Академический Документы

Профессиональный Документы

Культура Документы

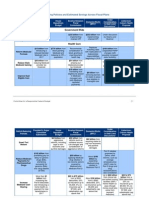

Comparing Medicare Reform Proposals

Загружено:

mng1mng1Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Comparing Medicare Reform Proposals

Загружено:

mng1mng1Авторское право:

Доступные форматы

Proposals

for Medicare Reform

Rivlin-Domenici

Date

November 2010

Rep. Ryan's FY2012 Budget

April 2011

Ryan-Wyden

December

2011

Romney

December

2011

Burr-Coburn

Proposal

February

2012

Budget Control Act

August 2011

Plan Summary Premium supprt / Privatization Maintain traditional Medicare as default

In 2018, transition Medicare to a premium supportsystem that gives beneficiaries payments to purchase Eliminate traditional Medicare in private insurance on a regulated "Medicare Exchange"; maintain 2022; Replace it with a "premium traditional Medicare as default option. support" system.

In 2016, the plan would introduce a Premium Support option to compete Similar to original Rivlin-Domenici with the traditional FFS Medicare proposal. Transition Medicare to a Similar to original Domenici-Rivlin "Implement a sequester to plan in a competitive bidding proces. "premium support" contribution Proposal. Transition Medicare to Medicare payments to providers Plans would be required to offer program in 2022; maintain traditional a "premium support" program in benefits actuarially equal to the and plans, if by 2014 the debt-to- Medicare as a default option, but with 2022; maintain traditional GDP ratio is projected to exceed prior years Medicare benefits.

higher beneficiary premiums.

Medicare as a default option.

2.8% for 2015-2019." NA NA

The

plan

says

that

premium

support

payments

will

be

tied

to

average

bids,

but

does

not

say

exactly

what

tied

to

means;

furthermore,

the

proposal

does

not

include

a

cap

spending

growth

for

premium

support

beneficiary

payments. Proposes

an

increase

in

the

age

of

eligibility

to

67,

by

increaseing

the

age

by

two

months

each

year,

beginning

with

people

who

were

born

in

1949.

Beneficiary Payments

Premium support will be set at the same initial level and will grow by the annual rate of GDP growth per capita +1% - both for individuals entering the Exchange and for those who remain in traditional Medicare.

Program growth after 2022 could not "Premium Support" payment for 65 exceed nominal GDP growth plus 1%. year olds in 2022 is specified to be To achieve this, low-income seniors $8,000; payments increase each year would receive fully funded savings by an amount that reflects both the accounts to help offset increased out- increase in the consumer price index of-pocket costs and assistance for (CPI-U) and the effects of aging. wealthier seniors would be reduced. Starting in 2022, the age of eligibility for Medicare would increase by two months per year until it reached 67 in 2033.

Unclear

NA

Age of Medicare eligibilty

Not mentioned

Not mentioned

Unclear

NA

Budget Deficit*

Reduce federal budget deficits over the Budget deficits under the proposal 2011-2020 period by about $280 would be around 2 percent of GDP in billion; the total effect in 2020 would the 2020s and would decline during be a reduction in the deficit of the 2030s. The budget would be in approximately $90 billion. surplus by 2040.

Unclear

Unclear

The super committee's failure to reduce the deficit by at least Senators Coburn and Burr estimate that their proposal will $1.2 trillion triggers a 2% across the board cut to Medicare in reduce Medicare spending by between $300-$500 billion over 2013, which translates into about $123 billion over the next decade. the next decade.

Health care spending* Physician payments / sustainable growth rate Assumes a permanent fix to the SGR mechanism for physician payments. (SGR)

Reduce federal health care spending to Reduce federal health care spending around 6% of GDP in 2020, 8% in 2030 to around 6% of GDP in 2030-2040 and 10% of GDP in 2050. and 5% of GDP in 2050.

Reduces Medicare spending as a % of GDP, but CBO has not yet analyzed this proposal independently.

Unclear

Not available, as the proposal has not yet been evaluated by the Congressional Budget Office. Freeze physician payments at the current rate for the near future.

Not mentioned

Not mentioned

Unclear

Other

Fradually raises premiums for Medicare Part B from 25% to 35% of program costs over 5 years.

Change applies to people turning 65 beginning in 2022; beneficiaries who turn 65 before then would remain in traditional Medicare with option of Changes wil not impact any senior at converting to the new system. or above age 55 in 2011.

Link to Proposal * Denotes estimates from the Congressional Budget Office

http://wyden.senate.gov/issues/issue http://www.bipartisanpolicy.org/proje budget.house.gov/UploadedFiles/Path /?id=ab82bb35-a617-4d66-b6e2- cts/debt-initiative/about ToProsperityFY2012.pdf c9f9b4758c59

Repeal the Independent Payment Advisory Board. http://blogs- images.forbes.com/aroy/files/20 http://www.gpo.gov/fdsys/pkg/PL Not yet officially released (as of 12/02/Seniors-Choice-Act- AW-112publ25/pdf/PLAW- December 2011) Summary.pdf 112publ25.pdf

Вам также может понравиться

- Medicare Table of Reform Proposals 2 0518Документ1 страницаMedicare Table of Reform Proposals 2 0518mng1mng1Оценок пока нет

- Social Security Trustees Report 2010Документ20 страницSocial Security Trustees Report 2010Beverly TranОценок пока нет

- A Message To The PublicДокумент24 страницыA Message To The Publicthe kingfishОценок пока нет

- CBO Long Term FINALДокумент6 страницCBO Long Term FINALCommittee For a Responsible Federal BudgetОценок пока нет

- Overlapping Policies and Estimated Savings Across Fiscal PlansДокумент12 страницOverlapping Policies and Estimated Savings Across Fiscal PlansCommittee For a Responsible Federal BudgetОценок пока нет

- Douglas W. Elmendorf, Director U.S. Congress Washington, DC 20515Документ50 страницDouglas W. Elmendorf, Director U.S. Congress Washington, DC 20515josephragoОценок пока нет

- Medicaid Cuts in The Senate Repeal Bill - Quantifying The Fiscal Harm To Your StateДокумент10 страницMedicaid Cuts in The Senate Repeal Bill - Quantifying The Fiscal Harm To Your StateLiz HackettОценок пока нет

- Overlapping Policies and Estimated Savings Across Fiscal PlansДокумент13 страницOverlapping Policies and Estimated Savings Across Fiscal PlansCommittee For a Responsible Federal BudgetОценок пока нет

- Medicare Is Not BankruptДокумент3 страницыMedicare Is Not BankruptMustaffah KabelyyonОценок пока нет

- Medicare: Issue BriefДокумент7 страницMedicare: Issue BriefDave McCarronОценок пока нет

- Final Report - New Jersey Pension and Health Benefit Study Commission - Dec. 6, 2017Документ10 страницFinal Report - New Jersey Pension and Health Benefit Study Commission - Dec. 6, 2017The (Bergen) RecordОценок пока нет

- Medicaid's Soaring Cost: Time To Step On The Brakes, Cato Policy Analysis No. 597Документ20 страницMedicaid's Soaring Cost: Time To Step On The Brakes, Cato Policy Analysis No. 597Cato InstituteОценок пока нет

- Paul Ryan TableДокумент3 страницыPaul Ryan TableCommittee For a Responsible Federal BudgetОценок пока нет

- Collaborative Financial Solutions, LLC Cost-of-Living Adjustments: What They Are and Why They MatterДокумент4 страницыCollaborative Financial Solutions, LLC Cost-of-Living Adjustments: What They Are and Why They MatterJanet BarrОценок пока нет

- Trustees PaperДокумент6 страницTrustees PaperCommittee For a Responsible Federal BudgetОценок пока нет

- Paul Ryan Comparison TableДокумент3 страницыPaul Ryan Comparison TableCommittee For a Responsible Federal BudgetОценок пока нет

- EntitlementsДокумент4 страницыEntitlementsRichard HortonОценок пока нет

- Patient-Centered Care Solution PresentationДокумент10 страницPatient-Centered Care Solution Presentationapackof2Оценок пока нет

- November 2010Документ32 страницыNovember 2010cookie1961Оценок пока нет

- KFF Graham CassidyДокумент11 страницKFF Graham CassidyiggybauОценок пока нет

- CRFB's Long-Term Realistic Baseline June 30, 2011: HairmenДокумент4 страницыCRFB's Long-Term Realistic Baseline June 30, 2011: HairmenCommittee For a Responsible Federal BudgetОценок пока нет

- Medicare Deciphering The DebateДокумент1 страницаMedicare Deciphering The DebateRob MentzerОценок пока нет

- CBO Correction of Long-Term Deficit SavingsДокумент3 страницыCBO Correction of Long-Term Deficit SavingsMarkWarnerОценок пока нет

- Managed Care, Hospitals' Hit Tolerable When Covid Emergency EndsДокумент5 страницManaged Care, Hospitals' Hit Tolerable When Covid Emergency EndsCarlos Mendoza DomínguezОценок пока нет

- Social Security and Medicare Trustees ReportДокумент28 страницSocial Security and Medicare Trustees ReportAustin DeneanОценок пока нет

- Romney Budget Proposals Would Necessitate Very Large Cuts in Medicaid, Education, Health Research, and Other ProgramsДокумент11 страницRomney Budget Proposals Would Necessitate Very Large Cuts in Medicaid, Education, Health Research, and Other ProgramsJamie SandersonОценок пока нет

- 2022 Proposed Budget For Livingston CountyДокумент384 страницы2022 Proposed Budget For Livingston CountyWatertown Daily TimesОценок пока нет

- Background and Summary of Fiscal Commission PlanДокумент8 страницBackground and Summary of Fiscal Commission PlanCommittee For a Responsible Federal BudgetОценок пока нет

- State and Local Pension Funds 2022Документ48 страницState and Local Pension Funds 2022Hoover InstitutionОценок пока нет

- GAO Report Fall 2009Документ13 страницGAO Report Fall 2009thecynicaleconomistОценок пока нет

- Fact Sheet - Health Care - FINALДокумент6 страницFact Sheet - Health Care - FINALsarahkliffОценок пока нет

- VBID 2022 First Eval ReportДокумент168 страницVBID 2022 First Eval ReportCronopios Cortázar BurgosОценок пока нет

- Social Security & Medicare Shortfalls Exceed $100 Trillion Over 30 YearsДокумент20 страницSocial Security & Medicare Shortfalls Exceed $100 Trillion Over 30 YearsOWNEditorОценок пока нет

- SonaДокумент5 страницSonaApple StarkОценок пока нет

- Principle 3Документ5 страницPrinciple 3Committee For a Responsible Federal BudgetОценок пока нет

- CaidActuarial Report 2011Документ59 страницCaidActuarial Report 2011QMx2014Оценок пока нет

- DeficitReduction ScreenДокумент46 страницDeficitReduction ScreenPeggy W SatterfieldОценок пока нет

- CRS Report Mandatory Spending Since 1962 03-2015Документ20 страницCRS Report Mandatory Spending Since 1962 03-2015R Street InstituteОценок пока нет

- 5 3 11healthДокумент10 страниц5 3 11healthJamie SandersonОценок пока нет

- Testimony On The 2013 Long-Term Budget OutlookДокумент8 страницTestimony On The 2013 Long-Term Budget OutlookSteven HansenОценок пока нет

- Focus On Ag: Written by Kent Thiesse Farm Management Analyst and Senior Vice President, Minnstar BankДокумент2 страницыFocus On Ag: Written by Kent Thiesse Farm Management Analyst and Senior Vice President, Minnstar BankFluenceMediaОценок пока нет

- 2010 Budget Perspective: The Real Deficit Effect of The Health BillДокумент5 страниц2010 Budget Perspective: The Real Deficit Effect of The Health BillWashington ExaminerОценок пока нет

- Mac Guineas Testimony Medicare Reform 12oct11Документ12 страницMac Guineas Testimony Medicare Reform 12oct11Committee For a Responsible Federal BudgetОценок пока нет

- CBO On Minimum WageДокумент17 страницCBO On Minimum WageThe Western JournalОценок пока нет

- Kenneth Thorpe's Analysis of Bernie Sanders's Single-Payer Proposal.Документ7 страницKenneth Thorpe's Analysis of Bernie Sanders's Single-Payer Proposal.Dylan Matthews57% (7)

- UntitledДокумент16 страницUntitledapi-227433089Оценок пока нет

- Analysis of The Presidents Fiscal Year 2015 BudgetДокумент7 страницAnalysis of The Presidents Fiscal Year 2015 BudgetShirley FarraceОценок пока нет

- Budget Update March 142006Документ10 страницBudget Update March 142006Committee For a Responsible Federal BudgetОценок пока нет

- 2011.04.07. EPI. Ryan's Budget Would Undermine Economic Security For MillionsДокумент4 страницы2011.04.07. EPI. Ryan's Budget Would Undermine Economic Security For MillionsAshesh RambachanОценок пока нет

- 2019 Riverside County Pension Advisory Review Committee ReportДокумент20 страниц2019 Riverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comОценок пока нет

- Averting A Fiscal Crisis 0Документ26 страницAverting A Fiscal Crisis 0Committee For a Responsible Federal BudgetОценок пока нет

- Fitch Affirms Uruguay's Rating at 'BBB-' Outlook NegativeДокумент6 страницFitch Affirms Uruguay's Rating at 'BBB-' Outlook NegativeYamid MuñozОценок пока нет

- Results in Brief Highlights of The Fiscal Year 2019 Financial Report of The U.S. GovernmentДокумент2 страницыResults in Brief Highlights of The Fiscal Year 2019 Financial Report of The U.S. GovernmentLokiОценок пока нет

- The Impact of The ACA and The Exchange On Minnesota: Updated EstimatesДокумент25 страницThe Impact of The ACA and The Exchange On Minnesota: Updated EstimatesMinnesota Public RadioОценок пока нет

- Cato Handbook Congress: Washington, D.CДокумент13 страницCato Handbook Congress: Washington, D.CFaraidi Ratu Almira HuseinОценок пока нет

- War Between The Generations: Federal Spending On The Elderly Set To Explode, Cato Policy Analysis No. 488Документ22 страницыWar Between The Generations: Federal Spending On The Elderly Set To Explode, Cato Policy Analysis No. 488Cato InstituteОценок пока нет

- BudgetHighlights2012 2013Документ2 страницыBudgetHighlights2012 2013Pallavi ShuklaОценок пока нет

- CalPERS LTC Recommendation and AnalysisДокумент6 страницCalPERS LTC Recommendation and Analysisjon_ortizОценок пока нет

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0 0Документ53 страницыAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0 0Committee For a Responsible Federal BudgetОценок пока нет