Академический Документы

Профессиональный Документы

Культура Документы

Avani Winter Project

Загружено:

Kakadia PayalИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Avani Winter Project

Загружено:

Kakadia PayalАвторское право:

Доступные форматы

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.

COM

Industry Profile

NAVNIRMAN INSTITUTE OF MANAGEMENT 1

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Demat account is more or less an essential requirement for all the investors who invest in equities, bonds and debentures. Demat account allows you to buy, sell and transact shares without the endless paperwork and delays. It is also safe, secure and convenient. There is no transaction possible today without a demat account.

Demat Account in India

Demat or Dematerialized account is to store stocks in electronics form. It is just like opening a bank account to store your money. Now nobody is interested to keep shares in physical forms and going for electronic based filing of shares. This has changed the style of operation in main Indian stock markets like BSE Sensex (Bombay Stock Exchange Sensitive Index) and Nifty (National Stock Exchange of India) and its brokers.

Despite various efforts by the regulators to make electronic transactions as cheap as possible for the ordinary investors, the charges for Demat accounts continue to remain on higher side. Depending upon the individual profile, requirements and suitability, different investors open DP accounts with major banks, big online broking houses or local brokers.

NAVNIRMAN INSTITUTE OF MANAGEMENT

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Depository

Depository is responsible for keeping stocks of investors in electronics form. There are two depositories in India, NSDL (National Securities Depository Ltd) and CDSL (Central Depository Services Ltd). Depository on NSDL: National Securities Depository Limited (NSDL), India's first and the largest depository has crossed 1,00,00,000 (one crore) demat accounts. These accounts have more than 80% of securities held and settled in dematerialised form in India, indicating preference and trust the investors have in maintaining their assets with NSDL. Over the period of last two years, more than 40 lakh new demat accounts were opened with NSDL. These accountholders are serviced by 281 Depository Participants through more than 9,600 service centres across about 1,000 cities/towns in the country.

Capital Market

The capital market is a market for financial assets which have a long or indefinite maturity. It deals with long term securities which have a maturity period of above one year. Its further classified into 1) Primary market 2) Secondary market 1) Primary market:

Primary market is a market for new issues or new financial claims. The primary market deals with those securities which are issued to the public for the firs time. In the primary market, borrowers exchange new financial securities for long term funds. Thus, primary market facilitates capital formation. The primary market deals with the Initial public offerings (IPO) or sales of shares by companies to the public for the first time.

NAVNIRMAN INSTITUTE OF MANAGEMENT 3

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

There are tree ways by which a company may raise capital in a primary market. They are public issue, rights issue, and private placement.

Public issue: Under this method, the issuing company directly offers to the general public a fixed number of shares at a stated price through a document called prospectus. This is the most common method follows by joint stock companies to raise capital through the issue of securities.

Rights issue: Right issue is a method of raising funds in the market by existing company.

Private placement: Under this method, the brokers buy the securities outright with the intention of placing them with their clients afterwards. The brokers would make profit in the process of reselling to the public.

2) Secondary market:

Secondary market is a market for secondary sale of securities. Securities which have already passed through the new issue market are traded in this market. This market consists of all stock exchanges recognized by the government of India. Secondary market more commonly known as stock markets.

NAVNIRMAN INSTITUTE OF MANAGEMENT

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Company Profile

NAVNIRMAN INSTITUTE OF MANAGEMENT 5

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

ICICI BANK

ICICI Bank started as a wholly owned subsidiary of ICICI Limited, an Indian financial institution, in 1994. Four years later, when the company offered ICICI Bank's shares to the public, ICICI's shareholding was reduced to 46%. In the year 2000, ICICI Bank offered made an equity offering in the form of ADRs on the New York Stock Exchange (NYSE), thereby becoming the first Indian company and the first bank or financial institution from non-Japan Asia to be listed on the NYSE. In the next year, it acquired the Bank of Madura Limited in an allstock amalgamation. Later in the year and the next fiscal year, the bank made secondary market sale to institutional investors.

With a change in the corporate structure and the budding competition in the Indian Banking industry, the management of both ICICI and ICICI Bank were of the opinion that a merger between the two entities would prove to be an essential step. It was in 2001 that the Boards of Directors of ICICI and ICICI Bank sanctioned the amalgamation of ICICI and two of its whollyowned retail finance subsidiaries, ICICI Personal Financial Services Limited and ICICI Capital Services Limited, with ICICI Bank. In the following year, the merger was approved by its shareholders, the High Court of Gujarat at Ahmadabad as well as the High Court of Judicature at Mumbai and the Reserve Bank of India.

NAVNIRMAN INSTITUTE OF MANAGEMENT

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Present Scenario ICICI Bank has its equity shares listed in India on Bombay Stock Exchange and the National Stock Exchange of India Limited. Overseas, its American Depositary Receipts (ADRs) are listed on the New York Stock Exchange (NYSE). As of December 31, 2008, ICICI is India's secondlargest bank, boasting an asset value of Rs. 3,744.10 billion and profit after tax Rs. 30.14 billion, for the nine months, that ended on December 31, 2008. Products & Services:

Personal Banking Deposits Loans Cards Investments Insurance Demat Services Wealth Management NRI Banking Money Transfer Bank Accounts Investments Property Solutions Insurance Loans Business Banking Corporate Net Banking Cash Management

NAVNIRMAN INSTITUTE OF MANAGEMENT 7

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Trade Services FXOnline SME Services Online Taxes Custodial Services

ICICI Bank (Industrial Credit and Investment Corporation of India) is India's largest private sector bank by market capitalization and second largest overall in terms of assets. Bank has total assets of Rs. 3,793.01 billion (US$ 75 billion) at March 31, 2009 and profit after tax Rs. 37.58 billion for the year ended March 31, 2009. The Bank also has a network of 1,520 branches and about 4,721 ATMs in India and presence in 18 countries, as well as some 24 million customers (at the end of July 2007). ICICI Bank offers a wide range of banking products and financial services to corporate and retail customers through a variety of delivery channels and specialized subsidiaries and affiliates in the areas of investment banking, life and non-life insurance, venture capital and asset management. The Industrial Credit & investment corporation of India limited was introduced on 5th January 1995 as a public limited company under the Indian companies & subsequently renamed ICICI limited with effect from 11th sept. 1955

NAVNIRMAN INSTITUTE OF MANAGEMENT 8

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

In 1994, the bank set up an in-house training institute at pune which was inaugurated on 13th Oct. to case of the long time training needs of the employees of all the companys in ICICI group at various level. It has been admitted as the 18th Depository Participant during the week ended 22nd Feb. 1997. In 1999, ICICI, the 2nd largest financial institution, has proposed a yearly commission not exceeding 1% of net profit to its non-whole time directors. ICICI bank, the first commercial bank from India to get its stock listed on NYSE in the year 2000.

ICICI Bank Demat Services boasts of an ever-growing customer base of over 16.29 lacs customer base as on 30.09.09 account holders.

NAVNIRMAN INSTITUTE OF MANAGEMENT

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Theoretical Framework

NAVNIRMAN INSTITUTE OF MANAGEMENT 10

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

3.1 INTRODUCTION

(a) Dematerialized Trading

Indian investor community has undergone see changes in the past few years. India now has a very large investor population and ever increasing volumes of trades. However, this continuous growth in activities has also increased problems associated with stock trading. Most of these problems arise due to the intrinsic nature of paper based trading and settlement, like theft or loss of share certificates. This system requires handling of huge volumes of paper leading to increased costs and inefficiencies. Risk exposure of the investor due to this trading in paper. Some of these risks are: 1. Delay in transfer of shares. 2. Possibility of forgery on various documents leading to bad deliveries, legal disputes etc. 3. Possibility of theft of share certificates in the market. 4. Multiplication or loss of share certificates in transit. 5. Prevalence of fake certificates in the market.

The physical form of holding and trading in securities also acts as a bottleneck for broking community in capital market operations. The introduction of NSE and BOLT has increased the reach of capital market manifolds. The increase in number of investors participating in the capital market has increased the possibility of being hit by a bad delivery. The cost and time spent by the brokers for rectification of these bad deliveries tends to be higher with the geographical spread of the clients. The increase in trade volumes lead to exponential rise in the back office operations thus limiting the growth potential of the broking members. The inconvenience faced by investors (in areas that are far flung and away from the main metros) in settlement of trade also limits the opportunity for such investors, especially in participating in auction trading. This has made the investors as well as broker wary of Indian capital market. In this scenario, dematerialized trading is certainly a welcome move.

NAVNIRMAN INSTITUTE OF MANAGEMENT 11

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

(b) What is Dematerialization?

Dematerialization or Demat is a process whereby your securities like shares, debentures etc, are converted into electronic data and stored in computers by a Depository. Securities registered in your name are surrendered to depository participant (DP) and these are sent to the respective companies who will cancel them after Dematerialization and credit your depository account with the DP. The securities on Dematerialization appear as balances in your depository account. These balances are transferable like physical shares. If at a later date, you wish to have these Demat securities converted back into paper certificates; the Depository helps you to do this. Dematerialization is the process of converting the securities held in physical form (certificates) to an equivalent number of securities in electronic form and crediting the same to the investors Demat account. Dematerialized securities do not have any certificate numbers or distinctive numbers and are dealt only in quantity i.e.; the securities are fungible. Dematerialization of your holdings is not mandatory. You can hold your secure Demat form or in physical form. You can also keep part of your holdings (in the same script) in Demat form & part in physical form. However, securities specified by SEBI can be delivered only in Demat form in the stock exchanges connected to NSDL and / or CDSL.

(c) NSDL and CDSL

At present there are two depositories in India, National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL). NSDL is the first Indian depository; it was inaugurated in November 1996. NSDL was set up with an initial capital of US$28mn, promoted by Industrial Development Bank of India (IDBI), Unit Trust of India (UTI) and National Stock Exchange of India Ltd. (NSEIL). Later, State Bank of India (SBI) also became a shareholder. The other depository is Central Depository Services (CDS). It is still in the process of linking with the stock exchanges. It has registered around 20 DPs and has signed up with 40 companies. It had received a certificate of commencement of business from SEBI on February 8, 1999.

12

NAVNIRMAN INSTITUTE OF MANAGEMENT

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

These depositories have appointed different Depository Participants (DP) for them. An investor can open an account with any of the depositories DP. But transfers arising out of trades on the stock exchanges can take place only amongst account-holders with NSDLs DPs. This is because only NSDL is linked to the stock exchanges (nine of them including the main ones-National Stock Exchange and Bombay Stock Exchange). In order to facilitate transfers between investors having accounts in the two existing depositories in the country the Securities and Exchange Board of India has asked all stock exchanges to link up with the depositories. SEBI has also directed the companies registrar and transfer agents to effect change of registered ownership in its books within two hours of receiving a transfer request from the depositories. Once connected to both the depositories the stock exchanges have also to ensure that inter-depository transfers take place smoothly. It also involves the two depositories connecting with each other. The NSDL and CDSL have signed an agreement for inter-depository connectivity. NSDL performs the following functions through its various participants: a) Enable surrender and withdrawal of securities to and from the depository. b) Maintains investors holdings in the electronic form. c) Effects settlement of securities traded on exchanges. d) Carries out settlements of trader that have not been done on the stock exchanges. NSDL (DP) Depository Participant can be a public financial institution, bank, custodian, registered stock broker or a NBFC subject to approval from the depository company and the SEBI, Brokers and NBFCs are required to have a minimum net worth of Rs. 50 lakhs. DP has to pay a security deposit of Rs. 10 lakhs and an admission fee of Rs. 25,000 to NSDL. The depository participants are likely to pass on these charges to the investors.

NAVNIRMAN INSTITUTE OF MANAGEMENT

13

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

NSDL charges: NSDL charges are chargeable extra at actual. Present NSDL Charges are: Sell: Market and Off- Rs. 8/- per debit instruction (nil for commercial paper and Market Rematerialization Pledge Creation short term debt instruments) Rs. 10/- per certificate Rs. 25/- per instruction

Conditions: The value of shares and charges is calculated as per NSDL formula and rates. There will be a charge of Rs. 100/- for dishonor of any cheque or unsuccessful attempt to recover payment through direct debit or ECS. The depository services are liable to discontinuation if ICICI Bank is unable to recover charge from the customer for any reason whatsoever. In such cases there will be a charge of Rs. 250/- for resumption of services and the services will be resumed after a minimum of three working days from the date of receipt request at Central Processing Office. Mumbai. Any service that is not indicated above will be charged separately as per the rates applicable from time to time. ICICI Bank reserves the right to revise the tariff structure from time to time, with notice of 30 days. The notice may be given by ordinary post or by advertisement in a national daily. If the Demat Account is dosed during the year, no pro-rate refund of Annual Service Charge will be made.

NAVNIRMAN INSTITUTE OF MANAGEMENT

14

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

CDSL charges: CDSL fees structure to its depository participants is as follows: SR.NO. Details of Charges 1 Account Opening Charges 2 Account Maintenance Charges 3 4 Transaction Charges Market & Off-Market Transaction Charges Clearing Member Accounts Custody Charges Demat Charges Remat Charges Pledge/Hypothecation Charges CDSL NIL NIL for individuals Rs.500/- p.a. to Corporate Rs.6/- ** Flat charge of Rs.500/- per month on CM accounts for pay-in and pay-outs received from CH NIL NIL Rs.10/- per 100 securities or part quantity or Rs. 10/- per cert. whichever is higher. Pledge acceptance - Rs.12/- per request. Unpledged acceptance - Rs.12/- per request. Pledge Invocation Acceptance -Nil

5 6 7 8

(d) SEBI Act

The Securities and Exchange Board of India Act, 1992 is having retrospective effect and is deemed to have come into force on January 30, 1992. Relatively a brief act containing 35 sections, the SEBI Act governs all the stock Exchanges and the Securities Transactions in India.

A Board by the name of the Securities and Exchange Board of India (SEBI) was constituted under the SEBI Act to administer its provisions. It consists of one Chairman and five members.

One each from the department of Finance and Law of the Central Government, one from the Reserve Bank of India and two other persons and having its head office in Bombay and regional offices in Delhi, Calcutta and Madras.

NAVNIRMAN INSTITUTE OF MANAGEMENT

15

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

The Central Government reserves the right to terminate the services of the Chairman or any member of the Board. The Board decides questions in the meeting by majority vote with the Chairman having a second or casting vote.

Section 11 of the SEBI Act provides that to protect the interest of investors in securities and to promote the development of and to regulate the securities market by such measures, it is the duty of the Board. It has given power to the Board to regulate the business in Stock Exchanges, register and regulate the working of stock brokers, sub-brokers, share transfer agents, bankers to an issue, trustees of trust deeds, registrars to an issue, merchant bankers, underwriters, portfolio managers, investment advisers, etc., also to register and regulate the working of collective investment schemes including mutual funds, to prohibit fraudulent and unfair trade practices and insider trading, to regulate take-over, to conduct enquiries and audits of the stock exchanges, etc. All the stock brokers, sub-brokers, share transfer agents, bankers to an issue, trustees of trust deed, registrars to an issue, merchant bankers, underwriters, portfolio managers, investment advisers and such other intermediary who may be associated with the Securities Markets are to register with the Board under the provisions of the Act, under Section 12 of the Sebi Act. The Board has the power to suspend or cancel such registration. The Board is bound by the directions vested by the Central Government from time to time on questions of policy and the Central Government reserves the right to supersede the Board. The Board is also obliged to submit a report to the Central Government each year, giving true and full account of its activities, policies and programs. Any one of the aggrieved by the Board's decision is entitled to appeal to the Central Government.

NAVNIRMAN INSTITUTE OF MANAGEMENT

16

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

3.2 TRADING

Trading in dematerialized securities is quite similar to trading in physical securities. The major difference is that at the time of settlement, instead of delivery/ receipt of securities in the physical form, it is done through account transfer. An investor cannot trade in dematerialized securities through his DP. Trading at the stock exchanges can be done only through a registered trading member (broker) of the stock exchange irrespective of whether the securities are held in physical or dematerialized form. DPs role will only be to facilitate settlement of trade in the dematerialized form, by transferring securities from and to the account of the investor, for selling and buying respectively. Trading in dematerialized securities is presently available at NSE, BSE, CSE, DSE, LSE, MSE, ISE and OTCEI. These exchanges have a segment exclusive for trading in dematerialized securities and a segment where trades could be settled either in the physical or in the dematerialized form as per the choice of the delivering client. In unified (erstwhile - physical) segment securities can be delivered either in the physical form or in the dematerialized form at the choice of the delivering party. However, securities that have to be mandatorily settled in demat form (both by institutional investors & all category of investors) cannot be settled in physical form. Also for securities that have to be mandatorily settled in demat form by all categories of investors the concept of market lot is eliminated i.e. the tradable lot is one share from the date they become compulsory.

NAVNIRMAN INSTITUTE OF MANAGEMENT

17

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

3.3 SETTLEMENT

The settlement of trades in the stock exchanges is undertaken by the clearing corporation (CC)/ clearing house (CH) of the corresponding stock exchanges. While the settlement of dematerialized securities is effected through depository, the funds settlement is effected through the clearing banks. The clearing members directly with the CC/ CH settle the physical securities. Exclusive Demat segment follows rolling settlement (T+5) cycle and the unified (erstwhile physical) segment follows account period settlement cycle. In case of rolling settlement cycle, the account period is reduced to one day. In case of settlement of trades done in exclusive Demat segments, the pay-in and pay out of funds and securities are affected on the same day afternoon and evening (same day) thus reducing the blockage of funds and limiting exposure to the clearing corporation. Settlement of funds is effected through the clearing banks and depository plays no role in this. Settlement of securities is effected through NSDL depository system. Clearing and settlement of the regular market trades is affected through the clearing members of the clearinghouses of respective stock exchanges. All trading members of stock exchanges are clearing members of clearing houses. In addition, for settlement of institutional trades, custodians are also allowed to act as clearing members. Clearing members of clearinghouse, dealing in dematerialized securities are expected to open a clearing account with any DP for the purpose of settling trades in dematerialized securities. As, in the mixed (unified) segment, there is a possibility for all clearing members to receive dematerialized securities, they are expected to open clearing accounts. If there is any short delivery at the time of pay-in of securities, these short positions are auctioned in the Demat segment as done in the Unified (erstwhile-physical) segment.

NAVNIRMAN INSTITUTE OF MANAGEMENT

18

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

For trades executed on Wednesday (TD 1): Final/ Net obligation statement download - Friday (T+2nd working day) Settlement day (SD 1) i.e. pay in and pay out of funds and securities - next Wednesday (T+5th working day) Auction trade day (ATD 1) - next Thursday (T+6th working day) Auction settlement day (ASD 1) - Monday (2nd working day from auction trade day i.e. T+8th working day) Similarly, for trades executed on Thursday (TD 2): Final/ Net obligation statement download - Monday (T+2nd working day) Settlement day (SD 2) - next Thursday (T+5th working day) Auction trade day (ATD 2) - next Friday (T+6th working day) Auction settlement day (ASD 2) - Tuesday (2nd working day from auction trade day i.e. T+8th working day)

NAVNIRMAN INSTITUTE OF MANAGEMENT

19

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

3.4 Comparison of Demat Charges

Account Opening and documentation charges Nil + Stamp paper fees Nil Folio Maintenance Charges 500

Transaction Charges for Debit of Shares (in case of sell)

Axis Bank Asit Mehta Investmentz.com

0.04% of the transaction value, minimum 20 per transaction No Annual Maintenance Charge Transaction charge as per various plans Lowest plan Rs.500 per year, which includes 60 free transactions Note: even if nos of transactions are less than 60 or nil, you will have to pay Rs.500 per year Above 60 transactions, Rs.20 per transaction 0.02% of the transaction value, minimum 25 per transaction 0.06% of the transaction value, minimum 17 per transaction 11 flat per transaction10 flat per transaction 0.04% of the transaction value, minimum 21 per transaction Free up to first ten transactions , thereafter 100 per transaction 0.04% of the transaction value, subject to minimum 10,15 or 30 depending upon where and how you submit the delivery instruction slip 10 flat per transaction10 flat per transaction 0.04% of the transaction value, subject to minimum 22 per transaction 12 flat per transaction 0.03% of the transaction value, minimum 10-30 per transaction depending upon where and how you submit delivery instructions 0.03% of the transaction value, minimum 30 per transaction

Bajaj Capital Citi Bank Geojit HDFC Bank HSBC ICICI Bank

Nil Nil Nil NIL Not known 100/- stamp paper charges

250 250 300 500 per year 750 500 per year

India Bulls Kotak Securities Reliance Money SBI

100 Not known Not known 100

500 30 per month; 360 per year 200 per year 400

Sharekhan

Nil

300

NAVNIRMAN INSTITUTE OF MANAGEMENT

20

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Note:

As per the regulator SEBI, no broker can levy transaction charges for credit of shares (when you buy) and therefore it is free. On the above charges, the banks levy service tax and education cess at the rate of 10.3% Many banks and brokers offer account opening and documentation free of cost if you open trading account with them Many banks waive off annual maintenance charges for the first year If you opt for E-Statements, some of the banks can offer you discounts If you have a trading and DP account with the same broker, you may have to pay substantially lesser charges for annual maintenance and transactions.

NAVNIRMAN INSTITUTE OF MANAGEMENT

21

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

3.5 Products and Services

A product for every need: ICICIdirect.com is the most comprehensive website, which allows investors to invest in Shares, Mutual funds, Derivatives (Futures and Options) and other financial products.

1. Trading in shares: ICICIdirect.com offers you various options while trading in shares.

Cash Trading This is a delivery based trading system, which is generally done with the intention of taking delivery of shares or monies.

Margin Trading One can also do an intra-settlement trading upto 3 to 4 times with their available funds, wherein one can take long buy/ short sell positions in stocks with the intention of squaring off the position within the same day settlement cycle.

Margin PLUS Trading Through Margin PLUS one can do an intra-settlement trading upto 25 times with their available funds, wherein one can take long buy/ short sell positions in stocks with the intention of squaring off the position within the same day settlement cycle. Margin PLUS will give a much higher leverage in ones account against their limits.

NAVNIRMAN INSTITUTE OF MANAGEMENT

22

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Spot Trading This facility can be used only for selling ones demat stocks which are already existing in their demat account. When one is looking for an immediate liquidity option, 'Cash on Spot' may work the best for you,

BTST Buy Today Sell Tomorrow (BTST) is a facility that allows selling shares even on 1st and 2nd day after the buy order date, without having to wait for the receipt of shares into demat account. Trading on NSE/BSE: Through ICICIdirect.com, one can trade on NSE as well as BSE. Market Order One could trade by placing market orders during market hours that allows to trade at the best obtainable price in the market at the time of execution of the order. Limit Order Allows one to place a buy/sell order at a price defined by one.

2. TRADE IN DERIVATIVES: FUTURES Through ICICIdirect.com, one can now trade in index and stock futures on the NSE. In futures trading, one take buy/sell positions in index or stock(s) contracts having a longer contract period of up to 3 months.

NAVNIRMAN INSTITUTE OF MANAGEMENT 23

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

OPTIONS An option is a contract, which gives the buyer the right to buy or sell shares at a specific price, on or before a specific date. For this, the buyer has to pay to the seller some money, which is called premium. There is no obligation on the buyer to complete the transaction if the price is not favorable to him.

3. Investing in Mutual funds: ICICIdirect.com offers you various options while investing in Mutual Funds: Purchase, Redemption, Switch, Systematic Investment plans (SIP), Systematic withdrawal plan, Transfer-in.

4. IPOs and Bonds Online: You could also invest in Initial Public Offers (IPOs) and Bonds online without going through the hassles of filling ANY application form/ paperwork.

5. Content Features: Get breaking news from CNBC and Reuters. Catch a glimpse of News Headlines through our scrolling Direct News Headlines. Get a snapshot of the latest developments in the markets through the day using Market Commentary One can get weekly snapshots also. Use Pick of the week which focuses on fundamental stocks with sound prospects.

NAVNIRMAN INSTITUTE OF MANAGEMENT 24

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Direct Technical Charts offer interactive charting with advanced indicators. Gets a birds eye view of over 5000 companies at a single click using Company Snapshot. Glance through analyst recommendations using Multex Global Estimates. In case, one is not too comfortable with share trading, try our Learning Centre, which is a tutorial on investments and My Research, that helps you to research a stock better. Catch interviews, reactions and comments from industry leaders with CEO Call. Track the movement of leading scrips within a sector across 12 sectors using Market@Desktop.

6. Personal Finance: Use ICICIs Personal Finance section and get hold of tools that can help you plan your investments, retirement, tax etc. Analyse Ones risk profile through the Risk Analyzer and get a suitable investment portfolio plan using Asset Allocator.

7. Customer Service Features: With 'ICICIdirect Customer Tools & Updates' one can trouble shoot all their problems online. Address ones trading queries on-line through "Easy Mail". One can view and change profile or password on-line through General Profile option.

Get details of ICICI Centers, sales and service offices, across India through branch locator.

View Account Statement and Bill Summary of your transactions online using bills & accounts.

NAVNIRMAN INSTITUTE OF MANAGEMENT 25

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

View Digital Contract Notes instantly. View various charges through the Fee Schedule option Give feedback or viewpoint through the Viewpoint online. Enroll oneself for various ICICIdirect Workshops through Register for Customer Sessions.

NAVNIRMAN INSTITUTE OF MANAGEMENT

26

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

3.6 Procedure for Demat

How to open account with ICICI Direct?

For Online Stock Trading with ICICI, investor needs to open 3 accounts...ICICI Bank Account, ICICI Direct Trading Account and ICICI Demat Account (DP Account).

Note: If you already have a bank account or demat account with ICICI, you could link it with new ICICI Direct trading account.

Opening trading account with ICICI is easy. You could use one of the following options to open account with ICICI Direct.

Visit ICICIDirect.com and fill the "Open an Account" form. Call ICICI and tell them that you are interested in opening an account with them.

NAVNIRMAN INSTITUTE OF MANAGEMENT

27

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

3.7 Charges of Demat

Account Opening Charges: Rs. 750 In case you open an account before March 31, 2000, the account opening charge of Rs 750 can be set off against the brokerage paid by you for all trades done till Sep 30, 2000. Thus if you do a volume of trade of approximately Rs 2,00,000 till Sept 30, 2000 at the current brokerage rates the entire account opening charges of Rs 750 would be refunded on September 30, 2000. In case the brokerage paid by you till September 30, 2000 is less than Rs 750 (say Rs 500) only the same will be refunded.

Cash Product Commission Schedule:

Trades that result in delivery: 0.85%-* of value of trade all inclusive with a minimum of Rs.150 per trade Trades that are squared off within the settlement cycle: 0.85% for the first leg and no commissions for the second leg. In case your volume in a quarter exceeds Rs 10,00,000, you will get a rebate of 0.25% (i.e. effective brokerage of 0.60% against standard brokerage of 0.85%). The rebate amount will be computed on all the transactions done during the quarter and will be credited to your account at the end of each quarter. The quarters for the purpose of the computation are defined as: Q1 Jan1-March 31, Q2 April 1- June 30, Q3 July 1 - Sept 30, Q4 Oct 1- Dec 31. Start of trading using our cash product is expected within the next few weeks subject to regulatory approvals. For the current year the first quarter will be from commencement to 30th June 2000 for computation of commissions.

Bank Fee Schedule:

No minimum balance required for savings accounts opened with e-invest account trades.

Demat Fee schedule:

Schedule of Charges (for Resident Non-Corporate) effective from November 1, 1999.

NAVNIRMAN INSTITUTE OF MANAGEMENT

28

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Fee Head

1 2 A/c opening Charges Annual Services Charges

DP Charges

NIL Rs.300/-payable at the time of signing of agreement and every year in the month of April. (waived for the first year for all ICICIDirect customers) Rs.20/- (included in the e-invest account opening charges) a. No custody charges (including NSDL custody charges) on ICICI and ICICI Bank Shares b. No custody charges on other shares, upto Rs.25 lacs of average asset value c. Custody charges will be calculated @ 0.05% per annum on Average Asset value exceeding Rs.25 lacs 0.05% of the transaction value with a minimum of Rs.25/per trade (included in the commission structure of ICICIdirect.com customers) 0.02% of the transaction value subject to a minimum of Rs.25/- per transaction+ 0.05% of the transaction value subject to a minimum of Rs.25/- per transaction + Rs.25/- per entry (+Plus NSDL charges of 0.02% of the transaction value for buy and sell transactions) a. Free Demat for ICICI and ICICI Bank shares b. For other scrips Rs.2 per certificate subject to a minimum of Rs.25/- per DRF Rs.2/- per Certificate * (*Plus NSDL Charges of Rs.10/-Per certificate or 0.10% of the market value of the securities whichever is higher) NIL 0.05% of the transaction value subject to a minimum of Rs.50/- per ISIN and per request

3 4

Agreement Stamp Paper Custody charges

a. Transaction Charges (Market) BUY & SELL b. Transaction Charges (off-Market ) SELL c) Rejections/fails

Demat Charges

Remat Charges

8 9

Closure of Account Pledge Creation/Invocation/ Revocation/Confirmation

NAVNIRMAN INSTITUTE OF MANAGEMENT

29

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Research Methodology

NAVNIRMAN INSTITUTE OF MANAGEMENT 30

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Research Methodology refers to search of knowledge .One can also define research methodology as a scientific and systematic search for required information on a specific topic.

4.1 Primary Objective

The main objective of the study is to know about the satisfaction level of the clients of ICICI. To know the demat services provided by ICICI direct. To know the demat charges and other charges of ICICI direct. To collect the real time information about preference level of customers using Demat account.

4.2 Secondary Objective

Awareness program on Demat. To make aware investors regarding demat account.

4.3 Response Rate

Survey response rate is broadly defined as the percentage of the total attempted interview that is completed. As theatrically personal methods gets higher response rate for survey. For the survey I went to the 75 ICICI Direct account holders, so my response rate is 100%.

NAVNIRMAN INSTITUTE OF MANAGEMENT

31

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

4.4 Data Collection Method

There are mainly two types for data collection: 1. Primary data collection 2. Secondary data collection In the project work Primary data and secondary data (both) sources of data has been used. 1. Primary data collection:

In dealing with real life problem it is often found that data at hand are inadequate, and hence, it becomes necessary to collect data that is appropriate. There are several ways of collecting the appropriate data which differ considerably in context of money costs, time and other resources at the disposal of the researcher.

Primary data can be collected either through experiment or through survey. The data collection for this study was done in the following manner: Through personal interviews:A rigid procedure was followed and we were seeking answers to many pre-conceived questions through personal interviews. Through questionnaire:Information to find out the investment potential and goal was found out through questionnaires. Through Tele-Calling:Information was also taken through telephone calls.

2. Secondary sources of data: In the secondary sources of data Internet, magazines, books, journals are used.

NAVNIRMAN INSTITUTE OF MANAGEMENT

32

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

4.5 Sample Size

My sample size is 75 for the survey of Customers Satisfaction regarding Demat Account in ICICI Direct.com

4.6 Sampling Frame

A list, map or other specification of the units which constitute the available information relating to the population designated for a particular sampling scheme. My main area for the survey of customer satisfaction regarding demat account at ICICI Direct is in Surat. The main reason to cover this area is that, I choose the branch of ICICI Direct is in Surat so I can get customers response easily.

4.7 Sampling Method

A random sample implies equal probability to every unit in the population. It is necessary that the selecting of the sample must be free from human judgment. My sampling method is simple random sampling from whole customer from ICICI Direct from surat city.

4.8 Survey Tool

There are mainly two types to decide the structure of questions. a. Open ended questions. b. Structured questions. My questionnaire is made from one of these types, structured questions. In structure questions, I used multiple choice questions, and single choice question.

NAVNIRMAN INSTITUTE OF MANAGEMENT 33

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

4.9 Limitations

The results of the study may not be universally applicable due to regional constraints. Personal biasness may be included in the research work. Money was also considered as a major constraint during the research work. The lack of information sources for the analysis part.

NAVNIRMAN INSTITUTE OF MANAGEMENT

34

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Analysis & Findings

NAVNIRMAN INSTITUTE OF MANAGEMENT 35

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Analysis

To clear my second objective that is Awareness program on Demat it become necessary to analyze among salaried and self-employed persons answers for following questions arose for it. They are:

(I)

To find out the number of persons investing or interested in investing, in securities.

(II)

How much does a person have knowledge about DEMAT A/C?

(III)

Point of view of investors regarding DEMAT services provided by the bank.

NAVNIRMAN INSTITUTE OF MANAGEMENT

36

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Findings

1. Do you have a demat account? a) Yes b) No

a. b.

Yes No Total

75 0 75

80 70 60 50 40 30 20 10 0

75

0 Yes a. No b.

Interpretation:

This chart shows that all respondent have a demat account with ICICI Direct.com As, I take the response of only ICICI Direct users.

NAVNIRMAN INSTITUTE OF MANAGEMENT 37

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

2. If yes, then with whom? a) Broker b) Bank c) Depositary Participant

a. b. c.

Broker Bank Depositary Participant

9 75 3

80 70

75

60

50 40 30 20 10 0 Broker a. Bank b. Depositary Participant c. 9 3

NAVNIRMAN INSTITUTE OF MANAGEMENT

38

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Interpretation:

This chart shows that 75 respondents have demat account with ICICI dierect.com, but they have also account with broker and with depositary participants. All respondent have account with ICICI Direct, 9 respondents have their account also with broker and 3 have account also with depository participants.

NAVNIRMAN INSTITUTE OF MANAGEMENT

39

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

3. In which of these financial instruments do you invest? a) Equity b) Preference c) Bonds d) Mutual Funds e) Derivatives

a. b. c. d. e. f. g. h. i.

f) Government Securities g) Real esset h) Commodity I) Post Office Securities j) Other, Specify_______________ Equity Preference Bonds Mutual Funds Derivatives Government Securities Real esset Commodity Post Office Securities

36 48 30 34 9 5 3 8 51

60 50 40 30 20 10 0

48 36 30 34

51

9 Bonds Mutual Funds

Derivatives Preference Equity

5

Government Securities

3

Real esset

8 Commodity h. Post Office Securities i.

40

a.

b.

c.

d.

e.

f.

g.

NAVNIRMAN INSTITUTE OF MANAGEMENT

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Interpretation:

Here, all investors have investing their funds into more than one financial instrument. This chart shows that 51 investors have invest in post office securities. Then 48 has invest in preference securities, 36 has invest in equity, 34 has invest in mutual funds, 30 has invest in bonds, 9 has invest in derivatives and 88 has invest in commodity, 5 has in Government securities and 3 has invest real esset as financial instrument. Overall we can see that most investors are likely to invest in post office securities as it is a safe financial instrument.

NAVNIRMAN INSTITUTE OF MANAGEMENT

41

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

4. Are you aware about the companies, who is providing share trading? a) Yes b) No

a. b. Yes No Total 75 0 75

80 70 60 50

75

40

30 20 10 0 Yes a. 0 No b.

Interpretation:

This question is asked to know that how many respondents aware about companies which are online providing share trading. This chart shows that all respondents know companies, who are providing share trading

NAVNIRMAN INSTITUTE OF MANAGEMENT

42

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

5. How long have you been dealing in the stock market? a) Less then 1 year b) 1 year c) 2 year d) More then 3 year

a. b. c. d.

Less then 1 year 1 year 2 year More then 3 year Total

10 21 22 22 75

25 21 20 15 10 5 0 10 22 22

Less then 1 year

a.

1 year

b.

2 year

c.

More then 3 year

d.

NAVNIRMAN INSTITUTE OF MANAGEMENT

43

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Interpretation:

The above chart clearly shows that from a sample size of 75 respondents, 22 have been trading in the stock exchange for more than 3 years. 22 investors were trading for 2 years and 21 investors were trading for 1 years remaining 10 for less than a year. Overall we can see that most respondent are trading from last 2 to 3 years.

NAVNIRMAN INSTITUTE OF MANAGEMENT

44

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

6. Are you trading regularly at ICICI Direct? a) Daily b) Once in a week c) Twice in a week d) Every fornight e) Once in month f) Rarely

a. b. c. d. e. f.

Daily Once in a week Twice in a week Every fornight Once in month Rarely Total

35 24 5 5 4 2 75

40 35 30 25 20 15 10 5 0

35 24

4 Once in month e.

2 Rarely f.

Daily a.

Once in a Twice in a Every week week fornight b. c. d.

NAVNIRMAN INSTITUTE OF MANAGEMENT

45

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Interpretation:

This chart shows that, 2 persons use their account rarely, 4 persons prefer to use their accounts monthly in a given period, where 5 persons were use it fortnightly, 24 were going to use their accounts weekly and 5 were using their account twice in a week, rest of all were use it daily. Here, most respondents are trading daily.

NAVNIRMAN INSTITUTE OF MANAGEMENT

46

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

7. Which service do you use frequently at ICICI Direct?

a) I-quote b) Direct Alerts c) Auto Allocations of Shares d) Subscription for Mailers e) Event Reminder f) Register for Online Password Regeneration a. b. c. d. e. f. I-quote Direct Alerts Auto Allocations of Shares Subscription for Mailers Event Reminder Register for Online Password Regeneration 40 37 12 23 18 4

45 40 35 30 25 20 15 10 5 0

40

37 23 18 12 4 Auto Allocations of Shares Subscription for Mailers Event Reminder

I-quote

Direct Alerts

a.

b.

c.

d.

e.

Register for Online Password Regeneration f.

NAVNIRMAN INSTITUTE OF MANAGEMENT

47

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Interpretation:

Here, also investors like to use more then one services product provided by ICICI Direct. Iquote Service is most used by the respondents as 40 respondent like to use that service most, and then 37 respondents uses direct alerts, 23 respondents uses subscription for mailers, 18 respondents uses event reminder, 12 respondents uses Auto Allocation of shares and 4 respondents uses register for Online Password Regeneration which are provided by ICICI Direct.com Overall we can see that I-quote service is most used by respondent which is provided by ICICI Direct.

NAVNIRMAN INSTITUTE OF MANAGEMENT

48

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

8. Do you get regular alert messages from the ICICI Direct? a) Yes b) No

a. b. Total

Yes No

74 1 75

80 70 60 50 40 30 20 10 0

74

1 Yes a. No b.

Interpretation:

This chart shows that out of 75 respondent 74 are agree with that they got regular alert messages from the ICICI Direct, where 1 respondent is not agree with that he got regular alert messages from the ICICI Direct.

NAVNIRMAN INSTITUTE OF MANAGEMENT

49

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

9. Are you satisfied with your query resolution by ICICI Direct? a) Yes b) No

a. b.

Yes No Total

72 3 75

80 70 60 50 40 30 20 10 0

72

Yes

a.

No

b.

Interpretation:

This chart shows that out of 75 respondents 72 are satisfied with their query resolution by ICICI Direct, where 3 respondents are not satisfied with query resolution by ICICI Direct.

NAVNIRMAN INSTITUTE OF MANAGEMENT

50

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

10. Which bank charges less brokerage rate? a) ICICI direct b) HDFC Bank c) SPB bank d) standard Charter e) Axis Bank f) Other, Specify _______________

a. b. c. d. e.

ICICI direct HDFC Bank SPB bank Standard Charter Axis Bank

75 3 2 1 3

80 70

75

60

50 40 30 20 10 0 ICICI direct HDFC Bank a. b. SPB bank c. Standard Charter d. Axis Bank e. 3 2 1 3

NAVNIRMAN INSTITUTE OF MANAGEMENT

51

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Interpretation:

Here, respondents have given more then one answer. According to them other banks has also less brokerage rate. This chart shows that 75 respondent thinks that ICICI direct has less brokerage rate, and also 6 respondents thinks that HDFC and Axis bank has less brokerage rate, 2 respondents thinks that SPB has less brokerage rate, and 1 thinks that Standard Charter has less brokerage rate. Overall, we can see that all respondent thinks that ICICI Direct has less brokerage rate.

NAVNIRMAN INSTITUTE OF MANAGEMENT

52

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

11. Are you trading from? a) Office b) House c) Broker d) Through friends e) Other, Specify _______________

a. b. c. d.

Office House Broker Through friends

43 36 17 0

50 45 40 35 30 25 20 15 10 5 0

43 36

17

Office

a.

House

b.

Broker

c.

Through friends

d.

Interpretation:

Here, also in this question respondent attempt more then one option. This chart shows that 43 respondent is trading from their office, 36 respondents trading from their house and 17 respondents trading from broker, and no one trading through friend. Overall, investors like to trade from their offices as they can have more preferable atmosphere at their office.

NAVNIRMAN INSTITUTE OF MANAGEMENT 53

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

12. Are you satisfied with your demat service provider? a) Yes b) No

a. b. Yes No Total 71 4 75

80 70 60 50 40 30 20 10 0

71

4 Yes a. No b.

Interpretation:

This chart shows that out of 75 respondents 71 respondents are satisfied with demat services provider by ICICI Direct.com, where 4 respondents are not satisfied. Overall, we can say that 71 respondents are satisfied with demat service provider by ICICI Direct.com

NAVNIRMAN INSTITUTE OF MANAGEMENT

54

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Conclusion & Recommendation

NAVNIRMAN INSTITUTE OF MANAGEMENT

55

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Conclusion

I have taken response of 75 respondents of ICICI Direct.com users. With the help of structured questioner I can conclude that all are very satisfied. Out of 75 respondents, 71 respondents are satisfied with demat service provider.

A good brand is always welcomed over here people are aware of quality so they go for ready to spend bucks of money.

Online trading facility given by bank is beneficial to investors, through which they can easily transact from anywhere in the country.

Without DEMAT A/C no sale of shares and warrants can take place and ICICI Direct provides its very easily.

All respondent have account with ICICI Direct, as I take response of ICICI Direct.com users.

Most investors are likely to invest in post office securities as it is a safe financial instrument.

Most respondent are trading from last 2 to 3 years.

Most respondents are trading daily as it is their source of income.

I-quote service is most used by respondent which is provided by ICICI Direct.

According to respondent, ICICI Direct has less brokerage rate.

Most investors like to trade from their offices as they can have more preferable atmosphere at their office.

NAVNIRMAN INSTITUTE OF MANAGEMENT 56

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Recommendation

As far as people preference regarding opening of demat a/c is concerned then they mainly prefer two factors i.e. service and trust. So it becomes necessary for the company to take care of these two factors.

Most if the people are not finding any spare time to convert their shares electronically. So company should approach to such people at their doorstep to open their demat account.

They should focus on print and electronic media advertisements to make more people aware about them.

They should provide proper guidance to their customers about demat.

They should provide offers and facilities to their customers to increase their attractiveness about demat.

For opening an account they require lots of signatures in a kit, which should be reduced.

NAVNIRMAN INSTITUTE OF MANAGEMENT

57

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Bibliography

NAVNIRMAN INSTITUTE OF MANAGEMENT

58

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

For Website

http://en.wikipedia.org/wiki/ICICI http://www.icicibank.com/pfsuser/aboutus/investorelations/pressrelease/feestructure.htm http://www.indiahousing.com/icici-bank/icici-demat-account.html http://financialawarenessportal.com/an-overview-on-demat-account-charges-in-india/ http://demataccount.com/ http://www.composite.co.in/demat_services.asp http://www.icicibank.com/Personal-Banking/demat/demat.html https://nsdl.co.in/pressrelease/cirPre_19Aug09.php http://www.zonkerala.com/articles/demat-account.htm https://secure.icicidirect.com/customer/customer.asp http://www.cdslindia.com/abt_cdsl/tariff.htm

http://content.icicidirect.com/Product.asp

http://alexmthomas.wordpress.com/2006/08/03/indian-stock-market-the-basics/ http://finance.indiamart.com/india_business_information/sebi_administration.html

For Book

Research Methodology Methods & Techniques, C.R. Kothari, revised 2nd edition. Market Research, G.C.Berri, 4th edition, TATA MC GRAW-hill publishing company limited, New Delhi.

NAVNIRMAN INSTITUTE OF MANAGEMENT

59

CUSTOMER SATISFACTION REGARDING DEMAT SERVICES AT ICICI DIRECT.COM

Annexure

NAVNIRMAN INSTITUTE OF MANAGEMENT

60

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- ETF Trading Strategies RevealedДокумент44 страницыETF Trading Strategies Revealedpsoonek100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Bankers Notice of Accept PrestmДокумент13 страницBankers Notice of Accept Prestmapi-374440888% (34)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Wyckoff - Method of Tape Reading PDFДокумент405 страницWyckoff - Method of Tape Reading PDFBen Gdna100% (6)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

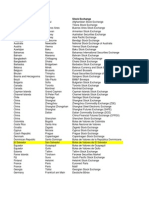

- List of Stock ExchangeДокумент15 страницList of Stock ExchangeTimothy MununuziОценок пока нет

- Role of RBI in FOREX MarketДокумент14 страницRole of RBI in FOREX Marketlagfdf88Оценок пока нет

- TB ListДокумент46 страницTB ListWee Tan33% (3)

- Pre-Study: Practice Exam Part IДокумент46 страницPre-Study: Practice Exam Part IJessica Hong100% (1)

- HBP FinanceДокумент20 страницHBP FinancePrerna Goel56% (9)

- Tiger Global BrochureДокумент27 страницTiger Global Brochureanandoiyer9100% (2)

- Capital MarketДокумент439 страницCapital MarketRohit Agarwal100% (1)

- TOPBOT Mini Public PDFДокумент18 страницTOPBOT Mini Public PDFletuanОценок пока нет

- Risk Management Techniques for Hedging Foreign Exchange ExposureДокумент21 страницаRisk Management Techniques for Hedging Foreign Exchange Exposuremoody84Оценок пока нет

- ADM3318 Sample Questions and AnswersДокумент11 страницADM3318 Sample Questions and AnswersClair LaurelleОценок пока нет

- 597 PDFsam 290120 CUДокумент197 страниц597 PDFsam 290120 CUSomenath PaulОценок пока нет

- BOJ - Functions and Operations of The BOJДокумент344 страницыBOJ - Functions and Operations of The BOJ007featherОценок пока нет

- Ashok Leyland Annual Report 2016-17Документ252 страницыAshok Leyland Annual Report 2016-17Madhur Deshmukh100% (1)

- Evanston Alternative Opportunities Fact Sheet 10-01-2019Документ5 страницEvanston Alternative Opportunities Fact Sheet 10-01-2019David BriggsОценок пока нет

- New Straits Times - Interview The Expert With Kathlyn Toh - Benefit of Trading The U.S. Stock MarketДокумент1 страницаNew Straits Times - Interview The Expert With Kathlyn Toh - Benefit of Trading The U.S. Stock MarketBeyond InsightsОценок пока нет

- Annual Report 2010 2Документ158 страницAnnual Report 2010 2alimnaqviОценок пока нет

- Mid Term - IIIДокумент2 страницыMid Term - IIIvasanthbabu26Оценок пока нет

- Airline Industry: Stan Li, Jessica Liu, Ben Mui, Edison Pei, Tony YeungДокумент89 страницAirline Industry: Stan Li, Jessica Liu, Ben Mui, Edison Pei, Tony YeungSakthi MuruganОценок пока нет

- ANALYSIS OF EQUITY MUTUAL FUNDS AT ICICI SECURITIESДокумент4 страницыANALYSIS OF EQUITY MUTUAL FUNDS AT ICICI SECURITIESJayanth RajОценок пока нет

- Buy BackДокумент12 страницBuy BackNiraj PandeyОценок пока нет

- Capm in ExcelДокумент31 страницаCapm in ExcelJagrОценок пока нет

- Fit 2018 12 18 PDFДокумент18 страницFit 2018 12 18 PDFcarlallopesОценок пока нет

- Macroeconomics1:: Open-Economy Macroeconomics: Basic Concepts (Chapter 31)Документ32 страницыMacroeconomics1:: Open-Economy Macroeconomics: Basic Concepts (Chapter 31)Donghun ShinОценок пока нет

- Capital MarketsДокумент10 страницCapital MarketsAadityaMahanteОценок пока нет

- Role of SEBI in Foreign Investment: An Analysis: Mr. Ankit AwasthiДокумент24 страницыRole of SEBI in Foreign Investment: An Analysis: Mr. Ankit AwasthiOnindya MitraОценок пока нет

- Duties of Directors and Controlling StockholdersДокумент58 страницDuties of Directors and Controlling StockholderssalinaОценок пока нет

- Wealth CreationДокумент23 страницыWealth CreationSweta HansariaОценок пока нет