Академический Документы

Профессиональный Документы

Культура Документы

Stock Research Report For APA As of 3/26/2012 - Chaikin Power Tools

Загружено:

Chaikin Analytics, LLCОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Stock Research Report For APA As of 3/26/2012 - Chaikin Power Tools

Загружено:

Chaikin Analytics, LLCАвторское право:

Доступные форматы

Apache Corp (APA)

Price: $101.77

Industry: Oil-Exploration & Production

Chaikin Power Gauge Report | Generated: Mon Mar 26 12:22 EDT 2012 Power Gauge Rating

APA - Bullish

The Chaikin Power Gauge Rating for APA is bullish due to very attractive financial metrics and very strong earnings performance. The rating also reflects bearish price/volume activity and negative expert opinions. APA's earnings performance is very strong as a result of a relatively low projected P/E ratio and consistent earnings over the past 5 years.

TM

News Sentiment Rating

No News Stories

APA Apache Corp

N/A

News Sentiment :No News Story

Power Trend - 5 Year Chart

The Power Gauge distills a 20 factor model into a concise picture of a stock's potential.

High Potential

Neutral

Low Potential

I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here

www.chaikinpowertools.com

Financials & Earnings

Financial Metrics

Financial Metrics Rating

LT Debt/Equity Ratio

Very Bullish

APA's financial metrics are excellent. The company does not hold much long term debt relative to its industry group and may be undervalued. The rank is based on a low long term debt to equity ratio relative to its industry group, low price to book value, high return on equity and low price to sales ratio.

Price to Book Value

Return on Equity

Price to Sales Ratio

Business Value

Assets and Liabilities

Ratio Current Ratio LT Debt/Equity TTM 0.97 0.24

Valuation

Ratio Price/Book Price/Sales TTM 1.41 2.32

Returns

Ratio Return on Invest Return on Equity TTM 13.8% 18.4%

Earnings Performance

Earnings Performance Rating

Earnings Growth

Very Bullish

APA's earnings performance has been very strong. The company is priced relatively low compared to next year's projected EPS and has a stable 5 year earnings trend. The rank is based on an upward trend in earnings this year, a relatively low projected P/E ratio and consistent earnings over the past 5 years.

Earnings Surprise

Earnings Trend

Projected P/E Ratio

Earnings Consistency

5 Year Revenue and Earnings Growth

12/07 Revenue(M) Rev % Growth EPS EPS % Growth 9,977.86 20.38% $8.45 9.46% 12/08 12,389.75 24.17% $2.11 -75.03% 12/09 8,614.83 -30.47% $-0.87 -141.23% 12/10 12,092.00 40.36% $8.53 1,080.46% 12/11 16,888.00 39.66% $11.74 37.63%

EPS Estimates

Factor Quarterly EPS Yearly EPS Factor 3-5 year EPS Actual EPS Prev $2.91 $11.74 Actual EPS Growth 18.82% EST EPS Current $3.02 $12.46 Est EPS Growth 6.42% Change +0.11 +0.72 Change -12.40

EPS Surprise

Estimate Latest Qtr 1 Qtr Ago 2 Qtr Ago 3 Qtr Ago $2.87 $2.82 $3.09 $2.61 Actual $2.94 $2.95 $3.22 $2.87 Difference $0.07 $0.13 $0.13 $0.26 % Difference 2.44 4.61 4.21 9.96

EPS Quarterly Results

FY 12/09 12/10 12/11 Qtr 1 $-5.25 $2.09 $2.91 Qtr 2 $1.32 $2.55 $3.23 Qtr 3 $1.31 $2.14 $2.56 Qtr 4 $1.73 $1.79 $3.05 Total $-0.89 $8.57 $11.75

Fiscal Year End Month is December.

I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here

www.chaikinpowertools.com

Price Trend & Expert Opinions

Price/Volume Activity

Price/Volume Activity Rating

Relative Strength vs Market

Bearish

Price and volume activity for APA is bearish. APA has a declining price trend and has underperformed the S&P 500 over 26 weeks. The rank for APA is based on a negative Chaikin price trend.

Chaikin Money Flow

Price Trend

Price Trend ROC

Volume Trend

Relative Strength vs S&P500 Index

Chaikin Money Flow

Chart shows whether APA is performing better or worse than the market.

Chaikin Money Flow analyzes supply and demand for a company's stock.

Price Activity

Factor 52 Week High 52 Week Low % Change YTD Rel S&P 500 Value 133.37 76.50 7.76%

Price Activity

Factor % Change Price - 4 Weeks % Change Price - 24 Weeks % Change Price - 4 Wks Rel to S&P % Change Price - 24 Wks Rel to S&P Value -7.42% 18.01% -9.65% -1.60%

Volume Activity

Factor Average Volume 20 Days Average Volume 90 Days Chaikin Money Flow Persistency Value 2,666,578 2,955,751 58%

Expert Opinions

Expert Opinions

Earnings Estimate Revisions

Bearish

Expert opinions about APA are negative. Analysts's opinions on APA have been more negative recently and analysts are lowering their EPS estimates for APA. The rank for APA is based on analysts revising earnings estimates downward, a low short interest ratio and pessimistic analyst opinions.

Short Interest

Insider Activity

Analyst Opinions

Relative Strength vs Industry

Earnings Estimate Revisions

Current Current Qtr Next Qtr 3.02 3.07 Current Current FY 12.46 7 Days Ago % Change 3.00 3.08 +0.67% -0.32%

Analyst Recommendations

Factor Mean this Week Mean Last Week Change Mean 5 Weeks Ago Value Strong Buy Strong Buy 0.00 Strong Buy

EPS Estimates Revision Summary

Last Week Up Curr Qtr Curr Yr Next Qtr 1 1 0 0 Down 1 1 1 1 Last 4 Weeks Up 4 7 3 3 Down 2 2 2 2

30 Days Ago % Change 12.19 0.27

Next Yr

I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here

www.chaikinpowertools.com

The Company & Its Competitors

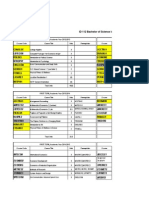

APA's Competitors in Oil-Exploration & Production

Company APA EOG DVN QEP APC CHK NBL Power Gauge Historic EPS growth 18.82% 27.60% 6.65% 15.42% 12.28% 13.53% 9.00% Projected EPS growth 6.42% 14.30% 9.75% 24.00% 27.12% 9.96% 25.04% Profit Margin 27.14% 10.77% 41.07% 8.66% -18.97% 14.97% 12.04% PEG 1.27 1.55 1.15 0.63 0.74 1.41 0.62 PE 8.49 29.64 11.73 17.20 23.56 8.78 18.50 Revenue(M) 16,888 10,126 11,454 3,159 13,967 11,635 3,763

News Headlines for APA Apache Completes Acquisition of 49-Percent Stake in Burrup Fertilisers Plant in Western Australia for $439 Million - Feb 1, 2012 Apache buying Cordillera Energy in $2.85B deal - Jan 23, 2012 Apache Completes Acquisition of ExxonMobil's Beryl Field, Other UK North Sea Assets - Jan 3, 2012 Apache to Buy 65% Interest in Burrup Fertilisers Plant in Western Australia, Sets Plans for New Technical Ammonium Nitrate Project - Dec 18, 2011 Circle Star Energy Announces All Stock Transactio ...

Company Details Apache Corp 2000 POST OAK BLVD STE 100 HOUSTON, TX 77056-4400 USA Phone: 7132966000 Fax: 713-296-6480 Website: http://http://www.apachecorp.com Full Time Employees: 5,299 Sector: Oils/Energy

Company Profile Apache Corporation is an independent energy company that explores for, develops and produces natural gas, crude oil and natural gas liquids. In North America, Apache's exploration and production interests are focused on the Gulf of Mexico, the Anadarko Basin, the Permian Basin, the Gulf Coast and the Western Sedimentary Basin of Canada. Outside of North America, Apache has exploration and production interests offshore Western Australia and in Egypt, and exploration interests in Poland and offshore The People's Republic of China.

Power Gauge Ratings are created using a relative ranking system that assigns a rank of 0 to 100 (100 being the highest) to each stock in the universe. Rank is calculated by evaluating each of the stocks factors and combining them into a single number using a weighting formula. A stock's rank ranges from 100-0, where 100 is the strongest, and a rank of 95 indicates the stock is better than 95% of the stocks in the universe. Chaikin Stock Research(CSR) is not registered as a securities broker dealer or investment advisor with either the U.S. Securities and Exchange Commission or with any state securities regulatory authority. CSR is not responsible for trades executed by users of this research report, our web site or mobile app based on the information included herein. The information presented in this report does not represent a recommendation to buy or sell stocks or any financial instrument nor is it intended as an endorsement of any security or investment. The information in this report is generic by nature and is not personalized to the specific financial situation of any individual. The user bears complete responsibility for their own investment research and should seek the advice of a qualified investment professional before making any investment decisions. Copyright (c) 1978-(Present) by ZACKS Investment Research, Inc ("ZACKS"). The information, data, analyses and opinions contained herein (1) includes the confidential and proprietary information of ZACKS, (2) may not be copied or redistributed, for any purpose, (3) does not constitute investment advice offered by ZACKS, (4) are provided solely for informational purposes, and (5) are not warranted or represented to be correct, complete, accurate or timely. ZACKS shall not be responsible for investment decisions, damages or other losses resulting from, or related to, use of this information, data, analyses or opinions. Past performance is no guarantee of future performance. ZACKS is not affiliated with Chaikin Power Tools. This report from Chaikin Power Tools is for informational purposes only and is not a recommendation to buy or sell securities.

LM 2.3 DS 3.0 LS 2.1

Data Provided by ZACKS Investment Research, Inc., www.zacks.com

Special offers to trade stocks from optionsXpress: www.chaikinpowertools.com

Вам также может понравиться

- 5 Simple Steps For Investing SmarterДокумент66 страниц5 Simple Steps For Investing SmarterChaikin Analytics, LLCОценок пока нет

- Stock Research Report For WFC As of 3/26/2012 - Chaikin Power ToolsДокумент4 страницыStock Research Report For WFC As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Rachel Fox: Short-Term Trading Tips and Strategies With Chaikin AnalyticsДокумент26 страницRachel Fox: Short-Term Trading Tips and Strategies With Chaikin AnalyticsChaikin Analytics, LLC0% (1)

- Stock Market Tips From Marc ChaikinДокумент4 страницыStock Market Tips From Marc ChaikinChaikin Analytics, LLCОценок пока нет

- Pick Bullish Stocks and Avoid The Bearish With Chaikin AnalyticsДокумент14 страницPick Bullish Stocks and Avoid The Bearish With Chaikin AnalyticsChaikin Analytics, LLCОценок пока нет

- Stock Research Report For WLT As of 3/26/2012 - Chaikin Power ToolsДокумент4 страницыStock Research Report For WLT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Stock Research Report For GM As of 3/26/2012 - Chaikin Power ToolsДокумент4 страницыStock Research Report For GM As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Stock Research Report For ASNA As of 3/26/2012 - Chaikin Power ToolsДокумент4 страницыStock Research Report For ASNA As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Stock Research Report For MYL As of 3/26/2012 - Chaikin Power ToolsДокумент4 страницыStock Research Report For MYL As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Stock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsДокумент4 страницыStock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Stock Research Report For HNZ As of 2/29/12 - Chaikin Power ToolsДокумент4 страницыStock Research Report For HNZ As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Chaikin Power Gauge Report CSCO 29feb2012Документ4 страницыChaikin Power Gauge Report CSCO 29feb2012Chaikin Analytics, LLCОценок пока нет

- Stock Research Report For INTC As of 2/29/12 - Chaikin Power ToolsДокумент4 страницыStock Research Report For INTC As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Chaikin Power Gauge Report GMCR 29feb2012Документ4 страницыChaikin Power Gauge Report GMCR 29feb2012Chaikin Analytics, LLCОценок пока нет

- Chaikin Power Gauge Report GILD 29feb2012Документ4 страницыChaikin Power Gauge Report GILD 29feb2012Chaikin Analytics, LLCОценок пока нет

- Stock Research Report For WYNN As of 2/29/12 - Chaikin Power ToolsДокумент4 страницыStock Research Report For WYNN As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Chaikin Power Gauge Report CVS 29feb2012Документ4 страницыChaikin Power Gauge Report CVS 29feb2012Chaikin Analytics, LLCОценок пока нет

- Stock Research Report For Yamana Gold Inc TSN As of 11/17/11 - Chaikin Power ToolsДокумент4 страницыStock Research Report For Yamana Gold Inc TSN As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Stock Research Report For Yamana Gold Inc URS As of 11/17/11 - Chaikin Power ToolsДокумент4 страницыStock Research Report For Yamana Gold Inc URS As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Stock Research Report For Yamana Gold Inc LEG As of 11/17/11 - Chaikin Power ToolsДокумент4 страницыStock Research Report For Yamana Gold Inc LEG As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Stock Research Report For Yamana Gold Inc MMM As of 11/17/11 - Chaikin Power ToolsДокумент4 страницыStock Research Report For Yamana Gold Inc MMM As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Stock Research Report For Yamana Gold Inc ITW As of 11/17/11 - Chaikin Power ToolsДокумент4 страницыStock Research Report For Yamana Gold Inc ITW As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Stock Research Report For Yamana Gold Inc GAS As of 11/17/11 - Chaikin Power ToolsДокумент4 страницыStock Research Report For Yamana Gold Inc GAS As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Business Finance Week 1 and 2Документ56 страницBusiness Finance Week 1 and 2Jonathan De villaОценок пока нет

- Demand and Supply Trading Zones - The Best Method Forever !Документ11 страницDemand and Supply Trading Zones - The Best Method Forever !Shrikanth KundagolОценок пока нет

- Crescent Standard Modaraba: Managed by B.R.R. Investment (Private) LimitedДокумент10 страницCrescent Standard Modaraba: Managed by B.R.R. Investment (Private) Limiteds_kha100% (2)

- EurobondsДокумент217 страницEurobondslovergal1992Оценок пока нет

- Account CurrentДокумент13 страницAccount Currentfathima.comafug23Оценок пока нет

- Cost Goods Manufactured Schedule V13Документ12 страницCost Goods Manufactured Schedule V13Osman AffanОценок пока нет

- Tally Era Conti...Документ5 страницTally Era Conti...Olivia OwenОценок пока нет

- NISM XA - Investment Adviser 1 Short Notes PDFДокумент41 страницаNISM XA - Investment Adviser 1 Short Notes PDFSAMBIT SAHOO100% (1)

- Agency Theory AssignmentДокумент6 страницAgency Theory AssignmentProcurement PractitionersОценок пока нет

- Chapter 11Документ23 страницыChapter 11narasimha50% (6)

- Deposits Training DocumentДокумент29 страницDeposits Training DocumentKarthikaОценок пока нет

- Bengkalis MuriaДокумент10 страницBengkalis Muriareza hariansyahОценок пока нет

- Shareholders-Equity - Part 1Документ29 страницShareholders-Equity - Part 1cj bОценок пока нет

- RexДокумент17 страницRexErick KinotiОценок пока нет

- AE-MGT FlowchartДокумент9 страницAE-MGT FlowchartJean Thor Renzo MutucОценок пока нет

- Borrowing Powers of CompanyДокумент37 страницBorrowing Powers of CompanyRohan NambiarОценок пока нет

- The Investing EnlightenmentДокумент40 страницThe Investing Enlightenmentlongchempa100% (1)

- Options Futures and Other DerivativesДокумент9 страницOptions Futures and Other Derivativessmita prajapatiОценок пока нет

- Daftar Pustaka: GOKMARIA SIMARMATA, Supriyadi, M.SC., PH.D., CMA., CA., AkДокумент3 страницыDaftar Pustaka: GOKMARIA SIMARMATA, Supriyadi, M.SC., PH.D., CMA., CA., AkMuhammad WildanОценок пока нет

- Louw11 (Completing The Audit 1)Документ24 страницыLouw11 (Completing The Audit 1)ClaraОценок пока нет

- Solved International Paint Company Wants To Sell A Large Tract ofДокумент1 страницаSolved International Paint Company Wants To Sell A Large Tract ofAnbu jaromiaОценок пока нет

- 1 Basic Concepts Quiz-MergedДокумент50 страниц1 Basic Concepts Quiz-MergedsukeshОценок пока нет

- Bcom Sem Vi Business EconomicsДокумент36 страницBcom Sem Vi Business EconomicsRamesh BabuОценок пока нет

- Pakistan Stock Exchange (PSX)Документ13 страницPakistan Stock Exchange (PSX)NAQASH JAVED100% (2)

- NMC GOLD FINANCE LIMITED - Forensic Report 1Документ11 страницNMC GOLD FINANCE LIMITED - Forensic Report 1Anand KhotОценок пока нет

- CORPORATE LAW REVIEWER (Ladia)Документ12 страницCORPORATE LAW REVIEWER (Ladia)Neil Davis BulanОценок пока нет

- Past Lecture 5 8 Multiple Choice QuestionsДокумент9 страницPast Lecture 5 8 Multiple Choice QuestionsJohnson ZhengОценок пока нет

- Standard, The Conceptual Framework Overrides That StandardДокумент6 страницStandard, The Conceptual Framework Overrides That StandardwivadaОценок пока нет

- Mastering Financial Modelling File ListДокумент1 страницаMastering Financial Modelling File ListNamo Nishant M PatilОценок пока нет

- PWB VR VUer 6 NW SG2 CДокумент5 страницPWB VR VUer 6 NW SG2 CManeendra ManthinaОценок пока нет