Академический Документы

Профессиональный Документы

Культура Документы

Investment Dar - CI Rating

Загружено:

Hamad Al SalemАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Investment Dar - CI Rating

Загружено:

Hamad Al SalemАвторское право:

Доступные форматы

THE INVESTMENT DAR

Kuwait 1 May 2001 CI RATING BBTELEPHONE ++357 5 342 300

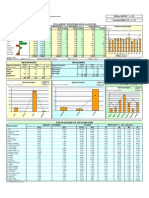

ANALYSTS Rory Keelan Darren Stubing AUDITED BALANCES US$mn 12/00 12/99 Total Assets 358.0 406.9 Net Isl Fin Facilities 321.3 332.6 Liquid Assets 5.8 59.6 Deposits & MLT Liab 235.3 283.4 Total Capital 110.2 112.0 Net Income 7.3 10.7 POSITIVE FACTORS Solid capitalisation and shareholders Increased fee income

E-MAIL rory.keelan@ciratings.com.cy darren.stubing@ciratings.com.cy

CI RATIOS % 12/00 12/99 Return on Average Assets 1.9 3.1 Return on Average Equity 6.6 9.7 Expenses/Gross Income 38.4 27.4 Total Capital/Total Assets 30.8 27.6 Liquid Asset Ratio 1.6 14.7 Isl Fin Fac/Dep & MLT Liab 117.3 117.3 NEGATIVE FACTORS Still heavily dependent on automobile financing although diversification has increased In common with other finance companies, official support is less assured than for a bank Increased competition reduced 2000 profitability Tight liquidity mitigated by committed funding. COMPANY PROFILE The Investment Dar (TID) was established in October 1994 and began operations in August 1995. It is a wholly Kuwaiti-owned Islamic finance company. There are about 200 private individual and institutional investors. The main shareholders are the governmentcontrolled Public Institution for Social Security (10.8%), Ali Mohammad Thunayan Al-Ghanim & Sons Co for Motor Vehicles (9.5%), Mohammad Naser Al-Sayer & Sons Establishment (9.5%) and The International Investor (6.7%). TIDs objectives are to provide a range of Islamic services, including consumer finance, investment, brokering, real estate and fund management services. While the bulk of the companys activities continue to centre on vehicle financing, TID has begun to widen the product range. Non-auto products include financing of household goods and electronic equipment, residential mortgages, management services and tapping the small investor market of middle-income nationals. Management is also planning to expand operations abroad through the creation of jointventures. One such venture has been established in Qatar and others are under consideration. TID is listed on the Kuwait stock exchange and has ISO-9001 certification. RATING RATIONALE Within a relatively short period of time, TID had carved itself a lucrative share of the highly competitive car financing business in Kuwait although competition has recently intensified. The company appears to be well managed by a team of qualified bankers and is sponsored by wealthy and well-known shareholders. Operating in a narrow market segment had been the highest risk to which the company was exposed and this had been a constraint on the ratings assigned to TID. Management has now diversified the asset base and has begun to diversify the liability base. In the medium term, the companys risk profile is likely to benefit although there has been some short-term pressure on earnings. The scope of regulation and supervision is good. In particular, the same central bank classification and provisioning rules now apply and financials issued by TID are subject to central bank approval. Support by the authorities in case of default is however still likely to be less assured than

Capital Intelligence Ltd., Oasis Complex, Block E, Gladstone Street, P.O. Box 53585, CY 3303 Limassol, Cyprus, Telephone : 357 5 342300, Facsimile: 357 5 817750 E-mail: capital@ciratings.com.cy. Web site: http://www.ciratings.com

2 for a bank. Despite no asset growth and lower profits in 2000, TID expects profits to rebound in 2001 as the new business segments begin to contribute revenue. CI maintains the rating at BB-.

SUMMARY ANALYSIS

TID is regulated and supervised by the central bank of Kuwait (CBK) as a financial institution, while the Ministry of Commerce and Industry (which is the licencing authority) supervises it as a closed Kuwaiti shareholding company. As with other investment and financial companies in the country, the company is not subject to CBK regulation on capital adequacy and liquidity requirements. However, the company is subject to CBK regulations on asset quality and provisioning. The accounts have been jointly audited by PriceWaterhouseCoopers and KPMG in accordance with International Accounting Standards (IAS). Asset Quality In 1999, all assets and liabilities were booked within Kuwait but in 2000 a small amount of non-Kuwait risk was added. This however remains of limited significance at just over 1% of total assets. The bulk of transactions are conducted in Kuwaiti dinars and the company is largely shielded from currency risk. The largest risk to which TID is exposed to is credit risk as the Islamic trade debtors accounted for 89.8% of end 2000 total assets. These facilities are still largely (67%) in the form of instalment sales for the purchase of new and used cars. The company deals through dealerships whose owners are also shareholders in the company. Most of the companys clients are government employees who have bank accounts to which their monthly salaries are credited. From these accounts, instalments due to TID are automatically transferred through the customers irrevocable standing orders. In all cases, the extension of credit requires security in the form of promissory notes and/or post-dated cheques (which can be enforced under criminal rather than the civil codes), and if necessary, a customer is asked to provide a guarantor. This is particularly the case when dealing with non-Kuwaiti nationals. In 2000, the Company diversified its asset base by adding inventory financing (16%) and real estate financing (12%). While automobile financing will always be an important activity for TID, the intention is to reduce its share, over the medium term, to 50% of receivables. Real estate is an increasingly important business for TID. This includes trading in both undeveloped land and in housing units. In 2000, the Company also entered the development market in partnership with a contractor. Under this arrangement, TID provides site and materials while the contractor provides construction services. The profits obtained upon sale of the houses are then shared according to an agreed formula. The first phase of the project has been very successful and the second phase is now underway. TID will also consider other projects such as office buildings or warehouses. TID adheres to the classification and provisioning policies stipulated by the central bank of Kuwait. Management states that the level of default has continued to be minimal, hovering at around 1.5% of gross facilities. Given the specific provisioning balance of KWD6.0mn, it would appear that TID overprovides for its doubtful debt. The company also makes the same 2% general risk reserve as the banks. This raises total provisions to KWD6.6mn or 6.3% of gross facilities. Management has provided CI with details of both past due receivables and associated provisioning. These confirm that management takes a prudent approach to classification and provisioning. Dealings with related-parties are authorised by the companys memorandum of agreement and articles of association, and endorsed by the central bank. The extent of such dealings is significant, amounting to 50.2% of capital, down from 76% in 1999. This is mainly driven by TIDs purchase of vehicles from several dealers which are also the companys shareholders. The company is not allowed to hold vehicles as stock and therefore makes a refundable advance payment to lock in supply and price. The year-end outstandings represent a small portion of total purchases from these suppliers over the year as a whole and represent roughly one months supply.

4 Capital Adequacy TID received a fresh capital injection in 1998, boosting its paid-in capital from KWD15.8mn in 1997 to KWD22.8mn. This capital increase was intended to carry the company forward for several more years and no further increases of capital are planned. It is the companys policy that the debt to equity ratio does not exceed 3 to 1 in the first five years of operations. Having fallen to 1 to 7 after the capital increase, the ratio is now 2.25 to 1. Liquidity There have been changes in policy on liquidity, and these have made the ratios in the CI spreadsheets much tighter. The limited liquid asset classes available to Islamic institutions tend to produce tighter liquidity ratios. Previously a three-month liquidity cushion was maintained. This however was expensive in that earnings on the cushion were rather lower than the company average cost of funds. Effective liquidity has been maintained by obtaining committed lines from banks and from existing Murabaha investors. Funding is still mainly derived from domestic government bodies and other Islamic financial institutions such as KFH and The International Investor. Investors in murabaha payables also include commercial banks investing on an Islamic basis. However, given the still limited (albeit growing) market for Islamic funds in the domestic sector, CI believes that there are significant concentrations in the funding base although the Company has begun to develop liability side products designed for smaller investors. Nonetheless, the companys liabilities are well matched against the maturity of assets and the mis-matches are relatively small. TID runs a positive gap in all periods up to three years. The company normally makes facilities available for periods between one to five years but with the bulk at an average initial life of 52 months. Investments in murabaha payables (an item on the liability side of the balance sheet) are mostly for a standard initial tenor of four years but the company also has murabaha payables with initial tenors of three and five years. The high level of net IFF to funding reflects the Companys high capital and its use in funding the receivables book. Profitability Strong results have been achieved since inception, with return on average assets exceeding 3.5% over the three years to end 1998. In 1999 however the rate of return slipped to just over 3%. This trend continued into 2000 with ROAA falling to 1.9%. The competitive pressures identified in 1999 intensified in 2000. This impacted both market share and margins. In particular, it became much more difficult to obtain purchase discounts from automobile suppliers. Income from this source fell by KWD 0.5mn. TID has moved to compensate for the tighter conditions in the automobile market by diversifying its revenue sources. This will pay dividends in future periods but it has also had the effect of adding costs in 2000. CI welcomes TIDs focus on diversifying the revenue base to negate risk related to excessive concentration. Expenses again rose last year but the increase was rather lower than in the previous year. There were also further front-end costs in product development in support of the diversification policy. Higher costs and lower revenues raised the cost/income ratio to 38.4% at year-end. Provisioning had been relatively high over the three years to 1999 for a company that has been in existence for such a short time. However much of the provisions taken in 1999 and, to a lesser extent in 2000 were taken in order to meet the requirement for a 2% general risk provision. With the oil price staying high and government spending at last beginning to rise, consumer spending should also rise supported by a budgeted 13% rise in government payrolls this year. The Company expects there to be a sharp recovery in revenues in 2001 and is budgeting for profits in line with (or above) those of 1999.

Ref: KW1800RR/01-05-2001

Reproducing or distributing this publication without the publishers consent is prohibited. A Capital Intelligence rating is not a recommendation to purchase, sell, or hold a security of the institution, inasmuch as it does not comment as to market price or suitability for a particular investor. Information has been obtained by Capital Intelligence from sources believed to be reliable. However, because of the possibility of human or mechanical error by our source, Capital Intelligence, or others, Capital Intelligence does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any error or omissions or for the results obtained from use of such information. Copyright Capital Intelligence Limited 2001.

Capital Intelligence Ltd. Spreadsheets & Ratios

5

15-Mar-2001 KW18

THE INVESTMENT DAR SPREADSHEET & RATIOS PERFORMANCE RATIOS

External Audit A SIZE FACTORS

1 Total Assets (USD 000) 2 Total Capital (USD 000) 357,980 110,166 405,943 111,992 295,164 109,698

AUD 12/2000

AUD 12/1999

AUD 12/1998

AUD 12/1997

215,576 57,806

B ASSET QUALITY

3 4 5 6 7 8 9 10 11 Total Assets Growth Rate (Year on Year %) IFF-Loss Reserve to Gross IFF (%) Non-Performing IFF to Gross IFF (%) IFF-Loss Reserve to Non-Performing IFF (%) Unprovided Non-Performing IFF to Free Capital (%) IFF-Loss Provision Charge on Gross IFF (%) Reserve for Dimin. of Investments to Total Investments (%) Related Party Loans to Total Capital (%) Total Contingents on Total Assets (%) -11.00 6.31 38.76 5.19 35.39 4.62 74.57 3.87

1.05

1.70

1.86

2.35

C CAPITAL ADEQUACY

12 13 14 15 16 17 18 19 20 21 22 CI Risk Asset Ratio (%) Estimated BIS Risk Asset Ratio (%) Estimated BIS RAR on Tier One Capital (%) Actual Risk Asset Ratio to Local Standards (%) Internal Capital Generation (%) Total Capital Growth Rate (Year on Year %) Total Capital to Total Assets (%) Total Capital to Gross IFF (%) Free Capital Funds (KWD 000) Estimated BIS RAR Shortfall (KWD 000) Risk Weighted Assets on Total Footings (%) 26.80 30.70 30.70 -0.75 -0.73 30.77 32.12 27,214 0 97.61 30.67 31.05 31.05 2.92 3.01 27.59 31.93 32,589 0 86.51 40.30 40.73 40.73 2.10 87.65 37.17 40.98 32,485 0 91.25 28.83 29.61 29.61 14.17 6.50 26.81 30.60 16,972 0 90.55

D LIQUIDITY

23 24 25 26 27 28 29 30 31 32 Net IFF to Total Deposits (%) Net IFF to Total Customer Deposits (%) Net IFF to Stable Funds (%) Customer Deposits to Total Deposits (%) Liquid Asset Ratio (%) Quasi-Liquid Asset Ratio (%) FX Currency Assets to FX Currency Liabilities (%) FX Currency IFF to FX Currency Deposits (%) Interbank Assets to Interbank Liabilities (%) Net Interbank Assets (KWD 000) 117.30 99.19 1.61 1.61 85.15 14.69 14.69 144.19 236.93 0.00 10.24 10.24 195.56 0.00

169

11,880

12.44 -46,740.00

21.87 -22,120.00

E PROFITABILITY

33 34 35 36 37 38 39 40 41 42 43 44 45 Return on Average Assets (%) Return on Average Equity (%) Underlying Profits on Average Assets (%) Underlying Profits on Average Equity (%) Funding Cost (%) Profit Sharing on Average Earning Assets (%) Profit Sharing Differential (%) Non-Profit Sharing Income to Gross Income (%) Operating Expenses to Gross Income (%) Operating Profit Growth Rate (%) Operating Profit on Average Assets (%) Risk Provisioning Charge to Operating Profit (%) Dividend Payout Ratio (%) 1.93 6.63 3.08 9.74 3.84 11.71

8.48 38.44 -34.01 2.91 32.46 111.29

-0.50 26.95 13.62 4.84 35.21 69.59

4.56 22.48 13.90 5.85 33.16 76.63

3.45 22.15 64.27

0.00

RATES:

Exchange Rate (Units per USD) Inflation Rate (%) Imputed Interest Rate on Free Capital (%) (Three Month Treasury Bills) 0.3070 NA NA 0.3042 NA NA 0.3015 NA NA 0.3049 NA 6.98

NOTES:

The 1996 financial statements reflect period from 27 August 1995 to 31 December 1996.

Capital Intelligence Ltd. Spreadsheets & Ratios

THE INVESTMENT DAR BALANCE SHEET - ASSETS (KWD 000)

RISK WGHT 0% 0% 10% 20% 20% External Audit LIQUID ASSETS: Cash & 7 Day Central Bank Treasury Bills Government Securities Other TOTAL LIQUID ASSETS DEPOSITS WITH BANKS: Short - up to 1 yr Dep. with Islamic Financial Inst. Non - OECD Medium Term TOTAL DEPOSITS WITH BANKS MARKETABLE SECURITIES ISLAMIC FINANCING FACILITIES Government Guaranteed First Mortgage IFF Morabaha - Musharaka Medium/Long Term Other - related co's Non-Performing IFF IFF-Loss Reserve NET ISL. FIN. FACILITIES UNQUOTED INVESTMENTS NON-FINANCIAL SUBS & AFFILS. FINANCIAL SUBS & AFFILIATES FIXED ASSETS OTHER ASSETS TOTAL ASSETS CONTINGENT ACCOUNTS: Fin. Gtees/SLCs/Acceptances Bid & Performance Bonds LCs/Bank & Govt Guarantees Bonding for Banks & Govts IR Swaps/Bank & Govt LCs TOTAL CONTINGENT ACCOUNTS TOTAL FOOTINGS RISK WEIGHTED ASSETS 12/2000 USD 000 5,215 AUD 12/2000 1,601 AUD 12/1999 6,258 AUD 12/1998 2,479 AUD Growth (%) Breakdown (%) 12/1997 12/2000 12/1999 12/1998 12/1997 12/2000 12/1999 12/1998 12/1997 1,260 -74.42 152.44 96.75 11.80 1.46 5.07 2.79 1.92

5,215

1,601

6,258

2,479

1,260

-74.42

152.44

96.75

11.80

1.46

5.07

2.79

1.92

20% 20% 100% 100% 20% 50% 100% 100% 100% 100% 100% 100% 100% 100% 100%

550 550

169 169

11,880 11,880

6,638 6,638

6,192 6,192

-98.58 -98.58

78.97 78.97

7.20 7.20

10.28 10.28

0.15 0.15

9.62 9.62

7.46 7.46

9.42 9.42

342,945

105,284

106,702

80,698

57,598

-1.33

32.22

40.11

86.49

95.80

86.41

90.68

87.63

-21,632 321,313 7,827 2,906 18,616 1,554 357,980

-6,641 98,643 2,403 892 5,715 477 109,900

-5,540 101,162 2,229 902 577 480 123,488

-3,730 76,968 2,182 0 589 136 88,992

-2,230 55,368 2,182 0 653 74 65,729

19.87 -2.49 7.81 -1.11 890.47 -0.63 -11.00

48.53 31.43 2.15 -2.04 252.94 38.76

67.26 39.01 0.00 -9.80 83.78 35.39

154.86 84.50 -23.63 64.44 74.57

-6.04 89.76 2.19 0.81 5.20 0.43 100.00

-4.49 81.92 1.81 0.73 0.47 0.39 100.00

-4.19 86.49 2.45 0.00 0.66 0.15 100.00

-3.39 84.24 3.32 0.00 0.99 0.11 100.00

100% 50% 20% 10% 5%

357,980 349,420

109,900 107,272

123,488 106,824

88,992 81,203

65,729 59,515

-11.00 0.42

38.76 31.55

35.39 36.44

74.57 85.79

Capital Intelligence Ltd. Spreadsheets & Ratios

THE INVESTMENT DAR BALANCE SHEET - LIABILITIES (KWD 000)

External Audit INTERBANK LIABILITIES: Current & 7 Day Short Other - Government & Financial Institutions TOTAL INTERBANK LIABILITIES CUSTOMER DEPOSITS: Demand Savings Time Other TOTAL CUSTOMER DEPOSITS OFFICIAL DEPOSITS TOTAL DEPOSITS + INTERBANK OTHER LIABILITIES MEDIUM/LONG TERM LIABILITIES TIER TWO CAPITAL: Asset Revaluation Reserve Hybrid Capital Instruments Subordinated Term Debt TOTAL TIER TWO CAPITAL TIER ONE CAPITAL: Paid Up Capital Minority Interests Reserves TOTAL TIER ONE CAPITAL TOTAL CAPITAL TOTAL LIABILITIES AND CAPITAL 12/2000 USD 000 AUD 12/2000 AUD 12/1999 AUD 12/1998 AUD Growth (%) Breakdown (%) 12/1997 12/2000 12/1999 12/1998 12/1997 12/2000 12/1999 12/1998 12/1997

0 0 0 0 0 0 0 0 0 12,508 235,306 0 0 0 0 74,111 0 36,055 110,166 110,166 357,980

0 0 0 0 0 0 0 0 0 3,840 72,239 0 0 0 0 22,752 0 11,069 33,821 33,821 109,900

0 0 0 0 0 0 0 0 0 3,210 86,210 0 0 0 0 22,752 0 11,316 34,068 34,068 123,488

53,378 53,378 0 0 0 0 0 0 53,378 2,540 0 0 0 0 0 22,752 0 10,322 33,074 33,074 88,992

28,312 28,312 0 0 0 0 0 0 28,312 3,465 16,327 0 0 0 0 15,800 0 1,825 17,625 17,625 65,729

19.63 -16.21 0.00 -2.18 -0.73 -0.73 -11.00

-100.00 -100.00 -100.00 26.38 0.00 9.63 3.01 3.01 38.76

88.53 1,315.60 88.53 1,315.60 88.53 1,315.60 -26.70 -8.70 -100.00 6.66 44.00 465.59 87.65 87.65 35.39 0.00 143.33 6.50 6.50 74.57

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 3.49 65.73 0.00 0.00 0.00 0.00 20.70 0.00 10.07 30.77 30.77 100.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 2.60 69.81 0.00 0.00 0.00 0.00 18.42 0.00 9.16 27.59 27.59 100.00

59.98 59.98 0.00 0.00 0.00 0.00 0.00 0.00 59.98 2.85 0.00 0.00 0.00 0.00 0.00 25.57 0.00 11.60 37.17 37.17 100.00

43.07 43.07 0.00 0.00 0.00 0.00 0.00 0.00 43.07 5.27 24.84 0.00 0.00 0.00 0.00 24.04 0.00 2.78 26.81 26.81 100.00

Capital Intelligence Ltd. Spreadsheets & Ratios

THE INVESTMENT DAR PROFIT AND LOSS ACCOUNT (KWD 000)

External Audit Income from Islamic Financing Depositor's Share of Income Net income from Islamic Financing Fees and Commissions FX Trading Income Dealing Securities Income Other Investment Income Other Income Non Profit Sharing Income GROSS INCOME Administrative Expenses Depreciation Other Expenses OPERATING EXPENSES OPERATING PROFIT Provisions for Doubtful IFF Prov. for Dimin. of Investments GROSS PROFIT (or -LOSS) Extraordinary Items Tax & Equivalent NET PROFIT (or -LOSS) Transfers/Adjustments APPROPRIATION: Minority Interests Bonus Shares Issued Dividends Movement in Reserves TOTAL 12/2000 USD 000 AUD 12/2000 AUD 12/1999 AUD 12/1998 AUD Growth (%) % of Average Total Assets 12/1997 12/2000 12/1999 12/1998 12/1997 12/2000 12/1999 12/1998 12/1997

16,427 1,765

5,043 542

7,071 265

5,570 266

4,926 176

-28.68 104.53

26.95 -0.38

13.07 51.14

30.15

4.32 0.46

6.66 0.25

7.20 0.34

-244 1,521 17,948 6,329 570 6,899 11,049 -3,586 7,463 0 -137 7,326 23 0 0 8,153 -805 7,349

-75 467 5,510 1,943 175 2,118 3,392 -1,101 2,291 0 -42 2,249 7 0 0 2,503 -247 2,256

-300 -35 7,036 1,700 196 1,896 5,140 -1,810 3,330 0 -61 3,269 0 0 0 2,275 994 3,269 266 5,836 1,161 151 1,312 4,524 -1,500 3,024 0 -55 2,969 7,803 0 0 2,275 8,497 10,772

75.00 176 1,434.29 5,102 -21.69 1,026 14.29 104 -10.71 1,130 3,972 -1,355 2,617 0 -119 2,498 0 0 1,422 0 1,075 2,497 11.71 -34.01 -39.17 -31.20 -31.15 -31.20 10.02 -124.85 -30.99 -113.16 20.56 46.43 29.80 44.51 13.62 20.67 10.12 10.91 10.10 -100.00 0.00 -88.30 -69.65 51.14 14.39 13.16 45.19 16.11 13.90 10.70 15.55 -53.78 18.86 -100.00 690.42 331.40 34.80 -21.74 85.71 -17.34 64.27 54.86 69.60 0.00 75.42 -100.00 -100.00 45.27 0.77

-0.06 0.40 4.72 1.67 0.15 1.82 2.91 -0.94 1.96 0.00 -0.04 1.93 0.01 0.00 0.00 2.14 -0.21 1.93

-0.28 -0.03 6.62 1.60 0.18 1.78 4.84 -1.70 3.13 0.00 -0.06 3.08 0.00 0.00 0.00 2.14 0.94 3.08 0.34 7.54 1.50 0.20 1.70 5.85 -1.94 3.91 0.00 -0.07 3.84 10.09 0.00 0.00 2.94 10.98 13.92

10

RATIO FORMULAE

A. Size Factors

1. TOTAL ASSETS (USD 000) 2. TOTAL CAPITAL (USD 000)

B. Asset Quality Ratios

3. TOTAL ASSETS GROWTH RATE (YEAR ON YEAR %) 4. LOAN-LOSS RESERVE TO GROSS LOANS (%) 5. NON-PERFORMING LOANS TO GROSS LOANS (%) 6. LOAN-LOSS RESERVE TO NON-PERFORMING LOANS (%) 7. UNPROVIDED NON-PERFORMING LOANS TO FREE CAPITAL (%) 8. LOAN-LOSS PROVISION CHARGE ON GROSS LOANS (%) 9. RESERVE FOR DIMINUTION OF INVESTMENTS TO TOTAL INVESTMENTS (%) 10. RELATED PARTY ASSETS TO TOTAL CAPITAL (%) 11. TOTAL CONTINGENTS ON TOTAL ASSETS (%)

(CURRENT YEAR TOTAL ASSETS - LAST YEAR TOTAL ASSETS) X 100 LAST YEAR TOTAL ASSETS LOAN-LOSS RESERVE X 100 GROSS LOANS NON-PERFORMING LOANS X 100 GROSS LOANS LOAN-LOSS RESERVE X 100 NON-PERFORMING LOANS NON-PERFORMING LOANS - LOAN LOSS RESERVE X 100 FREE CAPITAL PROVISIONS FOR DOUBTFUL DEBTS CHARGE X 100 GROSS LOANS RESERVE FOR DIMINUTION OF INVESTMENTS X 100 TOTAL INVESTMENTS RELATED PARTY ASSETS X 100 TIER ONE + TIER TWO CAPITAL TOTAL CONTINGENTS X 100 TOTAL ASSETS

C. Capital Adequacy Ratios

12. CI RISK ASSET RATIO (%) 13. ESTIMATED BIS RISK ASSET RATIO (%) 14. ESTIMATED BIS RAR ON TIER ONE CAPITAL (%). 15. ACTUAL RISK ASSET RATIO TO LOCAL STANDARDS (%) 16. INTERNAL CAPITAL GENERATION (%). 17. TOTAL CAPITAL GROWTH RATE (YEAR ON YEAR %) 18. TOTAL CAPITAL TO TOTAL ASSETS (%) 19. TOTAL CAPITAL TO GROSS LOANS (%) 20. FREE CAPITAL FUNDS (LOCAL CURRENCY) 21. ESTIMATED BIS RAR SHORTFALL (LOCAL CURRENCY)

FREE CAPITAL FUNDS X 100 RISK WEIGHTED ASSETS - NON-FINANCIAL SUBS. - FIXED ASSETS (TOTAL CAPITAL - FINANCIAL SUBSIDIARIES) X 100 RISK WEIGHTED ASSETS TIER ONE CAPITAL - FINANCIAL SUBSIDIARIES X 100 RISK WEIGHTED ASSETS

FROM BANK / OTHER SOURCES

(NET PROFIT - DIVIDENDS -EXTRAORDINARY ITEMS) X 100 TIER ONE CAPITAL (CURRENT YEAR TOTAL CAPITAL - LAST YEAR TOTAL CAPITAL) X 100 LAST YEAR TOTAL CAPITAL TOTAL CAPITAL X 100 TOTAL ASSETS TOTAL CAPITAL X 100 GROSS LOANS TOTAL CAPITAL - FINANCIAL & NON FINANCIAL SUBSIDIARIES - FIXED ASSETS IF BIS RISK ASSET RATIO IS LESS THAN 8% (0.08 X RISK WEIGHTED ASSETS) (TOTAL CAPITAL - FINANCIAL SUBSIDIARIES) RISK WEIGHTED ASSETS X 100 TOTAL FOOTINGS

22. RISK WEIGHTED ASSETS ON TOTAL FOOTINGS (%)

D. Liquidity Ratios

23. NET LOANS TO TOTAL DEPOSITS (%) 24. NET LOANS TO TOTAL CUSTOMER DEPOSITS (%) 25. NET LOANS TO STABLE FUNDS (%) 26. CUSTOMER DEPOSITS TO TOTAL DEPOSITS (%) 27. LIQUID ASSET RATIO (%) 28. QUASI-LIQUID ASSET RATIO (%) 29. FOREIGN CURRENCY ASSETS TO FOREIGN CURRENCY LIABILITIES (%) 30. FOREIGN CURRENCY LOANS TO FOREIGN CURRENCY DEPOSITS (%) 31. INTERBANK ASSETS TO INTERBANK LIABILITIES (%) 32. NET INTERBANK ASSETS (LOCAL CURRENCY)

NET LOANS X 100 TOTAL CUSTOMER DEPOSITS & INTERBANK NET LOANS X 100 TOTAL CUSTOMER DEPOSITS NET LOANS X 100 STABLE FUNDS TOTAL CUSTOMER DEPOSITS X 100 TOTAL DEPOSITS & INTERBANK (TOTAL LIQUID ASSETS + TOTAL DEPOSITS WITH BANKS) X 100 TOTAL ASSETS QUASI-LIQUID ASSETS X 100 TOTAL ASSETS FOREIGN CURRENCY ASSETS X 100 FOREIGN CURRENCY LIABILITIES OREIGN CURRENCY LOANS X 100 FOREIGN CURRENCY BORROWINGS + FOREIGN CURRENCY DEPOSITS TOTAL DEPOSITS WITH BANKS X 100 TOTAL INTERBANK LIABILITIES

TOTAL DEPOSITS WITH BANKS - TOTAL INTERBANK LIABILITIES

11

E. Profitability Ratios

33. RETURN ON AVERAGE ASSETS (%) 34. RETURN ON AVERAGE EQUITY (%) 35. UNDERLYING PROFITS ON AVERAGE ASSETS (%) 36. UNDERLYING PROFITS ON AVERAGE EQUITY (%) 37. FUNDING COST (%)

NET PROFIT (or LOSS) X 100 AVERAGE TOTAL ASSETS NET PROFIT (or LOSS) X 100 AVERAGE TIER ONE CAPITAL +AVERAGE REVALUATION RESERVE (OPERATING PROFIT - INTEREST ON AVERAGE FREE CAPITAL) X 100 AVERAGE TOTAL ASSETS (OPERATING PROFIT - INTEREST ON AVERAGE FREE CAPITAL) X 100 AVERAGE TIER ONE CAPITAL + AVERAGE REVALUATION RESERVE INTEREST EXPENSE X 100 AVERAGE TOTAL DEPOSITS & INTERBANK+AVERAGE MEDIUM/LONG TERM LIABILITIES+AVERAGE HYBRID CAPITAL INSTRUMENTS+AVERAGE SUBORDINATED TERM DEBT INTEREST INCOME X 100 AVERAGE CASH & 7 DAY+AVERAGE T-BILLS+AVERAGE GOVERNMENT SECURITIES+AVERAGE OTHER LIQUID ASSETS+AVERAGE TOTAL DEPOSITS WITH BANKS+AVERAGE MARKETABLE SECURITIES+AVERAGE NET LOANS

38. INTEREST ON AVERAGE EARNING ASSETS (%)

39. INTEREST DIFFERENTIAL (%) 40. NON-INTEREST INCOME TO GROSS INCOME (%) 41. OPERATING EXPENSES TO GROSS INCOME (%) 42. OPERATING PROFIT GROWTH RATE (YEAR ON YEAR %) 43. OPERATING PROFIT ON AVERAGE ASSETS (%) 44. RISK PROVISIONING CHARGE TO OPERATING PROFIT (%) 45. DIVIDEND PAYOUT RATIO (%)

INTEREST ON AVERAGE EARNING ASSETS (%) - FUNDING COST (%)

(GROSS INCOME - NET INTEREST) X 100 GROSS INCOME OPERATING EXPENSES X 100 GROSS INCOME (CURRENT YEAR OPERATING PROFIT - LAST YEAR OPERATING PROFIT) X 100 LAST YEAR OPERATING PROFIT OPERATING PROFIT X 100 AVERAGE TOTAL ASSETS PROV. CHARGE FOR DOUBTFUL DEBTS & DIM. OF INVESTMENTS X 100 OPERATING PROFIT DIVIDENDS X 100 NET PROFIT (or LOSS)

DEFINITIONS:

FREE CAPITAL:STABLE FUNDS:QUASI LIQUID ASSETS:TOTAL INVESTMENTS:-

FREE CAPITAL FUNDS - TIER TWO CAPITAL. TOTAL CUSTOMER DEPOSITS + OFFICIAL DEPOSITS + MEDIUM/LONG TERM LIABILITIES + FREE CAPITAL FUNDS. TOTAL LIQUID ASSETS + TOTAL DEPOSITS WITH BANKS + MARKETABLE SECURITIES. MARKETABLE SECURITIES + UNQUOTED INVESTMENTS + NON-FINANCIAL SUBSIDIARIES & AFFILIATES + FINANCIAL SUBSIDIARIES & AFFILIATES. WEIGHTED TOTAL OF ASSETS APPLYING THE FOLLOWING PERCENTAGES:100% Non-OECD medium term deposits, marketable securities, bills discounted & short term loans, medium/long term loans, other loans, non-performing loans, loan-loss provisions, unquoted investments, non-financial subsidiaries & affiliates, fixed assets, other assets, fin. gtees/standby LCs/acceptances. 50% First mortgage loans, bid & performance bonds. 20% Government securities, other liquid assets, up to 1 year deposits with banks, short/other deposits with banks, government guaranteed/collateralised loans, LCs/bank & government guarantees. 10% T-Bills, bonding for banks & governments. 5% Interest rate swaps/bank & government LCs. GOVERNMENT GUARANTEED, FIRST MORTGAGE LOANS, BILLS DISC. & SHORT TERM, MEDIUM/LONG TERM LOANS, OTHER LOANS, NONPERFORMING LOANS. TIER ONE CAPITAL + ASSET REVALUATION RESERVE

RISK WEIGHTED ASSETS:-

GROSS LOANS:-

EQUITY:-

12

RATING DEFINITIONS

FOREIGN CURRENCY RATINGS CI foreign currency ratings assess the likelihood that obligations will be repaid in a timely manner. The foreign currency ratings take into account all sovereign risk factors and are subject to the sovereign ceiling of the host country. CI assigns sovereign ratings to every country where an institution is rated. Foreign currency ratings assigned to an institution will not normally breach the sovereign rating assigned to the country by CI. However, it may be possible to achieve a rating above the sovereign ceiling through financial or legal structuring or through an institution possessing a significant transnational asset profile. Both CIs long- and short-term foreign currency ratings take into account the full impact of transfer risk and the risk that the host country may be unable or unwilling to service its foreign currency obligations. FOREIGN CURRENCY LONG-TERM RATINGS: Investment Grade AAA The highest credit quality. Exceptional capacity for timely fulfilment of financial obligations and most unlikely to be affected by any foreseeable adversity. Extremely strong financial condition and very positive nonfinancial factors. Very strong and stable operating environment. Very high credit quality. Very strong capacity for timely fulfilment of financial obligations. Unlikely to have repayment problems over the long term and unquestioned over the short and medium terms. Strong operating environment. Adverse changes in business, economic and financial conditions unlikely to affect the institution significantly. High credit quality. Strong capacity for timely fulfilment of financial obligations. Possesses many favourable credit characteristics but may be vulnerable slightly to adverse changes in business, economic and financial conditions. However, operating environment is solid. Good credit quality. Satisfactory capacity for timely fulfilment of financial obligations. Acceptable credit characteristics but some vulnerability to adverse changes in business, economic and financial conditions. Medium grade credit characteristics and the lowest investment grade category. Speculative Grade BB Speculative credit quality. Capacity for timely fulfilment of financial obligations vulnerable to adverse changes in internal or external circumstances. Financial and/or non-financial factors do not provide significant safeguard and the possibility of investment risk may develop. Unstable operating environment. Significant credit risk. Capacity for timely fulfilment of financial obligations very vulnerable to adverse changes in internal or external circumstances. Financial and/or non-financial factors provide weak protection; high probability for investment risk exists. Weak operating environment. Substantial credit risk is apparent and the likelihood of default is high. Considerable uncertainty as to timely repayment of financial obligations. Credit is of poor standing with financial and/or non-financial factors providing little protection. Obligations are currently in default.

AA

BBB

FOREIGN CURRENCY SHORT-TERM RATINGS: Investment Grade A1 Superior credit quality. Highest capacity for timely repayment of short-term financial obligations that is extremely unlikely to be affected by unexpected adversities. Institutions with a particularly strong credit profile have a + affixed to the rating. Very strong capacity for timely repayment but may be affected slightly by unexpected adversities. Strong capacity for timely repayment that may be affected by unexpected adversities. Speculative Grade B C D Adequate capacity for timely repayment that could be seriously affected by unexpected adversities. Inadequate capacity for timely repayment if unexpected adversities are encountered in the short term. May be in an untenable position and is likely to default if it does not receive immediate external support.

A2 A3

13

DOMESTIC STRENGTH RATINGS CIs domestic strength ratings indicate CIs opinion of a banks inherent financial strength and risk profile. CIs domestic strength ratings exclude, to the extent possible, the impact of transfer risk, i.e. the risk that the host country may be unable or unwilling to service its foreign currency obligations. Domestic strength ratings also exclude support factors. As transfer risk is excluded, the domestic strength ratings are local currency based. Domestic strength ratings do not assess the likelihood that specific obligations will be repaid in a timely manner. The domestic strength ratings summarise the probability that an institution will require external assistance from third parties to overcome adversities. Domestic strength ratings do not measure the likelihood that the bank will receive such external support, nor do they address sovereign risk factors which may affect an institutions capacity to honour its financial obligations, be they domestic or foreign currency. In assigning a domestic strength rating, CI considers both internal and external factors. Internal factors include financial fundamentals, business operations and market position. Although specific transfer risk is excluded, CIs domestic strength ratings take into account the banks operating environment including the economy, the structure, strength and stability of the financial system, the legal system, and the quality of banking regulation and supervision. CI maintains global consistency in its domestic strength rating methodology.

DOMESTIC STRENGTH RATINGS: AAA AA A BBB BB Financially in extremely strong condition with positive financial trends; significant strengths in other nonfinancial areas. Operating environment highly attractive and stable. Financially in very strong condition and significant strengths in other non-financial areas. Operating environment likely to be very attractive and stable. Strong financial fundamentals and very favourable non-financial considerations. Operating environment may be unstable but institutions market position and/or financial strength more than compensate. Basically sound overall; slight weaknesses in financial or other factors could be remedied fairly easily. May be limited by unstable operating environment. One or two significant weaknesses in the banks financial makeup could cause problems. May be characterised by a limited franchise; other factors may not be sufficient to avoid a need for some degree of temporary external support in cases of extraordinary adversity. Unstable operating environment likely. Fundamental weaknesses are present in the bank's financial condition or trends, and other factors are unlikely to provide strong protection from unexpected adversities; in such an event, the need for external support is likely. Bank may be constrained by weak market position and/or volatile operating environment. In a very weak financial condition, either with immediate problems or with limited capacity to withstand adversities. May be operating in a highly volatile operating environment. Extremely weak financial condition and may be in an untenable position.

C D

Capital Intelligence uses "+" and "-" signs appended to an institutions domestic strength and foreign currency long-term ratings to indicate that their relative position is, respectively, slightly greater or less than that of similarly rated peers. In order to indicate whether CI expects an institutions ratings to improve or deteriorate over the twelve-month period following their publication, a letter denoting "Outlook" is added to each set of ratings. The Outlook may be "P" (Positive) "S" (Stable) or "N" (Negative). A subscript letter "Q" following an institutions ratings indicates that the ratings are "Qualified". Ratings are qualified in cases where the data and/or cooperation forthcoming from an institution are such that it is not possible to formulate ratings to CI's high standards of robustness and reliability. CI makes every effort to ensure that qualifications are removed at the earliest opportunity.

14

SUPPORT RATINGS CI support ratings assess the likelihood that a bank would receive support in case of difficulties. Although subjective, they are based on a thorough assessment of a banks ownership, market position and importance within the sector and economy, as well as the countrys regulatory and supervisory framework. Support ratings do not address the financial soundness of an institution. CIs support ratings also do not specifically address transfer risk as a result of economic and/or political events.

SUPPORT RATINGS: 1 2 Government-owned or clear legal guarantee on part of the state, or of such importance to the country, that the state would provide support in case of need. The state must clearly be able, and willing, to provide support. Government support extremely likely despite absence of written guarantee. There may be some uncertainty regarding the states willingness or ability to provide support. A private bank which has extremely strong ownership. Owners of very good reputation and resources, and which can provide clear support. Support is likely but not certain. No clear support and/or support cannot be relied upon.

3 4 5

Вам также может понравиться

- Television - Newspapers Magazines: QATAR - 2012 (Jan-Dec) Millions US$ 461 + 4% Thousand SESU 178 + 1%Документ1 страницаTelevision - Newspapers Magazines: QATAR - 2012 (Jan-Dec) Millions US$ 461 + 4% Thousand SESU 178 + 1%Hamad Al SalemОценок пока нет

- JORDAN - 2012 (Jan-Dec) Millions US$ 139 - 3%: Pan Arab Research CenterДокумент1 страницаJORDAN - 2012 (Jan-Dec) Millions US$ 139 - 3%: Pan Arab Research CenterHamad Al SalemОценок пока нет

- Low-Cost and Traditional Airlines - Ratio Analysis and Equity Valuation by The Residual Earnings ModelДокумент71 страницаLow-Cost and Traditional Airlines - Ratio Analysis and Equity Valuation by The Residual Earnings ModelW.J. Zondag100% (1)

- DCFДокумент20 страницDCFHamad Al SalemОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- British Universal Steel Columns and Beams PropertiesДокумент6 страницBritish Universal Steel Columns and Beams PropertiesjagvishaОценок пока нет

- Pemaknaan School Well-Being Pada Siswa SMP: Indigenous ResearchДокумент16 страницPemaknaan School Well-Being Pada Siswa SMP: Indigenous ResearchAri HendriawanОценок пока нет

- EIRA v0.8.1 Beta OverviewДокумент33 страницыEIRA v0.8.1 Beta OverviewAlexQuiñonesNietoОценок пока нет

- 2021 JHS INSET Template For Modular/Online Learning: Curriculum MapДокумент15 страниц2021 JHS INSET Template For Modular/Online Learning: Curriculum MapDremie WorksОценок пока нет

- Money Laundering in Online Trading RegulationДокумент8 страницMoney Laundering in Online Trading RegulationSiti Rabiah MagfirohОценок пока нет

- Ultra Slimpak G448-0002: Bridge Input Field Configurable IsolatorДокумент4 страницыUltra Slimpak G448-0002: Bridge Input Field Configurable IsolatorVladimirОценок пока нет

- Statistical Quality Control, 7th Edition by Douglas C. Montgomery. 1Документ76 страницStatistical Quality Control, 7th Edition by Douglas C. Montgomery. 1omerfaruk200141Оценок пока нет

- Revision Worksheet - Matrices and DeterminantsДокумент2 страницыRevision Worksheet - Matrices and DeterminantsAryaОценок пока нет

- CENG 5503 Intro to Steel & Timber StructuresДокумент37 страницCENG 5503 Intro to Steel & Timber StructuresBern Moses DuachОценок пока нет

- Bula Defense M14 Operator's ManualДокумент32 страницыBula Defense M14 Operator's ManualmeОценок пока нет

- Marshall Stability Test AnalysisДокумент5 страницMarshall Stability Test AnalysisZick Zickry50% (2)

- Physioex 9.0 Exercise 1 Act 1Документ5 страницPhysioex 9.0 Exercise 1 Act 1Adela LhuzОценок пока нет

- Meet Joe Black (1998) : A Metaphor of LifeДокумент10 страницMeet Joe Black (1998) : A Metaphor of LifeSara OrsenoОценок пока нет

- SNC 2p1 Course Overview 2015Документ2 страницыSNC 2p1 Course Overview 2015api-212901753Оценок пока нет

- Business Case PresentationДокумент27 страницBusiness Case Presentationapi-253435256Оценок пока нет

- Mutual Fund PDFДокумент22 страницыMutual Fund PDFRajОценок пока нет

- Breaking NewsДокумент149 страницBreaking NewstigerlightОценок пока нет

- Longman ESOL Skills For Life - ShoppingДокумент4 страницыLongman ESOL Skills For Life - ShoppingAstri Natalia Permatasari83% (6)

- Typical T Intersection On Rural Local Road With Left Turn LanesДокумент1 страницаTypical T Intersection On Rural Local Road With Left Turn Lanesahmed.almakawyОценок пока нет

- Inborn Errors of Metabolism in Infancy: A Guide To DiagnosisДокумент11 страницInborn Errors of Metabolism in Infancy: A Guide To DiagnosisEdu Diaperlover São PauloОценок пока нет

- SOP-for RecallДокумент3 страницыSOP-for RecallNilove PervezОценок пока нет

- GS16 Gas Valve: With On-Board DriverДокумент4 страницыGS16 Gas Valve: With On-Board DriverProcurement PardisanОценок пока нет

- Wheeled Loader L953F Specifications and DimensionsДокумент1 страницаWheeled Loader L953F Specifications and Dimensionssds khanhОценок пока нет

- SolBridge Application 2012Документ14 страницSolBridge Application 2012Corissa WandmacherОценок пока нет

- Service Manual: Precision SeriesДокумент32 страницыService Manual: Precision SeriesMoises ShenteОценок пока нет

- THE DOSE, Issue 1 (Tokyo)Документ142 страницыTHE DOSE, Issue 1 (Tokyo)Damage85% (20)

- SEC QPP Coop TrainingДокумент62 страницыSEC QPP Coop TrainingAbdalelah BagajateОценок пока нет

- Objective Mech II - IES 2009 Question PaperДокумент28 страницObjective Mech II - IES 2009 Question Paperaditya_kumar_meОценок пока нет

- Rapport DharaviДокумент23 страницыRapport DharaviUrbanistes du MondeОценок пока нет

- EA Linear RegressionДокумент3 страницыEA Linear RegressionJosh RamosОценок пока нет