Академический Документы

Профессиональный Документы

Культура Документы

HFR 11april 2001 Young Funds Report

Загружено:

Peter UrbaniОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

HFR 11april 2001 Young Funds Report

Загружено:

Peter UrbaniАвторское право:

Доступные форматы

CROSSBORDER CAPITAL

Absolute Return Fund Research

April 2001

The Young Ones

Many investors assume that young funds perform better than their seasoned counterparts. However, the issue of survivor bias muddles the exact degree of out-performance. In this report, we show the results of a database screening that compares hedge fund performance by maturity adjusting for survivor bias. Young funds do outperform. And the results strongly suggest making an investment in the first three years of a funds life. Main Points Young funds outperform seasoned funds after adjustment for risk of failure Fund failures peak at 28 months Adjusting for survivor bias, the youngest decile beats the oldest by 970 basis points per annum Investors should buy young funds in the first three years of their existence

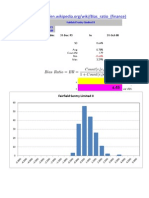

Figure 1. Hedge Fund Returns (Unadjusted) By Age Decile, 1994-2000

Decile 1 2 3 4 5 6 7 8 9 10 Median Median Age 13 19 25 32 38 47 57 70 90 142 43 Average Annual Return 23.2% 20.5 18.2 17.2 18.3 15.4 13.4 14.6 12.7 11.7 13.4

Source: CrossBorder Capital, TASS/Tremont

The Young Ones April 2001, Page 2 of 7

CROSSBORDER CAPITAL

Many investors believe that young hedge funds1 perform better than long-established hedge funds. Several reasons are provided, such as the existence of a temporary niche that is ultimately arbitraged away; the higher energy devoted to performance by a new entrepreneur, and then the adoption of a more conservative investment approach once the managers massive performance fees have been invested in the fund. However, a worrying counterargument focuses on survivor2 bias in the data samples. It suggests that there is likely to be a higher failure rate among new funds, and a fund that fails, by definition, falls out of the database. Some studies have shown that survivor bias may add or subtract as much as 2% to aggregate hedge fund statistics3. If young funds have a still higher failure rate, their survivor bias is likely to be greater. Consequently, returns from investing in younger funds may prove unattractive once this risk of failure is factored in. Clearly, this is a proposition that is worth testing. Using the TASS/Tremont database for the 1994-2000 period, we first screened according to age decile. The results for 3,733 funds, shown in Figures 1 and 2, reveal a median return of 13.4% for all deciles and a median return of a whopping 23.2% for the youngest decile. In other words, there is a massive spread of around 980 basis points in favour of young funds. Figure 2. Hedge Fund Returns (Unadjusted) By Age Decile, 1994-2000

24% 22% 20% 18% 16% 14% 12% 10% 0 20 40 60 80 100 120 140 160 y = -0.0482Ln(x) + 0.3457 R2 = 0.9262

Source: CrossBorder Capital, TASS/Tremont Usually defined as those offering a track record of less than three years. Also known as survivorship bias. 3 A negative or downward bias to future returns occurs when a very successful fund closes to new money and so fails to maintain its voluntary reporting. A positive or upward bias takes place when a poorly performing fund closes down.

2 1

CROSSBORDER CAPITAL

The Young Ones April 2001, Page 3 of 7

The above data make a strong case for investing in young funds. However, it has not been adjusted for survivor bias. Sceptics suggest that positive survivor bias unfairly flatters young funds because their allegedly higher failure rate is not captured in these crude figures. The sceptics are wrong. Figures 3 and 4 show the incidence of failure4 by age (i.e. the point when reporting stopped). Of the original 3,733 funds that reported in 1999, 341 or 9.1%, for some reason, failed to report in 2000. The breakdown of this subset of funds by age reveals a noticeable difference in failure rates between young and seasoned funds. Failure in the first year was, not surprisingly, low: managers were able to struggle on. Failure in year two was correspondingly higher. In each subsequent year, the failure rate fell. Overall, the probability of failure during the first three years at 4.2% was only slightly less than the 4.9% probability of failure for years four onwards. The large proportion of failures reported in year six and above (25.1%) is simply an aggregation of fund failures aged six years, seven years, eight years, etc.

Figure 3. Incidence Of Failure By Age

Age (Years) 1 or less 2 3 4 5 6 and above Source: CrossBorder Capital, TASS/ Tremont Proportion of All Failures (%) 7.4 20.3 18.6 15.8 12.9 25.1

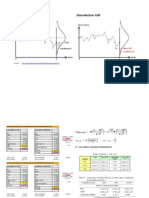

Figure 4. Incidence Of Failure By Age

% of All Failures

28 26 24 22 20 18 16 14 12 10 8 6 4 2 0 10 20 30 40 50 60 70 80 90 100 110 120 130 140 150

Months

Source: CrossBorder Capital, TASS/ Tremont

4

Failure is used generically in the sense of failure to report.

The Young Ones April 2001, Page 4 of 7

CROSSBORDER CAPITAL

The regression line fitted to the data in Figure 4 shows that the failure rate of hedge funds rises to a peak at 28 months and then decays at a roughly constant rate of 2-3% points per annum. These probabilities of failure (i.e. failure to report) can be applied to surviving funds to create a return series that shows the true costs and benefits of investing in funds of specific maturities. The first two columns of Figures 5 exclude all funds that reported in 1999 but failed to report in 2000. This adjustment covers funds that only reported in 1999, but not in 2000, as well as funds that reported from 1994-99 and not 2000. It should capture both negative (i.e. good funds that close) and positive (i.e. bad funds that fail) survivor bias. Both types of bias are likely to affect young funds. Managers that kick-off on the wrong foot may be forced to close down in the first year-or-two, thereby dragging down the true performance of the median young fund relative to older funds. Equally, successful new managers may quickly attract funds. If they then close to new money, it is probable that they will stop reporting their good performances. Young funds suffer most from negative survivor bias. Yet there is surprisingly little difference between the two data sets. The data for surviving funds slightly reinforce rather than dilute the case for young funds: around % per annum is added to the performance of the youngest three fund deciles after this first adjustment. Across the entire sample of 3392 funds the median ex post return only rises a tad to 13.6% from 13.4%. However, these ex post numbers do not show the expected returns from investing in different aged hedge funds. These are reported in the final column of Figure 5. Expected or ex ante returns are calculated by multiplying the survivors returns by the probability of future survival by age decile. We have assumed two things: (1) all failures are bad funds that fail, and (2) 30% of initial capital is lost5. These major constraints exaggerate the underperformance of failed funds6. Nonetheless, even with these heavy constraints, the expected returns shown in Figure 5 make a persuasive case for young funds. The youngest decile generates an expected return of 21.5%, or

Anecdotal evidence suggests that a fund that loses 30% of starting capital will likely close 6 Expected returns are constructed as survivors return times survival rate in decile a less initial capital times failure rate in decile a, e.g. for decile 1: 23.8% x 0.991 - 100% x 0.021 = 23.6% - 2.1% = 21.5%.

CROSSBORDER CAPITAL

The Young Ones April 2001, Page 5 of 7

760 basis points above the (estimated) median7 of 13.9%. This compares to 980 basis points for the crude data. The spread between the youngest and oldest deciles in the adjusted sample is 970 basis points, compared to 1,150 basis points in the crude data. For the second youngest decile, the excess return over the median drops to 290 basis points, against 710 basis points according to the crude data.

Conclusion: Catch A Rising Star

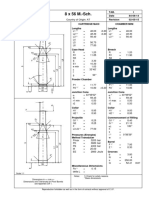

Young funds or rising stars should be a part of hedge fund investors portfolios. There is well-established and constant erosion of performance with time and maturity. The case looks more compelling once the performance data are adjusted for survivor bias. Regression results strongly suggest that rising stars should be captured in the first three years of their existence. The (logarithmic) regression data shown in Figure 7 indicates that each 10% increase in the age/maturity of a manager reduces the potential return by around 0.4%. Thus, between years 1 and 2, potential annual returns drop by around 4%; between years 2 and 3 by a further 2% and between years 3 and 4 and years 4 and 5 by another 1%, respectively. Figure 5. Hedge Fund Returns (Adjusted For Survivor Bias) By Age Decile, 1994-2000

Median Age 13 19 25 32 39 47 58 71 90 142 43 SurvivorsAnnual Average Return (ex post) 23.8% 20.8 18.7 16.9 18.9 16.8 13.3 14.5 13.1 11.8 13.6 Probability of Failure 0.9% 1.6 1.8 1.8 1.7 1.5 1.2 0.9 0.5 0.0 1.6 Probability of Success 99.1% 98.4 98.2 98.2 98.3 98.5 98.8 99.1 99.5 100.0 98.4 Expected Return (ex ante) 21.5% 16.8 14.2 12.5 14.7 13.1 10.4 12.4 11.9 11.8 13.9

Decile 1 2 3 4 5 6 7 8 9 10 Median

Source: CrossBorder Capital, TASS/Tremont

A sample median does not exist. Consequently, we have estimated a median value by inserting the median age of the survivors sample into a regression equation that calculates expected returns by age.

The Young Ones April 2001, Page 6 of 7

CROSSBORDER CAPITAL

Figure 6. Hedge Fund Returns (Adjusted For Survivor Bias) By Age Decile, 1994-2000

26% 24% 22% 20% 18% 16% 14% 12% 10% 8% 0 20 40 60 80 100 120 140 160 y = -0.0356Ln(x) + 0.2729 R2 = 0.6542

Expected Returns (ex post)

Survivors' Return (ex ante)

Source: CrossBorder Capital

Figure 7. Regression Analysis Between Age And Performance, 1994-2000

Hedge Fund Data Unadjusted Adjusted for Survivor Bias Source: CrossBorder Capital Alpha 34.6% 27.3% Beta (log) -4.82 -3.56 R-Squared 92.6% 65.4%

CROSSBORDER CAPITAL

The Young Ones April 2001, Page 7 of 7

CROSSBORDER CAPITAL LTD, 2001. ALL RIGHTS RESERVED REGULATED BY THE SFA MARCOL HOUSE 289-293 REGENT STREET LONDON W1B 2HJ TELEPHONE 44 20 7535 0400 FACSIMILE 44 20 7535 0435 E-MAIL: HEDGEFUND@LIQUIDITY.COM CROSSBORDER CAPITAL BERMUDA LIMITED A SUBSIDIARY OF CROSSBORDER CAPITAL LIMITED REGULATED BY THE BMA 129 FRONT STREET PO BOX 1916 HAMILTON BERMUDA TELEPHONE 441 295 3294 FACSIMILE 441 292 2239 E-MAIL: JBARTON@IBL.BM This document researches a fund not authorised or recognised as a collective regulated investment scheme for the purposes of the UK Financial Services Act 1986 and is therefore for private circulation only and is not intended and must not be distributed to private investors. It is for information purposes only and does not offer any specific investment advice. Under no circumstances should it be used or considered as an advisory or offer to sell or a solicitation of any offer or advisory to buy any securities. The information in this document has been obtained from sources believed reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. In addition any information contained herein does not imply any knowledge of the entire universe of such funds and CrossBorder Capital may or may not receive a fee from the fund manager for the promotion of such funds. Deduction for charges and expenses may not be made uniformly through the life of the investment. As a high volatility investment this fund may be subject to sudden falls in value and these could lead to a large loss on realisation which could equal the amount invested. An investor in the fund will not be liable to compensation for any losses. CrossBorder Capital points out that the value of all investments and the income derived therefrom can decrease as well as increase (this may be partly due to exchange rate fluctuations in investments that have an exposure to currencies other than the base currency of the fund). In addition that fund may from time to time use options, futures and warrants which are highly specialised activities and entail greater than ordinary investment risks. Thus a relatively small movement in the price of a security to which these relate may result in a disproportionately large percentage movement, unfavourable a well as favourable, in their price. The fund may gear itself by s other means as well. Past performance is no guide to future performance. Whilst given in good faith neither we nor any officer, employee, or agent of ours shall be liable for loss or damage, whether direct or indirect, which may be suffered by using or relying on the information, research, opinions, advice or recommendations contained herein or in any prior or subsequent written or verbal presentations. The employees of CrossBorder Capital Limited may have a position or otherwise be interested in funds mentioned in this report. This report may not be reproduced, distributed or published by any recipient for any purpose. CrossBorder Capital Limited is regulated by the SFA for the conduct of investment business in the UK.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Distressed Debt HF's Update (Mar 2013)Документ40 страницDistressed Debt HF's Update (Mar 2013)Peter UrbaniОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Random Forest in Excel and VBAДокумент24 страницыRandom Forest in Excel and VBAPeter UrbaniОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Do You Have To Be Abnormal To Beat The MarketДокумент3 страницыDo You Have To Be Abnormal To Beat The MarketPeter UrbaniОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Ishares Portfolio Analytics Coskew and CoKurt VBA3Документ178 страницIshares Portfolio Analytics Coskew and CoKurt VBA3Peter Urbani100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Cholesky Versus SVDДокумент4 страницыCholesky Versus SVDPeter UrbaniОценок пока нет

- Benford Bias Ratio VBA 2014Документ136 страницBenford Bias Ratio VBA 2014Peter UrbaniОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Impact of Auto-Correlation On Expected Maximum DrawdownДокумент67 страницImpact of Auto-Correlation On Expected Maximum DrawdownPeter UrbaniОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Chimp Chump or ChampДокумент7 страницChimp Chump or ChampPeter UrbaniОценок пока нет

- Portfolio - Analytics Coskew and CoKurt VBA3Документ131 страницаPortfolio - Analytics Coskew and CoKurt VBA3Peter Urbani0% (1)

- Partial Correlation Network Graph VBA (DJINDI)Документ463 страницыPartial Correlation Network Graph VBA (DJINDI)Peter UrbaniОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Singular Spectrum Analysis Demo With VBAДокумент12 страницSingular Spectrum Analysis Demo With VBAPeter UrbaniОценок пока нет

- Intra-Horizon VaR and Expected Shortfall Spreadsheet With VBAДокумент7 страницIntra-Horizon VaR and Expected Shortfall Spreadsheet With VBAPeter Urbani0% (1)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Opalesque NewManagers Sep 2012Документ38 страницOpalesque NewManagers Sep 2012Peter UrbaniОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- POD For GS VIP Hedge Fund Indices (Q3 2012)Документ72 страницыPOD For GS VIP Hedge Fund Indices (Q3 2012)Peter UrbaniОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Portfolio POD VBAДокумент14 страницPortfolio POD VBAPeter Urbani100% (1)

- Risk Perspectives: What Is Risk? Its Measurement, Dimensions, Modeling (Asset Classes, Risk Factors and Regimes)Документ11 страницRisk Perspectives: What Is Risk? Its Measurement, Dimensions, Modeling (Asset Classes, Risk Factors and Regimes)Peter UrbaniОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Opalesque NewManagers July 2012Документ45 страницOpalesque NewManagers July 2012Peter UrbaniОценок пока нет

- Opalesque New Managers May 2012Документ51 страницаOpalesque New Managers May 2012Peter Urbani0% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Opalesque NewManagers Jun 2012Документ43 страницыOpalesque NewManagers Jun 2012Peter UrbaniОценок пока нет

- Opalesque New Managers April 2012Документ42 страницыOpalesque New Managers April 2012Peter UrbaniОценок пока нет

- Opalesque New Managers May 2012Документ51 страницаOpalesque New Managers May 2012Peter Urbani0% (1)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Performance of NZ Super Vs Avg. Australian SuperfundДокумент49 страницPerformance of NZ Super Vs Avg. Australian SuperfundPeter UrbaniОценок пока нет

- Do Emerging Managers Add Value (Mar 2012)Документ19 страницDo Emerging Managers Add Value (Mar 2012)Peter UrbaniОценок пока нет

- Opalesque New Managers Jan 2012Документ36 страницOpalesque New Managers Jan 2012Peter UrbaniОценок пока нет

- Emerging Manager Time Series DecompositionДокумент1 страницаEmerging Manager Time Series DecompositionPeter UrbaniОценок пока нет

- ETFdb Screening Model (March 2012)Документ507 страницETFdb Screening Model (March 2012)Peter UrbaniОценок пока нет

- Opalesque New Managers March 2012Документ37 страницOpalesque New Managers March 2012Peter UrbaniОценок пока нет

- Opalesque New Managers Feb 2012Документ37 страницOpalesque New Managers Feb 2012Peter UrbaniОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Why Distributions Matter (16 Jan 2012)Документ43 страницыWhy Distributions Matter (16 Jan 2012)Peter UrbaniОценок пока нет

- Unit-Ii Syllabus: Basic Elements in Solid Waste ManagementДокумент14 страницUnit-Ii Syllabus: Basic Elements in Solid Waste ManagementChaitanya KadambalaОценок пока нет

- Assignment November11 KylaAccountingДокумент2 страницыAssignment November11 KylaAccountingADRIANO, Glecy C.Оценок пока нет

- Module 7 NSTP 1Документ55 страницModule 7 NSTP 1PanJan BalОценок пока нет

- Domesticity and Power in The Early Mughal WorldДокумент17 страницDomesticity and Power in The Early Mughal WorldUjjwal Gupta100% (1)

- Chapter1 Intro To Basic FinanceДокумент28 страницChapter1 Intro To Basic FinanceRazel GopezОценок пока нет

- Advanced Herd Health Management, Sanitation and HygieneДокумент28 страницAdvanced Herd Health Management, Sanitation and Hygienejane entunaОценок пока нет

- PRESENTACIÒN EN POWER POINT Futuro SimpleДокумент5 страницPRESENTACIÒN EN POWER POINT Futuro SimpleDiego BenítezОценок пока нет

- MSCM Dormitory Housing WEB UpdateДокумент12 страницMSCM Dormitory Housing WEB Updatemax05XIIIОценок пока нет

- Abas Drug Study Nicu PDFДокумент4 страницыAbas Drug Study Nicu PDFAlexander Miguel M. AbasОценок пока нет

- Coke Drum Repair Welch Aquilex WSI DCU Calgary 2009Документ37 страницCoke Drum Repair Welch Aquilex WSI DCU Calgary 2009Oscar DorantesОценок пока нет

- CandyДокумент24 страницыCandySjdb FjfbОценок пока нет

- VRARAIДокумент12 страницVRARAIraquel mallannnaoОценок пока нет

- Fashion DatasetДокумент2 644 страницыFashion DatasetBhawesh DeepakОценок пока нет

- Landscape ArchitectureДокумент9 страницLandscape Architecturelisan2053Оценок пока нет

- Febrile Neutropenia GuidelineДокумент8 страницFebrile Neutropenia GuidelineAslesa Wangpathi PagehgiriОценок пока нет

- Communicating Value - PatamilkaДокумент12 страницCommunicating Value - PatamilkaNeha ArumallaОценок пока нет

- B-GL-385-009 Short Range Anti-Armour Weapon (Medium)Документ171 страницаB-GL-385-009 Short Range Anti-Armour Weapon (Medium)Jared A. Lang100% (1)

- Partnership Digest Obillos Vs CIRДокумент2 страницыPartnership Digest Obillos Vs CIRJeff Cadiogan Obar100% (9)

- Densha: Memories of A Train Ride Through Kyushu: By: Scott NesbittДокумент7 страницDensha: Memories of A Train Ride Through Kyushu: By: Scott Nesbittapi-16144421Оценок пока нет

- ACC030 Comprehensive Project April2018 (Q)Документ5 страницACC030 Comprehensive Project April2018 (Q)Fatin AkmalОценок пока нет

- MEMORANDUM OF AGREEMENT DraftsДокумент3 страницыMEMORANDUM OF AGREEMENT DraftsRichard Colunga80% (5)

- Data Science ProjectsДокумент3 страницыData Science ProjectsHanane GríssetteОценок пока нет

- Forensic IR-UV-ALS Directional Reflected Photography Light Source Lab Equipment OR-GZP1000Документ3 страницыForensic IR-UV-ALS Directional Reflected Photography Light Source Lab Equipment OR-GZP1000Zhou JoyceОценок пока нет

- The Marriage of Figaro LibrettoДокумент64 страницыThe Marriage of Figaro LibrettoTristan BartonОценок пока нет

- MegaMacho Drums BT READ MEДокумент14 страницMegaMacho Drums BT READ MEMirkoSashaGoggoОценок пока нет

- Measuring Road Roughness by Static Level Method: Standard Test Method ForДокумент6 страницMeasuring Road Roughness by Static Level Method: Standard Test Method ForDannyChaconОценок пока нет

- E-CRM Analytics The Role of Data Integra PDFДокумент310 страницE-CRM Analytics The Role of Data Integra PDFJohn JiménezОценок пока нет

- 8 X 56 M.-SCH.: Country of Origin: ATДокумент1 страница8 X 56 M.-SCH.: Country of Origin: ATMohammed SirelkhatimОценок пока нет

- Flipkart Labels 06 Jul 2022 09 52Документ37 страницFlipkart Labels 06 Jul 2022 09 52Dharmesh ManiyaОценок пока нет

- Ty Baf TaxationДокумент4 страницыTy Baf TaxationAkki GalaОценок пока нет