Академический Документы

Профессиональный Документы

Культура Документы

Decleration

Загружено:

montezuma777Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Decleration

Загружено:

montezuma777Авторское право:

Доступные форматы

Name of the Company Employee Name Employee PAN ID No.

NeilMed Devices Pvt Ltd Paritosh Karthick AVGPK1418B Emp# 63

I hereby declare that the following investments will be made by me during the period 1st April 2012 to 31st March 2013 Details of the Dependents Name of the Dependent

Relation

Age

House Rent

I am staying in a rented house and I agree to submit rent receipts or agreement with the land lord when required. If yes, House Rent per month paid Rs. _______________ x _____(months) 9,000 X 12 months Yes No Y

Amount

1,08,000 15,000

Medical Allownce

If I do not produce the bills to the extent of my eligiblity (maximum Rs.15000/- p.a) to the co., by 10th Feb 2013, then the company can consider the amount paid towards medical towards medical reimbursement for income tax purposes and deduct tax I agree Yes

Deduction under Chapter VI A

1. Sec 80 D - Medical Insurance Premium - Rs15000 for self and family, Rs.15000/- for dependent parents Rs. 20000/- if the dependent parents are senior citizens 2. Sec 80DD - Medical treatment / insurance of handicapped dependent - Rs.50000/Severe disability ( disability which is more than 80%) Rs 1,00,000/3. Sec 80DDB - Medical treatment (specified diseases only) Rs. 40,000/For senior citizen Rs 60,000/4. Sec 80E - Repayment of laon taken for Higher Education - Interest only - No limit 5. Sec 80G - Deduction in respect of donations to certain funds, charitable inst. Etc Donations above Rs.10000/- in cash will not be eligible for exemption. 6. Sec 80U - Self Handicapped Rs. 50,000/-, Severe disablility Rs 1,00,000/-.

Deductions under Section 80C

1. Life Insurance Premium /Pension Plan 2. Investment in Tax exempted Fixed Deposit for 5 years with a Scheduled Bank 3. Deposit in Public Provident Fund 4. Deposit in Post Office Savings scheme / NSC/ NSS 5. Interest on NSC Reinvested (upto 5th completed year only) 6. Investment in ULIP of UTI / LIC 7. Housing loan repayment - PRINCIPAL 8. Tution Fees towards Children's education 9. ELSS - Investment in Infrastructure bonds / Mutual Funds 10. Others (please specify) Pertol Bills Total Investment(Max Rs.100000/- .only)

26,400

Yes No

PREVIOUS EMPLOYMENT SALARY

Salary earned from 1st April 2012 till date of joining the company ( Tax computation Sheet at the time of Full and Final Settlement 0r From 16 to be attached)

INCOME OTHER THAN SALARY INCOME

I earn income from sources other than my salary If yes, Form 12C detailing other income is attached Yes Yes No No

DEDUCTION UNDER SECTION 24- HOUSING LOAN

Interest on Housing Loan - if self occupied then limited to Rs. 150,000/- amount Interest on Housing Loan - if let out then no limit NOTE: Form 12C along with the calculation of loss on house property needs to be attached for considering the above, please also specify the Pre-EMI interest paid during the previous years for consideration under loss from house property 1. I hereby declare that the information given above is correct and true in all respects. 2. I also undertake to indemnify the company for any loss / liability that may arise in the event of the above information being incorrect.

Date: Place:

16-Apr-12 Bangalore

Signature of the employee

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Fort Bonifacio vs. CIRДокумент3 страницыFort Bonifacio vs. CIRDNAAОценок пока нет

- Introduction to GST Chapter 1: Constitutional Framework and Defects in Indirect TaxesДокумент5 страницIntroduction to GST Chapter 1: Constitutional Framework and Defects in Indirect TaxesAniket SharmaОценок пока нет

- Untitled Form (Responses)Документ1 страницаUntitled Form (Responses)Sufiyan KhanОценок пока нет

- Philippine Power & Development Co. franchise tax caseДокумент16 страницPhilippine Power & Development Co. franchise tax caseLou StellarОценок пока нет

- Commissioner of Internal Revenue vs. Mcgeorge Food Industries, IncДокумент1 страницаCommissioner of Internal Revenue vs. Mcgeorge Food Industries, IncRaquel DoqueniaОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент4 страницыStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSandeep Pramanik0% (1)

- Washing Machine InvoiceДокумент1 страницаWashing Machine Invoices.thrinadhraoОценок пока нет

- Contract of EngagementДокумент14 страницContract of EngagementAbhilash PaulОценок пока нет

- Nova Pulse Ivf Clinic PVT LTDДокумент2 страницыNova Pulse Ivf Clinic PVT LTDHarinathОценок пока нет

- Commercial InvoiceДокумент4 страницыCommercial InvoiceEric Luna0% (1)

- Tax QuizДокумент48 страницTax QuizJaneОценок пока нет

- June 2017 Payment Summary and Loan DetailsДокумент3 страницыJune 2017 Payment Summary and Loan DetailsAlinaОценок пока нет

- Flexible Benefit Plan For LTTS FTCДокумент1 страницаFlexible Benefit Plan For LTTS FTCDavidОценок пока нет

- Transaction Dispute FormДокумент1 страницаTransaction Dispute FormKvvPrasadОценок пока нет

- Invoice - Zoya Ali Traders LLC 2023-02-02Документ2 страницыInvoice - Zoya Ali Traders LLC 2023-02-02Bahar AliОценок пока нет

- Payment Slip 2020200001570099Документ1 страницаPayment Slip 2020200001570099Sam MacОценок пока нет

- Statement of Account: South Bangla Agriculture & Commerce Bank LTDДокумент1 страницаStatement of Account: South Bangla Agriculture & Commerce Bank LTDjhohan freestyleОценок пока нет

- Credit Card Fraud Modus OperandiДокумент32 страницыCredit Card Fraud Modus OperandiRESHMI J URK19ISD011Оценок пока нет

- Solution - Exercise Chapter 7 - ACC117Документ3 страницыSolution - Exercise Chapter 7 - ACC117nurhidayah sadonОценок пока нет

- American Express Gold CardДокумент6 страницAmerican Express Gold CardashwaracingОценок пока нет

- Offer LetterДокумент2 страницыOffer LetterRICKSON KAWINAОценок пока нет

- Details RequireДокумент2 страницыDetails RequireVadim KuzinОценок пока нет

- Publication 54 - IRSДокумент44 страницыPublication 54 - IRSabraham.caaОценок пока нет

- Bustax Final ExamДокумент13 страницBustax Final Examshudaye100% (3)

- CIR v. MarubeniДокумент31 страницаCIR v. Marubenimceline19Оценок пока нет

- Ratio Analysis of WALMART INCДокумент5 страницRatio Analysis of WALMART INCBrian Ng'enoОценок пока нет

- IFRS-Deferred Tax Balance Sheet ApproachДокумент8 страницIFRS-Deferred Tax Balance Sheet ApproachJitendra JawalekarОценок пока нет

- Chandra Jayasir I P A Domestic Gampaha 05-09-083 GMA1037 071 537 Gonigahalanda Watta, Ranweli Place, GampahaДокумент1 страницаChandra Jayasir I P A Domestic Gampaha 05-09-083 GMA1037 071 537 Gonigahalanda Watta, Ranweli Place, Gampahasasanka123asiri123Оценок пока нет

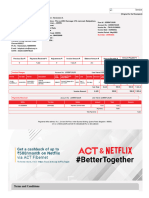

- Act Internet InvoiceДокумент2 страницыAct Internet InvoiceSaravanan GuruОценок пока нет

- Overview:: Plot Size Full Price 10% Down PaymentДокумент3 страницыOverview:: Plot Size Full Price 10% Down PaymentKhair Ur RehmanОценок пока нет