Академический Документы

Профессиональный Документы

Культура Документы

AT & T vs. CIR

Загружено:

rolandbcaspeИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

AT & T vs. CIR

Загружено:

rolandbcaspeАвторское право:

Доступные форматы

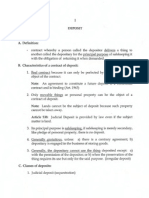

AT&T COMMUNICATIONS SERVICES PHILIPPINES, INC. versus COMMISSIONER OF INTERNAL REVENUE, G.R. No.

182364 August 3, 2010 FACTS: AT&T Communications Services Philippines, Inc. (petitioner) is a domestic corporation primarily engaged in the business of providing information, promotional, supportive and liaison services to foreign corporations .AT&T Global Communications Services, Inc. and Acer, Inc., an enterprise registered with the Philippine Economic Zone Authority (PEZA). Under Service Agreements forged by petitioner with the above-named corporations, remuneration is paid in U.S. Dollars and inwardly remitted in accordance with the rules and regulations of the Bangko Sentral ng Pilipinas Petitioner incurred input VAT when it generated and recorded zero-rated sales in connection with its Service Agreements in the peso equivalent of P56,898,744.05. Petitioner also incurred input VAT from purchases of capital goods and other taxable goods and services, and importation of capital goods. Despite the application of petitioners input VAT against its output VAT, an excess of unutilized input VAT in the amount of P2,050,736.69 remained. As petitioners unutilized input VAT could not be directly and exclusively attributed to either of its zero-rated sales or its domestic sales, an allocation of the input VAT was made which resulted in the amount of P1,801,826.82 as petitioners claim attributable to its zero-rated sales. Petitioner filed with the Commissioner of Internal Revenue (respondent) an application for tax refund and/or tax credit of its excess/unutilized input VAT from zero-rated sales CTA First Division, conceding that petitioners transactions fall under the classification of zero-rated sales, nevertheless denied petitioners claim for lack of substantiation, The CTA First Division, held that since petitioner is engaged in sale of services, VAT Official Receipts should have been presented in order to substantiate its claim of zero-rated sales, not VAT invoices which pertain to sale of goods or properties. The CTA En Banc, affirmed that of the CTA First Division. ISSUE: W/N petitioner is entitled to tax refund. HELD: Parenthetically, to determine the validity of petitioners claim as to unutilized input VAT, an invoice would suffice provided the requirements under Sections 113 and 237 of the Tax Code are met. Sales invoices are recognized commercial documents to facilitate trade or credit transactions. They are proofs that a business transaction has been concluded, hence, should not be considered bereft of probative value.1[9] Only the preponderance of evidence threshold as applied in ordinary civil cases is needed to substantiate a claim for tax refund proper.2[10]

IN FINE, the Court finds that petitioner has complied with the substantiation requirements to prove entitlement to refund/tax credit. The Court is not a trier of facts, however, hence the need to remand the case to the CTA for determination and computation of petitioners refund/tax credit.

Вам также может понравиться

- TVS Logistics-Building A Global Supply Chain - Group 7Документ8 страницTVS Logistics-Building A Global Supply Chain - Group 7Piyush Kumar Pattnayak100% (2)

- Chattel MortgageДокумент9 страницChattel MortgageAlpha BetaОценок пока нет

- Medardo Ag. Cadiente vs. Bithuel Macas G.R. No 161946 - November 14, 2008Документ2 страницыMedardo Ag. Cadiente vs. Bithuel Macas G.R. No 161946 - November 14, 2008Andrea GarciaОценок пока нет

- Cpra Canon IiiДокумент10 страницCpra Canon IiiJane BanaagОценок пока нет

- Commissioner of Internal Revenue Fireman'S Fund Insurance Company and The Court ofДокумент2 страницыCommissioner of Internal Revenue Fireman'S Fund Insurance Company and The Court ofjulyenfortunatoОценок пока нет

- Lopez Vs CaДокумент1 страницаLopez Vs CaChammyОценок пока нет

- Cir Vs CA, 203 Scra 72Документ11 страницCir Vs CA, 203 Scra 72Dario G. TorresОценок пока нет

- Pale CasesДокумент17 страницPale CasescathydavaoОценок пока нет

- CIR v. GonzalesДокумент2 страницыCIR v. Gonzaleskim_santos_20100% (1)

- Afisco Insurance Corp V CAДокумент2 страницыAfisco Insurance Corp V CADon TiansayОценок пока нет

- Gonzales v. CFIДокумент2 страницыGonzales v. CFIsdfoisaiofasОценок пока нет

- Testate Estate of Abada v. AbajaДокумент9 страницTestate Estate of Abada v. Abajajuju_batugalОценок пока нет

- Bacolod Vs CBДокумент2 страницыBacolod Vs CBAnonymous apYVFHnCYОценок пока нет

- Revilla Law IRRДокумент2 страницыRevilla Law IRRPaulОценок пока нет

- Omictin Vs Ca PDFДокумент17 страницOmictin Vs Ca PDFLarssen IbarraОценок пока нет

- 33 National Development Company vs. Golden Horizon Realty CorporationДокумент1 страница33 National Development Company vs. Golden Horizon Realty CorporationJemОценок пока нет

- Code of Professional Responsibility and Accountability-1Документ28 страницCode of Professional Responsibility and Accountability-1Nurol IzzahОценок пока нет

- de Castro vs. EcharriДокумент3 страницыde Castro vs. EcharriLance Christian ZoletaОценок пока нет

- Far East Bank Vs Pacilan JRДокумент2 страницыFar East Bank Vs Pacilan JRJeraldine Tatiana PiñarОценок пока нет

- Garcia-Rueda v. Pascasion TortsДокумент4 страницыGarcia-Rueda v. Pascasion TortsIrish GarciaОценок пока нет

- Final Scrimp Rob Lock A Pen A Clemente AДокумент5 страницFinal Scrimp Rob Lock A Pen A Clemente Aemen penaОценок пока нет

- TSN EstateДокумент19 страницTSN EstateGrace EnriquezОценок пока нет

- GREGORIO DE VERA V CA CASE DIGESTДокумент4 страницыGREGORIO DE VERA V CA CASE DIGESTKristanne Louise YuОценок пока нет

- 05 Mercantile Law Syllabus 2018Документ61 страница05 Mercantile Law Syllabus 2018Andrea Ivy DyОценок пока нет

- Agency - EДокумент25 страницAgency - EvalkyriorОценок пока нет

- Digest 3Документ2 страницыDigest 3Edmund Pulvera Valenzuela IIОценок пока нет

- PALE Digest 2Документ4 страницыPALE Digest 2Sarah TaliОценок пока нет

- AMA LAND, INC. v. WACK WACK RESIDENTS' ASSOCIATION, INC.Документ2 страницыAMA LAND, INC. v. WACK WACK RESIDENTS' ASSOCIATION, INC.Nina Riavel DEOMAMPOОценок пока нет

- FAY V WitteДокумент2 страницыFAY V WitteKeith Ivan Ong MeridoresОценок пока нет

- Emilio Vs CAДокумент3 страницыEmilio Vs CAMsIc GabrielОценок пока нет

- Sumifru (Philippines) Corporation, Petitioner, vs. Spouses Danilo Cereño and Cerina Cereño, Respondents. ResolutionДокумент30 страницSumifru (Philippines) Corporation, Petitioner, vs. Spouses Danilo Cereño and Cerina Cereño, Respondents. ResolutionJohn GenobiagonОценок пока нет

- 32 College of Oral & Dental Surgery V CTAДокумент2 страницы32 College of Oral & Dental Surgery V CTAReinier Jeffrey AbdonОценок пока нет

- 2 Remedial DigestedДокумент3 страницы2 Remedial DigestedShynnMiñozaОценок пока нет

- In Re PalagnasДокумент2 страницыIn Re Palagnasralliv jacОценок пока нет

- REVIEWER COL Week 2Документ3 страницыREVIEWER COL Week 2G FОценок пока нет

- Veronica Sanchez Vs CirДокумент3 страницыVeronica Sanchez Vs CirArthur John Garraton0% (1)

- Rio y Olabarrieta and MolinaДокумент2 страницыRio y Olabarrieta and MolinaGela Bea BarriosОценок пока нет

- Subic Telecom Vs SBMAДокумент2 страницыSubic Telecom Vs SBMACy PanganibanОценок пока нет

- Vda de Cabalu V Tabu DigestДокумент2 страницыVda de Cabalu V Tabu DigestChrissa MagatОценок пока нет

- Nieva and Alcala vs. Alcala and Deocampo.Документ9 страницNieva and Alcala vs. Alcala and Deocampo.Bion Henrik PrioloОценок пока нет

- 114-Collector of Internal Revenue vs. University of Visayas 1 Scra 669Документ12 страниц114-Collector of Internal Revenue vs. University of Visayas 1 Scra 669Jopan SJОценок пока нет

- Evidence - Chinabank Vs CAДокумент3 страницыEvidence - Chinabank Vs CADyannah Alexa Marie RamachoОценок пока нет

- 03 Jonathan Dee v. Harvest All, Et. Al.Документ2 страницы03 Jonathan Dee v. Harvest All, Et. Al.Le100% (1)

- Commissioner Vs Magsaysay LinesДокумент2 страницыCommissioner Vs Magsaysay LinesVerlynMayThereseCaroОценок пока нет

- (Property) 185 - Velasco V Manila Electric CoДокумент2 страницы(Property) 185 - Velasco V Manila Electric Cochan.aОценок пока нет

- Constantino vs. Heirs of ConstantinoДокумент3 страницыConstantino vs. Heirs of ConstantinoJesh RadazaОценок пока нет

- Given To Messrs. Kuenzle and Streiff."Документ2 страницыGiven To Messrs. Kuenzle and Streiff."Mickey RodentОценок пока нет

- Sales Final Codal PDFДокумент10 страницSales Final Codal PDFGen GrajoОценок пока нет

- Vda de PamanДокумент2 страницыVda de PamanChristian Rize NavasОценок пока нет

- 1 - Estate of K.H. Hemady vs. Luzon Surety Co.Документ6 страниц1 - Estate of K.H. Hemady vs. Luzon Surety Co.Radel LlagasОценок пока нет

- 21 Phil Charter Insurance V ChemoilДокумент2 страницы21 Phil Charter Insurance V Chemoilkmand_lustregОценок пока нет

- Collector vs. HaygoodДокумент5 страницCollector vs. HaygoodAJ AslaronaОценок пока нет

- 16 Macalinao V BpiДокумент7 страниц16 Macalinao V BpiBelle MaturanОценок пока нет

- LTD CasesДокумент13 страницLTD CasesRobinson AntonioОценок пока нет

- 12 James v. US (1961)Документ1 страница12 James v. US (1961)Marlene TongsonОценок пока нет

- TAXATION 1 Section 30 To 83 Explanatory NotesДокумент37 страницTAXATION 1 Section 30 To 83 Explanatory NotesyotatОценок пока нет

- Mof Company Shin YangДокумент4 страницыMof Company Shin YangNicki Vine CapuchinoОценок пока нет

- Meralco Vs YatcoДокумент4 страницыMeralco Vs YatcoArkhaye SalvatoreОценок пока нет

- Republic Vs SerranoДокумент2 страницыRepublic Vs SerranoArahbellsОценок пока нет

- RBSM vs. MB Case DigestДокумент2 страницыRBSM vs. MB Case DigestCaitlin KintanarОценок пока нет

- GR 183531Документ3 страницыGR 183531ChaОценок пока нет

- App Form Salary2013 FillДокумент3 страницыApp Form Salary2013 FillrolandbcaspeОценок пока нет

- PrintДокумент3 страницыPrintrolandbcaspeОценок пока нет

- Ess801x My1 enДокумент28 страницEss801x My1 enrolandbcaspeОценок пока нет

- Accomplishment ReportДокумент2 страницыAccomplishment Reportrolandbcaspe100% (1)

- 43735rmc No. 5-2009 - Annex CДокумент1 страница43735rmc No. 5-2009 - Annex CrolandbcaspeОценок пока нет

- What Is The Sickness BenefitДокумент6 страницWhat Is The Sickness BenefitrolandbcaspeОценок пока нет

- Sinag Fund Raising Sale For Medical Mission Of: Sta. Maria Della Strada ParishДокумент1 страницаSinag Fund Raising Sale For Medical Mission Of: Sta. Maria Della Strada ParishrolandbcaspeОценок пока нет

- Who Are Covered Under The SSSДокумент8 страницWho Are Covered Under The SSSrolandbcaspeОценок пока нет

- Maternity Notification Form2010Документ1 страницаMaternity Notification Form2010Amanda De Leon SartoОценок пока нет

- Prayer For Special Intentions To Blessed Pedro CalungsodДокумент1 страницаPrayer For Special Intentions To Blessed Pedro CalungsodrolandbcaspeОценок пока нет

- What Is The Maternity BenefitДокумент3 страницыWhat Is The Maternity BenefitrolandbcaspeОценок пока нет

- Mat2 FormДокумент2 страницыMat2 FormTirso Leo Adelante100% (1)

- Guidelines CPU AccreditationДокумент5 страницGuidelines CPU AccreditationrolandbcaspeОценок пока нет

- Bod Meeting 12042014Документ1 страницаBod Meeting 12042014rolandbcaspeОценок пока нет

- Syllabus Tax2Документ9 страницSyllabus Tax2rolandbcaspeОценок пока нет

- Mock Bar Examination Questions in Legal Ethics and Legal and Judicial FormsДокумент21 страницаMock Bar Examination Questions in Legal Ethics and Legal and Judicial FormsrolandbcaspeОценок пока нет

- Memo 1Документ5 страницMemo 1Ma Jean Baluyo CastanedaОценок пока нет

- Talusan vs. TayagДокумент11 страницTalusan vs. TayagrolandbcaspeОценок пока нет

- Preparing For Bar 2011Документ18 страницPreparing For Bar 2011Ma Pamela Corales CastilloОценок пока нет

- Petition Bar NewДокумент7 страницPetition Bar NewrolandbcaspeОценок пока нет

- Cases Atty SantosДокумент61 страницаCases Atty SantosrolandbcaspeОценок пока нет

- Civil LawДокумент14 страницCivil LawrolandbcaspeОценок пока нет

- Psycho CasesДокумент64 страницыPsycho CasesrolandbcaspeОценок пока нет

- Procurement Statement of WorkДокумент4 страницыProcurement Statement of WorkAryaan RevsОценок пока нет

- Industry Analysis of InsuranceДокумент48 страницIndustry Analysis of InsuranceDebojyotiSahoo100% (1)

- 2nd Annual Balik Scientist Program Convention 2Документ3 страницы2nd Annual Balik Scientist Program Convention 2kaiaceegeesОценок пока нет

- Comparative Analysis of Advantages and Disadvantages of The Modes of Entrying The International MarketДокумент9 страницComparative Analysis of Advantages and Disadvantages of The Modes of Entrying The International MarketTròn QuayyОценок пока нет

- Presentation On 2 Wheeler Segment in IndiaДокумент19 страницPresentation On 2 Wheeler Segment in IndiaMayank BangarОценок пока нет

- Prof. Labitag (Property)Документ49 страницProf. Labitag (Property)Chad Osorio50% (2)

- Jsis A 242 Feb 14 ExamДокумент4 страницыJsis A 242 Feb 14 Examapi-532751872Оценок пока нет

- HP Compaq - Case StudyДокумент8 страницHP Compaq - Case StudyRohit JainОценок пока нет

- Impact of Foreign Direct Investment On Indian EconomyДокумент8 страницImpact of Foreign Direct Investment On Indian Economysatyendra raiОценок пока нет

- Akrigg, Population and Economy in Classical Athens PDFДокумент286 страницAkrigg, Population and Economy in Classical Athens PDFJulian Gallego100% (3)

- Urban Renewal DelhiДокумент18 страницUrban Renewal DelhiaanchalОценок пока нет

- Advantages and Problems of PrivatisationДокумент4 страницыAdvantages and Problems of PrivatisationShahriar HasanОценок пока нет

- Budget and BudgetryДокумент6 страницBudget and Budgetryram sagar100% (1)

- Magana Jose Excel MasteryДокумент12 страницMagana Jose Excel Masteryapi-377101001Оценок пока нет

- NumericalReasoningTest2 SolutionsДокумент32 страницыNumericalReasoningTest2 SolutionsMuhammad Waseem100% (1)

- New Microsoft Word DocumentДокумент2 страницыNew Microsoft Word DocumentAnonymous e9EIwbUY9Оценок пока нет

- Theories of Demand For MoneyДокумент15 страницTheories of Demand For MoneykamilbismaОценок пока нет

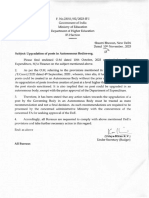

- Upgradation of Posts in Autonomous BodiesДокумент2 страницыUpgradation of Posts in Autonomous BodiesNaveen KumarОценок пока нет

- Swot ShanДокумент4 страницыSwot Shanq_burhan_a33% (3)

- Amartya Sen PPT FinДокумент28 страницAmartya Sen PPT FinTaher DahodwalaОценок пока нет

- Studi Kelayakan Bisnis Bengkel Bubut Cipta Teknik Mandiri (Studi Kasus Di Perumnas Tangerang Banten)Документ8 страницStudi Kelayakan Bisnis Bengkel Bubut Cipta Teknik Mandiri (Studi Kasus Di Perumnas Tangerang Banten)Billy AdityaОценок пока нет

- PDF Document 3Документ1 страницаPDF Document 3Bilby Jean ThomasОценок пока нет

- 669Документ1 страница669mundhrabharatОценок пока нет

- Philippine Bank vs. NLRC Case DigestДокумент1 страницаPhilippine Bank vs. NLRC Case Digestunbeatable38Оценок пока нет

- Roof India Exhibition 2019Документ6 страницRoof India Exhibition 2019Jyotsna PandeyОценок пока нет

- Pricing StrategyДокумент5 страницPricing StrategyShantonu RahmanОценок пока нет

- Ac Far Quiz8Документ4 страницыAc Far Quiz8Kristine Joy CutillarОценок пока нет

- CEV 420 Basic Environmental SciencesДокумент2 страницыCEV 420 Basic Environmental Sciencesbotakmbg6035Оценок пока нет

- Gann CyclesДокумент16 страницGann CyclesChandraKant Sharma33% (3)