Академический Документы

Профессиональный Документы

Культура Документы

C. Comptroller General.: Content: Concept Level: Easy Wilson - Chapter 12 #16

Загружено:

Guddi PatelИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

C. Comptroller General.: Content: Concept Level: Easy Wilson - Chapter 12 #16

Загружено:

Guddi PatelАвторское право:

Доступные форматы

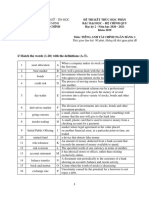

16.

Which of the following federal officials is a "principal" of the Joint Financial Management Improvement Program who considers and approves or disapproves accounting and reporting standards recommended by the Federal Accounting Standards Advisory Board? A. Chair of the Federal Accounting Standards Advisory Board. B. Secretary of the Interior. C. Comptroller General. D. All of the above.

Content: Concept Level: Easy Wilson - Chapter 12 #16

17. FASAB has identified four major user groups of federal financial reports, they are A. Congress, executives, program managers, and citizens. B. Congress, executives, citizens, and bond rating agencies. C. Congress, program managers, foreign governments, and citizens. D. Congress, program managers, bond rating agencies, and political parties.

Content: Concept Level: Medium Wilson - Chapter 12 #17

18. The "net position" of a federal agency may include which of the following components? A. Unexpended Appropriations. B. Cumulative Results of Operations.

C. Appropriations represented by undelivered orders and unobligated balances. D. All of the above.

Content: Concept Level: Easy Wilson - Chapter 12 #18

19. Which of the following is not an objective identified in FASAB Statement of Accounting and Reporting Concepts No. 1? A. To assist report users in evaluating budgetary integrity. B. To assist report users in evaluating the extent to which tax burdens have changed. C. To assist report users in evaluating stewardship. D. To assist report users in evaluating operating performance.

Content: Concept Level: Medium Wilson - Chapter 12 #19

20. Which of the following statements most accurately describes the dual-track accounting system used in federal agency accounting? A. Recording internal budgetary transactions along with financial transactions with external parties. B. Use of double-entry accounting. C. Maintaining self-balancing sets of proprietary and budgetary accounts and recording the effects of transactions on both available budgetary resources and proprietary accounts, the latter measured on the accrual basis to better promote agency management. D. Keeping separate books, one on a tax basis and the other on a GAAP basis.

Content: Concept Level: Medium Wilson - Chapter 12 #20

21. In federal government accounting, recording the estimated amount of equipment prior to actually placing an order or entering into a contract is called a (an) A. Obligation. B. Apportionment. C. Allotment. D. Commitment

Content: Concept Level: Medium Wilson - Chapter 12 #21

A certain federal agency placed an order for office supplies at an estimated cost of $14,400. Later in the same fiscal year these supplies were received at an actual cost of $14,800. Assume commitment accounting is not used by this agency.

Wilson - Chapter 12

22. When the order is placed the required journal entry (or entries) will affect the accounts shown in what net amounts: A. Budgetary accounts: $14,400; Proprietary accounts: $14,400 B. Budgetary accounts: $14,400; Proprietary accounts: $14,800 C. Budgetary accounts: $14,400; Proprietary accounts: $0 D. Budgetary accounts: $0; Proprietary accounts: $0

Content: Compute Level: Medium Wilson - Chapter 12 #22

23. When the order is received the required journal entry (or entries) will affect the accounts shown in what net amounts: A. Budgetary Accounts: $14,400; Proprietary Accounts: $14,400 B. Budgetary Accounts: $14,400; Proprietary Accounts: $14,800 C. Budgetary Accounts: $400; Proprietary Accounts: $14,800 D. Budgetary Accounts: $0; Proprietary Accounts: $14,800

Content: Journal Entry Level: Medium Wilson - Chapter 12 #23

24. Which of the following accounts used in state and local government accounting is most like the federal budgetary account "Undelivered Orders"? A. Encumbrance. B. Expenditure. C. Appropriation. D. Reserve for Encumbrance.

Content: Concept Level: Medium Wilson - Chapter 12 #24

25. Which of the following financial statements is not required by OMB Bulletin No. 01-09?

A. Statement of budgetary resources. B. Statement of cash flows. C. Balance sheet. D. Statement of changes in net position.

Content: Concept Level: Medium Wilson - Chapter 12 #25

26. One of the purposes of the Federal Financial Management Improvement Act of 1996 enacted by Congress was to A. Establish a requirement that the financial statements of the federal government as a whole be audited. B. Improve the effectiveness of programs receiving federal funds. C. Establish generally accepted federal accounting principles. D. Rebuild the credibility and restore public confidence in the federal government.

Content: Concept Level: Medium Wilson - Chapter 12 #26

27. Which of the following persons has some responsibility for establishing and maintaining a sound financial structure for the federal government? A. Chief Financial Officer of the Congressional Budget Office. B. Chair of the Governmental Accounting Standards Board. C. Secretary of the Treasury.

D. Chair of the Federal Accounting Standards Advisory Board.

Content: Concept Level: Medium Wilson - Chapter 12 #27

28. The Comptroller General of the United States is the head of the: A. Government Accountability Office. B. Office of the Management and Budget. C. Congressional Budget Office. D. Federal Accounting Standards Advisory Board.

Content: Concept Level: Easy Wilson - Chapter 12 #28

29. The required report or statements in the general purpose federal financial report that addresses forward-looking information regarding the possible effects of currently known demands, risks, and uncertainties, and trends in the federal entity is (are): A. Basic statements. B. Required supplemental information. C. Management discussion and analysis. D. Related notes to the financial statements.

Content: Concept Level: Medium Wilson - Chapter 12 #29

30. Which of the following is an accurate list of the three perspectives from which the federal government can be viewed, as described in SFFAS No. 2 "Entity and Display?" A. Function, department, and program. B. Organizational, budget, and program. C. Budget, program, and line-item. D. Fund, activity, and account.

Content: Concept Level: Medium Wilson - Chapter 12 #30

31. The management's discussion and analysis (MD&A) required in general purpose federal financial reporting is different than that required by GASB of state and local governments in that: A. There are no significant differences. B. It is outside the general purpose federal financial report and is optional, not required. C. It is a part of the basic financial statements. D. Federal agencies should address the reporting entity's performance goals and results in addition to financial activities.

Content: Concept Level: Medium Wilson - Chapter 12 #31

32. Which of the following federal programs involve nonexchange transactions for which there is some accounting guidance on recording liabilities but for which much more research is needed? A. National parks. B. Social insurance.

C. Post offices. D. Heritage assets.

Content: Concept Level: Medium Wilson - Chapter 12 #32

33. Which of the following describes the usual flow of budgetary authority through the budgetary accounts of a federal agency? A. Apportionment, allotment, appropriation, commitment, obligation, expended appropriation. B. Allotment, commitment, obligation, expended appropriation, apportionment. C. Appropriation, apportionment, allotment, commitment, obligation, expended appropriation. D. Commitment, obligation, appropriation, apportionment, allotment, expended appropriation.

Content: Concept Level: Medium Wilson - Chapter 12 #33

34. Which of the following statements is not true about the United States government-wide financial report? A. Since 1997, the financial statements of the U.S. Government as a whole have been audited by the GAO. B. The majority of the 24 major federal agencies required to be audited have received unqualified audit opinions by the GAO. C. The federal government received an unqualified opinion from the GAO on the most recent financial statements government as a whole.

D. The Comptroller General of the United States has rendered a disclaimer of opinion on the U.S. Government's consolidated financial statements for as long as that office has audited these statements.

Content: Concept Level: Medium Wilson - Chapter 12 #34

35. Which of the following is required by OMB Bulletin No. 01-09 in the basic financial statements? A. Statement of changes in net position. B. Statement of net assets. C. Statement of revenues, expenditures, and changes in fund balances. D. Statement of activities.

Content: Concept Level: Medium Wilson - Chapter 12 #35

36. The following are key terms in Chapter 12 that relate to accounting and financial reporting for federal agencies and the federal government: A. Apportionment B. Governmental assets C. Stewardship land D. Intragovernmental assets E. Heritage assets F. Expended appropriation

G. Budgetary resources H. Stewardship investments For each of the following definitions, indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition. _____ 1. Federal capital assets that possess educational, cultural, or natural characteristics _____ 2. Claims by or against a reporting entity that arise from transactions between that entity and other reporting entities _____ 3. Assets that arise from transactions of the federal government or an entity of the federal government with nonfederal entities _____ 4. A distribution made of a federal appropriation by the Office of Management and Budget into amounts available for specified time periods _____ 5. Federal land other than that included in general property, plant and equipment 1. E, 2. D, 3. B, 4. A, 5. C

Вам также может понравиться

- Accounting For Public Sector and Civil Model Exit Exam1Документ4 страницыAccounting For Public Sector and Civil Model Exit Exam1tame kibruОценок пока нет

- Acc OrgДокумент9 страницAcc OrgDena Heart OrenioОценок пока нет

- Chapter 14 - Test BankДокумент29 страницChapter 14 - Test BankVictor MedinaОценок пока нет

- Accounting For Governmental and Nonprofit Entities 15th Edition Wilson Test Bank Full Chapter PDFДокумент53 страницыAccounting For Governmental and Nonprofit Entities 15th Edition Wilson Test Bank Full Chapter PDFfinnhuynhqvzp2c100% (17)

- Accounting For Governmental and Nonprofit Entities 15th Edition Wilson Test BankДокумент32 страницыAccounting For Governmental and Nonprofit Entities 15th Edition Wilson Test Bankmisstepmonocarp1b69100% (30)

- Chap 016Документ52 страницыChap 016Hemali MehtaОценок пока нет

- Advance Government and NFPДокумент57 страницAdvance Government and NFPHabte DebeleОценок пока нет

- Advanced Accounting 11Th Edition Hoyle Solutions Manual Full Chapter PDFДокумент36 страницAdvanced Accounting 11Th Edition Hoyle Solutions Manual Full Chapter PDFbetty.slaton822100% (15)

- Accounting For Governmental and Non Profit Entities Wilson 15th Edition Test BankДокумент12 страницAccounting For Governmental and Non Profit Entities Wilson 15th Edition Test BankPhyllis Sollenberger100% (26)

- Obo ANfgp 1422Документ5 страницObo ANfgp 1422Chala tursaОценок пока нет

- Chapter 16 Solutions ManualДокумент22 страницыChapter 16 Solutions ManualLisa Cooley100% (1)

- Accounting For Governmental and Nonprofit Entities Reck 16th Edition Test BankДокумент23 страницыAccounting For Governmental and Nonprofit Entities Reck 16th Edition Test Bankdanielhernandezmiwcbptrde100% (41)

- Accounting For State and Local Governments (Part One) : Chapter OutlineДокумент56 страницAccounting For State and Local Governments (Part One) : Chapter OutlineJordan YoungОценок пока нет

- Accounting For Government Organizations Mock CEДокумент15 страницAccounting For Government Organizations Mock CEDena Heart OrenioОценок пока нет

- Model Exam - On ApscsДокумент13 страницModel Exam - On Apscsnewaybeyene5Оценок пока нет

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018От EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018Оценок пока нет

- Chapter 16Документ48 страницChapter 16jthemansmith1Оценок пока нет

- 3b - 2016 - Advanced Final Govt Text Chapters Outline and AnswersДокумент12 страниц3b - 2016 - Advanced Final Govt Text Chapters Outline and AnswersLâm HàОценок пока нет

- POST TEST 3 and POST 4, in ModuleДокумент12 страницPOST TEST 3 and POST 4, in ModuleReggie Alis100% (1)

- Test Bank For Governmental and Nonprofit Accounting, 10th Edition Robert J. FreemanДокумент6 страницTest Bank For Governmental and Nonprofit Accounting, 10th Edition Robert J. Freemansamuel debebe100% (2)

- Chapter 009 Test BankДокумент13 страницChapter 009 Test Banknadecho1Оценок пока нет

- Government Accounting Exam PhilippinesДокумент3 страницыGovernment Accounting Exam PhilippinesPrincess Claris Araucto100% (5)

- Acc 365 Chapter 1 FlashcardsДокумент17 страницAcc 365 Chapter 1 FlashcardsdissidentmeОценок пока нет

- QUIZДокумент4 страницыQUIZBryan Ibarrientos100% (2)

- Accy161 Final Fa08 KeyДокумент4 страницыAccy161 Final Fa08 KeyOluwafeyikemi Temitope JohnsonОценок пока нет

- Accounting For Governmental and Non Profit Entities Wilson 15th Edition Test BankДокумент12 страницAccounting For Governmental and Non Profit Entities Wilson 15th Edition Test Bankdanielhernandezmiwcbptrde100% (41)

- Freeman10e TIF Ch01 MCДокумент6 страницFreeman10e TIF Ch01 MCEbraam FayekОценок пока нет

- Government Accounting Exam PhilippinesДокумент3 страницыGovernment Accounting Exam PhilippinesIrdo Kwan64% (11)

- Government Accounting Exam PhilippinesДокумент4 страницыGovernment Accounting Exam PhilippinesPrince Oliver ArauctoОценок пока нет

- CH3 SolutionДокумент10 страницCH3 SolutionGabriel Aaron DionneОценок пока нет

- ACC117-CON09 Module 1 ExamДокумент10 страницACC117-CON09 Module 1 ExamMarlon LadesmaОценок пока нет

- NGASДокумент4 страницыNGASelminvaldezОценок пока нет

- CertIPSAS Sample QuestionsДокумент2 страницыCertIPSAS Sample QuestionsTawanda ZimbiziОценок пока нет

- CertIPSAS Sample Questions PDFДокумент2 страницыCertIPSAS Sample Questions PDFICAF-GFPОценок пока нет

- American Public Policy Promise and Performance 10th Edition Peters Test Bank Full Chapter PDFДокумент41 страницаAmerican Public Policy Promise and Performance 10th Edition Peters Test Bank Full Chapter PDFaffluencevillanzn0qkr100% (12)

- American Public Policy Promise and Performance 10th Edition Peters Test BankДокумент20 страницAmerican Public Policy Promise and Performance 10th Edition Peters Test Bankstephenthanh1huo100% (23)

- Budget Cycle (Budget Accountability) TEAM 1Документ43 страницыBudget Cycle (Budget Accountability) TEAM 1Patrick LanceОценок пока нет

- Chapter 16 IMSMДокумент49 страницChapter 16 IMSMZachary Thomas CarneyОценок пока нет

- Chapter 16 1Документ19 страницChapter 16 1YourMotherОценок пока нет

- 508Документ46 страниц508swutea100% (1)

- CH 16Документ4 страницыCH 16Cas YscheОценок пока нет

- New Government Accounting SystemДокумент12 страницNew Government Accounting SystemIrdo KwanОценок пока нет

- ACCTG 6 Midterm ExaminationДокумент16 страницACCTG 6 Midterm ExaminationJudy Anne RamirezОценок пока нет

- Application of Concepts SFPДокумент10 страницApplication of Concepts SFPblancocarizagioОценок пока нет

- Dwnload Full Accounting Information Systems Basic Concepts and Current Issues 3rd Edition Hurt Test Bank PDFДокумент32 страницыDwnload Full Accounting Information Systems Basic Concepts and Current Issues 3rd Edition Hurt Test Bank PDFassapancopepodmhup100% (14)

- ACG 4501 Exam 3 Practice-2Документ10 страницACG 4501 Exam 3 Practice-2rprasad05Оценок пока нет

- Govacc TheoriesДокумент82 страницыGovacc Theoriesorly100% (1)

- Midterm Summative Assessment 2Документ12 страницMidterm Summative Assessment 2Von Andrei MedinaОценок пока нет

- Chap 17Документ34 страницыChap 17ridaОценок пока нет

- AA4102 ExamДокумент5 страницAA4102 ExamAlyssa AnnОценок пока нет

- Acc11 Accounting For Government and Not-For-profit EntitiesДокумент5 страницAcc11 Accounting For Government and Not-For-profit EntitiesKaren UmaliОценок пока нет

- Quiz 1 - ACGN PrelimsДокумент9 страницQuiz 1 - ACGN Prelimsnatalie clyde matesОценок пока нет

- Quiz 2 Acctg Major 8Документ4 страницыQuiz 2 Acctg Major 8Jovyl InguitoОценок пока нет

- Prelim Exam GovaccДокумент4 страницыPrelim Exam GovaccEloisa JulieanneОценок пока нет

- Quiz 1: Public Accounting and BudgetingДокумент6 страницQuiz 1: Public Accounting and BudgetingjaleummeinОценок пока нет

- Educating Voters for Rebuilding America: National Goals and Balanced BudgetОт EverandEducating Voters for Rebuilding America: National Goals and Balanced BudgetОценок пока нет

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersОт EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersОценок пока нет

- Đề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Документ4 страницыĐề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Hoang TrieuОценок пока нет

- Financial Accounting: Accounting For Merchandise OperationsДокумент84 страницыFinancial Accounting: Accounting For Merchandise OperationsAnnie DuolingoОценок пока нет

- Private Equity AsiaДокумент12 страницPrivate Equity AsiaGiovanni Graziano100% (1)

- Lect 12 EOQ SCMДокумент38 страницLect 12 EOQ SCMApporva MalikОценок пока нет

- Auditing and Assurance: Specialized Industries - Midterm ExaminationДокумент14 страницAuditing and Assurance: Specialized Industries - Midterm ExaminationHannah SyОценок пока нет

- Procurement WorkДокумент8 страницProcurement WorkbagumaОценок пока нет

- Maranguinot V NLRC (G.R. No. 120969. January 22, 1998)Документ15 страницMaranguinot V NLRC (G.R. No. 120969. January 22, 1998)Shila Tabanao VisitacionОценок пока нет

- The Millionaire Fastlane: Crack The Code To Wealth and Live Rich For A Lifetime! - MJ DeMarcoДокумент6 страницThe Millionaire Fastlane: Crack The Code To Wealth and Live Rich For A Lifetime! - MJ DeMarcowureleli17% (6)

- Case Etbis 9Документ3 страницыCase Etbis 9hifdyОценок пока нет

- Bangladesh TransportДокумент19 страницBangladesh TransportMasud SanvirОценок пока нет

- BPO Philippines - Sample Case Study PDFДокумент59 страницBPO Philippines - Sample Case Study PDFAir0% (1)

- Butchery Business Plan-1Документ12 страницButchery Business Plan-1Andrew LukupwaОценок пока нет

- O&SCM Introduction & Operations Strategy - PPSXДокумент60 страницO&SCM Introduction & Operations Strategy - PPSXRuchi DurejaОценок пока нет

- Aswath Damodaran Tesla ValuationДокумент60 страницAswath Damodaran Tesla ValuationHarshVardhan Sachdev100% (1)

- Cost Concept and ApplicationДокумент11 страницCost Concept and ApplicationGilbert TiongОценок пока нет

- 01 Activity 1 Strategic MGTДокумент1 страница01 Activity 1 Strategic MGTAlvarez JafОценок пока нет

- Money Banking and Financial Markets 3Rd Edition Cecchetti Solutions Manual Full Chapter PDFДокумент41 страницаMoney Banking and Financial Markets 3Rd Edition Cecchetti Solutions Manual Full Chapter PDFKatherineJohnsonDVMinwp100% (8)

- IC38 SushantДокумент46 страницIC38 SushantAyush BhardwajОценок пока нет

- Nama: Christian Candra Wijaya NIM: F0321067 Kelas: C: InstructionsДокумент6 страницNama: Christian Candra Wijaya NIM: F0321067 Kelas: C: InstructionswijayaОценок пока нет

- Practie-Test-For-Econ-121-Final-Exam 1Документ1 страницаPractie-Test-For-Econ-121-Final-Exam 1mehdi karamiОценок пока нет

- Case Study Assignment - Neha Nair 26021Документ3 страницыCase Study Assignment - Neha Nair 26021NEHA NAIRОценок пока нет

- Summary of Articles: 1. Samsung's Noida Plant: Empowerment Has Led To High ProductivityДокумент5 страницSummary of Articles: 1. Samsung's Noida Plant: Empowerment Has Led To High ProductivityMayank Vilas SankheОценок пока нет

- Positioning and PLCДокумент14 страницPositioning and PLCAvishek JainОценок пока нет

- Solution Jan 2018Документ8 страницSolution Jan 2018anis izzatiОценок пока нет

- C4 - HandoutДокумент19 страницC4 - HandoutMaii O. SnchzОценок пока нет

- Heritage Tourism: Submitted By, Krishna Dev A.JДокумент5 страницHeritage Tourism: Submitted By, Krishna Dev A.JkdboygeniusОценок пока нет

- Unemployment ProblemДокумент12 страницUnemployment ProblemMasud SanvirОценок пока нет

- Firms in Competitive MarketsДокумент9 страницFirms in Competitive MarketsYasmine JazzОценок пока нет

- Bata Pak (Final)Документ32 страницыBata Pak (Final)Samar MalikОценок пока нет

- Free Printable Financial Affidavit FormДокумент3 страницыFree Printable Financial Affidavit FormfatinОценок пока нет