Академический Документы

Профессиональный Документы

Культура Документы

Transaction Code and SPRO Nodes

Загружено:

sharat_tj5758Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Transaction Code and SPRO Nodes

Загружено:

sharat_tj5758Авторское право:

Доступные форматы

Transaction Code:-OH00 Define employee attributes Organizational Assignment Organizational Data Personnel Administration Personnel Management Transaction Code:-OH00

Define employee attributes Organizational Assignment Organizational Data Personnel Administration Personnel Management Transaction Code:-OH00 Define employee attributes Organizational Assignment Organizational Data Personnel Administration Personnel Management Transaction Code:-OH00 Create payroll area Organizational Assignment Organizational Data Personnel Administration Personnel Management Transaction Code:-OH00 Create payroll area Organizational Assignment Organizational Data Personnel Administration Personnel Management Transaction Code:-PE03 Check Default Payroll Area Organizational Assignment Organizational Data Personnel Administration Personnel Management Transaction Code:-PA03 Create control record Organizational Assignment Organizational Data Personnel Administration Personnel Management Transaction Code:-PA03 Create control record Organizational Assignment Organizational Data Personnel Administration Personnel Management Transaction Code:-OH00 Basic Payroll Data Personnel Administration Personnel Management Define EE Sub Group Grourping for PCR and Collective Agreement Pay Provision

Transaction Code:-OH00 Define Reason for Change Basic Pay Payroll Data Personnel Administration Personnel Management Transaction Code:-OH00 Check PayScale Type Basic Pay Payroll Data Personnel Administration Personnel Management Transaction Code:-OH00 Check PayScale Area Basic Pay Payroll Data Personnel Administration Personnel Management Transaction Code:-OH00 Basic Payroll Data Personnel Administration Personnel Management Check Assignment of PayScale Structure to Enterprise Structure Pay Transaction Code:-OH00 Determine Default for PayScale Data Basic Pay Payroll Data Personnel Administration Personnel Management Transaction Code:-OH00 Setup Payroll Period for Collective Agreement Provision Basic Pay Payroll Data Personnel Administration Personnel Management Transaction Code:-OH00 Define PayScale Salary ranges Basic Pay Payroll Data Personnel Administration Personnel Management Transaction Code:-OH11 Create Wage Type Wage Types Basic Pay Payroll Data Personnel Administration Personnel Management Transaction Code:-OH11 Create Wage Type Wage Types Basic Pay Payroll Data Personnel Administration Personnel Management

Transaction Code:-OH00 Check Wage Type Group Basic Pay Wage Types Basic Pay Payroll Data Personnel Administration Personnel Management Check Wage Type Text Check Wage Type Catalog Wage Types Basic Pay Payroll Data Personnel Administration Personnel Management Transaction Code:-OH13 Basic Payroll Data Personnel Administration Personnel Management Check Entry Permissibility Per Check Wage Type Catalog Wage Types Pay Infotype Transaction Code:-OH13 Basic Payroll Data Personnel Administration Personnel Management Check Wage Type Characteristics Check Wage Type Catalog Wage Types Pay Transaction Code:-OH13 Basic Payroll Data Personnel Administration Personnel Management Check Wage Type Characteristics Check Wage Type Catalog Wage Types Pay Transaction Code:-OH00 Employee Sub Group Grouping for Primary Wage Wage Types Basic Pay Payroll Data Personnel Administration Personnel Management Transaction Code:-OH00 Basic Payroll Data Personnel Administration Personnel Management Personnel Sub Area Grouping for Primary Wage Type Wage Types Pay Transaction Code:-OH00 Basic Payroll Data Personnel Administration Personnel Management Define Wage Type Permissibility for each PS and ESG Wage Types Pay Transaction Code:-OH00 Basic Payroll Data Personnel Administration Personnel Management Define Wage Type Permissibility for each PS and ESG Wage Types Pay Transaction Code:-OH00 Define Reason for Change Recurring Payment and Deduction Payroll Data Personnel

Administration Personnel Management Transaction Code:-OH11 Create Wage Type Catalog Wage Types Recurring Payment and Deduction Payroll Data Personnel Administration Personnel Management Transaction Code:-OH11 Create Wage Type Catalog Wage Types Recurring Payment and Deduction Payroll Data Personnel Administration Personnel Management Transaction Code:-OH00 Recurring Payroll Data Personnel Administration Personnel Management Check Wage Type Group Recurring Wage Types Payment and Deduction Payments and Deduction Transaction Code:-OH13 Recurring Payroll Data Personnel Administration Personnel Management Check Wage Check Wage Type Catalog Wage Types Payment and Deduction Type text Transaction Code:-OH13 Recurring Payroll Data Personnel Administration Personnel Management Check Entry Check Wage Type Catalog Wage Types Payment and Deduction Permissibility Per Infotype Transaction Code:-OH13 Recurring Payroll Data Personnel Administration Personnel Management Check Wage Check Wage Type Catalog Wage Types Payment and Deduction Type Characteristics Transaction Code:-OH13 Recurring Payroll Data Personnel Administration Personnel Management Check Wage Check Wage Type Catalog Wage Types Payment and Deduction Type Characteristics Transaction Code:-OH00 Recurring Payroll Data Personnel Administration Personnel Management Define Employee Sub Group Grouping for Wage Types Payment and Deduction Primary Wage Type.

Transaction Code:-OH00 Recurring Payroll Data Personnel Administration Personnel Management Define Personnel Area Grouping for Wage Types Payment and Deduction Primary Wage Type Transaction Code:-OH00 Recurring Payroll Data Personnel Administration Personnel Management Define Wage Type Permissibility for Wage Types Payment and Deduction each PS and ESG Transaction Code:-OH00 Recurring Payroll Data Personnel Administration Personnel Management Define Wage Type Permissibility for Wage Types Payment and Deduction each PS and ESG Transaction Code:-OH00 Define Reasons for Changes Additional Payments Payroll Data Personnel AdministrationaP Personnel Management Transaction Code:-OH11 Create Wage Type Catalog Wage Types Additional Payments Payroll Data Personnel AdministrationaP Personnel Management Transaction Code:-OH11 Create Wage Type Catalog Wage Types Additional Payments Payroll Data Personnel Administration Personnel Management Transaction Code:-OH00 Additional Payroll Data Personnel Administration Personnel Management Check Wage Type Group Additional Wage Types Payments and Deduction Payments Transaction Code:-OH13 Additional Payroll Data Personnel Administration Personnel Management Check Wage Check Wage Type Catalog Wage Types Payments and Deduction Type Transaction Code:-OH13 Additional Payroll Data Personnel Administration Personnel Management Check Entry Permissibility Check Wage Type Catalog Wage Types Payments for Additional

Payments Transaction Code:-OH13 Additional Payroll Data Personnel Administration Personnel Management Check Wage Type Check Wage Type Catalog Wage Types Payments Characteristics. Transaction Code:-OH13 Pe Personnel ManagementAdditional Payroll Data rsonnel Administration Check Wage Type Check Wage Type Catalog Wage Types Payments Characteristics. Transaction Code:-OH00 Additional Payroll Data Personnel Administration Personnel Management Define Employee Sub Group Grouping for Primary Wage Wage Types Payments Type. Transaction Code:-OH00 Additional Payroll Data Personnel Administration Personnel Management Define Employee Sub Group Grouping for Primary Wage Wage Types Payments Type. Transaction Code:-OH00 Additional Payroll Data Personnel Administration Personnel Management Define Wage Type Permissibility for each PS and ESG Wage Types Payments Transaction Code:-OH00 Additional Payroll Data Personnel Administration Personnel Management Define Wage Type Permissibility for each PS and ESG Wage Types Payments Transaction Code:-PA03 Check Payroll Accounting Area Payroll Organization Basic Settings Payroll India Payroll Transaction Code:-OG00 Generate Payroll Periods Payroll Organization Basic Settings Payroll India Payroll Transaction Code:-OH00

Check Date of Payday Generate Payroll Periods Payroll Organization Basic Settings Payroll India Payroll Transaction Code:-OG00 Generate Calender for Cumulation Payroll Organization Basic Settings Payroll India Payroll Transaction Code:-OH00 Define Payscale Groupings for Allowances Payscale Groupings Payroll India Payroll Transaction Code:-OH00 Asssign Payscale Groupings for Allowances Payscale Groupings Payroll India Payroll Transaction Code:-OH00 Asssign Basic Wage Types to Basic Salary for India Payroll India Payroll Groupings for Allowances Transaction Code:-OH00 Asssign Basic Wage Types to Basic Salary for India Payroll India Payroll Groupings for Allowances Transaction Code:-OH00 Assign Basic Codes for Allowance Groups Basic Salary for India Payroll India Payroll Transaction Code:-OH00 Assign Wage type Model for Payscale Grouping for Allowances Reimbursements, Allowances and Perks Payroll India Payroll Transaction Code:-OH00 Maintain Default Wage Types for Basic Pay Reimbursements, Allowances and Perks Payroll India Payroll Transaction Code:-OH00 Maintain Reimbursements, Allowances and Perks Payroll India Payroll Wage Types Characteristics

Transaction Code:-OH00 Maintain Reimbursements, Allowances and Perks Payroll India Payroll Wage Types Characteristics Transaction Code:-OH00 Maintain PayScale Groups and Levels. Reimbursements, Allowances and Perks Payroll India Payroll Transaction Code:-OH00 Maintain PayScale Groups and Levels Reimbursements, Allowances and Perks Payroll India Payroll Transaction Code:-OH00 Maintain Valuation of Basic of Basic Wage Type Reimbursements, Allowances and Perks Payroll India Payroll Transaction Code:-OH00 Maintain Allowance Rules Based on Slabs Reimbursements, Allowances and Perks Payroll India Payroll Transaction Code:-OH00 Calculate Eligibility for RAPs Reimbursements, Allowances and Perks Payroll India Payroll Transaction Code:-OH00 Calculate Eligibility for RAPs Reimbursements, Allowances and Perks Payroll India Payroll Transaction Code:-OH00 Calculate Eligibility for RAPs Reimbursements, Allowances and Perks Payroll India Payroll Transaction Code:-OH00 Create a Loan Type Master Data Company Loans Payroll India Payroll

Transaction Code:-SPRO Assign Repayment Type Master Data Company Loans Payroll India Payroll Transaction Code:-SPRO Create Loan Conditions Master Data Company Loans Payroll India Payroll Transaction Code:-SPRO Create Loan Conditions Master Data Company Loans Payroll India Payroll Transaction Code:-SPRO Create Loan Conditions Master Data Company Loans Payroll India Payroll Transaction Code:-OH00 Maintain Loan Eligibility Checks and Limits Master Data Company Loans Payroll India Payroll Transaction Code:-SPRO Reporting for Posting Results to Accounting Payroll India Payroll Define Employee Grouping and Symbolic Accounts Activities in HR System Employee Grouping Account Determination Transaction Code:-SPRO Reporting for Posting Results to Accounting Payroll India Payroll Define Employee Grouping and Symbolic Accounts Activities in HR System Symbolic Accounts Transaction Code:-OH02 Reporting for Posting Results to Accounting Payroll India Payroll Define Posting Maintain Wage Types Activities in HR System Characteristics for Wage Types Transaction Code:-OH02 Reporting for Posting Results to Accounting Payroll India Payroll Define Posting Maintain Wage Types Activities in HR System Characteristics for Wage Transaction Code:-OG00 Reporting for Posting Results to Accounting Payroll India Payroll Maintain Posting

Periods Maintain Wage Types Activities in HR System for Payroll Periods Transaction Code:-OH00 Reporting for Posting Results to Accounting Payroll India Payroll Maintain Posting Periods Maintain Wage Types Activities in HR System for Payroll Periods Transaction Code:-SPRO Create Posting Variants Activities in HR System Reporting for Posting Results to Accounting Payroll India Payroll Transaction Code:-OBYE Assign Expense Accounts Assigning Accounts Reporting for Posting Results to Accounting Payroll India Payroll Transaction Code:-OBYE Reporting for Posting Results to Accounting Payroll India Payroll Assign Expense Accounts Assigning Accounts Activities in HR System Transaction Code:-OBYG Assign Balance Sheet Accounts Assigning Accounts Reporting for Posting Results to Accounting Payroll India Payroll Transaction Code:-OBYG Assign Balance Sheet Accounts Assigning Accounts Reporting for Posting Results to Accounting Payroll India Payroll Transaction Code:-OG00 Check Customizing for Account Determination Reporting for Posting Results to Accounting Payroll India Payroll Transaction Code:-OG00 Check Customizing for Account Determination Reporting for Posting Results to Accounting Payroll India Payroll Transaction Code:-SPRO

Define Schedule for Payroll Calender Payroll Calender Payroll India Payroll Transaction Code:-SPRO Define Schedule for Payroll Calender Payroll Calender Payroll India Payroll Try this From Sdn.sap.com (https://www.sdn.sap.com/irj/scn/forums) Sikindar IT to be maintained for Indian PY http://help.sap.com/saphelp_47x200/helpdata/en/d8/38a63a04227748e10000000a11402f/fr ameset.htm For Material on Indian PY https://websmp102.sap-ag.de/hrin http://help.sap.com/saphelp_47x200/helpdata/en/dd/38a63a04227748e10000000a11402f/fr ameset.htm http://www.easymarketplace.de/online-pdfs.php?Area=4soi& http://www.insightcp.com/res_13.htm#top http://www.insightcp.com/res_19.htm http://www.sap-img.com/hr009.htm http://www.planetsap.com/hr_payroll_main_page.htm http://www.hrexpertonline.com/archive//Volume_02_(2004)/Issue_06_(July)/V2I6A4.cfm ?session=

Payroll India (PY-IN) Payroll in the SAP System Payroll Basics (PY-XX-BS) The Payroll Process Payroll in a Background Operation Off-Cycle Activities (PY-XX-OC) Off-Cycle Workbench Payroll History

Off-Cycle Payroll Bonus Accounting Regular Payroll On Demand Advance Payment Absence Payment Running Off-Cycle Payroll Reasons, Types and Categories for Off-Cycle Payroll The One-Time Payments Off-Cycle Infotype (0267) Off-Cycle Payroll - Integration for India Off-Cycle Subsequent Processing Infotypes for Personnel Administration and Payroll Personnel Administration and International Payroll Personal Data (International) Personal Data (Infotype 0002) Addresses (Infotype 0006) Bank Details (Infotype 0009) Family Member/Dependents (Infotype 0021) Challenge (infotype 0004) Internal Medical Service (Infotype 0028) Personnel Actions (International) Actions (Infotype 0000) Organizational Data (International) Organizational Assignment (infotype 0001) Cost Distribution (Infotype 0027) Reference Personnel Number (Infotype 0031) Reference Personnel Number Priority (Infotype 0121 Sales Data (Infotype 0900) Contractual and Corporate Agreements (international) Contract Elements (Infotype 0016) Corporate Function (infotype 0034) Internal Control (Infotype 0032) Powers of Attorney (infotype 0030) Company Instructions (infotype 0035) Objects on Loan (Infotype 0040) Works Councils (infotype 0054) Payroll Data (International) Payroll Status (Infotype 0003) Basic Pay (Infotype 0008) Recurring Payments/Deductions (Infotype 0014) Additional Payments (Infotype 0015) The One-Time Payments Off-Cycle Infotype (0267) External Bank Transfers (infotype 0011) External Wage Components (Infotype 0579) Loans (Infotype 0045) Limits on Deductions (Infotype 0165)

Insurance (Infotype 0037) Membership Fees (Infotype 0057) Time Quota Compensation Infotype (0416) Appraisals (Infotype 0025) Infotype: Export Status (0415) Employee Remuneration Info Infotype (2010) Notifications Infotype (0128) Infotype Printing Remuneration Statement (0655) Reporting Bases (International) Date Specifications (infotype 0041) Monitoring of Tasks (Infotype 0019) Employee Qualification (International) Education (Infotype 0022) Qualifications (Infotype 0024) Other/Previous Employers (Infotype 0023) Communication (International) Communication (Infotype 0105) Authorization Management (International) Test Procedures (Infotype 0130) Payroll India Previous Employment Tax Details Infotype (0580) Housing(HRA / CLA / COA) Infotype (0581) Exemptions Infotype (0582) LTA Subtype Exemptions Infotype (0582) MDA Subtype Exemptions Infotype (0582) SCEA/SCHA Subtypes Car & Conveyance Infotype (0583) Income From Other Sources Infotype (0584) Section 80 Deductions Infotype (0585) Investment Details (Sec88) Infotype (0586) Provident Fund Contribution Infotype (0587) Other Statutory Deductions Infotype (0588) Subtype ESI (0001) Other Statutory Deductions Infotype (0588), LWF Subtype (0002) Other Statutory Deductions Infotype (0588), PTX subtype (0003) Long Term Reimbursements Infotype (0590) Nominations Infotype (0591) Loans Infotype (0045) - India Pay Scale Grouping for Allowances Pay Scale Grouping for Allowances Definition Indirect Evaluation (INVAL) and 40ECS Feature Indirect Evaluation (INVAL) and 40ECS Feature Definition Mid Year Go Live Transferring Legacy Payroll Results Gross Part of Payroll Wage Types

Dialog Wage Type Time Wage Type Secondary Wage Type Processing Class Evaluation Class Wage Type Copier Wage Type Catalog Creating the Customer-Specific Wage Type Catalog Copy Model Wage Types of a Wage Type Group Copy a Model Wage Type as a Prototype Duplicating a Wage Type List of Copied Wage Types Copying Wage Types Manually Time-Based Delimitation of a Wage Type Deleting Wage Types List of Deleted Wage Types Deleting or Delimiting Wage Types Manually Assigning Wage Types to Wage Type Groups Displaying the Assignment of Wage Types to Wage Type Groups Deleting Customer Wage Types from a Wage Type Group Assigning Customer Wage Types to a Wage Type Group Using Wage Types Create a Wage Type Utilization List Wage Type Split Wage Type Split: Example 1 Wage Type Split: Example 2 Payments Basic Pay (Infotype 0008) Editing Basic Pay Pay Scale Reclassification Performing A Pay Scale Reclassification Standard Pay Increase Effecting a Standard Pay Increase Recurring Payments/Deductions (Infotype 0014) Processing Recurring Payments and Deductions Additional Payments (Infotype 0015) Processing Additional Payments Standard Wage Maintenance Standard Wage Maintenance (Infotype 0052) Time Quota Compensation Infotype (0416) Employee Remuneration Info Infotype (2010) Time Management Aspects in Payroll Integration with Time Management Day Processing of Time Data in Payroll

Sequence of Day Processing/Wage Type Selection Time Wage Type Selection Integration Between Time Evaluation and Payroll Importing Time Wage Types from the Previous Period Shift Change Compensation Activity with a Higher Rate of Pay Entering a Different Payment for Time Infotype Records Employee Remuneration Information Employee Remuneration Info Infotype (2010) Maintaining Employee Remuneration Information Absences Valuating Absences Technical Procedure for Absence Valuation Refinement of Absences Wage Type Valuation Dialog Wage Types Valuation Time Wage Types Valuation Valuating Wage Types Using Valuation Bases Technical Procedure for Wage Type Valuation using Valuation Base Wage Type-Dependent Constant Valuation Bases Wage Type- Dependent Constant Valuation Bases Example Personnel Calculation Rule XMOD Constant Valuation Bases that Depend on the Collec Constant Valuation Bases that Depend on the Collective Agreement Employee-Related Valuation Basis Person-Related Valuation Bases: Example Percentage Advance Pay for Individual Valuation Ba Valuating using the Principle of Averages Frozen Averages Determining the Average Value without a Basis Old and New Processing of Averages Technical Process of Average Processing (New) Relevancy Test for Valuation According To the New Principle of A Technical Process of Average Processing (Old) Valuation of Primary Wage Types Relevancy Test for Valuation Using the Principle of Averages (ol Cumulating Average Bases Determining Relevant Previous Periods Final Processing of Averages Adapting the Average Bases to Increased Payments Incentive Wages: Overview Incentive Wages Accounting: Processes Monthly Wage Calculation for Incentive Wages Calculating the Earnings Factor for Incentive Wages

Earnings Factor: Example Incentive Wages Accounting: Hourly Wage Earners Incentive Wage Accounting: Tools Incentive Wages Accounting: Personnel Calculation Schemas Personnel Calculation Rules DIW0 and XIW0 Functions PW1 and PW2 Incentive Wages Accounting: Personnel Calculation Rules Special Operations Wage Types Wage Types from Basic Pay Wage Types on Time Tickets Wage Types as Accounting Results Partial Period Remuneration (Factoring) Application Examples for Reductions Application Examples for Period-Specific Remuneration Calculatio Partial Period Factor Factoring Parameter Technical Sequence for Partial Period Remuneration PWS Method Payment Method Deduction Method Hybrid of Payment and Deduction Methods All or Nothing Method Reduction of Payments: Example Calculating Period-Specific Remuneration: Example Salary Packaging Salary Package Customizing Creating an Employee's Salary Package Sample Employee Salary Package (India) Salary Packaging Dearness Allowance Batch Program - DA Report (HINIDAB0) Housing Exemptions and Perquisites on Housing Housing(HRA / CLA / COA) Infotype (0581) Car and Conveyance Exemption and Perquisite Calculation for Car and Conveyance Car & Conveyance Infotype (0583) Long Term Reimbursements Long Term Reimbursements Infotype (0590) Claims Reimbursement for Employees Transaction (PC00_M40_REMP) Claims Balance Disbursement Report (HINCREMT)

Status for claims Report (HINCREMS) Claims Balance upload program (HINUUPCF) Claims Carry Forward Balance Report (HINCREMC) Period End Treatment of Balances Bonus India specific Bonus calculation Report (HINCBON0) Gratuity Gratuity Definition Gratuity Process Gratuity Listing Report (HINCGRY0) Superannuation Superannuation Configuration Superannuation Process Superannuation Report (HINCSAN0) Leave Encashment Exemptions on Leave Encashment Exemption on Voluntary Retirement Scheme Net Part of Payroll Income Tax Income Tax Calculation Section 80 Deduction Section 80 Deductions Infotype (0585) Batch Program for Section 80 (HINIS800) Section 88 Rebate Investment Details (Sec88) Infotype (0586) Batch Program for Section 88 (HINIS880) Section 89(1) Relief Section 89(1) Relief Computation Section 89(1) External Data Capture Third Party Deductions Income from Other Sources Income From Other Sources Infotype (0584) Exemptions Exemption on Leave Travel Allowance (LTA) Defining Exemption on Leave Travel Allowance (LTA) Exemptions Infotype (0582) LTA Subtype Medical Exemption Exemption on Medical Reimbursement Defining Exemptions on Medical Reimbursement Exemption on Medical Insurance Premium Defining Exemption on Medical Insurance Premium Incremental Medical Perk Exemptions Infotype (0582) MDA Subtype

Exemption on Child Education Allowance/Child Hostel Allowance Defining Exemptions on Child Education/Child Hostel Allowances Exemptions Infotype (0582) SCEA/SCHA Subtypes Exemption on Other Allowances and Reimbursements Exemption on Other Allowances and Reimbursements Configuration Leave Encashment Exemptions on Leave Encashment Exemption on Voluntary Retirement Scheme Exemptions and Perquisites on Housing Exemption and Perquisite Calculation for Car and Conveyance Previous Employment Tax Details Previous Employment Tax Details Infotype (0580) Tax on Arrears Professional Tax Defining Professional Tax Professional Tax Computation Retroactive Professional Tax Calculation Professional Tax Report (HINCPTX0) Professional Tax Report for Mahrashtra (HINCPTX1) Other Statutory Deductions Infotype (0588), PTX subtype (0003) Provident Fund Defining Provident Fund Provident Fund Calculation Provident Fund Contribution Infotype (0587) Employee State Insurance Employee State Insurance Set Up Retroactive Employee State Insurance Calculation Form 6 and 7 for Employees' State Insurance Report (HINCESI0) Other Statutory Deductions Infotype (0588) Subtype ESI (0001) Labour Welfare Fund Other Statutory Deductions Infotype (0588), LWF Subtype (0002) Labour Welfare Fund Legal Reports (HINCLWF1) Recovery of Rounded Off Amounts Recovery of Rounded Off Amounts Setup Minimum Net Pay Deductions Loans Loans (Infotype 0045) Payment type Creating Loans and Loan Payments Correcting Incorrect Entries Creating a Special Repayment Changing the Value of a Loan

Processing Loans in the Case of a Change in Company Code Processing Loans for an Employee Who Leaves Processing Loans for Inactive Agreements Deleting Loans Repayment Repayment of Installment Loans Example: Repayment of Installment Loans Repayment Plan Example: Repayment Plan Creating Repayment Plans Displaying Conditions Interest Calculation Example: Interest Calculation Calculating Imputed Income Example of an Imputed Income Calculation Evaluating a Loan Loan Wage Types Loans Enhancement - India Loans Configuration for India Loans Infotype (0045) - India Loans Summary Report (HINCLON1) Batch Program for Penal Interest (Loans) Report (HINILON0) Arrears Processing for Deductions Technical Procedure of Arrears Processing Processing Reduced Gross Tax Amounts Processing Arrears in Retroactive Accounting One Day Salary Deduction One Day Salary Deduction Calculation Minimum Net Pay Subsequent Activities Wage and Salary Payments in India Payment-Related Information in the Master Data Payment-Related Information in the Payroll Results Preliminary Program DME Repeating a Payment Run Wage and Salary Payments by Bank Transfer Wage and Salary Payments by Check Wage and Salary Payments by Check with Integrated Remuneration S Salary Payments by Bank Transfer with Payment Advice Printing Cash Payment with Multicurrency Cash Breakdown List Cash Payment with Cash Breakdown List Remuneration Statement (Report RPCEDTx0; HxxCEDT0) Creating Remuneration Statements

Notifications Infotype (0128) Creating a General Notification Assigning a Notification to a Remuneration Statement Editing Personal Notifications Infotype Printing Remuneration Statement (0655) Parallel Execution of Evaluation Programs Starting Evaluation Programs Simultaneously Payroll Account (Report RPCKTOx0; HxxCKTO0) In-Period / For-Period / In-Period View / For-Period View Creating a Payroll Account Payroll Journal (Report RPCLJNx0; HxxCLJN0) Creating a Payroll Journal Wage Type Statement Creating a Wage Type Statement Wage Type Distribution Creating the Wage Type Distribution List Wage Type Reporter (H99CWTR0) SAP List Viewer (ALV) Displaying the Excel Table Creating a List of Wage Types Posting to Accounting (PY-XX-DT) Central Objects Symbolic Account Posting run Posting Documents Business Basics Example: Posting a Salary Complete Posting Example for Germany: Complete Posting Example for Switzerland: Complete Posting Integration with the Posting of Payment Transactions Germany: Integration with the Posting of Payment Transactions USA: Integration with the Posting of Payment Transactions Technical Aspects Technical Sequence of Posting Posting-Relevant Information from Master Data, Time Data and Org Posting-Relevant Information in the Payroll Result Example: Posting-Relevant Information in the Payroll Result Account Determination Document Split Account Posting Retroactive Accounting Data Example: Posting Retroactive Accounting Data Generation of Recalculation Differences

Posting Recalculation Differences Posting Period and Posting Date Posting to Substitute Cost Centers Substitution Logic for Closed CO Account Assignment Objects Steps Performing the Posting Simulating a Posting Run Creating a Posting Run Checking a Posting Run Checking the Posting Documents Releasing Posting Documents Posting Posting Documents Checking Accounting Documents Checking the Completeness of the Postings Technical Document Trace Subsequent Activities in Financial Accounting Displaying an Overview of the Posting Runs Changing or Creating a Text for a Posting Run Displaying the Attributes of a Posting Run Deleting a Posting Run Displaying the Document Overview Displaying Posting Documents Displaying Revision Information Reversal of Posting Documents Reversing Posting Documents Displaying the Status History Displaying Detailed Information Posting in Previous Releases Posting from HR Systems < 4.0 Using Revision Information Posting to AC Systems < 4.0 Special Business Requirements for Posting Posting with Personnel Numbers Example: Posting Using Personnel Numbers Posting to Customer and Vendor Accounts Example: Posting to Customer Accounts for Employees Summarization in the Accounting Components Posting to Fixed Cost Centers Example: Posting With or Without a Fixed Cost Center Posting to Special Periods Example: Posting to Special Periods Cross-Company Code Transactions Summary Clearing Proportional Assignment to Several Company Codes within a Payrol

Retroactive Accounting for Summary Clearing Retroactive Accounting in Several Company Codes with Summary Cle Clearing Using Company Code Clearing Accounts Proportional Assignment to Several Company Codes within a Payrol Retroactive Accounting in Several Company Codes - Clearing Using Retroactive Accounting after a Retrospective Change of Company C Postings Relevant to Value-Added Tax Travel Expenses Invoices to Employees Amounts Paid by the Employees Germany: Account Determination for Specific Service Types in Acc EMU: Special Features of Posting to Accounting Integration with Other Components Posting to Funds Management Posting to FM without Entering FM Account Assignments Integration of Funds Management without using Position Managemen Integration of Funds Management without using Position Managemen Process Flow for Integrated Position Management Payroll with Position Management Posting with Position Management Special Cases of Integration between Funds Management and Positi Providing Data for Personnel Cost Planning Troubleshooting Posting Run Cancelled with Status "Selection Running" Personnel Numbers not Selected or Rejected Accounting Documents Were not Created Posting Run is Missing in the Posting Run Overview Resetting the Reversal after Termination Reports Evaluating the Payroll Results Using ITs or the Logical Database Infotypes for Evaluating Payroll Results Payroll Results Infotypes: Period Values (0402 and 0403) Monthly Cumulations (Infotype 0458) Quarterly Cumulations (Infotype 0459) Annual Cumulations (Infotype 0460) Application of Logical Database for Payroll Structure of Logical Database for Payroll Conversion of Evaluation Reports ABAP Coding: Read International Payroll Results ABAP Coding: Read National Payroll Results ABAP Coding: Report EXAMPLE_PNP_GET_PAYROLL for Evaluation of Pa Utility Macros for Report Conversion Example Old Coding Example: Variant A: New Coding Example: Variant B: New Coding

Report Category Creating a Report and Report Category Evaluate Archived Payroll Results Using the Logical Database Reporting Basic - General Increments Report (HINIBSG0) Basic Promotions Report (HINIBSP0) Print Program for Form 16 Tax Deducted and Deposited into Central Government Account Annexure to Form No.16 Form No.12BA Print Program for Form 24 Form 217 (2A) of the Companys Act (HINC2170) Batch Program - DA Report (HINIDAB0) Batch Program for Section 80 (HINIS800) Batch Program for Section 88 (HINIS880) Professional Tax Report (HINCPTX0) Professional Tax Report for Mahrashtra (HINCPTX1) Form 6 and 7 for Employees' State Insurance Report (HINCESI0) Labour Welfare Fund Legal Reports (HINCLWF1) Status for claims Report (HINCREMS) Claims Carry Forward Balance Report (HINCREMC) Claims Balance Disbursement Report (HINCREMT) Claims Balance upload program (HINUUPCF) India specific Bonus calculation Report (HINCBON0) Loans Summary Report (HINCLON1) Batch Program for Penal Interest (Loans) Report (HINILON0) Termination Workbench Termination Workbench Definition Termination Transaction (PC00_M40_TERM) Termination Workbench Computations Gratuity Listing Report (HINCGRY0) Superannuation Report (HINCSAN0) Interface Toolbox for Human Resources (PX-XX-TL) Technology for Interface Scenarios Example 1: Export Master Data to an External System Example 2: Export Master Data and Payroll Results to External Sy Example 3: Gross Payroll in SAP System, Net Payroll in External Setting Up the Interface for Export with the Toolbox Data Export with the Toolbox Interface Format Create Objects Database Object Cluster Object Table Object Field Object

Creating an Interface Format Inserting a Field Object Delete Objects Deleting Objects Data Definition for Cluster Objects Changing or Displaying the Data Definition for a Cluster Object Table Entries Selecting Table Entries Conversion for Field Objects Constant Conversion Type Example: Replacing a Constant Generically Table Value Conversion Type Database Table Example: Replacing a Table Value User Exit Conversion Type Example: User Exit with Form Routine Selecting the Conversion for A Field Object Restrictions for Field Objects Creating Restrictions for a Field Object Attributes in the Interface Format Data Definition Include Creating an Include Automatically or Using an Existing Include Change Validation Comparison Period for Change Validation Setting the Comparison Period for Multiple Export Setting the Comparison Period for Retroactive Accounting Determination of Comparison Period Using First Method if New cha Determination of Comparison Period Using First Method if New cha Second Method for Setting the Comparison Period Create Objects Creating Objects Delimit Objects Example: Delimiting an Infotype Delimiting Objects Single Field Validation Example: Single Field Validation Validating Single Fields Key Fields Example: Key Fields Defining Key Fields Relations Example: Relations Between Field Objects Creating Relations

Wage types User-Defined Change Validation Naming Conventions for Export Data Example: Customer Program for Change Validation Activating User-Defined Change Validation Wage Type Processing with the Toolbox Wage Type Tables in the Interface Format Wage Type Selection in the Interface Format Structure of a Wage Type Wage Type Options for Retroactive Accounting Comparison Period for Wage Type Options in Retroactive Accountin In-Period Information / For-Period Information Example: Comparison Period for Wage Type Differences for Several Activating Wage Type Options for Retroactive Accounting Wage Types in Change Validation Change Validation and Wage Type Tables Change Validation and Wage Type Comparison Wage Types and Split Indicators Activating Wage Types for Change Validation Activating Wage Types for Change Validation Wage Type Delimitation for Change Validation Delimiting Wage Types for Change Validation Examples: Interaction of Wage Types and Wage Type Options for Re Example 1: Third-Party Payroll System Runs Retroactive Accountin Example 2: Third-Party Payroll System Runs Retroactive Accountin Example 3: Third-Party Payroll System Runs Retroactive Accountin Example 4: Third-Party Payroll System Runs Retroactive Accountin Example 5: Third-Party Payroll System Without Retroactive Accoun Example 6: Third-Party Payroll System Without Retroactive Accoun Generation - Interface Format for the Export Program Generating the Export Program Export Program Starting the Export Program Infotype: Export Status (0415) Export History for Interface Results Displaying the Interface Format Deleting Interface Results Automatic Conversion of Interface Results Manual Conversion of Interface Results Displaying TemSe Files Managing TemSe Files Downloading an Export File File Layout Processing the File Layout

Editing and Attributes for the File Layout User Exits and User-Defined Form Routines Constant Values as Input Parameters Interface Format Values as Input Parameters Interface Variables as Input Parameters Blocks in the File Layout User Exit Before (Block) User Exit After (Block) Structures in the File Layout User Exit Before (Structure) User Exit After (Structure) Field Functions in the File Layout Calling Specific Interface Data Interface Block Buffer Interface Format Data Access to Export Data in a User-Defined File Layout Structure Definition Creating a File Layout Generating the File Layout Generating the File Layout Conversion with the File Layout Converting a File Layout File Format of Export File (SAP Standard) Structure of an Export File Display Export Files Using Operator Blocks Operators for the Export File Begin Preamble BPR (01) / End Preamble (02) Begin Secondary Information BSC (17)/End Secondary Information E Begin Personnel Number BOP (05) / End Personnel Number EOP (06) Begin Payroll Period BPE (07) / End Payroll Period EPE (08) Begin Table BOT (09) / End Table EOT (0A) Begin Table Entry BOE (0B) / End Table Entry EOE (0C) Begin Field String BOF (0D) / End Field String EOF (0E) Begin Infotype BOI (0F) / End Infotype EOI (10) Begin Wage Type BOW (11) / End Wage Type EOW (12) Begin Postamble BPO (03) / End Postamble EPO (04) Display of Export File - Formatted Secondary Files Structure of the Secondary File (Formatted) Generation of Secondary File Generating the Secondary File Importing wage types Starting the Import

Вам также может понравиться

- Kindly Find The Complete Steps For Indian Payroll ConfigurationДокумент10 страницKindly Find The Complete Steps For Indian Payroll ConfigurationAmruta HanagandiОценок пока нет

- Basic Concepts: Payroll OverviewДокумент7 страницBasic Concepts: Payroll OverviewmohitОценок пока нет

- Financial Accounting - Configuration Steps in Order With Transport RequestДокумент19 страницFinancial Accounting - Configuration Steps in Order With Transport RequestmoorthykemОценок пока нет

- OM PA and Payroll Stepwise ConfigurationsДокумент11 страницOM PA and Payroll Stepwise Configurationsnalini saxenaОценок пока нет

- Wage Type PostingДокумент11 страницWage Type Postingrumadhan03Оценок пока нет

- Oracle R12 P2P Interview Preparation - by Dinesh Kumar SДокумент94 страницыOracle R12 P2P Interview Preparation - by Dinesh Kumar Sdineshcse86gmailcomОценок пока нет

- Define Company in Sap Group Company PDFДокумент5 страницDefine Company in Sap Group Company PDFNelson Karunakar DarlaОценок пока нет

- Oracle R12 Setup GuideДокумент2 страницыOracle R12 Setup GuideDivin joseОценок пока нет

- Oracle Apps Financial Functional R12 TrainingДокумент10 страницOracle Apps Financial Functional R12 TrainingMindMajix TechnologiesОценок пока нет

- What Is Company Code? & How To Define Company Code in SAPДокумент5 страницWhat Is Company Code? & How To Define Company Code in SAPmanthuОценок пока нет

- Define Company Code in SapДокумент5 страницDefine Company Code in Sapparamp12900100% (1)

- R12 ReportsДокумент176 страницR12 ReportsStacey BrooksОценок пока нет

- How To Assign Credit Control Area To Company Code in SapДокумент5 страницHow To Assign Credit Control Area To Company Code in SapJOHN BHARKLAY TIMAОценок пока нет

- InnovBase Features ListДокумент5 страницInnovBase Features ListHappy DealОценок пока нет

- SETUP LIST (Distribution& Manufacturing)Документ26 страницSETUP LIST (Distribution& Manufacturing)Tharmaraj MuralikrishnanОценок пока нет

- EIP FinanceДокумент88 страницEIP Financemurugakings2008100% (1)

- How To Create Retained Earnings Account in SAPДокумент5 страницHow To Create Retained Earnings Account in SAPkirankumar bhairiОценок пока нет

- Financial Accounting and Taxation Using TallyДокумент7 страницFinancial Accounting and Taxation Using TallySanjay KumarОценок пока нет

- Step Number Required StepДокумент2 страницыStep Number Required Stepsureshm984Оценок пока нет

- Tally Course Syllabus PDFДокумент8 страницTally Course Syllabus PDFकरण साळुंकेОценок пока нет

- Sap Fico Enterprise Structure:: Join Soft CorpДокумент5 страницSap Fico Enterprise Structure:: Join Soft CorpSandeep SinghОценок пока нет

- Elshayeboracler12purchasing 141118065305 Conversion Gate02Документ247 страницElshayeboracler12purchasing 141118065305 Conversion Gate02ashibekОценок пока нет

- Riesgos Sap GRCДокумент24 страницыRiesgos Sap GRCLeocadio23Оценок пока нет

- Sap HRДокумент36 страницSap HRanup20janОценок пока нет

- Sap Fico: Timings: Mode of Training: Course Duration: What We Offer: Class Duration: Server VersionДокумент4 страницыSap Fico: Timings: Mode of Training: Course Duration: What We Offer: Class Duration: Server VersionNikhil AgarwalОценок пока нет

- Fusiontech Fusion FinancialДокумент119 страницFusiontech Fusion Financialsiva_lord0% (2)

- Enterprise Structure: General LedgerДокумент5 страницEnterprise Structure: General LedgervikasbumcaОценок пока нет

- Sap-Fico Course Content: Erp Concepts General Ledger Accounting (GL)Документ2 страницыSap-Fico Course Content: Erp Concepts General Ledger Accounting (GL)kumar_3233Оценок пока нет

- Define Business Area in SapДокумент5 страницDefine Business Area in SapAMIT AMBREОценок пока нет

- How To Prepare A Cash Flow StatementДокумент8 страницHow To Prepare A Cash Flow Statementk4kazim100% (8)

- SAP Business One Key Features & FunctionalityДокумент3 страницыSAP Business One Key Features & FunctionalityRajendra LaddaОценок пока нет

- Sap Fi Accounts PayableДокумент91 страницаSap Fi Accounts PayableAnonymous 2AYQKfPn5oОценок пока нет

- Actvity and Transaction Codes For Sap Fico Module S.NoДокумент60 страницActvity and Transaction Codes For Sap Fico Module S.NoJitender DalalОценок пока нет

- Sap FicoДокумент119 страницSap FicoVijay PatoleОценок пока нет

- Order To CashДокумент18 страницOrder To CashVenkatesh GurusamyОценок пока нет

- AP Slide DownloadДокумент87 страницAP Slide DownloadNguyen HoaОценок пока нет

- There Are Two Target Groups That Use Information From Financial AccountingДокумент9 страницThere Are Two Target Groups That Use Information From Financial AccountingHari Chandan100% (1)

- Spro-Financial Accounting-Account Receivable & Account Payable-Vendor Accounts-Master Data-Preparation For Creating Vendor Master Data-Define Account Group With Screen Layout (Vendor)Документ6 страницSpro-Financial Accounting-Account Receivable & Account Payable-Vendor Accounts-Master Data-Preparation For Creating Vendor Master Data-Define Account Group With Screen Layout (Vendor)Anonymous 7CVuZbInUОценок пока нет

- Ar and ApДокумент3 страницыAr and ApTamal BiswasОценок пока нет

- FI CO ProcessesДокумент14 страницFI CO ProcessesShiОценок пока нет

- R12 Project Accounting SetupsДокумент183 страницыR12 Project Accounting SetupsmaddiboinaОценок пока нет

- Manual PDFДокумент828 страницManual PDFIzwan YusofОценок пока нет

- Oracle Financials Functional Modules Online TrainingДокумент10 страницOracle Financials Functional Modules Online TrainingEbs FinancialsОценок пока нет

- Topic 11 Audit of Payroll & Personnel CycleДокумент14 страницTopic 11 Audit of Payroll & Personnel Cyclebutirkuaci100% (1)

- High Level Setup For Accounts Payable (AP) On R12Документ3 страницыHigh Level Setup For Accounts Payable (AP) On R12gopii_mОценок пока нет

- SAP MM-Automatic Creation of Intercompany PO and Billing-2Документ26 страницSAP MM-Automatic Creation of Intercompany PO and Billing-2Rahul PillaiОценок пока нет

- 0242 1Документ2 страницы0242 1mpullareddyОценок пока нет

- SAP Paths and Transaction Codes For SAP FICO ConfigurationДокумент9 страницSAP Paths and Transaction Codes For SAP FICO ConfigurationPartho87Оценок пока нет

- Audit and Accounting UpdateДокумент4 страницыAudit and Accounting UpdateOConnor DaviesОценок пока нет

- Oracle Financials Functional Consultant TrainingДокумент6 страницOracle Financials Functional Consultant TrainingEbs FinancialsОценок пока нет

- R12 ReportsДокумент74 страницыR12 ReportsSravan DilseОценок пока нет

- Dynamics365for Financials PDFДокумент813 страницDynamics365for Financials PDFKakumanu Siva100% (1)

- Introduction To ERP, Advantages of SAP Over Other ERP PackagesДокумент5 страницIntroduction To ERP, Advantages of SAP Over Other ERP PackagesvishviОценок пока нет

- SAP Procure To PayДокумент13 страницSAP Procure To PayAfifa Ahsan JannatОценок пока нет

- What is Financial Accounting and BookkeepingОт EverandWhat is Financial Accounting and BookkeepingРейтинг: 4 из 5 звезд4/5 (10)

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursОт EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursОценок пока нет

- 108.3.3.3 Schedule Revisions at Request of Department:: Section 108: Prosecution and Progress Page 76Документ3 страницы108.3.3.3 Schedule Revisions at Request of Department:: Section 108: Prosecution and Progress Page 76Opata OpataОценок пока нет

- Nirma ProjectДокумент75 страницNirma ProjectRoshni Menezes0% (1)

- 100 - mgt503 Solved QuizzДокумент14 страниц100 - mgt503 Solved QuizzJAZZYBABAОценок пока нет

- Work Measurement: Work Study TIME STUDY (Direct Time Study & Activity Sampling) Job Design Principles of Motion StudyДокумент53 страницыWork Measurement: Work Study TIME STUDY (Direct Time Study & Activity Sampling) Job Design Principles of Motion StudyElisbeth MurugasОценок пока нет

- WOS-Paychex Direct Deposit Form 2014Документ1 страницаWOS-Paychex Direct Deposit Form 2014Anonymous 4aUlLdHl2Оценок пока нет

- Declaration Format PDFДокумент1 страницаDeclaration Format PDFmsl UNОценок пока нет

- Human Resource ManagementДокумент6 страницHuman Resource ManagementPranjal SrivastavaОценок пока нет

- The Year in US OHS Yearbook 2017Документ64 страницыThe Year in US OHS Yearbook 2017Celeste Monforton100% (2)

- BADM6020 Train&Dev Quiz Ch3 1Документ3 страницыBADM6020 Train&Dev Quiz Ch3 1Jasmin FelicianoОценок пока нет

- Department of Labor: ls-200Документ2 страницыDepartment of Labor: ls-200USA_DepartmentOfLaborОценок пока нет

- Summary of Steer and Rhodes Model On AbsenteeismДокумент9 страницSummary of Steer and Rhodes Model On Absenteeismjulie100% (4)

- Javier vs. Fly Ace CorporationДокумент13 страницJavier vs. Fly Ace CorporationKrister VallenteОценок пока нет

- Occupational Health and SafetyДокумент2 страницыOccupational Health and SafetyPamela Grace RamoranОценок пока нет

- Interview of HR ExecutiveДокумент10 страницInterview of HR Executivekavan sardaОценок пока нет

- Core HRMS Important TablesДокумент4 страницыCore HRMS Important TablesBalaji ShindeОценок пока нет

- Employee Benefits Literature Review and Emerging IДокумент19 страницEmployee Benefits Literature Review and Emerging IAMIT K SINGHОценок пока нет

- REPORTДокумент33 страницыREPORTshivamОценок пока нет

- A Study On The Recuitment and Selection AT Ivrcl Ifrastructure & Projects LTDДокумент82 страницыA Study On The Recuitment and Selection AT Ivrcl Ifrastructure & Projects LTDRama KrishnaОценок пока нет

- Organization ChartДокумент14 страницOrganization ChartUmarОценок пока нет

- HR Value DaveДокумент39 страницHR Value DaveLipika haldarОценок пока нет

- 19 - BPI Employees Union v. BPI - G.R. No. 178699. September 21, 2011Документ2 страницы19 - BPI Employees Union v. BPI - G.R. No. 178699. September 21, 2011Jesi CarlosОценок пока нет

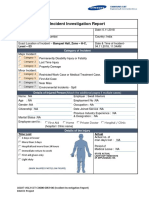

- Incident Investigation Report - Fire Incedent - 04-11-2018 Swati InteriorsДокумент4 страницыIncident Investigation Report - Fire Incedent - 04-11-2018 Swati InteriorsMobin Thomas AbrahamОценок пока нет

- Project On Employee SatisfactionДокумент113 страницProject On Employee SatisfactionDhanabalan S Chetty100% (3)

- New Health Insurance Scheme, 2016Документ2 страницыNew Health Insurance Scheme, 2016HanifОценок пока нет

- Project On ComplianceДокумент70 страницProject On Compliancerashmi wasnik100% (1)

- Standard Pre-Qualification Form (PQF) : General InformationДокумент7 страницStandard Pre-Qualification Form (PQF) : General InformationArash KamranОценок пока нет

- 10 Alano v. ECC DigestДокумент1 страница10 Alano v. ECC DigestJaysieMicabalo100% (1)

- HR Newsletter 07Документ2 страницыHR Newsletter 07api-520317260Оценок пока нет

- Dimension Meaning Example of Car: PerformanceДокумент2 страницыDimension Meaning Example of Car: PerformanceBELLY DANCEОценок пока нет