Академический Документы

Профессиональный Документы

Культура Документы

Proposed Attorneys For The Debtor and Debtor-in-Possession

Загружено:

oldhillbillyИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Proposed Attorneys For The Debtor and Debtor-in-Possession

Загружено:

oldhillbillyАвторское право:

Доступные форматы

12-12553-jmp

Doc 5

Filed 06/15/12

Entered 06/15/12 12:04:25 Pg 1 of 11

Main Document

RATTET PASTERNAK, LLP Proposed Attorneys for the Debtor and Debtor-in-Possession 550 Mamaroneck Avenue Harrison, New York 10528 Tel. (914) 381-7400 Fax. (914) 381-7406 JONATHAN S. PASTERNAK, ESQ. ERICA R. FEYNMAN, ESQ. UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK In re: ATRINSIC, INC., Debtor. : : : : : : : Chapter 11 Case No. 12-12553

MOTION OF THE DEBTOR FOR AN ORDER (A) AUTHORIZING THE DEBTOR TO (1) PAY AND HONOR CERTAIN PREPETITION CLAIMS FOR (I) WAGES, SALARIES, EMPLOYEE BENEFITS AND OTHER COMPENSATION AND (II) WITHHOLDINGS AND DEDUCTIONS; (2) CONTINUE TO PROVIDE EMPLOYEE BENEFITS IN THE ORDINARY COURSE OF BUSINESS; (3) PAY ALL RELATED COSTS AND EXPENSES; AND (B) DIRECTING BANKS TO RECEIVE, PROCESS, HONOR AND PAY ALL CHECKS PRESENTED FOR PAYMENT AND ELECTRONIC PAYMENT REQUESTS RELATED TO THE FOREGOING

TO:

UNITED STATES BANKRUPTCY JUDGE:

1.

Atrinsic Inc., the above-captioned debtor and debtor-in-possession (the Debtor),

by its proposed attorneys, Rattet Pasternak, LLP hereby submits this motion (the Motion) for authority to, inter alia, (1) pay and honor certain prepetition claims for (i) wages, salaries, employee benefits and other compensation and (ii) withholdings and deductions; (2) continue to provide employee benefits in the ordinary course of business; (3) pay all related costs and expenses; and (B) directing banks to receive, process, honor and pay all checks presented for

12-12553-jmp

Doc 5

Filed 06/15/12

Entered 06/15/12 12:04:25 Pg 2 of 11

Main Document

payment and electronic payment requests related to the foregoing. In support of this Motion, the Debtor respectfully states as follows: JURISDICTION 2. The Court has jurisdiction over this Motion under 28 U.S.C. 157 and 1334.

This matter is a core proceeding within the meaning of 28 U.S.C. 157(b)(2). Venue of this proceeding and this Motion in this District is proper under 28 U.S.C. 1408 and 1409. 3. The statutory bases for the

relief

requested herein are sections 105(a), 363(b),

507(a)(3) and 507(a)(4) of title 11 of the United States Code, 11 U.S.C. 101, et seq. (the Bankruptcy Code). BACKGROUND 4. On June 15, 2012 (the Filing Date), the Debtor filed a voluntary petition for

reorganization pursuant to Chapter 11 of the Bankruptcy Code (the Chapter 11 Case). 5. Thereafter the instant proceedings were referred to your Honor for administration

under the Bankruptcy Code. 6. The Debtor has continued in possession of its property and the management of its

business affairs as a debtor-in-possession pursuant to 1107(a) and 1108 of the Bankruptcy Code. No trustee, examiner or statutory committee has been appointed. 7. The Debtor is a publicly-traded corporation, traded on the over-the-counter

bulletin board under the ticker symbol ATRN, organized under the laws of the State of Delaware, with its principal place of business located at 469 Seventh Avenue, 10th Floor, New York, New York 10018. 8. Prior to the Petition Date, the Debtor had two (2) primary business units:

subscription services (Subscription Services) and transactional services (Transactional

12-12553-jmp

Doc 5

Filed 06/15/12

Entered 06/15/12 12:04:25 Pg 3 of 11

Main Document

Services). 9. The Debtors Subscription Services segment derived revenue from monthly

subscription services consisting of music content and other services as the (then) exclusive U.S. licensee of the Kazaa subscription music streaming program, which license has since been terminated. The Subscription Services segment also includes certain services for the mobile phone market, including ringtones and smartphone applications. 10. The Debtors Transactional Services segment was a full-service marketing agency

known as Atrinsic Interactive which offered advertisers an integrated service across paid search, SEO (search engine optimization), display, affiliate marketing, business intelligence and brand protection services. 11. As of the Petition Date, both the Subscription Services and the Transactional

Services have ceased all operations.

RELIEF REQUESTED 12. At present, the Debtor employs 3 employees, a human resources administrator, an

accountant and an information technology specialist (the Employees).1 13. The Employees are critical to the successful orderly wind down of the Debtor as

they are essential to the Debtors continued day to day operations. Specifically, the Employees perform a variety of critical functions, including operation of critical systems, accounting, bookkeeping and wind down of all personal related matters. 14. In order to minimize the personal hardship that the Employees will suffer if

prepetition employee-related obligations are not paid when due, and to maintain morale and an

The Debtors Chief Restructuring Officer (CRO), employed via a consulting agreement and its Controller, employed on a part-time contractual basis through Robert Half (employment agency) are consultants and the Debtor is not seeking authority to pay any pre-petition wages or fees in connection with their employment.

1

12-12553-jmp

Doc 5

Filed 06/15/12

Entered 06/15/12 12:04:25 Pg 4 of 11

Main Document

essential workforce during this critical time, the Debtor hereby seeks authority, in its discretion, to pay and honor certain prepetition claims for, among other items, wages, salaries and other compensation, federal and state withholding taxes and other amounts withheld (e.g., garnishments, Employees share of insurance premiums, and taxes), Employee health benefits2, insurance benefits, workers compensation benefits, vacation time and all other Employee benefits that the Debtor has historically provided in the ordinary course of business (collectively, and as more fully described in this Motion, the Wages and Benefits), and to pay all fees and costs incident to the foregoing, including amounts to third-party administrators. 15. In addition, the Debtor seeks authority to modify, change and discontinue any of

the Wages and Benefits, as well as any other employment related policies, wages or benefits in the ordinary course of business during this Chapter 11 case, in its discretion, without the need for further Court approval. 16. Finally, the Debtor requests that banks and other financial institutions be

authorized and directed to receive, process, honor and pay all checks presented for payment and electronic payment requests related to the foregoing. I. EMPLOYEE COMPENSATION A. Unpaid Compensation. 17. The Debtors approximate bi-weekly compensation for Employees is

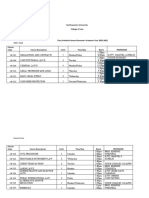

approximately $10,000. The total amount that the Debtor seeks authority to pay is $7,456.66 for its domestic Employees and $2,882.32 (Canadian Dollars) (equal to approximately $2,799.89 USD) for its one Canadian employee (the Unpaid Compensation). This amount covers one complete two week payroll which period closed on June 15, 2012, the Petition Date. A schedule

2

The Debors health care premium for June, 2012 was paid in May, 2012 and is effective through June 30, 2012. The Debtor does not expect to continue its health care coverage beyond that time however, it reserves the right to continue such coverage if it determines, in its business judgment, to do so.

12-12553-jmp

Doc 5

Filed 06/15/12

Entered 06/15/12 12:04:25 Pg 5 of 11

Main Document

detailing the Unpaid Compensation is annexed hereto as Exhibit A. 18. There are no Employees who have Unpaid Compensation as of the Petition Date

that exceed the $11,725 priority cap contained in 507(a)(4) of the Bankruptcy Code. 19. For the reasons discussed below, the Debtor is requesting authority to pay such

Unpaid Compensation claims. B. Continued Remittance and Payment of Payroll Deductions. 20. In connection with the payment of Wages and Benefits to Employees, the Debtor

routinely deducts certain amounts from paychecks, including, without limitation, direct banking deposits, payments, pre and post-tax deductions (collectively, the Deductions). In most instances, the Debtor then forwards these Deductions to various third-parties. 21. Due to the commencement of the Chapter 11 Case, certain funds which were

deducted from Employees earnings may not have been forwarded to the appropriate third-party recipients prior to the Petition Date. Accordingly, the Debtor seeks authority, in its discretion, to continue to forward these prepetition Deductions (which the Debtor holds in trust and does not believe constitute property of the Debtors estate) to the applicable third-party recipients on a postpetition basis, in the ordinary course of business, as routinely done prior to the Petition Date. 22. The Debtor is also required to withhold certain federal, state and local income

taxes, social security, Medicare taxes and other amounts from their Employees wages for remittance, along with certain required employer contributions, to the proper taxing authority (Payroll Taxes). 23. Before the Petition Date, the Debtor withheld amounts from Employees earnings

for the Payroll Taxes, but such funds may not have been forwarded to the appropriate taxing authorities prior to the Petition Date. The Debtor seeks authority, in its discretion, to continue to

12-12553-jmp

Doc 5

Filed 06/15/12

Entered 06/15/12 12:04:25 Pg 6 of 11

Main Document

honor and process the prepetition obligations with respect to the Payroll Taxes on a postpetition basis, in the ordinary course of business, as routinely done prior to the Petition Date. II. EMPLOYEE BENEFITS 24. The Debtor has established various plans and policies to provide its Employees

with health benefits, insurance coverage and other important benefits in the ordinary course of business. It is crucial that the Debtor be able to continue to provide these benefits to the Employees and the Employees rely on the provision of benefits as an incident of their employment. Disruption to the provision of benefits could cause the loss of critical Employees on which the Debtor relies. A. Health Benefits 25. Specifically, the Debtor provides certain Employees with health benefits,

including medical coverage (Health Benefits). 26. By this Motion, the Debtor seeks authority, in its discretion, to (a) continue the

Health Benefits for its Employees in the ordinary course of business on a postpetition basis, (b) modify its prepetition policies related thereto as they deem appropriate, (c) continue making the above-described contributions to such Health Benefits programs, (d) continue to pay fees of third-party administrators, including, but not limited to ERISA compliance, as necessary and (e) pay any amounts related thereto, including any premiums and claim amounts that (i) accrued prepetition and (ii) accrued postpetition but related to the prepetition period. B. Vacation Time 27. The Debtor provides vacation time to all full-time Employees (Vacation Time),

which varies based on the Employees location, position and seniority. Vacation Time for Employees is accrued based on time worked and years of service, and when used, Employees are

12-12553-jmp

Doc 5

Filed 06/15/12

Entered 06/15/12 12:04:25 Pg 7 of 11

Main Document

paid at their regular hourly or salaried rates. Employees may be paid for their unused Vacation Time. 28. By this Motion, the Debtor seeks authority, in its discretion, to (a) continue to

honor its Vacation Time policies in the ordinary course of business, (b) modify their prepetition policies related thereto as they deem appropriate and (c) honor and pay any obligations related thereto that (i) accrued prepetition and (ii) accrued postpetition but related to the prepetition period. BASIS FOR RELIEF A. Ample Cause Exists For the Court to Authorize the Debtor to Pay Employee Wages and Honor Employee Benefits Programs.

29.

Pursuant to 363(b) and 105(a) of the Bankruptcy Code, the Debtor seeks

authority to continue its Wages and Benefits policies and programs on a postpetition basis, and to pay all of its obligations owed thereunder in the ordinary course of business as of the Filing Date, without regard to whether such obligations accrued before or after the Filing Date. 30. Courts in this district have routinely granted the relief requested herein. See, e.g.,

In re Dana Corp., Case No. 06-10354 (BRL) (Bankr. S.D.N.Y. March 3, 2006); In re Musicland Holding Corp., Case No. 06-10064 (SMB) (Bankr. S.D.N.Y. Feb. 1, 2006); In re Calpine Corp., Case No. 05-60200 (BRL) (Bankr. S.D.N.Y. Dec. 21, 2005); In re Delphi Corp., Case No. 0544481 (RDD) (Bankr. S.D.N.Y. Oct. 13, 2005); In re Delta Air Lines, Case No. 05- 17923 (PCB) (Bankr. S.D.N.Y. Sept. 16, 2005). 31. 105(a) of the Bankruptcy Code provides that [t]he court may issue any order,

process, or judgment that is necessary or appropriate to carry out the provisions of this title. 11 U.S.C. 105(a). 105(a) is frequently cited as a basis to authorize the relief sought herein. See,

12-12553-jmp

Doc 5

Filed 06/15/12

Entered 06/15/12 12:04:25 Pg 8 of 11

Main Document

In re Chateaugay Corp., 80 B.R. 279, 287 (S.D.N.Y. 1987) (affirming a bankruptcy court order authorizing the debtor to pay prebankruptcy wages, salaries, employee benefits, reimbursements and workers compensation claims and premiums). 32. The Court may also grant the relief requested herein pursuant to 363 of the

Bankruptcy Code which provides that [t]he trustee, after notice and a hearing, may use, sell, or lease, other than in the ordinary course of business, property of the estate. 11 U.S.C. 363(b)(1). In order to do so, the debtor must articulate some business justification, other than the mere appeasement of major creditors, In re Ionosphere Clubs, Inc., 98 B.R. at 175. Here, the Debtor has a significant workforce on which they rely heavily. Payment of the Wages and Benefits to the Employees is critical in order to maintain its workforce and move towards a successful reorganization. 33. This Court and other courts have authorized debtors to pay certain prepetition

claims pursuant to 363 of the Bankruptcy Code. See, In re Dana Corp., Case No. 06-10354 (BRL); In re Calpine Corp., Case No. 05-60200 (BRL). 34. The Debtor submits that grounds exist to grant the request to pay prepetition

amounts related to Wages and Benefits policies and programs. 35. The Debtor also believes that the all of the amounts related to Wages and Benefits

that it seeks to pay pursuant to this Motion are entitled to priority status under 507(a)(4) and 507(a)(5) of the Bankruptcy Code and do not exceed $11,725 for any individual Employee. As such, the Debtor is required to pay these claims in full to confirm a plan of reorganization. See 11 U.S.C. 1129(a)(9)(B) (requiring payment of certain allowed priority claims for wages, salaries, and commissions, and certain allowed unsecured claims for contributions to an employee benefit plan).

12-12553-jmp

Doc 5

Filed 06/15/12

Entered 06/15/12 12:04:25 Pg 9 of 11

Main Document

36.

Accordingly, granting the relief sought herein would only affect the timing, and

not the amount, of the payment with respect to the Wages and Benefits. 37. The Debtors request for authorization to continue to honor and remit Deductions,

Payroll Taxes and other Withheld Amounts should also be approved. Such amounts principally represent Employee earnings that governments (in the case of taxes), Employees (in the case of voluntarily withheld amounts) and judicial authorities (in the case of involuntarily withheld amounts) have designated for deduction from Employees paychecks. The failure to pay these benefits could result in hardship to certain Employees as well as administrative problems for the Debtor. 38. Additionally, the failure to remit Payroll Taxes and other Withheld Amounts may

subject the Debtor and its directors and officers to federal or state liability. Furthermore, because such funds do not constitute property of the Debtors estate, the funds are not subject to the normal bankruptcy prohibitions against payment. 39. The Debtor therefore requests authority to transmit such withheld amounts to the

proper parties and authorities in the ordinary course of business. 40. Finally, the Debtor does not to seek to assume any executory contracts or

obligations at this time, and therefore, nothing contained in this Motion should be deemed to be an assumption or adoption of any policy, procedure or executory contract that may be described or referenced herein. Also, the Debtor will retain the discretion to not make the payments contemplated by this Motion for particular Employees, and nothing in this Motion will, in and of itself, constitute a promise or guarantee of any payment to any Employee. B. The Court Should Authorize the Debtors Financial Institutions to Honor Checks and Electronic Fund Transfers Related to Employee Wages and Benefits.

12-12553-jmp

Doc 5

Filed 06/15/12

Entered 06/15/12 12:04:25 Pg 10 of 11

Main Document

41.

The Debtor further requests that all applicable banks and other financial

institutions be authorized and directed to receive, process, honor and pay all checks presented for payment, and to honor all fund transfer requests made by the Debtor relating to the Wages and Benefits policies and programs, whether such checks were presented or fund transfer requests were submitted prior to or after the Petition Date. 42. For the foregoing reasons, the Debtor believes that granting the relief requested

herein is appropriate and in the best interests of all parties in interest. RESERVATION OF RIGHTS 43. Notwithstanding anything in this Motion or the Order to the contrary, the payment

of any claims pursuant to the Order (if entered by the Court) and other honoring of the Employee Wages and Benefit claims shall neither (i) make such obligations administrative expenses of the estates entitled to priority status under 503 and 507 of the Bankruptcy Code nor (ii) constitute approval by this Court of any employee plan or program under any section of the Bankruptcy Code, including 503(c). Also, the extent the Debtor seeks to assume any employee programs, prior to the confirmation of any plan of reorganization, the Debtor will seek such assumption by separate motion. NOTICE 44. This Motion will be served on notice to all parties asserting secured claims

against the Debtor, and all other parties entitled to notice pursuant to Bankruptcy Rule 4001(d) and in accordance with the Order Scheduling Hearing on Shortened Notice.

45.

WHEREFORE, the Debtor respectfully requests that the Court enter an Order,

(A) authorizing, but not directing, the Debtor to (1) pay and honor certain prepetition claims for

10

12-12553-jmp

Doc 5

Filed 06/15/12

Entered 06/15/12 12:04:25 Pg 11 of 11

Main Document

(i) wages, salaries, employee benefits and other compensation and (ii) withholdings and deductions (2) continue to provide employee benefits in the ordinary course of business; (3) pay all related costs and expenses; (B) directing banks to receive, process, honor and pay all checks presented for payment and electronic payment requests related to the foregoing; and (C) granting such other and further relief as the Court deems appropriate.

Dated: Harrison, New York June 15, 2012 RATTET PASTERNAK, LLP Proposed Attorneys for the Debtor 550 Mamaroneck Avenue Harrison, New York 10528 (914) 381-7400

By: /s/ Erica R. Feynman Erica R. Feynman

11

Вам также может понравиться

- Proposed Attorneys For The Debtor and Debtor-in-PossessionДокумент15 страницProposed Attorneys For The Debtor and Debtor-in-Possessionjballauer2139Оценок пока нет

- Debtors Motion for Interim and Final Orders Pursuant to Bankruptcy Code Sections 105, 363(b), 507(a), 541, 1107(a) and 1108, Authorizing, But Not Directing, the Debtor, Inter Alia, to Pay Prepetition Wages, Compensation, and Employee Benefits filed by Scott Eric Ratner on behalf of Dewey & LeBoeuf LLP. (Attachments: # (1) Exhibit A - Proposed Interim Order# (2) Exhibit B - Proposed Final Order)Документ22 страницыDebtors Motion for Interim and Final Orders Pursuant to Bankruptcy Code Sections 105, 363(b), 507(a), 541, 1107(a) and 1108, Authorizing, But Not Directing, the Debtor, Inter Alia, to Pay Prepetition Wages, Compensation, and Employee Benefits filed by Scott Eric Ratner on behalf of Dewey & LeBoeuf LLP. (Attachments: # (1) Exhibit A - Proposed Interim Order# (2) Exhibit B - Proposed Final Order)Chapter 11 DocketsОценок пока нет

- Hampden County Physician Associates Bankruptcy PapersДокумент24 страницыHampden County Physician Associates Bankruptcy PapersJim KinneyОценок пока нет

- BinderДокумент17 страницBinderMy-Acts Of-SeditionОценок пока нет

- Et At./: RLF16087186v.lДокумент29 страницEt At./: RLF16087186v.lChapter 11 DocketsОценок пока нет

- ResCap KERP OpinionДокумент22 страницыResCap KERP OpinionChapter 11 DocketsОценок пока нет

- Et Al.Документ19 страницEt Al.Chapter 11 DocketsОценок пока нет

- Declaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day Relief (The "First DayДокумент15 страницDeclaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day Relief (The "First DayChapter 11 DocketsОценок пока нет

- 12-12553-jmp Doc 12Документ3 страницы12-12553-jmp Doc 12oldhillbillyОценок пока нет

- Capitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionДокумент3 страницыCapitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionoldhillbillyОценок пока нет

- Fox Rothschild LLP Yann Geron 100 Park Avenue, Suite 1500 New York, New York 10017 (212) 878-7900Документ11 страницFox Rothschild LLP Yann Geron 100 Park Avenue, Suite 1500 New York, New York 10017 (212) 878-7900Chapter 11 DocketsОценок пока нет

- 10000000736Документ94 страницы10000000736Chapter 11 DocketsОценок пока нет

- Motion For Authorzing The Retention and Compensation of Ordinary Course ProffessionalsДокумент16 страницMotion For Authorzing The Retention and Compensation of Ordinary Course ProffessionalsJun MaОценок пока нет

- Chapter 11 GuidelinesДокумент32 страницыChapter 11 Guidelinesricetech100% (10)

- Lorenzo Tangga An v. Philippine Transmarine CarriersДокумент4 страницыLorenzo Tangga An v. Philippine Transmarine CarriersMike HamedОценок пока нет

- G.R. No. 186070 April 11, 2011 Clientlogic Philppines, Inc. (Now Known As Sitel), Joseph Velasquez, Irene Roa, and RODNEY SPIRES, Petitioners, BENEDICT CASTRO, RespondentДокумент4 страницыG.R. No. 186070 April 11, 2011 Clientlogic Philppines, Inc. (Now Known As Sitel), Joseph Velasquez, Irene Roa, and RODNEY SPIRES, Petitioners, BENEDICT CASTRO, RespondentMarra RicaldeОценок пока нет

- Clientlogic Vs Castro (Labor)Документ6 страницClientlogic Vs Castro (Labor)Mary Lorie BereberОценок пока нет

- Joint Liquidating Second Amended Plan of Fastship, Inc. and Its Subsidiaries Pursuant To Chapter 11 of The United States Bankruptcy Code (The "Plan") Filed On June 27, 2012, PursuantДокумент39 страницJoint Liquidating Second Amended Plan of Fastship, Inc. and Its Subsidiaries Pursuant To Chapter 11 of The United States Bankruptcy Code (The "Plan") Filed On June 27, 2012, PursuantChapter 11 DocketsОценок пока нет

- 10000004182Документ58 страниц10000004182Chapter 11 DocketsОценок пока нет

- Broadview EE MotionДокумент40 страницBroadview EE MotionChapter 11 DocketsОценок пока нет

- Dominguez & Paderna Law Offices For Petitioners. The Solicitor General For Public RespondentsДокумент66 страницDominguez & Paderna Law Offices For Petitioners. The Solicitor General For Public RespondentsBonito BulanОценок пока нет

- 10000022229Документ302 страницы10000022229Chapter 11 DocketsОценок пока нет

- Re: Docket Nos. 78, 110, 124Документ4 страницыRe: Docket Nos. 78, 110, 124Chapter 11 DocketsОценок пока нет

- Davao Fruits Corp Vs ALUДокумент4 страницыDavao Fruits Corp Vs ALUtengloyОценок пока нет

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Date: June 10, 2008 Time: 9:30 A.M. in ReДокумент70 страниц1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Date: June 10, 2008 Time: 9:30 A.M. in ReChapter 11 DocketsОценок пока нет

- 10000022228Документ302 страницы10000022228Chapter 11 DocketsОценок пока нет

- Fox Rothschild LLP Yann Geron 100 Park Avenue, Suite 1500 New York, New York 10017 (212) 878-7900Документ11 страницFox Rothschild LLP Yann Geron 100 Park Avenue, Suite 1500 New York, New York 10017 (212) 878-7900Chapter 11 DocketsОценок пока нет

- PublishedДокумент25 страницPublishedScribd Government DocsОценок пока нет

- Attorneys For Midland Loan Services, Inc.: Limited Objection To Motion To Approve Fee Procedures Page 1 of 6 F-283676Документ6 страницAttorneys For Midland Loan Services, Inc.: Limited Objection To Motion To Approve Fee Procedures Page 1 of 6 F-283676Chapter 11 DocketsОценок пока нет

- 170174-2014-Phil. Long Distance Telephone Co. V PDFДокумент7 страниц170174-2014-Phil. Long Distance Telephone Co. V PDFFrance SanchezОценок пока нет

- United States Bankruptcy Court Southern District of New YorkДокумент8 страницUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsОценок пока нет

- 10000018182Документ665 страниц10000018182Chapter 11 DocketsОценок пока нет

- PDFДокумент284 страницыPDFChapter 11 DocketsОценок пока нет

- In The United States Bankruptcy Court For The District of DelawareДокумент28 страницIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsОценок пока нет

- 10000017641Документ507 страниц10000017641Chapter 11 DocketsОценок пока нет

- In The United States Bankruptcy Court For The District of DelawareДокумент28 страницIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsОценок пока нет

- In The United States Bankruptcy Court For The District of DelawareДокумент29 страницIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsОценок пока нет

- CA-1032 RevisedДокумент9 страницCA-1032 RevisedSandy Zertuche50% (2)

- Et Al.: Hearing Date: August 28, 2012 at 11:00 A.M. Objection Deadline: July 30, 2012 at 4:00 P.MДокумент7 страницEt Al.: Hearing Date: August 28, 2012 at 11:00 A.M. Objection Deadline: July 30, 2012 at 4:00 P.MChapter 11 DocketsОценок пока нет

- Hearing Date: July 12, 2012 at 2:00 P.M. (EDT) Objection Deadline: July 6, 2012 at 4:00 P.M. (EDT)Документ28 страницHearing Date: July 12, 2012 at 2:00 P.M. (EDT) Objection Deadline: July 6, 2012 at 4:00 P.M. (EDT)Chapter 11 DocketsОценок пока нет

- United States Bankruptcy Court District of DelawareДокумент27 страницUnited States Bankruptcy Court District of DelawareChapter 11 DocketsОценок пока нет

- 10000027207Документ76 страниц10000027207Chapter 11 Dockets0% (1)

- NOMALA V Applicant's Heads of Argument-10698Документ31 страницаNOMALA V Applicant's Heads of Argument-10698Nyameka PekoОценок пока нет

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionДокумент24 страницыIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsОценок пока нет

- 128440-1993-Davao Fruits Corp. v. Associated Labor Unions20180914-5466-E44lg4 PDFДокумент5 страниц128440-1993-Davao Fruits Corp. v. Associated Labor Unions20180914-5466-E44lg4 PDFAlan Jay CariñoОценок пока нет

- Maynilad Assoc V MayniladДокумент13 страницMaynilad Assoc V MayniladEmaleth LasherОценок пока нет

- Davao Fruits Corporation v. Associated Labor UnionДокумент6 страницDavao Fruits Corporation v. Associated Labor UnionKari LeyvaОценок пока нет

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionДокумент8 страницIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsОценок пока нет

- Brief Memorandum in Support of Motion For Summary JudgmentДокумент73 страницыBrief Memorandum in Support of Motion For Summary JudgmentblakejonathanОценок пока нет

- Hearing Date: July 27, 2012 at 1:00 P.M. (ET) Objection Deadline: July 20, 2012 at 4:00 P.M. (ET)Документ74 страницыHearing Date: July 27, 2012 at 1:00 P.M. (ET) Objection Deadline: July 20, 2012 at 4:00 P.M. (ET)Chapter 11 DocketsОценок пока нет

- Debtors' Motion For Entry of Interim and Final OrdersДокумент88 страницDebtors' Motion For Entry of Interim and Final OrdersPhiladelphiaMagazine100% (1)

- F. Ray Marshall, Secretary of Labor v. George Snyder, Irving Rosenzweig, Anthony Calagna, Clarence Clarke, James Isola, William Snyder, Joseph Grippo, Benjamin Petcove, General Teamsters Industrial Employees Local 806, 806 Record Processors, Inc., 572 F.2d 894, 2d Cir. (1978)Документ11 страницF. Ray Marshall, Secretary of Labor v. George Snyder, Irving Rosenzweig, Anthony Calagna, Clarence Clarke, James Isola, William Snyder, Joseph Grippo, Benjamin Petcove, General Teamsters Industrial Employees Local 806, 806 Record Processors, Inc., 572 F.2d 894, 2d Cir. (1978)Scribd Government DocsОценок пока нет

- Attorneys For Midland Loan Services, IncДокумент27 страницAttorneys For Midland Loan Services, IncChapter 11 DocketsОценок пока нет

- Declaration of Daniell. Fitchett in Support of Chapter 11Документ21 страницаDeclaration of Daniell. Fitchett in Support of Chapter 11Chapter 11 DocketsОценок пока нет

- New Jersey Carpenters and Trus v. Tishman Construction Corp of N, 3rd Cir. (2014)Документ13 страницNew Jersey Carpenters and Trus v. Tishman Construction Corp of N, 3rd Cir. (2014)Scribd Government DocsОценок пока нет

- CA-Petition For Certiorari (Yambao) - 30may2023Документ9 страницCA-Petition For Certiorari (Yambao) - 30may2023Michael Anthony Del RosarioОценок пока нет

- United States Court of Appeals, Second Circuit.: No. 342, Docket 93-7370Документ14 страницUnited States Court of Appeals, Second Circuit.: No. 342, Docket 93-7370Scribd Government DocsОценок пока нет

- Avoiding Workplace Discrimination: A Guide for Employers and EmployeesОт EverandAvoiding Workplace Discrimination: A Guide for Employers and EmployeesОценок пока нет

- Newman's Billing and Coding Technicians Study GuideОт EverandNewman's Billing and Coding Technicians Study GuideРейтинг: 4.5 из 5 звезд4.5/5 (2)

- 12-12553-jmp Doc 49Документ2 страницы12-12553-jmp Doc 49oldhillbillyОценок пока нет

- 12-12553-jmp Doc 11Документ135 страниц12-12553-jmp Doc 11oldhillbillyОценок пока нет

- Brian Blankenship Vs TD Ameritrade Case 13-cv-08048 Document 8 Filed 05-16-13Документ10 страницBrian Blankenship Vs TD Ameritrade Case 13-cv-08048 Document 8 Filed 05-16-13oldhillbillyОценок пока нет

- Atrinsic BK Doc 75Документ170 страницAtrinsic BK Doc 75oldhillbillyОценок пока нет

- 8 2Документ6 страниц8 2oldhillbillyОценок пока нет

- 12-12553-jmp Doc 13Документ21 страница12-12553-jmp Doc 13oldhillbillyОценок пока нет

- 24 1Документ19 страниц24 1oldhillbillyОценок пока нет

- 12-12553-jmp Doc 46Документ39 страниц12-12553-jmp Doc 46oldhillbillyОценок пока нет

- Atrinsic, Inc. Disclosure Statement Exhibits B and C: To Be Filed at A Later DateДокумент1 страницаAtrinsic, Inc. Disclosure Statement Exhibits B and C: To Be Filed at A Later DateoldhillbillyОценок пока нет

- 12-12553-jmp Doc 12Документ3 страницы12-12553-jmp Doc 12oldhillbillyОценок пока нет

- 24Документ54 страницы24oldhillbillyОценок пока нет

- 8 1Документ7 страниц8 1oldhillbillyОценок пока нет

- 12-12553-jmp Doc 23Документ19 страниц12-12553-jmp Doc 23oldhillbillyОценок пока нет

- 12-12553-jmp Doc 44 Filed 081712Документ14 страниц12-12553-jmp Doc 44 Filed 081712oldhillbillyОценок пока нет

- 12-12553-jmp Doc 14Документ2 страницы12-12553-jmp Doc 14oldhillbillyОценок пока нет

- 12-12553-jmp Doc 11Документ135 страниц12-12553-jmp Doc 11oldhillbillyОценок пока нет

- 12-12553-jmp Doc 7Документ4 страницы12-12553-jmp Doc 7oldhillbillyОценок пока нет

- 8Документ11 страниц8oldhillbillyОценок пока нет

- 12-12553-jmp Doc 9Документ3 страницы12-12553-jmp Doc 9oldhillbillyОценок пока нет

- ATRN Main DocumentДокумент52 страницыATRN Main Documentjballauer2139Оценок пока нет

- Capitalized Terms Not Otherwise Defined Herein Shall Have The Meanings Ascribed To Such Terms in The ApplicationДокумент4 страницыCapitalized Terms Not Otherwise Defined Herein Shall Have The Meanings Ascribed To Such Terms in The ApplicationoldhillbillyОценок пока нет

- 12-12553-jmp Doc 10Документ3 страницы12-12553-jmp Doc 10oldhillbillyОценок пока нет

- 5 1Документ1 страница5 1oldhillbillyОценок пока нет

- Capitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionДокумент3 страницыCapitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionoldhillbillyОценок пока нет

- Exhibit Exhibit A Loan Documents Pt. 5Документ18 страницExhibit Exhibit A Loan Documents Pt. 5oldhillbillyОценок пока нет

- Exhibit Exhibit A Loan Documents Pt. 4Документ68 страницExhibit Exhibit A Loan Documents Pt. 4oldhillbillyОценок пока нет

- Exhibit Exhibit A Loan Documents Pt. 3Документ42 страницыExhibit Exhibit A Loan Documents Pt. 3oldhillbillyОценок пока нет

- Exhibit Exhibit A Loan Documents PT 1Документ42 страницыExhibit Exhibit A Loan Documents PT 1oldhillbillyОценок пока нет

- Exhibit Exhibit A Loan Documents Pt. 2Документ42 страницыExhibit Exhibit A Loan Documents Pt. 2oldhillbillyОценок пока нет

- Bank Nationalization Case SummaryДокумент13 страницBank Nationalization Case SummaryPrajwal VasukiОценок пока нет

- M S Geodis India PVT LTDДокумент2 страницыM S Geodis India PVT LTDrupesh.srivastavaОценок пока нет

- IPR Course Chapter4Документ37 страницIPR Course Chapter4VELUSAMY MОценок пока нет

- Statutory Registers Under Companies ActДокумент16 страницStatutory Registers Under Companies ActAmey PatwardhanОценок пока нет

- Stewart Title Warning To Maryland Title CompaniesДокумент9 страницStewart Title Warning To Maryland Title CompaniesTodd WetzelbergerОценок пока нет

- Former Marco Island Councilor Victor N. Rios Charged For Ballot Forging - FDLE News Release Feb. 7, 2021Документ1 страницаFormer Marco Island Councilor Victor N. Rios Charged For Ballot Forging - FDLE News Release Feb. 7, 2021Omar Rodriguez OrtizОценок пока нет

- Regulating Flawed Bite Mark EvidenceДокумент54 страницыRegulating Flawed Bite Mark Evidencerobsonconlaw100% (1)

- Revised Rules On Criminal ProceduresДокумент28 страницRevised Rules On Criminal ProceduresMilagros Aguinaldo100% (4)

- Born - Cláusulas PatológicasДокумент8 страницBorn - Cláusulas PatológicasKimberly GBОценок пока нет

- Requests For Admission in CaliforniaДокумент3 страницыRequests For Admission in CaliforniaStan Burman100% (2)

- AR.A.S.P.V.P.V. Automobiles Private Limited: Tax InvoiceДокумент4 страницыAR.A.S.P.V.P.V. Automobiles Private Limited: Tax InvoicePratheesh .P100% (1)

- RA 9282 Amending RA 1125Документ4 страницыRA 9282 Amending RA 1125edwardmlimОценок пока нет

- Digital Forensics: Legality of The Process in Cameroon: Joan B.AliДокумент10 страницDigital Forensics: Legality of The Process in Cameroon: Joan B.AliMbangse MarcelОценок пока нет

- Bilkis Yakub Rasool Vs Union of India UOI and Ors SC20240901241738112COM632747Документ98 страницBilkis Yakub Rasool Vs Union of India UOI and Ors SC20240901241738112COM632747Prince KumarОценок пока нет

- IEBC Petition by Wafula BukeДокумент6 страницIEBC Petition by Wafula BukeDeep CogitationОценок пока нет

- First Counselling Schedule - CET IPU 2009Документ4 страницыFirst Counselling Schedule - CET IPU 2009infobash100% (2)

- BDO Vs VTLДокумент2 страницыBDO Vs VTLjovifactorОценок пока нет

- Northwestern University College of LawДокумент5 страницNorthwestern University College of LawNorma ArquilloОценок пока нет

- Aratuc Vs ComelecДокумент19 страницAratuc Vs ComelecKyle JamiliОценок пока нет

- Abella Vs ComelecДокумент4 страницыAbella Vs Comelecsamantha.tirthdas2758100% (1)

- Stat Con Cases (1-4)Документ47 страницStat Con Cases (1-4)Maricar BautistaОценок пока нет

- Kawasaki Port Service Corporation vs. AmoresДокумент10 страницKawasaki Port Service Corporation vs. AmoresHariette Kim TiongsonОценок пока нет

- Pawnshop ReportДокумент5 страницPawnshop ReportJo Vic Cata BonaОценок пока нет

- Baby Delight v. Clute - ComplaintДокумент16 страницBaby Delight v. Clute - ComplaintSarah BursteinОценок пока нет

- Estate Planning Intake FormДокумент8 страницEstate Planning Intake Formbash shangОценок пока нет

- University of The Cordilleras, Pama, Basaen, & Janeo Vs LacanariaДокумент29 страницUniversity of The Cordilleras, Pama, Basaen, & Janeo Vs LacanariaRudnar Jay Bañares BarbaraОценок пока нет

- 3 People Vs TabacoДокумент25 страниц3 People Vs TabacoCherrylyn CaliwanОценок пока нет

- Pendakwa Syarie Negeri Selangor v Khalid bin Abdul SamadДокумент36 страницPendakwa Syarie Negeri Selangor v Khalid bin Abdul SamadShahzleen100% (1)

- Ebook PDF Criminology A Canadian Perspective 8th by Rick Linden PDFДокумент41 страницаEbook PDF Criminology A Canadian Perspective 8th by Rick Linden PDFedward.furr108100% (39)

- Dineen v. Merck & Co., Inc., Et Al - Document No. 2Документ11 страницDineen v. Merck & Co., Inc., Et Al - Document No. 2Justia.comОценок пока нет