Академический Документы

Профессиональный Документы

Культура Документы

Payment and Tokenization SAP User Guide - Feb 2012-R2

Загружено:

2varmaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Payment and Tokenization SAP User Guide - Feb 2012-R2

Загружено:

2varmaАвторское право:

Доступные форматы

Payment and Tokenization for SAP

User Guide

Copyright 2011 Paymetric, Inc. All rights reserved. Paymetric and the Paymetric logo are registered trademarks of Paymetric, Inc. XiPay and XiSecure are trademarks or service marks of Paymetric, Inc. All other brand or product names may be trademarks or registered trademarks of their respective companies or organizations.

Supports: PCMA 1.5.0 and above, XiSecure SAP IK 2.1.0 and above (w/ DI) Feb ruary 2012-R2

User Guide

Contents

Table of Contents

Revision History 4

Chapter 1: Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

. Overview . Usage Chapter 2: PCMA Reports . . . . . . . .& . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 .............. Chapter 3: DI for SAP - Retrieving Tokens . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 ....... Chapter 4: Sales and Distribution. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

................................................................................................................................... 16 Payment Card Authorization Response by Date ................................................................................................................................... 18 Payment Card Activity by Partner Number ................................................................................................................................... 20 Expiring Payment Card Authorizations ................................................................................................................................... 22 Orders with P-Card Payment Data and NO Card Data ................................................................................................................................... 24 Orders with Material Availability AFTER Auth Expiration ................................................................................................................................... 27 Payment Card Work List (Automated) ................................................................................................................................... 28 Documents with Payment Card Information

....... Chapter 5: Financial Accounting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

................................................................................................................................... 32 Documents by Settlement Batch Number ................................................................................................................................... 34 Documents by Settlement Date Range ................................................................................................................................... 37 Reauthorize and Release Billing Documents ................................................................................................................................... 40 Reverse Clearing with Payment Card Data ................................................................................................................................... 44 Documents with Payment Card Information

Chapter 6: Receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47 Management

................................................................................................................................... 47 Open AR

.......................................................................................................................................................................... 48 Select Open Item s for Processing .......................................................................................................................................................................... 55 Clear All Open AR Item s .......................................................................................................................................................................... 61 Process Paym ent Card Paym ent via Manual Authorization .......................................................................................................................................................................... 69 Process Paym ent Card Paym ent via Blind Authorization

................................................................................................................................... 77 A/R Payments by Customer/Date ................................................................................................................................... 78 Direct AR

.......................................................................................................................................................................... 79 Apply Lum p Sum Dollar Am ount

................................................................................................................................... 92 Auto AR

.......................................................................................................................................................................... 93 Create an AR Batch Processing Variant .......................................................................................................................................................................... 97 Using a Batch Job to Process Open Item s

Chapter 7: Settlement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 104

................................................................................................................................... 104 Settlement ................................................................................................................................... 115 Repeat Settlement ................................................................................................................................... 121 Manually Update Host Details of SAP Batch

2012 Paymetric, Inc. Feb ruary 2012-R2

User Guide

Contents

................................................................................................................................... 122 Settlement Verification

. . . Tools Chapter 8: Administration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 124

................................................................................................................................... 124 Determine Connection Status ................................................................................................................................... 128 Test Authorization RFC ................................................................................................................................... 132 Test Settlement RFC

..... Chapter 9: Request Support . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 133 . .......... ...... ... ......... Chapter 10: Appendix A: .Standard SAP.Payment. Card. Processing . . . . . . . . . . . . . 134

................................................................................................................................... 134 Process a document or sales order with a payment card ................................................................................................................................... 139 Change Postal Code on Sales Order ................................................................................................................................... 142 Standard SAP How-to Guide ................................................................................................................................... 148 RFC Failures

2012 Paymetric, Inc.

Feb ruary 2012-R2

Revision History

Revision History

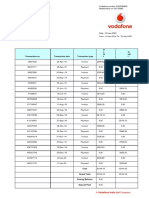

Date 02/17/2012 09/13/2011 7/15/2011 Version Feb 2011-R2 Sept 2011-R1 July 2011-R1 Description of Change Added Change Postal Code on Sales Order 139 topic in the Appendix. Added General Notes About the DI SA Web GUI Token Retrieval section.

16

in the DI for SAP -

Authority checks added in PCMA 1.5.0. Added notes through-out that Users should check with their PCMA/SAP System Administrators if they receive authorization denied errors. Updated for XiSecure SAP IK 2.0.0 release. Added DI for SAP - Token Retrieval 13 topic. Added references to the DI for SAP Token Retrieval Procedures wherever payment card or card numbers are entered in the PCMA reports. Added the PCMA Reports Overview and Usage 5 section.

5/31/2011

May 2011-R1

2012 Paymetric, Inc.

Feb ruary 2012-R2

Introduction

Introduction

PCMA is a package of robust SAP functionality that offers the following features: Process payment card payments via online, manual, or blind authorizations Post incoming and transfer payments Apply lump sum dollar amounts to an account Batch processing of payment card payments on open AR accounts Easily secure online authorizations and settlement An integrated reporting and analytic module that enhances the ability to extract pertinent payment card related data PCMA also offers the ability to plug-in to several encryption solutions for protecting payment numbers along with other sensitive data.

Audience

The PCMA User Guide is intended for use by PCMA Users and Administrators.

Purpose

The purpose of this guide is to provide end-users with the following information: An overview of the PCMA application A How-to guide to execute transactions to support your business processes. The step-by-step procedures for processing receivables, generating reports, executing settlement, and managing encryption.

PCMA Reports Overview & Usage

The Enhanced Reporting and Utilities are sets of custom reports and tools integrated into SAP. Each report was written using SAP ABAP List Viewer (ALV) functionality to provide as much SAP report manipulation functionality as possible. In each of the ALV enabled reports, users have the ability to sort, filter, subtotal, export to MS Excel, export to MS Word, save as a local file, send via SAP email as an attachment, reorder columns and save display variants among other options. Each of the reports also contains interactive elements, such as the ability to drill into any document simply by clicking on the appropriate document number. This section provides an overview of each report with a description and use case. The reports are grouped by the following areas: Sales and Distribution Financial Accounting Settlement

8 10 6

Receivables Management (A/R)

11

2012 Paymetric, Inc.

Feb ruary 2012-R2

PCMA Reports Overview & Usage

Sales and Distribution Reports

Payment Card Authorization Response by Date /PMPAY/AUTHRESP Description: Use Case:

16

Displays all Payment Card CSR Supervisors/managers proactively monitor card authorization responses and the authorization activity and investigate appropriate auths, current status of those responses declines or communication failures and orders. for a date/time range. Authorization Permits cleanup of data prior to the end of a CSR shift date is the only mandatory field in Better customer service/cost management by easily this report. identifying instances where customers should be contacted same-day to revalidate data. Permits immediate, interactive access of list of reports with non-approved responses and allows user to maintain card data in those orders quickly Auth metrics (as opposed to settlement) by date range, by CSR (who did what, when), by card type, by auth-response, sales-ord, doc-type, currency, MID, etc. Able to display all authorization responses of a certain type and filter out all other response types such as showing only Declines and Communication Failure responses and filtering out Approvals.

Payment Card Activity by Partner Number /PMPAY/PARTNER Description: Displays all Payment Card authorization responses and the current status of those responses for a given partner

18

Use Case: Same as Payment Card Authorization Response by Date except isolated to a specific SAP customer regardless of the card number used. Can display all orders for a certain customer within a specified date range on which any credit card was used.

Expiring Payment Card Authorizations /PMPAY/EXPAUTH Description: Displays all Payment Card authorizations that will expire during a given date range (based on the authorization horizon defined in configuration) if not settled before those dates or the

20

Use Case: Proactively manage the identification and reprocessing of authorizations that are due to expire (become stale) on a specific date or have previously expired within a given date range. SAP natively only identifies expired auths when an order is

2012 Paymetric, Inc.

Feb ruary 2012-R2

PCMA Reports Overview & Usage

Expiring Payment Card Authorizations /PMPAY/EXPAUTH

20

final date on which authorizations touched for an update or for delivery or invoice processing, will be considered valid. The so the value-add is: report also has the ability to submit Scenario one: Auth expires on an order, but not due for orders, on which expired delivery for a while authorizations exist, to have new Result: Merchant exposes liability against that order as it authorizations attempted. no longer carries a valid auth PM Value-add: Permits management of this scenario and timely re-auth (or other action) to reduce this exposure Scenario two: Auth expires on an order, ultimately detected by std SAP during the DELIVERY or BILLING run/creation Result: Means scenario one has been in place for some period. Result: Delivery or Invoice can not proceed until new authorization achieved. We have user exits to make this real-time in many instances (for deliveries), but if the realtime (at time of delivery) reauth FAILS then fulfillment process WILL definitely be interrupted for this order. PM Value-add: Same as scenario one, AND permits management of this scenario and timely re-auth (or other action) PRIOR to attempting delivery or billing, to reduce reprocessing and fulfillment interruption.

Orders with Payment Card Payment Terms/Method and NO Card data /PMPAY/PAYT Description: Displays all order documents that were created with payment card Payment terms or a Payment method (both freely definable), yet contain no payment card information in the payment card screen Use Case:

22

Avoid instance of not requesting payment (e.g sending an invoice stating Do not pay, paid by CC or not sending an invoice at all, under the scenario when there is actually no CC data present and therefore no auth/settle)

Orders with Material Availability after Auth Expiration /PMPAY/SCHCHK Description: Displays all order documents that contain line items with Material Use Case:

24

Some customers choose to permit auth requests now for goods that will not be available much further in the future

2012 Paymetric, Inc.

Feb ruary 2012-R2

PCMA Reports Overview & Usage

Orders with Material Availability after Auth Expiration /PMPAY/SCHCHK Availability dates that extend beyond the date on which the authorization(s) will be considered expired

24

when it is known that the auth will have already expired. E. g. requesting an auth today for goods not available for another 3 months. For these customers, proactive management of this subset of auths to know how many and how much and identify specific orders needing attention or follow-up action.

Payment Card Work List /PMPAY/VCC1 Description:

27

Use Case: This enhanced version of standard SAP transaction VCC1 can be run as a scheduled batch job in addition to an interactive report. This allows for the automated Credit Release of documents on Credit Hold due to insufficient authorization.

A general purpose reporting tool that can be used to manage sales documents and deliveries associated with payment cards

Documents with Payment Card Information /PMPAY/DOCS Description: Displays all Sales Orders, Invoices and Accounting documents in a given date range on which a particular card number is referenced.

28

Use Case: A customer calls the Merchant questioning a charge on their statement for which they are unfamiliar. This report allows the CSR to quickly locate all relevant documents on which the card number (token), amount and dates match in order to quickly provide the customer information about the charge for example by viewing the Invoice document. This replaces a manual search through all cleared items on a customer's account.

Financial Accounting

Documents with Payment Card Information

28

/PMPAY/DOCS (same as the one listed under S&D) Description: Displays all Sales Orders, Invoices and Accounting documents in a given date range on which a particular card number is referenced. Use Case: A customer calls the Merchant questioning a charge on their statement for which they are unfamiliar. This report allows the CSR to quickly locate all relevant documents on which the card number (token), amount and dates match in order to quickly provide the customer information about the

2012 Paymetric, Inc.

Feb ruary 2012-R2

PCMA Reports Overview & Usage

Documents with Payment Card Information

28

/PMPAY/DOCS (same as the one listed under S&D) charge for example by viewing the Invoice document. This replaces a manual search through all cleared items on a customer's account.

Documents by Settlement Batch Number /PMPAY/BATITEM Description: List all documents included in a settlement batch. This report is intended to be used to assist in the settlement reconciliation process

32

Use Case: Shows full authorization info including auth-codes Enables estimation of processor fees per batch Break out (sorting/subtotals, etc) of debits/credits, card types, customers, etc Use for accurate and efficient reconciliation, and research and management of exceptions especially because of the presence of the authorization detail

Documents by Settlement Date Range /PMPAY/BATDATE Description:

34

Use Case:

Lists settlement items across This report is very useful for period based reporting such as settlement batches for a given date Month-end, Quarter-end, Year-end, etc. Will display range. subtotals by credit and debit and approximate fees.

Reauthorize and Release Billing Documents /PMPAY/VFX3 Description: An enhanced version of the standard SAP transaction VFX3 (Release Billing Documents for Accounting). The results will list all billing documents which are blocked from posting to accounting due to insufficient payment card authorization.

37

Use Case: This enhanced version of standard SAP transaction VFX3 can be run as a scheduled batch job in addition to an interactive report. This allows for the automated identification of Invoices on Credit Hold due to insufficient authorization, re-saving of the related Sales Order and thus a new Authorization attempt. If the Authorization is Approved, the Invoice is automatically released to Accounting.

2012 Paymetric, Inc.

Feb ruary 2012-R2

PCMA Reports Overview & Usage

10

Reverse Clearing with Payment Card Data /PMPAY/FBRC Description: Allows a settled accounting document to be reversed when the corresponding payment card authorization has been rejected as a charge back. This will create a new accounting document with a DEBIT to the customers AR account and a CREDIT to the Bank clearing account as defined in the IMG.

40

Use Case: Basically a search engine built around standard SAP transaction FBRC. This report assists in locating transactions which should be reversed from the Settlement Clearing account and posted back to the Customer AR account. This is commonly performed when the item has been rejected from a Settlement request or the customer has won a Chargeback dispute.

Receivables Management (A/F)

Open AR

47

/PMPAY/OAR Description: Displays all open items (Credits and Debits) that are currently on the customers account. The user may choose any of the items, including a mixture of debits and credits, and attempt to clear the full or partial amount with a payment card or electronic check. Use Case: Allows an end-user to view open items on a customers AR account, select items against which to process a payment and enter payment details. If successful, the program posts a clearing document moving the liability from the Customer AR account (by clearing the item(s) selected) and into the appropriate Credit Card Receivable account so it can be picked up by the standard SAP Settlement program. Most commonly used for outbound collection calls on past due invoices or simply as a customer service offering allowing customers to change their method of payment from Payment Terms to Credit Card. Fills a GAP in the standard SAP business logic in which a card payment can NOT be taken directly against an Open Item on a Customers AR account in the Financial Module.

A/R Payments by Customer/Date /PMPAY/ARPAY Description:

77

Use Case: An invoice was cleared with a payment through Open AR and a manager would like to know who the end user was that processed the payment. This report includes the payment document number, the number of all Open Items which were cleared by that payment, the SAP username of

This report displays all clearing documents posted by the Open AR or Auto AR programs within a given date range.

2012 Paymetric, Inc.

Feb ruary 2012-R2

PCMA Reports Overview & Usage

11

A/R Payments by Customer/Date /PMPAY/ARPAY

77

the end user who performed the payment and the Authorization response details.

Direct AR

78

/PMPAY/DAR Description: Provides the ability to automatically accept credit card payment without reference to open Accounts Receivables. The program also automatically creates an open item on the customers account by posting an incoming payment document. Use Case: This functionality is similar to that of a customer sending in a check with no reference to any current open item and then requesting that the funds are placed as an open credit amount to their account. Commonly used for Downpayment functionality with a credit card. For example, if a customer has placed an order that requires a lead time to acquire materials in order to build the products and the Merchant would like a downpayment Direct AR can be used for this scenario.

Auto AR

92

/PMPAY/AUTOAR Description: The Auto AR program provides the ability to automatically accept credit card payment on open Accounts Receivables in a scheduled batch job on a recurring basis. The program then automatically clears open items on a customers account by posting an incoming payment document. Use Case: Similar to the Open AR program but intended to be run as a scheduled job. Open Items must be flagged for processing during the Order creation or Invoice creation process mostly commonly by using a custom Payment Term (EX: ZAUT) on the document. When the program is executed, it identifies open items for payment, locates the card to be used for payment (by default the program uses the Default card on the Customer Master record) and attempts Authorization and clears the liability to the appropriate Credit Card Receivable account for processing by the standard SAP Settlement program.

Settlement

Settlement 104 /PMPAY/FCC1 Description: An enhanced version of the Use Case: This program offers the ability to PING the XiPay server

2012 Paymetric, Inc.

Feb ruary 2012-R2

PCMA Reports Overview & Usage

12

Settlement 104 /PMPAY/FCC1 standard SAP transaction FCC1 (Payment Cards: Execute Settlement). before executing settlement. Standard SAP settlement posts a document clearing funds from the Payment Card Clearing account into the Bank Settlement Clearing account BEFORE determining if there is a communication error thus giving the false impression in the GL accounts that you are awaiting a deposit. The RFC connections are selected by default. If the RFC connections are not active, the program terminates immediately, leaving the funds in the Payment Card Clearing account accurately reflecting that communication with the clearinghouse has not occurred.

Repeat Settlement 115 /PMPAY/FCC2 Description: Use Case:

An enhanced version of the Has the same added benefit as /PMPAY/FCC1 above that it standard SAP transaction FCC2 verifies the RFC connection is active. (Payment Cards: Execute Settlement). This program is used to re-execute settlement after an RFC Call has failed.

Manually Update Host Details of SAP Batch 121 /PMPAY/FCC4 Description: Allows you to manually update host details of an SAP batch. Use Case: Allows for the editing of the Settlement Batch log details for a specific batch in addition to viewing the details. Helpful when SAP encounters an error and the Settlement program is unsuccessful in writing an entry to the Settlement log for a batch.

2012 Paymetric, Inc.

Feb ruary 2012-R2

PCMA Reports Overview & Usage

13

DI for SAP - Retrieving Tokens

Token Retrieval Methods

There are four ways to retrieve a token and enter it into the Payment card field directly from SAP: Token Retrieval Method Browser Description Launches the DI Web GUI to generate a new or obtain an existing token for a given card number. The Web GUI has the option to either copy the token to the clipboard with a single click or download the token to a file. The "download to file" option from the Web GUI is a different file than the "File" Transfer Method. The file generated from the browser contains just the single token that was returned on the browser page and you can name the file and save it to any location. Clipboard Places the latest value that is currently in the Windows clipboard into the Payment card field.

Customer Master Either provides a list of tokens from the Customer Master in the Search Help dialogue box or allows you to search for a token in the Customer Master using the last four digits of the card if using the keystroke integration method. File Opens a defined .txt file that contains a list tokens that were placed in the file by copying and pasting. This can be used to store a list of tokens for commonly used credit cards so you can quickly bring up the list, select the token and continue processing your order. The file naming convention and location is configured by your SAP System Administrator. The standard naming conventions are as follows: USERID.txt (where the SAP userID is used as the filename) TOKEN.txt Note that the file naming convention is customizable via the DI Parmaters Paymetric User Exit (PUE) under DI Options in the IMG. Simply make a 'Z' or 'Y' version of the /PMENC/PEX_DI_PARAM Function Module and modify as desired.

Token Entry Integration Methods

There are two integration methods used when implementing DI for SAP as follows: Keystroke-Only Integration Method - you enter a pre-configured letter, number or special character in the credit card number field to launch (or trigger) the token retrieval method. Search Help (F4) Integration Method - you can enter a pre-configured letter, number, or special character and click the Matchcode icon to launch (or trigger) the token retrieval method or leave the field blank and click on the SAP Matchcode icon to launch the Primary retrieval method that is configured by your SAP

2012 Paymetric, Inc.

Feb ruary 2012-R2

DI for SAP - Retrieving Tokens

14

System Administrator. o If Browser is marked as Primary, clicking the Matchcode icon opens a Browser window with the DI Web GUI URL. o If Customer Master is marked as Primary, clicking the Matchcode icon opens the Search Help dialog box and automatically displays the Tokens in the Customer master record for the defined Customer on the screen or all Customers if there is no customer number. o If File is marked as Primary, clicking the Matchcode icon opens the Search Help dialog box and displays the token(s) in the File defined in the DI configuration. Regardless, of what is set as Primary, you can always launch any configured retrieval method by entering the defined keystroke character and then clicking the Matchcode icon.

Obtain the Following from your SAP System Administrator to Use DI for SAP

1. Ask if Search Help was implemented. 2. Ask which token retrieval (or transfer) methods were configured. 3. Ask what trigger characters were configured for each of those token retrieval methods. 4. If the File retrieval method is configured, ask what file naming convention and file path are used. There are steps defined within the applicable report procedures on how to retrieve the tokens; these steps do require answers to the above questions.

Token Retrieval Procedures

Token retrieval using DI for SAP requires knowledge of certain configuration details from your SAP System Administrator. See for more information. Do NOT perform a manual copy/paste form the DI Standalone Web GUI into SAP when using DI for SAP. Use one of the sub-steps below based on the integration method. If you are using...

The DI Keystroke method for "Browser",

Then...

1. Click in the Payment card or Card number field. 2. Type the configured character for 'Browser' and then press the [Enter] key. The DI Web GUI is launched. 3. Login to the DI Web GUI. Enter the card number and click [Generate Token] button. 4. Click "Copy to clipboard". The token automatically populates in the payment card field in SAP.

2012 Paymetric, Inc.

Feb ruary 2012-R2

DI for SAP - Retrieving Tokens

15

5. Continue to the next step.

You also have to option to Download to a file if you wish to save the token locally. The DI Search Help method for "Browser", 1. From the Payment card or Card number field, click the Matchcode press the [F4] key to launch the Browser. icon or

a. Note that if Browser is not set as the Primary retrieval method, you will need to enter the configured character for Browser and press the [Enter] key. 2. Login to the DI Web GUI. Enter the card number and click [Generate Token] button. 3. Click "Copy to clipboard", the token automatically populates in the payment card field in SAP. 4. Continue to the next step.

You also have to option to Download to a file if you wish to save the token locally. The DI Keystroke method for "Customer Master", 1. Click in the Payment card or Card number field. 2. Type the configured character for "Customer Master". a. If a Default payment card is defined for the Customer, the token is automatically populated in the field. b. If there is NO Default payment card, a message displays "No default card" and you will need to use another keystroke method. 3. Continue to the next step. The DI Search Help method for "Customer Master", 1. From the Payment card or Card number field, click the Matchcode press the [F4] key. icon or

a. If a Customer number is present on the screen, the Search Help dialog box opens and displays the tokens from the Customer Master for that Customer. b. If a Customer number is NOT present on the screen, the Search Help dialog box opens and displays all tokens from all Customer Master records. 2. Select the desired token from the dialog box. 3. Continue to the next step. The DI Keystroke method for "File", 1. Click in the Payment card or Card number field. 2. Type the configured character for "File" OR enter the character and the last four digits of the card number (e.g. F1111) and then press the [Enter] key. a. If you do NOT enter the last four digits of the card number and a Default payment card is defined for the Customer, the token for that number is populated in the field. b. If you do NOT enter the last four digits of the card number, the first token in the File is populated in the field. c. If you do enter the last four digits of the card number, the token for that card

2012 Paymetric, Inc.

Feb ruary 2012-R2

DI for SAP - Retrieving Tokens

16

number is populated in the field. 3. Continue to the next step. The DI Search Help method for "File", 1. From the Payment card or Card number field, click the Matchcode press the [F4] key. icon or

a. If there is more than one token in the File, the Search Help dialog box opens and displays the tokens. Select the desired token form the list. b. If there is only one token in the file, that token automatically populates in the field and dialog box does not open. 2. Continue to the next step.

General Notes about the DI Web GUI

Your Organization Admin may have Card Type enabled in which case you will also see a Card Type dropdown field in addition to the credit card number field. A Luhn check is performed when you click the Generate Token button unless it is disabled by your Organization Administrator. If the Luhn check is enabled and you are tokenizing an eCheck account number or non-standard credit card, you will receive an error message that the number is not valid. Contact your DI SA Organization Administrator.

Sales and Distribution

This chapter contains procedures for the following: Payment Card Authorization Response by Date Payment Card Activity by Partner Number Expiring Payment Card Authorizations Payment Card Work List (Automated)

18 22 16

Orders with P-Card Payment Data and NO Card Data

20

Orders with Material Availability AFTER Auth Expiration

27 28

24

Documents with Payment Card Information

4.1

Payment Card Authorization Response by Date

Purpose

This report displays all Payment Card authorization responses and the current status of those responses for a date/time range. Authorization date is the only mandatory field in this report.

Additional Information

The report shows the existing Order, Billing, and Accounting documents the authorization response is related to. These documents are found on a single row of the report if related in document flow.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Payment Card Authorization Response by Date

17

This report contains four tabs on the selection screen: Organizational data Order status Payment Card data Additional data

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Navigate to the Sales and Distribution Payment Card Authorization Response by Date menu option (program name: /PMPAY/PRE_AUTH_RES).

2. On the Payment Card data tab, select the Payment card type. 3. Click in the Card Number field and either enter the raw card number or if you are using DI for SAP, refer to the Token Retrieval Procedures 14 for details. 4. Verify the Authorization date. 5. Enter any other reporting criteria as necessary.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Payment Card Authorization Response by Date

18

6. Click

Click

for the definition of traffic lights and color coding on this report.

7. Scroll right to view the entire report. You may click on the document and partner number fields to view the corresponding document or partner master screen.

4.2

Payment Card Activity by Partner Number

Purpose

This report displays all Payment Card authorization responses and the current status of those responses for a given partner. Customer number and partner function are the only mandatory fields in this report.

Additional Information

The report shows the existing Order, Billing and Accounting documents the authorization response is related to. These documents are found on a single row of the report if related in document flow.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Payment Card Activity by Partner Number

19

This report contains four tabs on the selection screen: Organizational data Order status Payment Card data Additional data

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Navigate to the Sales and Distribution Payment Card Activity by Partner Number menu option (program name: /PMPAY/PRE_PART_ACT).

1. On the Partner/Order data tab, enter the Customer number. 2. Click in the Partner function field and select the appropriate function from the drop down list. 3. Enter any other desired reporting criteria. 4. Click .

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Payment Card Activity by Partner Number

20

Click

for the definition of traffic lights and color coding on this report.

3. Scroll right to view the entire report.

You may click on the document and partner number fields to view the corresponding document or partner master screen.

4.3

Expiring Payment Card Authorizations

Purpose

This report displays all Payment Card authorizations that will expire during a given date range (based on the authorization horizon defined in configuration) if not settled before those dates or the final date on which authorizations will be considered valid. The report also has the ability to submit orders, on which expired authorization exist, to have new authorizations attempted. Authorization expiration date is a mandatory field.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Expiring Payment Card Authorizations

21

Additional Information

The checkbox labeled Show invoiced authorizations? will display those authorizations that have been invoiced and posted to accounting in SAP but not yet settled. The checkbox labeled Show approved, unexpired authorizations? will display those authorizations that are still valid in the system. However, for these authorizations, the report will display the date on which the authorization will expire or the last date on which it will be valid depending on the radio button selected.

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Navigate to the Sales and Distribution (program name: /PMPAY/PU_EXP_AUTH). Expiring Payment Card Authorizations

1. Enter desired report criteria. 2. Click .

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Expiring Payment Card Authorizations

22

Click

for the definition of traffic lights and color coding on this report.

3. Choose from the following options: If you want to Submit an item for authorization Then Click the checkbox next to the item(s) and click . Click to submit all selected items for a new authorization attempt. Remove an item from being submitted for authorization Click .

4.4

Orders with P-Card Payment Data and NO Card Data

Purpose

The Orders with Payment Card Payment Terms/Method and No Card Data report displays all order documents that were created with payment card Payment terms or a Payment method (both freely definable), yet contain no payment card information in the

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Orders with P-Card Payment Data and NO Card Data

23

payment screen. Document date and Payment terms or Payment method are mandatory fields.

Additional Information

The checkbox labeled Display orders w/CC requests? will display those documents where payment card information was entered, but no authorization attempt was made and/or no response was received.

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Navigate to the Orders with Credit Card payment terms but NO Card data menu option (program name: /PMPAY/PRE_PAY_TERM).

1. On the Document data tab, verify the Document date. 2. Click in the Payment terms field. Click the drop down list to select the appropriate payment term. 3. Enter any other desired report criteria. 4. Click .

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Orders with P-Card Payment Data and NO Card Data

24

This report can be sorted or filtered by any column as well as be exported to MS Excel. Also, all document and partner number fields allow for single-click navigation to the corresponding document or partner master screen.

4.5

Orders with Material Availability AFTER Auth Expiration

Purpose

This report displays all order documents that contain line items with Material Availability dates that extend beyond the date on which the authorization(s) will be considered expired.

NOTE: This situation will normally only occur if userexits or other means have been used to force authorizations for line items that normally would not yet be eligible for authorization.

Additional Information

Authorization expiration date is the only mandatory field.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Orders with Material Availability AFTER Auth Expiration

25

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Navigate to the Material Avail. date AFTER Authorization Expiration date program: / PMPAY/PRE_SCH_CHK.

1. Enter Organizational data to view data for all card types, or click the Payment Card data tab to indicate a specific card. If you are using DI for SAP, refer to the Token Retrieval Procedures 14 for details. 2. Click .

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Orders with Material Availability AFTER Auth Expiration

26

Click

to learn about the traffic lights and color coding on this report.

This report can be sorted or filtered by any column as well as be exported to MS Excel. Also, all document and partner number fields allow for single-click navigation to the corresponding document or partner master screen.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Orders with Material Availability AFTER Auth Expiration

27

4.6

Payment Card Work List (Automated)

Purpose

This report is an enhanced version of the standard SAP transaction VCC1 (Payment Cards: Work List). The results will list all order and/or delivery documents which are on credit hold due to insufficient payment card authorization. However, this enhanced version of the program, when run online or as a background job, can submit the order(s) found for a new authorization attempt. If the result of the authorization attempt is an approval, then standard SAP functionality will re-determine the credit status as approved. The selection screen of the standard SAP transaction VCC1 and the enhanced Paymetric version do not differ except in the title.

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Navigate to the Payment Cards Work List (Automated) menu option (program name: /PMPAY/PU_VCC1).

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Payment Card Work List (Automated)

28

2. Click

The standard transaction will display a list of all order and/or delivery documents that are currently on credit hold (for any reason) but also refer to a credit card on the order document as shown below:

The enhanced Paymetric version of the program automatically selects all items and forwards the order documents for a new authorization attempt. Once the authorization response is received the credit status of the order document will automatically be redetermined based on the response.

4.7

Documents with Payment Card Information

Purpose

This report will display all Order, Billing and Accounting documents containing the payment

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Documents with Payment Card Information

29

card information entered on the selection screen. This report is useful in quickly finding documents related to a specific card number and can assist in answering customer service questions.

Additional Information

This report will allow searches on three document types: Sales documents Billing documents (invoices, credit/debit memos) Accounting documents You can further refine your search for each document type by entering additional search criteria.

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Navigate to the Documents with Payment Card Information program: /PMPAY/ PRE_DOCS.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Documents with Payment Card Information

30

1. On the Payment Card data tab, enter the Payment card type and select the Card Number. If you are using DI for SAP, refer to the Token Retrieval Procedures 14 for details.

To select multiple card types or multiple cards, click these fields as needed.

and enter the additional selections for

2. On the Organizational data tab, determine which types of document types to display.

Only the selection criteria for the document types selected is available for input. 3. Enter the required selection criteria. 4. Click .

2012 Paymetric, Inc.

Feb ruary 2012-R2

Sales and Distribution

Documents with Payment Card Information

31

Click

to learn about the traffic lights and color coding on this report.

Single-click navigation to the documents as well as the Payer and Sold-to Partner Master Records is available on this report.

Financial Accounting

This chapter contains procedures for the following: Documents by Settlement Batch Number Documents by Settlement Date Range

34 37 40 28 32

Reauthorize and Release Billing Documents Reverse Clearing with Payment Card Data Documents with Payment Card Information

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Documents by Settlement Batch Number

32

5.1

Documents by Settlement Batch Number

Purpose

The results will list all documents included in a settlement batch. This report is intended to be used to assist in the settlement reconciliation process.

Additional Information

The selection screen of this report, shown below, is similar in function to the standard SAP transaction FCCR (Payment Card Evaluations).

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Navigate to the Settlement batch documents by batch number program: /PMPAY/ PRE_BAT_ITEM.

1. Enter the Settlement batch number or click on the drop down list to select the batch number.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Documents by Settlement Batch Number

33

2. Choose one of the following options: Select To

Calculate processor fees?

Display a popup box for every card type in the batch to be displayed when the program is executed The values entered in this popup box are used to calculate an approximation of the fees that you should expect to be charged by the merchant processor for the items in this batch. The approximate amounts are listed per item and as subtotal/total amounts. (Approximate fees are not calculated for credit items unless the labeled Calculate fees for credits? checkbox is checked.)

Calculate fees for credits?

Approximate fees are calculated for credit items unless the labeled Calculate fees for credits? checkbox is checked. Exclude the settlement clearing accounting document from the report allowing for subtotaling and totals to be displayed.

Exclude Settle. clear doc?

4. Click

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Documents by Settlement Batch Number

34

Also, the key fields of the report: Accounting Document number and Sold-to partner, as well as the Sales, Clearing, and Reversal document number fields allow for single-click navigation to the corresponding document or customer master record. Click to view the legend for definition of the color coding of fields. Click criteria and data statistics. to view the sort

5.2

Documents by Settlement Date Range

Purpose

This report is driven by a date range. It allows for the reporting of settlement items across settlement batches and is useful for month-end or other time period reporting of payment card settlement information.

Additional Information

This report is similar in functionality to the Documents by Settlement Batch Number 32 program. The main difference is that this report is driven by a date range rather than a single settlement batch number.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Documents by Settlement Date Range

35

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Navigate to the List of settlement batch items by date range program: /PMPAY/ PRE_BAT_ITEM_DATE.

1. Enter the Settlement Date. 2. Choose from the following options: Select Clearing document posted Exclude Settle. clear doc? To Exclude any items from batches where a clearing document was not posted. Exclude the settlement clearing accounting document from the report allowing for subtotaling and totals to be displayed. Display items from batches where the OK checkbox is checked regardless of the status of the Errors checkbox.

OK, with or without Errors

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Documents by Settlement Date Range

36

OK, with NO Errors

Display items from batches where the OK checkbox is checked but the Errors checkbox is NOT checked. Display items from batches where the Errors checkbox is checked regardless of the status of the OK checkbox. Display items from batches where the Errors checkbox is checked but the OK checkbox is NOT checked Display a popup box for every card type in the batch to be displayed when the program is executed

Errors, with or without OK

Errors with NO OK

Approximate processor fees?

The values entered in this popup box are used to calculate an approximation of the fees that you should expect to be charged by the merchant processor for the items in this batch. The approximate amounts are listed per item and as subtotal/total amounts. Approximate fees are not calculated for credit items unless the labeled Calculate fees for credits? checkbox is checked. Approximate fees for credits? Approximate fees are calculated for credit items unless the labeled Calculate fees for credits? checkbox is checked.

4. Click

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Documents by Settlement Date Range

37

The key field of the report: Accounting Document number, as well as the Sales document number, Clearing document number, Reversal document number, Sold-to number, Payer number and Settlement batch number fields allow for single-click navigation to the corresponding document or customer master record. Click to view the legend for definition of the color coding of fields. Click criteria and data statistics. to view the sort

5.3

Reauthorize and Release Billing Documents

Purpose

This report is an enhanced version of the standard SAP transaction VFX3 (Release Billing Documents for Accounting). The results will list all billing documents which are blocked from posting to accounting due to insufficient payment card authorization.

Additional Information

When run as a background job, the enhanced version of the program can submit the order (s) from which these billing documents originated for a new authorization attempt. If the

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Reauthorize and Release Billing Documents

38

result of the authorization attempt is an approval, the program will attempt to release the billing document to accounting automatically. Several additional selection options are available in a section labeled Process release: With safety check (do not attempt to release documents simulation run) Release billing documents (automatically attempt to release all billing documents to accounting without selecting them individually)

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Navigate to the Reauthorize and Release Billing Documents for Accounting program: / PMPAY/PU_VFX3.

2. Enter the Payer(s) number. 3. Enter the Sales organization. 4. In the Process release section, select With safety check to run in simulation mode OR Release Billing documents to automatically attempt to release all billing documents to accounting without selecting them individually.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Reauthorize and Release Billing Documents

39

If the Error in Authorization checkbox is selected a report screen basically the same as the standard SAP transaction VFX3 listing billing documents block from posting to accounting for insufficient authorization will be displayed. 5. In the Incomplete due to section, select the reasons desired. 6. From the menu bar, select Program >> Execute in background. 7. Go to SAP transaction /nsm37.

8. Click on the desired line and click

9. Click on the line of the spool to view the spool results. The Incomplete due to column explains why the accounting documents were not created.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Reauthorize and Release Billing Documents

40

When run as a background job with the Release billing documents checkbox checked the program automatically re-submits the order(s) from which the billing document originated for a new authorization attempt. If this attempt is successful the billing document will automatically be released to accounting. If the attempt is unsuccessful, drill into the document and perform the actions necessary to make the correction. When you return to the spool request screen, the item will only show is the correction was not successful.

5.4

Reverse Clearing with Payment Card Data

Purpose

This program allows a settled accounting document to be reversed when the corresponding payment card authorization has been rejected as a charge back. This will create a new accounting document with a DEBIT to the customers AR account and a CREDIT to the Bank clearing account as defined in the IMG.

This report should NOT be used to reverse a Settlement Batch clearing document! This report is intended to reverse only single items within a settlement batch. Reversal of a Settlement Batch clearing document can be performed with transaction FBRA.

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Navigate to the Reverse clearing with Payment Card data program: /PMPAY/PU_FBRC

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Reverse Clearing with Payment Card Data

41

2. You may choose to run the program by Settlement batch, Accounting document number, or Card type and Number (If you are using DI for SAP, refer to Token Retrieval Procedures 14 for details.) Enter the appropriate information. 3. Click .

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Reverse Clearing with Payment Card Data

42

Click

to view the legend for definition of the color coding of fields.

4. Select the checkbox of the payment(s) to reverse.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Reverse Clearing with Payment Card Data

43

5. Click 6. Click .

. The item(s) will be highlighted green.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Reverse Clearing with Payment Card Data

44

The reversal document number is displayed in the Status line and in the Revers. doc column highlighted in red.

5.5

Documents with Payment Card Information

Purpose

This report will display all Order, Billing and Accounting documents containing the payment card information entered on the selection screen. This report is useful in quickly finding documents related to a specific card number and can assist in answering customer service questions.

Additional Information

This report will allow searches on three document types: Sales documents Billing documents (invoices, credit/debit memos) Accounting documents You can further refine your search for each document type by entering additional search criteria.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Documents with Payment Card Information

45

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Navigate to the Documents with Payment Card Information program: /PMPAY/ PRE_DOCS.

1. On the Payment Card data tab, enter the Payment card type and select the Card Number. (If you are using DI for SAP, refer to the Token Retrieval Procedures 14 for details.)

To select multiple card types or multiple cards, click these fields as needed.

and enter the additional selections for

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Documents with Payment Card Information

46

2. On the Organizational data tab, determine which types of document types to display.

Only the selection criteria for the document types selected is available for input. 3. Enter the required selection criteria. 4. Click .

2012 Paymetric, Inc.

Feb ruary 2012-R2

Financial Accounting

Documents with Payment Card Information

47

Click

to learn about the traffic lights and color coding on this report.

Single-click navigation to the documents as well as the Payer and Sold-to Partner Master Records is available on this report.

Receivables Management

This chapter contains procedures for the following: Open AR

47 77

A/R Payments by Customer/Date Direct AR Auto AR

78

92

6.1

Open AR

Overview

This program displays all open items (Credits and Debits) that are currently on the

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

48

customers account. The user may choose any of the items, including a mixture of debits and credits, and attempt to clear the full or partial amount with a payment card or electronic check. Payments are posted to the same GL accounts as SD payment card payments and automatically processed by the standard SAP settlement program.

Features

The Open AR Clearing program offers the following features: Display of open items on customer account Selection of open items (debits and credits) for payment by payment card or electronic check Integration to standard SAP Payment Card Interface (PCI) Automatic posting of payment upon receipt of payment card authorization or electronic check validation Allows for partial or residual payments of open items with or without reason codes Display of partial payments related to an open item Result report detailing results of program processing. Provides links to payment documents posted or details about errors during authorization or payment posting. Allows cross-company code processing upon activation of custom user exit

6.1.1

Select Open Items for Processing Purpose

This topic describes the options for selecting open AR items for processing. There are subsequent topics that detail the actual processing of the items.

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Navigate to the Receivables Management name: /PMPAY/PRE_OPEN_AR). Open AR menu option (program

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

49

2. On the Customer information tab, enter the Customer number or click in the field and choose the Customer number from the drop down list. 3. Enter the Company Code. 4. Enter the Currency. 5. Click to populate the Customer address information. This information can be changed as needed.

The button is used to perform "blind", or non-accounting document related, authorizations. Refer to Process Payment Card Payment via Blind Authorization 69 for further instructions. Blind authorization for credits is never allowed regardless of your security permissions. 6. Click the Document information tab.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

50

The Document information criteria section contains options to restrict the open items selected for processing based on the Accounting Document type, Document number, Fiscal year (in which the document number falls), Document posting date, Document date, Document entry date, and Payment method or Payment terms. 7. Enter restriction criteria as necessary. 8. Click on the Processing options tab.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

51

9. Choose the following options as necessary: Field Process ALL open items Description Displays both open debits and open credits. When deselected, the Process Open Debits and Process Open Credits options are open for selection. Displays only open debits for processing. Displays only open credits for processing. Displays the original open items as well as any partial payments made against those open items. Open items are presented in a hierarchical view. Restricts the items displayed for processing to those items posted up to and including the specified key date. Defaults

Process Open Debits Process Open Credits Display partial payments

Open items at key date

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

52

to the system date. Age of oldest item (days) Restricts the items displayed for processing to those that are past due by the number of days entered or are due in the future. Attempts a separate authorization for each open item selected

Authorize each item separately

Retry on communication error Automatically attempts once to reauthorize a transaction if a communication error is detected during the authorization RFC call to XiPay. If subsequent communication errors are detected for the same transaction, no additional authorization will be attempted. Stop processing after decline Stops the program from attempting authorization (assuming multiple documents are selected for processing and the checkbox Authorize each item separately is checked) for any items remaining to be processed. Manual auth when NOT approved Reauthorization on comm. error Credit Card Electronic Check Capture CVV/CID value? When selected, presents a popup box for entering a manual authorization after a non-approval response is received during an authorization attempt. When selected, automatically attempts reauthorization when a communication error is detected during the authorization RFC call to XiPay. Select to process credit card payments. Select to process electronic check payments. Allows the entry of the CVV/CID security code for the card.

Addn'l info for UK Debit Cards Allows the entry of a Payment Card Suffix and Valid From Date as required by some EU debit card types. Default Action code to be used Manual Input Allowed The special handling default code which indicates whether you are processing only ECP US or ECP for US and Canada. Allows you to manually enter a special handing code for ECP payments during the clearing process.

10.Click the Doc. Posting Options tab.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

53

11.Choose the following options as necessary: Field Enter reference number (text) Enter Document Header Text Description This value is used as the reference number text for all clearing documents which will be created and may be changed. This value is used as the document header text for all clearing documents which will be created. When not checked, a popup box for entry of a Document Header Text will appear prior to each clearing document creation. This text is free form.

Customer clearing text Text displayed on the Customer line on the clearing document which will be created. This value may be changed. Payment line item clear. text Clearing document type Document date Posting date Text displayed on the Payment Card Clearing GL account line on the clearing document which will be created. This value may be changed. Determines what document type the clearing document will be. Defaulted to the system date and determines what the clearing documents document date will be. Defaulted to the system date and determines what the clearing documents posting date will be.

Payment Debit Posting Defaulted to 40 - the posting key to be used on the clearing

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

54

Key Payment Credit Posting Key Profit Center BDC Run mode

document when posting a DEBIT payment Defaulted to 50 - the posting key to be used on the clearing document when posting a CREDIT payment Complete this field to set the profit center ensuring the open AR items go to the appropriate G/L payment card clearing account. Determines what screens to display when the clearing document is posted using standard SAP transaction FB05. By default, the field is set to N so that no screens are shown.

If the value in the BDC Run Mode field is changed, the user will be shown a popup message after clicking to view the list of open items for the customer warning that results are not guaranteed and that you may proceed at your own risk. Post as incoming payment Post as transfer payment Partial payment Dictates what type of payment will be posted on the clearing document. Dictates what type of payment will be posted on the clearing document. Relevant only if a partial payment is made against an open item. This field causes a payment to be posted with reference to the original item. Relevant only if a partial payment is made against an open item. This field causes the original item to be cleared completely with the remaining open amount posted as a new open item. Allows for a reason code to be defaulted on all open items when the open items are displayed. If a partial or residual payment is made, this reason code is used to add additional description to the payment explaining why it was not a full payment.

Residual item

Payment item reason code

Ignore discounts (use When checked, all discounts associated with the Terms of gross) Payment on the open item are disregarded and payment is made for the full open item amount .

12.Click the Misc. Options tab.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

55

13.Select options as necessary. 14.Choose one of the following processing options to continue: To View a list of open items, Clear all open items via an Online Authorization, Process a manual authorization, Process a blind authorization, Click .

Go to the Clear All Open AR Items via an Online Authorization 55 topic. Go to the Process Payment Card Payment via Manual Authorization 61 topic. Go to the Process Payment Card Payment via Blind Authorization 69 topic.

6.1.2

Clear All Open AR Items PURPOSE

This option will attempt a real-time, online authorization through the SAP standard RFC interface for the CA-PCI.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

56

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Select Open Items for Processing

48

2. To select an open item for processing, click on the selection checkbox at the beginning of the open item row and then click .

The Open amount is added to the to the Amount to process title line total. Included items are highlighted green.

To remove an open item from processing, click on the selection checkbox at the beginning of the open item row and then click title line total. 3. Click . The amount is removed from the Amount to process

to attempt a new authorization.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

57

The card marked on the Customer's master record as the DEFAULT card is listed first. To select another card stored on the customer's master record that is not listed, select Other Credit Card to enter the card details to be used.

4. Use the following table to determine your next action: If are processing... A credit card payment using the default card from Master Data, Then... A dialog box displays prompting you to confirm the Authorization.

Click [Yes] and continue to the next step. A credit card payment using a different card, A dialog box displays prompting you to enter the card information.

Complete the fields, click

and continue to the next step.

If you are using DI for SAP, refer to the Token Retrieval

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

58

If are processing...

Then... Procedures

14

for details.

An eCheck payment,

A dialog displays prompting you to enter the ECP information.

Complete the fields, click

and continue to the next step.

US RDFI number is the bank routing number. 5. The standard SAP message Authorization is being carried out displays in the status line indicating that the authorization RFC has been called. 6. The Authorization attempt response is received.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

59

6. Press Enter or click to update the display of the Open item view. The open amount of the previously selected items is decreased to reflect the payment received and ALL items previously selected are de-selected. Also, the Amount to process title line is returned to an amount of 0.00 USD.

The newly posted clearing document number displays in the status line.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

60

7. Click

to view the Results Report.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

61

To apply either a partial or residual amount, overwrite the amount in the Amount to process column. This allows accurate amount to be authorized. The assigned reason code will determine how the outstanding amount is applied.

6.1.3

Process Payment Card Payment via Manual Authorization Purpose

This option allows the entry, at any time, of an authorization number, authorization reference code (XiPay transaction ID) and authorization amount received from an external source (ex.: over the phone) and does not attempt an online authorization through the SAP standard RFC interface for the CA-PCI. The GL account and Merchant ID to be posted to are determined using the Account Determination sequence defined in configuration (see Configuration). From this point the transaction is processed as if the authorization had indeed been obtained through an online authorization.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

62

This option may not be used when displaying open CREDIT items or for amounts less than or equal to zero when processing all items.

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access. 1. Select Open Items for Processing

48

To select an open item for processing, click on the selection checkbox at the beginning of the open item row and then click . This will also add the value of the selected open item to the Amount to process title line total.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

63

To remove an open item from processing, click on the selection checkbox at the beginning of the open item row and then click . This will also subtract the value of the selected open item to the Amount to process title line total. 2. Click .

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

64

The card marked on the Customer's master record as the DEFAULT card is listed first. To select another card stored on the customer's master record that is not listed, select Other Credit Card to enter the card details to be used. If you are using DI for SAP, refer to the Token Retrieval Procedures 3. Choose the payment method and click .

14

for details.

4. Enter the Authorization number, Authorization reference code, and the authorized amount in the pop-up box and click .

5. Review the information in the pop-up box and click

to continue.

When is selected, the payment is processed and a payment document is posted. The document number is displayed in the status line.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

65

6. Click

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

66

7. Scroll to the right to view the processing message in the Description field.

Partial Payments

In this scenario, because full payment for document 90001273 has now been received, the Open amount, Curr., and Amount paid fields for this document have been highlighted in green to indicate full payment has been received and the Amount to process title line and Amount to process column have been reset to 0.00 USD. At this point additional items may be selected for processing for this customer / company code / payment card combination. The user may also exit out of the transaction and change the customer or payment card information to continue.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

67

Two (2) partial payments: one payment for 100.00 USD (document 14000398) and another payment for 8.25 USD (document 14000399) have been received for the full amount of open item 90001273. These payments can now be auto-cleared against document 90001273 using transaction F.13 (or similar) for Automatic Clearing. The effect of this will be to clear and close all three documents in the customers AR. The settlement program also indicates that the 8.25 USD payment for document 14000399 is seen along with the 100.00 USD payment for document 14000398 and both are ready to be transmitted in the next settlement batch as shown below.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

68

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

69

6.1.4

Process Payment Card Payment via Blind Authorization

This topic includes procedures for: Processing a blind authorization

69 71

Processing a payment card payment using a blind authorization

Purpose

This option allows an existing blind authorization and any item(s) on the Open item overview to be cleared at any time. This process does NOT attempt an online authorization through the SAP standard RFC interface for the CA-PCI. The GL account and Merchant ID to be posted to are determined using the Account Determination sequence defined in configuration. From this point, the transaction is processed as if the authorization had indeed been obtained through an online authorization.

This option may not be used when displaying open CREDIT items or for amounts less than or equal to zero when processing ALL items.

The blind authorizations are NOT submitted for settlement until they are applied to an accounting document in SAP. This means they will NOT be listed as a charge on the customers card statement until they have been submitted for settlement.

Procedure

If you get an Access Denied error, contact your SAP/PCMA System Administrator as he/she controls program access.

Receive Blind Authorization

Processing blind authorizations 1. Select Open Items for Processing

48

2. On the Customer information tab, enter the Customer number or click in the field and choose the Customer number from the drop down list. 3. Enter the Company Code. 4. Enter the Currency. 5. Press [Enter] key to populate the Customer address information. This information can be changed as needed. 6. In the Customer info group box, click .

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

70

The card marked on the Customer's master record as the DEFAULT card is listed first. To select another card stored on the customer's master record that is not listed, select Other Credit Card to enter the card details to be used. If you are using DI for SAP, refer to the Token Retrieval Procedures 7. Choose the payment method and click .

14

for details.

8. Enter the amount to be authorized against the card selected.

9. Select to make an authorization. The standard SAP message Authorization is being carried out is displayed in the status line indicating that the authorization RFC has been called.

2012 Paymetric, Inc.

Feb ruary 2012-R2

Receivables Management

Open AR

71