Академический Документы

Профессиональный Документы

Культура Документы

Retention of Title and Consignment Agreements - A Brave New World

Загружено:

api-140871676Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Retention of Title and Consignment Agreements - A Brave New World

Загружено:

api-140871676Авторское право:

Доступные форматы

Retention of Title and Consignment Agreements A Brave New World

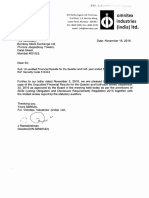

The Personal Property Securities Act, (PPSA) came into th effect on the 30 January 2012. For business, this creates a brave new world which fundamentally changes the law in respect of the securitization of personal property. In this article we look at two key areas for small to medium business which the legislation affects, Retention of Title and Consignment Agreements. It is no longer effective just to have title remains with the supplier until payment is made on your invoices and consignment agreements and expect to be able to collect your goods if your customers do not pay. Registration of your supply agreements rather than ownership is now the key if you wish to maximise your prospects of retrieving your goods from delinquent customers. In the Past: Legal ownership was the key principle. In general, providing you could prove legal ownership until payment was made, and your customers were aware of this, you were able to collect your goods from your customer, administrator or liquidator if you were not paid for the goods. Now: Your ability to collect your goods if they are not paid for will be at risk if you have not registered your supply agreement on the Personal Property Securities Register, (PPSR).The PPSR is a national register replacing the state based registers, (e.g. Vehicle Security Register, Stock and Crop Lien register) as well as the ASIC Register of Company Charges. Registration is completed online at www.ppsr.gov.au. By registering your agreements, you have a security interest in the goods you have supplied and improve your prospects of being able to collect your goods from delinquent Customers and or administrators and Liquidators. The Consequences: The dire consequences of non registration become apparent if your customer goes into administration or liquidation. In these circumstances you will be ranked alongside other unsecured creditors, which may allow other creditors who have registered a security interest over your customers assets to be compensated through the sale of your goods before you receive any payment. What should you do? Have a good look at whom you supply, on what terms you supply to them and ask yourself the following questions: Are my terms of trade with my customers up to date? What is the value of the goods supplied to them? What is the risk to my business if my customers do not pay? What is the risk to my business if I can not get back my stock? If your documentation is out of date and the risk to your business is high, you should update your agreements and register them on the PPSR. Depending on your circumstances, it may also be appropriate to seek specialised accounting or legal advice. For further information contact:

Adrian Belperio Business Advisory Services Tel: +61 8 8373 1266

This is not advice. Clients should not act solely on the basis of the material contained in this Bulletin. Items herein are general comments only and do not constitute or convey advice perse. Also changes in legislation may occur quickly. We therefore recommend that our formal advice be sought before acting in any of the areas. The Bulletin is issued as a helpful guide to clients and for their private information. Therefore it should be regarded as confidential and not be made available to any person without our prior approval. Newsletter written by (author name(s) of (Bentleys firm name). A member of Bentleys, an association of independent accounting firms in Australia. The member firms of the Bentleys association are affiliated only and not in partnership.

Вам также может понравиться

- Credit Restore Secrets They Never Wanted You to KnowОт EverandCredit Restore Secrets They Never Wanted You to KnowРейтинг: 4 из 5 звезд4/5 (3)

- IRL Information SheetДокумент1 страницаIRL Information SheetMaria SoleilОценок пока нет

- Bond - Standard Client AgreementДокумент4 страницыBond - Standard Client AgreementEnos PhillipsОценок пока нет

- Common Law Vs Statutory TrustsДокумент2 страницыCommon Law Vs Statutory TrustsrmaqОценок пока нет

- Heldlawyersnewslettermay 2012Документ2 страницыHeldlawyersnewslettermay 2012api-284203178Оценок пока нет

- 7 Legal Aspects of Running A BusinessДокумент5 страниц7 Legal Aspects of Running A BusinessmomowasediОценок пока нет

- Pepa Project FinalДокумент25 страницPepa Project FinalSoundharya SomarajuОценок пока нет

- Why Secured PartyДокумент8 страницWhy Secured PartyKas4ever89% (9)

- Protect Assets From CreditorsДокумент7 страницProtect Assets From Creditorsjudgmentprooftv100% (4)

- CEO GUIDE To Creditor Protection-CA-mag2Документ4 страницыCEO GUIDE To Creditor Protection-CA-mag2NewhouseCounselОценок пока нет

- PPSAДокумент2 страницыPPSAreception2999Оценок пока нет

- Lender (Sgs Finance, Inc.) Privacy Policy: Facts Why?Документ28 страницLender (Sgs Finance, Inc.) Privacy Policy: Facts Why?bootybethathangОценок пока нет

- 8 Legal Steps For Starting Your BusinessДокумент11 страниц8 Legal Steps For Starting Your BusinessRayzel Ann Balbalosa PutuLinОценок пока нет

- General Banking Conditions - 20170301 - Final - tcm18-41694Документ20 страницGeneral Banking Conditions - 20170301 - Final - tcm18-41694the_uniqueОценок пока нет

- A Handbook For Consumer AdvisersДокумент24 страницыA Handbook For Consumer AdvisersUZNAPMОценок пока нет

- Facts: Reasons We Can Share Your Personal Information Does NBKC Bank Share? Can You Limit This Sharing?Документ3 страницыFacts: Reasons We Can Share Your Personal Information Does NBKC Bank Share? Can You Limit This Sharing?DmitryОценок пока нет

- Commercial Insurance Template PackageДокумент6 страницCommercial Insurance Template PackageCanadian Society for the Advancement of Science in Public Policy100% (1)

- Anne Harrington: 5111 S 12TH ST Apt 2 TACOMA, WA 98465Документ38 страницAnne Harrington: 5111 S 12TH ST Apt 2 TACOMA, WA 98465Anne HarringtonОценок пока нет

- 5fc86f76b40dee91d975a774 - Entity Engagement LetterДокумент9 страниц5fc86f76b40dee91d975a774 - Entity Engagement Letterwan hoe TingОценок пока нет

- Commercial - Small BusinessДокумент5 страницCommercial - Small BusinessRamiza BeeОценок пока нет

- April 2014 EbriefДокумент6 страницApril 2014 EbriefkyliemkaОценок пока нет

- So Ya Think You Know CREDITДокумент16 страницSo Ya Think You Know CREDITgabby maca100% (8)

- Faqs Regarding SFM Offshore Company FormationДокумент10 страницFaqs Regarding SFM Offshore Company FormationInition TechnologyОценок пока нет

- Project CДокумент5 страницProject CKort JenselОценок пока нет

- Credit ControlДокумент7 страницCredit ControlFaina NaqviОценок пока нет

- CAR FSG v8.9 - PPMДокумент8 страницCAR FSG v8.9 - PPMdfsdjgflksjgnawОценок пока нет

- Sole TradersДокумент7 страницSole TradersAnu Benjamin anuОценок пока нет

- Learning The LegaleseДокумент30 страницLearning The LegaleseapachedaltonОценок пока нет

- Business Law: Basics of Law TAV18NVNL GRДокумент26 страницBusiness Law: Basics of Law TAV18NVNL GREisvina JonušytėОценок пока нет

- Irrevocable TrustДокумент6 страницIrrevocable Trustunapanther100% (6)

- Topic 1: Opening and Managing A Legal FirmДокумент26 страницTopic 1: Opening and Managing A Legal FirmYi YingОценок пока нет

- ATO Top 500 GST Assurance ProgramДокумент206 страницATO Top 500 GST Assurance Program8nkwv7q272Оценок пока нет

- Start Your Own HOME-BASED BUSINESS: Choose From 25 Great BUSINESS PLANSОт EverandStart Your Own HOME-BASED BUSINESS: Choose From 25 Great BUSINESS PLANSОценок пока нет

- How to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessОт EverandHow to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessОценок пока нет

- Mortgages Important Information NW 13Документ4 страницыMortgages Important Information NW 13plendina50Оценок пока нет

- Sole TradersДокумент4 страницыSole TradersZain Ul AbideenОценок пока нет

- 1-Business StructureДокумент9 страниц1-Business StructureGen AbulkhairОценок пока нет

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessОт EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessРейтинг: 5 из 5 звезд5/5 (1)

- Regulatory Information and General DisclosuresДокумент5 страницRegulatory Information and General Disclosureskagiyir157Оценок пока нет

- 46 Consumer Reporting Agencies Investigating YouОт Everand46 Consumer Reporting Agencies Investigating YouРейтинг: 4.5 из 5 звезд4.5/5 (6)

- Jargon Buster Fact SheetДокумент9 страницJargon Buster Fact Sheettedi wediОценок пока нет

- Environmental RegulationsДокумент33 страницыEnvironmental RegulationsNarinder AhujaОценок пока нет

- Cashflow Guides ACCAДокумент14 страницCashflow Guides ACCAPhong Thủy Nhật QuangОценок пока нет

- Business Ownership Structures: Sole ProprietorДокумент5 страницBusiness Ownership Structures: Sole ProprietorFelipe AmadiОценок пока нет

- 1 Sole Proprietorship Business in IndiaДокумент6 страниц1 Sole Proprietorship Business in IndiaEMBA IITKGPОценок пока нет

- Escrow Institute of CaliforniaДокумент5 страницEscrow Institute of California51 PegasiОценок пока нет

- Mortgages Important Information RBSДокумент4 страницыMortgages Important Information RBSMr PerfectionistОценок пока нет

- How to Manage Start up Business: Legal . Purchasing . Negotiating . Pricing . Budgeting . PRОт EverandHow to Manage Start up Business: Legal . Purchasing . Negotiating . Pricing . Budgeting . PRОценок пока нет

- TOBA 11 - 2020 v1.0Документ3 страницыTOBA 11 - 2020 v1.0AminОценок пока нет

- What Does The Legal Department of A Business DoДокумент2 страницыWhat Does The Legal Department of A Business DoVergaeОценок пока нет

- Association of PersonsДокумент18 страницAssociation of PersonsNadeem AhmadОценок пока нет

- Cibc Bank Usa Smart Account Agreements and DisclosuresДокумент29 страницCibc Bank Usa Smart Account Agreements and Disclosureshino hinxОценок пока нет

- FINAL Exam - Revision QuestionsДокумент10 страницFINAL Exam - Revision QuestionsĐào ĐăngОценок пока нет

- FINAL Exam Revision QuestionsДокумент10 страницFINAL Exam Revision QuestionsĐào ĐăngОценок пока нет

- Balance Sheet: Main AuthorДокумент3 страницыBalance Sheet: Main AuthorMohamed BahkirОценок пока нет

- Chapter 1 Notes - Bus 393Документ4 страницыChapter 1 Notes - Bus 393KaranОценок пока нет

- IEPF-2 Capital First 2016-17 August 10 2017Документ123 страницыIEPF-2 Capital First 2016-17 August 10 2017Dhansingh KokareОценок пока нет

- RMFI Software v1.00Документ39 страницRMFI Software v1.00RENJiiiОценок пока нет

- Commerce & Management Pre-Ph.D SyllabiДокумент16 страницCommerce & Management Pre-Ph.D SyllabiSugan PragasamОценок пока нет

- Makati Vs CamposДокумент3 страницыMakati Vs CamposNaiza Mae R. BinayaoОценок пока нет

- Virtual Piggy (VPIG) Aka Rego Payment (RPMT) ExposeДокумент11 страницVirtual Piggy (VPIG) Aka Rego Payment (RPMT) ExposebuyersstrikewpОценок пока нет

- Serco Ratio AnalysisДокумент4 страницыSerco Ratio Analysisfcfroic0% (1)

- The Philippine Stock ExchangeДокумент3 страницыThe Philippine Stock ExchangeJay Gallardo AmadorОценок пока нет

- High Frequency TradingДокумент4 страницыHigh Frequency TradingAmsalu WalelignОценок пока нет

- Nego ReviewerДокумент10 страницNego ReviewersigfridmonteОценок пока нет

- Financial ManagementДокумент13 страницFinancial ManagementWajidSyedОценок пока нет

- Credit Suisse S&T Cover Letter 1Документ1 страницаCredit Suisse S&T Cover Letter 1Dylan AdrianОценок пока нет

- Risk Management in Banks 2Документ56 страницRisk Management in Banks 2Aquib KhanОценок пока нет

- The Cost of Trigger Happy InvestingДокумент4 страницыThe Cost of Trigger Happy InvestingBrazil offshore jobsОценок пока нет

- Ashoka BuildconДокумент11 страницAshoka Buildconpritish070Оценок пока нет

- Theoritical Market PriceДокумент3 страницыTheoritical Market PriceJОценок пока нет

- Final Qualifying ReviewerДокумент15 страницFinal Qualifying Reviewerreina maica terradoОценок пока нет

- PartnershipДокумент11 страницPartnership555angelОценок пока нет

- CH 10 RevisedДокумент3 страницыCH 10 RevisedRestu AnggrainiОценок пока нет

- WYCKOFF Timing Your Commitments - SandC V9.6 (224-227)Документ8 страницWYCKOFF Timing Your Commitments - SandC V9.6 (224-227)CAD16Оценок пока нет

- Factoring Project ReportДокумент15 страницFactoring Project ReportSiddharth Desai100% (3)

- Chapter 7-Risk, Return, and The Capital Asset Pricing ModelДокумент18 страницChapter 7-Risk, Return, and The Capital Asset Pricing Modelbaha146100% (1)

- FBNBank Ghana Limited 3rd Quarter Financial Statement (2021)Документ1 страницаFBNBank Ghana Limited 3rd Quarter Financial Statement (2021)Fuaad DodooОценок пока нет

- Alfacurrate AAA PMS Jul16Документ39 страницAlfacurrate AAA PMS Jul16flytorahulОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Negotiable Instruments Memo Aid390935500Документ25 страницNegotiable Instruments Memo Aid390935500Christine PalisОценок пока нет

- The Cheyne SIV Case Summary Judgment RulingДокумент97 страницThe Cheyne SIV Case Summary Judgment RulingscottleeyОценок пока нет

- Finance 300 Assignment 1AДокумент3 страницыFinance 300 Assignment 1Adullrich44Оценок пока нет

- Manju Honda Finance ProjectДокумент101 страницаManju Honda Finance Projectpriyanka repalle100% (2)

- A Beaver Financial Statement Analysis and The Prediction of Financial DistressДокумент26 страницA Beaver Financial Statement Analysis and The Prediction of Financial DistressKusumaaОценок пока нет

- FinMath Lecture 2 DerivativesДокумент32 страницыFinMath Lecture 2 DerivativesavirgОценок пока нет