Академический Документы

Профессиональный Документы

Культура Документы

DPS 02 Risk

Загружено:

melissa_danaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

DPS 02 Risk

Загружено:

melissa_danaАвторское право:

Доступные форматы

Dr Pepper Snapple Risk Analysis Dr Pepper Snapple has few risks to their financial results that are not

shared by competitors. In their 10-K filing that is part of their 2011 Annual Report, DPS offers a list of all possible risk factors that affect their business. Some of them are serious, some are of concern, and most are necessary to list but of low concern. Examples of low concern risks over which DPS has little control and pertain to the entire industry include disruptions to our information systems and third-party service providers weather and climate changes recession, financial and credit market disruptions and other economic conditions (DPSG 2011 Annual Report for the Web, p ii)

Examples of moderate risk about which DPS has individual risk that is in some way controllable by the company include maintaining our relationships with our large retail customers maintaining our relationships with our allied brand owners substantial disruption at our manufacturing or distribution facilities (DPSG 2011 Annual Report for the Web, p ii)

Some discussion of these moderate risks is appropriate. Large retail customers have significant power in the soft drink space who may take action against one or all of the competitors in the space. While relationships need to be carefully managed these large retailers have the capacity but not the present willingness to demand significant cuts in price. Buyers like Walmart typically provide stability to the market. Allied brand owners can terminate their agreements with DPS. Their share of DPS sales is presently not significant; however, they do participate in the non-

carbonated side of the market where sales are growing. DPS does concentrate the majority of the bottling work it does at one plant in St. Louis. The instances of disaster due to severe weather events are rare, but DPS backs up its production bottling capacity within its partner network bottling and distribution systems.

Examples of serious risk which must be considered and managed include changes in consumer preferences, trends and health concerns increases in the cost of commodities used in our business (DPSG 2011 Annual Report for the Web, p ii) Consumer preferences can and do change. Over the past two decades as per capita soft drink consumption has dropped 16%, soda makers have moved away from carbonated to noncarbonated drinks (Strom) A look at the PepsiCo web site shows that they have extensive lines of ready-to-drink beverages through a deal with Lipton, and they have also added brands like Aquafina, SoBe, Gatorade, and Tropicana. PepsiCo also has a wide array of non-beverage products. Coca Cola has a similar effort to diversify. The source of change in consumer preferences is concern about the health effects of sugared beverages on obesity and related illnesses. Popular news sources like CNN run stories linking sugary soft drinks to obesity on a weekly basis. (Hellerman) Most of this coverage focuses on full calorie soft drinks like Coke and Pepsi and to a lesser extent Dr Pepper. DPS has made similar moves away from a reliance on carbonated beverages with their merger with Snapple, and also with the purchases of Motts and Clamato, among others. The DPS moves into this market are called inadequate by an otherwise positive analyst at Morningstar.

We don't believe that many of the company's noncarbonated brands (including Snapple, Mott's and Hawaiian Punch) are as strong as the company's core Dr Pepper franchise. The volume changes experienced by these noncarbonated tend to be more volatile than the company's soft drinks and their penetration levels on grocer shelves is noticeably lower than the company's Dr Pepper, 7UP, and Sunkist brands. (Mullarkey) Soft drink companies, analysts, and special interest groups do not know how big the risk will be of changing consumer preferences because of health care concerns. The question is, Are we seeing a modest, multiyear decline that will bottom out? Or are we seeing the beginning of a paradigm shift away from carbonated soft drinks? said John Sicher, publisher of Beverage Digest. (Strom) This is the next stage of where battle lines being drawn, said Dr. Harold Goldstein, executive director of the California Center for Public Health Advocacy. (Strom) the countrys largest soda companies insist their carbonated soft drinks business will still grow, if not at as fast a clip as it has historically. This is not a zero-sum game, said Sandy Douglas, president of Coca Cola North America. (Strom) Interested observers of DPS and the entire soft drink industry will want to see how Dr Pepper Snapple manages the risk associated with their core product.

The second risk is more present in the near term. It is that costs for commodities used in the production of DPS products may increase substantially. In fact, these costs already have increased. Between 2010 and 2011, DPS revenue grew from $5.6B to $5.9B, or a rate of 4.74%. Cost of Goods Sold (excluding Depreciation and Amortization) grew from $2.15B to $2.37B, a growth rate of 10.23%. Simply put, as revenues increased by 5%, COGS increased by 10%. (Marketwatch) This issue was addressed in a February 15, 2012 Earnings Call for Q4 2011 featuring Martin Ellen, the Chief Financial Officer of Dr Pepper Snapple. The increase in commodity ingredient costs was glossed over four times by President and CEO Larry Young before Mr. Ellen directly

addressed it. Remember that his comments are for the results of only one quarter. Clearly DPS is concerned about increased component costs. As I did last quarter, before I cover corporate and other financial items, I'd like to briefly outline the impact that both cost inflation and volatility in certain commodity prices had on our gross margins for the quarter. Higher input costs increased cost of goods sold by approximately $50 million, reducing gross margin by 360 basis points year-over-year. This higher inflation also required us to record a $5 million LIFO inventory provision, as compared to a $3 million provision in the prior year. We also recorded $7 million of unrealized mark-to-market losses on commodity hedges in cost of goods, driven by reductions in certain commodity prices at the end of the quarter. This compares to a $3 million unrealized mark-to-market gain last year. (Seeking Alpha) DPS takes the issue seriously enough that the CEO mentions input costs four times before the CFO opens his remarks it. Missing is a real and lasting way to manage commodity price risk in the future. Mr. Ellen did say how they managed it in part during the past quarter. Positive pricing was the principal factor that allowed us to somewhat offset these headwinds and limit the gross margin decline to about 200 basis points. (Seeking Alpha)

Positive pricing? That is a price increase, and prices cannot increase indefinitely, and DPS does not enjoy the same economies of scale that its larger competitors have as a buyer. For purposes of comparison, look at the ratio of Cost of Goods Sold as a percent of Revenue for each the previous four quarters of Coke and Dr Pepper Snapple.

Q1 2011 DPS KO 40% 35%

Q2 2011 41% 35%

Q3 2011 39% 35%

Q4 2011 41% 35% Source: Marketwatch

As a percentage component of revenue, COGS was substantially lower for Coke than for Dr Pepper Snapple. It is not obvious from these numbers if the advantage comes from higher

pricing or lower costs; the answer may include some of each. It is clear that DPS suffers from a disadvantages related to economies of scale, and that disadvantage escalates when input prices rise. In the question and answer section of the Q4 2011 Earnings Call DPS forecast COGS input cost inflation to be at 2% or 3% for the full year of 2012. (Seeking Alpha) This is a significant improvement over the 2011 growth or inflation rate of COGS of approximately 10% but the analysts will be watching this forecast closely inasmuch as it impacts profitability and competitiveness.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Case Study 2 NutraSweetДокумент5 страницCase Study 2 NutraSweetRyan Kay50% (2)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Chapter 19 Test BankДокумент100 страницChapter 19 Test BankBrandon LeeОценок пока нет

- JPM Bitcoin ReportДокумент86 страницJPM Bitcoin ReportknwongabОценок пока нет

- Ch02 PRДокумент17 страницCh02 PRpks009Оценок пока нет

- Digital Marketing Strategy For New Product Launch - Russell MarketingДокумент8 страницDigital Marketing Strategy For New Product Launch - Russell MarketingRussell MarketingОценок пока нет

- Elliott Waves - Fibonacci Application Click-By-Click - Forex Indicators GuideДокумент1 страницаElliott Waves - Fibonacci Application Click-By-Click - Forex Indicators GuideAgape Cahaya100% (1)

- Company Analysis and Valuation Project PDFДокумент19 страницCompany Analysis and Valuation Project PDFAugusto LopezОценок пока нет

- The Transactions Listed Below Are Typical of Those Involving SouthernДокумент1 страницаThe Transactions Listed Below Are Typical of Those Involving SouthernTaimour HassanОценок пока нет

- Starbucks: Delivering Customer ServiceДокумент13 страницStarbucks: Delivering Customer ServiceMOHD SAHIL ZAIDIОценок пока нет

- South-Tek Systems Appoints Jens Bolleyer As CEOДокумент3 страницыSouth-Tek Systems Appoints Jens Bolleyer As CEOPR.comОценок пока нет

- Baydoun Willett (2000) Islamic Corporate Reports PDFДокумент20 страницBaydoun Willett (2000) Islamic Corporate Reports PDFAqilahAzmiОценок пока нет

- Behavioral Finance and Technical AnalysisДокумент28 страницBehavioral Finance and Technical AnalysisochirubaraОценок пока нет

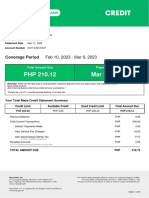

- MayaCredit SoA 2023MARДокумент2 страницыMayaCredit SoA 2023MARJan SaysonОценок пока нет

- Avon Products Inc - 2009Документ22 страницыAvon Products Inc - 2009Charisse L. SarateОценок пока нет

- Financial Reporting Week 4Документ9 страницFinancial Reporting Week 4islam hamdyОценок пока нет

- SCM TableДокумент5 страницSCM TableRed VelvetОценок пока нет

- Dse 05Документ3 страницыDse 05SharifMahmudОценок пока нет

- Chapter 29 ReviewДокумент18 страницChapter 29 ReviewTata NozadzeОценок пока нет

- Abid ResumeДокумент3 страницыAbid ResumeMohd Abid RazaОценок пока нет

- Costco Case Study and Strategic Analysis PDFДокумент11 страницCostco Case Study and Strategic Analysis PDFMaryam KhushbakhatОценок пока нет

- 1846635969Документ85 страниц1846635969Riadh RidhaОценок пока нет

- ConvergEx Traders Guide 2014 Q2 PDFДокумент166 страницConvergEx Traders Guide 2014 Q2 PDFthisthat7Оценок пока нет

- Arora's Cash Store - Business - PlanДокумент27 страницArora's Cash Store - Business - PlanmasroorОценок пока нет

- Marketing Reserach Paper II English VersionДокумент132 страницыMarketing Reserach Paper II English VersionMayukh.Оценок пока нет

- Qualities of A Successful Marketing ExecutiveДокумент2 страницыQualities of A Successful Marketing Executivesumith1990Оценок пока нет

- Aerari ProfileДокумент7 страницAerari ProfilemobinjabbarОценок пока нет

- Difference Between Sales and MarketingДокумент24 страницыDifference Between Sales and MarketingCYBER VILLA INTERNET CAFEОценок пока нет

- Competition Issues in India Mobile Handset IndustryДокумент96 страницCompetition Issues in India Mobile Handset Industryakshay shindeОценок пока нет

- Resource Allocation and Strategy Maritan2017Документ10 страницResource Allocation and Strategy Maritan2017crystalia diamondaОценок пока нет

- Vanguard VEAДокумент114 страницVanguard VEARaka AryawanОценок пока нет