Investment Mantra For Growth of Your WealthHaresh NavadiyaОценок пока нет

- SIP Is A Method of Investing A Fixed Sum SynopsisДокумент23 страницыSIP Is A Method of Investing A Fixed Sum SynopsisPochender vajrojОценок пока нет

- Vennala SIP Is A Method of Investing A Fixed Sum SynopsisДокумент20 страницVennala SIP Is A Method of Investing A Fixed Sum SynopsisPochender vajrojОценок пока нет

- Questions and Answers Capital IQДокумент28 страницQuestions and Answers Capital IQrishifiib08100% (1)

- The Best Funds To Invest In: How You Can Invest in A Mutual FundДокумент4 страницыThe Best Funds To Invest In: How You Can Invest in A Mutual FundAnonymous YWS7ndsiОценок пока нет

- Chapter 7 PDFДокумент7 страницChapter 7 PDFBaldhariОценок пока нет

- Think FundsIndia July 2014Документ10 страницThink FundsIndia July 2014marketingОценок пока нет

- Sip-Of A Mutual FundДокумент7 страницSip-Of A Mutual Fundankit7329Оценок пока нет

- Investment Is An ArtДокумент3 страницыInvestment Is An ArtCool Deepak GoelОценок пока нет

- How To Double Your Money: Small Contributions HelpДокумент5 страницHow To Double Your Money: Small Contributions HelpHimanshu TandonОценок пока нет

- How To Build WealthДокумент12 страницHow To Build WealthAshishОценок пока нет

- Blog 1 All About Mutual Fund InvestmentsДокумент2 страницыBlog 1 All About Mutual Fund InvestmentsinfoОценок пока нет

- SimpleДокумент3 страницыSimplehrammrpОценок пока нет

- Are Ulips or Insurance Linked Plan Worth An Investment?Документ2 страницыAre Ulips or Insurance Linked Plan Worth An Investment?Mithun JishnuОценок пока нет

- How An SIP Work, How To Find A Good Company To Invest.Документ9 страницHow An SIP Work, How To Find A Good Company To Invest.Mukesh PrajapatiОценок пока нет

- Sip 230120Документ4 страницыSip 230120DBCGОценок пока нет

- TipsДокумент2 страницыTips9824534642Оценок пока нет

- Report On Mutual FundДокумент9 страницReport On Mutual FundSiddhi SharmaОценок пока нет

- Equity / Growth Fund Debt/ Income FundДокумент6 страницEquity / Growth Fund Debt/ Income FundChiunnu JanuОценок пока нет

- How Much Commission Mutual Fund Agent GetsДокумент19 страницHow Much Commission Mutual Fund Agent GetsjvmuruganОценок пока нет

- How To Build WealthДокумент12 страницHow To Build WealthsushilОценок пока нет

- CAGR, XIRR, Rolling ReturnДокумент9 страницCAGR, XIRR, Rolling ReturnKarthick AnnamalaiОценок пока нет

- Capital Letter August 2011Документ5 страницCapital Letter August 2011marketingОценок пока нет

- Fidelity's: Top TipsДокумент24 страницыFidelity's: Top Tipsmandar LawandeОценок пока нет

- Are Your Investments Losing Money? Here's HelpДокумент3 страницыAre Your Investments Losing Money? Here's HelpsarkctОценок пока нет

- MFSAssign RelatedДокумент4 страницыMFSAssign RelatedRohit KumarОценок пока нет

- From The Editor, S Desk: Best Regards, NSDLДокумент8 страницFrom The Editor, S Desk: Best Regards, NSDLDikshit KashyapОценок пока нет

- SIP-direct Equity PRESENTATIONДокумент17 страницSIP-direct Equity PRESENTATIONmahesh lokhandeОценок пока нет

- Ncial Education: Portfolio Strategy Using Mutual FundДокумент5 страницNcial Education: Portfolio Strategy Using Mutual FundMayank kaushikОценок пока нет

- Ultimate Guide To SIP in Pakistan Ebook FinalДокумент39 страницUltimate Guide To SIP in Pakistan Ebook FinalbisaxОценок пока нет

- Inflation. Inflation Is The Rate at Which The Cost of Living Increases The Cost of Living IsДокумент5 страницInflation. Inflation Is The Rate at Which The Cost of Living Increases The Cost of Living Isedukit8606Оценок пока нет

- Basics of Financial Market: Report By: Rahul SinghДокумент47 страницBasics of Financial Market: Report By: Rahul Singhrrajpoot_1Оценок пока нет

- Capital Letter May 2011Документ6 страницCapital Letter May 2011marketingОценок пока нет

- Investor Awareness ProgramДокумент7 страницInvestor Awareness Programdeepti sharmaОценок пока нет

- Equity Linked Savings Scheme (ELSS)Документ2 страницыEquity Linked Savings Scheme (ELSS)Anant TutejaОценок пока нет

- Investing !! What's That?Документ37 страницInvesting !! What's That?sandeep_953Оценок пока нет

- ELSS - Ways To Efficient Tax SavingsДокумент4 страницыELSS - Ways To Efficient Tax SavingsDhiraj KhatriОценок пока нет

- Handbook On Basics of Financial Markets: National Stock Exchange of India LimitedДокумент20 страницHandbook On Basics of Financial Markets: National Stock Exchange of India Limitedहरिओम पांडेОценок пока нет

- Handout On Investment in MF Through SIPДокумент2 страницыHandout On Investment in MF Through SIPpushpita4Оценок пока нет

- Capital Letter December 2011Документ5 страницCapital Letter December 2011marketingОценок пока нет

- Vaibhav Hirwani - SIP ProjectДокумент62 страницыVaibhav Hirwani - SIP ProjectSushank AgrawalОценок пока нет

- Cryptocurrency InvestmentДокумент10 страницCryptocurrency InvestmentRyan JaralbioОценок пока нет

- Invt Sem 5Документ9 страницInvt Sem 5Pradumn AgarwalОценок пока нет

- Chapter 13Документ5 страницChapter 13Marvin StrongОценок пока нет

- Financial Management - Overview of Financial ManagementДокумент22 страницыFinancial Management - Overview of Financial ManagementSoledad PerezОценок пока нет

- Basic Finance-An Introduction To Financial Institutions Investments and Management 10th Edition Mayo Test BankДокумент10 страницBasic Finance-An Introduction To Financial Institutions Investments and Management 10th Edition Mayo Test BankRobinson MojicaОценок пока нет

- Security Analysis and Portfolio Management by Rohini Singh 2018Документ446 страницSecurity Analysis and Portfolio Management by Rohini Singh 2018Aman Kumar SharanОценок пока нет

- Share Market and Mutual Fund " For: "A Study of Performance and Investors Opinion AboutДокумент73 страницыShare Market and Mutual Fund " For: "A Study of Performance and Investors Opinion AboutakshayОценок пока нет

- A Study On Performance of Mutual FundДокумент25 страницA Study On Performance of Mutual Fundanushakc1991Оценок пока нет

- Mock 2Документ28 страницMock 2Sayan Kumar PatiОценок пока нет

- Federal Reserve Bank - Two Faces of DebtДокумент28 страницFederal Reserve Bank - Two Faces of Debtpwilkers36100% (1)

- MDRT 2017 Membership InfoДокумент14 страницMDRT 2017 Membership InfoJayson Solomon50% (2)

- Investment Decision and Portfolio Management (ACF 722)Документ36 страницInvestment Decision and Portfolio Management (ACF 722)yebegashetОценок пока нет

- A Beginners Guide To The Stock Market Ev - Matthew R KratterДокумент69 страницA Beginners Guide To The Stock Market Ev - Matthew R KratterAfsal Mohamed Kani 004Оценок пока нет

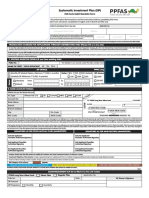

- Ppfas Sip FormДокумент2 страницыPpfas Sip FormAmol ChikhalkarОценок пока нет

- ICICI Prudential Life Insurance AR09Документ51 страницаICICI Prudential Life Insurance AR09praveenarnОценок пока нет

- 4 Pillars of InvestingДокумент32 страницы4 Pillars of InvestingVaradharajan RagunathanОценок пока нет

- My Journey Dec2020Документ28 страницMy Journey Dec2020sunil unnithan100% (1)

- Vedika Project ReportДокумент86 страницVedika Project ReportVedika KeshariОценок пока нет

- Axis Mutual Fund Annual Report 2020-21Документ669 страницAxis Mutual Fund Annual Report 2020-21Boat08Оценок пока нет

- Nischith ProjectДокумент17 страницNischith ProjectMadhu RaoОценок пока нет

- Investments An Introduction 11th Edition Mayo Solutions Manual DownloadДокумент12 страницInvestments An Introduction 11th Edition Mayo Solutions Manual DownloadArnold Evans100% (15)

- A Comparative Analysis of Performance of Mutual Funds Between Private and Public SectorsДокумент86 страницA Comparative Analysis of Performance of Mutual Funds Between Private and Public Sectorssk912577002771% (7)

- ABM-BUSINESS FINANCE 12 - Q1 - W3 - Mod3 PDFДокумент18 страницABM-BUSINESS FINANCE 12 - Q1 - W3 - Mod3 PDFDivine Bravo79% (19)

- Mutual Funds: by - Gaurang TrivediДокумент7 страницMutual Funds: by - Gaurang TrivedisanskritiОценок пока нет

- A Mutual Fund Preference Survey - Google FormsДокумент7 страницA Mutual Fund Preference Survey - Google FormsADITYA SINGH RAJAWAT 1923605Оценок пока нет

- Mutual Funds Association of Pakistan: Asset Management Companies (Amcs) in PakistanДокумент5 страницMutual Funds Association of Pakistan: Asset Management Companies (Amcs) in PakistanMuhammad Khuram ShahzadОценок пока нет

- Michel Aglietta, Antoine Reberioux - Corporate Governance Adrift - A Critique of Shareholder Value (Saint-Gobain Centre For Economic Studies) (2005)Документ321 страницаMichel Aglietta, Antoine Reberioux - Corporate Governance Adrift - A Critique of Shareholder Value (Saint-Gobain Centre For Economic Studies) (2005)Ricardo ValenzuelaОценок пока нет

- Sapm Questions For Semester ExamДокумент3 страницыSapm Questions For Semester ExamAmir PashaОценок пока нет

- Advisorkhoj LIC Mutual Fund ArticleДокумент6 страницAdvisorkhoj LIC Mutual Fund ArticleHariprasad ManchiОценок пока нет

- Mobilisation Saving Through Mutual FundДокумент82 страницыMobilisation Saving Through Mutual FundAniket ShawОценок пока нет

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (13)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsОт EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsРейтинг: 5 из 5 звезд5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItОт EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItРейтинг: 5 из 5 звезд5/5 (13)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!От EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Рейтинг: 4.5 из 5 звезд4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)От EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Рейтинг: 4 из 5 звезд4/5 (33)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookОт EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookРейтинг: 5 из 5 звезд5/5 (4)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОт EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОценок пока нет

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCОт EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCРейтинг: 5 из 5 звезд5/5 (1)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessОт EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessРейтинг: 4.5 из 5 звезд4.5/5 (28)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsОт EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsРейтинг: 4 из 5 звезд4/5 (7)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookОт EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookОценок пока нет

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeОт EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeРейтинг: 4 из 5 звезд4/5 (21)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetОт EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetОценок пока нет

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyОт EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyРейтинг: 5 из 5 звезд5/5 (1)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditОт EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditРейтинг: 5 из 5 звезд5/5 (1)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyОт EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyРейтинг: 4.5 из 5 звезд4.5/5 (37)