Академический Документы

Профессиональный Документы

Культура Документы

Market Environment Analysis and Overview of Brazil

Загружено:

Jenny LeeИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Market Environment Analysis and Overview of Brazil

Загружено:

Jenny LeeАвторское право:

Доступные форматы

GlobeBill--Internet Payment Solutions for Credit and Debit Card Processing

Market Environment Analysis and Overview of Brazil

Part One

Foreign Trade

While the banking industry, like most others, is better off since the Real Plan went into effect than before, the short-term benefits are not as great. This is because banks tend to do better in periods of high inflation than they do under stable economy. For banks, high inflation generated income from "float" and also large spreads on money market operations. Banks became averse to lending during high inflation, especially as the better commercial risks moved to reduce leverage and stopped borrowing. Stabilization has brought considerable down-sizing, and banks resumed lending as one way to develop new income sources. Payment gateways are finding alternatives to income generated from float, including higher interest rates, higher volumes, and service charges. Some problems still occur as more than 70% of the Brazilians don't have a bank account - a remain from high inflation days when saving wasn't profitable. Another remain of the old days is the fact, that the main competitors for the banks are the stores, giving credit to the consumer with lower interest rates. Classification of financial Institutions by Activity The state or interstate development banks are regional financial institutions controlled by respective state governments, which grant medium or long term loans for fixed or working capital, according to the economic and social needs of the region of which they operate. The principal and activities of these entities are the on lending of loans and providing of loans for the financing of rural and industrial development schemes. Federal and state saving banks are financial institutions which undertake almost the same types as the commercial banks. They accept savings from individuals, by means of deposit in current accounts, and make loans. Commercial banks - They engage in both wholesale and retail banking and are the main source of short- and medium-term loans. In addition to making loans, they provide other financial services, such as accepting deposits, paying checks, issuing letters of credit, dealing in foreign exchange, cash management services, investment banking services and investment management.

GlobeBill-http://www.globebill.com

GlobeBill--Internet Payment Solutions for Credit and Debit Card Processing

Investments banks- They specialize in medium- and long-term loans finance for the supply of capital and the investment of third party funds. Credit, finance and investments companies - They specialize in credit opening operations by acceptance of bills of exchange to finance purchases of goods and services by consumers or by final users. They include subsidiaries of large manufacturing or retail companies. Financiers charge higher rates than commercial banks. Securities dealership and brokers - They function as the securities dealers of the Brazilian financial conglomerates. Through the distribuidora, the other financial institutions in the group sell their financial paper to the market. International Banks The participation in Brazil's banking sector is presently frozen at levels set 40 years ago, but there is a tendency to liberalize the possibilities of foreign participation. Several foreign banks hold minority ownership positions in local banks. A few foreign banks also have local subsidiaries or branches. As examples Credit Commercial France-Brazil, ABN Amor Bank, Bank of Boston and Citibank have subsidiaries in Brazil. In addition many foreign banks have chosen to have representative offices, in the main business areas. For example Merit Bank has a representative office in S Paulo. o Representative offices can make foreign currency loans to Brazilian banks but according to Brazilian law they cannot pursue any banking activities other than putting potential Brazilian borrowers in touch with the foreign parent bank and act as a local representative. Financing Projects In order to obtain financing for projects, guarantees are needed because the cash flow usually isn't sufficient and additional guarantees are needed to hedge the country risk. Some possible sources of financing may include the following. Commercial Banks Finnish commercial banks as well as foreign banks offer for example services including Letter of credit confirmations, bank to bank guarantees, and other short- and medium-term trade finance services with a select number of Brazilian banks. On March 26 1997 the Central Bank of Brazil imposed provisions on import, regulating that only risks with maturities of a minimum 361 days or clear cash on delivery financing is approved when importing to Brazil. These provisions can, however, be seen as a considerable trade barrier, and thus not consistent with the GATT rules. Finnish Export Credit

GlobeBill-http://www.globebill.com

GlobeBill--Internet Payment Solutions for Credit and Debit Card Processing

Finnish Export Credit had loans to Central and Latin America of up to USD 50 million in 1996. The financing was mainly focused on Brazil, Chile and Mexico. Because of the positive development of these countries new projects are going to be launched especially in the area of telecommunication, wood industry and energy.

GlobeBill-http://www.globebill.com

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- ACUITE RATINGS AND RESEARCH - PowerPoint PresentatonДокумент28 страницACUITE RATINGS AND RESEARCH - PowerPoint Presentatonmpk srihariОценок пока нет

- Universal Standards On Social Performance ManagementДокумент21 страницаUniversal Standards On Social Performance ManagementTherese MarieОценок пока нет

- BFF5916 2016 S2 AssignmentДокумент10 страницBFF5916 2016 S2 AssignmentMr PlayerОценок пока нет

- HES Solutions OverviewДокумент22 страницыHES Solutions OverviewDushyant KashyapОценок пока нет

- Important Reports 2012-13Документ14 страницImportant Reports 2012-13Pavan VasanthamОценок пока нет

- D.1 UM vs. BSPДокумент1 страницаD.1 UM vs. BSPNLainie OmarОценок пока нет

- Customer Service PolicyДокумент26 страницCustomer Service PolicyThol Lyna100% (1)

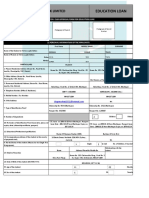

- Sbi Education Loan FormДокумент4 страницыSbi Education Loan FormHarish MishraОценок пока нет

- Social Lending SchemeДокумент23 страницыSocial Lending SchemesvmkishoreОценок пока нет

- Deposit Collection and Loan Disbursement Procedures OF Pubali Bank LimitedДокумент48 страницDeposit Collection and Loan Disbursement Procedures OF Pubali Bank LimitedMehedi HasanОценок пока нет

- Loan Management System For HESFBДокумент42 страницыLoan Management System For HESFBMohamed Ahmed AbdiОценок пока нет

- 1 T1TOL - Overview - R10.1Документ55 страниц1 T1TOL - Overview - R10.1Tanaka Machana100% (1)

- Borrowing CostsДокумент17 страницBorrowing CostsJatin SunejaОценок пока нет

- Rural BankДокумент17 страницRural BankMarieleОценок пока нет

- A Study On Consumer Awareness and Adoption of Green Banking PractisesДокумент67 страницA Study On Consumer Awareness and Adoption of Green Banking PractisesArdra SabuОценок пока нет

- CHAPTER 1 - General Provisions On Contracts (Arts. 1305-1317)Документ14 страницCHAPTER 1 - General Provisions On Contracts (Arts. 1305-1317)Mike GallegoОценок пока нет

- This Study Resource Was: Determine The Following 1. Deductible Interest Expense For The Year P129,500.00Документ8 страницThis Study Resource Was: Determine The Following 1. Deductible Interest Expense For The Year P129,500.00Kin LeeОценок пока нет

- Talking Art LLC - Operating-Agreement - LastДокумент13 страницTalking Art LLC - Operating-Agreement - LastValerio SpinaciОценок пока нет

- Advanced Accounting Accounting Standards Suggested Answers PDFДокумент58 страницAdvanced Accounting Accounting Standards Suggested Answers PDFanupОценок пока нет

- Plaint For Recovery of MoneyДокумент4 страницыPlaint For Recovery of MoneyGautam JhaОценок пока нет

- LL Line of CreditДокумент20 страницLL Line of Creditamir mahmudОценок пока нет

- Intac Reviewer 2Документ10 страницIntac Reviewer 2rochelle lagmayОценок пока нет

- Original Contract To Convert To Word DocumentДокумент34 страницыOriginal Contract To Convert To Word DocumentEdgar JemsОценок пока нет

- United States Court of Appeals, Fifth CircuitДокумент6 страницUnited States Court of Appeals, Fifth CircuitScribd Government DocsОценок пока нет

- Personal Loan AgreementДокумент1 страницаPersonal Loan AgreementLoraine Corpuz100% (2)

- Real Estate Market Outlook Spain 2018Документ44 страницыReal Estate Market Outlook Spain 2018alejandroОценок пока нет

- UBL Bannu Branch, Internship ReportДокумент88 страницUBL Bannu Branch, Internship ReportadnanirshadОценок пока нет

- Approval in PrincipalДокумент2 страницыApproval in PrincipalYang LiuОценок пока нет

- Vehicle Loan ProjectДокумент99 страницVehicle Loan ProjectAnkit Vardhan68% (37)

- MBF13e Chap08 Pbms - FinalДокумент25 страницMBF13e Chap08 Pbms - FinalBrandon Steven Miranda100% (4)