Академический Документы

Профессиональный Документы

Культура Документы

MB0045 - Financial Management Assignment Set-1 (60 Marks)

Загружено:

Ahmed BarkaatiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

MB0045 - Financial Management Assignment Set-1 (60 Marks)

Загружено:

Ahmed BarkaatiАвторское право:

Доступные форматы

http://educationblog2012.blogspot.

in/

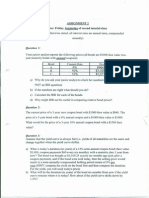

MB0045 Financial Management Assignment Set- 1 (60 Marks)

Q1. Show the relationship between require d rate of return and coupon rate on the value of a bond. A1. It is important for prospective bond buyers to know how to determine the price of a bond because it will indicate the yield received should the bond be purchased. In this section, we will run through some bond price calculations for various types of bond instruments. Bonds can be priced at a premium, discount, or at par. If the bonds price is higher than its par value, it will sell at a premium because its interest rate is higher than current prevailing rates. If the bonds price is lower than its par value, the bond will sell at a discount because its interest rate is lower than current prevailing interest rates. When you calculate the price of a bond, you are calculating the maximum price you would want to pay for the bond, given the bonds coupon rate in comparison to the average rate most investors are currently receiving in the bond market.Required yield or required rate of return is the interest rate that a security needs to offer in orderto encourage investors to purchase it. Usually the required yield on a bond is equal to or greater than the current prevailing interest rates. Fundamentally, however, the price of a bond is the sum of the present values of all expected coupon payments plus the present value of the par value at maturity. Calculating bond price is simple: all we are doing is discounting the known future cash flows. Remember that to calculate present value (PV) which is based on the assumption that each payment is re- investedat some interest rate once it is received we have to know the interest rate that would earn us aknown future value. For bond pricing, this interest rate is the required yield. (If the concepts of present and future value are new to you or you are unfamiliar with the calculations, refer to Understanding the Time Value of Money. Here is the formula for calculating a bonds price, which uses the basic present value ( PV

http://educationblog2012.blogspot.in/

formula: C=couponpayment n=numberofpayments i=interestrate,orrequiredyield M = value at maturity, or par value

The succession of coupon payments to be received in the future is referred to as an ordinary annuity, which is a series of fixed payments at set intervals over a fixed period of time. (Coupons on a straight bond are paid at ordinary annuity.) The first payment of an ordinary annuity occursone interval from the time at which the debt security is acquired. The calculation assumes thistime is the present.You may have guessed that the bond pricing formula shown above may be tedious to calculate,as it requires adding the present value of each future coupon payment. Because these paymentsare paid at an ordinary annuity, however, we can use the shorter PV-of-ordinary-annuity formulathat is mathematically equivalent to the summation of all the PVs of future cash flows. This PV-of-ordinary-annuity formula replaces the need to add all the present values of the future coupon.The following diagram illustrates how present value is calculated for an ordinary annuity:Each full moneybag on the top right represents the fixed coupon payments (future value)received in periods one, two and three. Notice how the present value decreases for those couponpayments that are further into the future the present value of the second coupon payment is worthless than the first coupon and the third coupon is worth the lowest amount today. The farther intothe future a payment is to be received, the less it is worth today is the fundamental concept for which the PV-of-ordinary-annuity formula accounts. It calculates the sum of the present valuesof all future cash flows, but unlike the bond pricing formula we saw earlier, it doesnt require that we add the value of each coupon payment. (For more on calculating the time valueof annuities, see Anything but Ordinary: Calculating the Present and Future Value of Annuities and Understanding the Time Value of Money.)By incorporating the annuity model into the bond pricing formula, which requires us to alsoinclude the present value of the par value received at maturity, we arrive at the followingformula: Lets go through a basic example to find the price of a plain vanilla bond.

http://educationblog2012.blogspot.in/

Example 1: Calculate the price of a bond with a par value of $1,000 to be paid in ten years, a coupon rate of 10%, and a required yield of 12%. In our example well assume that coupon payments are made semi-annually to bond holders and that the next coupon payment is expectedin six months. Here are the steps we have to take to calculate the price: 1. Determine the Number of Coupon Payments: Because two coupon payments will be madeeach year for ten years, we will have a total of 20 coupon payments. 2. Determine the Value of Each Coupon Payme nt: Because the coupon payments are semiannual, divide the coupon rate in half. The coupon rate is the percentage off the bonds par value. As a result, each semi-annual coupon payment will be $50 ($1,000 X 0.05). 3. Determine the Semi-Annual Yield: Like the coupon rate, the required yield of 12% must bedivided by two because the number of periods used in the calculation has doubled. If we left the

required yield at 12%, our bond price would be very low and inaccurate. Therefore, the requiredsemi-annual yield is 6% (0.12/2). 4. Plug the Amounts Into the Formula: From the above calculation, we have determined that the bond is selling at a discount; the bondprice is less than its par value because the required yield of the bond is greater than the couponrate. The bond must sell at a discount to attract investors, who could find higher interestelsewhere in the prevailing rates. In other words, because investors can make a larger return inthe market, they need an extra incentive to invest in the bonds. Accounting for Diffe rent Payment Frequencies In the example above coupons were paid semi-annually, so we divided the interest rate andcoupon payments in half to represent the two payments per year. You may be now wonderingwhether there is a formula that does not require steps two and three outlined above, which arerequired if the coupon payments occur more than once a year. A simple modification of theabove formula will allow you to adjust interest rates and coupon payments to calculate a bondprice for any payment frequency:Notice that the only modification to the original formula is the addition of F , which represents

http://educationblog2012.blogspot.in/

the frequency of coupon payments, or the number of times a year the coupon is paid. Therefore,for bonds paying annual coupons, F would have a value of one. Should a bond pay quarterlypayments, F would equal four, and if the bond paid semi-annual coupons, F would be two.

Q2. What do you understand by operating cycle? A2. An operating cycle is the length of time between the acquisition of inventoryand the saleof that inventory and subsequent generation of a profit. The shorter the operating cycle, the fastera business gets areturn on investment(ROI) for the inventory it stocks. As a general rule,companies want to keep their operating cycles short for a number of reasons, but in certainindustries, a long operating cycle is actually the norm. Operating cycles are not tied toaccounting periods, but are rather calculated in terms of how long goods sit in inventory beforesale.When a business buys inventory, it ties up money in the inventory until it can be sold. Thismoney may be borrowed or paid up front, but in either case, once the business has purchasedinventory, those funds are not available for other uses. The business views this as an acceptabletradeoff because the inventory is an investment that will hopefully generate returns, but keeping the operating cycle short is still a goal for most businesses so they can keep their liquidity high.Keeping inventory during a long operating cycle does not just tie up funds. Inventory must bestored and this can become costly, especially with items that require special handling, such as humidity controls or security. Furthermore, inventory can depreciate if it is kept in a store toolong. In the case of perishable goods, it can even be rendered unsalable. Inventory must also beinsured and managed by staff members who need to be paid, and this adds to overall operating expenses. There are cases where a long operating cycle in unavoidable. Wineries and distilleries, forexample, keep inventory on hand for years before it is sold, because of the nature of the business.In these industries, the return on investment happens in the long term, rather than the short term.Such companies are usually structured in a way that allows them to borrow against existinginventory or land if funds are needed tofinanceshort-term operations.Operating cycles can fluctuate. During periods of economic stagnation, inventory tends to sitaround longer, while periods of growth may be marked by more rapid turnover. Certain productscan be consistent sellers that move in and out of inventory quickly. Others, like big ticket items,may be purchased less frequently. All of these issues must be accounted for when makingdecisions about ordering and pricing items for inventory.

Q3. What is the implication of ope rating leverage for a firm? A3. Operating leverage is the extent to which a firm uses fixed costs inproducing its goods or offering its services. Fixed costs includeadvertisingexpenses,administrative costs, equipment and technology, depreciation, and taxes, but not interest on debt,which is part of financial leverage. By using fixed production costs, a company can increase itsprofits. If a company

http://educationblog2012.blogspot.in/

has a large percentage of fixed costs, it has a high degree of operatingleverage. Automated and high-tech companies, utility companies, and airlines generally havehigh degrees of operating leverage.As an illustration of operating leverage, assume two firms, A and B, produce and sell widgets.Firm A uses a highly automated production process with robotic machines, whereas firm B assembles the widgets using primarily semiskilled labour. Table 1 shows both firms operating cost structures.Highly automated firm A has fixed costs of $35,000 per year and variable costs of only $1.00 perunit, whereas labour-intensive firm B has fixed costs of only $15,000 per year, but its variablecost per unit is much higher at $3.00 per unit. Both firms produce and sell 10,000 widgets peryear at a price of $5.00 per widget.Firm A has a higher amount of operating leverage because of its higher fixed costs, but firm Aalso has a higher breakeven point the point at which total costs equal total sales. Nevertheless,a change of Ipercent in sales causes more than a I percent change in operating profits for firm A, but not for firm B. The degree of operating leverage measures this effect. The following simplified equation demonstrates the type of equation used to compute the degree of operatingleverage, although to calculate this figure the equation would require several additional factorssuch as the quantity produced, variable cost per unit, and the price per unit, which are used todetermine changes in profits and sales: Operating leverage is a double-edged sword, however. If firm As sales decrease by I percent, its profits will decrease by more than I percent, too. Hence, the degree of operating leverage showsthe responsiveness of profits to a given change in sales. Implications: Total risk can be divided into two parts: business risk and financial risk. Business risk refers to the stability of a companys assets if it uses no debt or preferred stock financing. Business risk stems from the unpredictable nature of doing business, i.e., the unpredictability of consumer demand for products and services. As a result, it also involves the uncertainty of long-term profitability. When a company uses debt or preferred stock financing, additional risk financial risk

http://educationblog2012.blogspot.in/

is placed on the companys common shareholders. They demand a higher expected return for assuming this additional risk, which in turn, raises a companys costs. Consequently, companies with high degrees of business risk tend to be financed with relativelylow amounts of debt. The opposite also holds: companies with low amounts of business risk canafford to use more debt financing while keeping total risk at tolerable levels. Moreover, usingdebt as leverage is a successful tool during periods of inflation. Debt fails, however, to provideleverage during periods of deflation, such as the period during the late 1990s brought on by theAsian financial crisis.

Q4. What are the factors that affect the financial plan of a company? A4. To help your organization succeed, you should develop a plan that needs to be followed.This applies to starting the company, developing new product, creating a new department or anyundertaking that affects the companys future. There are several factorsthat affect planning in anorganization. To create an efficient plan, you need to understand the factors involved in theplanning process. Priorities In most companies, the priority is generating revenue, and this priority can sometimes interferewith the planning process of any project. For example, if you are in the process of planning alarge expansion project and your largest customer suddenly threatens to take their business toyour competitor, then you might have to shelve the expansion planning until the customer issueis resolved. When you start the planning process for any project, you need to assign each of theissues facing the company a priority rating. That priority rating will determine what issues willsidetrack you from the planning of your project, and which issues can wait until the process iscomplete. Company Resources Having an idea and developing a plan for your company can help your company to grow andsucceed, but if the company does not have the resources to make the plan come together, it canstall progress. One of the first steps to any planning process should be an evaluation of theresources necessary to complete the project, compared to the resources the company hasavailable. Some of the resources to consider are finances, personnel, space requirements, accessto materials and vendor relationships Forecasting

http://educationblog2012.blogspot.in/

A company constantly should be forecasting to help prepare for changes in the marketplace.Forecasting sales revenues, materials costs, personnel costs and overhead costs can help acompany plan for upcoming projects. Without accurate forecasting, it can be difficult to tell if the plan has any chance of success, if the company has the capabilities to pull off the plan and if the plan will help to strengthen the companys standing within the industry. For example, if your forecasting for the cost of goods has changed due to a sudden increase in material costs, then thatcan affect elements of your product roll-out plan, including projected profit and the long-termcommitment you might need to make to a supplier to try to get the lowest price possible. Contingency Planning To successfully plan, an organization needs to have a contingency plan in place. If the companyhas decided to pursue a new product line, there needs to be a part of the plan that addresses thepossibility that the product line will fail. The reallocation of company resources, the acceptablefinancial losses and the potential public relations problems that a failed product can cause allneed to be part of the organizational planning process from the beginning .

Q5. An employee of a bank deposits Rs. 30000 into his PF A/c at the end of each year for 20 years. What is the amount he will accumulate in his PF at the end of 20 years, if the rate of interest given by PF authorities is 9%? Hint Amount= 1534800 A.5

30000*FVIFA (9%, 20Y) = 30000*51.160 = Rs. 1534800

Q6. Mr.Anant purchases a bond whose face value is Rs.1000, and which has a nominal interest rate of 8%. The maturity period is 5 years. The required rate of return is 10%. What is the price he should be willing to pay now to purchase the bond? Hint: 924.28 A.6

Interest payable=1000*8%=Rs. 80 Principal repayment is Rs. 1000 Required rate of return is 10%

http://educationblog2012.blogspot.in/

V0=I*PVIFA(kd, n) + F*PVIF(kd, n) Value of the bond=80*PVIFA(10%, 5y) + 1000*PVIF(10%, 5y) = 80*3.791 + 1000*0.621 = 303.28 + 621

=Rs. 924.28

This implies that the company is offering the bond at Rs. 1000 but is worth Rs. 924.28 at the required rate of return of 10%. The investor may not be willing to pay more than Rs. 924.28 bond today.

Вам также может понравиться

- MBA - Operating Cycle and Bond PricingДокумент8 страницMBA - Operating Cycle and Bond PricingAntony Joseph PrabakarОценок пока нет

- mb0045 FMДокумент6 страницmb0045 FMRavinder ChauhanОценок пока нет

- Bond Concepts: Bond Pricing: Ihtisham Abdul Malik (Department of Management Sciences)Документ9 страницBond Concepts: Bond Pricing: Ihtisham Abdul Malik (Department of Management Sciences)ammar123Оценок пока нет

- Advanced Bond ConceptsДокумент32 страницыAdvanced Bond ConceptsJohn SmithОценок пока нет

- Advanced Bond ConceptsДокумент8 страницAdvanced Bond ConceptsEllaine OlimberioОценок пока нет

- Yield To CallДокумент16 страницYield To CallSushma MallapurОценок пока нет

- Chapter Four FMДокумент7 страницChapter Four FMHope GoОценок пока нет

- Premium Discount Par: Understanding The Time Value of MoneyДокумент5 страницPremium Discount Par: Understanding The Time Value of Moneyvaibhavc87Оценок пока нет

- Premium Discount Par: Understanding The Time Value of MoneyДокумент5 страницPremium Discount Par: Understanding The Time Value of Moneyvaibhavc87Оценок пока нет

- Strategic Financial Management - V - STДокумент9 страницStrategic Financial Management - V - STWorlex zakiОценок пока нет

- Q.1 What Are The 4 Finance Decisions Taken by A Finance ManagerДокумент10 страницQ.1 What Are The 4 Finance Decisions Taken by A Finance ManagerHitesh BalujaОценок пока нет

- What Is The Cost of CapitalДокумент32 страницыWhat Is The Cost of CapitalFORCHIA MAE CUTARОценок пока нет

- Final FinДокумент28 страницFinal Finashraful islam shawonОценок пока нет

- Corporate Cost of Debt: The Issue of Premium or Discount BondsДокумент6 страницCorporate Cost of Debt: The Issue of Premium or Discount BondsDipal KotakОценок пока нет

- Security Valuation: Bond, Equity and Preferred StockДокумент40 страницSecurity Valuation: Bond, Equity and Preferred StockMohamed KoneОценок пока нет

- Finance - Cost of Capital TheoryДокумент30 страницFinance - Cost of Capital TheoryShafkat RezaОценок пока нет

- Financial DecisionsДокумент45 страницFinancial DecisionsLumumba KuyelaОценок пока нет

- FM 15-17Документ23 страницыFM 15-17HanaОценок пока нет

- Bond Valuations:: What Does "Bond Valuation" Mean?Документ7 страницBond Valuations:: What Does "Bond Valuation" Mean?SandeepОценок пока нет

- Abdul Qadir Khan (Fixed Income Assignement No.5)Документ10 страницAbdul Qadir Khan (Fixed Income Assignement No.5)muhammadvaqasОценок пока нет

- Notes On Weighted-Average Cost of Capital (WACC) : Finance 422Документ5 страницNotes On Weighted-Average Cost of Capital (WACC) : Finance 422Dan MaloneyОценок пока нет

- A Generic Credit Card ProfitДокумент5 страницA Generic Credit Card ProfitPradyumna LhilaОценок пока нет

- FM Ch-5Документ36 страницFM Ch-5Riad FaisalОценок пока нет

- Solución Mini Caso Cap. 8Документ5 страницSolución Mini Caso Cap. 8Anonymous 5qHvuEIVz0Оценок пока нет

- Required Rate of ReturnДокумент4 страницыRequired Rate of ReturnGladys Shen AgujaОценок пока нет

- ReportДокумент105 страницReportGanesh JounjalОценок пока нет

- F FM Coc 09.03.22Документ19 страницF FM Coc 09.03.22Yash PokernaОценок пока нет

- Session 1.: Debt Capital MarketsДокумент79 страницSession 1.: Debt Capital MarketsLeonardo MercuriОценок пока нет

- Valuation and Risk ModelsДокумент19 страницValuation and Risk ModelsAyush Kumar GuptaОценок пока нет

- I-Bond Rate: TreasurydirectДокумент19 страницI-Bond Rate: TreasurydirectkoggleОценок пока нет

- BondДокумент44 страницыBondSumit VaishОценок пока нет

- Time Value of Money (TVM)Документ7 страницTime Value of Money (TVM)Anonymous kVrZLA1RCWОценок пока нет

- CH 4 Financing DecisionsДокумент72 страницыCH 4 Financing DecisionsAnkur AggarwalОценок пока нет

- Valuation of Bonds and SharesДокумент30 страницValuation of Bonds and SharesJohn TomОценок пока нет

- Bond Value - YieldДокумент40 страницBond Value - YieldSheeza AshrafОценок пока нет

- COST OF CAPITAL Notes QnsДокумент17 страницCOST OF CAPITAL Notes QnschabeОценок пока нет

- Relationship Between Required Rate of Return, Coupon Rate and Bond ValueДокумент4 страницыRelationship Between Required Rate of Return, Coupon Rate and Bond ValueYuvraj SinghОценок пока нет

- 8 Mutual FundДокумент4 страницы8 Mutual Fundelise tanОценок пока нет

- Solutions Nss NC 16Документ12 страницSolutions Nss NC 16ELsha Santiago BroCeОценок пока нет

- Average Cost of FundsДокумент4 страницыAverage Cost of Fundsraiden6263Оценок пока нет

- Cost of Capital ChapterДокумент25 страницCost of Capital ChapterHossain Belal100% (1)

- Quantitative Methods For FinanceДокумент86 страницQuantitative Methods For Financefusion2000Оценок пока нет

- Calculating Cost of CapitalДокумент11 страницCalculating Cost of CapitalPatrick RiveraОценок пока нет

- Weighted Average Cost of CapitalДокумент26 страницWeighted Average Cost of CapitalAysi WongОценок пока нет

- Accounts ReceivableДокумент9 страницAccounts ReceivableTrang LeОценок пока нет

- Finance Assignment' 1Документ13 страницFinance Assignment' 1Daichi FaithОценок пока нет

- Finance: The Cost of EquityДокумент5 страницFinance: The Cost of EquityBenjamin ChikeОценок пока нет

- Unit 2Документ5 страницUnit 2Aditya GuptaОценок пока нет

- Dividend Discount ModelДокумент9 страницDividend Discount ModelVatsal SinghОценок пока нет

- An Overview of Financial ManagementДокумент7 страницAn Overview of Financial ManagementAbin Som 2028121Оценок пока нет

- Module 2 Getting Ready To BuyДокумент13 страницModule 2 Getting Ready To BuysukhveerОценок пока нет

- Asset Valuation: Basic Bond Andstock Valuation ModelsДокумент23 страницыAsset Valuation: Basic Bond Andstock Valuation ModelsMa Via Bordon SalemОценок пока нет

- Equity Valuation Explained: Why Determine a Stock's Intrinsic ValueДокумент12 страницEquity Valuation Explained: Why Determine a Stock's Intrinsic ValueRUKUDZO KNOWLEDGE DAWAОценок пока нет

- Microsoft Word - Week 6 Bonds Version - 1 Solution 9th 04 2019Документ6 страницMicrosoft Word - Week 6 Bonds Version - 1 Solution 9th 04 2019Mark LiОценок пока нет

- What Is Yield To Maturity (YTM) ?Документ5 страницWhat Is Yield To Maturity (YTM) ?Niño Rey LopezОценок пока нет

- Financial Management ImportantДокумент6 страницFinancial Management ImportantDippak ChabraОценок пока нет

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!От EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!Оценок пока нет

- Applied Corporate Finance. What is a Company worth?От EverandApplied Corporate Finance. What is a Company worth?Рейтинг: 3 из 5 звезд3/5 (2)

- SILCДокумент34 страницыSILCAhmed BarkaatiОценок пока нет

- MemsДокумент21 страницаMemssatyadev555Оценок пока нет

- NanotechnologyДокумент29 страницNanotechnologyAhmed BarkaatiОценок пока нет

- Free Space OpticsДокумент21 страницаFree Space OpticsAllanki Sanyasi RaoОценок пока нет

- Crusoe Is The New Microprocessor Which Has Been Designed Specially For TheДокумент31 страницаCrusoe Is The New Microprocessor Which Has Been Designed Specially For TheAjin AbrahamОценок пока нет

- Dept of IT 1Документ35 страницDept of IT 1Anjeer CashewОценок пока нет

- LRRДокумент27 страницLRRGurpreet Singh WaliaОценок пока нет

- Global Positioning SystemДокумент40 страницGlobal Positioning Systemjitturock124Оценок пока нет

- Landmines DetectionДокумент24 страницыLandmines DetectionSudip Pradhan100% (1)

- Intelligent NetworkДокумент28 страницIntelligent NetworkAhmed Barkaati100% (1)

- Intelligent Navigation SystДокумент41 страницаIntelligent Navigation SystAhmed BarkaatiОценок пока нет

- DTMДокумент33 страницыDTMcsestudent1Оценок пока нет

- Artificial Neural Networks 22Документ17 страницArtificial Neural Networks 22Dante PaceОценок пока нет

- Bluetooth Based Smart Sensor Networks Seminar TopicДокумент12 страницBluetooth Based Smart Sensor Networks Seminar TopicNaman Garg100% (1)

- Dense Wavelength Division MultiplexingДокумент22 страницыDense Wavelength Division Multiplexingsvt4bhosaleОценок пока нет

- The Standard Template Library TutorialДокумент56 страницThe Standard Template Library TutorialsalessandraseseОценок пока нет

- Micro Controller Based Power Theft IdentificationДокумент16 страницMicro Controller Based Power Theft Identificationmoon403100% (1)

- MIMO Wireless Channels: Capacity Prediction Based on Scattering ParametersДокумент13 страницMIMO Wireless Channels: Capacity Prediction Based on Scattering ParametersVineeth KommuruОценок пока нет

- Version Management With CVSДокумент176 страницVersion Management With CVSInfomasterОценок пока нет

- Wisenet: (Wireless Sensor Network)Документ13 страницWisenet: (Wireless Sensor Network)Shiva KumarОценок пока нет

- Face Recognition Using Neural Networks Sona CollegeДокумент19 страницFace Recognition Using Neural Networks Sona CollegeAjith Varghese0% (1)

- GSM Security and EncryptionДокумент18 страницGSM Security and EncryptionchjmohanОценок пока нет

- Data Security in Wireless NetworksДокумент17 страницData Security in Wireless NetworksPinkesh NakawalaОценок пока нет

- <!DOCTYPE HTML PUBLIC "-//W3C//DTD HTML 4.01 Transitional//EN" "http://www.w3.org/TR/html4/loose.dtd"> <HTML><HEAD><META HTTP-EQUIV="Content-Type" CONTENT="text/html; charset=iso-8859-1"> <TITLE>ERROR: The requested URL could not be retrieved</TITLE> <STYLE type="text/css"><!--BODY{background-color:#ffffff;font-family:verdana,sans-serif}PRE{font-family:sans-serif}--></STYLE> </HEAD><BODY> <H1>ERROR</H1> <H2>The requested URL could not be retrieved</H2> <HR noshade size="1px"> <P> While trying to process the request: <PRE> TEXT http://www.scribd.com/titlecleaner?title=Unix+commands+reference+card.pdf HTTP/1.1 Host: www.scribd.com Proxy-Connection: keep-alive Accept: */* Origin: http://www.scribd.com X-CSRF-Token: 155fb7fa517a5becb07621cfee52141124ac069c User-Agent: Mozilla/5.0 (Windows NT 6.1; WOW64) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/27.0.1453.116 Safari/537.36 X-Requested-With: XMLHttpRequest Referer: http://www.scribd.com/upload-document?archive_doc=1249Документ2 страницы<!DOCTYPE HTML PUBLIC "-//W3C//DTD HTML 4.01 Transitional//EN" "http://www.w3.org/TR/html4/loose.dtd"> <HTML><HEAD><META HTTP-EQUIV="Content-Type" CONTENT="text/html; charset=iso-8859-1"> <TITLE>ERROR: The requested URL could not be retrieved</TITLE> <STYLE type="text/css"><!--BODY{background-color:#ffffff;font-family:verdana,sans-serif}PRE{font-family:sans-serif}--></STYLE> </HEAD><BODY> <H1>ERROR</H1> <H2>The requested URL could not be retrieved</H2> <HR noshade size="1px"> <P> While trying to process the request: <PRE> TEXT http://www.scribd.com/titlecleaner?title=Unix+commands+reference+card.pdf HTTP/1.1 Host: www.scribd.com Proxy-Connection: keep-alive Accept: */* Origin: http://www.scribd.com X-CSRF-Token: 155fb7fa517a5becb07621cfee52141124ac069c User-Agent: Mozilla/5.0 (Windows NT 6.1; WOW64) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/27.0.1453.116 Safari/537.36 X-Requested-With: XMLHttpRequest Referer: http://www.scribd.com/upload-document?archive_doc=1249Rajashekhar VanjarapuОценок пока нет

- Wireless Lan Ieee 80211Документ28 страницWireless Lan Ieee 80211Nishit RanjanОценок пока нет

- Function Pointer PDFДокумент12 страницFunction Pointer PDFc406400Оценок пока нет

- Vim Quick ReferenceДокумент2 страницыVim Quick Referencebashwork100% (26)

- The C++ IOStreams LibraryДокумент15 страницThe C++ IOStreams Libraryheroddaji100% (1)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- PHP 4 Reference CardДокумент2 страницыPHP 4 Reference CardSneetsher CrispyОценок пока нет

- Open Office DG201 FunctionsДокумент32 страницыOpen Office DG201 FunctionsJavier LopezОценок пока нет

- Retail BondsДокумент1 страницаRetail BondsMonicaDeviOenОценок пока нет

- CH 5 SNДокумент17 страницCH 5 SNSam TnОценок пока нет

- Interest Theory QuestionsДокумент65 страницInterest Theory Questionsshivanithapar13100% (1)

- Chapter 5 Solutions V1Документ16 страницChapter 5 Solutions V1meemahsОценок пока нет

- CALCULATING YTM FOR BONDSДокумент4 страницыCALCULATING YTM FOR BONDSJapponjot SinghОценок пока нет

- Bond Yield CalculatorДокумент4 страницыBond Yield CalculatorJovan SevdoОценок пока нет

- W. P. Carey School of BusinessДокумент5 страницW. P. Carey School of BusinessgvsfansОценок пока нет

- Exercises Yield To MaturityДокумент2 страницыExercises Yield To MaturityJohnОценок пока нет

- Fixed Income Valuation: Case SolutionДокумент5 страницFixed Income Valuation: Case SolutionProf. Abhinav Kumar RajvermaОценок пока нет

- Free Mock For Jaiib & CaiibДокумент6 страницFree Mock For Jaiib & CaiibsandeepОценок пока нет

- BOND VALUATION With SolutionsДокумент30 страницBOND VALUATION With Solutionschiaraferragni75% (8)

- CHAPTER 6 BONDS AND THEIR VALUATIONДокумент53 страницыCHAPTER 6 BONDS AND THEIR VALUATIONkafuka_3967% (3)

- Exam FM Formula PDFДокумент15 страницExam FM Formula PDFMim AtchareeОценок пока нет

- AoF Tutorial02 SpotДокумент3 страницыAoF Tutorial02 SpotSeebsОценок пока нет

- QF2101 1112S1 Tutorial 3Документ3 страницыQF2101 1112S1 Tutorial 3Wei Chong KokОценок пока нет

- NTPCДокумент19 страницNTPCamritОценок пока нет

- NikeДокумент10 страницNikeCarissa KusumaОценок пока нет

- CH07new-Bond Price PPT With Ref. AnswerДокумент47 страницCH07new-Bond Price PPT With Ref. AnswerGordon Leung100% (1)

- Financial Management Quiz Results and AnalysisДокумент12 страницFinancial Management Quiz Results and AnalysisFreds_filesОценок пока нет

- CD and Promisory NoteДокумент18 страницCD and Promisory NoteChar LeneОценок пока нет

- Business Finance AssignmentДокумент3 страницыBusiness Finance Assignmentk_Dashy8465Оценок пока нет

- Inflation Instruments OpenGammaДокумент4 страницыInflation Instruments OpenGammadondan123Оценок пока нет

- Debt InstrumentsДокумент204 страницыDebt InstrumentsSitaKumariОценок пока нет

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ10 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali0% (1)

- Interest Rates - An IntroductionДокумент186 страницInterest Rates - An IntroductionAamirОценок пока нет

- Bond Market - MMSДокумент124 страницыBond Market - MMSkanhaiya_sarda5549Оценок пока нет

- HW9Документ2 страницыHW9Kristina AbuladzeОценок пока нет

- East Coast Yacht's Expansion Plans-06!02!2008 v2Документ3 страницыEast Coast Yacht's Expansion Plans-06!02!2008 v2percyОценок пока нет