Академический Документы

Профессиональный Документы

Культура Документы

Fin Acctg

Загружено:

Carl AngeloИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Fin Acctg

Загружено:

Carl AngeloАвторское право:

Доступные форматы

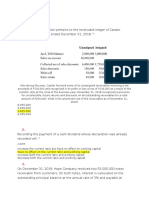

FINANCIAL ACCOUNTING 1 The building was constructed at cost of P12,000,000.

It has original estimated life of 24 years, zero scrap value. At the end of its 8th year, it is estimated that same could be constructed at present price level for the amount of P15,000,000, 100% condition. If it will shift to revaluation model, the amount to be credited to revaluation surplus should be a. P7,000,000 b. P3,000,000 c. P2,000,000 d. P1,500,000 Gross billings for merchandise sold by Lang Company to its customers last year amounted to P15,720,000; sales returns and allowances were P370,000, sales discounts were P175,000, and freight-out was P140,000. Net sales last year for Lang Company were a. P15,720,000. b. P15,350,000. c. P15,175,000. d. P15,035,000. On April 1, 2007, Florida Corporation. issued at 97 plus accrued interest, 2,000 of its 10%, P1,000 bonds. The bonds are dated January 1, 2007 and mature on January 1, 2017. Interest is payable semi-annually on January 1 and July 1. From the bond issuance, Florida would receive net cash of a. P1,940,000 b. P1,965,000 c. P1,890,000 d. P1,990,000 On January 1, 2002 X issued 1,000 of its P1,000 face value bonds for P1,500,000. Each bond had 4 detachable warrants eligible for the purchase of one share each of Xs P50 par value common stock for P60. At date of issue of bonds, the following market value are known: - Xs bonds, ex-warrant - Warrant - Common stock of X P1,330 P 17.50 each P 55.42 C

What is the amount to be reported as bond liability in the X balance sheet at date of issue? a. 1,425,000 b. 1,430,000 c. 1,439.996 d. 1,479,808 On November 1, 2002, Mason Corporation issued P4,000,000 of its 10-year, 8% term bonds dated October 1, 2002. The bonds were sold to yield 10% with the total proceeds of P3,500,000 plus accrued interest. Interest is paid every April1 and October 1. What should Mason report for interest payable in its December 31, 2002, balance sheet? a. 53,333 b. 80,000 c. 87,500 d. 100,000 Rich, Inc. acquired 30% of Doane Corp.'s voting stock on January 1, 2010 for P400,000. During 2010, Doane earned P160,000 and paid dividends of P100,000. Rich's 30% interest in Doane gives Rich the ability to exercise significant influence over Doane's operating and financial policies. During 2011, Doane earned P200,000 and paid dividends of P60,000 on April 1 and P60,000 on October 1. On July 1, 2011, Rich sold half of its stock in Doane for P264,000 cash. The carrying amount of this investment in Rich's December 31, 2010 balance sheet should be a. P400,000. b. P418,000. c. P448,000. d. P460,000. Norling Corporation reports the following information: Net income Dividends on common stock Dividends on preferred stock Weighted average common shares outstanding P500,000 140,000 60,000 200,000

Norling should report earnings per share of a. P1.50. b. P1.80 c. P2.20. d. P2.50. In a quasi-reorganization, a debit balance in Retained Earnings (a deficit) is eliminated by a. reducing paid-in capital or reorganization capital. b. reducing future depreciation charges. c. issuing more capital stock. d. writing down assets to lower, but fair, values. A machine of X is overhauled at cost of 1,600,000. The overhauling resulted to increase in production capacity of the

A 1

FINANCIAL ACCOUNTING machine. The machine was originally acquired at cost of P7,000,000 and the depreciated book value before overhauling was P5,600,000. If new similar machine would be purchased, it would have a cash price of 3,500,000. What amount should X recognized as retirement loss? a. 1,280,000 b. 1,600,000 c. 1,900,000 d. 2,100,000 The Magic Lamp Corporation was incorporated on January 1, 2002, with following authorized capitalization: 40,000 shares of common stock, no par value, stated value P40 per share 10,000 shares of 5% cumulative preferred stock, par value of P10 per share During 2002, Magic Lamp issued 24,000 shares of common stock for a total of P1,200,000 and 6,000 shares of preferred stock at P16 per share. In addition, on December 19,2002, subscriptions for 2,000 shares of preferred stock were taken at a purchase price of P17. These subscribed shares were paid for on January 4, 2003. What should Magic Lamp report as total contributed capital on its December 31, 2002 balance sheet? a. 1,040,000 b. 1,262,000 c. 1,296,000 d. 1,330,000 Ventura Corporation purchased machinery on January 1, 2009 for P630,000. The company used the sum-of-theyears-digits method and no salvage value to depreciate the asset for the first two years of its estimated six-year life. In 2010, Ventura changed to the straight-line depreciation method for this asset. The following facts pertain: 2009 2010 Straight-line P105,000 P105,000 Sum-of-the-years-digits 180,000 150,000 The amount that Ventura should report for depreciation expense on its 2011 income statement is a. P120,000. b. P105,000. c. P75,000. d. none of the above. Pastel Co. purchased a patent on January 1, 1999, for P714, 000. The patent was being amortized over its remaining legal life of 15 years expiring on January 1, 2008. During 2002, Pastel determined that the economic benefits of the patent would not last longer than 10 years from the date of acquisition. What amount should be charged to patent amortization expense for the year ended December 31, 2002? a. P47,600 b. P68,000 c. P81,600 d. P142,800 The stockholders equity of S Corp. shows the following balances on December 31, 2003: 10% Preferred stock, cumulative and non participating, P100 par, with liquidation value of P110, 20,000 shares.. P2,000,000 Common stock, P100 par, 30,000 shares. 3,000,000 Subscribed Common stock. 1,000,000 Subscription Receivable. 600,000 Treasury stock, 5,000 of common, at cost. 400,000 APIC.. 660,000 Retained earnings.. 1,580,000 What is the book value per share of common stocks, assuming preferred dividends are in arrears since 2001? a. 144.00 b. 149.70 c. 155.42 d. 161.14 In 2010, Benfer Corporation reported net income of P350,000. It declared and paid common stock dividends of P40,000 and had a weighted average of 70,000 common shares outstanding. Compute the earnings per share to the nearest cent. a. P4.43 b. P3.50 c. P4.50 d. P5.00 On January 1, 2011, M Company granted 90,000 stock options to certain executives. The options are exercisable no sooner than December 31, 2013 and expire on January 1, 2017. Each option can be exercised to acquire one share of P1 par common stock for P12. An option-pricing model estimates the fair value of the options to be P5 on the date of grant. If unexpected turnover in 2012 caused the company to estimate that 10% of the options would be forfeited, what amount should M recognize as compensation expense for 2012? A. P30,000 2

10

11

12

13

14

15

FINANCIAL ACCOUNTING B. P60,000 C. P120,000 D. P150,000 On October 1, 2005, Bitoy Company purchased a machine for P250,000 that was placed in service on November 30, 2005. Bitoy incurred additional costs for this machine, as follows: Shipping 10,000 Installation 15,000 Testing 35,000 In Bitoys December 31, 2005 balance sheet, the machines cost should be reported at a. 250,000 b. 295,000 c. 300,000 d. 310,000 During 2006, Kiyen Company made the following expenditures relating to its plant building: Repainted the plant building 110,000 Major improvements in the electrical wiring 100,000 Partial replacement of roof tiles 80,000 Continuing and frequent repairs 200,000 How much should be capitalized in the above expenditures a. 490,000 b. 290,000 c. 180,000 d. 100,000 Queenie Corporation was incorporated on January 2, 2007. The following information pertaining to Queenies ordinary stock transactions: 1/2/07 Number of shares authorized 1/1/07 Number of shares issued 7/1/07 Number of shares reacquired but not canceled 12/1/07 Two-for-one stock split 80,000 60,000 5,000

16

17

18

19

20

What is the number of shares of Queenies ordinary share outstanding at December 31, 2007? a. 150,000 b. 120,000 c. 115,000 d. 110,000 On January 1, 2006, Goll Corp. issued 1,000 of its 10%, P1,000 bonds for P1,040,000. These bonds were to mature on January 1, 2016 but were callable at 101 any time after December 31, 2009. Interest was payable semi-annually on July 1 and January 1. On July 1, 2011, Goll called all of the bonds and retired them. Bond premium was amortized on a straight-line basis. Before income taxes, Goll's gain or loss in 2011 on this early extinguishment of debt was a. P30,000 gain. b. P12,000 gain. c. P10,000 loss. d. P8,000 gain. The following accounts were abstracted from Starr Co.'s unadjusted trial balance at December 31, 2010: Debit Credit Accounts receivable P750,000 Allowance for uncollectible accounts 8,000 Net credit sales P3,000,000 Starr estimates that 2% of the gross accounts receivable will become uncollectible. After adjustment at December 31, 2010, the allowance for uncollectible accounts should have a credit balance of a. P60,000. b. P52,000. c. P23,000. d. P15,000. Percy Corporation was organized on January 1, 2010, with an authorization of 1,200,000 shares of common stock with a par value of P6 per share. During 2010, the corporation had the following capital transactions: January 5 July 28 December 31 issued 675,000 shares @ P10 per share purchased 90,000 shares @ P11 per share sold the 90,000 shares held in treasury @ P18 per share

21

22

Percy used the cost method to record the purchase and reissuance of the treasury shares. What is the total amount of additional paid-in capital as of December 31, 2010? a. P-0-. b. P2,070,000. c. P2,700,000. d. P3,330,000. On March 30, 2007, Mitz Co. declared a 30% ordinary share dividend. Shares were selling on the market on this date at P25 per share. The par value is Pl0 per share and 180,000 shares are outstanding. In distributing the stock

B 3

FINANCIAL ACCOUNTING dividend, Mitz Co. Issued fractional share warrants totaling 600 shares. Assuming that 60% of the warrants are exercised and the remaining warrants expire, the entry to record the exercise and expiration of the fractional share warrants is a. Fractional Share Warrants Issued 15,000 Ordinary Share 9,000 PIC from Forfeited Warrants 6,000 b. Fractional Share Warrants Issued 6,000 Ordinary Share 3,600 PIC from Forfeited Warrants 2,400 c. Fractional Share Warrants Issued 15,000 Ordinary Share 3,600 PIC from Forfeited Warrants 11,400 d. Fractional Share Warrants Issued 15,000 Ordinary Share 15,000 The directors of Pete Corporation, whose P50 par value ordinary share is currently selling at P70 per share, have decided to issue a stock dividend. Pete has an authorization for 250,000 ordinary shares, has issued 100,000 shares of which 10,000 shares are now held as treasury, and desires to capitalize P945,000 of the Retained Earnings balance. To accomplish this, the percentage of stock dividend that the directors should declare is a. 18.9% b. 15% c. 12% d. 9% Crane Company reported an impairment loss of P2,200,000 in its income statement for the year then ended December 31, 2005. This loss was related to an item of PPE acquired on January 1, 2004 with useful life of 10 years and residual value of P200,000. On December 31, 2005 balance sheet, Crane reported these PPE at P6,000,000 which is the fair value on that date. The original acquisition cost of the PPE is a. 8,200,000 b. 9,800,000 c. 10,200,000 d. 10,950,000 Darrell Joe purchases a patent from Ziggy on January 2, 2004. For P64,000. The patent has remaining legal life of 16 years at date of purchase. Darrell Joe feels the patent will be useful for 10 years. What should be the carrying value of the Patent in the books of Darrell Joe at the end of December, 2005? a. P51,200 b. P56,000 c. P57,600 d. P60,000 Consider the following: Cash in Bank checking account of P13,500, Cash on hand of P500, Post-dated checks received totaling P3,500, and Certificates of deposit totaling P124,000. How much should be reported as cash in the balance sheet? a. P 13,500. b. P 14,000. c. P 17,500. d. P131,500 The bonus agreement of Christian Company provides that the general manager shall receive an annual bonus of 10% of the net income after bonus and after tax. The income tax rate is 32%. How much should the general manager receive for the year as bonus if the pre-tax income after bonus is P2,500,000? a. 80,000 b. 153,000 c. 170,000 d. 250,000 Which of the following facts concerning plant assets should be included in the summary of significant accounting policies? Depreciation Method Composition a. No Yes b. Yes Yes c. Yes No d. No No On July 1, 2010, Nall Co. issued 2,500 shares of its P10 par common stock and 5,000 shares of its P10 par convertible preferred stock for a lump sum of P125,000. At this date Nall's common stock was selling for P24 per share and the convertible preferred stock for P18 per share. The amount of the proceeds allocated to Nall's preferred stock should be a. P62,500. b. P75,000. c. P90,000. d. P68,750. On October 1, 2002, Dean Company leased office space at a monthly rental of P30,000 for 10 years expiring September 30, 2012. As an inducement for Dean to enter into the lease, the lessor permitted Dean to occupy the premises rent-free from October 1 to December 31, 2002. for the year ended December 31, 2002, Dean should record

23

24

25

26

27

28

29

30

C 4

FINANCIAL ACCOUNTING rent expense of a. 0 b. 29,250 c. 87,750 d. 90,000 The mining property was acquired at cost of P12,000,000. It has estimated life of 5 years. After exploration cost of P1,000,000, it was developed at cost of P1,500,000 (intangible). AT the end of its life, the property could be sold for P3,000,000 after restoration cost of P500,000. Confirmed deposit is at 40,000,000 units. For its 1st year of operation, 7,500,000 units were produced at production cost of P5,250,000. 7,125,000 of production were sold during the year. The depletion cost in the inventory is a. 112,500 b. 140,625 c. 262,500 d. 2,137,500 On the December 31, 2010 balance sheet of Vanoy Co., the current receivables consisted of the following: Trade accounts receivable Allowance for uncollectible accounts Claim against shipper for goods lost in transit (November 2010) Selling price of unsold goods sent by Vanoy on consignment at 130% of cost (not included in Vanoy 's ending inventory) Security deposit on lease of warehouse used for storing some inventories Total P 75,000 (2,000) 3,000 26,000 30,000 P132,000

31

32

33

At December 31, 2010, the correct total of Vanoy's current net receivables was a. P76,000. b. P102,000. c. P106,000. d. P132,000. Honey Company has a herd of 10 2-year old animals on January 1, 2010. One animal aged 2.5 years was purchased on July 1, 2010 for P108, and one animal was born on July 1, 2010. No animals were sold or disposed of during the year. The fair value less cost to sell per unit is as follows: 2-year old animal on January 1 2.5-year old animal on July 1 New born animal on July 1 2- year old animal on December 31 2.5 year old on December 31 Newborn on December 31 3 year old on December 31 .5 year old on December 31 100 108 70 105 111 72 120 80

34

35

36

What is the gain from change in fair value of biological assets that should be recognized in 2010? a. 222 b. 292 c. 300 d. 332 To save transportation costs, X acquired its needed equipment in exchange of its inventory located in the suppliers business place. The equipment acquired has cash price of P650,000. The inventory of X has cost of P550,000, and X paid P80,000 cash for the difference in fair value of the two assets in exchange. In the books of X, the exchange is to be accounted as resulting to a. gain of P20,000 b. loss of P20,000 c. gain of P30,000 d. loss of P30,000 On June 1, 2010, Nott Corp. loaned Horn P400,000 on a 12% note, payable in five annual installments of P80,000 beginning January 2, 2011. In connection with this loan, Horn was required to deposit P5,000 in a noninterestbearing escrow account. The amount held in escrow is to be returned to Horn after all principal and interest payments have been made. Interest on the note is payable on the first day of each month beginning July 1, 2010. Horn made timely payments through November 1, 2010. On January 2, 2011, Nott received payment of the first principal installment plus all interest due. At December 31, 2010, Nott's interest receivable on the loan to Horn should be a. P0. b. P4,000. c. P8,000. d. P12,000. For the year ended December 31, 2010, Transformers Inc. reported the following: Net income Preferred dividends declared Common dividend declared P 60,000 10,000 2,000

FINANCIAL ACCOUNTING Unrealized holding loss, net of tax 1,000 Retained earnings, beginning balance 80,000 Common stock 40,000 Accumulated Other Comprehensive Income, Beginning Balance 5,000 What would Transformers report as total stockholders' equity? a. P172,000 b. P168,000 c. P128,000 d. P120,000 A P5,000,000 face value bonds were issued to acquire a building. At the time of acquisition, the fair value of the building is properly determined at P5,300,000 and the bonds are quoted at 110. The building is depreciated under the double declining method of depreciation with estimated economic life of 25 years and scrap value of P200,000. This was sold for P4,500,000 at end of its 2nd year . The gain (loss ) from sale is a. 14,080 b. 268,000 c. 183,360 d. (155,200) On December 1, 2010, Hogan Co. purchased a tract of land as a factory site for P800,000. The old building on the Property was razed, and salvaged materials resulting from demolition were sold. Additional costs incurred and salvage proceeds realized during December 2010 were as follows: Cost to raze old building Legal fees for purchase contract and to record ownership Title guarantee insurance Proceeds from sale of salvaged materials P70,000 10,000 16,000 8,000

37

38

39

40

In Hogan 's December 31, 2010 balance sheet, what amount should be reported as land? a. P826,000. b. P862,000. c. P888,000. d. P896,000. BoyD Company received Land as donation from its shareholder. At date of donation, the land has fair value of P1,000,000. The legal and documentation expenses to transfer the title amounted to P25,000 at the expense of BoyD Company. The land was previously acquired by the donor stockholder at P750,000. BoyD should record the land at a. 1,025,000 b. 1,000,000 c. 775,000 d. 750,000 Turner Corporation had the following information in its financial statements for the year ended 2010 and 2011: Cash dividends for the year 2011 Net income for the year ended 2011 Market price of stock, 12/31/11 Common stockholders equity, 12/31/10 Common stockholders equity, 12/31/11 Outstanding shares, 12/31/11 Preferred dividends for the year ended 2011 P 15,000 124,000 24 2,200,000 2,400,000 120,000 30,000

41

What is the book value per share for Turner Corporation for the year ended 2011? a. P19.17 b. P20.00 c. P10.43 d. P24.00 During 2010, Eaton Co. introduced a new product carrying a two-year warranty against defects. The estimated warranty costs related to peso sales are 2% within 12 months following sale and 4% in the second 12 months following sale. Sales and actual warranty expenditures for the years ended December 31, 2010 and 2011 are as follows: Sales P 800,000 1,000,000 P1,800,000 Actual Warranty Expenditures P12,000 30,000 P42,000

2010 2011

42

At December 31, 2011, Eaton should report an estimated warranty liability of a. P0. b. P10,000. c. P30,000. d. P66,000. An enterprise receives grant of P15,000,000 from the government as subsidy to defray safety and environmental costs within the area where the enterprise is located. The safety and environmental costs are expected to be incurred

A 6

FINANCIAL ACCOUNTING over four years as follows: Year 1 Year 2 Year 3 Year 4 P 2,000,000 4,000,000 6,000,000 8,000,000

43

The amount to be reported as in year 1 Income Statement as other Income from government grant is a. 1,500,000 b. 2,000,000 c. 3,750,000 d. 15,000,000 The stockholders equity of May Co. revealed the following on January 1, 2007: Preference Share, P100 par value Paid-in Capital in Excess of Par - Preference Ordinary Share, P15 par value Paid-in Capital in Excess of Par Ordinary Subscribed Ordinary Share Retained Earnings Notes Payable Subscription Receivable Ordinary P230,000 80,500 525,000 275,000 5,000 190,000 400,000 40,000

44

45

46

47

How much is the legal capital of the company? a. P1.3055M b. P1.115M c. P0.76M d. P0.755M Under the allowance method of recognizing uncollectible accounts, the entry to write off an uncollectible account a. increases the allowance for uncollectible accounts. b. has no effect on the allowance for uncollectible accounts. c. has no effect on net income. d. decreases net income. The accounting process is correctly sequenced as a. identification, communication, recording. b. recording, communication, identification. c. identification, recording, communication. d. communication, recording, identification. Laker, Inc. had outstanding 10 percent P1, 000,000 face value, convertible bonds maturing on December 31, 2005. Interest is paid December 31 and June 30. After amortization through June 340, 2002 the unamortized balance in the bond premium account was P30, 000. On that date, bonds with a face amount of P500, 000 were converted into 20, 000 shares of P20 par common stock, recording the conversion by using the value of the bonds, Laker should credit Additional Paid in Capital for a. P0 b. P85, 000 c. P100, 000 d. P115, 000 Tresh, Inc. had the following bank reconciliation at March 31, 2010: Balance per bank statement, 3/31/10 Add: Deposit in transit Less: Outstanding checks Balance per books, 3/31/10 Data per bank for the month of April 2010 follow: Deposits Disbursements P37,200 10,300 47,500 12,600 P34,900 P46,700 49,700

48

All reconciling items at March 31, 2010 cleared the bank in April. Outstanding checks at April 30, 2010 totaled P6,000. There were no deposits in transit at April 30, 2010. What is the cash balance per books at April 30, 2010? a. P28,200 b. P31,900 c. P34,200 d. P38,500 On January 1, 2010, Culver Corporation had 110,000 shares of its P5 par value common stock outstanding. On June 1, the corporation acquired 10,000 shares of stock to be held in the treasury. On December 1, when the market price of the stock was P8, the corporation declared a 10% stock dividend to be issued to stockholders of record on December 16, 2010. What was the impact of the 10% stock dividend on the balance of the retained earnings account? a. P50,000 decrease b. P80,000 decrease

FINANCIAL ACCOUNTING c. P88,000 decrease d. No effect Anders, Inc., has 5,000 shares of 5%, P100 par value, cumulative preferred stock and 20,000 shares of P1 par value common stock outstanding at December 31, 2011. There were no dividends declared in 2009. The board of directors declares and pays a P45,000 dividend in 2010 and in 2011. What is the amount of dividends received by the common stockholders in 2011? a. P15,000 b. P25,000 c. P45,000 d. P0 The stockholders equity of J Corp. on December 31, 2003 shown the following balances: 10% Preferred stock, 5,000 shares, P100 par P500,000 12% Preferred stock, 6,000 shares, P100 par 600,000 Common stock, 10,000 shares, P40 par 400,000 APIC 320,000 Retained Earnings. 480,000 The 10% Preferred stock is cumulative and fully participating, while the 12% preferred stock is non cumulative and fully participating. Dividends in arrears are 2 years. What is the book value per share of common stock? a. 44.00 b. 59.68 c. 60.27 d. 102.80 Long Co. issued 100,000 shares of P10 par common stock for P1,200,000. Long acquired 8,000 shares of its own common stock at P15 per share. Three months later Long sold 4,000 of these shares at P19 per share. If the cost method is used to record treasury stock transactions, to record the sale of the 4,000 treasury shares, Long should credit a. Treasury Stock for P76,000. b. Treasury Stock for P40,000 and Paid-in Capital from Treasury Stock for P36,000. c. Treasury Stock for P60,000 and Paid-in Capital from Treasury Stock for P16,000. d. Treasury Stock for P60,000 and Paid-in Capital in Excess of Par for P16,000. For the year ended December 31, 2010, Dent Co. estimated its allowance for uncollectible accounts using the year-end aging of accounts receivable. The following data are available: Allowance for uncollectible accounts, 1/1/10 P56,000 Provision for uncollectible accounts during 2010 (2% on credit sales of P2,000,000) 40,000 Uncollectible accounts written off, 11/30/10 46,000 Estimated uncollectible accounts per aging, 12/31/10 69,000 After year-end adjustment, the uncollectible accounts expense for 2010 should be a. P46,000. b. P62,000. c. P69,000. d. P59,000. East company manufactures stereo systems that carry a two-year warranty against defects. Based on the past experience, warranty costs are estimated at 5% of sales for the warranty period. During 2006, stereo system sales amounted to P5,000,000 and warranty costs of P100,000 were incurred. In its income statement for the year ended December 31,2006 East should report warranty expense of a. 125,000 b. 100,000 c. 150,000 d. 250,000 On January 1, year 1, the firm purchased for P2,400,000 a machine with useful life of 10 years, no scrap value. The machine was depreciated by the double declining balance method and the carrying amount of the machine was P1,536,000 on December 31, year 2. The firm can justify the change to straight line method of depreciation effective January 1, year 3. What would be the depreciation expense for year 3? a. 307,200 b. 240,000 c. 192,000 d. 153,600 X constructed its own building at a total labor, materials and overhead costs of P5,000,000, which was started January 1 and completed December 31 of the same year. During construction, the following loans are outstanding during the year, which are partly used in construction and partly used in regular operation: Principal amount Interest Rate P1,000,000 10% Construction costs for the year are as follows: Principal amount Date taken P2,000,000 Jan.1 1,000,000 April 1 1,000,000 July 1

49

50

51

52

53

54

55

FINANCIAL ACCOUNTING 1,000,000 Oct. 1 The capitalized borrowing costs as part of building cost is a. 350,000 b. 240,000 c. 140,000 d. 100,000 The company issued 10,000 5-year bonds, face value P500 each, sold at 105. Each bond is carrying a warrant that permits the bondholder to purchase 10 common shares, P50 par value, at P55 per share. At the date of issuance, the market value of bonds, ex-warrant was 98. 40% of the warrants were exercised 12 months after the bonds were issued and when the price for each share of common stock was P60. Upon the exercise of 40% stock warrants, what is the book value of remaining bonds if the issue date and date of bonds are the same? a. 4,880,000 b. 4,920,000 c. 5,060,000 d. 4,780,000 The following info pertain to X company which is to be acquired by Y company: BOOK VALUE CURRENT VALUE Tangible assets 1,500,000 2,000,000 Intangible, w/o goodwill 500,000 1,000,000 Liabilities.. 1,500,000 1,500,000 Normal rate of earning is 8% Xs expected earnings is at 14% per year for 5 years. What is the goodwill if agreed as equal to purchase of average excess earnings for 5 years? a. 90,000 b. 210,000 c. 350,000 d. 450,000 Torrey Co. manufactures equipment that is sold or leased. On December 31, 2011, Torrey leased equipment to Dalton for a five-year period ending December 31, 2016, at which date ownership of the leased asset will be transferred to Dalton. Equal payments under the lease are P220,000 (including P20,000 executory costs) and are due on December 31 of each year. The first payment was made on December 31, 2011. Collectibility of the remaining lease payments is reasonably assured, and Torrey has no material cost uncertainties. The normal sales price of the equipment is P770,000, and cost is P600,000. For the year ended December 31, 2011, what amount of income should Torrey realize from the lease transaction? a. P170,000 b. P220,000 c. P230,000 d. P330,000 Goren Corporation had the following amounts, all at retail: Beginning inventory Purchase returns Abnormal shortage Sales Employee discounts P 3,600 6,000 4,000 72,000 1,600 Purchases Net markups Net markdowns Sales returns Normal shortage P100,000 18,000 2,800 1,800 2,600

56

57

58

59

60

What is Gorens ending inventory at retail? a. P34,400. b. P36,000. c. P37,600. d. P38,400 Robertson Inc. bought a machine on January 1, 2000 for P300,000. The machine had an expected life of 20 years and was expected to have a salvage value of P30,000. On July 1, 2010, the company reviewed the potential of the machine and determined that its undiscounted future net cash flows totaled P150,000 and its discounted future net cash flows totaled P105,000. If no active market exists for the machine and the company does not plan to dispose of it, what should Robertson record as an impairment loss on July 1, 2010? a. P 0 b. P 8,250 c. P15,000 d. P53,250

Вам также может понравиться

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)От EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)От EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Рейтинг: 5 из 5 звезд5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)От EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Оценок пока нет

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)От EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Рейтинг: 5 из 5 звезд5/5 (1)

- Financial Accounting TestbankДокумент34 страницыFinancial Accounting Testbankemilio_ii71% (14)

- Essentials of Financial Management 3rd Edition Brigham Solutions ManualДокумент14 страницEssentials of Financial Management 3rd Edition Brigham Solutions ManualDavidWilliamsxwdgs100% (14)

- College of Accountancy Final Examination Acctg 206A InstructionsДокумент4 страницыCollege of Accountancy Final Examination Acctg 206A InstructionsCarmela TolinganОценок пока нет

- Financial Accounting and Reporting Ii Final Quiz 2/3Документ7 страницFinancial Accounting and Reporting Ii Final Quiz 2/3Patrick Ferdinand Alvarez50% (2)

- Chapters-1-10-Exam-Problem (2) Answer JessaДокумент6 страницChapters-1-10-Exam-Problem (2) Answer JessaLynssej BarbonОценок пока нет

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeОт EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeОценок пока нет

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideОт EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideОценок пока нет

- Agabin Chapter 12 - Globalization Back To The FutureДокумент3 страницыAgabin Chapter 12 - Globalization Back To The FutureCarl AngeloОценок пока нет

- Financial Management For Public Health and Not-For-Profit Organizations 4th Edition Finkler Solutions Manual DownloadДокумент10 страницFinancial Management For Public Health and Not-For-Profit Organizations 4th Edition Finkler Solutions Manual DownloadPeter Baker100% (25)

- College of Accountancy Final Examination Acctg 206B InstructionsДокумент4 страницыCollege of Accountancy Final Examination Acctg 206B InstructionsJERROLD EIRVIN PAYOPAYОценок пока нет

- Acctg 5Документ6 страницAcctg 5Charmane MatiasОценок пока нет

- Abc 6Документ4 страницыAbc 6Kath LeynesОценок пока нет

- p1 Midterm 2012Документ8 страницp1 Midterm 2012marygraceomacОценок пока нет

- FarДокумент64 страницыFarBrevin PerezОценок пока нет

- Quiz AppliedДокумент12 страницQuiz AppliedLharissa Ballesteros100% (1)

- Name: - Score: - Year/Course/Section: - ScheduleДокумент10 страницName: - Score: - Year/Course/Section: - ScheduleYukiОценок пока нет

- Quiz BowlДокумент3 страницыQuiz BowljayrjoshuavillapandoОценок пока нет

- Prac. 1Документ15 страницPrac. 1Lalaine De JesusОценок пока нет

- #Test Bank - Finc - L Acctg. 2 - 3 (V)Документ34 страницы#Test Bank - Finc - L Acctg. 2 - 3 (V)Nhaj100% (1)

- Far Probs - EvaluationДокумент7 страницFar Probs - EvaluationArvin John Masuela100% (1)

- Asset To LiabДокумент25 страницAsset To LiabHavanaОценок пока нет

- IA2 Finals ReviewerДокумент6 страницIA2 Finals ReviewerJoana MarieОценок пока нет

- Financial Quali - AДокумент9 страницFinancial Quali - ACarl AngeloОценок пока нет

- Final Exam Fin 2Документ3 страницыFinal Exam Fin 2ma. veronica guisihanОценок пока нет

- Quiz-Intercompany: C. Gain On Sale 70,000 Truck 50,000 Accum. Depreciation 113,636 Depreciation 6,364Документ2 страницыQuiz-Intercompany: C. Gain On Sale 70,000 Truck 50,000 Accum. Depreciation 113,636 Depreciation 6,364Richard Rhamil Carganillo Garcia Jr.Оценок пока нет

- Acctg 13 - Unit Test Final Answer KeyДокумент4 страницыAcctg 13 - Unit Test Final Answer Keyjohn.18.wagasОценок пока нет

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationДокумент6 страницEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanОценок пока нет

- Resa P2 Final April 2008Документ15 страницResa P2 Final April 2008Arianne Llorente100% (1)

- PRE BATTERY EXAM 2018 Part 1 FARДокумент11 страницPRE BATTERY EXAM 2018 Part 1 FARFrl RizalОценок пока нет

- FAR 2&3 Test BankДокумент63 страницыFAR 2&3 Test BankRachelle Isuan TusiОценок пока нет

- P1 2ND Preboard PDFДокумент9 страницP1 2ND Preboard PDFmaria evangelistaОценок пока нет

- National Mock Board Examination 2017 Auditing: A. Consolidated Net Profit After Tax Attributable To ParentДокумент13 страницNational Mock Board Examination 2017 Auditing: A. Consolidated Net Profit After Tax Attributable To ParentKez MaxОценок пока нет

- Midterm Exam 1Документ14 страницMidterm Exam 1Erisa MeloraОценок пока нет

- ACP Task 3 (20230328164424)Документ2 страницыACP Task 3 (20230328164424)Roque LestieОценок пока нет

- PARCOR DiscussionДокумент6 страницPARCOR DiscussionSittiОценок пока нет

- Quiz 1Документ2 страницыQuiz 1mkrisnaharq99Оценок пока нет

- RESA 1st PBДокумент9 страницRESA 1st PBRay Mond0% (1)

- Difficult Level Corpo-Drill3Документ4 страницыDifficult Level Corpo-Drill3julsОценок пока нет

- 2022 Accele4 M5 AssignmentДокумент6 страниц2022 Accele4 M5 AssignmentPYM MataasnakahoyОценок пока нет

- Practical Accounting IiДокумент18 страницPractical Accounting IiFerb CruzadaОценок пока нет

- Pract 1Документ22 страницыPract 1Ros Yaj NivrameОценок пока нет

- AP - Shareholders Equity PDFДокумент5 страницAP - Shareholders Equity PDFJasmin NgОценок пока нет

- Practical Accounting 2: 2011 National Cpa Mock Board ExaminationДокумент6 страницPractical Accounting 2: 2011 National Cpa Mock Board ExaminationMary Queen Ramos-UmoquitОценок пока нет

- Final Activity in Financial Accounting, PT 2 (ACCL04B)Документ4 страницыFinal Activity in Financial Accounting, PT 2 (ACCL04B)hae1234Оценок пока нет

- FAR-01 Contributed CapitalДокумент3 страницыFAR-01 Contributed CapitalKim Cristian MaañoОценок пока нет

- Bfjpia Cup 2 - Practical Accounting 1 Easy: Page 1 of 10Документ10 страницBfjpia Cup 2 - Practical Accounting 1 Easy: Page 1 of 10kristelle0marisseОценок пока нет

- Level 1 Questions FinalДокумент10 страницLevel 1 Questions FinalExequielCamisaCrusperoОценок пока нет

- p1 AДокумент8 страницp1 Aincubus_yeahОценок пока нет

- Audit Qualifying Exam 1 1Документ12 страницAudit Qualifying Exam 1 1Fery AnnОценок пока нет

- Cebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekДокумент23 страницыCebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekIzzy BОценок пока нет

- Compre RevДокумент7 страницCompre RevGellez Hannah MarieОценок пока нет

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsОт EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsОценок пока нет

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020От EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Оценок пока нет

- Using Economic Indicators to Improve Investment AnalysisОт EverandUsing Economic Indicators to Improve Investment AnalysisРейтинг: 3.5 из 5 звезд3.5/5 (1)

- Project Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityОт EverandProject Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityРейтинг: 4 из 5 звезд4/5 (2)

- 069 - Aguilar V CAДокумент6 страниц069 - Aguilar V CACarl AngeloОценок пока нет

- 006 - Burgos V Chief of StaffДокумент7 страниц006 - Burgos V Chief of StaffCarl AngeloОценок пока нет

- SECTION 2. Objectives: Application Form), Tax Residency Certificate (TRC) Duly Issued by The ForeignДокумент13 страницSECTION 2. Objectives: Application Form), Tax Residency Certificate (TRC) Duly Issued by The ForeignCarloAysonОценок пока нет

- Partnership Law ExamДокумент4 страницыPartnership Law ExamCarl AngeloОценок пока нет

- 090 - Sps Llobrera V FernandezДокумент6 страниц090 - Sps Llobrera V FernandezCarl AngeloОценок пока нет

- 006 - Burgos V Chief of StaffДокумент1 страница006 - Burgos V Chief of StaffCarl AngeloОценок пока нет

- 090 - Sps Llobrera V FernandezДокумент2 страницы090 - Sps Llobrera V FernandezCarl AngeloОценок пока нет

- 090 People Vs Siton DigestДокумент2 страницы090 People Vs Siton DigestCarl AngeloОценок пока нет

- 027 - Province of Zamboanga Del Norte V City of ZamboangaДокумент4 страницы027 - Province of Zamboanga Del Norte V City of ZamboangaCarl AngeloОценок пока нет

- 087 BPI v. CA CompensationДокумент2 страницы087 BPI v. CA CompensationCarl AngeloОценок пока нет

- 085 - BPI v. ReyesДокумент2 страницы085 - BPI v. ReyesCarl AngeloОценок пока нет

- 169 - People V Aida MarquezДокумент2 страницы169 - People V Aida MarquezCarl AngeloОценок пока нет

- 009 Pangasinan V AlmazoraДокумент2 страницы009 Pangasinan V AlmazoraCarl AngeloОценок пока нет

- 208 - Lozano Vs Martinez DigestДокумент2 страницы208 - Lozano Vs Martinez DigestCarl AngeloОценок пока нет

- 159 - Bongalon V PeopleДокумент1 страница159 - Bongalon V PeopleCarl AngeloОценок пока нет

- 129 - Serrano V PeopleДокумент2 страницы129 - Serrano V PeopleCarl AngeloОценок пока нет

- 202 - Allied Banking Corp Vs Ordonez DigestДокумент2 страницы202 - Allied Banking Corp Vs Ordonez DigestCarl AngeloОценок пока нет

- 163 Frenzel Vs Catito DigestsДокумент2 страницы163 Frenzel Vs Catito DigestsCarl AngeloОценок пока нет

- Broadway Vs Tropical Hut DigestДокумент2 страницыBroadway Vs Tropical Hut DigestCarl AngeloОценок пока нет

- 189 - People Vs Pulusan DigestДокумент2 страницы189 - People Vs Pulusan DigestCarl AngeloОценок пока нет

- Ferdinand Marcos/Imelda Marcos V Republic of The Philippines (Presidential Commission On Good Government)Документ2 страницыFerdinand Marcos/Imelda Marcos V Republic of The Philippines (Presidential Commission On Good Government)Carl AngeloОценок пока нет

- National Power Corporation Vs CA DigestДокумент2 страницыNational Power Corporation Vs CA DigestCarl AngeloОценок пока нет

- 155 - Limketkai vs. CA DigestДокумент2 страницы155 - Limketkai vs. CA DigestCarl AngeloОценок пока нет

- 153 - Cadwallader Vs Smith, Bell DigestДокумент1 страница153 - Cadwallader Vs Smith, Bell DigestCarl AngeloОценок пока нет

- 225 Gonzales V Office of The PresidentДокумент3 страницы225 Gonzales V Office of The PresidentCarl AngeloОценок пока нет

- Consing V CAДокумент2 страницыConsing V CACarl AngeloОценок пока нет

- Justifying Circumstance SummaryДокумент5 страницJustifying Circumstance SummaryCarl Angelo100% (1)

- De Guia Vs Manila Electric CoДокумент2 страницыDe Guia Vs Manila Electric CoCarl AngeloОценок пока нет

- 152 Lidasan V ComelecДокумент2 страницы152 Lidasan V ComelecCarl AngeloОценок пока нет

- Modern Portfolio Theory and Investment Analysis 9th Edition Elton Test BankДокумент7 страницModern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bankamywrightrcnmqbajyg100% (13)

- Horizontal and Vertical Dis AllowanceДокумент12 страницHorizontal and Vertical Dis Allowancesuhaspujari93Оценок пока нет

- Acai Chapter 17 QuestionnairesДокумент5 страницAcai Chapter 17 QuestionnairesKathleenCusipagОценок пока нет

- Fin358 Chap 4 BondДокумент5 страницFin358 Chap 4 Bondsyaiera aqilahОценок пока нет

- Crack Grade B: Monthly Current AffairsДокумент130 страницCrack Grade B: Monthly Current AffairsRajat ChoureyОценок пока нет

- WEEK-4 MAT1 StocksBondsДокумент14 страницWEEK-4 MAT1 StocksBondsClarence MartinezОценок пока нет

- Fnbslw444 - Case StudyДокумент5 страницFnbslw444 - Case Studyinfobrains05Оценок пока нет

- The IB Business of Trading Prime BrokerageДокумент78 страницThe IB Business of Trading Prime BrokerageNgọc Phan Thị BíchОценок пока нет

- NCM 110 Nursing Informatics Lab: Data Privacy Act Universal Health ActДокумент64 страницыNCM 110 Nursing Informatics Lab: Data Privacy Act Universal Health ActSan Michelle MoralesОценок пока нет

- Role of Sebi As A Regulatory BodyДокумент61 страницаRole of Sebi As A Regulatory Bodyneelam18100% (1)

- Asset Securitization - How Remote Is Bankruptcy RemoteДокумент25 страницAsset Securitization - How Remote Is Bankruptcy Remoteuser2127Оценок пока нет

- Module 1 Capital MarketДокумент6 страницModule 1 Capital MarketNovelyn Cena100% (1)

- Eco Lec3 Fin MathДокумент83 страницыEco Lec3 Fin MathMiguel Toriente0% (1)

- Quiz On Debt InvestmentДокумент2 страницыQuiz On Debt InvestmentYa NaОценок пока нет

- Investment and Speculation WorkДокумент5 страницInvestment and Speculation WorkWinifridaОценок пока нет

- Financial Accounting IIДокумент16 страницFinancial Accounting IIMiguel BuenoОценок пока нет

- DSP Blackrock Rajeev Gandhi Equity Saving Scheme (RGESS)Документ12 страницDSP Blackrock Rajeev Gandhi Equity Saving Scheme (RGESS)sushilbajaj23Оценок пока нет

- Credit Rating Rationale in The Distillers Industry: The Case of Brown-Forman and DiageoДокумент18 страницCredit Rating Rationale in The Distillers Industry: The Case of Brown-Forman and DiageokokoОценок пока нет

- Far FinalДокумент24 страницыFar FinalJon MickОценок пока нет

- Weygandt Managerial 6e SM Release To Printer ChAPPAДокумент19 страницWeygandt Managerial 6e SM Release To Printer ChAPPAzelОценок пока нет

- CAT T10/ FIA - FFM - Finance PassCardДокумент160 страницCAT T10/ FIA - FFM - Finance PassCardLe Duong Huy100% (3)

- ch14 Kieso IFRS4 PPTДокумент83 страницыch14 Kieso IFRS4 PPTĐức HuyОценок пока нет

- Stock Market: Over-The-Counter (OTC) or Off-Exchange Trading Is Done Directly Between TwoДокумент4 страницыStock Market: Over-The-Counter (OTC) or Off-Exchange Trading Is Done Directly Between TwoAli JumaniОценок пока нет

- Cup 6 (Audit) Comprehensive Problem IДокумент9 страницCup 6 (Audit) Comprehensive Problem IHannah AbeloОценок пока нет

- Ashwin Hedge Final ReportДокумент84 страницыAshwin Hedge Final ReportAmith KumarОценок пока нет

- Secret Currency PromoДокумент25 страницSecret Currency PromoShahrukh2687Оценок пока нет

- Outstanding SBN 2010 UploadДокумент42 страницыOutstanding SBN 2010 UploadriadhusОценок пока нет

- EN Appendix - Saving Plan (UL038)Документ8 страницEN Appendix - Saving Plan (UL038)Dai HungОценок пока нет