Академический Документы

Профессиональный Документы

Культура Документы

Chapter 2

Загружено:

Kate Wen GuanИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chapter 2

Загружено:

Kate Wen GuanАвторское право:

Доступные форматы

Chapter 2: The Recording Process The Account Account: individual accounting record of + and in a specific asset, liability, owners

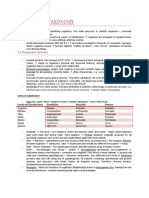

rs equity item. 3 parts: 1) title, 2) debit, 3) credit. E.g. a T account Debits and Credits Double-entry system: debit (left), credit (right): debits must equal credits in each transaction (dual, two sided). 1) logical method for recording transactions, 2) proves accuracy of recording amounts Normal Balance: every account has normal balance, and it helps you trace errors Assets: Debit +, Credit -, Normal Balance: Debit. (Abnormal balance in Cash: overdraft, deficit) Liabilities: Debit -, Credit +, Normal Balance: Credit Owners Capital: Debit -, Credit +, Normal Balance: Credit Drawings: Debit +, Credit -, Normal Balance: Debit Revenues: Debit -, Credit +, Normal Balance: Credit (identical to effect on owners capital) Expenses: Debit +, Credit -, Normal Balance: Debit Steps in the Recording Process 1. Analyze each transaction (evidence from business doc: sales slip, cheque) in terms of its effect on the accounts 2. Enter transaction info in a journal (book of original entry) 3. Transfer journal info to appropriate accounts in the ledger (book of accounts) Computerized accounting system: difference in entering + transferring info. Input+ processing of info file merging + report generation The Journal Book of original entry. Most companies have general journal Complete effect of a transaction (debits + credits) Chronological record of transactions Prevents + locates errors: DR and CR amounts can be compared Explains transactions + shows source document JOURNALIZING: entering transaction data in the journal Date, accounts and amounts, brief explanation General Journal J1 Date Account Titles and Explanation Ref. Debit Credit 2002 Cash 101 15000 Sept 1 M. Doucet, capital 301 15000 Invested Cash in the business. Space 1 Equipment 7000 Cash 7000 Purchased equipment for cash. Date: year, month, day Explanation: provides reference to source document Computerized systems: account name automatically inserted Use correct and specific titles Simple Entry: 2 accounts. Compound Entry: 3+ accounts. Ledger Entire group of accounts: 1 place with all info about changes in each account (summary of transactions + balance of each) General ledger: assets, liabilities, owners equity. Manual: loose-leaf binder or card file, each account on a separate sheet. Computerized: separate files Order: the way accounts are presented in financial statements. Numbered for identification Three-column form of account: debit, credit, balance (determined after every transaction). Explanation and reference columns (extra info) POSTING: transferring journal entries to ledger accounts Ledger: date, journal page, debit or credit amount from journal Reference column of journal: numbers show which entries have been posted, shows account numbers of accounts posted. Reference column of ledger: journal page Explanation: rarely used, because of journals explanation. Only for detailed analysis of activity Chronological order, postings made on timely basis (normally monthly)

Date 2002 Sept. 1 CHART OF ACCOUNTS First step of designing accounting system: framework for database of info: lists accounts + account numbers, identifying location in the ledger (differs for each enterprise, depending on necessary detail). E.g. 100-199 Assets, 200-299 Liabilities and Owners Equity, 300-399 Revenues, 400-599 Expenses The Recording Process Illustrated Transaction Analysis: purpose: identifying type of account involved, whether a debit/credit to account is required Transaction October 1, C.R. Byrd invests $10,000 cash in an advertising venture to be known as the Pioneer Advertising Agency. Basic The asset Cash is increased by $10,000, and owners equity item C.R. Byrd, Capital, is increased by Analysis $10,000. Debit/Credit Debits increase assets: debit Cash $10,000. Analysis Credits increase owners equity: credit C.R. Byrd, Capital $10,000. The Trial Balance list of accounts and balances at specific time prepared monthly, or end of each accounting period purpose: to prove/check that debits = credits. Can uncover mistakes + be used to prepare financial statements LIMITATIONS Situations where errors exist and the columns agree: 1. transaction is not journalized 2. correct journal entry is not posted 3. journal entry posted twice 4. incorrect amounts used in journalizing or posting 5. offsetting errors in recording amount of transaction LOCATING ERRORS 1. Error in amount like $1, $100, or $1000: recalculate trial balance columns, recalculate account balances 2. Error divisible by two: whether a balance equal to half the error has been entered in the wrong column 3. Error divisible by nine, retrace for transposition error (reversing order of numbers) 4. Error not divisible by two or nine: check if account balance in this amount has been omitted.

Computerized: occurs after each journal entry. Errors are detected + not processed until correction. Initial entries are looked at for subtle errors (such as abnormal account balances) Cash No.101 Explanation Ref. Debit Credit Balance J1 15,000 15000

Вам также может понравиться

- Chapter 10Документ6 страницChapter 10Kate Wen GuanОценок пока нет

- GAAPДокумент2 страницыGAAPKate Wen GuanОценок пока нет

- Chapter 13Документ7 страницChapter 13Kate Wen GuanОценок пока нет

- Chapter 14Документ7 страницChapter 14Kate Wen GuanОценок пока нет

- Chapter 6Документ5 страницChapter 6Kate Wen GuanОценок пока нет

- Chapter 12Документ2 страницыChapter 12Kate Wen GuanОценок пока нет

- Chapter 14Документ3 страницыChapter 14Kate Wen Guan100% (1)

- Accounting Chapter 5 BEДокумент1 страницаAccounting Chapter 5 BEKate Wen GuanОценок пока нет

- Chapter 9Документ4 страницыChapter 9Kate Wen GuanОценок пока нет

- Chapter 3Документ3 страницыChapter 3Kate Wen GuanОценок пока нет

- Chapter 5Документ5 страницChapter 5Kate Wen GuanОценок пока нет

- Chapter 2Документ8 страницChapter 2Kate Wen GuanОценок пока нет

- Chapter 13Документ11 страницChapter 13Kate Wen GuanОценок пока нет

- Chapter 1 QuestionsДокумент2 страницыChapter 1 QuestionsKate Wen GuanОценок пока нет

- Hapter Igestion and Utrition: 6.1 Organs and Organ SystemsДокумент5 страницHapter Igestion and Utrition: 6.1 Organs and Organ SystemsKate Wen GuanОценок пока нет

- Chapter 10Документ9 страницChapter 10Kate Wen GuanОценок пока нет

- Chapter 11Документ2 страницыChapter 11Kate Wen GuanОценок пока нет

- Chapter 7Документ4 страницыChapter 7Kate Wen GuanОценок пока нет

- Chapter 8 ReviewДокумент3 страницыChapter 8 ReviewKate Wen GuanОценок пока нет

- Chapter 9Документ10 страницChapter 9Kate Wen GuanОценок пока нет

- Chapter 4Документ6 страницChapter 4Kate Wen GuanОценок пока нет

- Chapter 5Документ6 страницChapter 5Kate Wen GuanОценок пока нет

- Chapter 3Документ9 страницChapter 3Kate Wen GuanОценок пока нет

- Chapter 7 QuestionsДокумент7 страницChapter 7 QuestionsKate Wen GuanОценок пока нет

- Hapter Igestion and Utrition: 6.1 Organs and Organ SystemsДокумент5 страницHapter Igestion and Utrition: 6.1 Organs and Organ SystemsKate Wen GuanОценок пока нет

- Chapter 1Документ3 страницыChapter 1Kate Wen Guan50% (2)

- Biology Exam ReviewДокумент8 страницBiology Exam ReviewKate Wen Guan100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- KWW 12thed Ch21 LeasesДокумент53 страницыKWW 12thed Ch21 LeasesRoss RickОценок пока нет

- Bankers Digest 2016 PDFДокумент158 страницBankers Digest 2016 PDFArun B100% (1)

- Spec Report eДокумент14 страницSpec Report eSt. Catharines StandardОценок пока нет

- Loan Covenants Examples: Holly Magister, CPA, CFPДокумент11 страницLoan Covenants Examples: Holly Magister, CPA, CFPDotse BlessОценок пока нет

- LeverageДокумент8 страницLeverageKalam SikderОценок пока нет

- Barclays Securitized Products Weekly Looking Past The EM ContagionДокумент44 страницыBarclays Securitized Products Weekly Looking Past The EM ContagiondhyakshaОценок пока нет

- Numerus ClaususДокумент5 страницNumerus ClaususVasile SoltanОценок пока нет

- Fonderia Torino Solution 2Документ4 страницыFonderia Torino Solution 2Marco ArnaldiОценок пока нет

- Working Capital MGTДокумент68 страницWorking Capital MGTSidd MishraОценок пока нет

- Commercial Mortgage Broker Leads ListДокумент102 страницыCommercial Mortgage Broker Leads ListMalik UzairОценок пока нет

- Importance of Classification of PropertiesДокумент1 страницаImportance of Classification of PropertiesTristan U. Adviento100% (1)

- HyperinflationДокумент10 страницHyperinflationHarvey Dienne Quiambao75% (8)

- SH Group Members in Tirunelveli DistrictДокумент9 страницSH Group Members in Tirunelveli Districtasir39Оценок пока нет

- Chamber Business Magazine 2018 - 4th QuarterДокумент16 страницChamber Business Magazine 2018 - 4th QuarterCadillac Area Chamber of CommerceОценок пока нет

- MCQ On Financial ManagementДокумент23 страницыMCQ On Financial Managementsvparo0% (1)

- FM ProjectДокумент10 страницFM ProjectriyapantОценок пока нет

- Retirement WithdrawalДокумент18 страницRetirement WithdrawalShekinahОценок пока нет

- PNB v. Sta. MariaДокумент2 страницыPNB v. Sta. MariaElle MichОценок пока нет

- The Burma Stamp ActДокумент15 страницThe Burma Stamp Actnyan-linn-aung-8693Оценок пока нет

- Research Essay Cs FinalДокумент13 страницResearch Essay Cs Finalapi-519794514Оценок пока нет

- Citizen's CharterДокумент5 страницCitizen's Charteromerremo2010Оценок пока нет

- Train Law Excise Tax 1Документ29 страницTrain Law Excise Tax 1Assuy AsufraОценок пока нет

- IFRS 9 - ECL ModelДокумент38 страницIFRS 9 - ECL ModelAntreas Artemiou50% (2)

- Dairy Farm Project Report - Buffalo (Large Scale)Документ2 страницыDairy Farm Project Report - Buffalo (Large Scale)VIJAYJKОценок пока нет

- (l6) Corporate Financial Management2015Документ22 страницы(l6) Corporate Financial Management2015Moses Mvula100% (2)

- As-Is Report 1 Organization StructureДокумент33 страницыAs-Is Report 1 Organization StructureBijay AgarwalОценок пока нет

- A Global View of Business Insolvency SystemsДокумент319 страницA Global View of Business Insolvency Systemsluuliitaa100% (1)

- Business Finance12 Q3 M4Документ20 страницBusiness Finance12 Q3 M4Chriztal TejadaОценок пока нет

- International Financial Management: Hedging Foreign Exchange RiskДокумент51 страницаInternational Financial Management: Hedging Foreign Exchange RiskNassir CeellaabeОценок пока нет

- Charges Upon Obligations of Absolute Community Property (ACP) and Conjugal Property of Gains (CPG)Документ13 страницCharges Upon Obligations of Absolute Community Property (ACP) and Conjugal Property of Gains (CPG)Bianca de GuzmanОценок пока нет