Академический Документы

Профессиональный Документы

Культура Документы

Project

Загружено:

jagatbioИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Project

Загружено:

jagatbioАвторское право:

Доступные форматы

A PROJECT ON MERGER & AQUISITIONS :-

SUBMITTED TO DR . P.K. AGARWAL IILM CMS ,G. NOIDA

SUBMITTED BY JAGAT SINGH SHEKHAWAT PGDM/10-12/042

VALUATION OF SHARES : Valuation of shares in an amalgamation or takeover is made on a consideration of number of relevant factors such as: stock exchange prices of the shares of the two companies, the dividend paid on the shares, relevant growth prospects of the companies, values of the net assets etc. Even factors which are not evident from the face of the balance sheet like quality and integrity of the management,

present and prospective competition, market sentiments etc. are also required to be considered. Valuing a business also requires the determination of its future earnings potential, the risk inherent in those future earnings, etc.

METHODOLOGY OF VALUATION OF SHARES : -

1. Historical (Traditional) based Methodologies :

a. Profit Earning Capacity Value Method / Yield Method

b. Net Asset Value Method

c. Return on Investment Method or Valuation based on Earnings Method

d. Price Earning Ratio Method

e. Market Price Method / Open Market Valuation Method a. net asset value method : NAV method is based on the simple assumption that adding the value of all assets of the company and subtracting the liabilities, leaving a net asset

valuation can best determine the value of a business. NAV of a going concern is calculated with reference to the book value of the assets and liabilities, as at the date of proposed transfer. This is generally done on the basis of audited financial accounts of the year immediately preceding the date of the proposed transfer. The drawback in adopting net asset value method is that this method is generally considered appropriate in a case where we desire to wind up the business and realize the surplus assets or alternatively where the main strength of the business is its asset backing rather than its capacity or potential to earn profits.

b. Profit earning capacity value method : This method considers the earning potential of the business as a measure of its value. The estimation of earning potential is generally

made having regard to the trend of earning in recent years as well as in future with suitable adjustments for extra ordinary elements.

Drawback: The underlying assumption that the past performance will be repeated in the future, which, in a dynamic scenario of growth/inflation/recession, may not hold true.

C . RETURN ON INVETMENT METHOD :. The purpose of valuation based on earnings is to determine the annuity available to the buyer for his outlay which he would expect to be commensurate with the price paid. In this method from the last earning declared, items such as tax, preference dividend, if any, are deducted and net earnings are calculated for the purpose of valuation.

D. PRICE EARNING RATIO METHOD : Under this method, valuation of shares is done on the basis of Price Earning ratio of companies. Price earning Ratio of a company can be calculated by dividing the current price of a share by its EPS. Thus, P/E = P/EPS Where, P Current Price EPS Earning per share P/E Price Earning Ratio E. Market Price Method : Under this method valuation of shares/business is done on the basis of market price of shares. The market price of shares takes into account all the factors affecting the share price and hence is a good measure of valuation. The average market price will be determined taking into account the stock market quotations in the preceding 3 years (after making

appropriate adjustments for bonus issues and dividend payouts) as under: a. The high and low of proceeding 2 years; and b. The high and low of each month in the preceding 12 months. Drawback The market value of shares at times does not reflect the true worth of a company as it may be reacting to the global price movements, peculiar issues affecting the local industry, the management attitude, sudden interest by the institutional investors and the like. 2. ECONOMICALLY BASED METHEDOLOGY : A. Discounted Cash Flow Method : The economic based discounted cash flow method is based on the premise that the value of a business is a direct function of its cash generating ability.

This method values a business by discounting its free cash flows for a pre-determined forecast period to the present at a discount factor. For this purpose, free cash flows means the cash available for distribution to the capital providers, after considering the reinvestment required to sustain the operations and growth of the business. This method captures all the elements of the value of a business compared to Net Asset value and Price Earning Capacity Value approaches, the discounted cash flow method comprehends the values after considering capital investments and other cash flows required to sustain these earnings. Drabacks : It may suffer from creditability and objectivity because projections can only be made based on estimates and assumptions. Hence, the genuity of this method will substantially depend on the quality of information availablity .

Conclusion / Combination of Methods / Fair Value of Share : Reliance on only one method of valuation can be misleading. Therefore, fair value of shares can be determined only by a good combination of the aforesaid two or more methods, by assigning appropriate weights. The weighted average of the aforesaid two or more methods is then considered as the fair value of share. IMPORTANT METHOD OF VALUATION : In general, Net Asset Value Method, Return on Investment Method and Market Value method are the important methods of valuation. In the last, it should be concluded with the fair value of Shares. In the case of an unlisted company : Net Asset Value Method, Profit Earning Capacity Value Method, Return on Investment Method and Discounted Cash Flow Method are the important methods of valuation. In the last, it should be concluded with the Fair Value of Shares.

In the case of a listed compan : Price Earning Ratio Method and Market Value Method are the important methods of valuation. In the last, it should be concluded with the Fair Value of Shares. Valuation on the basis of willing buyer-willing seller Concept : While as a general rule, the concept of willing buyer-Willing seller is not accepted for various reasons. However, the price agreed to between the parties can be accepted in the following two categories of cases: 1. Small Value Asset 2. Where the fair value is close to the agreed price . SMALL VALUE ASSET METHOD : If the total consideration involved does not exceed Rs. 5 lacs and the shares being transferred do not constitute more than 10% of the total equity

shareholding of the company, the transaction may be approved as if the price agreed to between the parties does not exceed: the ruling market price, if it is a listed company; the price as certified by the auditors of the company, if it is an unlisted company.

MERGER & ACQUISITIONS : Global M&A is one of the most happening and fundamental element of corporate strategy in today's world. Many companies around the world have merged with each other with a motive to expand their businesses and enhance revenue. In the span of few years there are many companies coming together for betterment across the globe. Recent mergers and acquisitions 2011 are Lipton Rosen & Katz in New York, Sullivan & Cromwell LLP in New York, Slaughter & May in London, Mallesons Stephen Jaques in Sydney, and Osler Hoskin & Harcourt LLP in Toronto. Even in India merger and acquisition has become a fashion today with a cut throat competition in the international market. There are domestic deals like Penta homes acquiring Agro Dutch Industries, ACC taking over Encore Cement and Addictive, Dalmia Cement acquiring Orissa Cement, Edelweiss Capital acquiring Anagram Capital. All these are recent merger and acquisition 2010 valued at about USD 2.16 billion.

RECENT MERGERS & ACQUISITION :

A) Tata Chemicals took over British salt based in UK with a deal of US $ 13 billion. This is one of the most successful recent mergers and acquisitions 2010 that made Tata even more powerful with a strong access to British Salt's facilities that are known to produce about 800,000 tons of pure white salt annually. B) Merger of Reliance Power and Reliance Natural Resources with a deal of US $11 billion is another biggest deal in the Indian industry. This merger between the two made it convenient and easy for the Reliance power to handle all its power projects as it now enjoys easy availability of natural gas. C) Airtel acquired Zain in Africa with an amount of US $ 10.7 billion to set new benchmarks in the telecom industry. Zain is known to be the third largest player in Africa and being acquired by Airtel it is deliberately increasing its base in the international market. D) ICICI Bank's acquisition of Bank of Rajasthan at aout Rs 3000 Crore is a greta move by ICICI to enhance its market share across the Indian boundaries especially in northern and western regions. E ) Fortis Healthcare acquired Hong Kong's Quality Healthcare Asia Ltd for around Rs 882 Crore and is now on move to acquire the largest dental service provider in Australia, the Dental Corp at about Rs 450 Crore.

CROSS BORDER MERGER & ACQUISITIONS

In a study conducted in 2000 by Lehman Brothers, it was found that, on average, large M&A deals cause the domestic currency of the target corporation to appreciate by 1% relative to the acquirer's local currency. The rise of globalization has exponentially increased the necessity for MAIC Trust accounts and securities clearing services for Like-Kind Exchanges for cross-border M&A. In 1997 alone, there were over 2333 cross-border transactions, worth a total of approximately $298 billion. Due to the complicated nature of cross-border M&A, the vast majority of crossborder actions have unsuccessful as companies seek to expand their global footprint and become more agile at creating high-performing businesses and cultures across national boundaries.[20][citation needed] Even mergers of companies with headquarters in the same country are can often be considered international in scale and require MAIC custodial services. For example, when Boeing acquired McDonnell Douglas, the two American companies had to integrate operations in dozens of countries around the world (1997). This is just as true for other apparently "single

country" mergers, such as the $29 billion dollar merger of Swiss drug makers Sandoz and Ciba-Geigy (now Novartis).

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Challan Format (Specialist)Документ1 страницаChallan Format (Specialist)hgfvhgОценок пока нет

- GFR FormsДокумент2 страницыGFR FormsSaurav GhoshОценок пока нет

- Consumer Price IndexДокумент20 страницConsumer Price IndexBritt John Ballentes0% (1)

- NISM-Series-VIII-Equity Derivatives Workbook (New Version September-2015)Документ162 страницыNISM-Series-VIII-Equity Derivatives Workbook (New Version September-2015)janardhanvn100% (3)

- Financial Management - PPT - 2011Документ183 страницыFinancial Management - PPT - 2011ashpika100% (1)

- Ultimate Reward Current Account GuideДокумент112 страницUltimate Reward Current Account GuideRyan BucuОценок пока нет

- Act1104midterm Exam Wit AnsДокумент9 страницAct1104midterm Exam Wit AnsDyen100% (1)

- Rural Finance and Micro FinanceДокумент32 страницыRural Finance and Micro FinanceThe Cultural CommitteeОценок пока нет

- UntitledДокумент6 страницUntitledB - Clores, Mark RyanОценок пока нет

- End of Season: Spring Summer 2021Документ29 страницEnd of Season: Spring Summer 2021Abdaud RasyidОценок пока нет

- KPMG Flash News Draft Guidelines For Core Investment CompaniesДокумент5 страницKPMG Flash News Draft Guidelines For Core Investment CompaniesmurthyeОценок пока нет

- Macroeconomics 2 ExamДокумент3 страницыMacroeconomics 2 ExamMWEBI OMBUI ERICK D193/15656/2018Оценок пока нет

- Honor Mobile Flyer 3419Документ2 страницыHonor Mobile Flyer 3419bilal asifОценок пока нет

- The Role of IPДокумент3 страницыThe Role of IPsamrat duttaОценок пока нет

- Statement of Cash FlowsДокумент13 страницStatement of Cash FlowsAldrin ZolinaОценок пока нет

- 2018 Working Capital Management: Test Code: R38 WCAM Q-BankДокумент6 страниц2018 Working Capital Management: Test Code: R38 WCAM Q-BankMarwa Abd-ElmeguidОценок пока нет

- Export Price List 2011-2012 SystemairДокумент312 страницExport Price List 2011-2012 SystemairCharly ColumbОценок пока нет

- Pennantpark Investment Corporation: PNNT - NasdaqДокумент8 страницPennantpark Investment Corporation: PNNT - NasdaqnicnicooОценок пока нет

- Chapter 2-GST Part B - Value of SupplyДокумент7 страницChapter 2-GST Part B - Value of SupplyPooja D AcharyaОценок пока нет

- Dividend Policy: by Group 5: Aayush Kumar Lewis Francis Jasneet Sai Venkat Ritika BhallaДокумент25 страницDividend Policy: by Group 5: Aayush Kumar Lewis Francis Jasneet Sai Venkat Ritika BhallaChristo SebastinОценок пока нет

- Sample MCQsДокумент6 страницSample MCQsRubal GargОценок пока нет

- Chapter 8: Cash and Bank Management Daily Procedures: ObjectivesДокумент26 страницChapter 8: Cash and Bank Management Daily Procedures: ObjectivesArturo GonzalezОценок пока нет

- New Signature Update FormДокумент3 страницыNew Signature Update FormKRIZMAL TRADING SOLUTIONS PVT LTDОценок пока нет

- Ticket Plus實名制購票流程 2023061301Документ14 страницTicket Plus實名制購票流程 2023061301daniel111478Оценок пока нет

- FCHN DisplayCheckRegisterДокумент3 страницыFCHN DisplayCheckRegisterSingh 10Оценок пока нет

- RatiosДокумент6 страницRatiosWindee CarriesОценок пока нет

- FIN 420 CASE STUDY Leverage RatioДокумент4 страницыFIN 420 CASE STUDY Leverage RatioNur AdibahОценок пока нет

- Pymnts Reinventing b2b Payments ReportДокумент27 страницPymnts Reinventing b2b Payments ReportTimmy O' CallaghanОценок пока нет

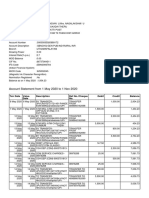

- Account Statement From 1 May 2020 To 1 Nov 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент9 страницAccount Statement From 1 May 2020 To 1 Nov 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceChellapandiОценок пока нет

- FINA1904 - ALL Weitzel - Spring 2019Документ11 страницFINA1904 - ALL Weitzel - Spring 2019JamesОценок пока нет