Академический Документы

Профессиональный Документы

Культура Документы

Probability Calculator

Загружено:

ansar99Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Probability Calculator

Загружено:

ansar99Авторское право:

Доступные форматы

Probability Calculator for Options Trading

2008 Parkwood Capital, LLC, all rights reserved

Data Input: Price: Target Price: Implied Volatility: Days to Expiration: $45.00 $55.00 152.00 46

Enter as a percentage, e.g. 12.45, not 0.1245

One Standard Deviation () Move = Probability of Stock Price Closing Above the Target Price: Probability of Stock Price Closing Below the Target Price: One One

$24.28 35.5% 64.5% $69.28 $20.72

Above the Current Price: Below the Current Price:

This calculation is based upon the assumption that stock prices behave according to a normal or Gaussian distribution (the classic bell shaped curve). Think of todays stock price as the peak of the bell shaped curve. The normal price distribution illustrates what we know intuitively, i.e., a larger move in price to the edges of the distribution curve is less likely. These calculations simply let us quantify the probabilities of our price estimates. If we were analyzing a stock's historical price behavior, we would use the stock's historical or statistical volatility in the distribution calculation. Since we are estimating the stock price movement for the future, we will use todays implied volatility for the stock's options as the market's best estimate of the stock's future volatility. Therefore, we can use the implied volatility as an estimate of the standard deviation for the price distribution calculation. For a normal distribution, the probability of the data point being contained within plus or minus three standard deviations of the mean is 99.74%. Similarly, a one standard deviation move in either direction should encompass 68% of the data. These calculated probabilities are the accurate predictions for a series of random events such as computing the probabilities of rolling a seven when playing dice. If stock prices behaved as statistically random events, like flipping a coin, one would expect stock price moves outside of the plus or minus three standard deviations to be an extremely rare event (only a 0.26% probability). In fact, it isn't. This is the so-called "fat tails" problem, i.e., the far ends of the distribution are higher or fatter than predicted. Stock prices are subject to many non-random forces - news events, crowd psychology, etc. Thus, stock price moves of greater than three standard deviations occur far more often than predicted. Therefore, do not look at these calculated probabilities as precise predictions of the stock price. But we could expect these probabilities to be more and more accurate if we were placing similar trades one after another. We can also use these probabilities to compare the relative risks of various trades. For example, one could compute the probability of the stock price closing above the sold strike price for a series of potential

covered call trades, and rank them on this basis. This form of a probability calculator can be used with many different options strategies. For example, if we are considering an OTM bear call spread on the SPX and want to know which strike prices to use for a high probability trade, we would enter the current price of the SPX, $1305, the current IV of 11.5% and 15 days to expiration, and calculate one standard deviation of $30 (the Greek letter, sigma (), is traditionally used to signify a standard deviation in statistics; thus, in this example, = 30). Therefore, a bear call spread at $1335/$1345 would be over one standard deviation away from the current price and would have a probability of about 84% of the SPX closing below $1335 in 15 days (68% for the area of plus or minus one , or $1275 to $1335, plus the area below $1275 which has a 16% probability). One could extend this calculation to an iron condor spread by establishing the bull put spread at $1265/$1275. Thus, both spreads are about one standard deviation away from the current price and this trade has a high probability of success. Using this system over time, one would expect to have winners about 80% of the time; however, the key success factor is managing the losses the other 20% of the time. Couple this technique with a solid stop loss discipline for a robust trading system. For more details and background, see: Options as a Strategic Investment, Larry McMillan, pages 456-489 A good source for implied volatility data is the CBOE web site: www.cboe.com, trading tools-IV Index Kerry W. Given July 25, 2008

avior, we would

s options as the olatility as an

s of the mean 68% of the data.

it isn't. This is

c. Thus, stock . Therefore, do not d expect these ther. We can

prices to use for

from the current

t price and this have winners

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- 5HP500-590 4139 - 751 - 627dДокумент273 страницы5HP500-590 4139 - 751 - 627ddejanflojd100% (24)

- The Trend Template Mark MinerviniДокумент4 страницыThe Trend Template Mark Minerviniansar990% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Linear Space-State Control Systems Solutions ManualДокумент141 страницаLinear Space-State Control Systems Solutions ManualOrlando Aguilar100% (4)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Bid-Ask Spreads PDFДокумент48 страницBid-Ask Spreads PDFansar99Оценок пока нет

- Isolated Flyback Switching Regulator W - 9V OutputДокумент16 страницIsolated Flyback Switching Regulator W - 9V OutputCasey DialОценок пока нет

- Discussion #3: The Concept of Culture Learning ObjectivesДокумент4 страницыDiscussion #3: The Concept of Culture Learning ObjectivesJohn Lery SurellОценок пока нет

- MOtivating Your Teenager PDFДокумент66 страницMOtivating Your Teenager PDFElleMichelle100% (1)

- THE LAW OF - John Searl Solution PDFДокумент50 страницTHE LAW OF - John Searl Solution PDFerehov1100% (1)

- NG Ee Hwa - How To Draw Trendlines 2007Документ2 страницыNG Ee Hwa - How To Draw Trendlines 2007ansar99Оценок пока нет

- Workshop 02.1: Restart Controls: ANSYS Mechanical Basic Structural NonlinearitiesДокумент16 страницWorkshop 02.1: Restart Controls: ANSYS Mechanical Basic Structural NonlinearitiesSahil Jawa100% (1)

- Comprehensive Shahru Ramadan Book PDFДокумент60 страницComprehensive Shahru Ramadan Book PDFansar99Оценок пока нет

- Har Mushkil Aur Pareshani Se Nijat Ke LiyeДокумент1 страницаHar Mushkil Aur Pareshani Se Nijat Ke Liyeansar99Оценок пока нет

- Some Problems in Determining The Origin of The Philippine Word Mutya' or Mutia'Документ34 страницыSome Problems in Determining The Origin of The Philippine Word Mutya' or Mutia'Irma ramosОценок пока нет

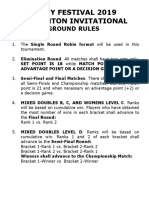

- Ground Rules 2019Документ3 страницыGround Rules 2019Jeremiah Miko LepasanaОценок пока нет

- Economic Value Added in ComДокумент7 страницEconomic Value Added in Comhareshsoni21Оценок пока нет

- Ielts Reading Whale CultureДокумент4 страницыIelts Reading Whale CultureTreesa VarugheseОценок пока нет

- Quadrotor UAV For Wind Profile Characterization: Moyano Cano, JavierДокумент85 страницQuadrotor UAV For Wind Profile Characterization: Moyano Cano, JavierJuan SebastianОценок пока нет

- CLASS 12 PracticalДокумент10 страницCLASS 12 PracticalWORLD HISTORYОценок пока нет

- Google Automatically Generates HTML Versions of Documents As We Crawl The WebДокумент2 страницыGoogle Automatically Generates HTML Versions of Documents As We Crawl The Websuchi ravaliaОценок пока нет

- Thesis Statement VampiresДокумент6 страницThesis Statement Vampireslaurasmithdesmoines100% (2)

- Em 1.4 RMДокумент18 страницEm 1.4 RMMangam RajkumarОценок пока нет

- A Study On Investors Perception Towards Sharemarket in Sharekhan LTDДокумент9 страницA Study On Investors Perception Towards Sharemarket in Sharekhan LTDEditor IJTSRDОценок пока нет

- Diabetes & Metabolic Syndrome: Clinical Research & ReviewsДокумент3 страницыDiabetes & Metabolic Syndrome: Clinical Research & ReviewspotatoОценок пока нет

- Measuring Trend and TrendinessДокумент3 страницыMeasuring Trend and TrendinessLUCKYОценок пока нет

- Eet 223 (1) Analog Electronics JagjeetДокумент79 страницEet 223 (1) Analog Electronics JagjeetMahima ArrawatiaОценок пока нет

- Ottley Sandra 2009Документ285 страницOttley Sandra 2009Lucas Fariña AlheirosОценок пока нет

- Rosenberg Et Al - Through Interpreters' Eyes, Comparing Roles of Professional and Family InterpretersДокумент7 страницRosenberg Et Al - Through Interpreters' Eyes, Comparing Roles of Professional and Family InterpretersMaria AguilarОценок пока нет

- Reported SpeechДокумент2 страницыReported SpeechmayerlyОценок пока нет

- German Monograph For CannabisДокумент7 страницGerman Monograph For CannabisAngel Cvetanov100% (1)

- Binary SearchДокумент13 страницBinary SearchASasSОценок пока нет

- Arctic Beacon Forbidden Library - Winkler-The - Thousand - Year - Conspiracy PDFДокумент196 страницArctic Beacon Forbidden Library - Winkler-The - Thousand - Year - Conspiracy PDFJames JohnsonОценок пока нет

- Mwa 2 - The Legal MemorandumДокумент3 страницыMwa 2 - The Legal Memorandumapi-239236545Оценок пока нет

- Grade 3Документ4 страницыGrade 3Shai HusseinОценок пока нет

- Grade 7 1ST Quarter ExamДокумент3 страницыGrade 7 1ST Quarter ExamJay Haryl PesalbonОценок пока нет

- Factor Causing Habitual Viewing of Pornographic MaterialДокумент64 страницыFactor Causing Habitual Viewing of Pornographic MaterialPretzjay BensigОценок пока нет