Академический Документы

Профессиональный Документы

Культура Документы

Week 9 Tutorial Questions Solutions

Загружено:

Anthony LiangИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Week 9 Tutorial Questions Solutions

Загружено:

Anthony LiangАвторское право:

Доступные форматы

ACCT1501

2011S1

Week 9 Tutorial Questions: DQ 8.8; Problems 8.4, 8.8, 9.11, CASE 8B

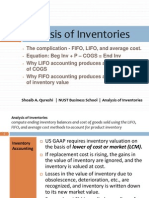

8 FIFO, weighted average and LIFO are assumptions made about the order in which units of inventory flow through the business. FIFO assumes that the first items acquired are the first ones sold and, therefore any ending inventory on hand consists of the most recently acquired units. Thus the older costs will appear in cost of goods sold and the more recent costs on the balance sheet. Weighted average assumes that ending inventory and cost of goods sold are composed of a mixture of old and new units. LIFO assumes the opposite of FIFO. Recent costs will appear in cost of goods sold and the older costs in the balance sheet. The three methods will give similar profit figures if inventory prices are fairly constant. They would give identical profit figures if cost prices of opening inventory and purchases remain unchanged throughout the financial period.

ACCT1501

2011S1

P roblem 8.4

ACCT1501

2011S1

P roblem 8.8

1 a Perpetual FIFO COGS = 60 x $5 + (50 x $5 + 70 x $6) + (10 x $6 + 80 x $7) = $1590 Closing inventory = 30 x $7 + 100 x $8 = $1010 b Perpetual LIFO COGS = 60 x $6 + (110 x $7 + 10 x $6) + 90 x $8 = $1910 Closing inventory = 110 x $5 + 10 x $6 + 10 x $8 = $690 Students who calculated that the total cost of goods available for sale was $2600 tended to perform better in this question as they had a method to test check their answer.

2 Only Closing inventory is adjusted the net realisable value is designed to prevent companies overstating their asset values. Therefore under both FIFO and LIFO, Closing inventory should be $650 (130 x $5). FIFO Closing inventory should be reduced by $360, LIFO by $40.

ACCT1501

2011S1

P roblem 9.11

Вам также может понравиться

- Excel Shortcuts (BIWS)Документ3 страницыExcel Shortcuts (BIWS)Anthony Liang100% (1)

- Determining The Monetary Amount of Inventory at Any Given Point in TimeДокумент44 страницыDetermining The Monetary Amount of Inventory at Any Given Point in TimeParth R. ShahОценок пока нет

- Libby Financial Accounting Chapter7Документ10 страницLibby Financial Accounting Chapter7Jie Bo Ti0% (2)

- Valuation of Inventories A Cost-Basis ApproachДокумент46 страницValuation of Inventories A Cost-Basis ApproachIrwan JanuarОценок пока нет

- Prelim Quiz - Business CombinationДокумент4 страницыPrelim Quiz - Business CombinationJeane Mae BooОценок пока нет

- CrisilДокумент59 страницCrisilsarangk87Оценок пока нет

- Lewis Corporation AbhilashДокумент6 страницLewis Corporation Abhilashchiranjit_datta100% (1)

- McKinsey ReportДокумент58 страницMcKinsey ReportSetiady MaruliОценок пока нет

- How to Rebalance Your Portfolio: Simple and Effective Ways to Protect Your Nest Egg: Thinking About Investing, #5От EverandHow to Rebalance Your Portfolio: Simple and Effective Ways to Protect Your Nest Egg: Thinking About Investing, #5Оценок пока нет

- Afs Slides - Lifo or FifoДокумент21 страницаAfs Slides - Lifo or FifoIntisar HyderОценок пока нет

- Inventory Balance Sheet: Inventory Valuation For Investors: FIFO and LifoДокумент5 страницInventory Balance Sheet: Inventory Valuation For Investors: FIFO and LiforanotabbsОценок пока нет

- Week 3 Chapter 5 - Inventories and Cost of Sales ACC 201 - National UniversityДокумент135 страницWeek 3 Chapter 5 - Inventories and Cost of Sales ACC 201 - National Universitymusic niОценок пока нет

- Task 10,11 & 12Документ2 страницыTask 10,11 & 12Ton VossenОценок пока нет

- Question #1: Inventory ItemДокумент7 страницQuestion #1: Inventory ItemAngelo TipaneroОценок пока нет

- Chapter 08 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Документ133 страницыChapter 08 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi100% (2)

- Inventories: 15.511 Corporate AccountingДокумент61 страницаInventories: 15.511 Corporate AccountingAnanda RamanОценок пока нет

- Accounting For InventoriesДокумент9 страницAccounting For InventoriesPrince AngelОценок пока нет

- Lifo FifoДокумент3 страницыLifo FifoVenus BhattiОценок пока нет

- 100 Chap 6Документ65 страниц100 Chap 6RishiShuklaОценок пока нет

- LIFO Vs FIFO Vs FEFO ExplainedДокумент8 страницLIFO Vs FIFO Vs FEFO ExplainedFayssal El haddad100% (1)

- 221 Chapter 6Документ25 страниц221 Chapter 6Shane HundleyОценок пока нет

- Inventory Accounting Methods: Specific Identification MethodДокумент9 страницInventory Accounting Methods: Specific Identification MethodVidhya ChuriОценок пока нет

- What Is Last In, First Out (LIFO) ?Документ2 страницыWhat Is Last In, First Out (LIFO) ?Niño Rey LopezОценок пока нет

- Acc 201 ch6 HWДокумент6 страницAcc 201 ch6 HWTrickster TwelveОценок пока нет

- Inventory Accounting Methods ExplainedДокумент12 страницInventory Accounting Methods ExplainedSina GolkarОценок пока нет

- 2016030f4150712chap 8 AssignmentДокумент3 страницы2016030f4150712chap 8 AssignmentReynante Dap-ogОценок пока нет

- Chapter 8 HomeworkДокумент7 страницChapter 8 Homeworkklm klm100% (1)

- Inventory Accounting and ValuationДокумент4 страницыInventory Accounting and ValuationFathi Salem Mohammed Abdullah100% (1)

- Transcript For Lecture Video 1Документ5 страницTranscript For Lecture Video 1StaygoldОценок пока нет

- FIN 408 - Ch.6Документ28 страницFIN 408 - Ch.6Shohidul Islam SaykatОценок пока нет

- Inventory: Slide 7.1Документ22 страницыInventory: Slide 7.1arshad mОценок пока нет

- Inventory Costing Methods: Reported By: Joanne OlivaДокумент19 страницInventory Costing Methods: Reported By: Joanne OlivaTon Nd QtanneОценок пока нет

- Inventory ManagementДокумент28 страницInventory ManagementNiloy MallickОценок пока нет

- Session 5 - Inventories - HandoutДокумент37 страницSession 5 - Inventories - HandoutJohn DoeОценок пока нет

- Chapter 2 Costing For Materials and LabourДокумент15 страницChapter 2 Costing For Materials and LabourVerrelyОценок пока нет

- R23 Financial Reporting StandardsДокумент30 страницR23 Financial Reporting StandardsDiegoОценок пока нет

- Fifo & LifoДокумент9 страницFifo & LifoTeodoraОценок пока нет

- Chapter 6 Lecture H-9Документ8 страницChapter 6 Lecture H-9ryanhuОценок пока нет

- Fifo & LIFO: Abhay Tyagi Saket Abhinav TyagiДокумент15 страницFifo & LIFO: Abhay Tyagi Saket Abhinav Tyagiabhaytytyagi123Оценок пока нет

- Inventories: Using Actual Physical Flow CostingДокумент25 страницInventories: Using Actual Physical Flow Costingمحمد محمد جارالله جاراللهОценок пока нет

- Chapter 8: Valuation of Inventories: A Cost Basis ApproachДокумент28 страницChapter 8: Valuation of Inventories: A Cost Basis ApproachChris WongОценок пока нет

- Exercise Chap 8Документ6 страницExercise Chap 8hangbg2k3Оценок пока нет

- Fundamentals of Financial Accounting Canadian 5th Edition Phillips Solutions ManualДокумент38 страницFundamentals of Financial Accounting Canadian 5th Edition Phillips Solutions Manualjeanbarnettxv9v100% (16)

- COMPARATIVE STUDY ON INVENTORY COSTING METHODS (FIFO, LIFO, AVERAGEДокумент5 страницCOMPARATIVE STUDY ON INVENTORY COSTING METHODS (FIFO, LIFO, AVERAGEAziz Bin AnwarОценок пока нет

- How Firms Value InventoryДокумент6 страницHow Firms Value InventoryShreya ChowdharyОценок пока нет

- Reading 22 InventoriesДокумент58 страницReading 22 InventoriesNeerajОценок пока нет

- MGMT 026 Connect Chapter 6 Learnsmart HQДокумент71 страницаMGMT 026 Connect Chapter 6 Learnsmart HQRashid V Mohammed100% (2)

- Homework Chapter 6Документ10 страницHomework Chapter 6Carroll MableОценок пока нет

- 2010-06-23 203304 Financialaccounting 2Документ6 страниц2010-06-23 203304 Financialaccounting 2pi!Оценок пока нет

- About Inventory TopicДокумент18 страницAbout Inventory TopicXin YiiОценок пока нет

- Inventory Practice ProblemsДокумент14 страницInventory Practice ProblemsmikeОценок пока нет

- Retail Inventory MethodДокумент5 страницRetail Inventory MethodEllaine CabalОценок пока нет

- Inventories and Cost of Good SoldДокумент20 страницInventories and Cost of Good Solda4306470Оценок пока нет

- Inventories Valuation A Cost Basis ApproachДокумент19 страницInventories Valuation A Cost Basis Approachabshir haybeОценок пока нет

- A201 Ch6 Fall 2013Документ44 страницыA201 Ch6 Fall 2013Set LuОценок пока нет

- HWChap 006Документ67 страницHWChap 006hellooceanОценок пока нет

- Short-Term Assets: Appendix 1: LIFO - FIFO ConversionДокумент10 страницShort-Term Assets: Appendix 1: LIFO - FIFO ConversionSonali AgarwalОценок пока нет

- Libby 4ce Solutions Manual - Ch08Документ66 страницLibby 4ce Solutions Manual - Ch087595522Оценок пока нет

- 4perACCT1501 2016 S2 Lecture Notes Week 8 - StudentДокумент18 страниц4perACCT1501 2016 S2 Lecture Notes Week 8 - StudentCode CloudОценок пока нет

- Accounting Principles: InventoriesДокумент50 страницAccounting Principles: InventoriesNayeem Ahamed AdorОценок пока нет

- Financial Accounting 7Th Edition Libby Solutions Manual Full Chapter PDFДокумент67 страницFinancial Accounting 7Th Edition Libby Solutions Manual Full Chapter PDFMichaelMurrayewrsd100% (10)

- Comparison AvgДокумент3 страницыComparison Avgabhi_19891Оценок пока нет

- Maintain Inventory RecordsДокумент16 страницMaintain Inventory Recordsjoy xoОценок пока нет

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationОт EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationОценок пока нет

- Sequence Comparison Homology and SimilarityДокумент12 страницSequence Comparison Homology and SimilarityAnthony LiangОценок пока нет

- 02 DatabasesДокумент8 страниц02 DatabasesAnthony LiangОценок пока нет

- 01-Intro To SequenceДокумент2 страницы01-Intro To SequenceAnthony LiangОценок пока нет

- Hapter: International Trade and Trade PolicyДокумент25 страницHapter: International Trade and Trade PolicyAnthony LiangОценок пока нет

- ACCT1501 Study NotesДокумент76 страницACCT1501 Study NotesAnthony LiangОценок пока нет

- English Syllabus From2010Документ101 страницаEnglish Syllabus From2010Anthony LiangОценок пока нет

- 2010 Trial Examination Papers - ModulesДокумент198 страниц2010 Trial Examination Papers - ModulesAnthony LiangОценок пока нет

- A Comparative Study of Financial Product of Icici Bank With Sbi BankДокумент97 страницA Comparative Study of Financial Product of Icici Bank With Sbi Bankdeepak paulОценок пока нет

- Applying the Importance Performance Matrix to analyze Singapore's financial clusterДокумент29 страницApplying the Importance Performance Matrix to analyze Singapore's financial clusterAlexОценок пока нет

- Small Finance Bank and Financial Inclusion - A Case Study of Ujjivan Small Finance BankДокумент10 страницSmall Finance Bank and Financial Inclusion - A Case Study of Ujjivan Small Finance BankNavneet LohchabОценок пока нет

- Macroeconomics Canadian 14th Edition Mcconnell Test BankДокумент32 страницыMacroeconomics Canadian 14th Edition Mcconnell Test Bankadeleiolanthe6zr1100% (27)

- Weekly Equity Report 17 Feb 2014Документ8 страницWeekly Equity Report 17 Feb 2014EpicresearchОценок пока нет

- Business FinanceДокумент2 страницыBusiness FinancejonaОценок пока нет

- Capital BudgetingДокумент219 страницCapital BudgetingprairnaОценок пока нет

- Invoicefile RD16874759594302051Документ3 страницыInvoicefile RD16874759594302051PRONAB MAJHIОценок пока нет

- Invoice For Portable Toilets - Nuggets ParadeДокумент1 страницаInvoice For Portable Toilets - Nuggets Parade9newsОценок пока нет

- Chapter 1. L1.4 Nature of Securities and Risks InvolvedДокумент3 страницыChapter 1. L1.4 Nature of Securities and Risks InvolvedvibhuОценок пока нет

- Bank Loan Application DetailsДокумент8 страницBank Loan Application Detailsbalamurali sankaranarayananОценок пока нет

- CBR Swing BasicДокумент29 страницCBR Swing BasickrisnaОценок пока нет

- Internship Report On Askari Bank LimitedДокумент46 страницInternship Report On Askari Bank Limitedbbaahmad89100% (4)

- Georgia Shacks Produces Small Outdoor Buildings The Company BegДокумент1 страницаGeorgia Shacks Produces Small Outdoor Buildings The Company BegAmit PandeyОценок пока нет

- Math WorksheetДокумент2 страницыMath WorksheetasdfghОценок пока нет

- International Financial Management Abridged 10 Edition: by Jeff MaduraДокумент17 страницInternational Financial Management Abridged 10 Edition: by Jeff MaduraHiếu Nhi TrịnhОценок пока нет

- Muthusundar Resume-Updated 05022023Документ1 страницаMuthusundar Resume-Updated 05022023muthusundarОценок пока нет

- Barney SMCA4 10Документ24 страницыBarney SMCA4 10kenjalbhandari100% (1)

- Chapter 3 Money MarketДокумент17 страницChapter 3 Money MarketJuanito Dacula Jr.Оценок пока нет

- QUESTION PAPER-S4 - Set 2Документ3 страницыQUESTION PAPER-S4 - Set 2Titus ClementОценок пока нет

- Nature of ExpenseДокумент7 страницNature of ExpenseAayush SinghОценок пока нет

- Financial ForecastingДокумент52 страницыFinancial ForecastingNoemie DelgadoОценок пока нет

- YES Premia Soc - Savings Account - A5 Dec 2019 - 01Документ4 страницыYES Premia Soc - Savings Account - A5 Dec 2019 - 01Rasmiranjan PradhanОценок пока нет

- Fiber Monthly Statement: This Month's SummaryДокумент3 страницыFiber Monthly Statement: This Month's SummarySwamy BudumuriОценок пока нет

- Recent Developments in RE Laws Taxation by CA. Jayesh Kariya 1 PDFДокумент55 страницRecent Developments in RE Laws Taxation by CA. Jayesh Kariya 1 PDFManu IttinaОценок пока нет

- Does Credit Growth Impact Credit Quality of Commercial Banks in Dong Nai, VietnamДокумент7 страницDoes Credit Growth Impact Credit Quality of Commercial Banks in Dong Nai, VietnamViệt Vi VuОценок пока нет

- CFAS - M3P2 AssignmentДокумент12 страницCFAS - M3P2 AssignmentMay OriaОценок пока нет