Академический Документы

Профессиональный Документы

Культура Документы

GS Recent Transactions

Загружено:

Omar NazzalИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

GS Recent Transactions

Загружено:

Omar NazzalАвторское право:

Доступные форматы

HTMARKETING\Website\Web update\Nov 2011\TMT update 11-2011.

docx Authorized User 1 Nov 2011 18:04 1/2

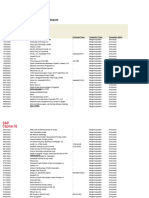

Our Technology, Media and Telecommunications group provides insights and services covering a wide range of industriesfrom electronics to software to Internet to wireless and cable companies. Here is a list of recent transactions.

GS Worldwide TMT M&A

Autonomys $10.3bn sale to HP Skypes $9.1bn sale to Microsoft Polkomtels $6.6bn sale to Spartan Capital National Semiconductors $6.5bn sale to Texas Instruments Vivo Participacoes $5.5bn sale to Telefonica Liberty Globals $4.5bn acquisition of Kabel BW Hitachi Global Storages $4.3bn sale to Western Digital Seven Medias $4.1bn sale to Western Australian Newspapers Holdings Global Crossings $3.2bn sale to Level 3 Communications Qualcomms $2.9bn acquisition of Atheros Warner Music Groups $2.9bn sale to Access Industries Austar United Communications $2.7bn sale to Foxtel BC Partners $2.7bn acquisition of Corn Hern eBays $2.3bn acquisition of GSI Commerce Landis + Gyrs $2.3bn sale to Toshiba Verizons $1.9bn acquisition of Terremark SBS Broadcastings $1.8bn sale to Sanoma Corporation Providence Equity Partners $1.7bn acquisition of SRA International Carl Icahns $1.7bn acquisition of Mentor Graphics Alcatel-Lucent (Genesys)s $1.5bn sale to Permira Universal Orlando Resorts $1.0bn sale to Comcast Austereos $899mm sale to Southern Cross Media Group Network Solutions $756mm sale to Web.com

Source: Thomson SDC

GS Worldwide TMT M&A (Contd)

NBNs $842mm acquisition of SingTel Optus Wholesale Broadband Business and its $121mm acquisition of Austar United Communications Choruss $740mm sale to Crown Fibre Holdings Permiras $686mm acquisition of Opodo Dells $612mm acquisition of SecureWorks Deutsche Telekoms $585mm acquisition of Hellenic Telecommunications LitePoints $580mm sale to Teradyne Rosetta Marketing Strategies $575mm sale to Publicis Groupe UKTVs $555mm sale to Scripps Apollos $534mm acquisition of CKX Soleras $520mm acquisition of Explore Information Services LSI External Storage Systems $480mm sale to NetApp Liberbank (Telecable)s $467mm sale to Carlyle Renaissance Learnings $427mm sale to Permira DG FastChannels $396mm acquisition of MediaMind iSOFTs $391mm sale to Computer Sciences Corporation Dogan Yayins $327mm sale to Dogus S3 Graphics $300mm sale to High Tech Computer Corporation Zorans $224mm sale to CSR Allus Global BPO Centers $206mm sale to Telemar Participacoes Northrop Grummans $190mm acquisition of Vocollect JA Solars $172mm acquisition of Age Holdings Daiwa House Industry Companys $138mm acquisition of ELIIY Power Amdocs $126mm acquisition of Bridgewater Systems

GS Worldwide TMT Equity Related Deals

IPOs $1.9bn The Nielsen Group IPO $1.4bn Yandex IPO $883mm Freescale IPO $345mm Bankrate IPO $269mm Fusion-io IPO $248mm HomeAway IPO $200mm ZipCar IPO $184mm RPX Corporation IPO $174mm Demand Media IPO $157mm Cornerstone OnDemand IPO $133mm MagnaChip IPO Other Equity-Related Deals $1.1bn Kabel Deutschland Follow On $1.0bn NXP Follow On $900mm LAM Research Convertible $888mm Amadeus Follow On $690mm Micron Convertible $593mm Youku Follow On $327mm Gartner Follow On $288mm Nielsen Convertible $265mm Universal Display Follow On $259mm Unisys Convertible $175mm Tesla Motors Follow-On $159mm Telekom Malaysia FollowOn $144mm A123 Convertible and $121mm Follow-On $120mm Broadsoft Convertible $71mm RPX Corporation Follow-On $59mm Mail.ru Group Follow-On

GS TMT Debt Transactions

$6.2bn and $4.6bn Verizon Debt Offering $4.0bn Cisco Debt Offering $4.0bn DirecTV Debt Offering $3.0bn AT&T Debt Offering $3.0bn Google Debt Offering $2.8bn Telefonica Debt Offering $2.7bn Intelsat High Yield $2.4bn and $1.8bn Panasonic Debt Offering $2.2bn Microsoft Debt Offering $2.0bn IBM Debt Offering $2.0 Time Warner Debt Offering $1.8bn Walt Disney Debt Offering $1.7bn Applied Materials Debt Offering $1.5bn Dell Debt Offering $1.5bn and $1.1bn Charter Communications High Yield $1.2bn Deutsche Telekom Debt Offering $1.2bn and $852mm Nippon Telegraph & Telephone Debt Offering $1.1bn Telecom Italia Debt Offering $1.0bn TeliaSonera Debt Offering $1.0bn Avaya High Yield $1.0bn Clear Channel High Yield $988mm Time Warner Debt Offering $952mm France Telecom Debt Offering $897mm SES ASTRA Debt Offering $768mm Odeon Cinemas High Yield $750mm NII Holdings High Yield $718mm Kabel High Yield $704mm CC Media High Yield $704mm eAccess High Yield

GS TMT Debt Transactions (Contd)

$700mm Cablevision High Yield $646mm Discovery Debt Offering $643mm Cequel High Yield $600mm, $446mm, and $206mm Windstream High Yield $550mm MEMC Electronic High Yield $500mm Sanmina-SCI High Yield $495mm PagesJaunes High Yield $492mm Viacom Debt Offering $425mm Grupo Corporativo High Yield $400mm SRA International High Yield $400mm Production Resources Group High Yield $406mm Groupe Videotron High Yield $397mm Leap Wireless High Yield $373mm Analog Devices Debt Offering $349mm Thomson Reuters Debt Offering $299mm Charter Comm High Yield

Вам также может понравиться

- LTE Signaling: Troubleshooting and OptimizationОт EverandLTE Signaling: Troubleshooting and OptimizationРейтинг: 3.5 из 5 звезд3.5/5 (2)

- 3G Broadband and Beyond 082108 QualcommДокумент34 страницы3G Broadband and Beyond 082108 QualcommdjordjebegОценок пока нет

- IridiumДокумент7 страницIridiumSazzad Hossain TuhinОценок пока нет

- ZTE IntroductionДокумент21 страницаZTE IntroductionChi VornОценок пока нет

- Amplifiers Signal SourcesДокумент16 страницAmplifiers Signal SourcesSudipto MitraОценок пока нет

- Telecom IndustryДокумент28 страницTelecom IndustryVishal ShahОценок пока нет

- Related LinksДокумент13 страницRelated LinkstekleyОценок пока нет

- Jim Seymour, Alcatel-Lucent LTE and LTE-Advanced PDFДокумент15 страницJim Seymour, Alcatel-Lucent LTE and LTE-Advanced PDFnizar200Оценок пока нет

- Essential 4G Guide: Learn 4G Wireless In One DayОт EverandEssential 4G Guide: Learn 4G Wireless In One DayРейтинг: 4.5 из 5 звезд4.5/5 (12)

- EE National Launch Press ReleaseДокумент4 страницыEE National Launch Press ReleaseSunil SharmaОценок пока нет

- Ico PresentationДокумент25 страницIco PresentationbobfultzОценок пока нет

- A Business Model: Presented byДокумент88 страницA Business Model: Presented byAayaam KapoorОценок пока нет

- ON Semi WriteupДокумент15 страницON Semi WriteupTim DiasОценок пока нет

- Unit 1 MA PART 1Документ63 страницыUnit 1 MA PART 1Jatin SharmaОценок пока нет

- Evolution of Set Top Box DataДокумент27 страницEvolution of Set Top Box DataSanjay BhoirОценок пока нет

- Connections for the Digital Age: Multimedia Communications for Mobile, Nomadic and Fixed DevicesОт EverandConnections for the Digital Age: Multimedia Communications for Mobile, Nomadic and Fixed DevicesОценок пока нет

- 4g TechnologyДокумент21 страница4g TechnologyPrimearnab DashОценок пока нет

- Metro Broadband TutorialДокумент157 страницMetro Broadband Tutorialkieunp1198Оценок пока нет

- New Manufacturer's Reps Join Our Land Mobile Division!: Icom America IncДокумент4 страницыNew Manufacturer's Reps Join Our Land Mobile Division!: Icom America IncTopcom Toki-VokiОценок пока нет

- Presented By:: Komal Kiran Reg:0901292340 Branch:CSEДокумент15 страницPresented By:: Komal Kiran Reg:0901292340 Branch:CSEKomal KiranОценок пока нет

- GSM/EDGE: Evolution and PerformanceОт EverandGSM/EDGE: Evolution and PerformanceDr. Mikko SailyОценок пока нет

- Everything You Need To Know About 5GДокумент7 страницEverything You Need To Know About 5GNunart SurapongОценок пока нет

- CDMA Evolution Path To LTEДокумент31 страницаCDMA Evolution Path To LTEGhallab AlsadehОценок пока нет

- Assignment2: EEE452 Summer 2019 Name: Safwan Hossain ID: 1610027042 Section: 08Документ2 страницыAssignment2: EEE452 Summer 2019 Name: Safwan Hossain ID: 1610027042 Section: 08Safwan Hossain Bokaul 1610027642Оценок пока нет

- Top 50 EMS 2012Документ1 страницаTop 50 EMS 2012Lina GanОценок пока нет

- OQAM/FBMC for Future Wireless Communications: Principles, Technologies and ApplicationsОт EverandOQAM/FBMC for Future Wireless Communications: Principles, Technologies and ApplicationsРейтинг: 3.5 из 5 звезд3.5/5 (3)

- S2 Convergence in TecnhologyДокумент6 страницS2 Convergence in Tecnhologyjeanpiero1905Оценок пока нет

- USAT Nilson Report Oct08Документ3 страницыUSAT Nilson Report Oct08Adil AhmadОценок пока нет

- Type of Celluller Network and ProjectorДокумент17 страницType of Celluller Network and ProjectorTeddy KwokОценок пока нет

- Spectrum Spats: There Is Simply Not Enough Spectrum To Go RoundДокумент21 страницаSpectrum Spats: There Is Simply Not Enough Spectrum To Go RoundKaran KadabaОценок пока нет

- Sample Business PlanДокумент65 страницSample Business PlanAKResearch100% (1)

- Broadbandits: Inside the $750 Billion Telecom HeistОт EverandBroadbandits: Inside the $750 Billion Telecom HeistРейтинг: 2.5 из 5 звезд2.5/5 (4)

- Understanding the Digital World: What You Need to Know about Computers, the Internet, Privacy, and Security, Second EditionОт EverandUnderstanding the Digital World: What You Need to Know about Computers, the Internet, Privacy, and Security, Second EditionОценок пока нет

- 1003buetow Table3Документ1 страница1003buetow Table3beroeberoeОценок пока нет

- Flextronics Case AnalysisДокумент31 страницаFlextronics Case AnalysisGauthamJayanОценок пока нет

- 2012 Cell Tower PresentationДокумент51 страница2012 Cell Tower PresentationDaniel KwanОценок пока нет

- Finals PaperДокумент15 страницFinals PaperAisah ReemОценок пока нет

- 5G The Nano CoreДокумент22 страницы5G The Nano CoreJason ClarkОценок пока нет

- Best Practices: Insights To Navigate The Technology MazeДокумент51 страницаBest Practices: Insights To Navigate The Technology MazeMohamed UwaisОценок пока нет

- Powermag200805 DLДокумент68 страницPowermag200805 DLOrlando BarriosОценок пока нет

- Lawton Constitution - $14B InvestmentДокумент1 страницаLawton Constitution - $14B InvestmentPrice LangОценок пока нет

- Telecom Revolution From 2G To 5GBДокумент46 страницTelecom Revolution From 2G To 5GBJYOTHI DIGGE100% (1)

- Ikanos Communications: (Nasdaq: Ikan) January 16, 2013Документ26 страницIkanos Communications: (Nasdaq: Ikan) January 16, 2013Stephen ChenОценок пока нет

- 1997-12 HP JournalДокумент128 страниц1997-12 HP JournalElizabeth WilliamsОценок пока нет

- House Hearing, 109TH Congress - The Role of Technology in Achieving A Hard Deadline For The DTV TransitionДокумент79 страницHouse Hearing, 109TH Congress - The Role of Technology in Achieving A Hard Deadline For The DTV TransitionScribd Government DocsОценок пока нет

- The 2016 Canadian Telecom Summit BrochureДокумент6 страницThe 2016 Canadian Telecom Summit BrochureMark GoldbergОценок пока нет

- KT's Strategies For The Era of Mobile Data ExplosionДокумент11 страницKT's Strategies For The Era of Mobile Data ExplosionChatpon AuangkittikunОценок пока нет

- Small Cells Coming To A Lightpost Near YouДокумент18 страницSmall Cells Coming To A Lightpost Near YouRyan BrookmanОценок пока нет

- Spectrum Report ColeagoДокумент49 страницSpectrum Report Coleagowalia_anujОценок пока нет

- Titanic Lessons For IT ProjectsДокумент45 страницTitanic Lessons For IT ProjectsAlekhya gummiОценок пока нет

- Riot Rattrapage2Документ3 страницыRiot Rattrapage2Sunmoon SamiabensalahОценок пока нет

- Broadband Scandal FreeДокумент408 страницBroadband Scandal FreeSean TomlinsonОценок пока нет

- Airify Communications The Wireless Router CompanyДокумент21 страницаAirify Communications The Wireless Router Companymogu08Оценок пока нет

- List of Mobile Phone Makers by CountryДокумент5 страницList of Mobile Phone Makers by CountryUday EdapalapatiОценок пока нет

- ContactsДокумент6 страницContactsBizimenyera Zenza TheonesteОценок пока нет

- DSLAM Fault ReportДокумент305 страницDSLAM Fault ReportJTO NIBОценок пока нет

- CV Muhamad IrfanДокумент4 страницыCV Muhamad Irfanirfanmkw100% (1)

- PembayaranДокумент34 страницыPembayaranHeri MarsudiОценок пока нет

- Nodes Details - UPDATEDДокумент876 страницNodes Details - UPDATEDsunil kumarОценок пока нет

- Declaration of Conformity: TP-Link Technologies Co., LTDДокумент21 страницаDeclaration of Conformity: TP-Link Technologies Co., LTDBianca Maria PopescuОценок пока нет

- Patrick C Hall@yahoo - com-TruthfinderReportДокумент13 страницPatrick C Hall@yahoo - com-TruthfinderReportsmithsmithsmithsmithsmithОценок пока нет

- Egcall RatesДокумент193 страницыEgcall Ratesapi-3698378Оценок пока нет

- Team Implementation - 10-Oct-2012Документ243 страницыTeam Implementation - 10-Oct-2012Rohit Kumar MeetОценок пока нет

- CCAR - 1161 - NCL - USD - A-Z - 20220816Документ3 804 страницыCCAR - 1161 - NCL - USD - A-Z - 20220816Patricia Carolina GoncalvesОценок пока нет

- POWER IC - CompatibilidadesДокумент9 страницPOWER IC - CompatibilidadesJeo OspiОценок пока нет

- Roaming Networks 27.02.18Документ3 страницыRoaming Networks 27.02.18Anonymous WKzd9gОценок пока нет

- Site Id Site Name Circle Discom Consumer NoДокумент15 страницSite Id Site Name Circle Discom Consumer NoJay BachhaneОценок пока нет

- Factura: Telekom Romania Mobile Communications SaДокумент6 страницFactura: Telekom Romania Mobile Communications SaRadu PasalanОценок пока нет

- Global Telecom Companies 2011Документ2 страницыGlobal Telecom Companies 2011kpkevin69Оценок пока нет

- IT & Tekecom TransactionsДокумент20 страницIT & Tekecom TransactionsRohil0% (1)

- 4G - KPI - Cell - Pool - Accumulated - P1MC51 & P1MC52Документ445 страниц4G - KPI - Cell - Pool - Accumulated - P1MC51 & P1MC52roniОценок пока нет

- Spam Shop EcoДокумент234 страницыSpam Shop EcoVăn Năm NguyễnОценок пока нет

- List SA1 99e Agreed ApproveddocxДокумент3 страницыList SA1 99e Agreed ApproveddocxabhishekinfoОценок пока нет

- Telecom CompaniesДокумент3 страницыTelecom CompaniesAnindya SharmaОценок пока нет

- List of MSC & SP Codes Allotted To All: Sl. No - Service Area Name of The Operator Level To Be OpenedДокумент31 страницаList of MSC & SP Codes Allotted To All: Sl. No - Service Area Name of The Operator Level To Be OpenedRazi Ul HabeebОценок пока нет

- HLR Lookup Api V 3.4Документ28 страницHLR Lookup Api V 3.4Hazem ElabedОценок пока нет

- Ericsson - Huawei KPI FormulaДокумент19 страницEricsson - Huawei KPI Formulaanthony_odo7810Оценок пока нет

- Smartpay Utility Billers List - Details - Nov18Документ30 страницSmartpay Utility Billers List - Details - Nov18Dilshad KarzayiОценок пока нет

- Vodafone Group PLCДокумент19 страницVodafone Group PLCRaghav MehraОценок пока нет

- Voicemail Carrier Function Codes Master ListДокумент1 страницаVoicemail Carrier Function Codes Master ListJohn AndersonОценок пока нет

- Satellite Guide IntelsatДокумент180 страницSatellite Guide IntelsatMohamad KhalifeОценок пока нет

- Korean in 60 Minutes - BerlitzДокумент9 страницKorean in 60 Minutes - BerlitzPascalОценок пока нет

- Possible AccessДокумент17 страницPossible AccessallkreeyОценок пока нет