Академический Документы

Профессиональный Документы

Культура Документы

Summary of Ratios

Загружено:

Kalpak DeИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Summary of Ratios

Загружено:

Kalpak DeАвторское право:

Доступные форматы

SUMMARY OF RATIOS Ratios to be Computed 1 Basic Components 2

Current Ratio Quick or Acid Test or Liquid Ratio (for immediate solvency). Absolute Liquid Ratio Inventory/stock Turnover Ratio Debtors or Receivables Turnover Ratio/ Velocity Average Collection Period Creditors/ Payables/ Turnover Ration/ Velocity Average Payment Period Working Capital Turnover Ratio Debt- Equity Ratio

Current Assets Current Liabilities Liquid/Quick Assets Current Liabilities Absolute Liquid Assets Current Liabilities Cost of Goods sold Average Inventory at cost Net Credit Annual Sales Average Trade Debtors Total Trade Debtors Sales Per day Net Credit Annual Purchase Average Trade Debtors Total Trade Creditors Average Daily Purchase Cost of Sales Net Working Capital Outsiders Funds or Shareholders Funds External Equities Internal Equities

Funded Debt to Total Capitalization Ratio Ratio of long term Debt to Shareholders Funds ( Debt-Equity)

Funded Debt * 100 Total Capitalization Long term debt Shareholders Funds

Proprietory or equity Ratio Solvency Ratio Fixed Assets Net Worth Ratio Fixed Assets Ratio or Fixed Assets To Long Term Funds. Ratio of Current Assets to Proprietors Funds Debt Service or Interest Coverage Ratio Total Coverage or Fixed Charge Coverage Preference Dividend Coverage Ratio

Shareholderss Funds Total Assets Total Liabilities to Outsiders Total Assets Fixed Assets (after depreciation) Shareholders Funds Fixed Assets (after depreciation). Total Long Term Funds. Currents assets Shareholders Funds Net Profit ( Before interest & Taxes) Fixed Interest Charges EBIT Fixed Interest Net Profit (before interest & Income taxes) Preference Dividend Annual Cash Flow(before Interest & Taxes) Sinking fund approp. On debt Interest + ------------------1-Tax Rate CF 1+ SFD 1-T Gross Profit * 100 Net Sales Operating Cost * 100 Net Sales Particular Expense * 100 Net Sales Net Profit after Tax * 100 Net Sales

Cash to Debt service Ratio or Debt Cash Flow Coverage

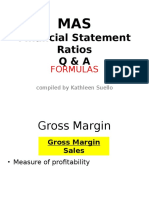

Gross Profit Ratio Operating Ratio Expense Ratio Net Profit Ratio

Operating Profit Ratio Return on Share Holders Investment or Networth (R.O.I). Return on Equity Capital

Operating Profit * 100 Net Sales Net Profit(after interest & tax) Shareholders Funds. Net Profit after taxPreference Div. Paid up Equity Capital. Net Profit after TaxPreference Dividend No. of Equity shares Adjusted Net Profit * 100 Gross Capital Employed Adjusted Net Profit * 100 Net Capital Employed Dividend per share Market value per share Dividend per Equity share Earnings per share

Earning Per Share(E.P.S)

Return on Gross Capital Employed Return on Net Capital Employed Dividend yield ratio Divident Pay-Out Ratio Or Pay-out Ratio Price Earning Ratio(P/E Ratio) Capital Gearing Ratio

Market price per equity share Earnings per share Equity share capital + Reserve & Surplus Pref. Capital + Long term debt bearing fixed interest. Shareholders funds + Long term Liabilities Long term Liabilities Outsiders Funds Shareholders Funds Fixed Assets Funded Debt Current Liabilities Shareholders Funds

Total Invetsment to Long Term Liabilities Debt Equity Ratio Ratio of Fixed Assets to Funded Debt Ratio of Current Liabilities to Proprietors Funds

Ratio of Reserves to Equity Capital Financial Leverage Operating Leverage

Reserves * 100 Equity Share Capital Earning Before Int. & Tax(EBIT) EBIT- Inter & Preference Dividend Contribution EBIT

Вам также может понравиться

- Financial Statement Analysis Ratios GuideДокумент13 страницFinancial Statement Analysis Ratios Guidesunilsims2Оценок пока нет

- A) Liquidity Ratios: - Current Ratio - Acid Test Ratio - Working CapitalДокумент3 страницыA) Liquidity Ratios: - Current Ratio - Acid Test Ratio - Working CapitalFariha MaqboolОценок пока нет

- ROI and Its ApplicationДокумент11 страницROI and Its Applicationbhavesh patelОценок пока нет

- Financial+Statement+Analysis LatestДокумент21 страницаFinancial+Statement+Analysis LatestShekhar Jadhav100% (1)

- Ratio Analysis: Ratio Analysis: A Ratio: Is Defined As AnДокумент19 страницRatio Analysis: Ratio Analysis: A Ratio: Is Defined As AnSaugata PoaliОценок пока нет

- Financial RatiosДокумент2 страницыFinancial Ratiossah.ravindra1Оценок пока нет

- SL No Description A Liquidity RatiosДокумент10 страницSL No Description A Liquidity RatiosAshish SharmaОценок пока нет

- Understanding Financial RatiosДокумент3 страницыUnderstanding Financial Ratiospv12356Оценок пока нет

- Ratio Analysis: Dr. Divya Gakhar Asst. Professor, USMSДокумент7 страницRatio Analysis: Dr. Divya Gakhar Asst. Professor, USMSSumit GargОценок пока нет

- Sessions 10 11 RatiosДокумент21 страницаSessions 10 11 Ratiosadharsh veeraОценок пока нет

- Financial Analysis RatiosДокумент34 страницыFinancial Analysis Ratioskrishna priyaОценок пока нет

- Annual ReportДокумент5 страницAnnual Reportmengjun0987654311Оценок пока нет

- Understanding Financial StatementsДокумент60 страницUnderstanding Financial StatementsAnonymous nD4Kwh100% (1)

- Financial RatiosДокумент5 страницFinancial RatioszarimanufacturingОценок пока нет

- Major Financial Statements: - Corporate Shareholder Annual and Quarterly Reports Must IncludeДокумент90 страницMajor Financial Statements: - Corporate Shareholder Annual and Quarterly Reports Must Includentpckaniha100% (1)

- Ratio AnalysisДокумент37 страницRatio AnalysisKaydawala Saifuddin 20Оценок пока нет

- Financial Statement Ratio Analysis PresentationДокумент27 страницFinancial Statement Ratio Analysis Presentationkarimhisham100% (1)

- Financial Control and Ratio AnalysisДокумент28 страницFinancial Control and Ratio Analysismalavika100% (1)

- Finance KEOWN CH4 NotesДокумент8 страницFinance KEOWN CH4 NotesJeongBin ParkОценок пока нет

- Ratio Analysis Guide: Understand Financial PerformanceДокумент26 страницRatio Analysis Guide: Understand Financial Performanceakhil batraОценок пока нет

- Chapter 5 - Profitability Analysis - SVДокумент39 страницChapter 5 - Profitability Analysis - SVĐoan Thục100% (1)

- Financial Ratios and Analysis for Banks, Insurance Cos, and Other Financial FirmsДокумент23 страницыFinancial Ratios and Analysis for Banks, Insurance Cos, and Other Financial FirmsSim BelsondraОценок пока нет

- Entrepreneurship 10 Money in The OrganisationДокумент13 страницEntrepreneurship 10 Money in The OrganisationAnusia ThevendaranОценок пока нет

- Financial Statement Analysis: by Aditi RodeДокумент36 страницFinancial Statement Analysis: by Aditi RodegrshneheteОценок пока нет

- RATIO AnalysisДокумент36 страницRATIO AnalysisRishika MadhukarОценок пока нет

- Ratio Analysis Guide for Financial Statement EvaluationДокумент79 страницRatio Analysis Guide for Financial Statement EvaluationSurjo Bhowmick100% (1)

- Return On Invested CapitalДокумент40 страницReturn On Invested Capitalhariyadi030267313100% (1)

- Asset Conversion CycleДокумент12 страницAsset Conversion Cyclessimi137Оценок пока нет

- Financial Ratio Analysis With FormulasДокумент3 страницыFinancial Ratio Analysis With FormulasLalit Bom Malla100% (1)

- Comparisons Within The Financial StatementsДокумент6 страницComparisons Within The Financial StatementsAkhil JainОценок пока нет

- Key Financial Ratios GuideДокумент25 страницKey Financial Ratios GuideGaurav HiraniОценок пока нет

- HO 4 Analisis Laporan KeuanganДокумент44 страницыHO 4 Analisis Laporan KeuanganChintiaОценок пока нет

- Topic 9Документ19 страницTopic 9sarahОценок пока нет

- Ratio AnalysisДокумент27 страницRatio AnalysisPratik Thorat100% (1)

- Topic 8Документ27 страницTopic 8sarah100% (1)

- RatiosДокумент4 страницыRatiosSoham SubhamОценок пока нет

- Investment: Dr. Kumail Rizvi, CFA, FRMДокумент113 страницInvestment: Dr. Kumail Rizvi, CFA, FRMsarakhan0622100% (1)

- Measuring Bank Performance & Risk with Key RatiosДокумент45 страницMeasuring Bank Performance & Risk with Key RatiospavithragowthamnsОценок пока нет

- Today's Agenda: Ratio Analysis Group Name Submission Group Name SubmissionДокумент18 страницToday's Agenda: Ratio Analysis Group Name Submission Group Name SubmissionKingston KimberlyОценок пока нет

- Ratio Analysis: Lecture 12 & 13 Required: Carry Annual ReportsДокумент62 страницыRatio Analysis: Lecture 12 & 13 Required: Carry Annual Reportslove_abhi_n_22Оценок пока нет

- Measuring Liquidity: Ratio AnalysisДокумент33 страницыMeasuring Liquidity: Ratio AnalysispujaadiОценок пока нет

- Financial Management ReviewerДокумент59 страницFinancial Management Reviewerkristoffer88% (8)

- Financial AnalysisДокумент30 страницFinancial AnalysisArchana DevdasОценок пока нет

- Financial Statement Analysis Ratios and Formulas (Flashcards)Документ52 страницыFinancial Statement Analysis Ratios and Formulas (Flashcards)Blesilda OracoyОценок пока нет

- borisagarharsh62Документ24 страницыborisagarharsh62Borisagar HarshОценок пока нет

- Session 24Документ40 страницSession 24Ashutosh GuptaОценок пока нет

- Chapter 3 Financial Statements Analysis: Vaibhav KabraДокумент29 страницChapter 3 Financial Statements Analysis: Vaibhav KabraSatyajit MallОценок пока нет

- Financial Statement AnalysisДокумент36 страницFinancial Statement AnalysisDakshi Saini100% (1)

- Financial Statement AnalysisДокумент59 страницFinancial Statement AnalysisRishu SinghОценок пока нет

- Ratio - Basics: Liquidity Ratios (Short Term Solvency Ratios)Документ5 страницRatio - Basics: Liquidity Ratios (Short Term Solvency Ratios)Avijash ShrivastavaОценок пока нет

- Ratio Analysis Notes - SATANДокумент26 страницRatio Analysis Notes - SATANinsomniac_satanОценок пока нет

- SL No Description A Liquidity RatiosДокумент21 страницаSL No Description A Liquidity RatiosvaibhavacОценок пока нет

- ANALYZE DEBT RATIOSДокумент16 страницANALYZE DEBT RATIOSRichard Sinchongco Aguilar Jr.Оценок пока нет

- Financial Management Re Vie WeДокумент60 страницFinancial Management Re Vie WeferroalОценок пока нет

- Bank Financial Statements and Performance MetricsДокумент107 страницBank Financial Statements and Performance MetricsNur AlamОценок пока нет

- Corporate FinanceДокумент20 страницCorporate FinanceHarshit GoyalОценок пока нет

- Working Capital MGTДокумент12 страницWorking Capital MGTssimi137Оценок пока нет

- Accounting and Finance Formulas: A Simple IntroductionОт EverandAccounting and Finance Formulas: A Simple IntroductionРейтинг: 4 из 5 звезд4/5 (8)

- Business Metrics and Tools; Reference for Professionals and StudentsОт EverandBusiness Metrics and Tools; Reference for Professionals and StudentsОценок пока нет

- Financial Accounting and Reporting Study Guide NotesОт EverandFinancial Accounting and Reporting Study Guide NotesРейтинг: 1 из 5 звезд1/5 (1)

- Hotel Dreamland Conference Room Sitting ArrangementДокумент2 страницыHotel Dreamland Conference Room Sitting ArrangementKalpak DeОценок пока нет

- Ict 706Документ12 страницIct 706Kalpak DeОценок пока нет

- The - Last - Don by Mario PujoДокумент412 страницThe - Last - Don by Mario PujoKalpak DeОценок пока нет

- Radio AdvertisingДокумент96 страницRadio AdvertisingKalpak De100% (1)

- TRPS Batch II Training Schedule HyderabadДокумент238 страницTRPS Batch II Training Schedule HyderabadKalpak DeОценок пока нет

- PCS-HR - Handbook (Updated Copy)Документ18 страницPCS-HR - Handbook (Updated Copy)Kalpak DeОценок пока нет

- PCS-HR - Handbook (Updated Copy)Документ18 страницPCS-HR - Handbook (Updated Copy)Kalpak DeОценок пока нет

- ( ), (Amarboi - Com)Документ527 страниц( ), (Amarboi - Com)Mrityunjoy DuttaОценок пока нет

- Resume Format: TH THДокумент2 страницыResume Format: TH THKalpak DeОценок пока нет

- Marketing Mix For Indian Automobile Company Maruti SuzukiДокумент5 страницMarketing Mix For Indian Automobile Company Maruti SuzukiKalpak DeОценок пока нет

- ASCII ValueДокумент17 страницASCII ValueKalpak DeОценок пока нет

- Fourier Series: A A A A X A A BДокумент10 страницFourier Series: A A A A X A A Bsmile0lifeОценок пока нет

- Case Study Day 14Документ7 страницCase Study Day 14Kalpak DeОценок пока нет

- Excelhonour - Com-Learning Material For DOEACC ITES WEP Training ProgramДокумент386 страницExcelhonour - Com-Learning Material For DOEACC ITES WEP Training ProgramWilson NgОценок пока нет

- Skills Development Through Distance EducationДокумент152 страницыSkills Development Through Distance EducationKalpak DeОценок пока нет

- Sample Paper - 2012 Class - X Subject - Mathematics: Topic - Coordinate GeometryДокумент2 страницыSample Paper - 2012 Class - X Subject - Mathematics: Topic - Coordinate GeometryKalpak DeОценок пока нет

- MB0041 Assignment Solved Feb2011Документ11 страницMB0041 Assignment Solved Feb2011Kalpak DeОценок пока нет

- CV - S P Dwibedi-T - Jul-Aug11Документ5 страницCV - S P Dwibedi-T - Jul-Aug11Kalpak DeОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- MB0044 (Set 1)Документ16 страницMB0044 (Set 1)Avinash GuptaОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- WBBSE VacancyДокумент2 страницыWBBSE VacancyKalpak DeОценок пока нет

- Manage Group of Hotels FinalДокумент33 страницыManage Group of Hotels FinalKalpak DeОценок пока нет

- Accounting 3Документ6 страницAccounting 3Princess Frean VillegasОценок пока нет

- Business Canvas for Metal Pipe ManufacturingДокумент3 страницыBusiness Canvas for Metal Pipe ManufacturingPrathmeshBhokariОценок пока нет

- Chapter 4 The Internal AssessmentДокумент17 страницChapter 4 The Internal AssessmentShe BayambanОценок пока нет

- Effects of Flipkart's advertising on BHU studentsДокумент27 страницEffects of Flipkart's advertising on BHU studentsTage Nobin81% (74)

- Public Relation NdeДокумент2 страницыPublic Relation NdeNarendra D EkboteОценок пока нет

- ABM Applied Economics Module 5 Evaluating The Viability and Impacts of Business On The CommunityДокумент112 страницABM Applied Economics Module 5 Evaluating The Viability and Impacts of Business On The Communitymara ellyn lacsonОценок пока нет

- Trắc Nghiệm English Tài Chính Doanh Nghiệp Chương 2Документ34 страницыTrắc Nghiệm English Tài Chính Doanh Nghiệp Chương 2Dương Viên NguyễnОценок пока нет

- Melanie S. Samsona Business Tax Chapter 7 ExercisesДокумент3 страницыMelanie S. Samsona Business Tax Chapter 7 ExercisesMelanie SamsonaОценок пока нет

- Section 2 - Microeconomics - Table of ContentsДокумент163 страницыSection 2 - Microeconomics - Table of ContentsKevin Velasco100% (1)

- The Interdependent Nature of BusinessДокумент7 страницThe Interdependent Nature of Businessdajiah greenОценок пока нет

- Introduction And: Entrepreneurial Finance Leach & MelicherДокумент33 страницыIntroduction And: Entrepreneurial Finance Leach & MelicherNadzirah Mohd SaidОценок пока нет

- ECN 104 Sample Problems CH 1-2Документ11 страницECN 104 Sample Problems CH 1-2y2k100Оценок пока нет

- Chapter 20 Corporate FinanceДокумент37 страницChapter 20 Corporate FinancediaОценок пока нет

- Steel and Scrap Swaps WebinarДокумент34 страницыSteel and Scrap Swaps Webinarinfo8493Оценок пока нет

- Barclays' Profits Were Higher Than Those of Lloyds TSB. F F T F F T TДокумент3 страницыBarclays' Profits Were Higher Than Those of Lloyds TSB. F F T F F T TWinda PutrianiОценок пока нет

- E-commerce-Assignment 01Документ4 страницыE-commerce-Assignment 01Abdul Rauf QureshiОценок пока нет

- Marketing, Finance & HR Project TitlesДокумент3 страницыMarketing, Finance & HR Project TitlesJadeja Satyajeetsinh100% (1)

- Introduction To The Wealth Added Index A New Performance Measurement and Strategic Planning PlatformДокумент0 страницIntroduction To The Wealth Added Index A New Performance Measurement and Strategic Planning PlatformDmitry PirshtukОценок пока нет

- Corporate Share Capital ExplainedДокумент16 страницCorporate Share Capital ExplainedPeter PiperОценок пока нет

- Webinar IPPC - Vendor SelectionДокумент27 страницWebinar IPPC - Vendor Selectionadhe.priyambodo8743Оценок пока нет

- MGT 368Документ4 страницыMGT 368Abid KhanОценок пока нет

- Design Process - BhavyaaДокумент47 страницDesign Process - Bhavyaasahay designОценок пока нет

- 61 - 2004 Winter-SpringДокумент25 страниц61 - 2004 Winter-Springc_mc2Оценок пока нет

- HRM Assignment SWOT AnalysesДокумент3 страницыHRM Assignment SWOT Analysesbint e zainabОценок пока нет

- Math in Finance MITДокумент22 страницыMath in Finance MITkkappaОценок пока нет

- Introduction to Indian Financial SystemДокумент14 страницIntroduction to Indian Financial SystemshrahumanОценок пока нет

- Te Impact of Modern Market To Traditional Traders - IJTRA 2014Документ7 страницTe Impact of Modern Market To Traditional Traders - IJTRA 2014Kartika DewiОценок пока нет

- Tutorial - Corporate Dividends - For StudentsДокумент3 страницыTutorial - Corporate Dividends - For StudentsBerwyn GazaliОценок пока нет

- Problem Market StructureДокумент3 страницыProblem Market StructureTonny NguyenОценок пока нет

- Bombay DyeingДокумент12 страницBombay Dyeing20ubaa114 20ubaa114Оценок пока нет