Академический Документы

Профессиональный Документы

Культура Документы

Business Law Project - Semi Final

Загружено:

Farhan AhmadИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Business Law Project - Semi Final

Загружено:

Farhan AhmadАвторское право:

Доступные форматы

Business Law in Pakistan

Business Law and the Global legal environment

Term Paper

Authors: Abu Bakar Bhatti Enum Naseer Faisal Mehmood Mariam Asif Omar Khan Waqar Nadeem

Section N

Submitted to: Mr Shariq Mehmood

Lahore School of Economics

Business Law in Pakistan

Table of Contents

Executive summary ....................................................................................................................................... 3 Law ................................................................................................................................................................ 4 Basic definitions: ....................................................................................................................................... 4 Historical Perspective: .............................................................................................................................. 4 Business Law: ............................................................................................................................................ 7 The Companies Ordinance 1984- A brief overview: ................................................................................. 7 Different Forms of Businesses ...................................................................................................................... 9 Sole Proprietorship ................................................................................................................................. 10 Partnership.............................................................................................................................................. 10 Limited Liability Company ....................................................................................................................... 12 Corporations ........................................................................................................................................... 12 Joint Venture ........................................................................................................................................... 13 Economic Environment ............................................................................................................................... 13 Monetary Policy: ..................................................................................................................................... 14 Fiscal Policy: ............................................................................................................................................ 14 Trade Policy:............................................................................................................................................ 15 Industrial Policy: ...................................................................................................................................... 15 Infrastructure: ......................................................................................................................................... 16 Political Environment .................................................................................................................................. 16 Political risk: ............................................................................................................................................ 16 Credit Risk: .............................................................................................................................................. 17 Legal Environment ...................................................................................................................................... 17 Types of business laws in Pakistan: ........................................................................................................ 17 Cultural environment .................................................................................................................................. 22 References .................................................................................................................................................. 33

Business Law in Pakistan

Executive summary

The term paper defines law- in the business context. It moves through the historical perspective of law and narrows down to law relating to the business entities in Pakistan. The Companies Ordinance, 1984 provides the legal framework for the law relating to the business organizations (companies) in Pakistan. The businesses are categorized into sole proprietorship, partnership, limited liability company (LLC), corporation and joint venture. The advantages and disadvantages of each form of business are studied in detail. Furthermore, different types of environment affecting performance of business entities are discussed i.e, economic, political, legal and cultural environment. Finally, the impact of global legal laws has also been taken into account which affects the businesses in Pakistan. These global laws and policies extend from the role of global organizations, such as WTO, GATT, ISO 9001 Certification and other business related regulatory authorities.

Business Law in Pakistan

Law

Basic definitions: There are multiple ways and perspectives of looking at what law means. Some of them are listed below: Rules established by a governing authority to institute and maintain orderly coexistence. Any system of regulations to govern the conduct of the people of a community, society or nation, in response to the need for regularity, consistency and justice based upon collective human experience. A rule of action to which men are obliged to make their conduct comfortable. Law is the command of the sovereign. It imposes a duty and is backed by a sanction. Command, duty and sanction are three elements of law.

Historical Perspective: Customs or a code of conduct governed by the force of the local king was replaced by laws in ancient times. The earliest law book was written about 2100 B.C. for Ur-Nammu, king of Ur, a Middle Eastern city-state. Within three centuries Hammurabi, king of Babylonia, had enumerated laws of private conduct, business and legal precedents, of what he wrote 282 articles have survived. The term "eye for an eye" (or the equivalent value) is found in his work and also the issue of unequal treatment of the rich and the poor was codified here first. It took written law codes a thousand years to be developed among Israel and Greek cities (especially Athens). The Chinese developed rules in congruence with those that the Egyptians did.

Business Law in Pakistan

In later years, American colonies followed the English Common Law with minor variations, and the four-volume Commentaries on the Laws of England by Sir William Blackstone (completed in 1769) was the legal "bible" for all American frontier lawyers and also it influenced, to a large extent, the development of state codes of law. To a great extent common law has been replaced by written statutes, and a gigantic body of such statutes has been enacted by legislatures both at the federal and state level and this is done to cater to the complexities of modern life.

A statute/ ordinance/ regulation that is acted upon and enforced by the legislative branch of a government and signed into law, or in some other nations created by decree without any democratic process is also known as a law. This is different from "natural law," which is does not have its basis on statute, but on alleged common-sense as in an understanding of what action is right or proper and this mostly has to do with the moral and/or religious understanding of acceptable and unacceptable behavior.

In the middle Ages, law was considered to have been dictated by Divine Will, and also to be revealed to wise men. The most ancient legal precedents/ customs were considered to be the best law, and much of Continental Europe ended up making secular law on the lines of the old Roman law. In Byzantium, secular and sacred law somewhat intertwined, where secular law took precedence. In western part of Europe, however, religious and secular law was considered to be two opposite things. Church law was referred to as Canon Law, and was applicable to the clergy, to the secular world in matters of the administration of the Sacraments such as marriage, and to the immunity of the clergy from secular law. This is where the conflict between the Church and the State found it roots. St. Augustine arranged law in three levels:

Divine law, a perfect system comprehended through faith and reason;

Business Law in Pakistan

Natural law, which could be understood by all creatures, lacked the perfection of faith, and could be improved by philosophy;

Temporal (secular) law, obedience to which was enjoined on all Christians, save where it conflicted with Divine or Canon law.

In its most general and comprehensive sense, law signifies a rule of action, and is applied indiscriminately to all kinds of action; whether animate or inanimate, rational or irrational. In its more confined sense, law denotes the rule, not of actions in general, but of human action or conduct.

Law can generally be divided into four main classes, namely:

Natural law; The law of nations; Public law; and, Private or civil law.

When considered in relation to its origin, it is statute law or common law. When examined as to its different systems it is divided into civil law, common law, canon law. When applied to objects, it is civil, criminal or penal.

It is also divided further into natural law and positive law as well as into written law, (lex scripta) and unwritten law (lex non scripta) and into merchant law, martial law, municipal law and foreign law. When considered as to their duration, laws are immutable and arbitrary or positive. When viewed as to their effect, they are prospective and retrospective.

Business Law in Pakistan

Business Law: Broadly speaking, business law refers to the laws that apply to business entities, such as partnerships and corporations. It gives us the rules that govern business interaction and organization. It defines the boundaries within which business can operate and also explicitly defines the penalties for violation of these. Not only this, but it also includes legislations and legalities regarding the entire business structure as well as providing a set of rules for setting up, starting and conducting business. It clearly points out all the rights and responsibilities of businesses.

The Companies Ordinance 1984- A brief overview: The Companies Ordinance 1984 is a broad piece of Pakistani legislation that, according to its preamble, was passed with the intent of serving as an ordinance to consolidate and amend the law relating to companies and certain other associations. All legal regulations and laws for businesses that are registered with the SECP or the Securities and Exchange Commission of Pakistan are covered in detail in this ordinance. It is enforced by the SECP. The SECP polices the actions of the business enterprises and keeps a watch on them to insure stakeholder interest.

The corporate sector in Pakistan is governed by the Companies Ordinance 1984 which was promulgated on 8th October 1984 and repealed the Companies Act, 1913. The avowed objectives of the Companies Ordinance 1984 were to consolidate and amend the law relating to companies and certain other associations for the purpose of healthy growth of corporate enterprises, protection of investors and creditors, promotion of investment and development of economy. The detailed provisions of the Companies Ordinance, 1984 sought to meet these objectives and have been amended and updated from time to time to keep in line with the changing circumstances.

Business Law in Pakistan

This piece of legislation has multi-faceted purposes and advantages. One of the positives that it has to its credit is the legal protection that it provides to the Pakistani business community. Other purposes and advantages that it has include promoting the healthy growth of the corporate enterprises, protection of investors and creditors, promotion of investment and development of economy.

In Pakistan, companies are the most favored form of organizations as far as medium and largescale enterprises go. The legal regime that serves dual purposes of establishment and regulation of companies is the Companies Ordinance, 1984. As far as the function of administration is concerned, it is vested in the Securities and Exchange Commission of Pakistan and the Registrar of Companies appointed by the Securities and Exchange Commission of Pakistan for a province of Pakistan where such company is to be registered. Under the Companies Ordinance, 1984 a company is a corporate body that is a separate legal entity and has a perpetual succession. It is formed by persons that associate for a lawful purpose and this is done by subscribing the names of all such persons to the Memorandum of Association and also complying with other requirements that concern the registration of a company (covered by the Companies Ordinance, 1984). The Companies Ordinance, 1984 provides for three different types of companies:

A company limited by shares A company limited by guarantee An unlimited liability company

Further, under the Companies Ordinance, 1984 two types of limited liability companies that are provided for, namely:

Business Law in Pakistan

A private limited company A public limited company (which may be listed or unlisted)

One or more persons who subscribe their name(s) to the Memorandum of Association and comply with other specific requirements stated in the Companies Ordinance, 1984 may incorporate a private limited company. If the company has only one person as the subscriber to the Memorandum of Association is known as a Single Member Company. Nevertheless, such a company will stay as a private limited company for all intents and purposes of the Ordinance. On the flip side, however, if three or more persons are associated, a public limited company is formed. In Pakistan, the most common and frequent form of business enterprise, for both, private and public is a company that is limited by shares.

Different Forms of Businesses

A business/company/enterprise or firm is a legally recognized organization comprising of a group of people working to earn profit. It is usually built to provide goods, services, or both to consumers or tertiary business in exchange for money. Businesses are predominant in capitalist or market economies also known as laissez faire, in which most businesses are privately owned and typically formed to earn profit that will increase the wealth of its owners. The owners and operators of private, for-profit businesses have as one of their main objectives the receipt or generation of financial returns in exchange for work and acceptance of risk. Businesses may also be designed with a purpose other than profit or can also be owned by the state.

Business Law in Pakistan

10

Businesses can be of various forms. To name a few:

Sole proprietorship Partnership Limited liability company Joint venture

Sole Proprietorship A sole proprietorship is the least expensive and easiest way to start your business. Sole Proprietorship refers to a single owner business. The owner and the business are not separate entities. It has very few legal requirements to set up. There are thus no set-up costs. Hence costs are lesser and the owner doesnt have to divide or share the profit with anyone. Ideas and knowledge is also less as compared to what there maybe with more heads to think. Sole proprietorships also have lesser taxes to pay. Only the income or self employment tax applies to this business. A sole-proprietor may also find it hard to get loans from the bank. Loss incurred will have to be born solely by that single owner. A sole proprietorship has unlimited liability i.e. in case of bad debts, the owner will have to pay them off personally by selling his personal assets if the business fails to. Therefore risk in such a business is higher. Examples of sole proprietorships are freelance writers, copy editors, photographers and craftspeople. A sole proprietorship also has no continuity. If the owner dies, the business ends.

Partnership Partnerships are two or more people working together. The two most common types of partnerships are limited partnerships and general partnerships. Two or more people can form a general partnership through a simple oral agreement. Starting a partnership with an oral

Business Law in Pakistan

11

agreement is not recommended, legal documents should be drawn up by an attorney, namely the partnership agreement. The costs may be higher than a sole proprietorship, but they would be less than for incorporating. A large benefit for having a legal partnership drawn up is that it aids in resolving any future business disputes. A down side to a partnership is that a partner can be held responsible for the actions of other partners in the business in addition to their own. A partnership is a business with more than one owner, usually two and up to twenty. Set up costs are fewer, but still it is difficult to raise as much money as a larger business. Also, the owners have unlimited liability, as does a sole proprietor: any debts incurred by the company must be paid by the owners, even if they have to use their own personal property. However there is continuity as if one owner dies, the partner continues it. The owner and the business are separate entities.

Some of the things included in a partnership agreement:

The compensation for partners. How long will the partnership last. How will the profits or losses be divided? What type of business is it? What is each partner investing into the business? If the partnership dissolves how will assets be distributed? Provisions for dissolution of the partnership. Provisions for future changes to the partnership. Define any restrictions to expenditures or authority. Provisions for death or incapacity.

Business Law in Pakistan

12

Limited Liability Company A limited liability company (LLC), also known as a company with limited liability (WLL), is a flexible form of enterprise that blends elements of partnership and corporate structures. It is a hybrid business entity having certain characteristics of both a corporation and a partnership or sole proprietorship (depending on how many owners there are). An LLC, although a business entity, is a type of unincorporated association and is not a corporation. The primary characteristic an LLC shares with a corporation is limited liability, and the primary characteristic it shares with a partnership is the availability of pass-through income taxation. It is often more flexible than a corporation and it is well-suited for companies with a single owner.

Corporations A legal entity, created under the authority of a statute, which permits a group of people, as shareholders, to apply to the government for an independent organization to be created, which then pursues set objectives, and is empowered with legal rights usually only reserved for individuals, such as to sue and be sued, own property, hire employees or loan and borrow money. Corporation is chartered by a state and given many legal rights as an entity separate from its owners. The shareholders of corporations have limited liability protection, and corporations have full discretion over the amount of profits they can distribute or retain. Corporations are presumed to be for-profit entities, and as such they can have an unlimited number of years with losses. Corporations must have at least one shareholder. An article of Association as well a Memorandum of Association is needed for set up. Corporation also provides companies with a more flexible way to manage their ownership structure. In addition, there are different tax implications for corporations, although these can be both advantageous and disadvantageous. In these respects, corporations differ from sole proprietorships and limited partnerships. Costs are

Business Law in Pakistan

13

higher and profits are divided amongst owners, so are the losses. Knowledge is more as there are more people involved. However there is continuity in this form of business as when an owner dies it is continued by other owners. The primary advantage of a for-profit corporation is that it provides the shareholders with a right to participate in the profits (by dividends) without any personal liability (the company absorbs the entire liability of the business).

Joint Venture A joint venture is a contractual agreement for a project joining together two or more parties or companies for the purpose of executing a particular business undertaking. In a joint venture, both parties are equally invested in the project in terms of money, time, and effort to build on the original concept; they agree to share the profit or loss. While joint ventures are generally small projects, major corporations also use this method in order to diversify. A joint venture can ensure the success of smaller projects for those that are just starting in the business world or for established corporations. Since the cost of starting new projects is generally high, a joint venture allows both parties to share the burden of the project, as well as the resulting profits.

Economic Environment

All types of businesses, either they fall in the category of single member company, partnership, private limited company or the public limited company, they all are affected by the Economic Environment of a particular country in which they are running or doing their business. The economic policies of a country like the monetary policy, fiscal policy, trade policy and the industrial policies along with the inflation rate also do affect the businesses in a particular country. The Human resources, physical resources and the network of infrastructure like the

Business Law in Pakistan

14

Road networks, communication systems and the energy consumption etc also affect the businesses of a country. If the above mentioned factors are positive, then they would have good impact on the companies and firms and they will have more chances of being successful.

Monetary Policy: During the last 8 to 9 years from 2000-2009, the government of Pakistan has implemented expansionary monetary policy that means the interest rates were set lower that caused the loans for businesses from the banks at lower interest. In other words the monetary policy of Pakistan was in the favor of firms and companies to do business and get finances at cheap rates. This expansionary monetary policy had some negative impact on Pakistans economy too, as the interest on the bank loans were set at lower rates the demand for money supply increased that lead to the inflation in the country, which means the depreciation of rupee in the international currency exchange, the imports got more expensive these additional costs were passed on by the producers to the final consumers that lead to the high prices of consumer products and ultimately in low demand from the consumers, because as the inflation would rise in Pakistan the purchasing power of its nationals would reduce, now they could buy less items with the same amount of money, that would result in low demand for products and would finally hurt the local businesses of Pakistan. Overall the monetary policy is in the favor of businesses as it helps them raise capital for expanding their operations, buts its side effects like the inflation along with other factors also do affect it in a negative way.

Fiscal Policy: Pakistan has been under the burden of external debt from the IMF and the bilateral sources, since decades now, and this debt is continuously increasing over the time, currently Pakistans external debt is around $55 billion dollars which is a huge burden on its economy. This debt is just one

Business Law in Pakistan

15

thing its annual debt payments is another problem for Pakistan, each year a major portion of its budget is spent on debt payments and another major portion on defense sector of Pakistan, so in order to run other departments and sectors Government impose taxes on individuals and on all types of businesses, over the years these taxes have been increased a lot. This increase in taxation by the government is mainly because of the conditionalities of International Monetary Fund which is the main donor of the funds (loans) given out to Pakistan. Now these higher taxes have negative effect on industries and businesses either they are Multi-national companies, single member companies partnership firms or private limited companies. These taxes will reduce the profits of the companies and would also be very unattractive for the MNCs to go into those countries that have such high corporate taxes.

Trade Policy: The excise duties and the import duties are also of a huge concern to the businesses. During the last few years Pakistan has opened up its borders for trade, according to the trade policy review of year 2002, Pakistans trade liberalization have got very positive response from international firms and multi-national banks and financial institutions. The tariffs and trade barriers have been reduced a lot over the years. These steps have contributed in reducing the unemployment and poverty in the country.

Industrial Policy: Industrialization is very important for countrys economy to grow. As far as the industrial policy of Pakistan is concerned, its not going that well, the government is trying to encourage publicprivate sector to grow, but certain factors like high power tariffs, lack of availability of power, high mark ups and difficulty in getting loans for the businesses are creating problems for businesses to grow. The government needs to focus on improving and liberalizing its industrial

Business Law in Pakistan

16

policy so it becomes attractive to the MNCs that would bring foreign direct investment in the country and also in bringing up the local businesses.

Infrastructure: Network of infrastructure is also very important for the businesses in a country, like the network of roads, rail network, the communication system in the country and the facilities like power supply; natural gas supply etc. without the availability of good and proper infrastructure businesses cannot grow, in a speedy way in any country. In case of Pakistan the infrastructure is not very good the industries do have suffer with the power shortages that makes it not very favorable for the MNCs to invest in Pakistan.

Political Environment

Along with the economic environment, the political environment of a country also matters for the businesses to grow. Firms require and prefer a stable form of government to conduct its business and a good law and order situation in the country. The political environment includes the Political risk, credit risk and the currency inconvertibility.

Political risk: Political risk is basically the risk of losing the investment made in a particular country due to the change in its government or a change in its policies such as tariff rates or taxes. If we talk about Pakistan, it has very high political risk due to its unstable ruling body, rapid change of governments, the enforcement of marshal laws, the corrupt governments and the issues of security as of terrorism in the country. These all factors are contributing in high political risk in

Business Law in Pakistan

17

Pakistan for international companies to invest in, because the investment might not probably seems a good safe option to them.

Credit Risk: The credit risk is also very high in Pakistan as it froze the foreign exchange accounts during 1980s when Pakistan had some serious issues with its foreign currency reserves that shackle the trust of many investment companies in Pakistan. Most of the multi-national companies do hesitate to invest in Pakistan due to its poor financial conditions and high credit risk.

Legal Environment

Law is an instrument of social justice of the state that seeks to provide justice, stability and security in the society- (Prasad, 2005) Law by its rules and regulations helps the individuals to maintain a uniform pattern of interactions and behaviors against each other. It is the command of the sovereign which is enforced by the legal institutions such as judiciary and court. In the business context, law helps the businesses to operate freely in a uniform manner in the global environment. It limits the actions of the businesses to an admissible level where the policies adopted by these businesses do not harm the society. Law also safeguards the interests of the businesses in bad circumstances. In case of non compliance to the rules and regulations, law defines the penalties and fine to the particular business organization.

Types of business laws in Pakistan: 1. Business formation laws:

Business Law in Pakistan

18

This law defines the type of business entity formed in Pakistan a sole proprietorship, partnership or a limited liability company (LLC). Each type of the business entities has different legal implications and tax standards. They have altogether different business processes, and duties to their stakeholders in the business environment. 2. License laws: Different forms of business entities need to take certain type of licenses to operate in Pakistan. They need to fulfill certain pre requisites before they get registered with the registrar or start their operations directly. In case of a sole proprietor, an individual may set up the business as sole proprietorship without any registration except with the tax authorities. The partnership can be formed by executing a partnership deed (on a stamp paper) between or among the partners whereby it defines the purpose of the business and the rights and liabilities of each partner in that business. The partnership firm may or may not get register with the registrar of firms. The Partnership Act, 1932 is the legal framework for the partnership firms. The securities and exchange commission of Pakistan (SECP) is the regulatory authority of the companies, whereas The Companies Ordinance, 1984 and The Companies (General Provisions and forms) rules, 1985 provides the legal framework in this regard. In Pakistan, the Ordinance provides the following categories of companies: A company limited by shares A company limited by guarantee An unlimited company

Companies can also be classifies according to their structures: Private company

Business Law in Pakistan

19

Public company (listed or unlisted) Single member company

In case of a listed company, the shares and stocks of a company can be listed on the three stock exchanges available in Pakistan: Karachi stock exchange Lahore stock exchange Islamabad stock exchange

3. Tax laws: As the business entity begins its operations and start generating sales, it needs to keep a record of all its transactions and at the end of the (fiscal) year it is required to pay a lump sum amount to the government in the form of taxes. The tax collection from these businesses is an important component of the tax revenues under fiscal policy management. The Central Board of Revenue (CBR) is the regulatory authority which is responsible for the management of the taxation system in Pakistan. It is engaged in the collection of taxes under various structures. These forms of taxes can be divided under two categories: A. Direct taxes: A tax whose burden cannot be shifted to the third party is classified as a direct tax. It means that the tax should be directly paid by the entity on which it is imposed. It consists of the income tax (business income) and the capital value tax. The income tax (also referred as corporate tax or profit tax) is levied on the

Business Law in Pakistan

20

income of the companies. According to the current fiscal year 2010-2011, the present corporate tax rate is 35% of the net taxable income of the company. The taxable income is subject to the gross earnings less the interest on debt. Also a 10% tax rate is applicable on the companies on the income from dividend. Moreover, the capital value tax was introduced through Finance Act, 1989. Capital gains are one of the heads of income and are taxed at the normal corporate rate. Gains derived from the sale of capital assets held for more than 1 year are reduced by 25% for tax purposes and, therefore, 75% of the net gain is taxable at a rate of 35%. B. Indirect taxes: When the ultimate burden of the tax can be shifted on someone else, it is known as an indirect tax. Examples of an indirect tax are the general sales tax, excise and custom duty. The Sales Act, 1990 forms the legal framework for the operation and collection of sales tax. Sales Tax is levied on the supply of goods and services, and the import of goods. The current sales tax rate in Pakistan is 17%. In Pakistan, sales tax returns and payments must be made on a monthly basis. The sales tax registration is mandatory for manufacturers if turnover exceeds PKR 5 million; for retailers, if the value of supplies exceeds PKR 5 million; and for importers and other persons if required by another federal or provincial law. The Custom Act, 1969 and Custom Rules, 2001 provides the legal framework for custom duty laws. The custom duty is applicable on the goods imported/exported, and brought into Pakistan from any other country. There are some exemptions on

Business Law in Pakistan

21

products on which custom duty does not apply. However, the custom rate varies from product to product. The Federal Excise Act, 2005 and the Federal Excise Rule, 2005 provides the legal framework for the excise tax. The rates and basis for levying the duty varies from item to item. 4. Employee law: The labor policy issued by the government of Pakistan identifies the workers rights. The policy also provides for the compliance with international labor standards ratified by Pakistan. At present, the labor policy as approved in year 2002 is in force. The total labor force of Pakistan is comprised of approximately 37.15 million people, with 47% within the agriculture sector, 10.50% in the manufacturing & mining sector and remaining 42.50% in various other professions. To address the issue the problem of child labor in Pakistan, the Employment of Children Act, 1991 is in practice. It says about the child labor protection: No child below the age of fourteen shall be engaged in any factory or mine or in any other hazardous employment. All forms of forced labor and human trafficking are prohibited." 5. Environmental laws: In 1983, the Pakistan Environmental Protection Ordinance (PEPO) was passed. Presently, the National Environment Policy, 2005 is in practice. The goal of National Environment Policy is to protect, conserve and restore Pakistans environment in order to improve the quality of life of the citizens through sustainable development. The policy highlights the sectoral guidelines for different sectors, whereby the guidelines for businesses includes

Business Law in Pakistan

22

the promotion of ISO 14000 Certifications, and the development of technologies to help control the detrimental effect of hazardous pollutants and wastes in the country. 6. Intellectual property laws: Intellectual property law safeguards the rights of the owner and his work from being copied or misused by someone else. Under this law, owners are granted exclusive rights to a number of intangible assets such as words, symbols, designs, artistic work etc. In the business context, it can be divided into trademarks, patents, industrial designs, integrated circuits, copyrights, geographical indications and plant breed rights.

Cultural environment

Culture is made up of values, beliefs, attitudes, assumptions and behaviors shared by a group of people in a particular place. Pakistani culture is being influenced by many empires and cultures; still it stands as a country having a rich and unique culture. In business context, the culture can be seen as having positive or negative influences. Different aspects of cultures of a society might be seen as hindering or assisting business performances. In order to do set up a business in Pakistan, there are key concepts and values which should be taken into account before hand. 1. Religion: Religion plays a very important role in the life of almost every Pakistani. Muslims must live according to the five pillars of Islam, which involves praying facing Mecca five times a day. That is why it is seen that most of the business organizations have the facilities of a mosque or a pray area; giving time to their employees to say their prayers

Business Law in Pakistan

23

during the working hours. Friday is the holy day when everything is closed during the juma break. Further restrictions may occur during the holy month of Ramadan, when Muslims fast and the working day are shortened. Also the food businesses have to make sure that the food they are selling is halal which do not contains any ingredients which are declared haram in Islam. 2. Language: The national language of Pakistan is Urdu, where English-the international language, is becoming dominant in the socio-economic class A and B extensively. So the businessesMNCs- have to take great care of this fact before communicating to their target audience. 3. Values and ethics: Values are the ideas and beliefs we hold as special. They are, in fact powerful drivers of how we think and behave. Pakistan is a country where family is the most important unit of social organization. Elders are given due respect in the society. Collectivism is one of the dominating factors of the society. Religious values form the basis of interaction among individuals. Businesses have to consider these factors before operating in Pakistan.

Business Law in Pakistan

24

Global Legal Laws and their effects on Pakistani economy

International Laws and treaties govern the conduct of independent nations in their relationships with one another. In this paper we will look at the major global laws and treaties and their respective effects on Pakistan.

GATT & WTO

Pakistan was one of the 23 founders of GATT in 1947. It actively participated in all the subsequent GATT negotiations and was involved in the Uruguay Round that resulted in the creation of the WTO. Pakistan was thus also one of the founding members of WTO that was established in 1995. There is a considerable impact of WTO on all sectors of Pakistan's economy, particularly, its industries - textile, agriculture and services. The nature of impact is predictable for some sectors, whereas, it is difficult for others in view of global developments in trade and the degree of complexity involved. As far as the industrial sector is concerned, Pakistans main exports are textile and related products. The non-textile exports of Pakistan are negligible but have a potential to grow tremendously under the WTO regime. On the import side, Pakistan has been rationalizing its tariff structure to a large extent under the trade liberalization principle as proposed by WTO. The average tariff in Pakistan is around 17 percent; however, there is a need to ensure that there are no adverse affects of trade liberalization on the domestic producers. This calls for a need to make adjustments in the policies for the domestic industry, so that they may be able to face the increased competition from global market. The complete integration of all textile and clothing products into the free trade environment under the Agreement on Textile and Clothing on 1st January 2005 was one of the most

Business Law in Pakistan

25

significant changes for Pakistan under the world trade regime. Pakistans economy finds itself heavily dependent on the textile and clothing (T&C) sector. It is because of the nature of textile industry being labor intensive and requiring less capital and technical skills. However, a quotafree trade era calls for structural and operational adjustments in the textile sector to enable Pakistan's exporters to be globally competitive. China is the biggest challenge to Pakistans textile exports in this post ATC regime. As far as agriculture is concerned, Pakistan being an agrarian economy is still a net importer of food items. The Agreement on Agriculture of WTO has been significant in molding agricultural policies of Pakistan. The Agreement on Agriculture provides rules regarding export subsidies, domestic support and market access. Furthermore, the WTO Agreement on the application of Sanitary Measures with regard to food safety and protection of human and animal life, and health from agricultural imports has considerable impact on Pakistan. Apart from the major crops, Pakistan needs to exploit its comparative advantage in the production and exports of meat, dairy products, fruits, vegetables, horticulture, etc. The developing countries and the developed world are at loggerheads over agriculture. With regard to agricultural negotiations in the WTO, Pakistan along with the other developing countries, insists on a world trading system that is fair. Moreover, Pakistan has a comparative advantage in many primary commodities. But in order to fully utilize its comparative advantage, it needs to focus on and solve the problems in supply side. Pertaining to the Agreement on trade related aspects of intellectual property rights (TRIPS), Pakistan needs to ensure that the industry is encouraged to provide intellectual property protection for its products and also make certain that there is effective protection of the intellectual property rights attached to imported products.

Business Law in Pakistan

26

Services are the largest and most dynamic component of both developed and developing country. It is impossible for any country to prosper today under the burden of an inefficient and expensive services infrastructure. In Pakistan, the services sector contributes more than half of the GDP. Workers remittances account for the largest component of services and the country has a large number of expatriates throughout the world. Being a developing country, Pakistan has adopted a cautious approach while making commitments in trade in services. However, the actual policy of the government is far liberal as compared to the binding commitments scheduled in the General Agreement on Trade in Services. Pakistan has made some general commitments that apply across the board, while in six sectors specific commitments have been made. These include Business services, Construction and related engineering services, Tourism and travel related services, Health and related social services, Telecommunication services, and Financial services. Pakistans domestic industry also faces problems of increased imports and unfair practices under the global trade regime. WTO Agreements have an in-built mechanism providing for trade remedial measures to counteract the effect of dumping, subsidies and surge of imports. Accordingly, Pakistan through national legislation has come up with anti-dumping laws against dumping, countervailing duties laws against subsidies and safeguard action laws against surge of imports in order to protect its domestic industry.

In a nutshell, at present Pakistan maintains a fairly liberal trade regime, where all quantitative restrictions on imports have either been removed or converted into tariffs. It is noteworthy that the applied tariffs in Pakistan are well below the bound tariffs under WTO, translating into market access. However, quality control is integral to competitiveness of Pakistan's exports. Low quality products fetch low price in the international market. The obvious problems of quality for

Business Law in Pakistan

27

Pakistan are those of technical precision, grading and specialization. The WTO Agreement on Technical Barriers to Trade is relevant in this regard. Proper support and prudent policies for the industry, along with intelligent balancing of imports and exports is vital for the sustainability and growth of Pakistan's economy and is likely to lead towards a bright future and trade enhancement under the WTO regime.

International Standards Organization

ISO (International Organization for Standardization) is the world's largest developer and publisher of International Standards. ISO is a network of the national standards institutes of 163 countries, one member per country, with a Central Secretariat in Geneva, Switzerland, that coordinates the system. ISO enables a consensus to be reached on solutions that meet both the requirements of business and the broader needs of society. The idea is to create a set standard of quality that can be ensured in companies that apply and carry the symbol of being an ISO certified company. The ISO certification has made it a lot easier for local firms to ensure their foreign clients that the products/services being sold would be of high quality and that it would meet/match international standards. Supporters of this organization say that it has lead to significant increase in the overall volume of international trade and enabled developing countries like Pakistan to capture markets that were once out of reach. Additionally, it has also raised the general quality standards of firms who either have the certification or desire to have it in the future. On the flip side, many trade analysts have criticized Pakistani ISO certifications as being redundant and not up to international standards.

Business Law in Pakistan

28

Protectionism vs Free Trade

Protectionism refers to the economic policy of restraining cross border trade through tools like Tariffs, Quotas, Embargoes, Exchange rate manipulation, Subsidies and Anti-Dumping Policies. The 21st century has been a huge critic of such policies and the developed world, especially countries like US and UK have tried to directly link FREE TRADE with Democracy and the overall well fare of the mankind. The World Trade Organization has continued to pressurize the developing world, and some very important free trade agreements have been signed by various countries. Yes, no one can deny that the fundamentals of free trade functioning under the umbrella of a FULLY globalized world offer irresistible benefits. But the important question is Will a Fully Globalised world ever shape up? According to most conservative analysts the developing world simply does not have the ability or the economic strength to compete with the already developed countries in an open market. And for the sake of debate, why should they? Didnt all these countries - who now form the Developed world, enjoy the benefits of protectionism during the course of their development? Of course they did! After all free trade as we see it today is a new concept. Then why should the developing countries of this era suffer? Isnt free trade just another poverty trap for states like us? Or is it simply a tool to expand into new markets for the Western businesses. Also, if all conservative economies adopt free trade, some of the worlds most troubled nations, like Pakistan would go into deeper trouble with massive BOP deficits and with limited Foreign exchange reserves, this could be a death sentence.

Business Law in Pakistan

29

Lets also not forget that tariffs on international trade are important means of generating revenue for most developing nations. Therefore, it would be a huge burden on their liquidity position to stop this all important stream of funds coming their way. Additionally, theyd also have to forgo a significant source of foreign exchange reserves. In addition, protectionism is the single most important instrument to protect local industries and save them from fierce international competition. If this is not done, local firms would often find it extremely difficult to operate and match the efficiency of International competitors. Businesses that succumb to competition would create unemployment which can further lead to many other problems. On the other hand, if state protection is not provided to infant (new) and sunset (declining) industries they would inevitably collapse to the competition provided by well established firms in the international market. This would again result in Unemployment, which in turn would lead to increase in poverty. Just like people, all countries are not equally blessed. Some have an abundance of natural resources, some depend on progressive R & D, and there are also those that have almost nothing. What they do is - form a potential market for others. Therefore it is completely fair if they use protectionism policies like Tariffs to milk this opportunity that they do have. Likewise, countries who have a natural or artificial edge in the production of certain goods often indulge in unethical practices like DUMPING in order to slaughter the competition in some international markets, especially where the local firms are not strong enough to fight back. Protectionism is a great shield against such practices

Business Law in Pakistan

30

Lets not forget that economic actions are very strongly bonded with politics. Protectionism promotes the all important principle of subsistence that recommends countries to produce what they consume. It is crucial that nations at least produce some of what they consume, so that in case of war food is the last of their worries. Also, weve seen that Hegemonic powers like US continue to use their economic strength to fuel their political might. They regularly use economic gimmicks to control the political actions of developing countries like Pakistan. Allowing them to further improve their economic power by offering our local markets would result in long-term political dependence which in itself is a very dangerous thing. Additionally, Protectionism also helps countries fight cultural attacks and assists in sustaining traditional and religious values. Example, Pakistan has banned certain products that go against our religious teachings (like Alcohol). Looking at the other side of the coin, protectionism reduces international trade volume and hampers economic progress of the combined world. It also creates an artificial bias and reduces the positive effects of competition. However, the inability of countries like Pakistan to compete freely in the global markets make it a luxury that the world would not enjoy for quite some time.

Business Law in Pakistan

31

Intellectual Property Law in Pakistan

Intellectual Property laws include the copyright laws, patent laws and trademark laws. Intellectual Property is often the most valuable and least protected asset of many businesses and creative individuals. This area of law protects the work of creative individuals and businesses and protects such creation from unauthorized use or exploitation by third parties. By utilizing Intellectual Property laws, creators and innovators can fully protect and benefit from their creations. Pakistan is a signatory to the Marrakesh Agreement, signed in Marrakech, Morocco, on April 15, 1994, which established the World Trade Organization. The WTO aims to increase international trade by promoting lower trade barriers and providing a platform for the negotiation of trade and to their business. Under the provisions of this agreement all states which subscribe to WTO become bound to a mutual recognition of intellectual property rights at a higher level of protection that the older conventions could offer. However, amendments have now been made in the Pakistani intellectual property laws, to accommodate the new WTO provisions.

Pakistan is also a signatory to the Berne Convention for the Protection of Literary and Artistic Work of 1886 and to the Agreement on Trade Related Aspects of Intellectual Property Rights, which came into being on January 1, 1995 (TRIPs). The TRIPs is an international treaty administered by the World Trade Organization, which sets down minimum standards for most forms of intellectual property regulations within all member countries of the WTO.

Even though Pakistan is an active member of the WTO and has also signed the TRIPs agreement, copyright infringement in Pakistan is not only normal but also very intense. In fact,

Business Law in Pakistan

32

Pakistan is one of the largest exporters of pirated CDs/DVDs in the world. The estimated consumption of pirated goods in Pakistan is put at a staggering figure of $80 billion USD. Therefore, the moral of the story is that not all international laws are effectively and actively imposed by signatories even though they agree to the basic idea promoted by that law/treaty. As far as intellectual property rights are concerned, the government of Pakistan needs to actively take steps before innovation and creativity which are already very low in the country completely disappear.

Business Law in Pakistan

33

References

Form of businesses. (n.d.). Retrieved fromhttp://library.thinkquest.org/16500/Articles/BizTypes.html

Corporation. (n.d.). Retrieved from http://www.investorwords.com/1140/corporation.html

Types of Business Laws: Small Business Formation Laws & More. (2008). Retrieved from

http://www.morebusiness.com/business-laws

Pakistan tax rates. (n.d.). Retrieved from http://www.taxrates.cc/html/pakistan-tax-rates.html Intellectual property organization of Pakistan Elements of culture. (n.d.). Retrieved from

http://changingminds.org/explanations/culture/elements_of_culture.htm

Вам также может понравиться

- Business LawДокумент78 страницBusiness LawEvangelist Kabaso SydneyОценок пока нет

- Sponsorship Prospectus - FINALДокумент20 страницSponsorship Prospectus - FINALAndrea SchermerhornОценок пока нет

- Chapter 1: Jurisprudence As A Science: 3. Definition 4. Kinds 5. Relation With Other Social SciencesДокумент3 страницыChapter 1: Jurisprudence As A Science: 3. Definition 4. Kinds 5. Relation With Other Social SciencesKashif KhanОценок пока нет

- FM.04.02.01 Project Demobilization Checklist Rev2Документ2 страницыFM.04.02.01 Project Demobilization Checklist Rev2alex100% (3)

- Research Notes: Legal Profession - Midterms CoverageДокумент6 страницResearch Notes: Legal Profession - Midterms CoverageDani MagsОценок пока нет

- International LawДокумент31 страницаInternational LawLaw StudentОценок пока нет

- Business LawДокумент100 страницBusiness LawDagmawi LeulsegedОценок пока нет

- Types of Legal SystemsДокумент33 страницыTypes of Legal SystemsNur Bazilah NordinОценок пока нет

- Introduction To Law PDFДокумент24 страницыIntroduction To Law PDFKenny JОценок пока нет

- Caribbean Legal Systems (1) .Doc (Module 1)Документ226 страницCaribbean Legal Systems (1) .Doc (Module 1)Oneil Chatbout Williams77% (13)

- Boquet 2017, Philippines, Springer GeographyДокумент856 страницBoquet 2017, Philippines, Springer Geographyfusonegro100% (3)

- Meaning and Structure of Law in IslamДокумент17 страницMeaning and Structure of Law in Islamaisha avalaretanaelОценок пока нет

- Definition, Classification and Sources of LawДокумент10 страницDefinition, Classification and Sources of LawSayed Alam100% (5)

- Legal MethodДокумент11 страницLegal Methodvanshikakataria554Оценок пока нет

- Belt and Road InitiativeДокумент17 страницBelt and Road Initiativetahi69100% (2)

- Democratic Developmental StateДокумент4 страницыDemocratic Developmental StateAndres OlayaОценок пока нет

- Law Educ 212Документ11 страницLaw Educ 212Aya Mivie DuhaylungsodОценок пока нет

- Nature of LawДокумент17 страницNature of Lawdaanunair2013Оценок пока нет

- PCJS Module 1 PDFДокумент9 страницPCJS Module 1 PDFPrinces joy LasalaОценок пока нет

- 3 Kinds of Legal Systems That Exist in Different Countries Across The WorldДокумент4 страницы3 Kinds of Legal Systems That Exist in Different Countries Across The Worldapril75Оценок пока нет

- 09 Chapter IДокумент45 страниц09 Chapter ISYED TAYYABОценок пока нет

- LAWHISTДокумент6 страницLAWHISTKarl Cyrille BelloОценок пока нет

- Laws DefineДокумент17 страницLaws DefineArki TektureОценок пока нет

- Introduction To LawДокумент11 страницIntroduction To Lawbeko dalechaОценок пока нет

- Persons Introduction Preliminary StatementДокумент11 страницPersons Introduction Preliminary StatementFAIDAHОценок пока нет

- Fundamentals of LawДокумент10 страницFundamentals of Lawalexa stanilaОценок пока нет

- The Legal Systems: What Is A Legal System?Документ19 страницThe Legal Systems: What Is A Legal System?Shabir Hussain ButtОценок пока нет

- NSW - Module 2 - Reading Guide-1Документ28 страницNSW - Module 2 - Reading Guide-1jashwantuОценок пока нет

- SSRN Id2055906Документ64 страницыSSRN Id2055906Abdullah BhattiОценок пока нет

- Legal MethodsДокумент14 страницLegal MethodsTUSHAR JAINОценок пока нет

- Concept of LawДокумент29 страницConcept of LawrinaОценок пока нет

- Law Text: Law 30Документ73 страницыLaw Text: Law 30Greg100% (3)

- LAWДокумент2 страницыLAWDutchОценок пока нет

- Jurisprudence, Concept and Philosophy of LawДокумент9 страницJurisprudence, Concept and Philosophy of LawAnkita GhoshОценок пока нет

- LAW 141 Lecture NotesДокумент21 страницаLAW 141 Lecture NotesKinayah MorainОценок пока нет

- Legal TranslationДокумент5 страницLegal TranslationDaniela NicolaevОценок пока нет

- Lecture 2 Slides PDFДокумент12 страницLecture 2 Slides PDFRana SalehОценок пока нет

- The Ideal Element in LawДокумент15 страницThe Ideal Element in LawHardiansyah GunawanОценок пока нет

- Legal SystemДокумент7 страницLegal SystemDiana MillsОценок пока нет

- Customs As A Source of LawДокумент4 страницыCustoms As A Source of LawRanvir SisodiaОценок пока нет

- Adnaan Belim LLM (Constitution) 1 SemesterДокумент3 страницыAdnaan Belim LLM (Constitution) 1 SemesterSahida ParveenОценок пока нет

- Jigar LawДокумент3 страницыJigar LawjigzzinОценок пока нет

- Nass Module 2 .Doc Legal and Parl AffairДокумент19 страницNass Module 2 .Doc Legal and Parl AffairJoel Gwenere100% (4)

- 2006 Issue 4 - Christian Counseling and The Law - Counsel of ChalcedonДокумент6 страниц2006 Issue 4 - Christian Counseling and The Law - Counsel of ChalcedonChalcedon Presbyterian ChurchОценок пока нет

- Assignment EnglishДокумент9 страницAssignment Englishdempe24Оценок пока нет

- Legal System of PakistanДокумент16 страницLegal System of PakistanShoukat khan ShaikhОценок пока нет

- III. PHILIPPINE CIVIL LAW - CyBAR OperationsДокумент6 страницIII. PHILIPPINE CIVIL LAW - CyBAR OperationsGABRIELLA ANDREA TRESVALLESОценок пока нет

- Moslem Legal SystemДокумент4 страницыMoslem Legal SystemLasana Tunica-ElОценок пока нет

- Business Law Lecture#1Документ14 страницBusiness Law Lecture#1Ahmed MumtazОценок пока нет

- Business Law 2Документ101 страницаBusiness Law 2Barzala CarcarОценок пока нет

- Magina Kubilu V R (CAT)Документ11 страницMagina Kubilu V R (CAT)RANDAN SADIQОценок пока нет

- BL Chapter 1Документ8 страницBL Chapter 1YASH RAJОценок пока нет

- Pound TheoryJudicialDecision 1923Документ23 страницыPound TheoryJudicialDecision 1923kashir khanОценок пока нет

- GLS Assignment - 051137Документ14 страницGLS Assignment - 051137roselyn.quayeОценок пока нет

- Man Made Law and ShariahДокумент15 страницMan Made Law and ShariahAhmad AmmarОценок пока нет

- Economic PerpestiveДокумент41 страницаEconomic PerpestiveMarcosarshavinОценок пока нет

- Unit 3 Meaning, Nature and Function of Law Part BДокумент63 страницыUnit 3 Meaning, Nature and Function of Law Part BKapepo ZemburukaОценок пока нет

- Haase - What Does It Mean To Codify LawДокумент6 страницHaase - What Does It Mean To Codify LawChristopher ReynoldsОценок пока нет

- Austin BenthamДокумент17 страницAustin BenthamAsjad AlamОценок пока нет

- Chapter 1. Introduction To Legal Heritage: 1.1. What Is Law?Документ8 страницChapter 1. Introduction To Legal Heritage: 1.1. What Is Law?Claudiu Clement100% (1)

- UNIT 1 (1) (MBA Online) With Ref 1Документ26 страницUNIT 1 (1) (MBA Online) With Ref 1Sai Krishna LinguntlaОценок пока нет

- What Is LawДокумент7 страницWhat Is Lawunaas fatimaОценок пока нет

- Law and MoralityДокумент10 страницLaw and MoralitySwathi SwazzОценок пока нет

- Paul Romer: Ideas, Nonrivalry, and Endogenous GrowthДокумент4 страницыPaul Romer: Ideas, Nonrivalry, and Endogenous GrowthJuan Pablo ÁlvarezОценок пока нет

- Globalization #1 PDFДокумент2 страницыGlobalization #1 PDFSuzette Hermoso100% (4)

- Ape TermaleДокумент64 страницыApe TermaleTeodora NedelcuОценок пока нет

- Lecture 6Документ19 страницLecture 6salmanshahidkhan100% (2)

- BAIN REPORT Global Private Equity Report 2017Документ76 страницBAIN REPORT Global Private Equity Report 2017baashii4Оценок пока нет

- Ram Kumar Mishra, Geeta Potaraju, and Shulagna Sarkar - Corporate Social Responsibility in Public Policy - A Case of IndiaДокумент12 страницRam Kumar Mishra, Geeta Potaraju, and Shulagna Sarkar - Corporate Social Responsibility in Public Policy - A Case of IndiaShamy Aminath100% (1)

- Annex 106179700020354Документ2 страницыAnnex 106179700020354Santosh Yadav0% (1)

- Independent Power Producer (IPP) Debacle in Indonesia and The PhilippinesДокумент19 страницIndependent Power Producer (IPP) Debacle in Indonesia and The Philippinesmidon64Оценок пока нет

- MHO ProposalДокумент4 страницыMHO ProposalLGU PadadaОценок пока нет

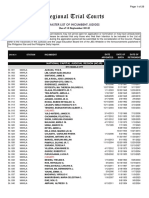

- Regional Trial Courts: Master List of Incumbent JudgesДокумент26 страницRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaОценок пока нет

- Pembayaran PoltekkesДокумент12 страницPembayaran PoltekkesteffiОценок пока нет

- Pandit Automotive Pvt. Ltd.Документ6 страницPandit Automotive Pvt. Ltd.JudicialОценок пока нет

- BS Irronmongry 2Документ32 страницыBS Irronmongry 2Peter MohabОценок пока нет

- JK Fenner (India) LimitedДокумент55 страницJK Fenner (India) LimitedvenothОценок пока нет

- Dak Tronic SДокумент25 страницDak Tronic SBreejum Portulum BrascusОценок пока нет

- DSE at A GlanceДокумент27 страницDSE at A GlanceMahbubul HaqueОценок пока нет

- Manual Goldfinger EA MT4Документ6 страницManual Goldfinger EA MT4Mr. ZaiОценок пока нет

- Smart Home Lista de ProduseДокумент292 страницыSmart Home Lista de ProduseNicolae Chiriac0% (1)

- Manual For SOA Exam FM/CAS Exam 2.: Chapter 7. Derivative Markets. Section 7.3. FuturesДокумент15 страницManual For SOA Exam FM/CAS Exam 2.: Chapter 7. Derivative Markets. Section 7.3. FuturesAlbert ChangОценок пока нет

- Zubair Agriculture TaxДокумент3 страницыZubair Agriculture Taxmunag786Оценок пока нет

- Letter InsuranceДокумент2 страницыLetter InsuranceNicco AcaylarОценок пока нет

- Contact Details of RTAsДокумент18 страницContact Details of RTAsmugdha janiОценок пока нет

- SWCH 01Документ12 страницSWCH 01mahakali23Оценок пока нет

- Latihan Soal PT CahayaДокумент20 страницLatihan Soal PT CahayaAisyah Sakinah PutriОценок пока нет

- Industry Analysis: Liquidity RatioДокумент10 страницIndustry Analysis: Liquidity RatioTayyaub khalidОценок пока нет