Академический Документы

Профессиональный Документы

Культура Документы

ICE Brent Crude Futures: Contract Specifications

Загружено:

eltowerИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ICE Brent Crude Futures: Contract Specifications

Загружено:

eltowerАвторское право:

Доступные форматы

ICE Futures Europe Mar 27, 2012

ICE Brent Crude Futures

Contract Specifications

Description

The ICE Brent Crude futures contract is a deliverable contract based on EFP delivery with an option to cash settle. Consecutive months will be listed to the December 2016 contract, inclusive. In addition, 6 contract months comprising of June and December contracts will be listed for the three subsequent calendar years up to and including 2019 Trading shall cease at the end of the designated settlement period on the Business Day (a trading day which is not a public holiday in England and Wales) immediately preceding:

Trading Period/Strip

Expiration Date (i) Either the 15th day before the first day of the contract month, if such 15th day is a Business Day (ii) If such 15th day is not a Business Day the next preceding Business Day. ICE Clear Europe acts as the central counterparty for trades conducted on the London exchanges. This enables it to guarantee the financial performance of every contract registered with it by its members (the clearing members of the exchanges) up to and including delivery, exercise and/or settlement. ICE Clear Europe has no obligation or contractual relationship with its members' clients who are non-member users of the exchange markets, or non-clearing members of the exchanges.

Contract Security

ICE Help Desk: Atlanta + 1 770 738 2101, London + 44 (0)20 7488 5100 or ICEHelpdesk@theice.com

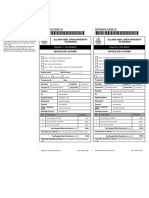

Contract Specifications

Trading Hours

UK Hours* Open 01:00 London local time (23.00 on Sundays) Close 23:00 London local time. EST Hours Open 20:00 (18:00 on Sundays) Close: 18:00 the following day. Chicago Hours Open 19:00 (17:00 on Sundays) Close: 17:00 the following day. Singapore Hours Open 08:00 (06:00 on Monday mornings) close 06:00 the next day. *A circular will be issued when the UK switches from GMT to BST and also when the US switches from DST which will affect the opening and closing times.

Quotation Contract Size Underlying Contract Size Minimum Price Flux Units of Trading Maximum Price Flux

The contract price is in US dollars and cents per barrel 1,000 barrels (42,000 US gallons) 1,000 barrels One cent per barrel, equivalent to a tick value of $10 One ICE Brent Crude futures Contract There are no limits The weighted average price of trades during a two minute settlement period from 19:28:00, London time. All open contracts are marked-to-market daily. The Brent crude future is a cash-settled contract. The Exchange's daily position management regime requires that any position greater than 100 lots in all contract months must be reported to the exchange on a daily basis. The Exchange has powers to prevent the development of excessive positions or unwarranted speculation or any other undesirable situation and may take any steps necessary to resolve such situations including the ability to mandate members to limit the size of such positions or to reduce positions where appropriate. Electronic futures, Exchange of futures for physical (EFP), Exchange of futures for swap (EFS) and Block Trades are available for this contract. The ICE Brent Crude futures contract is a deliverable contract based on EFP delivery with an option to cash settle, i.e the ICE Brent Index price for the day following the last trading day of the futures contract. B

Settlement Price

Daily Margin

Position Limits

Trading Methods

Delivery/Settlement Basis

Contract Symbol

ICE Help Desk: Atlanta + 1 770 738 2101, London + 44 (0)20 7488 5100 or ICEHelpdesk@theice.com

Contract Specifications

MIC Code Clearing Venue

IFEU ICEU

ICE Help Desk: Atlanta + 1 770 738 2101, London + 44 (0)20 7488 5100 or ICEHelpdesk@theice.com

Вам также может понравиться

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16От EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Оценок пока нет

- Business Guide to the United Kingdom: Brexit, Investment and TradeОт EverandBusiness Guide to the United Kingdom: Brexit, Investment and TradeОценок пока нет

- WTI, American-Style Option: Contract SpecificationsДокумент3 страницыWTI, American-Style Option: Contract SpecificationstacolebelОценок пока нет

- SMX Brent-Euro Futures Contract: ScopeДокумент4 страницыSMX Brent-Euro Futures Contract: ScopeArthur Helfstein Fragoso ZeitgeistОценок пока нет

- ProductSpec - 219 - ICE BrentДокумент3 страницыProductSpec - 219 - ICE Brentahanx9Оценок пока нет

- Deliverable Swap Futures - CMEДокумент2 страницыDeliverable Swap Futures - CMEjitenparekhОценок пока нет

- Clearingrequirement Factsheet FinalДокумент4 страницыClearingrequirement Factsheet FinalMarketsWikiОценок пока нет

- Circular: Page 1 of 2Документ2 страницыCircular: Page 1 of 2RockyphОценок пока нет

- Modification Contract Specification Brent Crude Oil Futures Contract 19062014Документ6 страницModification Contract Specification Brent Crude Oil Futures Contract 19062014Ankit AgarwalОценок пока нет

- Interest Rate FuturesДокумент73 страницыInterest Rate Futuresvijaykumar4Оценок пока нет

- About Equities: View Business Growth in CM SegmentДокумент20 страницAbout Equities: View Business Growth in CM SegmentJamal KaziОценок пока нет

- Currency Futures NivДокумент37 страницCurrency Futures Nivpratibhashetty_87Оценок пока нет

- CD 18178Документ4 страницыCD 18178Srinu RachuriОценок пока нет

- Specifications of Futures ContractДокумент2 страницыSpecifications of Futures ContractMeer Mazhar AliОценок пока нет

- Introduction:-: Rate, Such As The Euro To US Dollar Exchange Rate, or The British Pound To US Dollar ExchangeДокумент34 страницыIntroduction:-: Rate, Such As The Euro To US Dollar Exchange Rate, or The British Pound To US Dollar Exchangesarabjeet_toriОценок пока нет

- Contract Specification FTSE 100 OptionsДокумент3 страницыContract Specification FTSE 100 Optionsguggu1990Оценок пока нет

- Especificaciones de ContratoДокумент2 страницыEspecificaciones de ContratocmoОценок пока нет

- Three-Month Eurodollar Futures: 45200. Scope of ChapterДокумент2 страницыThree-Month Eurodollar Futures: 45200. Scope of ChapterEdward JiangОценок пока нет

- Unit - 5: Trading in Commodity MarketsДокумент3 страницыUnit - 5: Trading in Commodity MarketsÃkhîł Ćr ŚęvëńОценок пока нет

- Mechanics of Futures MarketsДокумент21 страницаMechanics of Futures MarketsJoeyyy121Оценок пока нет

- Forward and Futures Contracts: by Surya B. RanaДокумент30 страницForward and Futures Contracts: by Surya B. RanaUbraj NeupaneОценок пока нет

- Us Points To Note2Документ2 страницыUs Points To Note2satish sОценок пока нет

- Example: Currency Forward ContractsДокумент23 страницыExample: Currency Forward ContractsRenjul ParavurОценок пока нет

- Market For Currency FuturesДокумент24 страницыMarket For Currency FuturesSharad SharmaОценок пока нет

- Assignment 3, International Banking Shafiqullah, Reg No, Su-17-01-021-001, Bba 8th.Документ5 страницAssignment 3, International Banking Shafiqullah, Reg No, Su-17-01-021-001, Bba 8th.Shafiq UllahОценок пока нет

- Futures - Key HandoutДокумент9 страницFutures - Key Handoutvjean_jacquesОценок пока нет

- Circular 323-2016Документ52 страницыCircular 323-2016Om PrakashОценок пока нет

- Currency Risk Management: Futures and Forwards: Example VI.1Документ25 страницCurrency Risk Management: Futures and Forwards: Example VI.1ravi_nyseОценок пока нет

- Notification No. FEMA. 25/RB-2000 Dated May 3, 2000Документ4 страницыNotification No. FEMA. 25/RB-2000 Dated May 3, 2000Praveer MoreyОценок пока нет

- Moneycorp: Forward Contracts Regular Payments Hedging Service Join Mailing List Currency ConverterДокумент9 страницMoneycorp: Forward Contracts Regular Payments Hedging Service Join Mailing List Currency ConvertergruhopОценок пока нет

- Interest Rate Futures: Nkomo D.J. (FRM)Документ36 страницInterest Rate Futures: Nkomo D.J. (FRM)Elisha MakoniОценок пока нет

- Cboe XBT Bitcoin FuturesДокумент2 страницыCboe XBT Bitcoin FuturesJhonnyLizarazuRiosОценок пока нет

- Chapter 2 - Mechanics of Futures MarketsДокумент29 страницChapter 2 - Mechanics of Futures Marketsabaig2011Оценок пока нет

- Interest Rate FuturesДокумент22 страницыInterest Rate FuturesHerojianbuОценок пока нет

- Chapter 1Документ49 страницChapter 1ummuzzzОценок пока нет

- Chapter 7Документ73 страницыChapter 7Can BayirОценок пока нет

- Gas Oil Futures Contract SpecificationДокумент7 страницGas Oil Futures Contract SpecificationRavi Chandra ChakinalaОценок пока нет

- I. Currency Futures Contract 1. Definition of Currency Futures ContractДокумент12 страницI. Currency Futures Contract 1. Definition of Currency Futures ContractMiftahul FirdausОценок пока нет

- Komal Traesury AssignmentДокумент11 страницKomal Traesury AssignmentmanaskaushikОценок пока нет

- New Microsoft Word DocumentДокумент45 страницNew Microsoft Word Documentamp9895124999100% (1)

- Derivatives Commodity Derivatives FGLD Specification EnglishДокумент2 страницыDerivatives Commodity Derivatives FGLD Specification EnglishrexОценок пока нет

- Forwards Contract:: Futures and Forwards Are Financial Contracts Which Are Very Similar in Nature But ThereДокумент7 страницForwards Contract:: Futures and Forwards Are Financial Contracts Which Are Very Similar in Nature But ThereFardeen KhanОценок пока нет

- CFDs Online Trading ManualДокумент22 страницыCFDs Online Trading ManualsurfetoОценок пока нет

- BIR Ruling (DA - (FIT-002) 054-10) - FWT, GRT and DST On Treasury Bonds and On Secondary TradingДокумент14 страницBIR Ruling (DA - (FIT-002) 054-10) - FWT, GRT and DST On Treasury Bonds and On Secondary TradingJerwin DaveОценок пока нет

- Accounting PrincipalДокумент6 страницAccounting PrincipalAmol ChavanОценок пока нет

- Trade PolicyДокумент3 страницыTrade PolicyHassan AliОценок пока нет

- Launch of MCX iCOMDEX Bullion Index FuturesДокумент4 страницыLaunch of MCX iCOMDEX Bullion Index Futuresmkalidas2006Оценок пока нет

- Forward ContractsДокумент20 страницForward ContractsNeha ShahОценок пока нет

- Alternative Investment Management Association: Rule-Comments@sec - GovДокумент3 страницыAlternative Investment Management Association: Rule-Comments@sec - GovMarketsWikiОценок пока нет

- The Trade Lifecycle1Документ4 страницыThe Trade Lifecycle1Simon BrownОценок пока нет

- Intermediate Guide To E-Mini Futures Contracts - Rollover Dates and Expiration - InvestopediaДокумент5 страницIntermediate Guide To E-Mini Futures Contracts - Rollover Dates and Expiration - Investopediarsumant1Оценок пока нет

- Nse Clearing & SettlementДокумент3 страницыNse Clearing & SettlementChetna KochharОценок пока нет

- Risk Disclosure Uk 2021Документ4 страницыRisk Disclosure Uk 2021yassen bakerОценок пока нет

- General Risk Disclosure: Updated On 6.9.2018Документ6 страницGeneral Risk Disclosure: Updated On 6.9.2018የኛ TubeОценок пока нет

- Forex CFDs - Facts and Q&AДокумент4 страницыForex CFDs - Facts and Q&AVincent WangОценок пока нет

- PWC All Clear Eu Introduces Clearing and Reporting Regime For Otc DerivativesДокумент12 страницPWC All Clear Eu Introduces Clearing and Reporting Regime For Otc DerivativesPeter OlinОценок пока нет

- Mechanics of Futures MarketsДокумент20 страницMechanics of Futures Marketsuuuuufffff0% (1)

- World Trade Organization: Objectives of WTOДокумент14 страницWorld Trade Organization: Objectives of WTOSilas SargunamОценок пока нет

- Futures Contract Rollover ExplainedДокумент3 страницыFutures Contract Rollover ExplainedMichael MarioОценок пока нет

- Holding bankers to account: A decade of market manipulation, regulatory failures and regulatory reformsОт EverandHolding bankers to account: A decade of market manipulation, regulatory failures and regulatory reformsОценок пока нет

- Current Liabilities and ContingenciesДокумент12 страницCurrent Liabilities and ContingenciesLu CasОценок пока нет

- 1290 Bank Teller Interview Questions Answers GuideДокумент7 страниц1290 Bank Teller Interview Questions Answers GuideCrishawn BlakeОценок пока нет

- Supplier Usa ShopifyДокумент5 страницSupplier Usa ShopifyMeliana Merlitan AyuОценок пока нет

- Key Intellectual Property Concepts PDFДокумент4 страницыKey Intellectual Property Concepts PDFflatraОценок пока нет

- Ilec Unit 2 Company Law: Company Formation and ManagementДокумент4 страницыIlec Unit 2 Company Law: Company Formation and Managementხათუნა გოგიაშვილიОценок пока нет

- Important : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadДокумент1 страницаImportant : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadMian Husnain AliОценок пока нет

- Calculating BenefitsДокумент2 страницыCalculating Benefitsஅபூ மூபஸ்ஸராОценок пока нет

- EconomicsДокумент4 страницыEconomicsVenkateshОценок пока нет

- Compensation /reward System: Dr. Sukanya.R Assistant Professor Department of Commerce KSOU, MysoreДокумент8 страницCompensation /reward System: Dr. Sukanya.R Assistant Professor Department of Commerce KSOU, MysoreSukanya RОценок пока нет

- Benesse 2022Документ34 страницыBenesse 2022Asif KhanОценок пока нет

- For You And: Your EngineДокумент6 страницFor You And: Your EngineMintomo IrawanОценок пока нет

- 2023-07-12T02-55 Transaction #6425979030853126-12676821Документ1 страница2023-07-12T02-55 Transaction #6425979030853126-12676821mananwu07246Оценок пока нет

- TY BBA Sem 5 Service MGMT HDPДокумент15 страницTY BBA Sem 5 Service MGMT HDPakhileshОценок пока нет

- Chester Levings RobosignerДокумент1 страницаChester Levings RobosignerBradley WalkerОценок пока нет

- Ultimate Guide To Procurement Cost SavingsДокумент38 страницUltimate Guide To Procurement Cost SavingsLcl KvkОценок пока нет

- Credit Facility Form (Grand)Документ2 страницыCredit Facility Form (Grand)cyed mansoorОценок пока нет

- Study Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!Документ13 страницStudy Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!HARDIK JAINОценок пока нет

- Banking in China HIGH LEVEL BTX 1Документ4 страницыBanking in China HIGH LEVEL BTX 1Leire ArosteguiОценок пока нет

- Wo-013 - Valvetecq EngineersДокумент1 страницаWo-013 - Valvetecq EngineersDesign V-Tork ControlsОценок пока нет

- Industrial Policy of India: Vasu Singla Nikhil Aggarwal Akash Joshi Jagseer Singh Gagandeep NainДокумент40 страницIndustrial Policy of India: Vasu Singla Nikhil Aggarwal Akash Joshi Jagseer Singh Gagandeep NainVasu SinglaОценок пока нет

- Activity Based CostingДокумент7 страницActivity Based CostingKHAkadsbdhsgОценок пока нет

- Doradiana,+a8 The+Effect 125+-+140Документ16 страницDoradiana,+a8 The+Effect 125+-+140CheeweiLeeОценок пока нет

- Cheat Sheet BATДокумент4 страницыCheat Sheet BATUmar PatelОценок пока нет

- Agriculture in India: Euromonitor International March 2021Документ24 страницыAgriculture in India: Euromonitor International March 2021DDОценок пока нет

- Agreement For Software MembershipДокумент2 страницыAgreement For Software MembershipAnujit NandyОценок пока нет

- Chapter 08 MCQsДокумент3 страницыChapter 08 MCQsElena WangОценок пока нет

- Private Equity Interview Course Wall Street Oasis PDFДокумент278 страницPrivate Equity Interview Course Wall Street Oasis PDFJohn Gones100% (2)

- Sanc Nawada 4271914 263639Документ2 страницыSanc Nawada 4271914 263639kumarmanchun249Оценок пока нет

- SCM - Manufacturing Cloud: Update 21B OverviewДокумент26 страницSCM - Manufacturing Cloud: Update 21B OverviewSAINTJOE100% (1)

- Case Study (Group 5)Документ9 страницCase Study (Group 5)sone onceОценок пока нет