Академический Документы

Профессиональный Документы

Культура Документы

Group Assignment Financial Risk - Class 2.5 (030412)

Загружено:

tiendungpdgИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Group Assignment Financial Risk - Class 2.5 (030412)

Загружено:

tiendungpdgАвторское право:

Доступные форматы

University of Economics HCM City (UEH) International School of Business (ISB) Course: MBA Financial risk management March

25, 2012 Instructor: Vo Hong Duc Class 2.5 1. Nguyn Hong Minh Tr 2. V Tin Dng 3. Phm Duy Hng 4. Phan Th Trn Nga

5. Nguyn Anh Thi

Financial risk management

PART A: Question A.1 a. The rate that an importer will deal with the bank to buy at 1.015 b. The cost in the AUDs: 1,000,000 x 1.015= 1,015,000 Question A.2 The conception of the financial risk management relates to ABC Bank's outlook: Depend on situation the company will have hedging appropriate. (Forward or put option) The interest rate: if a firm borrows money from bank while the Reserve Bank of Australia increase interest rates substantially that impacts on increasing the interest rate of the firm. At that time, the firm can stop lending from the bank or choose another option with the lowest interest rate. When interest rate increase, Banks will face with the competition on interest rate on banking systems, Bank with higher interest rate is more attractive and easier to get debt financing from the market. Some small banks were faced with bankrupt due to they cannot get money for operation. Under the impact on increasing interest rate, the increasing interest rate of input material will lead to the increasing of interest rate of output material that means bad debt from the bank will go up because the bank may not collect money from the company.

-

MINI CASE STUDY

Commodity price: when the Reserve Bank of Australia increases interest rates substantially, the price of commodity will increase. Therefore, the company will pay more for material that means the cost of company will increase.

The exchange rate: when the AUD rises if the company has exported the products, the revenue on AUD of company will decrease. If the company has imported the products, the cost on AUD of company will decrease. Therefore, a firm can use suitable hedging tool (put option, forward option, and future option or call option).

Question A.3 The exposures will this loan create both now and in the future: - The interest rate: the difference between interest rate in USD and interest rate in AUD now and in future will affect the cost of capital of company and influence the comparative of company. - The exchange rate: the difference between spot rate AUD/USD when the company brings those funds back to Australia and future rate AUD/ USD ( when the company paying USD interest rate annually for five years, at which time the loan will need to repaid) will affect the cost of capital of company. In this case, the company earns the difference between interest rate in USD and interest rate in AUD. In contrast, the company loses the difference between spot rate AUD/USD

Financial risk management

when the company bring those funds back to Australia and future rate AUD/ USD because future rates are derived from interest rates. The future rate is based on the interest rate differential between the two currencies before taking in to account credit spread. If the company has export produces and received USD, the company still gets the difference between interest rate in USD and interest rate in AUD. Besides, the company does not lose the difference between spot rate AUD/USD when the company brings those funds back to Australia and future rate AUD/ USD. Question A.4 a. The 90-day forward AUD/USD exchange rate will be higher because we have known that any changes in the exchange rate is offset a change in the interest rate differential in such a way as to keep returns at the same level. The formula will illustrate for this scenario: (1+rA) = Sfw/So x (1 + rn) rA rn Sfw So

:

interest rate in AUD forward exchange rate

: interest rate in USD

:

: spot exchange rate

Therefore, when 90-day interest rate in AUD is higher than 90-day interest rate in USD, the forward AUD/USD exchange rate will be higher than keeping returns at the same level. b. The 90-day forward rate price is calculated as below: Sfw= 1.0115 x (1+4%/4)/ (1+3%/4) = 1.0140 The 90- day forward price: 5000000 x 1.0140 = 5070000 AUD. Question A.5 a. Regarding this scenario, the type of risk here is foreign exchange risk because the exchange rate AUD/USD may be higher (payment with 6 months) than now. Therefore, the payment for this contract will be increased due to the increasing cost of equipment and this lead to lose the money for the company. b. The impact on the company can have 2 options below if the AUD fell to AUD/USD of 0.9995 in 6-month time. If the company did not decide hedging, the amount of AUD (the cost of equipment) would be paid 1.999.000 (2mil x 0.9995). Conversely, if the company decided hedging, the amount of AUD (the cost of equipment) would depend on the option company for hedging:

Financial risk management

If the company chooses the forward exchange contract, the company must pay by AUD depending on the rate AUD/USD on the forward contract. If the company had bought the call option, the company would pay the amount AUD depending on the cost of the option. In general, in both cases the amount AUD that the company must always pay (the cost of equipment) higher if the company make a decision not to hedge. c. The effective AUD cost of the equipment in each scenario calculated (assume the spot rate has fallen to 0.9995 in 6 month time as below: - The company left its currency exposure unhedged will be: 2.000.000 x 0.9995 = 1.999.000 AUD - The company had entered into a forward exchange contract (FEC) at a rate AUD/USD of 1.0100. 2.000.000 x 1.0100 = 2020.000 AUD - The company had bought an AUD put option (bought an USD call option) with the strike price AUD/USD of 1.0102 and the cost of the option was 90 points. 2.000.000 x (0.9995 + 0.0090) = 2017.500 AUD d. If the company wanted to protect against a fall in the AUD but still benefit if the AUD rose, the company would buy an AUD put option (buy an USD call option). Question A.6 a. When the company has bought an AUD call option (bought an USD put option) with a strike of 0.9950, what the company would do if the AUD was trading at 1.0110 when the option expires depends on option cost mentioned below: If (0.9950 + option cost) < 1.0110, the company will not exercise the option and buy an AUD (sell an USD) in the spot market. If (0.9950 + option cost) > 1.0110, the company will exercised the option and buy an AUD (sell an USD) to this option. If (0.9950 + option cost) = 1.0110, it depends on making a decision because it brings the same profit. b. Assuming the option cost 90 points: 0.9950 + 0.0090 = 1.0040 < 1.0110, the company will not exercise this option and buy an AUD (sell an USD) in the spot market. Question A.7: Assuming we have two situations: a. The sales department forecasts correctly:

Financial risk management

If the spot rate AUD/USD in 6 month time higher than 1.0095 (0.9999+0.0096) and we use the AUD call option will get more profit than the FECs. If the spot rate AUD/ USD in 6- month time lower than 1.0095 (0.9999+0.0096) and we use the FECs will get more profit than the AUD call option. b. The sales department forecasts wrongly (the real revenue lower than forecasting revenue): We call the difference between forecast and real revenue is X and the spot rate AUD/ USD in 6- month time is Y. + If Y 0.9999 we use the FECs will get more profit than the AUD call option and we can buy amount X USD in the spot market then exercised the FECs. + If Y 1.0095 (0.9999+0.0096) we use the AUD call option will get more profit than the FECs. We will not exercise the AUD call option and buy an AUD (sell an USD) in the spot rate market. + If 0.9999 < Y < 1.0095 (0.9999 +0.0096) which strategy gets more profit depending on value of Y: [(0.9999 x 3000000) X (Y- 0.9999)] compare with [(Y x 3000000)] [(0.0096 x 3000000)]. This shows that if Y fall will affect the strategy use FECs more effective than strategy use AUD call option. As analysis above, choosing a kind of strategy, this depends on an exchange rate AUD/USD in 6month time. In this case, we believed that value of the AUD might raise that means an exchange rate AUD/ UAD will fall. Therefore, we should choose FECs.

Financial risk management

PART B:

RESEARCH & RECOMMENDATION Introduction

Every company in its business activities always faces many uncertain and unpredictable things such as changes in exchange rates, interest rates, commodity prices, and so on, that can affect the company dramatically. If these changes badly tends, they can put the company in problematic situation. We can call the probability of loss is risk. Risk is the chance that unexpected outcome will occur (Besley and Brigham, 2008, p.307), and risk is the probable variability of returns (Horcher, 2005, p.2). To do business or to invest is to face risks. Besley and Bringham (2008) stated, The greater variability of the possible outcome, the riskier the investment (p.307), or simply as someone said more rick more return. Financial risk comes from many factors, it can occur in the processes of sales and purchases, investments and loans, or it happens as a result of using financial tools such as debt financing or financial leverage, or it comes from the activities of management, from the law and the regulations of the government or the policies of the company. Financial risk comes from everywhere and is unavoidable that any entrepreneur must face to it. Therefore, identifying risks to control and set for an appropriate financial risk management strategy takes a vital role to any business or any investor. In the limitation of this paper, we cannot cover all kinds of risk with an ambition of giving out all solutions to all kinds of risk but it is intended to help readers having a general view of what risks in business are and how to identify and manage financial risk in reality. Where is financial risk from? According to Horcher (2005), there are three main sources of financial risk: - Financial risks arising from an organizations exposure to changes in market prices, such as interest rates, exchange rates, and commodity prices - Financial risks arising from the actions of, and transactions with, other organizations such as vendors, customers, and counterparties in derivatives transactions - Financial risks resulting from internal actions or failures of the organization, particularly people, processes, and systems.

Financial risk management

What is Financial Risk Management? According to Horcher (2005), Financial risk management is a process to deal with the uncertainties resulting from financial markets. It involves assessing the financial risks facing an organization and developing management strategies consistent with internal priorities and policies. Addressing financial risks proactively may provide an organization with a competitive advantage. It also ensures that management, operational staff, stakeholders, and the board of directors are in agreement on key issues of risk. (p.3) The process of financial risk management includes steps, which are called financial risk cycle as follow: The process of financial risk management is continuous activities. According to Horcher (2005), the THE FINANCIALRISK MANAGEMENT CYCLE process can be summarized as follows: Identify and prioritize key financial risks. Determine an appropriate level of risk tolerance. Implement risk management strategy in accordance with policy. Measure, report, monitor, and refine as needed. To study what kinds of financial risk a firm can face and what is financial risk management in reality, the group of researchers follows these steps to apply in a real corporation in Vietnam, named Hung Vuong Corporation as a sample to research. Some main features about the researched company Hung Vuong was established in 2003 under the form of Limited Company. In 2007, due to accomplish the scope in widening production and business a large, strong and professional Corporation in producing and exporting Pangasius to meet the increasing demand about harder and harder quality of market, Hung Vuong was transformed into HUNG VUONG CORPORATION. Now, it owns the closed system from produce breed, feed to raising farm, processing, cold store, and exporting. All of these create the high quality series of products from Pangasius, and then serve to the consumers all over the world. - The companys name: Hung Vuong Corporation. - Abbreviated name: HV Corp. - Email: info@hungvuongpanga.com - Telephone: + 84 73 385 4245 - 385 4247 - Stock code : HVG - Website : www.hungvuongpanga.com - Fax: + 84 73 385 4248 - Address: Block 44, My Tho Industrial Zone, Tien Giang Province, Vietnam.

Financial risk management

- Representative office in Ho Chi Minh City: + Address: 144 Chau Van Liem St - Ward 11 - District 5 - Ho Chi Minh City - Viet nam. + Phone: +84 8 385 36052 - 3853 6330. + Fax: +84 8 385 36051 - Charter capital: 659,980,730,000.00 VND. - The labour: more than 17,000 workers - Business registration licence: No 5303000053; renewed the 8th time on June 21st, 2010. Business sectors: + Aquaculture, processing, exporting seafood; + Production of feed (fish, domestic fowl); + Cold storage business; Certificates of quality standard: Golbal Gap, HACCP, BRC, IFS, GMP, ISO 9001:2008, ISO 22000:2005, HALAL, ISO 17025...

Exporting market: Hung Vuong is proud to be recognized as one of biggest processors and exporters of pangasius in Viet Nam. At present, Hung Vuongs product is exported to 60 countries in the world including Europe, Brazil, Mexico, Australia, the USA, Middle East and Asian countries. The chart below shows that how big is each export market share.

Financial risk management

Source: Hung Vuongs Website: http://www.hungvuongpanga.com/en/our-market.html Hung Vuong has gained many brilliant achievements from its exporting sales, and reached the figure of USD 200 million revenue of exporting by 2011.

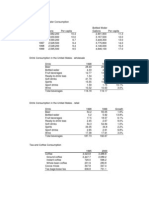

Source: Hung Vuongs Website : http://www.hungvuongpanga.com/en/our-market.html Revenue and cost structure - Revenue structure: VND Billion No. Items 2009 Amount % 3,087.28 94.66% 2,375.29 72.83% 660.54 20.25% 51.46 1.58% 0.00 0.00% 165.00 5.06% 9.31 0.29% 3,261.59 100.00% 2010 Amount % 4,431.59 93,28% 2,636.12 55,49% 1,773.82 37,34% 16.00 0,34% 5.65 0,12% 311.75 6,56% 7.63 0.16% 4,750.97 100.00% 2011 Amount % 7,835.25 97.00% 4,728.24 58.53% 3,050.03 37.76% 9.46 0.12% 47.53 0.59% 187.46 2.32% 55.25 0.68% 8,077.97 100.00%

I. Revenue from main activities Revenue from export sales Revenue from local sales Revenue from cold store revenue from supplying services II. Incom from Financial activities III. Incom from other activities Total: - Cost structure:

VND Billion No. Items 2009 2010 2011 Amount % Amount % Amount % 2,573.00 93,87% 3.822,88 92,33% 6.580,79 94,34% 1,496.80 54,61% 2.550,65 61,60% 3.887,62 55,73%

I. Cost of main activities Cost of export sales

Financial risk management

Cost of local sales Cost of cold store Cost of supplying services II. Cost of Financial activities III. Cost of other activities Total: 1,053.78 38,45% 1.241,09 29,97% 2.624,99 22.42 0,82% 27,89 0,67% 22,23 0.00 0,00% 3,25 0,08% 45,95 165.00 6.02% 311,75 7,53% 347,76 2.96 0.11% 5,85 0,14% 46,80 2,740.96 100.00% 4.140,48 100,00% 6.975,35 37,63% 0,32% 0,66% 4,99% 0,67% 100,00%

Source: Extracted from Financial statements of the company. Identifying Financial risk of the Company and suggesting strategies for financial risk management As the above introduction, Hung Vuong group is known as one of the Vietnamese leading corporations in seafood processing and exporting, especially in producing and exporting Pangasius. They own the closed system from produce breeds, feed to raising farm, processing, cold store, and exporting. All of these create the high quality series of products from Pangasius, and then serve to the consumers all over the world. With these scopes, Hung Vuong Corporation could meet financial risks as followings: 1. Market prices changes Market prices changes are the first financial risk, which for most of processing and exporting Corporations meet. They include interest rates, exchange rates, and commodity prices. Hung Vuong Group do not except, they also have experienced difficulties in fluctuation of domestic interest rates, foreign exchange rates, especially FX rate of VND/USD, and Pangasius, shrimp price in domestic and foreign market such as The United States of America, Europe, Japan. - Interest rates: According to World Bank data (2012), lending interest rates in Vietnam were not stable, and changed so much from 2008 to 2010. In January 2008, interest rate was 15.78% per year, it yet decreased strongly in 2009 just 10.07%/year. Then, it gained but not much to 13.14% in 2010 that released from report in 2011. According to Business Times (2011), lending interest rate of VND increases so high reached to nearly 20% annual year. Then, the below chart will show the changes of lending interest rates VND from 2008 -2011 clearly.

Financial risk management

Figure 1

Unit: Million VND Content Short - term Loans Long - term Loans Total loans Difference Loans (+/_) Difference Loans (%) Interest expense Difference interest expense (+/-) Difference interest expense (%) Equity Difference equity (+/-) 1,498,805 2008 927,222 18,000 945,222 2009 1,548,377 84,870 1,633,247 688,025 67% 74,139 15,908 27% 1,758,134 259,329 Source: Financial statement of Hung Vuong Group Any business operates in the market bear influence by changes in interest rates. Hung Vuong Corporation was also affected by these changes. In 2008, interest expense was 58 VND billion, and up to 74 VND billions, meant up 27% in 2009. It yet was up dramatically to 193 VND billion and 266 VND billion in 2010 and 2011. Whereas, loans included both short term and long term, that increased a little. In 2009, total loans ending balance was 1,633 VND billion (MLD) and it went up more 688 MLD than 2008, equivalent 73%. The situation reversed in 2010 and 2011, when total loans was up 40%, but interest rose 162%, and even loans just was up 8%, yet interest raised 37%. Therefore, the main reason of paying high interest expense was the increasing interest rates so high. This is the first risk caused from interest rate. 2010 2,171,551 63,113 2,234,664 601,416 40% 194,308 120,169 162% 1,858,517 100,382 2011 2,337,239 26,915 2,364,154 129,490 8% 265,719 71,410 37% 2,052,873 194,356

58,231

Financial risk management

Risks rise from interest rate, when it is up, input cost will be up, which makes output cost up. So these finished product price is high and will be difficult to compete to the same quality ones. Besides, another risk generates from increasing interest rate, even when input cost does not go up, is falling businesss profit. Obviously, it was the interest rate growth, Hung Vuongs policy cut down the loans in 2010 and 2011 in their fund structure. Although the loans were up, the increasing just was small proportion. To compensation for shortage fund, Hung Vuong increased equity such as issued common shares and increasing retained earnings. The other solution for declining interest expense is loan from foreign markets, which helps this group get the benefit from low interest rate and much lower than domestic interest rate. When making loans from these markets, the group also gets the profit from growth of foreign exchange rate if foreign currency is appreciated. Then, Hung Vuong will get revenue from export to pay back the loans. Therefore, this methods risk is limited. Moreover, issuing the convertible bond is a good way to be used cheap-cost fund. Because the interest rate of this type bond is lower than common bonds. Then, after period, the borrowing-fund will be converted to common shares, or different states equity will increase. Thus, using this method will receive benefit from both using low interest expense and rising equity. To carry out this, Hung Vuong Group can do through their partner, SSI, the leading financial institution in Vietnam, the largest securities firm in terms of market capitalization and listed on the Ho Chi Minh Stock Exchange. Foreign exchange rate: Foreign exchange rate is one of main factors cause financial risk that an export firm like Hung Vuong Corporation has to face. Vietnam is a developing economy in the Southeast Asia. In recent years, the nation has been rising as a leading agricultural exporter and an attractive foreign investment destination. Vietnam's key products are rice, cashew nuts, black pepper, coffee, tea, fishery products, and rubber. Manufacturing, information technology and high-tech industries constitute a fast growing part of the economy. To Hung Vuong that is considered as a part of contribution for our economy. Looking at the diagram below, we can see exchange rate VND/USD changed a lot from 2008 to 2011.

Financial risk management

Foreign exchange rate VND/USD from 2008 2011 Resource: Bloomberg, Citi investment research and analysis

It moved up to the trend higher and higher in the next period. The main reason caused the fluctuation of exchange rate was the financial crisis which started and has been happening from July 2008 until now. In that, the top exchange rates were in July 2008, October 2009, and December 2010. Because of the instable felling of business and individuals when seeing the increasing USD in international market, which made inspectors hoard USD. Addition, the demand USD for export import enterprises to pay maturity liabilities was much too high and increasing USD to import gold due to the large difference between inland gold price and international one. With Hung Vuong Group, a specified processing and exporting pangasius enterprise, has been affected by this changes. In 2009, total revenue was 3,087 VND billions, included 2,375 VND billion of export, equivalent 77%, and this proportion declined to 60% in 2010 when total revenue 4,432 VND billion, in that amount for export was 2,636 VND billions. In 2011, total revenue went up nearly double with 7,843 VND billions and revenue from export also grew up 4,779 VND billions, occupied 61% per total revenue. From this information, we can see export revenues proportion accounted for the large part in Hung Vuongs total revenue. Therefore, when exchange rate VND/USD increased continuously year by year that helped Hung vuong get benefit for export so much, but not profit, even loose for import. This is the risk caused by exchange rate. According to the state bank of Vietnam, the interbank average rate of VND versus USD at the end of year from 2008 to 2011 as the following chart.

Financial risk management

Hung Vuong group is famous for not only processing and exporting seafood but also aquaculture. Along with the upgrading of existing production lines and developing of new processing plants, Hung Vuong Corporation currently operates more than 350 hectares of Pangasius farming in many provinces of the MeKong Delta such as Tien Giang, Ben Tre, Vinh Long, Can Tho, SaDec, Dong Thap, An Giang. In Hung Vuong's farms, the fish are only fed by the floating balls feed which is high quality product from Hung Vuong - Tay Nam Join Stock Company and Viet Thang Join Stock Company (www.hungvuongpanga.com). Due to the input to produce seafood feed is imported mainly (SGTT, 2012), so when exchange rate went up, it meant growth of input cost because the importer have to pay more VND for the same quantity and lead to cost of processing material up. Then the cycle repeats as mentioned in interest rate. In order to decrease pressure of raising input cost for manufacturing feed, Hung Vuong should find out domestic material to replace or limit the import. Because seafood feeds are made mainly from agricultural products that Viet Nam is agriculture country, producing them can do. If Hung Vuong can conduct, they will fall down the dependence on foreign feed as well as reduce input cost of processing. Commodity selling price: This is important factor, which affects to the financial risk. As mentioned in the introduction, Hung Vuongs major output markets are EU, Australia and America which occupy 70% over total exporting value. However, the global financial crisis happened from 2008, especially in EU countries and America that made these regions pangasius demand has dropped down and leaded to selling price fell. Hung Vuong exporter as well as famers producing pangasius has many difficulties in finding to output market and the fund to re-production. At that time, to solve this problem, Hung Vuong has found a new market and Japan is considered as a

Financial risk management

potential market to replace the old ones. This is appreciated solution to untie the big problem, which they are facing. Inflation and commodity purchasing price: Vietnamese economy has rapid growth after joining to WTO. Together with the economics growth, Vietnam is facing with high inflation 19% in 2011 and will be expected 10.5% in 2012 (World Bank data 2011). Following the inflation, input materials went up and leading to result as the costing increased higher than the increase of selling price, which caused difficulties to the company in competition. At the present, the most of Seafood Companies have been facing with shortage of materials. Directorate of Fisheries (2012), 80% food for fishery sector was supplied by the foreign companies who are making high price together with the limited credit and high interest rate from the bank making farmers go bankrupt, leading to the fishpond suspension in which farmers don't know when they can start their breeding again. The main factor to set the high price on food is the high discount policy (20% discount) from the food manufacturers to the supply agencies. Hung Vuong is one of the biggest Seafood Company in Vietnam. Therefore, it has been also suffering from above disadvantages. In order to lower the risk from commodities, the company should have a closed relationship with the farmers who are feeding fishes to supply to the company by signing long term contracts, and give previous financial supports to the farmers in order to force the farmers sell the fishes to the company in return. By this way, the company can stabilize the input material resources for the factories with stable prices. 2. Debtor risk: As mentioned above, main markets of Hung Vuong are exportation including 40% of EU market, 22% of Mexico & American markets, 8% of Middle East Market, and the rest is local market. All export contracts through letter of credit (L/C) or TTR payments. Hung Vuongs revenue was increased from 4,431,594 millions VND in 2010 to 7,792,024 millions VND in 2011 (+ 79.79%). Bad debt was soaring increased from 15.404 millions VND in 2010 to 87.140 millions VND in 2011 (+465.70%) while the receivable account only increased +43.73% (from 1.567.597 millions VND to 2.253.048 millions VND). The big amount from bad debt came from foreign customers (83.716 millions VND, accounting for 96% per total bad debt). Hung Vuong has been facing with the debtor risk from export operation. Therefore Hung Vuong has to consider about the new customers from another countries out side Vietnam such as collecting detailed information from the new customers, research the economy of each country, be carefully with Africa market, do not trust 100% to the applicants banks in case of L/C payment. It is no meaning when the revenue went up and the bad debt is rabid increase.

Financial risk management

When the market is so bad and the world is facing with financial crisis (2012), especially European debt crisis. Hung Vuong has to consider about the liquidity from debtor firstly than profit. 3. Labor risk: Hung Vuong is facing with the fluctuation of the labors about quality and quantity. The workers are very limited in industrialized environment and ready to stop working as their like or going to another company who pay a little high salary. The capacity produce is not stable so that affects the delivery time. Hung Vuong has to consider about salary policy reasonable in order to encourage the workers work for the company long time and promote one's ability 4. Anti-dumping lawsuit risk: Many fishery companies in Viet Nam are facing with the lawsuit of anti-dumping when exporting Tra and Basa fish to EU and US markets. The same like that, Hung Vuong has suffered antidumping duty from those countries which is either bad effected or threaten to Hung Vuongs exporting operation. This is external risky, therefore Hung Vuong and Directorate of Fisheries has to oppose strongly the antidumping tax application on those countries.

5. Financial leverage risk (FL risk) Description Liabilities Equity Financial leverage (FL) ROE Vinh Hoans FL Minh Phus FL 2008 1,180,098 1,503,892 1.78 48.36% 3.04 2.36 2009 1,974,564 1,756,811 2.12 75.26% 2.28 2.01 2010 3,170,463 1,819,350 2.74 12.77% 1.89 3.13 2011 3,898,131 2,052,873 2.90 22.42% 1.92 4.08

Financial risk management

Base on the above data, Hung Vuong has strongly use financial leverage in 2011, increasing from 1.18 in 2008 to 2.90 in 2011 while the ROE went down from 48.36 % to 22.42%, and the FL & ROE trend will more fluctuate in the next coming years. Hung Vuong has to control the expenses in order to lower the costing, trying to collect money from receivable account (87.140 billions VND in 2011), and be carefully when using FL tool to finance the capital in case the market went down or global crisis (2011). 6. Short term payment risk: (Millions VND) Description Turnover COGS Cash Debtor/receivable account Inventory Short term investments Current liabilities Current ratio Quick ratio Cash ratio Debtor days=360/(Turn over/Avr. Receivable account) Inventorydays= 360/(COGS/average inventory) 2008 2,985,865 2,265,623 79,989 1,455,252 433,179 91,741 1,160,284 1.78 1.70 0.07 1,294,976 3,084,034 1.71 1.71 0.08 170 76 1.20 1.20 0.07 150 90 2009 2010 2011 7,792,023 6,580,794 303,638 2,724,919 1,967,950 1,570,194 977,119 50,530 3,839,618 1.21 1.20 0.08 115 77 1.47 1.45 0.07 144.72 81.10 1.91 1.2 Average Industrial index

3,087,283 4,432,490 2,567,863 3,812,928 106,943 206,931

1,453,579 2,238,051 653,971 1,251,130

Sources: http://www.hsx.vn/hsx/Uploaded/cttc_ctny http://www.cophieu68.com/category_finance.php?quarter=4&year=2010&search=Xem According to data listed above, the short term payment risks from Hung Vuong seem to be safety when comparing with the average Index in the same filed. But Hung Vuong has to control the bad debt from foreign customers. 7. Coefficient of Variance on ROA of Hung Vuong: Decription 2008 2009 2010 2011 Notes

Financial risk management

Net income Assets ROA Standard deviation Coefficient of Variance 171,352 630,727 27.17% 294,904 830,779 35.50% 250,930 4.66% 492,318 7.73% 18.76% 0.13 0.69

5,388,129 6,366,284

The Coefficient of Variance from Hung Vuong when comparing with Minh Phu Seafood Corporation (Minh Phu) and Vinh Hoan Corporation (Vinh Hoan) who are the top ten biggest companies in seafood or fisheries sector. We have data as under:

Description AVERAGE ROA STANDARD DEVIATION COEFFICIENT OF VARIATION (CV)

Hung Vuong 18.76% 0.13 0.69

Minh Phu 5.41% 0.05 0.87

Vinh Hoan 12.27% 0.03 0.28

Base on the CV, Hung Vuong also have risk. When comparing with Vinh Hoan, Hung Vuongs CV is bigger than Vinh Hoans CV. ROA dramatically decreased from 27.17% in 2008 to 7.73% in 2011 due to the increase of cost of goods sold (COGS) (+ 72.14%) and Administrative and selling expenses (+42.51%) are bigger than the increase of Revenue (+75.83%).

Conclusion Risk is living around the Companies that cannot either avoid or eliminate the risk. Companies have to live with risks, high risk high return. The very important factor is to identify and manage the risk in order to lower the risk. Hung Vuong is one of the top 10th biggest exporting companies in fishery sector therefore they suffered from fluctuation of the markets and also face with many kind of risks as we mentioned above. Hung Vuong has to enhance the role of sections, which control the risk such as financial department, department of internal risky control, etc. Those departments has to analyses data or information from the market then feedback to another sections, hence Hung Vuong can predict and indentify the risk in the future such as debtor risk, commodity risk, interest rate risk, govern risk which is riskiness incurring in Hung Vuong.

Financial risk management

Financial risk management is not a contemporary issue. Financial risk management has been a challenge for as long as there have been markets and price fluctuations.

Financial risks arise from an organizations exposure to financial markets, its transactions with others, and its reliance on processes, systems, and people. To understand financial risks, it is useful to consider the factors that affect financial prices and rates, including interest rates, exchange rates, and commodities prices. Since financial decisions are made by humans, a little financial history is useful in understanding the nature of financial risk. Risk management takes a vital part in the administration strategy of the company. Having good strategies The risk management process involves both internal and external analysis. The first part of the process involves identifying and prioritizing the financial risks facing an organization and understanding their relevance. It may be necessary to examine the organization and its products, management, customers, suppliers, competitors, pricing, industry trends, balance sheet structure, and position in the industry. It is also necessary to consider stakeholders and their objectives and tolerance for risk.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Project ReportДокумент29 страницProject Reportnikskool5Оценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- 07 Analysis of Daily Vessel CostsДокумент1 страница07 Analysis of Daily Vessel CostslavkeshОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Fidelity Guide To Equity InvestingДокумент16 страницThe Fidelity Guide To Equity Investingmandar LawandeОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Honest Tea - Help SpreadsheetДокумент12 страницHonest Tea - Help Spreadsheetvirgin51100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Aircraft LeasingДокумент132 страницыAircraft LeasingBenchmarking84100% (1)

- Landau Company Draft1Документ4 страницыLandau Company Draft1cedric sevilla100% (2)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- of Kingfisher AirlinesДокумент8 страницof Kingfisher AirlinesSneha KumarОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Australia Financial SystemДокумент14 страницAustralia Financial SystemVipra BhatiaОценок пока нет

- Financial Market & InstrumentДокумент73 страницыFinancial Market & InstrumentSoumya ShettyОценок пока нет

- Project RitesДокумент72 страницыProject RitesSachin ChadhaОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Internal Control GuideДокумент42 страницыInternal Control GuideOrlando Pineda Vallar100% (1)

- ANSWERS Expected Return and Standard Deviation For Individual Stocks and PortfoliosДокумент3 страницыANSWERS Expected Return and Standard Deviation For Individual Stocks and PortfoliosKashifОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Intrinsic Valuation - Aswath Damodaran PDFДокумент19 страницIntrinsic Valuation - Aswath Damodaran PDFramsiva354Оценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- How Banks Create MoneyДокумент28 страницHow Banks Create MoneyMathew Beniga Gaco100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Sample Capitalization Table With Pro-Forma Calculations Based On New Round Pricing.Документ4 страницыSample Capitalization Table With Pro-Forma Calculations Based On New Round Pricing.CooleyGO100% (7)

- VOF VNL VNI: Capital MarketsДокумент6 страницVOF VNL VNI: Capital Marketsflocke2Оценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Value Investing From Graham To Buffett and BeyondДокумент4 страницыValue Investing From Graham To Buffett and Beyondaasifimam100% (1)

- IAS 41 - Agriculture PDFДокумент14 страницIAS 41 - Agriculture PDFJanelle SentinaОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Satish PPT 1st ChapterДокумент14 страницSatish PPT 1st ChaptersatishОценок пока нет

- Integrated Case Study Complete EditionДокумент34 страницыIntegrated Case Study Complete EditionWan Ramss Jr.100% (10)

- NRDC Consolidated Coal Renewable Database 2017Документ38 страницNRDC Consolidated Coal Renewable Database 2017Yan LaksanaОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- ACTG 5100 - 2019W - Day 2Документ15 страницACTG 5100 - 2019W - Day 2Akash TalwarОценок пока нет

- Thunder Road Report AugustДокумент25 страницThunder Road Report AugustZerohedgeОценок пока нет

- 09 Chapter 1Документ113 страниц09 Chapter 1Sami ZamaОценок пока нет

- Chapter 2Документ5 страницChapter 2vimalvijayan89Оценок пока нет

- Multiple Choice Quiz NOTESДокумент3 страницыMultiple Choice Quiz NOTESAzer BaghirovОценок пока нет

- Chaitanya Chemicals - Capital Structure - 2018Документ82 страницыChaitanya Chemicals - Capital Structure - 2018maheshfbОценок пока нет

- Business Incubators and Technological ParksДокумент9 страницBusiness Incubators and Technological ParksamОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Account Presentation SlidesДокумент17 страницAccount Presentation SlidesMatthew VtecОценок пока нет