Академический Документы

Профессиональный Документы

Культура Документы

Chapter 16 Quiz

Загружено:

beckkl05Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chapter 16 Quiz

Загружено:

beckkl05Авторское право:

Доступные форматы

Name ____________________________

AC 211 Intermediate Accounting II Chapter 16 Quiz 15 points

Select the best answer for each of the matching questions by placing the appropriate letter in the space provided. Select the best answer for each of the multiple choice questions by circling the appropriate letter. Matching questions are worth 1 point each, multiple choice questions 1-4 are worth 1 point each, and multiple choice questions 5-7 are worth 2 points each. Show all work on problems as partial credit may be given. MATCHING Listed below are five independent situations. For each situation indicate (by letter) whether it will create, (A) a deferred tax asset, (L) a deferred tax liability, or (N) neither. 1. 2. 3. 4. 5. ____ ____ ____ ____ ____ An operating loss carryback. Bad debt expense under the allowance method in the income statement, but only allowable under the direct write-off method for taxes. Interest earned on investments in state and local government bonds. Current year contributions not currently deductible due to tax limitations but which can be carried forward to future tax years. Prepaid expenses, tax deductible when paid.

MULTIPLE CHOICE 1. At the end of the current year, Newsmax Inc. has $400,000 of subscriptions received in advance included in its balance sheet. A footnote reveals that the entire $400,000 will be earned in next year. In the absence of other temporary differences, in the balance sheet one would also expect to find a: A) B) C) D) Noncurrent deferred tax liability. Noncurrent deferred tax asset. Current deferred tax liability. Current deferred tax asset.

2.

If a company's deferred tax asset is not reduced by a valuation allowance, the company believes it is more likely than not that: A) B) C) D) Sufficient financial income will be generated in future years to realize the full tax benefit. Sufficient financial and taxable income will exist in future years to realize the full tax benefit. Sufficient taxable income will be generated in future years to realize the full tax benefit. Tax rates will not change in future years.

3.

Under SFAS 109 when there is a net operating loss carryforward: A) B) C) D) A deferred tax liability is recognized. A receivable is created. A deferred tax equity account is created. A deferred tax asset is recorded along with any applicable valuation allowance.

4.

A magazine publisher collects one year in advance for subscription revenue. In the year of providing the magazines, the company would record: A) B) C) D) An increase in a deferred tax asset. A decrease in a deferred tax asset. An increase in a deferred tax liability. A decrease in a deferred tax liability.

5.

For the current year ($ in millions), Centipede Corp. had $80 in pretax accounting income. This included bad debt expense of $6 based on the allowance method, and $20 in depreciation expense. Two million in receivables were written off as uncollectible, and MACRS depreciation amounted to $35. In the absence of other temporary or permanent differences, what was Centipede's income tax payable currently, assuming a tax rate of 40%? A) B) C) D) 19.6 million. 25.2 million. 27.6 million. 29.2 million.

6.

Alamo Inc. had $300 million in taxable income for the current year. Trace also had a decrease in deferred tax assets of $30 million and an increase in deferred tax liabilities of $60 million. The company is subject to a tax rate of 40%. The total income tax expense for the year was: A) B) C) D) $390 million. $210 million. $150 million. $30 million.

7.

Theodore Enterprises had the following pretax income (loss) over its first three years of operations: 2004 2005 2006 $500,000 (900,000) 1,500,000

For each year there were no deferred income taxes and the tax rate was 30%. In its 2005 tax return, Theodore elected a loss carryback. No valuation account was deemed necessary for the deferred tax asset as of December 31, 2005. What was Theodore's income tax expense in the year 2006? A) B) C) D) $450,000. $330,000. $270,000. $180,000.

Вам также может понравиться

- US Tax Refund MethodДокумент4 страницыUS Tax Refund MethodGonza Fred100% (5)

- Taxation 1 Notes PDFДокумент16 страницTaxation 1 Notes PDFJENNY BUTACAN100% (1)

- Managerial Economics ExercisesДокумент6 страницManagerial Economics ExercisesZia NuestroОценок пока нет

- (Contributions in Military History, 26) Hans Delbrück - History of The Art of War - Within The Framework of Political History. Vol. 3. The Middle Ages. 3-Greenwood Press (1982)Документ718 страниц(Contributions in Military History, 26) Hans Delbrück - History of The Art of War - Within The Framework of Political History. Vol. 3. The Middle Ages. 3-Greenwood Press (1982)AdrianOchoyanОценок пока нет

- SM Chapter 13Документ52 страницыSM Chapter 13Fedro Susantana0% (1)

- 1 ULO 1 To 3 Week 1 To 3 SHE Activities (AK)Документ10 страниц1 ULO 1 To 3 Week 1 To 3 SHE Activities (AK)Margaux Phoenix KimilatОценок пока нет

- CH 10Документ84 страницыCH 10Michael Fine100% (2)

- Problem I PDFДокумент20 страницProblem I PDFsino akoОценок пока нет

- Improperly Accumulated Earnings TaxДокумент7 страницImproperly Accumulated Earnings Taxmonica giduquioОценок пока нет

- Cert TitleДокумент2 страницыCert TitleDavid Valenzuela MendozaОценок пока нет

- Hoegh and PGNДокумент273 страницыHoegh and PGNSudОценок пока нет

- Accounting Information System ReviewerДокумент17 страницAccounting Information System ReviewerAcain RolienОценок пока нет

- FARAP-4516Документ10 страницFARAP-4516Accounting StuffОценок пока нет

- Chapter 8 SolucionesДокумент6 страницChapter 8 SolucionesIvetteFabRuizОценок пока нет

- Chap 017Документ33 страницыChap 017Anthony MaloneОценок пока нет

- Ia Shareholder's Equity Practice ProblemsДокумент5 страницIa Shareholder's Equity Practice ProblemsMary Jescho Vidal AmpilОценок пока нет

- Quiz Week 8 Akm 2Документ6 страницQuiz Week 8 Akm 2Tiara Eva TresnaОценок пока нет

- Ia2 Prob 1-32 & 33Документ1 страницаIa2 Prob 1-32 & 33maryaniОценок пока нет

- ReceivablesДокумент4 страницыReceivablesKentaro Panergo NumasawaОценок пока нет

- Walt Disney PaperДокумент15 страницWalt Disney PaperJerauld BucolОценок пока нет

- Lesson 4 Expenditure Cycle PDFДокумент19 страницLesson 4 Expenditure Cycle PDFJoshua JunsayОценок пока нет

- Investment in Associate Summary - A Project of Barters PHДокумент5 страницInvestment in Associate Summary - A Project of Barters PHEvita Faith LeongОценок пока нет

- Non Current Asset Held For SaleДокумент27 страницNon Current Asset Held For SaleAbdulmajed Unda MimbantasОценок пока нет

- Bsat 2019Документ23 страницыBsat 2019rowena adobasОценок пока нет

- FINMAN Answer KeyДокумент7 страницFINMAN Answer KeyReginald ValenciaОценок пока нет

- Chapter 5Документ11 страницChapter 5Ro-Anne LozadaОценок пока нет

- Chapter 4 InventoriesДокумент29 страницChapter 4 InventoriesTzietel Ann FloresОценок пока нет

- 6726 Revised Conceptual FrameworkДокумент7 страниц6726 Revised Conceptual FrameworkJane ValenciaОценок пока нет

- Chapter 8Документ4 страницыChapter 8Coursehero PremiumОценок пока нет

- Pas 24Документ7 страницPas 24angelo vasquezОценок пока нет

- 4A8 FormationДокумент5 страниц4A8 FormationCarl Dhaniel Garcia SalenОценок пока нет

- 05 - CAPITAL STRUCTURE AND LEVERAGE - PROBLEMS With AnswersДокумент6 страниц05 - CAPITAL STRUCTURE AND LEVERAGE - PROBLEMS With AnswersMerr Fe PainaganОценок пока нет

- Lecture Note - Receivables Sy 2014-2015Документ10 страницLecture Note - Receivables Sy 2014-2015LeneОценок пока нет

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Документ6 страницPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)verycooling100% (1)

- Stock Dividend: Date of PaymentДокумент6 страницStock Dividend: Date of PaymentmercyvienhoОценок пока нет

- Kunci Jawaban Intermediate AccountingДокумент41 страницаKunci Jawaban Intermediate AccountingbelindaОценок пока нет

- 3-Cash and Cash Equiv ExercisesДокумент8 страниц3-Cash and Cash Equiv ExercisesAngelica CastilloОценок пока нет

- Chapter 4Документ20 страницChapter 4Oskard MacoОценок пока нет

- Assignment 1 - Discontinued Operation Test 10 ItemsДокумент4 страницыAssignment 1 - Discontinued Operation Test 10 ItemsJeane Mae BooОценок пока нет

- CorporateДокумент28 страницCorporateRalkan KantonОценок пока нет

- Basics of Commercial Banking: SecuritiesДокумент9 страницBasics of Commercial Banking: SecuritiesLeo Sandy Ambe CuisОценок пока нет

- Partnershipsjoint Venture CoownershipДокумент4 страницыPartnershipsjoint Venture CoownershipJane TuazonОценок пока нет

- Chapter 1 - Statement of Financial Position 1Документ22 страницыChapter 1 - Statement of Financial Position 1Frost GarisonОценок пока нет

- Chapter 34Документ17 страницChapter 34Mike SerafinoОценок пока нет

- Lyceum-Northwestern University: L-NU AA-23-02-01-18Документ8 страницLyceum-Northwestern University: L-NU AA-23-02-01-18Amie Jane MirandaОценок пока нет

- AgricultureДокумент2 страницыAgricultureAramina Cabigting BocОценок пока нет

- Translation of Foreign FSДокумент7 страницTranslation of Foreign FSLloyd SonicaОценок пока нет

- Success Today Is No Guarantee of Success Tomorrow!Документ8 страницSuccess Today Is No Guarantee of Success Tomorrow!Ammad MaqboolОценок пока нет

- Chap 005Документ97 страницChap 005Ahmed El KhateebОценок пока нет

- Earnings Per ShareДокумент3 страницыEarnings Per ShareYeshua DeluxiusОценок пока нет

- FIN 2 Financial Analysis and Reporting: Lyceum-Northwestern UniversityДокумент7 страницFIN 2 Financial Analysis and Reporting: Lyceum-Northwestern UniversityAmie Jane MirandaОценок пока нет

- 3 Multiple Choice QuestionsДокумент8 страниц3 Multiple Choice QuestionsMohib Ullah YousafzaiОценок пока нет

- Prelim Quiz 2Документ11 страницPrelim Quiz 2Sevastian jedd EdicОценок пока нет

- Assignment 9 1Документ2 страницыAssignment 9 1mia uyОценок пока нет

- Cengage Eco Dev Chapter 13 - The Environment and Sustainable Development in AsiaДокумент32 страницыCengage Eco Dev Chapter 13 - The Environment and Sustainable Development in AsiaArcy LeeОценок пока нет

- Intermediate Accounting Practice QuestionsДокумент4 страницыIntermediate Accounting Practice QuestionsYsa Acupan100% (1)

- Pressures For Global IntegrationДокумент16 страницPressures For Global IntegrationMahpuja JulangОценок пока нет

- Chapter 3 - TheoriesДокумент10 страницChapter 3 - TheoriesXynith Nicole RamosОценок пока нет

- Investment in Equity Securities Intacc1Документ3 страницыInvestment in Equity Securities Intacc1GIRLОценок пока нет

- Chapter 33 - Financial Asset at Amortized Cost (Fair Value Option)Документ1 страницаChapter 33 - Financial Asset at Amortized Cost (Fair Value Option)Ianna ManieboОценок пока нет

- UCU Audit ProblemsДокумент9 страницUCU Audit ProblemsTCC FreezeОценок пока нет

- 06Документ61 страница06Ahmed El Khateeb100% (1)

- Answer: PH P 1,240: SolutionДокумент18 страницAnswer: PH P 1,240: SolutionadssdasdsadОценок пока нет

- Ias 2Документ4 страницыIas 2mnhammadОценок пока нет

- Group Work #1 With SolutionsДокумент3 страницыGroup Work #1 With SolutionsShadi MorakabatiОценок пока нет

- Assignment On Status and Self-Regulation of Gaming: Exercise 1Документ5 страницAssignment On Status and Self-Regulation of Gaming: Exercise 1somadatta bandyopadhyayОценок пока нет

- Transpo Cases #1Документ28 страницTranspo Cases #1Diane UyОценок пока нет

- BUILDSKILL Refrigerator, Washing Machine, Water Cooler, Air Cooler TrolleyДокумент1 страницаBUILDSKILL Refrigerator, Washing Machine, Water Cooler, Air Cooler Trolleysanat santraОценок пока нет

- PT Karya Mandiri SejahteraДокумент4 страницыPT Karya Mandiri SejahteraImroatul MufidaОценок пока нет

- Tax Mates - 9. Exemption of Non-Stock, Non-Profit Educational Institutions 160059 PDFДокумент2 страницыTax Mates - 9. Exemption of Non-Stock, Non-Profit Educational Institutions 160059 PDFSandyОценок пока нет

- Income From BusinessДокумент14 страницIncome From BusinessPreeti ShresthaОценок пока нет

- Analisis Laporan Keuangan Gajah TunggalДокумент4 страницыAnalisis Laporan Keuangan Gajah TunggalBramastho PutroОценок пока нет

- Realizing The American DreamДокумент27 страницRealizing The American DreamcitizenschoolsОценок пока нет

- Assessment of Agricultural IncomeДокумент3 страницыAssessment of Agricultural IncomeVikram VermaОценок пока нет

- Ericson Telecommunications, Inc., Vs City of PasigДокумент2 страницыEricson Telecommunications, Inc., Vs City of Pasigamsula_1990Оценок пока нет

- m20 ATX MYS QPДокумент13 страницm20 ATX MYS QPizzahderhamОценок пока нет

- Practice Questions - RevisionДокумент8 страницPractice Questions - RevisionGbamara RichardОценок пока нет

- Kamna BuildtehДокумент59 страницKamna BuildtehMakardhwaj MishraОценок пока нет

- SC746Документ1 страницаSC746Indîan NetizenОценок пока нет

- China Bank v. OrtegaДокумент7 страницChina Bank v. OrtegaChristiaan CastilloОценок пока нет

- OJT Scope of WorkДокумент4 страницыOJT Scope of WorkSheena Marie OuanoОценок пока нет

- Exports Under GSTДокумент5 страницExports Under GSTphani raja kumarОценок пока нет

- CeMAP-1 EXAM CДокумент18 страницCeMAP-1 EXAM CfmpallabОценок пока нет

- A Recession Is When Your Neighbour Loses His Job. A Depression Is When You Lose Your JobДокумент83 страницыA Recession Is When Your Neighbour Loses His Job. A Depression Is When You Lose Your JobAppurva SharmaОценок пока нет

- Absolutism Intro ComboДокумент4 страницыAbsolutism Intro Comboapi-262588001Оценок пока нет

- Descriptive Guidelines On Flexi Pay ComponentsДокумент5 страницDescriptive Guidelines On Flexi Pay Componentsshannbaby22Оценок пока нет

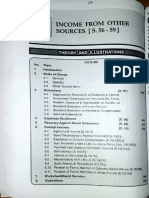

- Income From Other Sources (FA Module)Документ22 страницыIncome From Other Sources (FA Module)kalyaniraghuwashiОценок пока нет

- 17 5402ezbkДокумент64 страницы17 5402ezbkPhylicia MorrisОценок пока нет

- Konstitusi ArgentinaДокумент23 страницыKonstitusi ArgentinaDon JovianoОценок пока нет