Академический Документы

Профессиональный Документы

Культура Документы

5 1

Загружено:

oldhillbillyИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

5 1

Загружено:

oldhillbillyАвторское право:

Доступные форматы

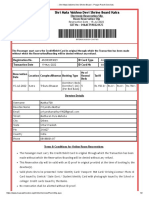

12-12553-jmp

Doc 5-1 Filed 06/15/12 Entered 06/15/12 12:04:25

Schedule of Unpaid Wages Pg 1 of 1

Exhibit

NEW YORK

Last Name

G&A

Johnson

Lennon

G&A

First

Amy

Patrick

TOTAL

Function

HR

Accountant

Annualized Salary

$

$

89,000 $

68,000 $

Daily rate

Regular (June

1-15)

342 $

262 $

$

3,708.33

2,833.33

6,542

PTO Hrs

9 $

0 $

9

Hourly

Rate

Employer

PTO Payout Social Security

taxes

43 $

33 $

$

385.10 $

$

385 $

Employer

Medicare

taxes

253.79 $

175.67 $

429 $

Total

Employer

taxes

59.36 $

41.08 $

100 $

Total Payroll

(US)

313.15 $

216.75 $

530 $

4,406.58

3,050.08

7,456.66

CANADA

Last Name

SUBSCRIPTION

Sanford

SUBSCRIPTION

First

Timothy

TOTAL

Function

Annualized Salary

60,000 $

Daily rate

Regular (June

1-15)

231 $

$

2,500

2,500

PTO Hrs

3 $

3

Hourly

Rate

PTO Payout

29 $

Employer CPP Employer EI

taxes

taxes

86.54 $

87

116.53 $

Total

Employer

taxes

66.26 $

182.79 $

183

Total fees

Total

Payroll

(CAD)

112.99 $ 2,882.32

113

2,882.32

Вам также может понравиться

- 12-12553-jmp Doc 49Документ2 страницы12-12553-jmp Doc 49oldhillbillyОценок пока нет

- 12-12553-jmp Doc 11Документ135 страниц12-12553-jmp Doc 11oldhillbillyОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Brian Blankenship Vs TD Ameritrade Case 13-cv-08048 Document 8 Filed 05-16-13Документ10 страницBrian Blankenship Vs TD Ameritrade Case 13-cv-08048 Document 8 Filed 05-16-13oldhillbillyОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Atrinsic BK Doc 75Документ170 страницAtrinsic BK Doc 75oldhillbillyОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- 8 2Документ6 страниц8 2oldhillbillyОценок пока нет

- 12-12553-jmp Doc 13Документ21 страница12-12553-jmp Doc 13oldhillbillyОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- 24 1Документ19 страниц24 1oldhillbillyОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- 12-12553-jmp Doc 46Документ39 страниц12-12553-jmp Doc 46oldhillbillyОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Atrinsic, Inc. Disclosure Statement Exhibits B and C: To Be Filed at A Later DateДокумент1 страницаAtrinsic, Inc. Disclosure Statement Exhibits B and C: To Be Filed at A Later DateoldhillbillyОценок пока нет

- 12-12553-jmp Doc 12Документ3 страницы12-12553-jmp Doc 12oldhillbillyОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- 24Документ54 страницы24oldhillbillyОценок пока нет

- 8 1Документ7 страниц8 1oldhillbillyОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- 12-12553-jmp Doc 23Документ19 страниц12-12553-jmp Doc 23oldhillbillyОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- 12-12553-jmp Doc 44 Filed 081712Документ14 страниц12-12553-jmp Doc 44 Filed 081712oldhillbillyОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- 12-12553-jmp Doc 14Документ2 страницы12-12553-jmp Doc 14oldhillbillyОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- 12-12553-jmp Doc 11Документ135 страниц12-12553-jmp Doc 11oldhillbillyОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- 12-12553-jmp Doc 7Документ4 страницы12-12553-jmp Doc 7oldhillbillyОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- 8Документ11 страниц8oldhillbillyОценок пока нет

- 12-12553-jmp Doc 9Документ3 страницы12-12553-jmp Doc 9oldhillbillyОценок пока нет

- ATRN Main DocumentДокумент52 страницыATRN Main Documentjballauer2139Оценок пока нет

- Capitalized Terms Not Otherwise Defined Herein Shall Have The Meanings Ascribed To Such Terms in The ApplicationДокумент4 страницыCapitalized Terms Not Otherwise Defined Herein Shall Have The Meanings Ascribed To Such Terms in The ApplicationoldhillbillyОценок пока нет

- 12-12553-jmp Doc 10Документ3 страницы12-12553-jmp Doc 10oldhillbillyОценок пока нет

- Proposed Attorneys For The Debtor and Debtor-in-PossessionДокумент11 страницProposed Attorneys For The Debtor and Debtor-in-PossessionoldhillbillyОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Capitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionДокумент3 страницыCapitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionoldhillbillyОценок пока нет

- Exhibit Exhibit A Loan Documents Pt. 5Документ18 страницExhibit Exhibit A Loan Documents Pt. 5oldhillbillyОценок пока нет

- Exhibit Exhibit A Loan Documents Pt. 4Документ68 страницExhibit Exhibit A Loan Documents Pt. 4oldhillbillyОценок пока нет

- Exhibit Exhibit A Loan Documents Pt. 3Документ42 страницыExhibit Exhibit A Loan Documents Pt. 3oldhillbillyОценок пока нет

- Exhibit Exhibit A Loan Documents PT 1Документ42 страницыExhibit Exhibit A Loan Documents PT 1oldhillbillyОценок пока нет

- Exhibit Exhibit A Loan Documents Pt. 2Документ42 страницыExhibit Exhibit A Loan Documents Pt. 2oldhillbillyОценок пока нет

- ELP-L8 - Performance Task 1bДокумент6 страницELP-L8 - Performance Task 1bWilhelm Ritz Pardey RosalesОценок пока нет

- Abortion in The Philippines-Reasons and ResponsibilitiesДокумент10 страницAbortion in The Philippines-Reasons and ResponsibilitiesAileen Grace Delima100% (60)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Sango bh.0Документ11 страницSango bh.0rayyanrashid.neОценок пока нет

- CRIMMINAL LAW II - TITLE 4 (AutoRecovered)Документ9 страницCRIMMINAL LAW II - TITLE 4 (AutoRecovered)Alexa Neri ValderamaОценок пока нет

- Up2020 - LTDДокумент36 страницUp2020 - LTDCG100% (1)

- Ethical Nursing Practice: An IntroductionДокумент5 страницEthical Nursing Practice: An IntroductionFOOTBALL IQОценок пока нет

- Revised Annex A for LGBT CoalitionДокумент1 страницаRevised Annex A for LGBT CoalitionJohn Marc FortugalizaОценок пока нет

- BFP Invitation Letter TemplateДокумент21 страницаBFP Invitation Letter TemplateJeremy Gardose AtanacioОценок пока нет

- Preliminary InjunctionДокумент6 страницPreliminary InjunctionThe Salt Lake TribuneОценок пока нет

- Land Subdivision Rules & RegulationsДокумент23 страницыLand Subdivision Rules & RegulationsAl Patrick Dela CalzadaОценок пока нет

- Globalization Has Renovated The Globe From A Collection of Separate Communities InteractingДокумент11 страницGlobalization Has Renovated The Globe From A Collection of Separate Communities InteractingVya Lyane Espero CabadingОценок пока нет

- Charge GSTДокумент70 страницCharge GSTHARSHОценок пока нет

- Special Power of Attorney For TitlingДокумент3 страницыSpecial Power of Attorney For TitlingGladys Ann A. Donato100% (1)

- Tax Invoice Cum Delivery ChallanДокумент1 страницаTax Invoice Cum Delivery Challanranjitbhakta100% (1)

- Punjab Courts Act 1918Документ24 страницыPunjab Courts Act 1918Taran Saini0% (1)

- Jo Roby Statement of HarmДокумент13 страницJo Roby Statement of HarmMichael_Lee_RobertsОценок пока нет

- Civil Bureaucracy and Democracy in Pakistan: Do They Mutually Co-Exist?Документ11 страницCivil Bureaucracy and Democracy in Pakistan: Do They Mutually Co-Exist?sadia khan SultaniОценок пока нет

- p158.01 LTR SPML Simi L-s1Документ2 страницыp158.01 LTR SPML Simi L-s1Kadi MagdiОценок пока нет

- The Champion Legal Ads 10-01-20Документ39 страницThe Champion Legal Ads 10-01-20Donna S. SeayОценок пока нет

- Forensic and Investigative Accounting Module 1Документ18 страницForensic and Investigative Accounting Module 1Jhelson SoaresОценок пока нет

- Standard Catalog of Provincial Banknotes of England & WalesДокумент538 страницStandard Catalog of Provincial Banknotes of England & WalesAumair Malik100% (2)

- Rig Com StationДокумент4 страницыRig Com StationCristof Naek Halomoan TobingОценок пока нет

- Intermediate: Level 2Документ5 страницIntermediate: Level 2Abdou NianeОценок пока нет

- Case 2 QuestionsДокумент3 страницыCase 2 QuestionsIqra AliОценок пока нет

- Municipal Court Documents in Falsification CaseДокумент11 страницMunicipal Court Documents in Falsification CaseJaime Gonzales100% (1)

- Enterprise Risk Management (ERM)Документ2 страницыEnterprise Risk Management (ERM)Amir Asraf Yunus100% (2)

- Antolin Vs DomondonДокумент4 страницыAntolin Vs DomondonRon AceОценок пока нет

- Cost WaiveДокумент3 страницыCost WaiveRimika ChauhanОценок пока нет

- Shri Mata Vaishno Devi Shrine Board - Poojan Parchi Services 2Документ1 страницаShri Mata Vaishno Devi Shrine Board - Poojan Parchi Services 2Shreyash mathurОценок пока нет

- Movie Analysis of Ek-Ruka-Hua-FaislaДокумент13 страницMovie Analysis of Ek-Ruka-Hua-FaislaPriyanshu SharmaОценок пока нет