Академический Документы

Профессиональный Документы

Культура Документы

Students Qaa MCSP 1006

Загружено:

chiew9890Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Students Qaa MCSP 1006

Загружено:

chiew9890Авторское право:

Доступные форматы

INTERNATIONAL

SUBJECT NO 19J

CORPORATE SECRETARYSHIP

SUGGESTED ANSWER

FOR THE

JUNE 2010 EXAMINATION DIET

SECTION A (This section carries 40 marks. Answer all questions.) QUESTION 1 a) Differentiate between transfer of shares and transmission of shares For transfer of shares, the ownership of the shares changes by voluntary act of the former owner such as when he sells his shares to another person or where he gives them away. For transmission of shares, it is a change of ownership not by agreement and voluntary action of the parties involved, but by operation of law and as a result of some other event such as death or bankruptcy of the former owner (4 marks)

b)

When a share certificate is destroyed, how may a shareholder apply for a duplicate certificate? A shareholder may request for a duplicate share certificate to replace certificate which is lost or destroyed provided the following procedure is followed: i) Request the owner to cause a further search to be made for the missing document. ii) Where the value of the shares is greater than RM500, applicant is required to advertise in the local newspaper stating that the certificate has been lost/destroyed and that the owner intends to apply to the company for a duplicate, after the expiration of fourteen (14) days from the date of advertisement. To furnish a bond (indemnity guaranteed by a bank or an insurance company) for an amount equal to at least the current market value of the shares. This bond shall indemnify the company against any loss if the original certificate is found. A statutory declaration that the certificate has been lost or destroyed and has not been pledged, sold or otherwise disposed of. An undertaking in writing that if the original certificate is found, it will be returned to the company. (4 marks)

iii)

iv)

v)

c)

List the differences between an ordinary and a special resolution. To pass an ordinary resolution, you need to give at least 14 days notice to call for the meeting and a simple majority is sufficient to pass the resolution To pass a special resolution, you need to give a 21 days notice to call for the meeting and a majority vote of at least 75% is required to pass the resolution (4 marks) 2

d)

What are the requirements of Section 142 of the Companies Act 1965 regarding a statutory meeting? A public company with a share capital is required to hold a statutory meeting within a period of not less than one (1) month and not more than three (3) months after the date at which it is entitled to commence business (Form 23). The statutory meeting is a members general meeting and it is held once in the entire life of a company incorporated as a public company limited by shares. A statutory report certified by at least two (2) directors must be circulated to all the members of the company at least seven (7) days before the date on which the statutory meeting is to be held. Failure to hold the statutory meeting or to lodge the statutory report is a ground upon which a petition to wind up the company may be presented. (4 marks)

e)

What do you understand by the term retirement by rotation for directors? There is no provision in the act on retirement by rotation and thus it is not a statutory requirement. Usually the articles of the company contain provisions relating to retirement by rotation for the purpose of giving the shareholders an opportunity to review the directors performance and if necessary to replace them. At the first AGM of the company all directors shall retire from office and every subsequent AGMs thereafter, one third of the directors shall retire from office. The directors to retire in every year shall be those who have been longest in office since their last election. A director appointed to fill casual vacancy or as additional director shall hold office until the next following AGM and shall then be eligible for re-election but shall not be taken into account in determining the number of directors who are to retire by rotation at the AGM. The provision of the articles relating to retirement by rotation shall not apply to a director of a public company attaining the age of 70 as the office of such a director automatically becomes vacant at the conclusion of the forthcoming AGM. (4 marks)

f)

Bursa Malaysia restricts the number of directorships that could be held by a director in public listed companies. What is the rationale behind such restriction? What is the maximum number of directorship in listed and non-listed companies that may be held by such director?

The number of directorships held in public listed companies shall not be more than 10; and in companies other than public listed companies shall not be more than 15. The restriction is aimed primarily at increasing the effectiveness of the boards of directors of public listed companies by allowing more time and energy to be focused on a smaller number of companies, thus enhancing the standard of corporate governance in public listed companies. (4 marks)

g)

The Memorandum and Articles of Association constitute a contract between the company and its members. Name any FOUR (4) statutory clauses that must be stated in the Memorandum of Association as required by section 18(1) of the Companies Act, 1965? i) The name clause which provides the name of the company

ii) The objects clause which provides the objects of the company, that is, the nature of business intended to be carried on iii) The capital clause which provides the nominal amount of the authorised share capital with which the company proposes to be registered (minimum RM100,000) and the division thereof into shares of a fixed amount if the company is limited by shares iv) The limited liability clause which provides that the liability of the members is limited (4 marks) h) Describe the composition of an audit committee of a public listed company as required by the revised Malaysian Code on Corporate Governance. must comprise of at least three directors, the majority of whom are independent. members of the audit committee shall elect a chairman who shall be an independent director, from amongst themselves. comprise only non-executive directors. at least one member of the audit committee shall be a member of the Malaysian Institute of Accountants, or a person who fulfills the requirements as may be prescribed by Bursa Securities from time to time. (4 marks)

i)

Generally, when a company raises funds from the public, it is required to issue a prospectus. Outline the contents of a prospectus as stipulated in the Fifth Schedule of the Companies Act, 1965.

i) ii)

Corporate information Summary of information on - Business - Past financial performance - Principal statistics relating to the public issue/offer for sale - Investment considerations - Future prospects Introduction information on the prospectus and the share capital structure Details of the public issue/offer for sale Information on the offerors Information on the company

iii) iv) v) vi)

vii) Financial information viii) Accountants Report ix) x) Directors Report Procedure for application and acceptance (4 marks) j) Identify any FOUR (4) types of transactions which are not regarded as related party transactions. i) Payment of dividend ii) Transaction with subsidiaries iii) Common directorship with no shareholdings iv) Acquisition or disposal where the related party holds less than 5% v) Directors fees and remuneration (4 marks) [Total 40 marks]

SECTION B (This section carries 60 marks. Answer only three questions from this section.) QUESTION 2 Diana, a fresh graduate of ICSA, is newly appointed as the Company Secretary for IQAS Sendirian Berhad (IQAS), a trading company which was incorporated on 1 October 2006. The Chairman of the Board informed her that the company was originally incorporated as a shelf company due to an urgent need to have a registered company to bid for a government tender. Upon changing the shelf companys name to IQAS Sendirian Berhad and receiving the resignation letters of the first named directors and first named secretary in the articles of association of the shelf company, IQAS never appointed any secretary for the company. In browsing through the company records, Diana found that IQAS did not hold any general meetings since its incorporation. According to the minutes of the First Board of Directors Meeting, the company financial year end was fixed at 31 December 2007 and for the subsequent years the financial year end is fixed on 31 December. The company has received letters from Companies Commission of Malaysia imposing penalties to the directors of IQAS for failing to comply with sections 143, 165 and 169 of the Companies Act, 1965. You are required to explain to the Chairman of the Board: a) on the requirements of Section 143 (annual general meeting), Section 165 (Annual return) and Section 169 (profit and loss account, balance sheet and directors report). Section 143 provides that every company must hold an AGM once in every calendar year. As for the first AGM, a company is allowed to hold it not later than 18 months from the date of its incorporation. Subsequent AGMs must be held within fifteen (15) months from the date of the preceding AGM. Section 169 of the Act requires directors of a company to provide a Directors Report signed by at least two (2) directors and attach it to the profit and loss accounts and balance sheet. The audited account must be tabled at an AGM within 6 months after the companys financial year end. Section 165 of the Act governs the filing of Annual Return by a company having a share capital. The annual return shall be made up to the date of the AGM of the company in the year or a date not later than fourteen (14) days after the date of the AGM. (9 marks)

b) on how these sections inter-related. Sections 169, 165 and 143 relate to the holding of AGM. Section 165 states that the company must hold an AGM once in every calendar and the purpose of holding the AGM is to table the companys audited accounts which according to Section 169, the accounts must be tabled within 6 months after the companys financial year end. Section 143 provides that the annual return must then be made on a date not later than 14 days after the date of the AGM. Thus the 3 sections are inter-related in the sense that the annual 6

accounts must be ready on time to be tabled at the AGM within 6 months after the financial year end and that the AGM must be held once in every, following which the annual return must be made up to a date not later than 14 days after the AGM. (6 marks) c) What needs to be done to rectify the situation and to update the records accordingly. i) The company needs to prepare the 3 sets of accounts for the year ended 31 December 2007, 2008 and 2009 respectively ii) Arrange for the above sets of accounts to be audited iii) Hold a paper AGM for the year 2008 and adjourned it as the account for the year ended 31 December 2007 was not ready iv) Hold a paper AGM for the year 2009 and adjourned it as the account for the year ended 31 December 2008 was not ready v) Hold an AGM in 2010 to adopt the 3 sets of accounts vi) File 3 sets of annual return for the years 2008, 2009 and 2010. (5 marks) [Total 20 marks] QUESTION 3 The board of directors of Supervision Berhad has instructed you, a company secretary to call for an annual general meeting to consider a resolution to declare a dividend as recommended by the directors. Upon receiving notice calling for a meeting, Micheal Broadband, a shareholder has written to you stating that he is unable to attend the forthcoming meeting and would like some clarification regarding the appointment of proxies and voting. You are required to write to Mr Broadband explaining: a) The statutory requirements on appointment of proxies, including the rights and responsibilities of a proxy at the annual general meeting as stipulated under section 149 of the Companies Act, 1965. Any member may attend a general meeting of the company personally or by proxy. A proxy is a person appointed by a member to attend and vote on his behalf. Unless the articles provide otherwise, section 149 provides the regulations for the appointment, voting rights, issuing of the proxy form and the notice regarding the appointment of the proxy. Section 149 of the act states that: A proxy shall not be entitled to vote only on a poll, not by show of hands A proxy shall be a member, or if he is not a member of the company, he shall be an advocate, an approved company auditor or a person approved by the CCM

A member shall not appoint more than two proxies to attend and vote at the same meeting, and where two proxies are appointed, the appointment shall be invalid unless the proportions of his holdings to be represented by each proxy are specified The articles contain provisions as to the form of proxy and the depositing of proxy form. It requires the proxy form to be in writing under the hand of the appointer and if the appointer is a corporation, either under seal or under the hand of an officer or attorney duly authorised. The proxy form or the power of attorney shall be deposited at the registered office not less than 48 hours before the time of meeting. (7 marks) b) the differences between the two methods of voting commonly used at company meetings namely voting by show of hands and by poll. Voting by show of hands The articles provide that every member or corporate representative present shall have one vote each on show of hands irrespective of their shareholdings. It further provides that at any general meeting a resolution put to vote shall be decided by show of hands first, unless a poll is demanded. The votes on show of hands shall be nullified once a poll is demanded in respect thereof. Voting by poll Votes are given proportionately to the number of shares held. (8 marks) c) the advantage of voting by poll and how should the poll vote be demanded. By poll, a member may utilise his full voting power and for this reason, the right to demand a poll is extremely important. The articles provide the manner on how poll should be demanded (i.e. before or on the declaration of the result of show of hands) by: The chairman At least 3 members present in person or by proxy Any member(s) present in person or by proxy holding more than 10% of the total voting rights of all the members present at the meeting Any member(s) holding shares more than 10% of the total paid up capital (5 marks) [Total 20 marks] QUESTION 4 Visual Vision Berhad (VV) is a company listed on the Bursa Malaysia. Recently due to the global economic recession, VVs share price plunged from RM6 to RM2. This prompted the board of directors of VV to pass a resolution authorising the buy back of the companys shares pursuant to section 67A of the Companies Act 1965. 8

You are required to advise the board of directors as to the following: a) the conditions that must be present before a company can exercise share buy back? The company must be solvent at the date of the purchase and will not become insolvent by incurring the debts involved in the obligation to pay for the shares so purchased The purchase is made through Bursa Malaysia on which the shares of the company are quoted and in accordance with the relevant rules of Bursa Malaysia The purchase is made in good faith and in the interest of the company (6 marks) b) assuming that the articles of association of VV have not been amended since its incorporation in 1990, what action must the directors take prior to purchasing the companys shares? i) The board of directors need to call for a shareholders meeting to alter the companys articles giving authority to the board of directors to exercise their powers to purchase the companys own shares and to comply with the requirements of Bursa Malaysia in respect of the purchase of the companys own shares. The company must immediately announce to Bursa Malaysia any decision made by the board of directors of the company to submit to shareholders a proposal for the company to be authorised to purchase its own shares. The company must ensure that a solvency declaration, signed by the majority of the directors, is lodged with Bursa Malaysia by the directors in accordance with section 67A of the Companies Act, 1965 The contents of the ordinary resolution in relation to a share buy-back must include the following information: The total number or percentage and description of the shares which the company is authorised to purchase on Bursa Malaysia The dates on which the authority conferred by the resolution will commence and determine The maximum funds to be allocated by the company for the purpose of purchasing its own shares Whether the shares are proposed to be cancelled or retained as treasury shares, or both and, if available, information as to percentage or number of shares purchased which are to be retained or cancelled, or both. (6 marks) 9

ii)

iii)

iv)

c) how may the board of directors account for the shares (known as treasury shares) after the share buy back exercise and what are the properties of these shares? Where a company buys back its own shares and the shares bought back may cancelled or retained in treasury Treasury shares can either be sold, cancelled or distributed as shares dividends to shareholders Where the company has sold any of its treasury or where the directors of the company have resolved to cancel any of its treasury shares, it shall within fourteen (14) days of such sale or cancellation lodge Form 28B - notice of sale or cancellation of treasury shares with CCM, Bursa Malaysia and SC

Properties of treasury shares: i) no voting rights and not to be counted in determination of any resolution ii) no dividend entitlement iii) not taken into account in calculating the number of percentage of shares of a class of shares for any purposes iv) not entitled to any notices of general meeting v) not taken into account for substantial shareholdings or takeovers vi) no rights for requisitioning of meetings vii) not counted for quorum purposes (8 marks) [Total 20 marks] QUESTION 5 You are a chartered secretary in practice. One of your clients, Lawrence Goh is a sole trader who owns a retail outlet selling electrical appliances in the city shopping centre. He approaches you and explains that he wishes to form a private limited company to take over and carry on his existing business. He is keen to use the name LG International Trading. Lawrence Goh estimates that his business has a net worth of RM500,000 and he will accept 500,000 ordinary shares of RM1.00 each fully paid, in the new company as full consideration. You are required to advise Mr Goh as to the following:

10

i)

his choice of name for the intended company In choosing the name of the intended company, the applicant has to ensure that the proposed name is: Not similar or identical to an existing companys name Not a trademark or patent name of any product unless a written consent from the owner of the trademark and patent name is produced Undesirable names Not names which the minister has directed the CCM not to accept for registration Pursuant to sections 22(1) and 341(1) of the Act, the minister has directed the CCM not to accept the following names for registration as the name of any company or a foreign company unless prior approval of the minister is obtained. Names suggesting connection with a member of the royal family or royal patronage. Names suggesting connection with a state or federal government department, statutory body, authority or government agency or any municipality or other local authority. Names suggesting connection with any ASEAN, Commonwealth, or foreign government or with the United Nation or with any other international organisations. Names suggesting connection with any political party, society, trade union, cooperative society or building society. Names including a registered trade mark, unless the consent of the owner of the trade mark is produced to the registrar of companies. Names that are misleading as to the identity, nature, objects or purposes of a company or in any other manner. Names that are blasphemous or likely to be offensive to members of the public. Names which: - are translations of a name of a company or foreign company registered under the Act - May resemble or be mistaken for the name of any other company or foreign company registered under the Act - May resemble or be mistaken for a name that is being reserved for the purpose of incorporation of a new company or registration of a foreign company or for the purpose of a change of a name of a company or foreign company registered under the act (6 marks)

11

ii)

the procedure for the registration of a private limited company In registering a company limited by shares, the following documents and forms together with the prescribed fees must be forwarded to the CCM: Form 13A (Request for availability of name) Original letter of approval on the availability of name from CCM Original letter of consent for use of name (if any) Memorandum and Articles of Association Form 48A (Statutory declaration by a person before appointment as director or by a promoter before incorporation of corporation) Form 48F (Declaration by a person before appointment as secretary) Photocopy of the identity card or passport for each director and secretary Form 6 (Declaration of compliance) Form 46 (Undertaking by director to take and pay for qualification shares), if any Bank draft or cheque for registration fees (8 marks)

iii)

the procedure for the transfer of the existing businesss assets into the new company Hold a board meeting to discuss on the net worth of the assets to be transferred to the company and arrange to call for a shareholders meeting At the shareholders meeting, the following resolution need to be passed: to accept the transfer of the existing businesss net worth assets of RM500,000 in exchange for 500,000 ordinary shares of RM1.00 each fully paid, as full consideration. directors to be given the power to allot 500,000 ordinary shares of RM1.00 each to Lawrence Goh to issue a share certificate to Lawrence Goh for the 500,000 ordinary shares allotted To update the Register of Members (6 marks) [Total 20 marks]

12

QUESTION 6 Telescope Malaysia Berhad is a subsidiary of Telescope International PLC. which has its registered office in London. United Kingdom. The holding company has PCW & Co. as their auditors. In conformity with the holding company, the board of directors of Telescope Malaysia Berhad has decided to change the companys auditors, AWI & Co. to PCW & Co. at the next annual general meeting. As the company secretary of Telescope Malaysia Berhad, you are required to advise the board of directors on: a) the procedure for the removal of AWI & Co. and the appointment of PCW & Co. as auditor of the company PCW & Co shall not be appointed as an auditor of the company at an AGM other than the retiring auditor, AWI & Co unless notice of nomination of PCW & Co as auditor was given to the company by a member not less than twenty one (21) days before the meeting. The company must send a copy of the notice of nomination to PCW & Co and to all members at least seven (7) days before the AGM. PCW & Co must give their consent in writing to act as the companys auditor. (5 marks) b) the drafting of the resolutions for the removal and appointment of auditors. Telescope Malaysia Berhad (Company No xxxx) Draft resolution We, the undersigned, being the board of directors does hereby RESOLVE: To remove AWI & Co. as company auditor and hereby appoint PCW & Co. as the new auditor subject to approval of the forthcoming annual general meeting. Dated (Signature of all directors) (5 marks) c) the drafting of the agenda for the forthcoming annual general meeting to include the item on the change of auditors. NOTICE IS HEREBY GIVEN THAT the companys 3rd annual general meeting will be held on Friday, 4 June 2010 at the Dewan MBSA, 40000 Shah Alam, Selangor at 3.00 pm to consider the following ordinary business: 1. To table and adopt the companys audited accounts for the year ended 31 December 2009 2. To re-elect directors 13

3. To consider the nomination of PCW & Co as the companys new auditor and to pass the following ordinary resolution: THAT AWI & Co be and is hereby terminated as the companys auditor and PCW & Co be and is hereby appointed as the companys new auditor with immediate effect. 4. To transact any other business By order of the Board Company Secretary 4 May 2010 (5 marks) d) the drafting of the nomination letter to PCW & Co. as the companys auditor. TELESCOPE MALAYSIA BERHAD

PCW & Co. Wisma Semantan Jalan Damansara 27500 Kuala Lumpur 1 April 2010

Dear Sir NOMINATION AS COMPANYS AUDITOR We have received a notice of nomination from a member of our company to nominate your firm as our companys auditor and we will be sending a copy of this notice of nomination to all members at least seven (7) days before the annual general meeting which scheduled to be held on 4 June 2010. We would appreciate if you could indicate your acceptance by giving us your consent to act as our companys auditor.

Yours truly, Company Secretary (5 marks) [Total 20 marks]

-End of suggested answer -

14

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Modul-Document Control Training - Agus F - 12 Juli 2023 Rev1Документ34 страницыModul-Document Control Training - Agus F - 12 Juli 2023 Rev1vanesaОценок пока нет

- IntroductionДокумент34 страницыIntroductionmarranОценок пока нет

- Yanmar America publication listing for engine parts, service, and operation manualsДокумент602 страницыYanmar America publication listing for engine parts, service, and operation manualsEnrique Murgia50% (2)

- Desert Power India 2050Документ231 страницаDesert Power India 2050suraj jhaОценок пока нет

- Single-Phase Induction Generators PDFДокумент11 страницSingle-Phase Induction Generators PDFalokinxx100% (1)

- Tatoo Java Themes PDFДокумент5 страницTatoo Java Themes PDFMk DirОценок пока нет

- TLE8 Q4 Week 8 As Food ProcessingДокумент4 страницыTLE8 Q4 Week 8 As Food ProcessingROSELLE CASELAОценок пока нет

- National Advisory Committee For AeronauticsДокумент36 страницNational Advisory Committee For AeronauticsSamuel ChristioОценок пока нет

- Human Resouse Accounting Nature and Its ApplicationsДокумент12 страницHuman Resouse Accounting Nature and Its ApplicationsParas JainОценок пока нет

- VEGA MX CMP12HP Data SheetДокумент2 страницыVEGA MX CMP12HP Data SheetLuis Diaz ArroyoОценок пока нет

- Ch07 Spread Footings - Geotech Ultimate Limit StatesДокумент49 страницCh07 Spread Footings - Geotech Ultimate Limit StatesVaibhav SharmaОценок пока нет

- Trading Course DetailsДокумент9 страницTrading Course DetailsAnonymous O6q0dCOW6Оценок пока нет

- Colour Ring Labels for Wireless BTS IdentificationДокумент3 страницыColour Ring Labels for Wireless BTS Identificationehab-engОценок пока нет

- PW CДокумент4 страницыPW CAnonymous DduElf20OОценок пока нет

- Key formulas for introductory statisticsДокумент8 страницKey formulas for introductory statisticsimam awaluddinОценок пока нет

- Self Team Assessment Form - Revised 5-2-20Документ6 страницSelf Team Assessment Form - Revised 5-2-20api-630312626Оценок пока нет

- Course: Citizenship Education and Community Engagement: (8604) Assignment # 1Документ16 страницCourse: Citizenship Education and Community Engagement: (8604) Assignment # 1Amyna Rafy AwanОценок пока нет

- Unit 1 Writing. Exercise 1Документ316 страницUnit 1 Writing. Exercise 1Hoài Thương NguyễnОценок пока нет

- Module 2Документ42 страницыModule 2DhananjayaОценок пока нет

- Judge Vest Printable PatternДокумент24 страницыJudge Vest Printable PatternMomОценок пока нет

- Doe v. Myspace, Inc. Et Al - Document No. 37Документ2 страницыDoe v. Myspace, Inc. Et Al - Document No. 37Justia.comОценок пока нет

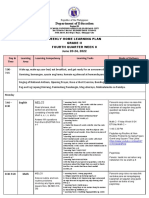

- Department of Education: Weekly Home Learning Plan Grade Ii Fourth Quarter Week 8Документ8 страницDepartment of Education: Weekly Home Learning Plan Grade Ii Fourth Quarter Week 8Evelyn DEL ROSARIOОценок пока нет

- Afu 08504 - International Capital Bdgeting - Tutorial QuestionsДокумент4 страницыAfu 08504 - International Capital Bdgeting - Tutorial QuestionsHashim SaidОценок пока нет

- Gi 007 Gerund InfinitiveДокумент2 страницыGi 007 Gerund Infinitiveprince husainОценок пока нет

- S2 Retake Practice Exam PDFДокумент3 страницыS2 Retake Practice Exam PDFWinnie MeiОценок пока нет

- Ijimekko To Nakimushi-Kun (The Bully and The Crybaby) MangaДокумент1 страницаIjimekko To Nakimushi-Kun (The Bully and The Crybaby) MangaNguyễn Thị Mai Khanh - MĐC - 11A22Оценок пока нет

- Installation Instruction XALM IndoorДокумент37 страницInstallation Instruction XALM IndoorVanek505Оценок пока нет

- Give Five Examples Each of Nature Having Reflection Symmetry and Radial Symmetry Reflection Symmetry Radial Symmetry Butterfly StarfishДокумент12 страницGive Five Examples Each of Nature Having Reflection Symmetry and Radial Symmetry Reflection Symmetry Radial Symmetry Butterfly StarfishANNA MARY GINTOROОценок пока нет

- Practical Research 2: Self-Learning PackageДокумент3 страницыPractical Research 2: Self-Learning PackagePrinces BaccayОценок пока нет

- Newcomers Guide To The Canadian Job MarketДокумент47 страницNewcomers Guide To The Canadian Job MarketSS NairОценок пока нет