Академический Документы

Профессиональный Документы

Культура Документы

Clild Plan Comparision

Загружено:

Ankit GoelИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Clild Plan Comparision

Загружено:

Ankit GoelАвторское право:

Доступные форматы

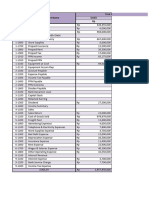

CHILDREN PLAN COMPARISION

Features ICICI Smart Kid Anticipated Endowment Matures between 22-25 years of the childs age. Term is 10-25 years HDFC Children's Plan Endowment 10-25 year LIC Komal Jeevan Anticipated Endowment Premium to be paid till the child attains age 18. Max. Term- 26 yrs Max New York Stepping Stone Anticipated Endowment 11-26 years Bajaj Allianz Child Gain Anticipated Endowment Child Gain 21 and Child Gain 21Plus - Max. Term- 21 yrs less current age at entry of child Child Gain 24 and Child Gain 24 Plus - Max. Term- 24 yrs less current age at entry of child 0 - 13 years

Plan Type Min / Max Term child

Min / Max Age of Child Min / Max Age of Parent Payment Modes Life Assured Beneficiar y Benefit Structure

0-12 years

N.A.

0 - 10 years

N.A.

20-60 years

18-60 years

N.A.

21-60 years

20-50 years

Regular

Regular Parent

Regular, Single Child Child Monies paid as per attained age: 18 yrs-20% of S.A, 20 yrs20% of SA, 22yrs-30% of SA, 24yrs30% of SA & 26 yrs- Bonus for entire Term + Loyalty Additions, if any

Regular Parent Child / Family 5 years before maturity - 30% of SA 2 years before maturity 35% of SA At maturity 35% of SA + 30% guaranteed addition + nonguaranteed bonus, if any

Regular Child Child / Family Child Gain 21 and Child Gain 21Plus - 18 yrs20% of S.A+ accrued bonuses, 19 yrs-25% of SA, 20yrs-25% of SA, 21yrs-35% of SA Child Gain 24 and Child Gain 24 Plus 18 yrs-25% of S.A+ accrued bonuses, 20 yrs-25% of SA, 22yrs-25% of SA, 24yrs40% of SA

Child Two Structures 1. When the child reaches his critical milestones (Xth, XIIth, Graduation, and Post Grad); % of S A is paid 2. Last 4 years before maturity; % of SA is paid over consecutive yrs SA paid up front. Child gets the guaranteed payments as chosen earlier

Child / Family Sum Assured + bonuses paid on maturity in lump sum

On Death of parent

1) Maturity Benefit Plan: future premiums are waived; maturity benefits are paid like normal on maturity

All Future Premiums Waived off. Child gets the guaranteed payments as per Structure + bonus paid at the end of the policy

In case of death of the life insured, an amount equal to sum assured is paid immediately, all future premiums are waived off and all pending survival benefits remain

In case of death of the parent, all future premiums are waived off and all pending survival benefits remain unaffected. Also, a monthly income benefit @1% of SA subject to max. of Rs.10,000/- p.m. is paid. In case of Child

term. 2)Accelerat ed Benefit Plan: Sum assured + bonuses paid to beneficiary on death & contract terminates 3)Double Benefit Plan: Sum assured paid immediately on death; future premiums are waived; maturity benefits are paid like normal on maturity Policy continues *In case premium waiver benefit rider is taken

unaffected, including maturity bonuses

Gain 21 Plus and Child Gain 24 Plus, an additional SA max upto Rs.10 lacs is payable i.e. Start of Life Benefit on death of parent

On Death of child

Policy continues as it is. It can be nominated to another child in that case also 3.5% of SA compunded annually for the first 4 years, annual bonuses declared thereafter ADBR/IBR

Bonus & Additions

Bonuses declared by company

Riders Available

None

On death after commenceme nt of risk , Sum Assured + Bonus till Date is paid & Plan Closes Guaranteed @ 7.5% of SA - simple interest. Paid on Child attaining age 26. Loyalty Additions, if any. Accident Cover, Premium Waiver Benefit

Policy continues as it is. It can be nominated to another child in that case also

On death after commencement of risk , Sum Assured + Accured Bonus till Date is paid & Plan Closes

Guaranteed 30% os sum assures, along with nonguaranteed bonuses as declared by the company from time to time ADB, CI, Term, Term R&C, WOP

Bonuses declared by company is paid on child attaining 18 years

Inbuilt Waiver of Premium, Family Income Benefit In case of Child Gain 21 Plus & Child Gain 24 Plus, Start of Life benefit inbuilt.

Вам также может понравиться

- Construction Equipment Management BookДокумент130 страницConstruction Equipment Management BookJosse Shandra100% (9)

- Income Taxation Solution Manual 2019 Ed PDFДокумент40 страницIncome Taxation Solution Manual 2019 Ed PDFCah Cords100% (12)

- Statement of Management's Responsibility For Annual Income TaxДокумент2 страницыStatement of Management's Responsibility For Annual Income TaxJohn Heil96% (25)

- Business Plan - Herbal Hair OilДокумент7 страницBusiness Plan - Herbal Hair Oilsaraedu100% (1)

- Ldce - Fasp - 08 PDFДокумент9 страницLdce - Fasp - 08 PDFDinesh Talele86% (7)

- LIC All Plans AvailableДокумент40 страницLIC All Plans AvailableAjit SinhaОценок пока нет

- What to Do When You're 73: Financial Considerations for Life’s StagesОт EverandWhat to Do When You're 73: Financial Considerations for Life’s StagesОценок пока нет

- Talk To ChuckДокумент28 страницTalk To ChuckAshish Dadoo100% (1)

- 14 - Audit Other Related ServicesДокумент38 страниц14 - Audit Other Related ServicesSyafiq AhmadОценок пока нет

- Final Version WeWork Article HBS HeaderДокумент25 страницFinal Version WeWork Article HBS HeaderDuc Beo100% (1)

- The Rice Bistro PowerpointДокумент69 страницThe Rice Bistro PowerpointChienny HocosolОценок пока нет

- Internship ReportCAA PakistanДокумент9 страницInternship ReportCAA PakistanUmairChJalandhariОценок пока нет

- 327-329 Plaridel Surety & Insurance v. CIR Collector v. Goodrich International Rubber Co.Документ2 страницы327-329 Plaridel Surety & Insurance v. CIR Collector v. Goodrich International Rubber Co.Eloise Coleen Sulla PerezОценок пока нет

- DAVAO v. APHIДокумент2 страницыDAVAO v. APHIEnverga Law School Corporation Law SC Division100% (1)

- HDFC Child PlanДокумент2 страницыHDFC Child Planshweta_shetty14Оценок пока нет

- Smartkid RPДокумент6 страницSmartkid RPRajbir Singh YadavОценок пока нет

- Lic - Child PlansДокумент5 страницLic - Child PlansRakhi SarohaОценок пока нет

- LIC Komal Jeevan ReviewsДокумент3 страницыLIC Komal Jeevan Reviewsgaganhungama007Оценок пока нет

- Whole Life Schemes: Sum Assured Min MaxДокумент48 страницWhole Life Schemes: Sum Assured Min MaxrajeevbachraОценок пока нет

- Table No 102Документ2 страницыTable No 102ssfinservОценок пока нет

- Product DetailsДокумент13 страницProduct Detailskannakumar1983Оценок пока нет

- Table No 184Документ2 страницыTable No 184ssfinservОценок пока нет

- Star Kid PPT (1) .Документ13 страницStar Kid PPT (1) .Dipak ChandwaniОценок пока нет

- Table No 185Документ2 страницыTable No 185ssfinservОценок пока нет

- Bhagyashree Child Welfare PolicyДокумент2 страницыBhagyashree Child Welfare PolicyKarthik SharmaОценок пока нет

- I Have Made Sure That My Child's Career Zooms Ahead No Matter WhatДокумент4 страницыI Have Made Sure That My Child's Career Zooms Ahead No Matter Whatsharma.shireesh264808Оценок пока нет

- Smart Junior Product Brochure NewДокумент11 страницSmart Junior Product Brochure NewSantosh KumarОценок пока нет

- Child Insurance EducationДокумент12 страницChild Insurance Educationsekar sОценок пока нет

- Standardized Product: TrainingДокумент44 страницыStandardized Product: TrainingHannington KondeОценок пока нет

- LIC's JEEVAN ANKUR 807 PDFДокумент3 страницыLIC's JEEVAN ANKUR 807 PDFgvspavan0% (2)

- Muzammil Qadeer Qureshi Phs Trainee Officer PAY ROLL NO: 21705-0Документ25 страницMuzammil Qadeer Qureshi Phs Trainee Officer PAY ROLL NO: 21705-0Muzammil QureshiiОценок пока нет

- Akansha Investment Services: Home Products Services SMS Service FAQ Contact DetailsДокумент6 страницAkansha Investment Services: Home Products Services SMS Service FAQ Contact Detailssarup007Оценок пока нет

- Aviva - Family Income BuilderДокумент3 страницыAviva - Family Income BuilderSahil KumarОценок пока нет

- SSGML Products Exclusive April 2012Документ9 страницSSGML Products Exclusive April 2012synergygroupОценок пока нет

- SSGML Products Exclusive April 2012Документ9 страницSSGML Products Exclusive April 2012synergygroupОценок пока нет

- Table No 103Документ2 страницыTable No 103ssfinservОценок пока нет

- Jiban Bima CorporationДокумент29 страницJiban Bima CorporationBijoy Salahuddin100% (1)

- Brochure SUD Life Jeevan AshrayДокумент6 страницBrochure SUD Life Jeevan Ashrayayushman rajОценок пока нет

- MMIP - Single PagerДокумент1 страницаMMIP - Single PagerVishwa VictoryОценок пока нет

- Rad 06 AF0Документ2 страницыRad 06 AF0Harish ChandОценок пока нет

- AR Educare Advantage Insurance Plan 5 May 2014Документ6 страницAR Educare Advantage Insurance Plan 5 May 2014ÌmřańОценок пока нет

- Child Career PlanДокумент17 страницChild Career Planishasalex03Оценок пока нет

- A Target Savings Plan With The Advantage of Liquidity and Life CoverДокумент11 страницA Target Savings Plan With The Advantage of Liquidity and Life CoverRishipal ChauhanОценок пока нет

- Aam Admi Bima Yojana Lic PolicyДокумент13 страницAam Admi Bima Yojana Lic PolicyNarendra KumarОценок пока нет

- BI KotakДокумент27 страницBI KotakThangarajОценок пока нет

- Edelweiss Tokio Life Edu Save PlanДокумент11 страницEdelweiss Tokio Life Edu Save Planbilu4uОценок пока нет

- Magic Plan - Retire and Enjoy IIДокумент6 страницMagic Plan - Retire and Enjoy IIabdulyunus_amirОценок пока нет

- Super Five Plus Final One PagerДокумент6 страницSuper Five Plus Final One PagerAditya Singh0% (1)

- Mediclaim 80dДокумент5 страницMediclaim 80dPaymaster ServicesОценок пока нет

- Lic'S Jeevan Ankur (Plan No. 807)Документ10 страницLic'S Jeevan Ankur (Plan No. 807)Narendar KumarОценок пока нет

- Aviva Life InsuranceДокумент3 страницыAviva Life InsuranceumashankarsinghОценок пока нет

- Life Insurance Products in NepalДокумент13 страницLife Insurance Products in NepalSachin PangeniОценок пока нет

- PWM Group 5Документ31 страницаPWM Group 5Gaurav AroraОценок пока нет

- Smart Junior Product Brochure NewДокумент11 страницSmart Junior Product Brochure Newmanuk193Оценок пока нет

- Childgain: Bajaj AllianzДокумент6 страницChildgain: Bajaj AllianzAsħîŞĥLøÝåОценок пока нет

- Help Your Child Today. To Become The Champ of Tomorrow.: Exide LifeДокумент4 страницыHelp Your Child Today. To Become The Champ of Tomorrow.: Exide LifearulkumarОценок пока нет

- CignaTTK ProHealth Vs Star ComprehensiveДокумент9 страницCignaTTK ProHealth Vs Star Comprehensivemaakabhawan26Оценок пока нет

- Promise Your Child An Independent Tomorrow: WWW - Sbilife.co - inДокумент14 страницPromise Your Child An Independent Tomorrow: WWW - Sbilife.co - inBARUNENDU GAGANОценок пока нет

- Child GainДокумент2 страницыChild GainNamananda SahuОценок пока нет

- JKR AssignmentДокумент28 страницJKR AssignmentAR MansurОценок пока нет

- Asse T Revi Ew: Activi Ty Centr e Educa Tion Plann ErДокумент13 страницAsse T Revi Ew: Activi Ty Centr e Educa Tion Plann ErkvijayasokОценок пока нет

- Allianz Life - Income Enhancer A5 Brochure V2 240613 R3Документ6 страницAllianz Life - Income Enhancer A5 Brochure V2 240613 R3Is EastОценок пока нет

- Astha Life Insurance Company LimitedДокумент8 страницAstha Life Insurance Company Limitedanisulislam asifОценок пока нет

- 1 LIC Jeevan Anurag PlanДокумент11 страниц1 LIC Jeevan Anurag PlanJayaram JaiОценок пока нет

- Jeevan SaralДокумент2 страницыJeevan Saralsandy dheerОценок пока нет

- Super Endowment BrochureДокумент13 страницSuper Endowment BrochuremiteshtakeОценок пока нет

- Jeevan Anurag: Assured BenefitДокумент10 страницJeevan Anurag: Assured BenefitMandheer ChitnavisОценок пока нет

- Dream ChildДокумент2 страницыDream ChildDinesh JocularОценок пока нет

- Jeevan Surabhi - 106 - 107 - 108Документ3 страницыJeevan Surabhi - 106 - 107 - 108Vinay KumarОценок пока нет

- Child Fortune Plus Write UpДокумент7 страницChild Fortune Plus Write Upap87Оценок пока нет

- Kotak Money Back PlanДокумент2 страницыKotak Money Back PlanDriptendu MaitiОценок пока нет

- Target Market SegmentationДокумент17 страницTarget Market SegmentationAnkit GoelОценок пока нет

- Super SaverДокумент13 страницSuper SaverAnkit GoelОценок пока нет

- Pension GuaranteeДокумент2 страницыPension GuaranteeAnkit GoelОценок пока нет

- The Trainer Pack: Planning A CourseДокумент50 страницThe Trainer Pack: Planning A CourseAnkit GoelОценок пока нет

- Siklus Akuntansi Pada PT Adi JayaДокумент11 страницSiklus Akuntansi Pada PT Adi Jayafitrianura04Оценок пока нет

- Chap 1 ExercisesДокумент3 страницыChap 1 ExercisesThabet HomriОценок пока нет

- Business Simulation - IntroductionДокумент7 страницBusiness Simulation - IntroductionVuong Bui VietОценок пока нет

- Bf015 Espp Plan Ver3Документ49 страницBf015 Espp Plan Ver3Hamdy MohamedОценок пока нет

- Chapter 11 Financial Statement Analysis: Accounting - What The Numbers Mean, 12e (Marshall)Документ6 страницChapter 11 Financial Statement Analysis: Accounting - What The Numbers Mean, 12e (Marshall)Jue WernОценок пока нет

- BSNL Working CapitalДокумент59 страницBSNL Working Capitaldivvyankgupta100% (1)

- A-What Are The Primary Information Needs of Each Manager?Документ3 страницыA-What Are The Primary Information Needs of Each Manager?Asma HatamОценок пока нет

- Innside TPI Winter 2014 - E-Mail PDFДокумент24 страницыInnside TPI Winter 2014 - E-Mail PDFSarah KuglinОценок пока нет

- AFM Capital Structure Cp5Документ61 страницаAFM Capital Structure Cp5drmsellan7Оценок пока нет

- Logical Ability For XATДокумент52 страницыLogical Ability For XATBharat BajajОценок пока нет

- Practice For Midterm 1Документ136 страницPractice For Midterm 1ennaira 06Оценок пока нет

- Case 2 RSPДокумент26 страницCase 2 RSPSabina DhakalОценок пока нет

- SNVM Unit 3Документ21 страницаSNVM Unit 3Megha PatelОценок пока нет

- Applications of Marginal Costing and CostДокумент3 страницыApplications of Marginal Costing and CostSahil BishnoiОценок пока нет

- CC-2004-06 (Guidelines On Payment of Disbursement)Документ4 страницыCC-2004-06 (Guidelines On Payment of Disbursement)Kiddo ApolinaresОценок пока нет

- Course Content For Stock MarketДокумент1 страницаCourse Content For Stock MarketSumon SarkarОценок пока нет

- Ferry Van Asperen and Bram Van Besouw de Sotos Thesis and The Roman EmpireДокумент21 страницаFerry Van Asperen and Bram Van Besouw de Sotos Thesis and The Roman EmpireFerdinandAlxОценок пока нет

- Cash Flow StatementДокумент1 страницаCash Flow StatementYagika JagnaniОценок пока нет