Академический Документы

Профессиональный Документы

Культура Документы

AP - Prelim

Загружено:

John Aries ReyesИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

AP - Prelim

Загружено:

John Aries ReyesАвторское право:

Доступные форматы

San Sebastian College-Recoletos

Canlubang Campus AY 2011-2012 2nd Semester College of Accountancy, Business Administration and Computer Studies

PRELIMINARY EXAMINATION

APPLIED AUDITING PART 2 Name:_______________________________ Score:_____________________ Yr& Section: __________________________ Date: _____________________ GENERAL DIRECTION: Choose the letter of the correct answer. Write the letter of your answer before the number. Answers requiring solution should be provided accordingly. Present your solution in good form. (2pts each) Problem 1 Mcdodo Co. wholesales food products to independent grocery stores. The company uses the perpetual inventory system and assigns cost to inventory on a first in first out basis. Transactions and other related information regarding two of the items (baked beans and plain flour) carried by Mcdodo are given below for December 2011, the last month of the companys reporting period. Baked Beans Plain Flour Unit of packaging Case containing 25x410g Box containing 12x4 kg bags cans Inventory 350 cases @ 196 625 boxes @ P384 Purchases 1. Dec. 10: 200 cases 1.Dec.3: 150 boxes@ P384.50 @ P195 per case 2.Dec.15:200 boxes@ P384.50 2. Dec. 19: 470 cases 3.Dec.29:240 boxes@ P390 @ P197 per case Purchase Terms 2/10,n/30, FOB shipping n/30, FOB destination December Sales 730 cases@ P285 950 boxes@ P400 Returns and A customer returned 50 As of Dec. 15 purchase was Allowances cases that had been unloaded, 10 boxes were shipped in error. The discovered damaged. A credit customers account was of P3,845 was received by credited for P14,250. McDodo Physical count at 326 cases on hand 15 boxes on hand December 31 Explanation of No explanation found Boxes purchased on Dec. 29 variance assumed stolen still in transit on Dec. 31 Net realizable value P290 per case P385 per box at Dec. 31 1. What is the cost of Baked Beans inventory that was assumed stolen? a. P2,744 b. P 4,060 c. P 2,370 d. P 2,758 2. What is the cost of Plain Flour inventory on December 31,2011 ? a. P 5,850 b. P 5,760 c. P 5,767 d. P 5,775 3. What is the total cost of McDodos inventory (Baked Beans and Plain Flour) on December 31,2011? a. P 69,989 b. P 72,747 c. P 77,301 d. P 100,315 4. What amount of loss on decline in value of inventory should be recognized by McDodo at the end of the reporting period? a. P 38,236 b. P 7,910 c. P 30,236 d. P 0

Page 1 of 7

Life shrinks or expands in proportion to one's courage. Anais Nin

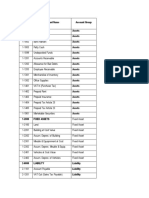

5. PAS 2 requires inventory to be stated at the lower of cost and a. Fair value c. nominal value b. Net realizable value d. net selling price Problem 2 You were engaged by First Love Corporation for the audit of the companys financial statements for the year ended December 31,2011. The company is engaged in the wholesale business and makes all sales at 25% over cost. The following were gathered from the clients accounting records: SALES Date Reference Amount P 5,200,000 40,000 150,000 10,000 46,000 68,000 16,000 (P5,530,000) P ---Date PURCHASES Reference Amount P 2,800,00 24,000 70,000 42,000 64,000 (P3,000,000) P ----

Balance forwarded Dec. 27 SI No.965 Dec.28 SI No. 966 Dec.28 SI No. 967 Dec.31 SI No. 969 Dec.31 SI No. 970 Dec.31 SI No. 971 Dec.31 Closing Entry

Balance Forwarded Dec.28 RR No. 1059 Dec 30 RR No.1061 Dec.31 RR No.1062 Dec.31 RR No.1063 Dec.31 Closing Entry

Note: SI = Sales Invoice Accounts Receivable Inventory Accounts Payable

RR = Receiving Report P500,000 600,000 400,000

You observed the physical inventory of goods in the warehouse on December 31 and were satisfied that it was properly taken. When performing a December 31, the shipments had need 968. The following sales and purchases cutoff test, you found out that at last receiving report used was No. 1063 and that no made on any sales invoice whose number is larger than No. additional information were likewise gathered:

1. Included in the physical inventory at December 31 were goods purchased and received per RR # 1060 but for which the invoice was not received until the following year. Cost was P 18,000 2. At the close of the business, December 31,2011, there were two trucks on the company siding: Truck No. CPA 123 was unloaded on January 2 of the following year and received on Receiving report No.1063. The freight was paid by the vendor. Truck No. ILU 143 was loaded and sealed on December 31 but left the company premises in January 2. This order was sold for P100,000 per Sales Invoice No. 968. 3. Temporarily stranded at December 31 at the railroad siding were two delivery trucks enroute to Brooks Trading Corporation. Brooks received the goods, which were sold on Sales Invoice No. 966, terms FOB Destination, the next day. 4. Enroute to the client on December 31 was a truckload of goods, which was received on Receiving Report No. 1064. The goods were shipped FOB Destination and freight of P2,000 was paid by the client. However the freight was deducted from the purchase price of P800,000. Page 2 of 7

Life shrinks or expands in proportion to one's courage. Anais Nin

Based on the result of your audit, determine the following: 6. Sales for the year ended December 31,2011 a. P5,250,000 b. P5,400,000 c. P5,150,000 7. Purchases for the year ended December 31,2011 a. P3,000,000 b. P3,018,000 c.P3,754,000 8. Inventory as of December 31, 2011 a. P864,000 b. P968,000 c. P800,000

d. P5,350,000 d.P3,818,000 d. P814,000

9. Accounts Receivable as of December 31, 2011 a. P350,000 b. P370,000 c. P220,000 10. Accounts Payable as of December 31, 2011 a. P418,000 b. 400,000 c. P354,000

d. P120,000

d. P1,218,000

Problem 3 MALABON SALES COMPANY uses first-in, first-out method in calculating cost of goods sold for the three products that the company handles. Inventories and purchases information concerning the three products are given for the month of October. Product C October1 Inventory 50,000 units At P6.00 70,000 units At P6.50 30,000 units At P8.00 105,000 units P8.00/unit 50,000 units P11.00/unit 45,000 units P2.00/unit Product P 30,000 units at P10.00 45,000 units at P10.50 Product A 65,000 units at P0.90 30,000 units at P1.25

October1-15 Purchases

October 16-31 Purchases

October 1-31 Sales October 31 Sales Price

On October 31, the companys suppliers reduced their prices from the most recent purchase prices by the following percentages: Product C,20%; Product P,10%; Product A,8%. Accordingly, Malabon decided to reduce its sales prices on all items by 10% effective November 1. Malabons selling cost is 10% of sales price. Products C and P have a normal profit (after selling costs) of 30% on sales prices, while the normal profit on Product A (after selling cost) is 15% of sales price. 11. Total cost of inventory at October 31 is a. P565,000 b. P557,310 c. P655,500

d. P617,500

12. The amount of inventory to be reported on the companys balance sheet at October 31 is a. P569,850 b. P559,350 c. P543,810 d. P595,350 13. The allowance for inventory writedown at October 31 is a. P5,650 b. P85,650 c. P13,500 d. P60,150 14. The cost of sales, after loss on inventory writedown, for the month of October is a. P1,293,650 b. P1,022,260 c. P1,290,650 d. P1,208,000

Page 3 of 7

Life shrinks or expands in proportion to one's courage. Anais Nin

15. Which of the following is not one of the independent auditors objectives regarding the audit of inventories? a. Verifying that inventory counted is owned by the client. b. Verifying that the client has used proper inventory pricing. c. Ascertaining the physical quantities of inventory on hand. d. Verifying that all inventory owned by the client is on hand at the time of the count. Problem 4 On the acquisition date, POMELO COMPANY designates purchased debt and equity securities as available for sale. POMELOs intent in buying investment securities is to make them available for sale when circumstances warrant, not to earn profit from short term fluctuations in price, and not necessarily to hold debt securities to maturity. Pomelo Companys fiscal year ends on December 31. No investments were held by the company at the beginning of the year. Described below are the companys investment related transactions: 2010 March 1 April 15 Purchased 30,000 PG, Inc. ordinary shares for P750,000 including brokerage fees and commissions. Purchased P1,000,000 Corporation. of 10% bonds at face value from OW

July 23 October 15 October 16 November 2

Received cash dividends of P60,000 on the investment in PG,Inc. ordinary shares. Received semiannual interest on the investment in OW Corporation bonds. Sold the OW Corporation bonds for P1,100,000 Purchased 250,000 ESP Co. preference shares including brokerage fees and commissions. for P12,500,000

December 31 Recorded the necessary adjusting entries relating to the investments. The market values of the investments are P30 per share for PG,Inc. and P44 per share for ESP Co. preference shares. 2011 January 27 March 2

Sold half the PG Inc, shares for P75 per share. Sold the ESP Co. preference shares for P78 per share.

16. What is the gain (loss) on the sale of the OW Corporation bonds on October 16,2010? a. P0 b. P200,000 c. (P100,000) d. P100,000 17. What is the total amount that would be reported on Pomelo Companys December 31,2010 income statement relative to these investments? a. P210,000 b. P260,000 c. P110,000 d. P160,000 18. How much unrealized gain(loss) should be reported in profit or loss in 2010? a. P150,000 b. (P1,500,000) c. P100,000 d. P0

Page 4 of 7

Life shrinks or expands in proportion to one's courage. Anais Nin

19. What amount of gain on sale of PG Inc. shares on January 27,2011 should Pomelo recognize? a. P75,000 b. P600,000 c. P450,000 d. P300,000 20. What is the gain on the sale of the ESP Co. preference shares on March 2,2011? a. P5,500,000 b. P9,000,000 c. P7,000,000 d.P1,500,000 Problem 5 On December 31,2010, LA COST COMPANYs statement of financial position showed the following balances related to its securities accounts: Trading Securities Available for sale securities Interest Receivable- Mayniladlad Water bonds Unrealized gain AFS La Costs securities following securities: portfolio on December P 1,477,500 1,180,000 12,500 100,000 made up of the

31,2010,was

Securities Classification 10,000 shares Yeye Bonel Corp. stock trading 8,000 shares Totoy Bibo, Inc. stock trading 10% Mayniladlad Water bonds (interest Payable semiannually on Jan1 and July1) trading 10,000 shares Bulaklak, Inc.stock AFS 20,000 shares Jumbo Hotdog Unlimited, Inc.stock AFS During 2011, the following transactions took place: Jan Mar Apr May July Oct 3 1 15 4 1 30

Cost P750,000 550,000 250,000 590,000 490,000

Market P762,500 528,250 186,750 630,000 550,000

Received interest on the Maynilad Water bonds. Purchased 3,000 additional shares of Yeye Bonel Corp. stock for P229,500, classified as trading security. Sold 4,000 shares of the Totoy Bibo,Inc. stock for P69 per share. Sold 4,000 shares of the Bulaklak, Inc. stock for P62 per share. Received interest on the Mayniladlad Water Bonds. Purchased 15,000 shares of Pasaway Co. stock for P832,500, classified as trading security

The market values of the stocks and bonds on December 31,2011 are as follows: Yeye Bonel Corporation stock Totoy Bibo,Inc. stock Pasaway Co. Stock Mayniladlad Water Bonds Bulaklak,Inc. stock Jumbo Hotdog Unlimited,Inc. stock P76.60 per share 68.50 per share 55.25 per share P205,550 61.00 per share 27.00 per share

Based on the above and the result of your audit, determine the following: 21. Gain or loss on sale of 4,000 Totoy Bibo,Inc. shares on April 15,2011 a. P1,000 gain b. P1,000 loss c. P11,875 gain d. P11,875 loss 22. Net realized gain or loss on sale of 4,000 Bulaklak,Inc. shares on May 4,2011 a. P12,000 gain b. P12,000 loss c. P4,000 gain d. P4,000 loss

Page 5 of 7

Life shrinks or expands in proportion to one's courage. Anais Nin

23. Carrying amount of trading securities as of December 31,2011 a. P2,337,000 b. P2,287,800 c. P2,304,100 d. P2,297,400 24. Carrying amount of available for sale securities as of December 31,2011 a. P844,000 b. P806,000 c. P906,000 d. P944,000 25. In 2011, what amount of unrealized gain or loss should be shown as component income and shareholders equity? Income Shareholders Equity a. P28,725 gain P62,000 gain b. P28,725 gain P22,000 loss c. P32,900 loss P122,000 loss d. P39,600 gain P78,000 gain 26. A client has a large and active investment portfolio that is kept in a bank safe deposit box. If the auditor is unable to count the securities at the balance sheet date, the auditor most likely will a. Request the bank to confirm to the auditor the contents of the safe-deposit box at the balance sheet date. b. Examine supporting evidence for transactions occurring during the year. c. Count the securities at a subsequent date and confirm with bank whether securities were added or removed since the balance sheet date. d. Request the client to have the bank seal the safe deposit box until the auditor can count the securities at a subsequent date. 27. When an auditor is unable to inspect and count a clients investment until after the balance sheet date, the bank where the securities are held in a safe deposit box should be asked to a. Verify any differences between the contents of the box and the balances in the clients subsidiary ledger. b. Provide a list of securities added and removed from the box between the balance sheet date and security count date. c. Count the securities in the box so that the auditor will have an independent direct verification d. Confirm that there has been no access to the box between the balance sheet date and the security count date. 28. Which of regarding the auditee? a. Examination purchased. b. Vouching all c. Simultaneous d. Confirmation the following is the least effective audit procedure existence assertion for the securities held by the of paid checks issued in payment of securities

changes during the year to supporting documents count of liquid assets from the custodian

29. Which of the following is the most effective audit procedure for verification of dividends earned on investments in equity securities? a. Tracing deposited dividend checks to the cash receipts book b. Reconciling the amounts received with published dividend records c. Comparing the amounts received with preceding year dividends received. d. Recomputing selected extensions and footings of dividend schedules and comparing totals to the general ledger. 30. In testing the long term investments,an auditor ordinarily would use analytical procedures to ascertain the reasonableness of the Page 6 of 7

Life shrinks or expands in proportion to one's courage. Anais Nin

a. b. c. d.

Classification between current and non current portfolios Valuation of marketable equity securities Existence of unrealized gains and losses in the portfolio Completeness of recorded investment income

END OF EXAMINATION

Happy holidays!

Page 7 of 7

Life shrinks or expands in proportion to one's courage. Anais Nin

Вам также может понравиться

- Audit Problem Inventories Part 1Документ4 страницыAudit Problem Inventories Part 1Rio Cyrel CelleroОценок пока нет

- NFJPIA - Mockboard 2011 - AP PDFДокумент6 страницNFJPIA - Mockboard 2011 - AP PDFSteven Mark MananguОценок пока нет

- NFJPIA Mockboard 2011 P1Документ7 страницNFJPIA Mockboard 2011 P1jhefster_81Оценок пока нет

- QUIZBOWL2018INVENTORYДокумент3 страницыQUIZBOWL2018INVENTORYRaymund CabidogОценок пока нет

- Computations MerchДокумент5 страницComputations MerchChayne Rodil100% (1)

- Substantive Testing For Inventories: Problem 1: The Makati Company Is On A Calendar Year Basis. The Following DataДокумент17 страницSubstantive Testing For Inventories: Problem 1: The Makati Company Is On A Calendar Year Basis. The Following DataPaul Anthony AspuriaОценок пока нет

- Applied Auditing Review Course Pre-Board - Answer KeyДокумент13 страницApplied Auditing Review Course Pre-Board - Answer KeyROMAR A. PIGAОценок пока нет

- Ap-5905 Inventories PDFДокумент9 страницAp-5905 Inventories PDFKathleen Jane SolmayorОценок пока нет

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationДокумент7 страницPractical Accounting 1: 2011 National Cpa Mock Board ExaminationkonyatanОценок пока нет

- Ap 1Документ4 страницыAp 1Joseph PamaongОценок пока нет

- 5th Year Exam APMIDTERMДокумент11 страниц5th Year Exam APMIDTERMMark Domingo MendozaОценок пока нет

- Set AДокумент5 страницSet ASomersОценок пока нет

- 123Документ11 страниц123Jandave ApinoОценок пока нет

- Far Probs - EvaluationДокумент7 страницFar Probs - EvaluationArvin John Masuela100% (1)

- Cpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Документ11 страницCpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Angelou100% (1)

- Applied Auditing Review Course Pre-Board - FinalДокумент13 страницApplied Auditing Review Course Pre-Board - FinalROMAR A. PIGAОценок пока нет

- PRACTICE SET III Audit of InventoriesДокумент9 страницPRACTICE SET III Audit of InventoriesAldyn Jade GuabnaОценок пока нет

- Chapter 4 5 6Документ4 страницыChapter 4 5 6nguyen2190Оценок пока нет

- Ap 17 PDFДокумент5 страницAp 17 PDFPdf FilesОценок пока нет

- NFJPIA - Mockboard 2011 - APДокумент12 страницNFJPIA - Mockboard 2011 - APHazel Iris CaguinginОценок пока нет

- Mock 3 FARДокумент10 страницMock 3 FARRodelLaborОценок пока нет

- Compre RevДокумент7 страницCompre RevGellez Hannah MarieОценок пока нет

- AP 5905 InventoriesДокумент9 страницAP 5905 Inventoriesxxxxxxxxx67% (3)

- Nfjpia Mockboard 2011 p1 - With AnswersДокумент12 страницNfjpia Mockboard 2011 p1 - With AnswersRhea SamsonОценок пока нет

- NFJPIA - Mockboard 2011 - AP PDFДокумент6 страницNFJPIA - Mockboard 2011 - AP PDFaizaОценок пока нет

- Audit Qualifying Exam 1 1Документ12 страницAudit Qualifying Exam 1 1Fery AnnОценок пока нет

- Lecture 6 Accounting For Inventory (I)Документ33 страницыLecture 6 Accounting For Inventory (I)chestervale1Оценок пока нет

- Case 1: Control Account and Subsidiary Ledger ReconciliationДокумент5 страницCase 1: Control Account and Subsidiary Ledger Reconciliationkat kaleОценок пока нет

- Quizzers 9Документ12 страницQuizzers 9Shanen Mendoza Young67% (6)

- IA 1 and 2 - Midterm Quiz - Student FileДокумент21 страницаIA 1 and 2 - Midterm Quiz - Student FileDaniella Mae ElipОценок пока нет

- Auditing Problems MC Quizzer 02Документ15 страницAuditing Problems MC Quizzer 02anndyОценок пока нет

- Quiz in ELEC 01 (Inventory Estimation)Документ3 страницыQuiz in ELEC 01 (Inventory Estimation)djanine cardinalesОценок пока нет

- QUIZ 3. Audit of Inventories ManuscriptДокумент3 страницыQUIZ 3. Audit of Inventories ManuscriptJulie Mae Caling MalitОценок пока нет

- 1 - CPAR - Audit of Inventory - Theo×ProbДокумент5 страниц1 - CPAR - Audit of Inventory - Theo×ProbMargaux CornetaОценок пока нет

- NFJPIA - Mockboard 2011 - AP PDFДокумент6 страницNFJPIA - Mockboard 2011 - AP PDFJohnny EspinosaОценок пока нет

- Mockboard AP PDFДокумент6 страницMockboard AP PDFKathleen JaneОценок пока нет

- Quiz BowlДокумент3 страницыQuiz BowljayrjoshuavillapandoОценок пока нет

- Cebu Cpar Center: Auditing Problems Audit of Inventories Problem No. 1Документ10 страницCebu Cpar Center: Auditing Problems Audit of Inventories Problem No. 1PaupauОценок пока нет

- Mockboard - Practical Accounting 1Документ8 страницMockboard - Practical Accounting 1Jaymee Andomang Os-agОценок пока нет

- Practical Accounting 1-MockboardzДокумент9 страницPractical Accounting 1-MockboardzMoira C. Vilog100% (1)

- Legend - Docx 1Документ101 страницаLegend - Docx 1Juberlina CerbitoОценок пока нет

- Quiz#2 Problem Solving InventoryДокумент3 страницыQuiz#2 Problem Solving InventoryMyles Ninon LazoОценок пока нет

- Exam ReviewerДокумент4 страницыExam ReviewerKirei MinaОценок пока нет

- MB2 2013 Ap Set AДокумент6 страницMB2 2013 Ap Set AMary Queen Ramos-UmoquitОценок пока нет

- Questions Problems Pre BQTAP 2018 2019Документ12 страницQuestions Problems Pre BQTAP 2018 2019GuinevereОценок пока нет

- Iac 11 Probs PDFДокумент12 страницIac 11 Probs PDFGuinevereОценок пока нет

- Accounting - 1st Quiz Cash and Cash Equivalent 2011Документ2 страницыAccounting - 1st Quiz Cash and Cash Equivalent 2011Louie De La Torre40% (5)

- Exercises For Accounting For Merchandise StoresДокумент4 страницыExercises For Accounting For Merchandise StoresAnne Dorene ChuaОценок пока нет

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- Buy and Hold is Still Dead (Again): The Case for Active Portfolio Management in Dangerous MarketsОт EverandBuy and Hold is Still Dead (Again): The Case for Active Portfolio Management in Dangerous MarketsОценок пока нет

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017От EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017Оценок пока нет

- Guide to Japan-Born Inventory and Accounts Receivable Freshness Control for Managers 2017 (English Version)От EverandGuide to Japan-Born Inventory and Accounts Receivable Freshness Control for Managers 2017 (English Version)Оценок пока нет

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for managersОт EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for managersОценок пока нет

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers: English versionОт EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers: English versionОценок пока нет

- Glass Containers, Domestic World Summary: Market Sector Values & Financials by CountryОт EverandGlass Containers, Domestic World Summary: Market Sector Values & Financials by CountryОценок пока нет

- Guide to Strategic Management Accounting for managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?От EverandGuide to Strategic Management Accounting for managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?Оценок пока нет

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsОт EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsОценок пока нет

- National Economic Accounting: The Commonwealth and International Library: Social Administration, Training Economics and Production DivisionОт EverandNational Economic Accounting: The Commonwealth and International Library: Social Administration, Training Economics and Production DivisionОценок пока нет

- RMC No. 014-2023 - DILG Memorandum Circular No. 2023-086 2023 SGLGДокумент34 страницыRMC No. 014-2023 - DILG Memorandum Circular No. 2023-086 2023 SGLGPrecious J Alolod ImportanteОценок пока нет

- Afan Ali CV 2Документ5 страницAfan Ali CV 2Afan AliОценок пока нет

- Kryptons Singapore VCC Guide June 2021Документ33 страницыKryptons Singapore VCC Guide June 2021Gilberto CalvliereОценок пока нет

- 2021 IMS Management Review ReportДокумент50 страниц2021 IMS Management Review ReportDebby JosephОценок пока нет

- WorldCom CaseДокумент7 страницWorldCom Casebayu pratama putraОценок пока нет

- Corporate Governance 4E Principles Policies and Practices 4Th Edition Full ChapterДокумент21 страницаCorporate Governance 4E Principles Policies and Practices 4Th Edition Full Chapteramy.perry17893% (27)

- Pertanyaan UAS Kelas L, Senin 12.40Документ21 страницаPertanyaan UAS Kelas L, Senin 12.40tsziОценок пока нет

- ABC Implementation Ethics Cma Adapted Applewood ElectronicДокумент2 страницыABC Implementation Ethics Cma Adapted Applewood Electronictrilocksp SinghОценок пока нет

- Business Plan For Starting A Chocolate CompanyДокумент26 страницBusiness Plan For Starting A Chocolate CompanyYummy Choc83% (6)

- Income StatementДокумент8 страницIncome Statementiceman2167Оценок пока нет

- A) B) C) D) E) A) B) C) D) E) A) B) C) D) E) A) B) C) D) E)Документ3 страницыA) B) C) D) E) A) B) C) D) E) A) B) C) D) E) A) B) C) D) E)Mharvie LorayaОценок пока нет

- SAP FICO Standard ReportsДокумент41 страницаSAP FICO Standard Reportssapfico2k8100% (2)

- Gao and Brink 2017Документ13 страницGao and Brink 2017Adityo NugrohoОценок пока нет

- Auditing Around The ComputerДокумент3 страницыAuditing Around The ComputerEdgardo Broñoza Teodoro Jr.Оценок пока нет

- COPAДокумент167 страницCOPANgoc Hong100% (1)

- AML Compliance Program GuideДокумент11 страницAML Compliance Program GuidelarissarovaneОценок пока нет

- Resume of JoemetellusДокумент2 страницыResume of Joemetellusapi-23439130Оценок пока нет

- Mulles Data EncodersДокумент4 страницыMulles Data EncodersMackenzie Heart ObienОценок пока нет

- Acca P1Документ26 страницAcca P1dabianОценок пока нет

- MYOB Qualification Test: LEVEL BASIC (MYOB Accounting v23)Документ8 страницMYOB Qualification Test: LEVEL BASIC (MYOB Accounting v23)Amalia Nur AfifahОценок пока нет

- Understanding Sarbanes OxleyДокумент11 страницUnderstanding Sarbanes OxleyrangoonroudyОценок пока нет

- Firm Profile IPSCOДокумент12 страницFirm Profile IPSCOIPS & Co.Оценок пока нет

- Accounting GovДокумент37 страницAccounting GovGelyn RaguinОценок пока нет

- Ap 59 PW - 5.06Документ18 страницAp 59 PW - 5.06xxxxxxxxxОценок пока нет

- Analytics Mindset Case Studies TechWearДокумент16 страницAnalytics Mindset Case Studies TechWearDEISY ESPINOSA0% (2)

- Revisi COA (Chart of Account)Документ3 страницыRevisi COA (Chart of Account)Simarfian jaya abadiОценок пока нет

- De AngeloДокумент17 страницDe AngeloAnnisaAyuLestariОценок пока нет

- 14TH Exam-Paper - 1 - Set - A PDFДокумент17 страниц14TH Exam-Paper - 1 - Set - A PDFrana_eieОценок пока нет

- Tutorial Solutions ACCT1501Документ24 страницыTutorial Solutions ACCT1501Samuēl BeedhamОценок пока нет

- Oriondo Vs CoaДокумент2 страницыOriondo Vs CoaFrancis Coronel Jr.100% (1)