Академический Документы

Профессиональный Документы

Культура Документы

Solution To Ch12 P10 Build A Model

Загружено:

scuevas_10Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Solution To Ch12 P10 Build A Model

Загружено:

scuevas_10Авторское право:

Доступные форматы

Chapter 12.

Solution for Ch 12-10 Build a Model

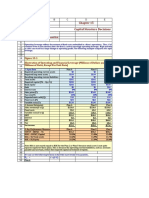

Zieber Corporation's 2010 financial statements are shown below. Forecast Zeiber's 2011 income statement and balance sheets. Use the following assumptions: (1) Sales grow by 6%. (2) The ratios of expenses to sales, depreciation to fixed assets, cash to sales, accounts receivable to sales, and inventories to sales will be the same in 2011 as in 2010. (3) Zeiber will not issue any new stock or new long-term bonds. (4) The interest rate is 9% for short-term debt and 11% for long-term debt. (5) No interest is earned on cash. (6) Dividends grow at an 8% rate. (6) Calculate the additional funds needed (AFN). If new financing is required, assume it will be raised as notes payable. Assume that any new notes payable will be borrowed on the last day of the year, so there will be no additional interest expense for the new notes payable. If surplus funds are available, pay a special dividend. a. What are the forecasted levels of notes payable and special dividends?

Key Input Data: Tax rate Dividend growth rate S-T rd L-T rd

Used in the forecast 40% 8% 9% 11%

December 31 Income Statements: (in thousands of dollars) Forecasting 2010 2010 basis Ratios $455,150 Growth $386,878 % of sales 85.000% $68,273 $14,565 % of fixed assets 8.000% $53,708 $11,880 Interest rate x beginning of year debt $41,828 $16,731 $25,097 $12,554 Growth $12,543 2011 Inputs 6.00% 85.00% 8.00% 2011 Forecast $482,459 $410,090 $72,369 $15,439 $56,930 $13,200 $43,730 $17,492 $26,238 $13,558 $0 $12,680

Sales Expenses (excluding depr. & amort.) EBITDA Depreciation and Amortization EBIT Net Interest Expense EBT Taxes (40%) Net Income Common dividends (regular dividends) Special dividends Addition to retained earnings (DRE)

8.00%

December 31 Balance Sheets (in thousands of dollars) 2010 Assets: Cash Accounts Receivable Inventories Total current assets Fixed assets $18,206 $100,133 $45,515 $163,854 $182,060 Forecasting basis % of sales % of sales % of sales % of sales 2010 Ratios 4.000% 22.000% 10.000% 40.000% 2011 Inputs 4.000% 22.000% 10.000% 40.000% Without AFN $19,298 $106,141 $48,246 $173,685 $192,984 2011 AFN

Total assets Liabilities and equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained Earnings Total common equity Total liabilities and equity

$345,914

$366,669

$31,861 % of sales $27,309 % of sales $0 Previous $59,170 $120,000 Previous $179,170 $60,000 Previous $106,745 Previous + DRE $166,745 $345,914 $0.000

7.000% 6.000%

7.000% 6.000%

$33,772 $28,948 $0 $62,720 $120,000 $182,720 $60,000 $119,424 $179,424 $362,144 $366,669 $362,144 $4,525 $4,525 $0

$4,525

Total assets = Planned liabilities and equity = Additional funds needed (AFN) = Required additional notes payable = Special dividends

Вам также может понравиться

- Chapter 13 - Build A Model SpreadsheetДокумент6 страницChapter 13 - Build A Model Spreadsheetdunno2952Оценок пока нет

- Ch12 P11 Build A ModelДокумент7 страницCh12 P11 Build A ModelRayudu RamisettiОценок пока нет

- Solution To Ch02 P15 Build A ModelДокумент3 страницыSolution To Ch02 P15 Build A ModelHaseeb Malik100% (2)

- Ch09 P18 Build A ModelДокумент2 страницыCh09 P18 Build A ModelsadolehОценок пока нет

- Ford Moto Company Ratio AnalysisДокумент7 страницFord Moto Company Ratio AnalysisEmon hassanОценок пока нет

- Assignment 2Документ3 страницыAssignment 2Lili GuloОценок пока нет

- CSU ID 2356325 Chapter 09 Cost of Capital ComponentsДокумент2 страницыCSU ID 2356325 Chapter 09 Cost of Capital Componentssadoleh83% (6)

- Ch03 P15 Build A ModelДокумент2 страницыCh03 P15 Build A ModelHeena Sudra77% (13)

- Ch06 P15 Build A ModelДокумент5 страницCh06 P15 Build A ModelChintan PatelОценок пока нет

- Ch07 P25 Build A Model LIDIAДокумент2 страницыCh07 P25 Build A Model LIDIALydia PerezОценок пока нет

- Ch14 P13 Build A ModelДокумент6 страницCh14 P13 Build A ModelRayudu Ramisetti0% (2)

- Case SolutionsДокумент106 страницCase SolutionsRichard Henry100% (5)

- Joshua & White Technologies financial analysisДокумент2 страницыJoshua & White Technologies financial analysis03020380% (1)

- Coca Cola Analysis in ExcelДокумент9 страницCoca Cola Analysis in Excelkatyayani90% (1)

- Chapter 14. Tool Kit For Distributions To Shareholders: Dividends and RepurchasesДокумент9 страницChapter 14. Tool Kit For Distributions To Shareholders: Dividends and RepurchasesHenry RizqyОценок пока нет

- Excel Solutions To CasesДокумент32 страницыExcel Solutions To Cases박지훈Оценок пока нет

- Solution To Ch02 P14 Build A ModelДокумент4 страницыSolution To Ch02 P14 Build A Modeljcurt8283% (6)

- Ch15 Tool KitДокумент20 страницCh15 Tool KitNino Natradze100% (1)

- Build a Model ChapterДокумент17 страницBuild a Model ChapterAbhishek Surana100% (2)

- 50 13 Pasting in Excel Full Model After HHДокумент64 страницы50 13 Pasting in Excel Full Model After HHcfang_2005Оценок пока нет

- Valuing Capital Investment ProjectsДокумент13 страницValuing Capital Investment ProjectsSiddhesh MahadikОценок пока нет

- Optimal Capital Structure for Campus DeliДокумент17 страницOptimal Capital Structure for Campus DeliJoshua Hines100% (1)

- Evaluacion Salud FinancieraДокумент17 страницEvaluacion Salud FinancieraWilliam VicuñaОценок пока нет

- Ch02 P20 Build A ModelДокумент6 страницCh02 P20 Build A ModelLydia PerezОценок пока нет

- Lyonscasesolution 141026100118 Conversion Gate02Документ9 страницLyonscasesolution 141026100118 Conversion Gate02Ankur ChughОценок пока нет

- Flash MemoryДокумент9 страницFlash MemoryJeffery KaoОценок пока нет

- Bond After-Tax Yield CalculatorДокумент7 страницBond After-Tax Yield CalculatorJohnОценок пока нет

- SNAP IPO Questions2Документ1 страницаSNAP IPO Questions2hao pengОценок пока нет

- HW8 AnswersДокумент6 страницHW8 AnswersPushkar Singh100% (1)

- Sampa VideoДокумент24 страницыSampa VideodoiОценок пока нет

- Estimating Cost of Capital for Goff Computer Using DellДокумент7 страницEstimating Cost of Capital for Goff Computer Using DellZahra ZfraОценок пока нет

- Build Model Solution Ch05 P24Документ6 страницBuild Model Solution Ch05 P24Angel L Rolon TorresОценок пока нет

- Solution of Corporate Finance Exams On 14th April Phuong Anh MDE10Документ8 страницSolution of Corporate Finance Exams On 14th April Phuong Anh MDE10api-3729903100% (1)

- Flash Memory, Inc.Документ2 страницыFlash Memory, Inc.Stella Zukhbaia0% (5)

- Risks and Cost of CapitalДокумент8 страницRisks and Cost of CapitalSarah BalisacanОценок пока нет

- Economy Shipping (HBS Case) - MSN SolutionДокумент24 страницыEconomy Shipping (HBS Case) - MSN SolutionPrasanta Mondal100% (2)

- 17 Answers To All ProblemsДокумент25 страниц17 Answers To All ProblemsRaşitÖnerОценок пока нет

- DCF valuation of video delivery business expansionДокумент24 страницыDCF valuation of video delivery business expansionHenny ZahranyОценок пока нет

- Solution of Textbook 1Документ4 страницыSolution of Textbook 1BảoNgọcОценок пока нет

- Valuation Analysis For Robertson ToolДокумент5 страницValuation Analysis For Robertson ToolPedro José ZapataОценок пока нет

- Case StudyДокумент6 страницCase StudyArun Kenneth100% (1)

- Worldwide Paper DCFДокумент16 страницWorldwide Paper DCFLaila SchaferОценок пока нет

- SBDC Valuation Analysis ProgramДокумент8 страницSBDC Valuation Analysis ProgramshanОценок пока нет

- Chapter 2 Cash Flows at Warf Computers IncДокумент4 страницыChapter 2 Cash Flows at Warf Computers IncTạ Công Khôi100% (1)

- Jones Electrical SlidesДокумент6 страницJones Electrical SlidesRohit AwadeОценок пока нет

- Chapter 5 ExerciseДокумент7 страницChapter 5 ExerciseJoe DicksonОценок пока нет

- TN-1 TN-2 Financials Cost CapitalДокумент9 страницTN-1 TN-2 Financials Cost Capitalxcmalsk100% (1)

- Calculate bond yield and machine replacement analysisДокумент10 страницCalculate bond yield and machine replacement analysisUbaid0% (1)

- FINC 536 Case Study 2Документ9 страницFINC 536 Case Study 2karimОценок пока нет

- Strong TieДокумент21 страницаStrong TieHarithra Shanmugam67% (3)

- Worldwide Paper Company New Woodyard InvestmentДокумент4 страницыWorldwide Paper Company New Woodyard InvestmentNoor Ji100% (2)

- Financial calculator practice for TVM problemsДокумент26 страницFinancial calculator practice for TVM problemsMUNDADA VENKATESH SURESH PGP 2019-21 BatchОценок пока нет

- Dell CaseДокумент3 страницыDell CaseJuan Diego Vasquez BeraunОценок пока нет

- Millions of Dollars Except Per-Share DataДокумент14 страницMillions of Dollars Except Per-Share DataVishal VermaОценок пока нет

- Butler CaseДокумент12 страницButler CaseJosh BenjaminОценок пока нет

- Financial Management C11 P11Документ4 страницыFinancial Management C11 P11lynusannОценок пока нет

- 06 Financial Planning Part AДокумент38 страниц06 Financial Planning Part Agopika.7mОценок пока нет

- Corporate Valuation and Financial PlanningДокумент52 страницыCorporate Valuation and Financial Planningsidra imtiazОценок пока нет

- 12 Problem: 10: Corporate Valuation and Financial PlanningДокумент141 страница12 Problem: 10: Corporate Valuation and Financial PlanningMarium RazaОценок пока нет

- CF5e PPT Ch12Документ52 страницыCF5e PPT Ch12Thang NguyenОценок пока нет

- CH 2 AnswersДокумент27 страницCH 2 Answersscuevas_10Оценок пока нет

- Stats Answers 1.3Документ3 страницыStats Answers 1.3scuevas_10Оценок пока нет

- Stats Answers 1.2Документ3 страницыStats Answers 1.2scuevas_10Оценок пока нет

- Attack On The World Trade Center September 11Документ4 страницыAttack On The World Trade Center September 11scuevas_10Оценок пока нет

- Attack On The World Trade Center September 11Документ4 страницыAttack On The World Trade Center September 11scuevas_10Оценок пока нет

- Stats Answers 1.5 TriolaДокумент8 страницStats Answers 1.5 Triolascuevas_10Оценок пока нет

- Asignación 3Документ6 страницAsignación 3scuevas_10Оценок пока нет

- TVM TablesДокумент2 страницыTVM Tablesanmol_sidОценок пока нет

- Ch02 P14 Build A Model AnswerДокумент4 страницыCh02 P14 Build A Model Answersiefbadawy1Оценок пока нет

- Damodaran - Trapped CashДокумент5 страницDamodaran - Trapped CashAparajita SharmaОценок пока нет

- New profit sharing ratiosДокумент9 страницNew profit sharing ratiosAman KakkarОценок пока нет

- CIMB Annual Report 2009Документ218 страницCIMB Annual Report 2009Hisham Ibrahim100% (1)

- Assignment: Financial Management: Dividend - MeaningДокумент4 страницыAssignment: Financial Management: Dividend - MeaningSiddhant gudwaniОценок пока нет

- Cluster Analysis On The Effect of Dollar Increment On The Economy of Nigeria RealДокумент58 страницCluster Analysis On The Effect of Dollar Increment On The Economy of Nigeria RealVictor Hopeson Eweh100% (1)

- Hybrid Rice Corporation: Case 1Документ10 страницHybrid Rice Corporation: Case 1btsvt1307 phОценок пока нет

- A Comparative Study of ELSSДокумент4 страницыA Comparative Study of ELSSSilparajaОценок пока нет

- Uma Salary Slip JulyДокумент1 страницаUma Salary Slip Julyjyothi sОценок пока нет

- CTTT - C5 (Eng)Документ18 страницCTTT - C5 (Eng)Tram AnhhОценок пока нет

- Advanced Accounting Chapter 5Документ19 страницAdvanced Accounting Chapter 5Ya Lun100% (1)

- Farm Financial Statements GuideДокумент8 страницFarm Financial Statements GuideGENER DE GUZMANОценок пока нет

- Wedding Photography and Videography QuotationДокумент1 страницаWedding Photography and Videography Quotationbhagyashree satamОценок пока нет

- IUGB TUITION Rev June102017 Rev032218Документ2 страницыIUGB TUITION Rev June102017 Rev032218claude BOHOUОценок пока нет

- Non-Current Liabilities Cheat SheetДокумент1 страницаNon-Current Liabilities Cheat SheetSarah SafiraОценок пока нет

- Philippine Bond MarketДокумент30 страницPhilippine Bond MarketMARY JUSTINE PAQUIBOTОценок пока нет

- A Study On 269SS & 269 TДокумент4 страницыA Study On 269SS & 269 TsivaranjanОценок пока нет

- 7110 w12 Ms 21Документ6 страниц7110 w12 Ms 21mstudy123456Оценок пока нет

- X ICSE Maths 01 PDFДокумент130 страницX ICSE Maths 01 PDFSujal KumarОценок пока нет

- ABM 1 Chapter 1Документ6 страницABM 1 Chapter 1Ruby Liza CapateОценок пока нет

- FAR: KEY ASPECTS OF PROPERTY, PLANT AND EQUIPMENT ACCOUNTINGДокумент13 страницFAR: KEY ASPECTS OF PROPERTY, PLANT AND EQUIPMENT ACCOUNTINGAl ChuaОценок пока нет

- PrabhДокумент3 страницыPrabhrajОценок пока нет

- Debit - Credit Auto-Debit Authrisation FormДокумент1 страницаDebit - Credit Auto-Debit Authrisation FormWan Muhammad ZamyrОценок пока нет

- Calculations OnlyДокумент10 страницCalculations OnlyPatience AkpanОценок пока нет

- Study of NPAs at Axis BankДокумент11 страницStudy of NPAs at Axis BankKuNaL HaJaReОценок пока нет

- Assessment in Income TaxДокумент3 страницыAssessment in Income Taxayush sikkewalОценок пока нет

- Balance of Payments: Chapter ThreeДокумент16 страницBalance of Payments: Chapter ThreeiMQSxОценок пока нет

- Principles of MacroeconomicsДокумент52 страницыPrinciples of Macroeconomicsmoaz21100% (1)

- Co Signers Statement2Документ1 страницаCo Signers Statement2Pharmastar Int'l Trading Corp.Оценок пока нет

- Icici Fyfm Efs ProjectДокумент9 страницIcici Fyfm Efs ProjectMihir DeliwalaОценок пока нет

- India's Balance of Payment Crisis and Its ImpactДокумент32 страницыIndia's Balance of Payment Crisis and Its ImpactShankari MaharajanОценок пока нет