Академический Документы

Профессиональный Документы

Культура Документы

Legal Provisions Related To Custom Duties

Загружено:

Ishtiaq AhmedОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Legal Provisions Related To Custom Duties

Загружено:

Ishtiaq AhmedАвторское право:

Доступные форматы

Legal Provisions related to Custom Duties

2nd Assignment

ALLAMA IQBAL OPEN UNIVERSITY

(Department of Business Administration) Assignment # 2 Taxation Management (5526)

TOPIC: LEGAL PROVISIONS RELATED TO

CUSTOM DUTIES

Submitted to: Sir Muhammad Zeeshan Submitted by: Ishtiaq Ahmed

AH-526270

1

Legal Provisions related to Custom Duties

2nd Assignment

Acknowledgement

All praises to Almighty Allah, the most Gracious, the most Beneficent and the most Merciful, who enabled me to complete this assignment. I feel great pleasure in expressing my since gratitude to my teacher, for his guidance and support for providing me an opportunity to complete my Project. My special thanks and acknowledgments to Mr. Zeeshan for providing me all relative information, guidance and support to compile the practical study at MCB. I will keep my hopes alive for the success of given task to submit this report to my honorable teacher Sir Muhammad Zeeshan, whose guidance; support and encouragement enable me to complete this assignment.

Legal Provisions related to Custom Duties

2nd Assignment

Executive Summary

A customs duty is a tariff or tax on the importation (usually) or exportation (unusually) of goods Customs duty is a kind of national tax revenue, which is its most essential nature. The purpose of customs duty collection is to maintain sovereignty and promote the national economic construction. The customs duty can be divided into different categories according to different standards or from different angles. According to the flow direction of the import and export goods, it can be divided into import duties, export duties and transit duties. Customs is an authority or agency in a country responsible for collecting and safeguarding customs duties and for controlling the flow of goods including animals, transports, personal effects and hazardous items in and out of a country. Custom Act 1969 defines some provisions related to custom duties. There are some weaknesses in the custom system of that can be removed by taking some steps.

3

Legal Provisions related to Custom Duties

2nd Assignment

Table of Contents

Contents

Page No

01 02 03 04 05 15 19 20 22

1. Title page 2. Acknowledgement 3. Executive Summary 4. Table of contents 5. Introduction to the topic 6. Practical study of organization 7. Data collection Methods 8. SWOT analysis 9. Conclusion

Legal Provisions related to Custom Duties

2nd Assignment

10. 11.

Recommendations References

23 24

Introduction to Topic

Customs Duty

A customs duty is a tariff or tax on the importation (usually) or exportation (unusually) of goods Customs duty is a kind of circulation tax levied on the goods and articles entering or leaving the customs territory by the Customs on behalf of the nation in conformity with the tariff policies formulated by the nation as well as the tax laws and the import and export tariffs promulgated and implemented by the nation. Customs duty is a kind of national tax revenue, which is its most essential nature. The nation is the subject of taxation of Customs duty. Customs duty is collected from the taxpayers by the Customs on behalf of the nation. The object of taxation is the goods and articles entering or leaving the customs territory. The laws, the administrative rules and regulations formulated by the nation are the foundation of the Customs duty collection.

5

Legal Provisions related to Custom Duties

2nd Assignment

Importance of Customs duty:

The importance of Customs duty is determined by its basic nature. Although the function of Customs duty is not entirely the same in different times of different countries, the basic function of it is the consistent embodiment of national sovereignty. The purpose of customs duty collection is to maintain sovereignty and promote the national economic construction. Practically, the so-called Import Duties and Taxes in some international conventions and agreements differ with the concept of Import Customs Duties. Import Duties and Taxes include Import Customs Duties and other domestic taxes levied on the imported goods. After going through duty-levying procedure and approved by the customs, imported goods should be regarded as the domestic commodities and treated equally with home-made commodities, and therefore, should be levied domestic taxes likewise. Usually, domestic taxes are levied by the customs during import period, but they dont fall into the category of customs duties.

The Classification of Customs Duties:

The customs duty can be divided into different categories according to different standards or from different angles. According to the flow direction of the import and export goods, it can be divided into import duties, export duties and transit duties; according to the taxation standard(or taxation method), it can be divided into ad valorem duties, specific duties, mixed duties (including compound

6

Legal Provisions related to Custom Duties

2nd Assignment

duties, alternative duties), sliding duties, seasonal duties, variable levies, etc; according to the nature of the customs duty, it can be divided into ordinary customs duties, preferential duties (mostfavored-nation duties, preferential duties, generalized system of preference, etc), differential duties (anti-dumping duties, antisubsidy duties and retaliatory taxes); according to the primary purpose of tax collection, it can be divided into revenue duties and protective duties, which are the concepts of customs duties sometimes used in making customs policies; according to the restrictions from other countries or international organizations when formulating customs duties, it can be divided into autonomous tariffs, non-autonomous tariffs, state-designated duties, agreement tariffs, and bound tariffs, etc. Customs duties can also be divided into principle duties and additional duties; the latter is as opposed to the former. The principle duty is the regular duty specifically listed in the customs tariffs while the additional duty is a kind of duty levied besides the principle duty due to some specific needs. Usually additional duties are temporary or provisional.

Customs

Customs is an authority or agency in a country responsible for collecting and safeguarding customs duties and for controlling the flow of goods including animals, transports, personal effects and hazardous items in and out of a country.

Legal Provisions related to Custom Duties

2nd Assignment

Depending on local legislation and regulations, the import or export of some goods may be restricted or forbidden, and the customs agency enforces these rules. The customs authority may be different from the immigration authority, which monitors persons who leave or enter the country, checking for appropriate documentation, apprehending people wanted by international arrest warrants, and impeding the entry of others deemed dangerous to the country. In most countries customs are attained through government agreements and international laws. Custom in law is the established pattern of behavior that can be objectively verified within a particular social setting. A claim can be carried out in defense of "what has always been done and accepted by law." Customary law exists where: 1. a certain legal practice is observed and 2. the relevant actors consider it to be law

Custom Act 1969

Short title, extent and commencement:

1) This Act may be called the Customs Act, 1969.

2) Extends to the whole of Pakistan. 3) It

shall come into force on such date as the Federal

Government may, by notification in the official Gazette, appoint.

General:

8

Legal Provisions related to Custom Duties

2nd Assignment

This section corresponds to Section 1 of the Sea Customs Act and Section 1 of the Land Customs Act. Provisions have been made for bringing into force the new Act from such date as may be considered expedient by the Federal Government.

Extent:

a) This Act extends to the whole of Pakistan. The Territories of Pakistan comprises of

b) The provinces of Baluchistan, the North West Frontier, the

Punjab

and

Sind;

the Islamabad Capital Territory (i.e. Federal Capital);

c) The Federally Administered Tribal Areas; and d) Such States and territories as are or may be included in

Pakistan, whether by accession or otherwise. (Article 1 (2) of the Constitution of the Islamic Republic of Pakistan, 1973).

Legal Provisions related to Custom Duties

A. Power to depute officers of customs to

board conveyances:

At any time while a conveyance is in a customs-station or is proceeding towards such station, the appropriate officer may depute one or more officers of customs to board the conveyance, and every officer so deputed shall remain on board such conveyance for such time as the appropriate officer may consider necessary.

Legal Provisions related to Custom Duties

2nd Assignment

B. Officer to be received and accommodation

to be provided:

Whenever an officer of customs is so deputed to be on board any conveyance, the person-in-charge shall be bound to receive him on board and provide him with suitable accommodation and adequate quantity of fresh water.

C. Officer's power to access, etc:

1. Every officer deputed as aforesaid shall have free access to

every part of the conveyance and may: a) Cause any goods to be marked before they are unloaded from the conveyance; b) Lock up, seal, mark or otherwise secure any goods carried in the conveyance or any place or container in which they are carried; or c) Fasten down any hatchway or entrance to the hold. 2. if any box, place or closed receptacle in any such conveyance be locked, and the key be withheld, such officer shall report the same to the appropriate officer, who may thereupon issue to the officer on board the conveyance, or to any other officer under his authority, a written order for search. 3. On production of such order, the officer empowered there under may require that any such box, place or closed

10

Legal Provisions related to Custom Duties

2nd Assignment

receptacle be opened in his presence; and if it be not opened upon his requisition, he may break open the same.

D. Sealing of conveyance:

Conveyance carrying transit goods for destinations outside Pakistan or goods from some foreign territory to a customs-station or from a customs-station to some foreign territory may be sealed in such cases and in such manner as may be provided in the rules.

E. Goods not to be loaded or unloaded or

water-borne except in presence of officer:

Save where general permission is given under section 67 or with permission in writing of the appropriate officer, no goods other than passengers' baggage or ballast urgently required to be loaded for the vessel's safety, shall be shipped or water-borne to be shipped or discharged from any vessel, in any customs-port, nor any goods except passengers' baggage shall be loaded in or unloaded from any conveyance other than a vessel at any land customs-station or customs-airport except in the presence of an officer of customs.

F. Goods not to be loaded or unloaded or

passed on certain days or at certain times:

Except with the permission in writing of the appropriate officer and on payment of such fees as may be prescribed by the Board no

11

Legal Provisions related to Custom Duties

2nd Assignment

goods, other than passengers' baggage or mail bags, shall in any customs-port be discharged, or be shipped or water-borne to be shipped or shall be loaded or unloaded or passed at any land customs-station or customs-airport a) on any public holiday within the meaning of section 25 of the Negotiable Instruments Act, 1881 (XXVI of 1881), or on any day on which the discharge or shipping of cargo at customs-port or loading, unloading passage or delivery of cargo at any land customs-station or customs-airport, as the case may be, is prohibited by the Board by notification in the official Gazette; or

b) On any day except between such hours as the Board may, from

time to time, by a like notification, appoint.

G. Goods not to be loaded or unloaded except

at approved places:

Save where general permission is given under section 67 or with permission in writing of the appropriate officer, no imported goods shall be unloaded or goods for export loaded at any place other than a place duly approved under clause (b) of section 10 for the unloading or loading of such goods.

H. Power to exempt from sections D and

G:

12

Legal Provisions related to Custom Duties

2nd Assignment

Notwithstanding anything contained in section 64 or section 66, the Board may, by notification in the official Gazette, give general permission for goods to be loaded at any customs-station from any place not duly appointed for loading and without the presence or authority of an officer of customs.

I. Boat-note

1) When any goods are water-borne for the purpose of being

landed from any vessel and warehoused or cleared for homeconsumption, or of being shipped for exportation on board any vessel, there shall be sent, with each boat-load or other separate dispatch, a boat-note specifying the number of packages so sent and the marks or number or other descriptions thereof. 2) Each boat-note for goods to be landed shall be signed by an officer of the vessel, and likewise by the officer of customs on board, if any such officer be no board, and shall be delivered on arrival to any officer of customs authorized to receive the same. 3) Each boat-note for goods to be shipped shall be signed by the appropriate officer and, if an officer of customs is on board the vessel on which such goods are to be shipped, shall be delivered to such officer, and if no such officer be on board, shall be delivered to the master of the vessel or to an officer of the vessel appointed by him to receive it. 4) The officer of customs who receives any boat-note of goods landed, and the officer of customs, master or other officer as

13

Legal Provisions related to Custom Duties

2nd Assignment

the case may be, who receives any boat-note of goods shipped, shall sign the same and note thereon such particulars as the Collector of Customs may from time to time direct. 5) The Board may from time to time, by notification in the official Gazette, suspend the operation of this section in any customsport or part thereof.

J. Goods water-borne to be forthwith landed

of shipped:

All goods water-borne for the purpose of being landed or shipped shall be landed or shipped without any unnecessary delay.

K. Goods to be transshipped without

permission:

Except in cases of imminent danger, no goods discharged into or loaded in any boat for the purpose of being landed or shipped shall be transshipped into any other boat without the permission of an officer of customs.

L. Power to prohibit plying of unlicensed

cargo-boats:

1) The Board may declare with regard to any customs-port, by notification in the official Gazette, that, after a date therein specified, no boat not duly licensed and registered shall be

14

Legal Provisions related to Custom Duties

2nd Assignment

allowed to ply as a cargo-boat for the landing and shipping of merchandise within the limits of such port. 2) In any port with regard to which such notification has been issued, the Collector of Customs or other officer whom the Board appoints in this behalf, may, subject to rules and on payment of such fees as the Board may, by notification in the official Gazette, prescribe, issue licenses for and register cargoboats, or cancel the same.

M.

Plying of ships of less than one hundred

tons:

1) Every boat belongs to a Pakistani ship and every other vessel

not exceeding one hundred tons, shall be marked in such manner as may be prescribed by rules.

2) Plying of all or any class or description of vessels of less than

one hundred tons, whether in sea or inland waters, may be prohibited or regulated or restricted as to the purposes and limits of plying by rules.

15

Legal Provisions related to Custom Duties

2nd Assignment

Practical Study of the Organization

AMIN FEROZ & CO. (PVT) LTD.

History of the Organization:

AFCO was established in 1935 to market and promote world class products of reputable overseas companies as their sole representatives in the South Asian region. After 1948, it served as sole agents for various companies including Monsanto Company, St. Louis (USA). Currently AFCO holds exclusive agencies for US-based Solutia Inc. (The chemicals group formed after spin-off of Monsanto Company's Life Sciences and Chemicals businesses); Finnfeeds International (USA); Flexsys Inc. of USA; J M Huber Corporation of USA; and Novus International (USA); all with offices world-wide.

16

Legal Provisions related to Custom Duties

2nd Assignment

As a result, AFCO supplies a vast variety of industrial raw materials manufactured by its overseas principals. Products include raw materials for plastics, rubber chemicals, leather chemicals, animal feed, detergents, enzyme systems, aviation fluids, heat-transfer fluids, special-purpose chemicals, and many other industrial materials. Amin Feroz & Company regularly serves over 30 satisfied industrial customers Pakistan-wide. We are a well established group of Pakistani companies operating since 1935. We are exclusive representatives for various multinationals in Pakistan. Products range from feed additives to industrial specialty chemicals. Our current industrial engagement involves operating the first fully-computerized poultry feed manufacturing plant in Pakistan, with all machinery, etc. imported from Holland. Our group headquarter is located in Karachi, with branch offices in all major cities of Pakistan (Lahore, Faisalabad, Gujranwala and Sialkot), employing over 180 persons. Group Companies include: AFCO, UIE, FFL and SG.

Group Product Lines:

GARMENTS

LEATHER & TEXTILE DYESTUFFS & PIGMENTS POULTRY FEEDS INDUSTRIAL CHEMICALS, SPECIALTY CHEMICALS

17

Legal Provisions related to Custom Duties

2nd Assignment

UNIQUE IMPORT EXPORT:

Established in 1978 as the exclusive distributor of world's leading dyestuffs manufacturers, UIE is well entrenched in the Pakistani Dyestuffs market. Working on the philosophy of consistent quality and competitive pricing, UIE supplies world-renowned dyes from BASF Germany (formerly ICI (Imperial Chemical Industries) UK's dyestuffs business), STHAL Leather Dyes of UK, and ATUL India Ltd (formerly ICI India). UIE also deals in dyes for Dystar of Germany. UIE serves customers in the Punjab and Sindh provinces, and covers a sizable fraction of Quality conscious customers. An independent & well-coordinated sales team with 10-25 years experience delivers reliable customer service on-site and keeps up-to-date with changing market trends. Expedient Technical Service is provided with the aid of our well-equipped laboratories located in Karachi and Lahore. These Quality Control laboratories are equipped with Color Matching DATA COLOR Systems HT Machines.

18

Legal Provisions related to Custom Duties

2nd Assignment

Practical Study of the Organization with respect to the issue

Amin Feroz & Company obeying all the Provisions that are defines in the Custom Act 1969, that provisions are given below, Power to depute officers of customs to board conveyances Officer to be received and accommodation to be provided Officer's power to access, etc Sealing of conveyance Goods not to be loaded or unloaded or water-borne except in presence of officer Goods not to be loaded or unloaded or passed on certain days or at certain times Goods not to be loaded or unloaded except at approved places Power to exempt from sections D and G Boat-note Goods water-borne to be forthwith landed of shipped Goods to be transshipped without permission Power to prohibit plying of unlicensed cargo-boats Plying of ships of less than one hundred tons

19

Legal Provisions related to Custom Duties

2nd Assignment

Data collection Methods

o o

Primary Data:

Keen observation Research

o o o o

Secondary Data:

Book Of Taxation Management Internet Teacher notes Discussions

20

Legal Provisions related to Custom Duties

2nd Assignment

SWOT analysis

The acronym SWOT stands for a firm is internal Strengths and Weaknesses and its external Opportunities and Threats. The purpose of such analysis is to build on companys strengths in order to exploit opportunities and counter threats and to correct companys weaknesses. SWOT analysis is based on the assumption that if managers carefully review such strengths, weaknesses, opportunities, and threats, a useful strategy for ensuring organizational success will become evident. Strengths and weaknesses typically relate to the internal

environment of an organization, whereas opportunities and threats are brought about by the external environment of an organization.

Strength:

Strength can be defined as an area where a company is best at doing something or a feature that puts the company at an advantage in comparison to its competitors. Covering the whole things Brief description is available on everything related to exports and imports Supported by Law

Weakness:

21

Legal Provisions related to Custom Duties

2nd Assignment

A weakness is defined as an area in an organization where the organization is not as good at doing something as its competitors or a thing which an organization lacks thus putting the organization at disadvantage in comparison to its competitors. Not completely following due to corruption Inefficient custom staff Importer and exporter are not well known about custom provisions.

Opportunities:

An opportunity can be defined as a change in external environment which if properly exploited with the organizational strengths will result in enhanced sales market share or income. Education and training of Custom staff

Threats:

Threat can define as a change in external environment which if not met with proper strategies will result in loss of revenues market share or income. Corruption

22

Legal Provisions related to Custom Duties

2nd Assignment

Conclusion

I have concluded that,

A customs duty is a tariff or tax on the importation (usually) or

exportation (unusually) of goods Customs duty is a kind of national tax revenue, which is its most essential nature. The purpose of customs duty collection is to maintain The customs duty can be divided into different categories Customs is an authority or agency in a country responsible sovereignty and promote the national economic construction. according to different standards or from different angles.

for collecting and safeguarding customs duties and for controlling the flow of goods.

AFCO is an import/Export company that is following the Custom Act 1969 defines some provisions related to custom There are some weaknesses in the custom system of Pakistan But these weaknesses can be removed by taking some steps.

23

provisions of custom act 1969 by spirit and by practice.

duties. like corruption and lack of knowledge related to custom duties.

Legal Provisions related to Custom Duties

2nd Assignment

Recommendation

Government of Pakistan should have to take strong steps Employees should be trained and educated. Time to time seminars should be held related to Custom Act Recruitment and selection process for customs staff should

against corruption in the Custom department.

for both importer/exporter and Custom staff. be strict and monitored by Federal Government.

24

Legal Provisions related to Custom Duties

2nd Assignment

Reference

Project report Legal provisions related to custom duties

www.slideshare.com http://www.afco.com.pk/ http://www.mcb.com.pk//whyMCB.php http://en.wikipedia.org/wiki/afco_Pakistan http://www.scribd.com/doc/24651033/HR-REPORT-culturalcompatible-practices-in- afco

25

Вам также может понравиться

- Reasons For Issues Warrants and ConvertiblesДокумент23 страницыReasons For Issues Warrants and ConvertiblesIshtiaq Ahmed50% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Role of Commercial Banks in Developing The Economy of PakistanДокумент40 страницRole of Commercial Banks in Developing The Economy of PakistanIshtiaq Ahmed84% (25)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Internal Control System of A Banking Organization Over Receipts and PaymentsДокумент21 страницаInternal Control System of A Banking Organization Over Receipts and PaymentsIshtiaq AhmedОценок пока нет

- Organizing and Staffing Project Office and TeamДокумент21 страницаOrganizing and Staffing Project Office and TeamIshtiaq Ahmed100% (4)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Need For Establishing Project OfficeДокумент19 страницNeed For Establishing Project OfficeIshtiaq AhmedОценок пока нет

- How Time Value of Money Affects Investments and Financial Decisions in Financial Minagement.Документ28 страницHow Time Value of Money Affects Investments and Financial Decisions in Financial Minagement.Ishtiaq Ahmed82% (11)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Data Analysis in ResearchДокумент29 страницData Analysis in ResearchIshtiaq Ahmed100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Financial Management StrategyДокумент23 страницыFinancial Management StrategyIshtiaq AhmedОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Strategy Evaluation ProcessДокумент38 страницStrategy Evaluation ProcessIshtiaq Ahmed0% (1)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Analysis and Application of Various Cost Concepts For Decision Making.Документ30 страницAnalysis and Application of Various Cost Concepts For Decision Making.Ishtiaq Ahmed100% (2)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Employees Recruitment and Selection ProcessДокумент26 страницEmployees Recruitment and Selection ProcessIshtiaq Ahmed50% (2)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- RevisionHistory APFIFF33 To V219Документ12 страницRevisionHistory APFIFF33 To V219younesОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- How To Control A DC Motor With An ArduinoДокумент7 страницHow To Control A DC Motor With An Arduinothatchaphan norkhamОценок пока нет

- TLE - IA - Carpentry Grades 7-10 CG 04.06.2014Документ14 страницTLE - IA - Carpentry Grades 7-10 CG 04.06.2014RickyJeciel100% (2)

- Water Hookup Kit User Manual (For L20 Ultra - General (Except EU&US)Документ160 страницWater Hookup Kit User Manual (For L20 Ultra - General (Except EU&US)Aldrian PradanaОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- IEC Blank ProformaДокумент10 страницIEC Blank ProformaVanshika JainОценок пока нет

- Action Plan Lis 2021-2022Документ3 страницыAction Plan Lis 2021-2022Vervie BingalogОценок пока нет

- Cs8792 Cns Unit 1Документ35 страницCs8792 Cns Unit 1Manikandan JОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- SM Land Vs BCDAДокумент68 страницSM Land Vs BCDAelobeniaОценок пока нет

- Dike Calculation Sheet eДокумент2 страницыDike Calculation Sheet eSaravanan Ganesan100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

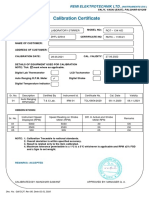

- Calibration CertificateДокумент1 страницаCalibration CertificateSales GoldClassОценок пока нет

- Simoreg ErrorДокумент30 страницSimoreg Errorphth411Оценок пока нет

- Introduction To Motor DrivesДокумент24 страницыIntroduction To Motor Drivessukhbat sodnomdorjОценок пока нет

- Final ExamSOMFinal 2016 FinalДокумент11 страницFinal ExamSOMFinal 2016 Finalkhalil alhatabОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Ingles Avanzado 1 Trabajo FinalДокумент4 страницыIngles Avanzado 1 Trabajo FinalFrancis GarciaОценок пока нет

- Delta AFC1212D-SP19Документ9 страницDelta AFC1212D-SP19Brent SmithОценок пока нет

- Unit Process 009Документ15 страницUnit Process 009Talha ImtiazОценок пока нет

- Ytrig Tuchchh TVДокумент10 страницYtrig Tuchchh TVYogesh ChhaprooОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- 09 WA500-3 Shop ManualДокумент1 335 страниц09 WA500-3 Shop ManualCristhian Gutierrez Tamayo93% (14)

- Check Fraud Running Rampant in 2023 Insights ArticleДокумент4 страницыCheck Fraud Running Rampant in 2023 Insights ArticleJames Brown bitchОценок пока нет

- Strobostomp HD™ Owner'S Instruction Manual V1.1 En: 9V DC Regulated 85maДокумент2 страницыStrobostomp HD™ Owner'S Instruction Manual V1.1 En: 9V DC Regulated 85maShane FairchildОценок пока нет

- Proceedings of SpieДокумент7 страницProceedings of SpieNintoku82Оценок пока нет

- Laporan Praktikum Fisika - Full Wave RectifierДокумент11 страницLaporan Praktikum Fisika - Full Wave RectifierLasmaenita SiahaanОценок пока нет

- Group 1 Disaster Management Notes by D. Malleswari ReddyДокумент49 страницGroup 1 Disaster Management Notes by D. Malleswari Reddyraghu ramОценок пока нет

- Form Three Physics Handbook-1Документ94 страницыForm Three Physics Handbook-1Kisaka G100% (1)

- GL 186400 Case DigestДокумент2 страницыGL 186400 Case DigestRuss TuazonОценок пока нет

- MRT Mrte MRTFДокумент24 страницыMRT Mrte MRTFJonathan MoraОценок пока нет

- Epidemiologi DialipidemiaДокумент5 страницEpidemiologi DialipidemianurfitrizuhurhurОценок пока нет

- Elastic Modulus SFRCДокумент9 страницElastic Modulus SFRCRatul ChopraОценок пока нет

- Sweet Biscuits Snack Bars and Fruit Snacks in MexicoДокумент17 страницSweet Biscuits Snack Bars and Fruit Snacks in MexicoSantiagoОценок пока нет

- Daraman vs. DENRДокумент2 страницыDaraman vs. DENRJeng GacalОценок пока нет