Академический Документы

Профессиональный Документы

Культура Документы

Regal Entertainment Group First Quarter Report 2012

Загружено:

RiverheadLOCALИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Regal Entertainment Group First Quarter Report 2012

Загружено:

RiverheadLOCALАвторское право:

Доступные форматы

5/30/12

Regal Entertainment Group - Investor Relations - Press Release

PrintPage CloseWindow

PRESS RELEASE

RegalEntertainmentGroupReportsResultsforFiscalFirstQuarter2012andDeclaresQuarterlyDividend KNOXVILLE,Tenn.(BUSINESSWIRE)May.1,2012RegalEntertainmentGroup(NYSE:RGC),aleadingmotion pictureexhibitorowningandoperatingthelargesttheatrecircuitintheUnitedStates,todayannouncedfiscalfirst quarter2012results. TotalrevenuesforthefirstquarterendedMarch29,2012were$684.9millioncomparedtototalrevenuesof$570.9 millionforthefirstquarterendedMarch31,2011.Netincome(loss)attributabletocontrollinginterestwas$46.3 millioninthefirstquarterof2012comparedto$(23.6)millioninthefirstquarterof2011.Dilutedearnings(loss)per sharewas$0.30forthefirstquarterof2012comparedto$(0.15)forthefirstquarterof2011.Adjusteddiluted earnings(loss)pershare (1)was$0.30forthefirstquarterof2012comparedto$(0.04)forthefirstquarterof2011. AdjustedEBITDA (3)was$153.8millionforthefirstquarterof2012and$83.9millionforthefirstquarterof2011. ReconciliationsofnonGAAPfinancialmeasuresareprovidedinthefinancialschedulesaccompanyingthispress release. RegalsBoardofDirectorsalsotodaydeclaredacashdividendof$0.21perClassAandClassBcommonshare, payableonJune15,2012,tostockholdersofrecordonJune5,2012.TheCompanyintendstopayaregularquarterly dividendfortheforeseeablefutureatthediscretionoftheBoardofDirectorsdependingonavailablecash,anticipated cashneeds,overallfinancialcondition,loanagreementrestrictions,futureprospectsforearningsandcashflowsas wellasotherrelevantfactors. Wearepleasedthatastrongfilmslatecombinedwithourcontinuedfocusoncostcontrolallowedustoachieveour highesteverfirstquarterAdjustedEBITDAandourhighestAdjustedEBITDAmarginforanyquarterinoverseven years,statedAmyMiles,CEOofRegalEntertainmentGroup."Weareexcitedabouttheupcomingsummermovie seasonthatkicksoffwithMarvelsTheAvengersandremainoptimisticaboutthepotentialforboxofficesuccessfor theremainderof2012,continuedMiles. ForwardlookingStatements: Thispressreleaseincludes"forwardlookingstatements"withinthemeaningofSection27AoftheSecuritiesActof 1933,asamended,andSection21EoftheSecuritiesExchangeActof1934,asamended.Allstatementsincluded herein,otherthanstatementsofhistoricalfact,mayconstituteforwardlookingstatements.AlthoughtheCompany believesthattheexpectationsreflectedinsuchforwardlookingstatementsarereasonable,itcangivenoassurance thatsuchexpectationswillprovetobecorrect.Importantfactorsthatcouldcauseactualresultstodiffermaterially fromtheCompany'sexpectationsaredisclosedintheriskfactorscontainedintheCompany's2011AnnualReporton Form10KfiledwiththeSecuritiesandExchangeCommissiononFebruary27,2012.Allforwardlookingstatements areexpresslyqualifiedintheirentiretybysuchfactors. ConferenceCall: RegalEntertainmentGroupmanagementwillconductaconferencecalltodiscussfirstquarter2012resultsonMay1, 2012at4:30p.m.(EasternTime).InterestedpartiescanlistentothecallliveontheInternetthroughtheinvestor relationssectionoftheCompany'sWebsite:www.REGmovies.com,orbydialing8774070778(Domestic)and201 6898565(International).Pleasedialintothecallatleast510minutespriortothestartofthecallorgototheWeb siteatleast15minutespriortothecalltodownloadandinstallanynecessaryaudiosoftware.Whenprompted,ask fortheRegalEntertainmentGroupconferencecall.Areplayofthecallwillbeavailablebeginningapproximatelytwo hoursfollowingthecall.Thoseinterestedinlisteningtothereplayoftheconferencecallshoulddial8776606853 (Domestic)or2016127415(International)andenteraccount#286andconferencecallID#382610. AboutRegalEntertainmentGroup: RegalEntertainmentGroup(NYSE:RGC)isthelargestmotionpictureexhibitorintheUnitedStates.TheCompany's theatrecircuit,comprisingRegalCinemas,UnitedArtistsTheatresandEdwardsTheatres,operates6,587screensin 523locationsin37statesandtheDistrictofColumbia.Regaloperatestheatresin43ofthetop50U.S.designated marketareas.Webelievethatthesize,reachandqualityoftheCompany'stheatrecircuitnotonlyprovideitspatrons withaconvenientandenjoyablemoviegoingexperience,butisalsoanexceptionalplatformtorealizeeconomiesof scaleintheatreoperations. AdditionalinformationisavailableontheCompany'sWebsiteatwww.REGmovies.com. RegalEntertainmentGroup ConsolidatedStatementsofIncome(Loss)Information FortheFiscalQuartersEnded3/29/12and3/31/11

investor.regmovies.com/phoenix.zhtml?c=222211&p=irol-newsArticle_print&ID=1689895&highlight= 1/4

5/30/12

Regal Entertainment Group - Investor Relations - Press Release

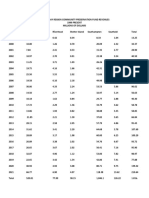

(inmillions,exceptpersharedata) (unaudited) QuarterEnded March March 29, 31, 2012 2011 Revenues Admissions Concessions Otheroperatingrevenues Totalrevenues Operatingexpenses Filmrentalandadvertisingcosts Costofconcessions Rentexpense Otheroperatingexpenses Generalandadministrativeexpenses(includingsharebasedcompensationof$2.3millionand $1.9millionforthequartersendedMarch29,2012andMarch31,2011,respectively) Depreciationandamortization Netlossondisposalandimpairmentofoperatingassets Incomefromoperations Interestexpense,net EarningsrecognizedfromNCM Lossonextinguishmentofdebt Other,net Income(loss)beforeincometaxes Provisionfor(benefitfrom)incometaxes Netincome(loss) Noncontrollinginterest,netoftax Netincome(loss)attributabletocontrollinginterest Dilutedearnings(loss)pershare Adjusteddilutedearnings(loss)pershare (1) Weightedaveragenumberofdilutedsharesoutstanding(2) ConsolidatedSummaryBalanceSheetInformation (dollarsinmillions) (unaudited) Asof March29,2012 Cashandcashequivalents Totalassets Totaldebt TotalstockholdersdeficitofRegalEntertainmentGroup $ 316.2 2,307.0 2,010.1 (550.9) OperatingData (unaudited) QuarterEnded March29,2012 March31,2011 Theatresatperiodend Screensatperiodend Averagescreenspertheatre Attendance(inthousands) 523 6,587 12.6 53,721 535 6,670 12.5 46,266

2/4

$ 474.1 180.0 30.8 684.9

$394.4 151.3 25.2 570.9

236.8 23.7 94.1 176.8 15.8 46.9 90.8 36.0 (13.8) (2.9) 71.5 25.2 46.3 $ 46.3 $ $ 0.30 0.30 154.8

196.2 20.5 93.7 175.3 16.8 52.0 6.7 9.7 39.0 (13.6) 21.9 0.4 (38.0) (14.3) (23.7) 0.1 $ (23.6) $ (0.15) $ (0.04) 153.6

Asof Dec.29,2011 $ 253.0 2,341.3 2,016.3 (570.9)

investor.regmovies.com/phoenix.zhtml?c=222211&p=irol-newsArticle_print&ID=1689895&highlight=

5/30/12

Regal Entertainment Group - Investor Relations - Press Release

Averageticketprice Averageconcessionsperpatron

$ $

8.83 3.35

$ $

8.52 3.27

ReconciliationofEBITDAtoNetCashProvidedbyOperatingActivities (dollarsinmillions) (unaudited) QuarterEnded March29,2012 March31,2011 EBITDA Interestexpense,net (Provisionfor)benefitfromincometaxes Deferredincometaxes Changesinoperatingassetsandliabilities Lossonextinguishmentofdebt Otheritems,net Netcashprovidedbyoperatingactivities $ 154.4 (36.0) (25.2) 7.7 11.7 4.9 117.5 $ 53.1 (39.0) 14.3 (12.9) (9.5) 21.9 14.3 42.2 ReconciliationofEBITDAtoAdjustedEBITDA (dollarsinmillions) (unaudited) QuarterEnded March29,2012 March31,2011 EBITDA Netlossondisposalandimpairmentofoperatingassets Sharebasedcompensationexpense Lossonextinguishmentofdebt Noncontrollinginterest,netoftaxandother,net AdjustedEBITDA (3) $ 154.4 2.3 (2.9) 153.8 $ 53.1 6.7 1.9 21.9 0.3 83.9 ReconciliationofNetCashProvidedbyOperatingActivitiestoFreeCashFlow (dollarsinmillions) (unaudited) QuarterEnded March29,2012 March31,2011 Netcashprovidedbyoperatingactivities $ 117.5 $ 42.2 Capitalexpenditures (10.9) (21.0) Proceedsfromassetsales 0.1 1.4 Freecashflow(3) $ 106.7 $ 22.6 ReconciliationofNetIncome(Loss)AttributabletoControllingInteresttoAdjusted DilutedEarnings(Loss)PerShare (dollarsinmillions,exceptpersharedata) (unaudited) QuarterEnded March March 29, 31, 2012 2011 $ 46.3 $(23.6) 13.6

3/4

Netincome(loss)attributabletocontrollinginterest Lossonextinguishmentofdebt,netofrelatedtaxeffects

investor.regmovies.com/phoenix.zhtml?c=222211&p=irol-newsArticle_print&ID=1689895&highlight=

5/30/12

Regal Entertainment Group - Investor Relations - Press Release

Netlossondisposalandimpairmentofoperating assets,netofrelatedtaxeffects Netincome(loss)attributabletocontrollinginterest,excludinglossonextinguishmentofdebt,net ofrelatedtaxeffects,andnetlossondisposalandimpairmentofoperatingassets,netofrelated taxeffects Weightedaveragenumberofdilutedsharesoutstanding(2) Adjusteddilutedearnings(loss)pershare (1) Dilutedearnings(loss)pershare

4.1

$ 46.3 154.8 $ 0.30 $ 0.30

$ (5.9) 153.6 $(0.04) $(0.15)

(1) Wehaveincludedadjusteddilutedearnings(loss)pershare,whichisdilutedearnings(loss)pershareexcluding lossonextinguishmentofdebt,netofrelatedtaxeffects,andnetlossondisposalandimpairmentofoperating assets,netofrelatedtaxeffects,becausewebelieveitprovidesinvestorswithausefulindustrycomparative andisafinancialmeasureusedbymanagementtoassesstheperformanceofourCompany. (2) Representsreportedweightedaveragenumberofdilutedsharesoutstandingforpurposesofcomputingdiluted earnings(loss)pershareandadjusteddilutedearnings(loss)pershareforthequartersendedMarch29,2012 andMarch31,2011.SincetheCompanyreportedanetlossattributabletocontrollinginterestof$23.6million andanetlossattributabletocontrollinginterest,excludinglossonextinguishmentofdebt,netofrelatedtax effectsandnetlossondisposalandimpairmentofoperatingassets,netofrelatedtaxeffectsof$5.9millionfor thequarterendedMarch31,2011,nocommonstockequivalentswereincludedastheeffectwouldhavebeen antidilutive. (3) AdjustedEBITDA(earningsbeforeinterest,taxes,depreciationandamortizationexpense,netlossondisposal andimpairmentofoperatingassets,sharebasedcompensationexpense,lossonextinguishmentofdebt,and noncontrollinginterest,netoftaxandother,net)wasapproximately$153.8millionforthequarterendedMarch 29,2012.WebelieveEBITDA,AdjustedEBITDAandFreeCashFlowprovideusefulmeasuresofcashflowsfrom operationsforourinvestorsbecauseEBITDA,AdjustedEBITDAandFreeCashFlowareindustrycomparative measuresofcashflowsgeneratedbyouroperationsandbecausetheyarefinancialmeasuresusedby managementtoassesstheliquidityofourCompany.EBITDA,AdjustedEBITDAandFreeCashFlowarenot measurementsofliquidityunderU.S.generallyacceptedaccountingprinciplesandshouldnotbeconsideredin isolationorconstruedasasubstituteforotheroperationsdataorcashflowdatapreparedinaccordancewith U.S.generallyacceptedaccountingprinciplesforpurposesofanalyzingourliquidity.Inaddition,notallfunds depictedbyEBITDA,AdjustedEBITDAandFreeCashFlowareavailableformanagement'sdiscretionaryuse. Forexample,aportionofsuchfundsaresubjecttocontractualrestrictionsandfunctionalrequirementstopay debtservice,fundnecessarycapitalexpendituresandmeetothercommitmentsfromtimetotimeasdescribed inmoredetailintheCompanys2011AnnualReportonForm10KfiledwiththeSecuritiesandExchange CommissiononFebruary27,2012.EBITDA,AdjustedEBITDAandFreeCashFlow,ascalculated,maynotbe comparabletosimilarlytitledmeasuresreportedbyothercompanies.

Source:RegalEntertainmentGroup FinancialContact: KevinMead RegalEntertainmentGroup VicePresidentInvestorRelationsandPlanning Kevin.Mead@regalcinemas.com 8659259685 or MediaContact: DickWesterling RegalEntertainmentGroup SeniorVicePresidentMarketing 8659259539

investor.regmovies.com/phoenix.zhtml?c=222211&p=irol-newsArticle_print&ID=1689895&highlight=

4/4

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

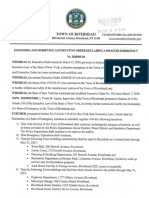

- Draft Scope Riverhead Logistics CenterДокумент20 страницDraft Scope Riverhead Logistics CenterRiverheadLOCALОценок пока нет

- N.Y. Downtown Revitalization Initiative Round Five GuidebookДокумент38 страницN.Y. Downtown Revitalization Initiative Round Five GuidebookRiverheadLOCALОценок пока нет

- Riverhead Town Proposed Battery Energy Storage CodeДокумент10 страницRiverhead Town Proposed Battery Energy Storage CodeRiverheadLOCALОценок пока нет

- RXR/GGV Qualified & Eligible Documents (Final 09.26.22)Документ23 страницыRXR/GGV Qualified & Eligible Documents (Final 09.26.22)RiverheadLOCALОценок пока нет

- Riverhead Budget Presentation March 22, 2022Документ14 страницRiverhead Budget Presentation March 22, 2022RiverheadLOCALОценок пока нет

- Riverhead Town Board Comprehensive Plan Status Discussion Feb. 17, 2022Документ30 страницRiverhead Town Board Comprehensive Plan Status Discussion Feb. 17, 2022RiverheadLOCALОценок пока нет

- AKRF Public Outreach Report AttachmentsДокумент126 страницAKRF Public Outreach Report AttachmentsRiverheadLOCALОценок пока нет

- League of Women Voters of NYS 2021 Voters Guide: Ballot PropositionsДокумент2 страницыLeague of Women Voters of NYS 2021 Voters Guide: Ballot PropositionsRiverheadLOCAL67% (3)

- 2022 - 03 - 16 - EPCAL Resolution & Letter AgreementДокумент9 страниц2022 - 03 - 16 - EPCAL Resolution & Letter AgreementRiverheadLOCALОценок пока нет

- Peconic Bay Region Community Preservation Fund Revenues 1999-2021Документ1 страницаPeconic Bay Region Community Preservation Fund Revenues 1999-2021RiverheadLOCALОценок пока нет

- Yvette AguiarДокумент10 страницYvette AguiarRiverheadLOCALОценок пока нет

- Kenneth RothwellДокумент5 страницKenneth RothwellRiverheadLOCALОценок пока нет

- Catherine KentДокумент7 страницCatherine KentRiverheadLOCALОценок пока нет

- Juan Micieli-MartinezДокумент3 страницыJuan Micieli-MartinezRiverheadLOCALОценок пока нет

- Robert E. KernДокумент3 страницыRobert E. KernRiverheadLOCALОценок пока нет

- 2021 General Election - Suffolk County Sample Ballot BookletДокумент154 страницы2021 General Election - Suffolk County Sample Ballot BookletRiverheadLOCALОценок пока нет

- Evelyn Hobson-Womack Campaign Finance DisclosureДокумент3 страницыEvelyn Hobson-Womack Campaign Finance DisclosureRiverheadLOCALОценок пока нет

- Riverhead Town Police Report, August 2021Документ6 страницRiverhead Town Police Report, August 2021RiverheadLOCALОценок пока нет

- "The Case of The DIsappering Landfill, or To Mine or Not To Mine" by Carl E. Fritz JR., PEДокумент10 страниц"The Case of The DIsappering Landfill, or To Mine or Not To Mine" by Carl E. Fritz JR., PERiverheadLOCALОценок пока нет

- Riverhead Town Police Monthly Report July 2021Документ6 страницRiverhead Town Police Monthly Report July 2021RiverheadLOCALОценок пока нет

- Town of Riverhead Draft Solid Waste Management PlanДокумент73 страницыTown of Riverhead Draft Solid Waste Management PlanRiverheadLOCALОценок пока нет

- Town of Southampton Police Reform PlanДокумент308 страницTown of Southampton Police Reform PlanRiverheadLOCALОценок пока нет

- Turtles of New York StateДокумент2 страницыTurtles of New York StateRiverheadLOCALОценок пока нет

- Aguiar-Kent Campaign Finance Report 32-Day Pre GeneralДокумент2 страницыAguiar-Kent Campaign Finance Report 32-Day Pre GeneralRiverheadLOCALОценок пока нет

- Old Steeple Church Time CapsuleДокумент4 страницыOld Steeple Church Time CapsuleRiverheadLOCALОценок пока нет

- Riverhead Police Reform Plan - FinalДокумент96 страницRiverhead Police Reform Plan - FinalRiverheadLOCALОценок пока нет

- 2021-2022 Proposed Budget SummaryДокумент2 страницы2021-2022 Proposed Budget SummaryRiverheadLOCALОценок пока нет

- Riverhead Town State of Emergency Order Issued May 12, 2021Документ3 страницыRiverhead Town State of Emergency Order Issued May 12, 2021RiverheadLOCAL100% (1)

- Riverhead Town Marijuana SurveyДокумент44 страницыRiverhead Town Marijuana SurveyRiverheadLOCALОценок пока нет

- Town of Riverhead Railroad Street TOD RedevelopmentДокумент54 страницыTown of Riverhead Railroad Street TOD RedevelopmentRiverheadLOCALОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Financial StatementsДокумент4 страницыFinancial StatementsConrad DuncanОценок пока нет

- Lecture 1Документ7 страницLecture 1Hodan RОценок пока нет

- GARP Code of ConductДокумент3 страницыGARP Code of ConductDhaval KondhiyaОценок пока нет

- Indian Money Market and Capital MarketДокумент17 страницIndian Money Market and Capital MarketMerakizz100% (1)

- CH 08Документ43 страницыCH 08LilyОценок пока нет

- FRM SwapsДокумент64 страницыFRM Swapsakhilyerawar7013Оценок пока нет

- Payables - Sample ProblemsДокумент2 страницыPayables - Sample ProblemsPanda ErarОценок пока нет

- Finance Case StudiesДокумент12 страницFinance Case StudiesWasp_007_007Оценок пока нет

- How To Get All The Money You Need To Buy PropertyДокумент83 страницыHow To Get All The Money You Need To Buy PropertyKora Sadler100% (2)

- Abridged Prospectus RECДокумент46 страницAbridged Prospectus RECGp MishraОценок пока нет

- Mitesh Patel - The Angry Young Man of Options TradingДокумент18 страницMitesh Patel - The Angry Young Man of Options Tradingbarkha rani100% (1)

- How To Trade Synthetic IndicesДокумент25 страницHow To Trade Synthetic IndicesKatleho Moloto100% (3)

- Ginnys Restaurant Case StudyДокумент4 страницыGinnys Restaurant Case Studynandyth100% (2)

- Ifrs 9Документ32 страницыIfrs 9AmberImtiazОценок пока нет

- Case Analysis of Investment Banking at Thomas Weisel PartnersДокумент2 страницыCase Analysis of Investment Banking at Thomas Weisel PartnersabhinavОценок пока нет

- Trading Course DetailsДокумент7 страницTrading Course DetailskinjalinОценок пока нет

- Vsa Basics PDFДокумент31 страницаVsa Basics PDFdiogonbig100% (1)

- SecuritisationДокумент74 страницыSecuritisationrohitpatil699Оценок пока нет

- (2012) Currency Derivatives and The Disconnection Between Exchange Rate Volatility and International TradeДокумент28 страниц(2012) Currency Derivatives and The Disconnection Between Exchange Rate Volatility and International TradeEmre GulsenОценок пока нет

- Online Trading ProposalДокумент14 страницOnline Trading ProposalAlex CurtoisОценок пока нет

- 4 - صناديق الاستثمار الإسلامية - نموذج مجلةДокумент42 страницы4 - صناديق الاستثمار الإسلامية - نموذج مجلةElabdallaoui AbdelghafourОценок пока нет

- How To Trade The ABCD PatternДокумент8 страницHow To Trade The ABCD PatternUtkarshОценок пока нет

- Chap 015Документ21 страницаChap 015Zaid Osama AldwekОценок пока нет

- Performance of Selected Life Insurance Companies - Comparative AnalysisДокумент7 страницPerformance of Selected Life Insurance Companies - Comparative AnalysisAnwar AdemОценок пока нет

- 5293 17017 1 PBДокумент11 страниц5293 17017 1 PBeferemОценок пока нет

- Understanding Income StatementsДокумент39 страницUnderstanding Income StatementsMarsh100% (1)

- 401K EnrollmentДокумент18 страниц401K EnrollmentKimberly HadadОценок пока нет

- Research Analysis Report VinamilkДокумент20 страницResearch Analysis Report VinamilkNga LêОценок пока нет

- DFL - Student - XLSX - Google Trang TínhДокумент1 страницаDFL - Student - XLSX - Google Trang TínhThư Nguyễn Huỳnh AnhОценок пока нет

- Bahan Ajar KonsolidasiДокумент13 страницBahan Ajar KonsolidasiZachra MeirizaОценок пока нет