Академический Документы

Профессиональный Документы

Культура Документы

Problems (p.112) : Derek Abbott WK 2 Homework

Загружено:

Derek AbbottИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Problems (p.112) : Derek Abbott WK 2 Homework

Загружено:

Derek AbbottАвторское право:

Доступные форматы

Derek Abbott Wk 2 Homework

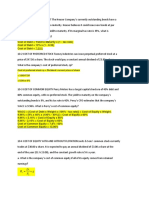

Problems (p.112) (3-1) Days Sales Outstanding Greene Sisters has a DSO of 20 days. The companys average daily sales are $20,000. What is the level of its accounts receivable? Assume there are 365 days in a year. Day Sales Outstanding = Receivables / Average Sales Per Day AR = 20 X $20,000 = $400,000 (3-2) Debt Ratio Vigo Vacations has an equity multiplier of 2.5. The companys assets are financed with some combination of long-term debt and common equity. What is the companys debt ratio? The equity multiplier is 2.5. For every dollar of equity the company has $2.5 of assets Equity Multiplier = 2.5 Equity Ratio = 1/EM Equity Ratio = 1/2.5 = 0.40 Debt Ratio + Equity Ratio = 1 Debt Ratio = 1 - Equity Ratio = 1 - 0.40 = 0.60 or 60% (3-3) Market/Book Ratio Winston Washerss stock price is $75 per share. Winston has $10 billion in total assets. Its balance sheet shows $1 billion in current liabilities, $3 billion in long-term debt, and $6 billion in common equity. It has 800 million shares of common stock outstanding. What is Winstons market/book ratio? Market value per share = $75 Common equity = 6,000,000 Number of shares outstanding = 800 million shares Market-to-book ratio = market value per share/(common equity/number of shares outstanding) Market-to-book ratio = $75/(6,000,000/800,000,000) Market-to-book ratio = $75/7.5 Market-to-book ratio = 10

Derek Abbott Wk 2 Homework

(3-4) Price/Earnings Ratio A company has an EPS of $1.50, a cash flow per share of $3.00, and a price/cash flow ratio of 8.0. What is its P/E ratio? Price /cash flow ratio = Price per share / cash flow per share Price per share = $8 x $3 = $24 P.E = Price per share / EPS P.E = $24 / 1.5 = 16 (3-5) ROE Needham Pharmaceuticals has a profit margin of 3% and an equity multiplier of 2.0. Its sales are $100 million and it has total assets of $50 million. What is its ROE? Profit Margin (PM) = Net Income (NI) / Sales 3 = NI /$100M NI = PM x 100 (3 x 100) = $300M Equity Multiplier (EM) = Total Assets (TA) / Common Equity (CE) 2.0 = $50M / CE CE = $50M / 2.0 = 25 Return on Common Equity (ROE) = ROA (NI / TA) x EM (TA / CE) ROE = (300/50) x (50/25) = 6 x 2 ROE = 12% (3-6) Du Pont Analysis Donaldson & Son has an ROA of 10%, a 2% profit margin, and a return on equity equal to 15%. What is the companys total assets turnover? What is the firms equity multiplier? ROA = Profit Margin x Total Asset turnover 10 = 2 x Total asset turnover Total Asset turnover = ROA / Profit margin = 10/2 Total Asset turnover = 5 ROE = ROA x Equity Multiplier 15 = 10 x Equity multiplier Equity multiplier = ROE / ROA = 15 /10 Equity multiplier = 1.5 (3-7)

Derek Abbott Wk 2 Homework

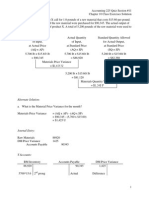

Current and Quick Ratios Ace Industries has current assets equal to $3 million. The companys current ratio is 1.5, and its quick ratio is 1.0. What is the firms level of current liabilities? What is the firms level of inventories? Current ratio = Current asset / Current liabilities 1.5 = $3M / Current liabilities Current liabilities = current assets / current ratio = $3M / 1.5 Current liabilities = $2M Quick ratio = (Current assets Inventories) / current liabilities 1 = $3M - Inventories / $2M Inventory = $3M - $2M = $1M [Quick ratio = ($3M - $1M = $2M) / $2M = 1] Problems (pp. 165-167) 4-1 FV of Single Amount If you deposit $10,000 in a bank account that pays 10% interest annually, how much will be in your account after 5 years? Formula from Excel FVn=PV (1+I) n where FV = Future value PV = investment I = interest rate N = period $10,000 (1.10) 5 = $16,105.10 FV = $16,105.10. 4-2 PV of Single Amount What is the present value of a security that will pay $5,000 in 20 years if securities of equal risk pay 7% annually? Formula from Excel PVn = FV/(1+I)n PV = $5,000/(1.07)20 = $1292.095 PV = $1,292.10. 4-6 FV of Ordinary Annuity What is the future value of a 7%, 5-year ordinary annuity that pays $300 each year? If this were an annuity due, what would its future value be? Formula from Excel FV = (0.07,5,300)= 1,725.221 Solution: FVA5 = $1,725.22 Formula from Excel FV = (.07,5,300,0,1) = 1,845.987 FVA5 Due = $1,845.99 4-13a PV of an Annuity

Derek Abbott Wk 2 Homework

Find the present value of the following ordinary annuities (see the Notes to Problem 4-12). a) $400 per year for 10 years at 10% Formula from Excel =PV(.1,10,400) $2,457.83 4-14 PV Uneven Cash Flow Stream Find the present values of the following cash flow streams. The appropriate interest rate is 8%. (Hint: It is fairly easy to work this problem dealing with the individual cash flows. However, if you have a financial calculator, read the section of the manual that describes how to enter cash flows such as the ones in this problem. This will take a little time, but the investment will pay huge dividends throughout the course. Note that, when working with the calculators cash flow register, you must enter CF0 = 0. Note also that it is quite easy to work the problem with Excel, using procedures described in the Chapter 4 Tool Kit.) Year 1 2 3 4 5 Cash Stream A $100 400 400 400 300 Cash Stream B $300 400 400 400 100

Cash Stream A Formula from Excel =NPV (.08, {100,400,400,400,300}) $1,251.25 Cash Stream B Formula from Excel = NPV (.08, {300,400,400,400,100}) $1,300.32 b. What is the value of each cash flow stream at a 0% interest rate? Cash Stream A Formula from Excel =NPV (.00, {100,400,400,400,300}) Solution: $1,600.00 Cash Stream B Formula from Excel = NPV (.00, {300,400,400,400,100}) Solution: $1,600.00

Вам также может понравиться

- Stock Split EPS CalculationДокумент10 страницStock Split EPS CalculationPd100% (1)

- Exercise Stock ValuationДокумент2 страницыExercise Stock ValuationUmair ShekhaniОценок пока нет

- Ch12 P11 Build A ModelДокумент7 страницCh12 P11 Build A ModelRayudu RamisettiОценок пока нет

- CH 07Документ33 страницыCH 07Nguyen Thanh Tung (K15 HL)Оценок пока нет

- Financial Management - Stock Valuation Assignment 2 - Abdullah Bin Amir - Section AДокумент3 страницыFinancial Management - Stock Valuation Assignment 2 - Abdullah Bin Amir - Section AAbdullah AmirОценок пока нет

- ANSWER: 4.375% or 4.38%: Stock Expected Return Standard Deviation BetaДокумент2 страницыANSWER: 4.375% or 4.38%: Stock Expected Return Standard Deviation BetaMicon100% (2)

- BFIN525 - Chapter 9 ProblemsДокумент6 страницBFIN525 - Chapter 9 Problemsmohamad yazbeckОценок пока нет

- Selected Solutions Chap 6 8Документ49 страницSelected Solutions Chap 6 8Arham SheikhОценок пока нет

- Relaxing Credit Standards Regency Rug Repair Company Is Trying To Decide Whether It Should Relax Its Credit StandardsДокумент3 страницыRelaxing Credit Standards Regency Rug Repair Company Is Trying To Decide Whether It Should Relax Its Credit StandardsBlair Bass0% (1)

- Bond After-Tax Yield CalculatorДокумент7 страницBond After-Tax Yield CalculatorJohnОценок пока нет

- Finance Chapter No 2Документ20 страницFinance Chapter No 2UzairОценок пока нет

- Managerial Accounting FoundationsДокумент49 страницManagerial Accounting FoundationsSyed Atiq TurabiОценок пока нет

- Consolidated statement of financial position for Hever group incorporating associateДокумент2 страницыConsolidated statement of financial position for Hever group incorporating associateGueagen1969Оценок пока нет

- ExerciseДокумент3 страницыExerciseHoang AnОценок пока нет

- Assignment 2Документ3 страницыAssignment 2Lili GuloОценок пока нет

- 18Документ4 страницы18Aditya Wisnu P100% (1)

- Quiz 3 Version BДокумент2 страницыQuiz 3 Version BMishal KhalidОценок пока нет

- ChapterДокумент7 страницChapterAhmed Ezzat AliОценок пока нет

- AssignДокумент18 страницAssignRalph Adrian MielОценок пока нет

- Role of Financial Management in OrganizationДокумент8 страницRole of Financial Management in OrganizationTasbeha SalehjeeОценок пока нет

- Assignment Chapter 9Документ4 страницыAssignment Chapter 9Anis Trisna PutriОценок пока нет

- Calculating Stock Value Using Constant Growth ModelДокумент2 страницыCalculating Stock Value Using Constant Growth Modelmahnoor javaidОценок пока нет

- Accounting Chapter 10 Solutions GuideДокумент56 страницAccounting Chapter 10 Solutions GuidemeaningbehindclosedОценок пока нет

- Financial Management - AssignmentДокумент1 страницаFinancial Management - AssignmentGeralf Jade Mojana100% (1)

- 3rd Sem Finance True and False PDFДокумент14 страниц3rd Sem Finance True and False PDFMausam GhimireОценок пока нет

- Liquidity Management Bauman Company's Total Assets, Total Current Liabilities, and Inventory For Each ofДокумент3 страницыLiquidity Management Bauman Company's Total Assets, Total Current Liabilities, and Inventory For Each ofEddie Mar JagunapОценок пока нет

- End Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying AbilityДокумент4 страницыEnd Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying Abilityawaischeema100% (1)

- 03B) Chapter 3 Questions - BrighamДокумент7 страниц03B) Chapter 3 Questions - BrighamMohammad Ather100% (1)

- Chapter 3 - Chapter 3: Financial Forecasting and PlanningДокумент35 страницChapter 3 - Chapter 3: Financial Forecasting and PlanningAhmad Ridhuwan AbdullahОценок пока нет

- AFN Forecasting - Practice QuestionsДокумент1 страницаAFN Forecasting - Practice QuestionsMuhammad Ali Samar100% (3)

- Chapter 17 Standard Costing Setting Standards and Analyzing VariancesДокумент23 страницыChapter 17 Standard Costing Setting Standards and Analyzing VariancesHashir AliОценок пока нет

- FIN 301 B Porter Rachna CH 11-1 Soln.Документ1 страницаFIN 301 B Porter Rachna CH 11-1 Soln.Nam TranОценок пока нет

- Bond Valuation - Practice QuestionsДокумент3 страницыBond Valuation - Practice QuestionsMuhammad Mansoor100% (3)

- Dysfunctional Behavior in AccountingДокумент4 страницыDysfunctional Behavior in AccountingHans Jonni100% (2)

- Accounting Ratio For CHP 4Документ5 страницAccounting Ratio For CHP 4HtetThinzarОценок пока нет

- ch08 SolДокумент18 страницch08 SolJohn Nigz Payee50% (2)

- The EwertДокумент2 страницыThe EwertAsif Nasseir100% (1)

- AssignmentДокумент7 страницAssignmentMona VimlaОценок пока нет

- Quantative Assignment and ExerciseДокумент4 страницыQuantative Assignment and ExerciseHassanОценок пока нет

- Bonus Assignment 1Документ4 страницыBonus Assignment 1Zain Zulfiqar100% (2)

- Finance Chapter 9 Questions and SolutionsДокумент28 страницFinance Chapter 9 Questions and SolutionsAliAltaf67% (3)

- QS11 - Class Exercises SolutionДокумент8 страницQS11 - Class Exercises Solutionlyk0tex100% (2)

- Capital Budgeting ExampleДокумент12 страницCapital Budgeting Exampleljohnson10950% (4)

- Chapter 12Документ167 страницChapter 12Ibnu RizalОценок пока нет

- Importance of liquidity for financial statement usersДокумент15 страницImportance of liquidity for financial statement usersSharmila Devi100% (1)

- BF2 AssignmentДокумент3 страницыBF2 AssignmentIbaad KhanОценок пока нет

- Solutions Manual For Financial Statement Analysis 11th Chap 3Документ52 страницыSolutions Manual For Financial Statement Analysis 11th Chap 3HompimpaОценок пока нет

- FCFF and FcfeДокумент23 страницыFCFF and FcfeSaurav VidyarthiОценок пока нет

- Comparing Projects with Unequal Lives Using Replacement Chain Method and Equivalent Annual AnnuityДокумент3 страницыComparing Projects with Unequal Lives Using Replacement Chain Method and Equivalent Annual AnnuitydzazeenОценок пока нет

- Chapter 11, Modern Advanced Accounting-Review Q & ExrДокумент12 страницChapter 11, Modern Advanced Accounting-Review Q & Exrrlg481467% (3)

- Model Chapter 12 - ThipДокумент14 страницModel Chapter 12 - ThipThipparatM60% (5)

- Chapter 17, Modern Advanced Accounting-Review Q & ExrДокумент23 страницыChapter 17, Modern Advanced Accounting-Review Q & Exrrlg481475% (4)

- Prospective AnalysisДокумент3 страницыProspective Analysischarlie simo100% (1)

- Solution: Wacc 0.98% 1.00% 7.50% 9.48%Документ22 страницыSolution: Wacc 0.98% 1.00% 7.50% 9.48%Narmeen KhanОценок пока нет

- IAS 16 (CAF5 S18) : (I) (Ii) (Iii) - Rs. in MillionДокумент41 страницаIAS 16 (CAF5 S18) : (I) (Ii) (Iii) - Rs. in MillionShameel IrshadОценок пока нет

- Exercise 8-26 Cost Classification: RequirementДокумент153 страницыExercise 8-26 Cost Classification: RequirementIkram100% (1)

- Chap 11 - Equity Analysis and ValuationДокумент26 страницChap 11 - Equity Analysis and ValuationWindyee TanОценок пока нет

- Pindi Yulinar Rosita - 008201905023 - Assignment 3Документ3 страницыPindi Yulinar Rosita - 008201905023 - Assignment 3Pindi YulinarОценок пока нет

- FM Math 1Документ17 страницFM Math 1Md Shahrier Jaman AyonОценок пока нет

- Cost of Capital Questions AnsweredДокумент7 страницCost of Capital Questions Answeredsmoky 22Оценок пока нет

- 19 07 31 DCDC Cred HandbookДокумент24 страницы19 07 31 DCDC Cred HandbookJAIME CHAVEZОценок пока нет

- EarthWear Materiality Mini-CaseДокумент9 страницEarthWear Materiality Mini-CaseZoe MoranОценок пока нет

- Module 1 Overview of Management Consultancy Services by CPAsДокумент4 страницыModule 1 Overview of Management Consultancy Services by CPAscha11Оценок пока нет

- MBP Case StudiesДокумент12 страницMBP Case StudiesKamalika SamantaОценок пока нет

- MHTP 2Документ2 страницыMHTP 2Nabeel MohammadОценок пока нет

- Muhammad Tughlaq's Token CurrencyДокумент3 страницыMuhammad Tughlaq's Token CurrencyAnjanaОценок пока нет

- 6th Edition PBDs - Infrastructure Projects With Bid Forms - 29OCT2020 PDFДокумент53 страницы6th Edition PBDs - Infrastructure Projects With Bid Forms - 29OCT2020 PDFRojen PadasasОценок пока нет

- Case Analysis - Charlotte Beers at Ogilvy and Mather WorldwideДокумент6 страницCase Analysis - Charlotte Beers at Ogilvy and Mather WorldwideNaheed Khan100% (2)

- Catalyst BrochureДокумент20 страницCatalyst Brochuredaraj darajОценок пока нет

- Bike Sale Letter FormatДокумент1 страницаBike Sale Letter Formattheking7865543Оценок пока нет

- Lift Equipment Inspection ReportsДокумент3 страницыLift Equipment Inspection ReportsRanjithОценок пока нет

- CMT Reading ListДокумент8 страницCMT Reading ListftbearОценок пока нет

- Bab Vii BalandcorcardДокумент17 страницBab Vii BalandcorcardCela Lutfiana100% (1)

- Module 1 - FINANCIAL MGT 2Документ16 страницModule 1 - FINANCIAL MGT 2Dan Ryan100% (1)

- 2021 Ana Future Programmatic ReportДокумент29 страниц2021 Ana Future Programmatic ReportSunil KumarОценок пока нет

- Here are the answers to the multiple choice questions:1. a2. a 3. b4. c5. b6. a7. b8. a9. c 10. c11. a12. a13. c14. b15. c16. c17. a18. dДокумент5 страницHere are the answers to the multiple choice questions:1. a2. a 3. b4. c5. b6. a7. b8. a9. c 10. c11. a12. a13. c14. b15. c16. c17. a18. dElias TesfayeОценок пока нет

- DepEd Nueva Vizcaya SRI payrollДокумент4 страницыDepEd Nueva Vizcaya SRI payrollChester BoliquenОценок пока нет

- Tuvsud ISO 19443 Webinar SlidesДокумент27 страницTuvsud ISO 19443 Webinar Slides오덕환Oh DuckhwanОценок пока нет

- R12.1 Oracle Bills of Material and Engineering Fundamentals: D59871GC10 Edition 1.0 September 2009 D60906Документ170 страницR12.1 Oracle Bills of Material and Engineering Fundamentals: D59871GC10 Edition 1.0 September 2009 D60906Abang Jaya WardhanaОценок пока нет

- Airline Passenger Data AnalysisДокумент9 страницAirline Passenger Data AnalysisAdeel ManafОценок пока нет

- CASE #19 Consolacion P. Chavez, Et - Al. Vs Maybank Philippines, Inc. G.R. No. 242852, July 29, 2019 FactsДокумент1 страницаCASE #19 Consolacion P. Chavez, Et - Al. Vs Maybank Philippines, Inc. G.R. No. 242852, July 29, 2019 FactsHarlene HemorОценок пока нет

- List of Courses PolyДокумент108 страницList of Courses PolyAdeniran GraceОценок пока нет

- Zara SWOT and StrategiesДокумент8 страницZara SWOT and StrategiesAntarleena Sikdar100% (4)

- Stakeholder Engagement Plan SEP GAMBIA FISCAL MANAGEMENT DEVELOPMENT PROJECT P166695Документ103 страницыStakeholder Engagement Plan SEP GAMBIA FISCAL MANAGEMENT DEVELOPMENT PROJECT P166695Ali ZilbermanОценок пока нет

- NORTHILLS COLLEGE OF ASIA SM ReportДокумент6 страницNORTHILLS COLLEGE OF ASIA SM ReportherbertalmaidAОценок пока нет

- Proforma Invoice for Biotech Analyzer ExportДокумент1 страницаProforma Invoice for Biotech Analyzer ExportJosé Carlos López LuqueОценок пока нет

- PTCL invoice details for January 2021 chargesДокумент1 страницаPTCL invoice details for January 2021 chargesNafees KhalidОценок пока нет

- AUDIT ACT, 2048 (1991) : Act No. 16 of 1991 An Act To Provide For Audit PreambleДокумент5 страницAUDIT ACT, 2048 (1991) : Act No. 16 of 1991 An Act To Provide For Audit PreambleDeep JoshiОценок пока нет

- BitGo Sales Deck December 2018 PDFДокумент28 страницBitGo Sales Deck December 2018 PDFTest IngОценок пока нет

- 8 Hrs Mandatory SeminarДокумент49 страниц8 Hrs Mandatory SeminarMarlon Bernardo100% (2)