Академический Документы

Профессиональный Документы

Культура Документы

Causes of Depreciation

Загружено:

Madhan PrasathИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Causes of Depreciation

Загружено:

Madhan PrasathАвторское право:

Доступные форматы

causes of depreciation

The main causes of depreciation may be divided into two categories, namely:

1. 2.

Internal Cause and External Causes

Internal Causes:

Depreciation which occurs for certain inherent normal causes, is known as internal depreciation. The main causes of internal depreciation are:

Wear and Tear:

Some assets physically deteriorate due to wear and tear in use. More and more use of an asset, the greater would be the wear and tear. Physical deterioration of an asset is caused from movement, strain, friction, erasion etc. An obvious example of this is motor car which rapidly wears out. Other assets like this are building, plant, machinery, furniture, etc. The wear and tear is general but primary cause of depreciation.

Depletion:

Some assets declines in value proportionate to the quantum of production, e.g. mine, quarry etc. With the raising of coal from coal mine the total deposit reduces gradually and after sometime it will be fully exhausted. Then its value will be reduced to nil.

External Causes:

Depreciation caused by some external reasons is called external depreciation. The main externalcauses are as follows:

Obsolescence:

Some assets, although in proper working order, may become obsolete. For example, old machine becomes obsolete with the invention of more economical and sophisticated machine whose productive capacity is generally larger and cost of production is therefore less. In order to survive in the competitive market the manufacturers must must install new machines replacing the old ones. Again, it may happen that the articles produced by old machine are no longer saleable in the market on account of change of habit and taste of the people. In such a case the old machine, although in good working condition, must be discarded and the new one purchased.

Efflux of Time:

Some assets diminish in value on account of sheer passage of time, even though they are not used e.g., leasehold property, patent right, copyright etc. Suppose we take a lease of a house for 10 years for $10,000. Its annual depreciation will be $1,000 (10,000/10), irrespective of the the whether the house has been used or not. Because with the end of lease after 10 years, the house will go out of possession.

Accident:

Assets may be destroyed by abnormal reasons such as fire, earthquake, flood etc. In such a case the destroyed asset must be written off as loss and a new one purchased.

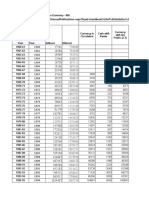

Sum-of-years' digits method

Sum-of-years' digits is a depreciation method that results in a more accelerated write-off than straight line, but less than declining-balance method. Under this method annual depreciation is determined by multiplying the Depreciable Cost by a schedule of fractions. depreciable cost = original cost salvage value book value = original cost accumulated depreciation Example: If an asset has original cost of $1000, a useful life of 5 years and a salvage value of $100, compute its depreciation schedule. First, determine years' digits. Since the asset has useful life of 5 years, the years' digits are: 5, 4, 3, 2, and 1. Next, calculate the sum of the digits. 5+4+3+2+1=15 The sum of the digits can also be determined by using the formula (n +n)/2 where n is equal to the 2 useful life of the asset. The example would be shown as (5 +5)/2=15 Depreciation rates are as follows: 5/15 for the 1st year, 4/15 for the 2nd year, 3/15 for the 3rd year, 2/15 for the 4th year, and 1/15 for the 5th year.

2

Total Book value at Depreciation depreciable beginning of year rate cost

Depreciation expense

Accumulated depreciation

Book value at end of year

$1,000 (original cost)

$900

5/15

$300 ($900 * 5/15)

$300

$700

$700

$900

4/15

$240 ($900 * 4/15)

$540

$460

$460

$900

3/15

$180 ($900 * 3/15)

$720

$280

$280

$900

2/15

$120 ($900 * 2/15)

$840

$160

$160

$900

1/15

$60 ($900 * 1/15) $900

$100 (scrap value)

Вам также может понравиться

- RTP Group I June 11Документ202 страницыRTP Group I June 11Hari Haritha0% (1)

- Tax Planning & JV AbroadДокумент16 страницTax Planning & JV AbroadAmit KapoorОценок пока нет

- Kaiburr DevOps Assessment PDFДокумент1 страницаKaiburr DevOps Assessment PDFGuruОценок пока нет

- Cola Wars - Five ForcesДокумент5 страницCola Wars - Five ForcesBrian ParkОценок пока нет

- Chapter Seven: Basic Accounting Principles & Budgeting FundamentalsДокумент35 страницChapter Seven: Basic Accounting Principles & Budgeting FundamentalsbelaynehОценок пока нет

- Indian Contract Act 1872 PDFДокумент28 страницIndian Contract Act 1872 PDFkeenu23Оценок пока нет

- Cost Estimation TechniquesДокумент22 страницыCost Estimation TechniquesanbuaedОценок пока нет

- Consumer Court - WikipediaДокумент6 страницConsumer Court - WikipediaManoj Kumar SharmaОценок пока нет

- Customs ACT: Dr. Gurumurthy K H Asst. Prof. in Commerce GFGC Magadi 9448226676Документ46 страницCustoms ACT: Dr. Gurumurthy K H Asst. Prof. in Commerce GFGC Magadi 9448226676Shiva KumarОценок пока нет

- Ch-2 Elements of Cost and Classification of CostДокумент25 страницCh-2 Elements of Cost and Classification of CostEruОценок пока нет

- What Are Material Losses in Cost Accounting?Документ10 страницWhat Are Material Losses in Cost Accounting?Keval HirparaОценок пока нет

- Accounting For Amalgamation - ProblemsДокумент8 страницAccounting For Amalgamation - ProblemsBrowse Purpose100% (1)

- Internship Report FormatДокумент15 страницInternship Report FormatvaibhavОценок пока нет

- Company Accounts Issue of Shares Par Premium DiscountДокумент20 страницCompany Accounts Issue of Shares Par Premium DiscountDilwar Hussain100% (1)

- Product Costing PowerPointДокумент20 страницProduct Costing PowerPointPrincessFabulОценок пока нет

- Double Entry Accounting ExplainedДокумент6 страницDouble Entry Accounting ExplainedKarthikacauraОценок пока нет

- Contract Costing (Unsolved)Документ6 страницContract Costing (Unsolved)ArnavОценок пока нет

- Book-Keeping Form TwoДокумент109 страницBook-Keeping Form TwoChizani Mnyifuna100% (1)

- Entrepreneurship DevelopmentДокумент2 страницыEntrepreneurship DevelopmentIna Pawar50% (2)

- SI vs CI Engine Comparison TableДокумент1 страницаSI vs CI Engine Comparison TableYash KalaОценок пока нет

- INCOME TAX Business & Profession MCQ - TY B COMДокумент5 страницINCOME TAX Business & Profession MCQ - TY B COMMani Kumar Sarvepalli100% (1)

- CVP AnalysisДокумент8 страницCVP AnalysisshishirjОценок пока нет

- Unit 4Документ21 страницаUnit 4yebegashet100% (1)

- Network Analysis OR MBA PPT 2Документ20 страницNetwork Analysis OR MBA PPT 2Babasab Patil (Karrisatte)0% (1)

- Economical Justification of Fms and Case StudiesДокумент13 страницEconomical Justification of Fms and Case StudiesShreyasОценок пока нет

- Ali & Co. Branch Accounts for Year Ended 2009Документ1 страницаAli & Co. Branch Accounts for Year Ended 2009charrisedelarosaОценок пока нет

- Electrical Wiring Components and AccessoriesДокумент14 страницElectrical Wiring Components and AccessoriesHarshit SaraswatОценок пока нет

- Learning ObjectivesДокумент10 страницLearning ObjectivesShraddha MalandkarОценок пока нет

- Badruka College Managerial Economics Pre-Final Exams 2019Документ2 страницыBadruka College Managerial Economics Pre-Final Exams 2019Afreen Fathima100% (2)

- Worksheet For Issue of Share and DebentureДокумент2 страницыWorksheet For Issue of Share and DebentureLaxmi Kant SahaniОценок пока нет

- B.tech. Syllabus AE With Short NotesДокумент64 страницыB.tech. Syllabus AE With Short NotesAryan KumarОценок пока нет

- CaseStudy-4 v2.0Документ7 страницCaseStudy-4 v2.0Salinda Arjuna LekamgeОценок пока нет

- Engineering EconomicsДокумент28 страницEngineering EconomicsTeeni AbeysekaraОценок пока нет

- Class Notes: Class: XII Topic: Accounting of Partnership Firm: Fundamentals Subject: ACCOUNTANCYДокумент4 страницыClass Notes: Class: XII Topic: Accounting of Partnership Firm: Fundamentals Subject: ACCOUNTANCYDilip ChenaniОценок пока нет

- Output CostingДокумент39 страницOutput CostingTarpan MannanОценок пока нет

- Internship Training at HMT Ltd - An IntroductionДокумент31 страницаInternship Training at HMT Ltd - An Introductionprajwal bdvtОценок пока нет

- Bad Debts and Provision For Doubtful Debts Bad DebtsДокумент28 страницBad Debts and Provision For Doubtful Debts Bad DebtsAngel LawsonОценок пока нет

- STD 9 CH 7 Joint Stock CompanyДокумент7 страницSTD 9 CH 7 Joint Stock CompanyGhalib HussainОценок пока нет

- E - Challan Government of Haryana E - Challan Government of HaryanaДокумент1 страницаE - Challan Government of Haryana E - Challan Government of HaryanaAmit KumarОценок пока нет

- R5311304-Operations ResearchДокумент4 страницыR5311304-Operations ResearchsivabharathamurthyОценок пока нет

- Non Conventional Machining PDFДокумент55 страницNon Conventional Machining PDFMarthande100% (1)

- Average Due DateДокумент19 страницAverage Due DatePriyanshuОценок пока нет

- Contract Costing OverviewДокумент18 страницContract Costing OverviewCalvince Ouma100% (2)

- Accounting Standard - 20 Earnings Per ShareДокумент34 страницыAccounting Standard - 20 Earnings Per ShareVelayudham ThiyagarajanОценок пока нет

- Sheet 7 PDFДокумент4 страницыSheet 7 PDFIniyan I TОценок пока нет

- Material Cost PDFДокумент45 страницMaterial Cost PDFtnchsg0% (2)

- CA Final Costing Guideline Answers May 2015Документ12 страницCA Final Costing Guideline Answers May 2015jonnajon92-1Оценок пока нет

- Question-Bank PPC MK 16marksДокумент5 страницQuestion-Bank PPC MK 16marksKannan MuthusamyОценок пока нет

- Contract Accounting Process & Notional Profit TreatmentДокумент3 страницыContract Accounting Process & Notional Profit TreatmentVishakh Nag100% (1)

- Database ManagementДокумент5 страницDatabase Managementanika fierroОценок пока нет

- Unit-4 - Hypothesis TestingДокумент24 страницыUnit-4 - Hypothesis TestingMANTHAN JADHAVОценок пока нет

- Training ReportДокумент18 страницTraining ReportSachin ShikotraОценок пока нет

- Aassignment ProblemДокумент22 страницыAassignment Problemsmsmba100% (1)

- Fund Flow Statement AnalysisДокумент16 страницFund Flow Statement AnalysisgopinathОценок пока нет

- Trends in International ManagementДокумент5 страницTrends in International ManagementAleksandra RudchenkoОценок пока нет

- Classification of IndustriesДокумент11 страницClassification of IndustriesAppan Kandala Vasudevachary100% (3)

- DBA MathsДокумент98 страницDBA Mathsvictor chisengaОценок пока нет

- Computing Fundamentals Lab ManualДокумент42 страницыComputing Fundamentals Lab ManualWajiha JavedОценок пока нет

- Cash Flow Statement PDFДокумент30 страницCash Flow Statement PDFDebashish GoraiОценок пока нет

- DepreciationДокумент8 страницDepreciationanjalikapoorОценок пока нет

- Investment Apraisal and DepriciationДокумент10 страницInvestment Apraisal and DepriciationShish DattaОценок пока нет

- PWC Global Annual Review 2021Документ97 страницPWC Global Annual Review 2021Sarah AndoОценок пока нет

- FA Work BookДокумент59 страницFA Work BookUnais AhmedОценок пока нет

- BiMedis - Your Own Online Store For Selling Medical EquipmentДокумент14 страницBiMedis - Your Own Online Store For Selling Medical Equipmentxbiomed.frОценок пока нет

- Noel Nettey ResumeДокумент6 страницNoel Nettey ResumeNoel NetteyОценок пока нет

- RBI DataДокумент86 страницRBI DatarumiОценок пока нет

- c9001 Chartered Financial Modeling Professional CFMP Brochure 1Документ11 страницc9001 Chartered Financial Modeling Professional CFMP Brochure 1Shit A Brick “Om Tegank”Оценок пока нет

- AbstrakДокумент7 страницAbstrakAldy SolawatОценок пока нет

- Capitalist Crew Corp JFC StramaДокумент56 страницCapitalist Crew Corp JFC StramaAkako MatsumotoОценок пока нет

- Real Estate Developer Revenue RecognitionДокумент2 страницыReal Estate Developer Revenue RecognitionEster SabatiniОценок пока нет

- Dictionary of Banking A Concise Encyclopaedia of Banking Law and PracticeДокумент590 страницDictionary of Banking A Concise Encyclopaedia of Banking Law and Practiceishmaeliam100% (2)

- Auditing IДокумент58 страницAuditing IBereket DesalegnОценок пока нет

- Ac 418 Group AssignmentДокумент6 страницAc 418 Group AssignmentJacob PossibilityОценок пока нет

- Axe Deodorant Marketing-2Документ10 страницAxe Deodorant Marketing-2moshin qureshiОценок пока нет

- BASF Catalysts - Leveraging Innovation to Serve Growing MarketsДокумент18 страницBASF Catalysts - Leveraging Innovation to Serve Growing Marketsccnew3000Оценок пока нет

- Design of Goods and Services:: Mcdonald'S Offer A Wide Range of Items in Their MenuДокумент2 страницыDesign of Goods and Services:: Mcdonald'S Offer A Wide Range of Items in Their MenuSamia AtiqueОценок пока нет

- Chapter 8 Valuation of Inventories MCQ UnansweredДокумент7 страницChapter 8 Valuation of Inventories MCQ UnansweredMa Teresa B. CerezoОценок пока нет

- MGT201 Presentation by Mozammel AhmedДокумент19 страницMGT201 Presentation by Mozammel AhmedIsrafil PannaОценок пока нет

- Understanding Entrepreneurial Motivation TheoriesДокумент31 страницаUnderstanding Entrepreneurial Motivation TheoriesCid AreОценок пока нет

- DIY Oxygen Absorber For Caching Food StorageДокумент7 страницDIY Oxygen Absorber For Caching Food StorageMHammondОценок пока нет

- Indraprastha Gas Limited (Igl)Документ72 страницыIndraprastha Gas Limited (Igl)ssat111Оценок пока нет

- Work Breakdown Structure Template 22Документ6 страницWork Breakdown Structure Template 22luismlmОценок пока нет

- Oracle® E-Business Suite Diagnostics: User's Guide Release 12.1Документ44 страницыOracle® E-Business Suite Diagnostics: User's Guide Release 12.1yadavdevenderОценок пока нет

- SAP S - 4HANA Cloud, Public Edition, 3-System Landscape - Upgrade & Maintenance ScheduleДокумент9 страницSAP S - 4HANA Cloud, Public Edition, 3-System Landscape - Upgrade & Maintenance ScheduleAnti VitaОценок пока нет

- Business Law Assignment Questions (Class E) - January 2024 IntakeДокумент5 страницBusiness Law Assignment Questions (Class E) - January 2024 Intakewtote404Оценок пока нет

- Productivity, Efficiency and Economic Growth in Asia PacificДокумент335 страницProductivity, Efficiency and Economic Growth in Asia PacificZainudin Mohamed100% (1)

- End Term Paper FACD 2020Документ8 страницEnd Term Paper FACD 2020Saksham SinhaОценок пока нет

- Ejercicios ContabilidadДокумент3 страницыEjercicios ContabilidadCarolina RvОценок пока нет

- How Does Harrah's Integrate The Various Elements of Its Marketing Strategy To Deliver More Than The Results of Data Base Marketing?Документ1 страницаHow Does Harrah's Integrate The Various Elements of Its Marketing Strategy To Deliver More Than The Results of Data Base Marketing?Harshad SachaniОценок пока нет

- Canara - Epassbook - 2023-10-10 202024.654466Документ49 страницCanara - Epassbook - 2023-10-10 202024.654466Kamal Hossain MondalОценок пока нет