Академический Документы

Профессиональный Документы

Культура Документы

Asset Liability Terms of Reference Jan 07

Загружено:

Mai HongИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Asset Liability Terms of Reference Jan 07

Загружено:

Mai HongАвторское право:

Доступные форматы

DAVENHAM GROUP PLC ASSET AND LIABILITY MANAGEMENT COMMITTEE TERMS OF REFERENCE 1.

SCOPE The Davenham Group Plc (the Company) Asset and Liability Management Committee (ALCO) is responsible for advising the Board on all matters relating to the balance sheet of the Company, specifically the following matters: Capital structure and related matters Funding Liquidity

The Committee will advise the Board and recommend actions it considers necessary or desirable to establish that the Companys balance sheet matters are suitably understood and managed. The Committee will report key recommendations and provide information to the Board. 2. AUTHORITY The Committee has been established under the specific authority of the Board. The Chairman of the Committee is empowered to establish working groups with a specific task and a finite life to assist the Committee. The Chairman of the Committee will brief the Board on significant risk issues arising. 3. RESPONSIBILITIES The key responsibilities of the Committee will be: 3.1. Balance Sheet Management 3.1.1. To ensure proper management within defined control parameters set by the Board, of the Companys net interest income and its structural exposure to movements in market rates and other changes in the external environment. 3.1.2. To consider interest rate forecasts and, in light of these forecasts and other information: To consider the Companys structural exposures, including the evaluation of appropriate stress scenarios, and to formulate actions, where required; To review information on the Companys net interest income margin performance in order to identify potential margin compression or similar concerns and formulate appropriate actions to be taken; and

Asset and Liability Management Committee Terms of Reference Asset Liability Terms of Reference Jan 07.doc31012007 Page 1 of 4

To oversee the transfer charging of capital, funding, liquidity and risk costs, in order to optimise value across divisions.

3.1.3. To consider the significance on ALM of any changes in customer behaviour and formulate appropriate actions. 3.2. Capital 3.2.1. To consider, if appropriate, the composition of the Companys capital structure, taking account of future regulatory requirements and rating agency views, and formulate appropriate actions where required. 3.2.2. To provide an overview of the Companys capital planning matters, including: monitoring of capital funds usage by divisions; banking covenants

3.2.3. To consider the capital needs of the Company and the process for the raising of capital; 3.2.4. To evaluate appropriate stress scenarios relating to the Companys capital position and formulate appropriate actions; 3.2.5. The Board will recommend actual capital allocation decisions. 3.3. Funding 3.3.1. To review and assess the management of funding undertaken by Company and formulate appropriate actions to be taken; 3.3.2. To review the Companys funding profile and consider: the diversification, cost and robustness of funding sources; the funding needs (both actual and projected); current and new funding structures e.g. securitisations; and the impact of structural investments; and formulate appropriate actions to be taken; 3.3.3. To evaluate the results of stress scenarios relating to the Companys funding position, and formulate appropriate actions. 3.4. Liquidity 3.4.1. To review and assess the management of the Companys liquidity across divisions within the framework and policies established by the Board, as the case may be, and formulate appropriate actions to be taken;

Asset and Liability Management Committee Terms of Reference Asset Liability Terms of Reference Jan 07.doc31012007 Page 2 of 4

3.4.2. To review the Companys liquidity profile and consider: the management of sterling and currency short term liquidity; collateral management; and formulate appropriate actions to be taken; 3.4.3. To evaluate the results of stress scenarios relating to the Companys liquidity position, and formulate appropriate actions. 3.5. Other matters 3.5.1. To review developments and changes in legal, regulatory, and accounting requirements and their impacts on ALM, funding, liquidity and capital management policies; 3.5.2. To review any other matters that affect ALM, capital management, funding and liquidity; and 3.5.3. To provide information to the Executive and Risk Committees, or their nominated committees, where required.

4. MEMBERS The Board will determine membership. Current members are: NED CEO FD MD Risk Director FD Risk Director David Stewart (Chair) David Coates Paul Burke Steve Marsh DavidBurke Paul Bowles David Bowles

Other Board members may attend for specific items. In addition, the Chairman of Davenham Group Plc is entitled to attend as an observer. 5. CHAIRMAN The Committee will be chaired by a duly appointed Non-Executive Director. 6. QUORUM The quorum for a meeting shall be a minimum of three members one of whom must be a NED.

Asset and Liability Management Committee Terms of Reference Asset Liability Terms of Reference Jan 07.doc31012007 Page 3 of 4

7. SECRETARY The Groups Company Secretary. 8. MINUTES Minutes of the Committee meetings will be circulated to the Board. 9. NOTICE AND FREQUENCY OF MEETINGS The Committee meets once every two months, with those members attending being given an Agenda and supporting papers at least five business days in advance. Adhoc Committee meetings can be convened at short notice, assuming a quorum is available. Requests for any ad-hoc Committee meeting should be submitted to the Chairman. Notice of all meetings will be provided to all members whether or not they are able to attend. 10. CHANGES TO THE TERMS OF REFERENCE The Board must approve changes to the Terms of Reference and these must be notified to Secretariat. 11. CHANGE HISTORY Version 1.0 - Terms of Reference approved on 31 January 2007.

Asset and Liability Management Committee Terms of Reference Asset Liability Terms of Reference Jan 07.doc31012007 Page 4 of 4

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- c15 ldn01610 SchematicДокумент4 страницыc15 ldn01610 SchematicJacques Van Niekerk50% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Engineering MetallurgyДокумент540 страницEngineering Metallurgymadhuriaddepalli100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Income Tax Banggawan Chapter 10Документ18 страницIncome Tax Banggawan Chapter 10Earth Pirapat100% (5)

- Drafting Foundation PlanДокумент24 страницыDrafting Foundation Planerol bancoroОценок пока нет

- Notes in Train Law PDFДокумент11 страницNotes in Train Law PDFJanica Lobas100% (1)

- GMDS - Course - FinalДокумент282 страницыGMDS - Course - FinalLuisPazPerdomo100% (1)

- Dilip - SFDC CPQ Architect14 GCДокумент5 страницDilip - SFDC CPQ Architect14 GCmariareddy17100% (1)

- Cash & Cash EquivalentsДокумент2 страницыCash & Cash EquivalentsYoonah KimОценок пока нет

- MN502 Lecture 3 Basic CryptographyДокумент45 страницMN502 Lecture 3 Basic CryptographySajan JoshiОценок пока нет

- 20091216-153551-APC Smart-UPS 1500VA USB SUA1500IДокумент4 страницы20091216-153551-APC Smart-UPS 1500VA USB SUA1500Ifietola1Оценок пока нет

- Mcqs Ethics and CSR)Документ9 страницMcqs Ethics and CSR)Maida TanweerОценок пока нет

- Resistor 1k - Vishay - 0.6wДокумент3 страницыResistor 1k - Vishay - 0.6wLEDОценок пока нет

- Lesson 2 - Graphing Rational Numbers On A Number LineДокумент9 страницLesson 2 - Graphing Rational Numbers On A Number Linehlmvuong123Оценок пока нет

- 5GMF WP101 11 5G Rat PDFДокумент26 страниц5GMF WP101 11 5G Rat PDFAvik ModakОценок пока нет

- Businesses ProposalДокумент2 страницыBusinesses ProposalSophia Marielle MacarineОценок пока нет

- Funny AcronymsДокумент6 страницFunny AcronymsSachinvirОценок пока нет

- MCQ (Chapter 6)Документ4 страницыMCQ (Chapter 6)trail meОценок пока нет

- PROCEMAC PT Spare Parts ManualДокумент27 страницPROCEMAC PT Spare Parts ManualMauricio CruzОценок пока нет

- Sihi Pompa LPG API 610Документ1 страницаSihi Pompa LPG API 610Andry RimanovОценок пока нет

- MC1413 D PDFДокумент8 страницMC1413 D PDFAnonymous oyUAtpKОценок пока нет

- Serial Number Microsoft Office Professioanal 2010Документ6 страницSerial Number Microsoft Office Professioanal 2010Kono KonoОценок пока нет

- Hukbalahap: March 16, 2019 Godwin M. Rarama Readings in The Philippine History Seat No. 35Документ2 страницыHukbalahap: March 16, 2019 Godwin M. Rarama Readings in The Philippine History Seat No. 35Godwin RaramaОценок пока нет

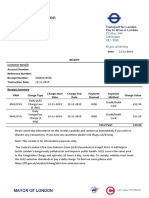

- Transport For London Pay To Drive in London: PO Box 344 Darlington Dl1 9qe TFL - Gov.uk/drivingДокумент1 страницаTransport For London Pay To Drive in London: PO Box 344 Darlington Dl1 9qe TFL - Gov.uk/drivingDanyy MaciucОценок пока нет

- PDF 24Документ8 страницPDF 24Nandan ReddyОценок пока нет

- EU MEA Market Outlook Report 2022Документ21 страницаEU MEA Market Outlook Report 2022ahmedОценок пока нет

- Experiment No 9 - Part1Документ38 страницExperiment No 9 - Part1Nipun GosaiОценок пока нет

- Thesis-Android-Based Health-Care Management System: July 2016Документ66 страницThesis-Android-Based Health-Care Management System: July 2016Noor Md GolamОценок пока нет

- Supercal 539: Universal Compact Heat MeterДокумент6 страницSupercal 539: Universal Compact Heat MeterVladimir ZaljevskiОценок пока нет

- CV - Nguyen Quang HuyДокумент5 страницCV - Nguyen Quang HuyĐoan DoãnОценок пока нет

- 5th Year PES Mrs - Hamdoud Research Methodology 2Документ3 страницы5th Year PES Mrs - Hamdoud Research Methodology 2Rami DouakОценок пока нет