Академический Документы

Профессиональный Документы

Культура Документы

CRM in Insurance Sector

Загружено:

Karan Singh ParmarИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CRM in Insurance Sector

Загружено:

Karan Singh ParmarАвторское право:

Доступные форматы

CRM IN INSURANCE SECTOR INTRODUCTION Analytical CRM can be deployed to understand processing of claims in Insurance sector.

Deregulation of Insurance industry in the global has resulted in increased number of players in the market hence competition. In India also Industry has undergone a major change. Before 2000, two state insurers i.e. LIC and GIC were the only players in the market. These companies were created after the nationalization of the life and non-life sectors in 1956 and 1952 respectively. Eventually government took a decision to dismount the monopoly. One of the reasons may be that competition would promote better products, value & service to the customers. This will increase the overall size of the sector. There are about twenty new entrants and majority of them (about 12 or so) in life and about 6 in non-life sector. Initially life sector has attracted more participants than non-life sector. Eventually the prediction is there will be about 16 to 26 companies in life and about 8 to 12 in non life sector. In general performance of non life sector is more challenging than life sector. With deregulation of Insurance sector financial companies, banks are getting into non life insurance sector to their existing customer base. This requires non-life insurers to add value in the value chain. Analytical CRM can be used in the insurance industry for the following applications. - Acquiring new customers - Identifying cross selling/ upselling opportunities - Establishing the premium rates - Assisting the regulators to understand from Rate and Models.

The two cases given below address the issue of establishing the rates and identification of cross selling opportunities. Establishing the premium rates is an important aspect of insurance business. The goal is to set rates that reflect the risk level of the policy holder. The lower the risk, the lower the premium rate. Identification of cross selling/ upselling opportunities involves identification of those customers in the existing database whose likelihood of responding to a product which they do not hold presently is the highest. As an example consider a case where we have a customer database of about 100,000. out of the 1,00,000 customers, say about 10,000 are currently holding a specific product and the balance 90,000 are not holding the product. We are interested in identifying about 20,000 customers out of the 90,000, the criterion being their probability of responding to the promotion/ marketing campaign is the highest so that we do not waste time and energy on those whose likelihood of buying is not high. This will also help to develop a focused marketing campaign/strategy. The above concept can be illustrated diagrammatically as given below : Existing and Potential Customers Profile of those most likely to Purchase Profile of those most likely to remain loyal

Вам также может понравиться

- Shelf Life ControlДокумент7 страницShelf Life ControlRushikesh Deshpande100% (1)

- Components of A Rainwater Harvesting SystemДокумент38 страницComponents of A Rainwater Harvesting SystembudiperОценок пока нет

- Successful CRM - Turning Customer Loyalty Into Profitability (Réparé)Документ10 страницSuccessful CRM - Turning Customer Loyalty Into Profitability (Réparé)mojiОценок пока нет

- Relationship Marketing in Banking PDFДокумент10 страницRelationship Marketing in Banking PDFarvind3041990Оценок пока нет

- Service MGT 260214Документ182 страницыService MGT 260214Shubhanshu BishtОценок пока нет

- Competitors Moving Ever Faster, The Race Will Go To Those Who Listen and Respond More Intently". - Tom Peters, Thriving On ChaosДокумент80 страницCompetitors Moving Ever Faster, The Race Will Go To Those Who Listen and Respond More Intently". - Tom Peters, Thriving On ChaosMithun NambiarОценок пока нет

- Innovation in InsuranceДокумент63 страницыInnovation in InsuranceShaheen ShaikhОценок пока нет

- Raymond Lo - The Feng Shui of Swine FluДокумент1 страницаRaymond Lo - The Feng Shui of Swine Fluay2004jan100% (1)

- Relationship MarketingДокумент241 страницаRelationship MarketingNishant Kumar100% (1)

- National Step Tablet Vs Step Wedge Comparision FilmДокумент4 страницыNational Step Tablet Vs Step Wedge Comparision FilmManivannanMudhaliarОценок пока нет

- Internet Marketing Filetype:pdfДокумент11 страницInternet Marketing Filetype:pdfnobpasit soisayampooОценок пока нет

- Chapter 3 Marketing Mix of Life InsuranceДокумент19 страницChapter 3 Marketing Mix of Life Insurancerahulhaldankar0% (1)

- Customer Relationship Management in Insurance SectorДокумент22 страницыCustomer Relationship Management in Insurance SectorNandini Jagan100% (2)

- The Relationship Marketing Process A Conceptualization and Application PDFДокумент14 страницThe Relationship Marketing Process A Conceptualization and Application PDFkoreanguyОценок пока нет

- 29 - Relationship Marketing of ServicesДокумент10 страниц29 - Relationship Marketing of ServicesHelen Bala DoctorrОценок пока нет

- Biotecnologia de Células AnimaisДокумент396 страницBiotecnologia de Células AnimaisKayo Paiva100% (1)

- Financial Risk Management (Zain Ullah)Документ12 страницFinancial Risk Management (Zain Ullah)Afaq AhmadОценок пока нет

- IPO-ICICI Securities LTDДокумент13 страницIPO-ICICI Securities LTDprojectОценок пока нет

- Customer Relationship Management of Birla Sun LifeДокумент72 страницыCustomer Relationship Management of Birla Sun LifepraveenworlОценок пока нет

- CRM in InsuranceДокумент11 страницCRM in Insuranceanilperfect100% (1)

- CRM in InsuranceДокумент23 страницыCRM in InsuranceSriraj NairОценок пока нет

- Customer Relationship Management: Strategic Application of ItДокумент52 страницыCustomer Relationship Management: Strategic Application of ItShipra SrivastavaОценок пока нет

- Customer Relationship Management in Bank PDFДокумент5 страницCustomer Relationship Management in Bank PDFdemetrio vaccaОценок пока нет

- Marketing of Services Unit 4Документ120 страницMarketing of Services Unit 4Kay BarretoОценок пока нет

- CRM in InsuranceДокумент4 страницыCRM in InsuranceInternational Journal of Application or Innovation in Engineering & ManagementОценок пока нет

- Private Label Consumer Goods Towards Customer Loyalty - Case Study of (X) Private Label GoodsДокумент21 страницаPrivate Label Consumer Goods Towards Customer Loyalty - Case Study of (X) Private Label Goodsdindo_waeОценок пока нет

- Introduction To Customer Relationship ManagementДокумент45 страницIntroduction To Customer Relationship ManagementMohammad FarazОценок пока нет

- Building Customer RelationshipДокумент9 страницBuilding Customer RelationshipDon Mario100% (1)

- Customer Relationship Management - Honors ThesisДокумент31 страницаCustomer Relationship Management - Honors ThesisNaveen KandukuriОценок пока нет

- Icici Bank Case CRMДокумент28 страницIcici Bank Case CRMRohit SemlaniОценок пока нет

- Institutional Support For EntrepreneuresДокумент27 страницInstitutional Support For EntrepreneuresMahesh LingayathОценок пока нет

- CRM Reliance Mart and BigbazaarДокумент19 страницCRM Reliance Mart and BigbazaarAbhijeet DuttaОценок пока нет

- b2b Industrial Marketing NotesДокумент14 страницb2b Industrial Marketing NotesAnkita SthapakОценок пока нет

- Customer Relationship ManagementДокумент5 страницCustomer Relationship Managementbharathshire701Оценок пока нет

- CRM in Icici BankДокумент21 страницаCRM in Icici BankSudil Reddy100% (5)

- Literature Review CRMДокумент9 страницLiterature Review CRMArshdeep SiinghОценок пока нет

- CRM InsuranceДокумент39 страницCRM Insuranceprjivi100% (1)

- Customer Relationship ManagementДокумент17 страницCustomer Relationship Managementdeepak balokhraОценок пока нет

- Literature Review of E-CrmДокумент10 страницLiterature Review of E-Crmanil24reddyОценок пока нет

- Differences Between B2B and B2C Customer Relationship Management. Findings From The Czech Republic1Документ6 страницDifferences Between B2B and B2C Customer Relationship Management. Findings From The Czech Republic1Phá LấuОценок пока нет

- An Introduction To CRMДокумент48 страницAn Introduction To CRMDora Nasike100% (2)

- Chapter # 1. Introduction To CRM: Customer Relationship ManagementДокумент88 страницChapter # 1. Introduction To CRM: Customer Relationship Managementtu5h7rОценок пока нет

- An Overview of Customer Relationship ManagementДокумент4 страницыAn Overview of Customer Relationship Managementpashish77Оценок пока нет

- Assignment BancassuranceДокумент10 страницAssignment BancassuranceGetrude Mvududu100% (4)

- Role of Customer Relationship Management in UK Banking IndustryДокумент15 страницRole of Customer Relationship Management in UK Banking IndustryNaushay MianОценок пока нет

- Customer Centric SellingДокумент33 страницыCustomer Centric Sellinghemang.shroffОценок пока нет

- Customer Relationship ManagementДокумент12 страницCustomer Relationship ManagementFerdows Abid Chowdhury100% (1)

- Services Marketing: Distributing Services Through Physical and Electronic ChannelsДокумент35 страницServices Marketing: Distributing Services Through Physical and Electronic ChannelsHusnain NaveedОценок пока нет

- A Study On Online Retailing Challenges and Oppotunitis at Nettyfish Networks PVT.,LTDДокумент6 страницA Study On Online Retailing Challenges and Oppotunitis at Nettyfish Networks PVT.,LTDIshwaryaОценок пока нет

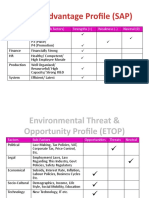

- Strategic Advantage Profile (SAP) : Factors Strategic (Sub Factors) Strengths (+) Weakness (-) NeutralДокумент3 страницыStrategic Advantage Profile (SAP) : Factors Strategic (Sub Factors) Strengths (+) Weakness (-) NeutralVivek AgarwalОценок пока нет

- A Study On Customer Perception On Organized Retail Stores in Tiruchirappalli TownДокумент11 страницA Study On Customer Perception On Organized Retail Stores in Tiruchirappalli TownIAEME PublicationОценок пока нет

- CRM in BajajДокумент81 страницаCRM in BajajDivyanshu JainОценок пока нет

- CRM Unit 1 Notes Introduction To CRMДокумент16 страницCRM Unit 1 Notes Introduction To CRMKeerthi Priya100% (1)

- Cable Sector Case StudyДокумент6 страницCable Sector Case StudySandeep PimpaleОценок пока нет

- Customer Relationship Management As A Strategic Tool - Richa Raghuvanshi, Rashmi - MKT024Документ21 страницаCustomer Relationship Management As A Strategic Tool - Richa Raghuvanshi, Rashmi - MKT024Pratyush TripathiОценок пока нет

- Retail Question Bank Mid TermДокумент2 страницыRetail Question Bank Mid TermAbhishek Shekhar100% (1)

- Digital Marketing Concepts and AspectsДокумент7 страницDigital Marketing Concepts and AspectsMihaela StefanОценок пока нет

- B2CДокумент27 страницB2CziabuttОценок пока нет

- A Study On Customer Satisfaction in Retail Banking of IndiaДокумент18 страницA Study On Customer Satisfaction in Retail Banking of IndiaRAJINDER_kaur25Оценок пока нет

- Grocery Store Marketing PlanДокумент5 страницGrocery Store Marketing PlanMylene BautistaОценок пока нет

- "A Project Report" On "ORGANISATION STUDY Carried Out At: Submitted To-Karthik T.L (HR)Документ12 страниц"A Project Report" On "ORGANISATION STUDY Carried Out At: Submitted To-Karthik T.L (HR)Karthik Bhat100% (1)

- Customer Relationship Management in Banking Sector-A Case Study of PNBДокумент27 страницCustomer Relationship Management in Banking Sector-A Case Study of PNBmanicoolgal4uОценок пока нет

- Insurance Industry Current Trends and DirectionsДокумент10 страницInsurance Industry Current Trends and DirectionsCheong Yook HarОценок пока нет

- Business Intelligence and InsuranceДокумент15 страницBusiness Intelligence and InsuranceNeelam_Mohanty4214Оценок пока нет

- The Role of Data Analytics in Insurance SectorДокумент4 страницыThe Role of Data Analytics in Insurance SectorIIM Indore Management Canvas100% (2)

- Critique PaperДокумент1 страницаCritique PapernicolealerОценок пока нет

- Breastfeeding PlanДокумент7 страницBreastfeeding Planapi-223713414Оценок пока нет

- 2006 SM600Документ2 страницы2006 SM600Ioryogi KunОценок пока нет

- 8291 w13 Ms 22Документ8 страниц8291 w13 Ms 22Caterina De LucaОценок пока нет

- Corporate Security Policy TemplateДокумент4 страницыCorporate Security Policy TemplateCoronaОценок пока нет

- Banco de Oro (Bdo) : Corporate ProfileДокумент1 страницаBanco de Oro (Bdo) : Corporate ProfileGwen CaldonaОценок пока нет

- Job Vacancy Kabil - Batam April 2017 RECARE PDFДокумент2 страницыJob Vacancy Kabil - Batam April 2017 RECARE PDFIlham AdeОценок пока нет

- Corp Given To HemaДокумент132 страницыCorp Given To HemaPaceОценок пока нет

- 13 ECCMinorAmendReqДокумент2 страницы13 ECCMinorAmendReqal bentulanОценок пока нет

- Heating Ventilation Air Conditioning Hvac ManualДокумент4 страницыHeating Ventilation Air Conditioning Hvac ManualShabaz KhanОценок пока нет

- Matriculation Chemistry Amino Acids-Part-1Документ24 страницыMatriculation Chemistry Amino Acids-Part-1iki292Оценок пока нет

- of Biology On Introductory BioinformaticsДокумент13 страницof Biology On Introductory BioinformaticsUttkarsh SharmaОценок пока нет

- Battle Healing PrayerДокумент9 страницBattle Healing PrayerSolavei LoanerОценок пока нет

- Profometer 5brochureДокумент2 страницыProfometer 5brochureLKBB Fakultas TeknikОценок пока нет

- Perdev - Module 9Документ9 страницPerdev - Module 9April Rose CortesОценок пока нет

- ChartДокумент27 страницChartFlorijan ŠafarОценок пока нет

- Topic 10 - The Schooler and The FamilyДокумент18 страницTopic 10 - The Schooler and The FamilyReanne Mae AbreraОценок пока нет

- UAW-FCA Hourly Contract SummaryДокумент20 страницUAW-FCA Hourly Contract SummaryClickon DetroitОценок пока нет

- Indian MaДокумент1 страницаIndian MaAnass LyamaniОценок пока нет

- Wetted Wall Gas AbsorptionДокумент9 страницWetted Wall Gas AbsorptionSiraj AL sharifОценок пока нет

- Extubation After Difficult IntubationДокумент3 страницыExtubation After Difficult Intubationramanrajesh83Оценок пока нет

- SM Electrical Guidelines: General Notes:: Site HereДокумент1 страницаSM Electrical Guidelines: General Notes:: Site HereNathaniel DreuОценок пока нет

- Polymer ProДокумент25 страницPolymer ProJeerisuda KingklangОценок пока нет

- TinyEYE Online Speech Therapy Media GuideДокумент4 страницыTinyEYE Online Speech Therapy Media GuideTinyEYE Therapy ServicesОценок пока нет