Академический Документы

Профессиональный Документы

Культура Документы

FM04 International Finance: Assignment No.I

Загружено:

Anant SenИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

FM04 International Finance: Assignment No.I

Загружено:

Anant SenАвторское право:

Доступные форматы

FM04 International Finance

Assignment No.I

Assignment Code: 2012FM04A1 Last Date of Submission: 15th April 2012 Maximum Marks:100

Attempt all the questions. All the questions are compulsory and carry equal marks.

Section-A Ques. 1 Briefly explain the following: 1. Spot market and forward market. 2. Purchasing Power Parity (PPP). 3. Transaction Exposure versus Economic Exposure. 4. Methods of Translation Exposure. What factors affect a firms degree of transaction exposure in a particular currency? For each factor explain the desirable characteristics that would reduce the transaction exposure? Countries can address the internal problems with external solutions . Why might a country in severe recession consider devaluation of its currency? Why might a country experiencing high inflation consider appreciation of its currency attractive? Liberalization of Capital Account should be viewed as a process and not as a single event Comment Section-B Case Study Your company exports goods to country K. Your job as an international cash manager requires you to forecast the value of country Ks currency called Krank with respect to dollar. Explain how each of the following would effect the value of Krank, holding all other things equal. Combine the impact of all of these to develop an overall forecast of currency Kranks movement against dollar : i. ii. iii. US inflation has suddenly increased substantially whereas the inflation in country remains low. US interest rates have increased substantially while that of country K remains low. Investors of both countries are attracted to high interest rates. US income base has increased substantially but that of country K has remained unchanged US is expected to place a small tariff on goods imported from country K

Ques. 2

Ques. 3

Ques. 4

Page No. 1 of 3

FM04 International Finance

Assignment No.II

Assignment Code: 2012FM04A2 Last Date of Submission: 15th May 2012 Maximum Marks:100

Attempt all the questions. All the questions are compulsory and carry equal marks.

Section-A Ques. 1 Ques. 2 Ques. 3 (a) What are the sources of Foreign Capital? (b) What are the factors that evaluate foreign Project? What are the specific problems in connection with multinational working capital management? (a) (b) Explain how the weighted cost of capital for an MNC can be calculated? Suppose that a foreign project has a beta of 0.85 the risk free return is 12% and the required return on the market is estimated at 19%. What is the cost of capital for the project?

Ques. 4

Discuss the various techniques to manage Accounting Exposure. Section-B

Case Study : BLADE INC.

John, the CFO of Blade Inc. has decided to counter the decreasing demand for its roller blades by exporting the product to Thailand. He has also decided to import rubber and plastic equipments from Thailand to reap cost advantage of about 20 percent. Currently, about 10 percent of the companys sales are from Thailand. The company does not face much competition from other US companies. The other US manufacturers invoice the exports in US dollars whereas Blade does the invoicing in Thai bath. It has provided Blade a competitive advantage because Thai importers need not worry about the currency fluctuations. The primary Thai customer of Blades is committed to purchase a certain quantity for the next three years in case invoicing is done in Thai baht. Due to its strategy and highly quality of products, the company is sure of its future content. However, as a financial analyst, you are not as confident. Your doubt is due to the weakening of Thai economy on account of the Asian financial crisis. For this reason, you anticipate high inflation, diminished national income and continued depreciation of baht. These could force companies to adjust their spending. To convince John, you have developed a list of questions which you wish to present to the CFO of Blade. These are :

Page No. 2 of 3

i. ii. iii. iv.

How could high level of inflation in Thailand affect Blades assuming US inflation to remain constant. How would Blade be effected by competition from local firms in Thailand, and the US firms conducting business in Thailand. How could continued depreciation of Thai baht affect Blades In case Blades increases business in Thailand and e Experiences serious financial problems, are there any international agencies that the company could approach for loan or other financial assistance?

v.

Page No. 3 of 3

Вам также может понравиться

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsОт EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsОценок пока нет

- ZARA Case Study 2 ZARA THE WORLD S LARGEST FASHION RETAILERДокумент6 страницZARA Case Study 2 ZARA THE WORLD S LARGEST FASHION RETAILERSinem DüdenОценок пока нет

- Question and Answer - 31Документ31 страницаQuestion and Answer - 31acc-expertОценок пока нет

- International Accounting Chap 001Документ24 страницыInternational Accounting Chap 001ChuckОценок пока нет

- 2008 F F3250 Exam 1 KeyДокумент8 страниц2008 F F3250 Exam 1 Keyproject44Оценок пока нет

- Chapter 05 - Financial Instruments and MarketsДокумент19 страницChapter 05 - Financial Instruments and MarketsAna SaggioОценок пока нет

- A Study On Buying Behaviour of Youngsters Towards Fast Food RestaurantsДокумент7 страницA Study On Buying Behaviour of Youngsters Towards Fast Food Restaurantsnastaeenbaig1Оценок пока нет

- International Finance First Exam GuidelinesДокумент12 страницInternational Finance First Exam GuidelinesHernanОценок пока нет

- F9 - Mock B - QuestionsДокумент7 страницF9 - Mock B - QuestionspavishneОценок пока нет

- Test Bank For International Accounting 5th Edition by DoupnikДокумент24 страницыTest Bank For International Accounting 5th Edition by DoupnikAllen Sylvester100% (34)

- FIN 370 Week 5 Questions and Problem Sets (Solutions)Документ3 страницыFIN 370 Week 5 Questions and Problem Sets (Solutions)KyleWalkeer0% (2)

- f9 2014 Dec QДокумент13 страницf9 2014 Dec QreadtometooОценок пока нет

- Test Bank For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector PereraДокумент24 страницыTest Bank For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector PereraCindy Mcclure100% (29)

- Test Bank For International Accounting 5th Edition by DoupnikДокумент24 страницыTest Bank For International Accounting 5th Edition by DoupnikLindsey Anderson100% (29)

- Test Bank For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector Perera Isbn10 1259747980 Isbn13 9781259747984Документ24 страницыTest Bank For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector Perera Isbn10 1259747980 Isbn13 9781259747984japerstogyxp94cОценок пока нет

- F9 Test 2Документ6 страницF9 Test 2asif iqbalОценок пока нет

- Test Bank For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector PereraДокумент24 страницыTest Bank For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector Pererajaperstogyxp94cОценок пока нет

- Test Bank For International Accounting 5th Edition by DoupnikДокумент24 страницыTest Bank For International Accounting 5th Edition by Doupnikjaperstogyxp94cОценок пока нет

- Chapter 01Документ25 страницChapter 01Wardah Naili UlfahОценок пока нет

- F9) QuestionsДокумент15 страницF9) Questionspavishne0% (1)

- C04-Fundamentals of Business Economics: Sample Exam PaperДокумент26 страницC04-Fundamentals of Business Economics: Sample Exam PaperLegogie Moses Anoghena100% (1)

- Reading 2 Capital Market Expectations, Part 2 Forecasting Asset Class Returns - AnswersДокумент25 страницReading 2 Capital Market Expectations, Part 2 Forecasting Asset Class Returns - AnswersAnshika SinghОценок пока нет

- Chapter 4 The Balance of Payments Multiple Choice and True/False Questions 4.1 Typical Balance of Payments TransactionsДокумент14 страницChapter 4 The Balance of Payments Multiple Choice and True/False Questions 4.1 Typical Balance of Payments Transactionsqueen hassaneenОценок пока нет

- Bloomberg Sample QuestionsДокумент7 страницBloomberg Sample QuestionsAditya Verma100% (1)

- Chapter 1 Introduction To International AccountingДокумент24 страницыChapter 1 Introduction To International AccountingGendis Freyona100% (1)

- C04-Fundamentals of Business Economics: Sample Exam PaperДокумент17 страницC04-Fundamentals of Business Economics: Sample Exam Paperhkanuradha100% (1)

- Bùa Hộ Mệnh Tài ChínhДокумент22 страницыBùa Hộ Mệnh Tài ChínhNguyệt Hằng HuỳnhОценок пока нет

- Tutorial Questions FinДокумент16 страницTutorial Questions FinNhu Nguyen HoangОценок пока нет

- Exam 2Документ7 страницExam 2LonerStrelokОценок пока нет

- International Business Management 2021-22 S2 - Individual Assignment 4Документ2 страницыInternational Business Management 2021-22 S2 - Individual Assignment 4Le HarryОценок пока нет

- N1591 2019-20 - Sample Exam QuestionsДокумент11 страницN1591 2019-20 - Sample Exam QuestionsMandeep SОценок пока нет

- Tutorial Question (New) - Sem1, 2024Документ20 страницTutorial Question (New) - Sem1, 2024phamminhngoc2k4Оценок пока нет

- Finc 445 HW IiiДокумент3 страницыFinc 445 HW IiiBruce_scribedОценок пока нет

- Cat/fia (FFM)Документ9 страницCat/fia (FFM)theizzatirosli100% (1)

- UntitledДокумент13 страницUntitledJocelyn GiselleОценок пока нет

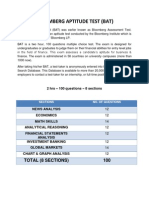

- BAT Sample QuestionsДокумент6 страницBAT Sample Questionssourabh_chowdhury_1Оценок пока нет

- EssayДокумент7 страницEssayKОценок пока нет

- Macroeconomics Exam - BBS - January 2021Документ5 страницMacroeconomics Exam - BBS - January 2021Peris WanjikuОценок пока нет

- Tutorial Question (New) - Sem1, 2024Документ20 страницTutorial Question (New) - Sem1, 202422070825Оценок пока нет

- Section 2 - CH 1 - Part 2Документ11 страницSection 2 - CH 1 - Part 2Jehan OsamaОценок пока нет

- IGCSE Balance of PaymentsДокумент25 страницIGCSE Balance of PaymentsQWERTYОценок пока нет

- Sample Exam #1Документ6 страницSample Exam #1btseng01Оценок пока нет

- Economics GA End of Course ExamДокумент24 страницыEconomics GA End of Course Examwenatchee25Оценок пока нет

- CIMA Certificate in Business Accounting Test 03 CIMA C04 Fundamentals of Business EconomicsДокумент7 страницCIMA Certificate in Business Accounting Test 03 CIMA C04 Fundamentals of Business EconomicsdigitalbooksОценок пока нет

- 2 L-T Financial Management - Financial InstrumentsДокумент54 страницы2 L-T Financial Management - Financial InstrumentsMohammad DwidarОценок пока нет

- Bloomberg Aptitude Test (BAT)Документ10 страницBloomberg Aptitude Test (BAT)Shivgan Joshi100% (1)

- Practice Questions: Set #1: International Finance Professor Michel A. RobeДокумент9 страницPractice Questions: Set #1: International Finance Professor Michel A. RobeSchelter Cuteness MiserableОценок пока нет

- Binder 1Документ155 страницBinder 1adad9988Оценок пока нет

- Test ML 574 122021Документ1 страницаTest ML 574 122021K60 NGUYỄN THỊ HỒNG NGỌCОценок пока нет

- F9 Past PapersДокумент32 страницыF9 Past PapersBurhan MaqsoodОценок пока нет

- IfmДокумент46 страницIfmTatjana BabovicОценок пока нет

- Full Course Test 3Документ10 страницFull Course Test 3Shaily SetiaОценок пока нет

- CIA-III-pass4sure QuestionsДокумент6 страницCIA-III-pass4sure Questionsmuhammet.ozkan.1988Оценок пока нет

- Level 1 - Financial StatementДокумент11 страницLevel 1 - Financial StatementVimmi BanuОценок пока нет

- 19-Arid-271 Macro AssignmentДокумент3 страницы19-Arid-271 Macro AssignmentReHmañ ÇhОценок пока нет

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)От EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Оценок пока нет

- Cost of Doing Business Study, 2012 EditionОт EverandCost of Doing Business Study, 2012 EditionОценок пока нет

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresОт EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresОценок пока нет

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersОт EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersОценок пока нет

- Managing Concentrated Stock Wealth: An Advisor's Guide to Building Customized SolutionsОт EverandManaging Concentrated Stock Wealth: An Advisor's Guide to Building Customized SolutionsОценок пока нет

- Assessment Consent Form - Retail FinancingДокумент1 страницаAssessment Consent Form - Retail Financingcba4092_sktsОценок пока нет

- 5d6d01005f325curriculum MPSM LatestДокумент51 страница5d6d01005f325curriculum MPSM LatestMostafa ShaheenОценок пока нет

- DownloadДокумент2 страницыDownloadJOCKEY 2908Оценок пока нет

- Marico Equity Research ReportДокумент47 страницMarico Equity Research ReportamitОценок пока нет

- Multi-Dimensions of Unit Linked Insurance Plan Among Various Investment AvenuesДокумент8 страницMulti-Dimensions of Unit Linked Insurance Plan Among Various Investment AvenuesRahul TangadiОценок пока нет

- Fy 2016 YebДокумент16 страницFy 2016 YebElizabeth VasquezОценок пока нет

- Instructions For Accreditation:: SET RequirementsДокумент3 страницыInstructions For Accreditation:: SET RequirementsMySolutions Inc OfficialОценок пока нет

- Entrepreneurship 11/12 First: Learning Area Grade Level Quarter DateДокумент4 страницыEntrepreneurship 11/12 First: Learning Area Grade Level Quarter DateDivine Mermal0% (1)

- It Governance Technology-Chapter 01Документ4 страницыIt Governance Technology-Chapter 01IQBAL MAHMUDОценок пока нет

- VWV2023 - Sale Brochure (EP1) FAДокумент6 страницVWV2023 - Sale Brochure (EP1) FAsarahОценок пока нет

- All ZtcodeДокумент4 страницыAll Ztcodetamal.me1962100% (1)

- O&SCM Introduction & Operations Strategy - PPSXДокумент60 страницO&SCM Introduction & Operations Strategy - PPSXRuchi DurejaОценок пока нет

- G.R. No. 190506 Coral Bay Nickel Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Bersamin, J.Документ3 страницыG.R. No. 190506 Coral Bay Nickel Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Bersamin, J.carlo_tabangcuraОценок пока нет

- A Platform For Innovation: Speech Given by Mark Carney, Governor Bank of EnglandДокумент7 страницA Platform For Innovation: Speech Given by Mark Carney, Governor Bank of EnglandHao WangОценок пока нет

- Addressing The Sustainable Development Through Sustainable Procurement What Factors Resist The Implementation of Sustainable Procurement in PakistanДокумент37 страницAddressing The Sustainable Development Through Sustainable Procurement What Factors Resist The Implementation of Sustainable Procurement in PakistanEngr Awais Tahir MughalОценок пока нет

- Questions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)Документ4 страницыQuestions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)rishi dhungel100% (1)

- Banking System Is Composed of Universal and Commercial Banks, Thrift Banks, Rural andДокумент10 страницBanking System Is Composed of Universal and Commercial Banks, Thrift Banks, Rural andgalilleagalillee100% (1)

- A Comparative Study of E-Banking in Public andДокумент10 страницA Comparative Study of E-Banking in Public andanisha mathuriaОценок пока нет

- BRIC Nations: The Future of The WorldДокумент8 страницBRIC Nations: The Future of The Worldmoney4nileshОценок пока нет

- Nama: Christian Candra Wijaya NIM: F0321067 Kelas: C: InstructionsДокумент6 страницNama: Christian Candra Wijaya NIM: F0321067 Kelas: C: InstructionswijayaОценок пока нет

- Company Analysis Report On M/s Vimal Oil & Foods LTDДокумент32 страницыCompany Analysis Report On M/s Vimal Oil & Foods LTDbalaji bysani100% (1)

- Marketing Plan GuidelinesДокумент24 страницыMarketing Plan Guidelinesrajeshiipm08Оценок пока нет

- Sahil Tiwari Personality Develpoment Assignment PDFДокумент5 страницSahil Tiwari Personality Develpoment Assignment PDFsahiltiwari0777Оценок пока нет

- Anik Nayak (KP)Документ54 страницыAnik Nayak (KP)Meet gayakvadОценок пока нет

- Chapter 2 Dissolution and Liquadation of PartnersipДокумент17 страницChapter 2 Dissolution and Liquadation of PartnersipTekaling NegashОценок пока нет

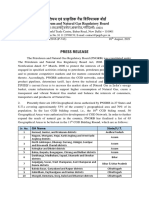

- Press Release: पेट्रोलियम एवं प्राकृलिक गैस लवलियामक बोर्ड Petroleum and Natural Gas Regulatory BoardДокумент3 страницыPress Release: पेट्रोलियम एवं प्राकृलिक गैस लवलियामक बोर्ड Petroleum and Natural Gas Regulatory BoardSWPL HYBRIDОценок пока нет

- Econ 221 Chapter 7. Utility MaximizationДокумент9 страницEcon 221 Chapter 7. Utility MaximizationGrace CumamaoОценок пока нет

- Interest Rate Swaptions: DefinitionДокумент2 страницыInterest Rate Swaptions: DefinitionAnurag ChaturvediОценок пока нет