Академический Документы

Профессиональный Документы

Культура Документы

Ifood Corporation

Загружено:

Getre SandigИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ifood Corporation

Загружено:

Getre SandigАвторское право:

Доступные форматы

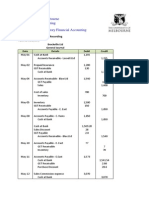

iFOOD CORPORATION NOTES TO FINANCIAL STATEMENTS

1. Corporation Information iFood Corporation (the Company) was registered with the Securities and Exchange Commission on October 06, 2009 and started commercial operations on January 2010. The Company is engaged in business of food processing and repacking; buying, selling, distributing, marketing at wholesale insofar as maybe permitted by law, all kinds of goods, commodities, wares and merchandise of every kind and description, such as but not limited to marinated roasted chicken, pork bellies (liempo) and other food items. The Companys office address is located at Lot 11, Blk. 5, Tiongquiao St., BF Martinville, Las Pias City. The financial statements of the company as of December 31, 2010 and 2009 were authorized for issue by the Board of Directors on March 23, 2011. 2. Summary of Significant Accounting Policies 2.1 Basis of Preparation The accompanying financial statements have been prepared in accordance with the Philippine Financial Reporting Standard for Small and Medium-sized Entities (PFRS for SMEs) issued by the International Accounting Standards Board and under the historical cost convention. These financial statements are presented in Philippine pesos. 2.2 Statement of Compliance The financial statements have been prepared in compliance with PFRS for SMEs. 2.3 Policies Adopted The Company adopted the following PAS based on revised PAS that are relevant to the company: PFRS 1, First-time adoption of Philippine Financial Reporting Standards, requires the company to comply with PFRS effective at the reporting date of its first PFRS financial statements. In particular, the PFRS requires the Company to do the following in the opening PFRS balance sheet that it prepares as a starting point for its accounting under PFRS: (a) recognize all assets and liabilities whose recognition is required by PFRS; (b) not recognize all assets or liabilities if PFRS do not permit such recognition; (c) reclassify items that it recognized under previous generally accepted accounting principles as one type of asset, liability or component of equity, but are different type of asset, liability or component of equity under PFRS; and (d) apply PFRS in measuring all recognized asset and liability. Any additional disclosure requirements by this standard will be presented accordingly.

PAS 1, Presentation of Financial Statement, provides a framework within which an entity assesses how to present fairly the effects of transactions and events; provides the base criteria for classifying liabilities as current or noncurrent, prohibits the presentation of income from operating activities and extraordinary items as separate line items in statement of income; and specifies the disclosures about key sources of estimation, uncertainty and judgments management has made in the process of applying the entitys accounting policies. PAS 2, Inventories, reduces the alternatives for measurement of inventories. It does not permit the use of last in, first out (LIFO) formula to measure the cost of inventories. PAS 7, Cash Flow Statements, requires the provision of information about the historical changes in cash and cash equivalents of an entity by means of cash flow statement which classifies cash flows during the period from operating, investing and financing activities. PAS 8, Accounting Policies, Changes in Accounting Estimates and Errors, removes the concept of fundamental error and the allowed alternative to retrospective application of voluntary changes in accounting policies and retrospective restatement to correct prior period errors. It defines material omission or misstatements, and describes how to apply the concept of materiality when applying accounting error. PAS 10, Events After the Balance Sheet Date, which prescribes when the company should adjust its financial statements for events after the balance sheet date and the disclosures that an entity should give about when the financial statements were authorized for issue and about events after the balance sheet date. This Standards also requires the company not to prepare its financial statements on a going concern basis if events after the balance sheet date indicate that the going concern assumption is not appropriate. PAS 12, Accounting for Income Taxes, The objective of this Statement is to prescribe the accounting treatment for income taxes. The principal issue in accounting for income taxes is how to account for the current and future tax consequences of: a. The future recovery (settlement) of the carrying amount of assets (liabilities)that are recognized in the entities balance sheet; and b. Transactions and other events of the current period that are recognized in the entities financial statements. PAS 16, Property, Plant and Equipment, provides additional guidance and clarification on recognition and measurement of items of property, plant and equipment. It also provides that each part of the item of property, plant and equipment with a cost that is significant in relation to the total cost of the item shall be depreciated separately.

PAS 17, Lease, provides a limited revision to clarify the classification of a lease of land and buildings and prohibits expensing of initial direct cost in the financial statement of the lessors. PAS 18, Revenue, provides additional guidelines as to the timely recognition of revenue, which is measured at the fair value of the consideration received or receivable. PAS 24, Related Party Disclosure, provides additional guidance and clarity in the scope of the standard, the definitions and disclosures for related parties. It also requires disclosure of the compensation of key management personnel by benefit type. PAS 36, Impairment of Assets, prescribes the procedure that an entity applies to ensure that its assets are carried at no more than their recoverable amount. An asset is carried more than its recoverable amount if its carrying amount exceeds the amount to be recovered through use or sale of the asset. If this is the case, the asset is described as incurred in the standard requires the entity to recognize an impairment loss. The Standard also specifies when an entity should reverse an impairment and prescribes disclosures. PAS 37, Provisions, Contingent Liabilities and Contingent Assets, provides the criteria for the recognition and bases for measurement of provisions, contingent liabilities and contingent assets. Additional disclosures required by the standard, principally the change in the provisions for the year, were included in the financial statements. The adoption of the above standards has no material effect on the financial position or performance of the company. The significant accounting policies and practices of the company are set forth to facilitate the understanding of the financial statement: Cash Cash includes cash on hand and in bank. Trade Receivables Trade receivables are stated at outstanding balances. The company did not maintain an allowance for impairment losses at a level considered adequate to provide for potential uncollectible since receivable are 100% collectible as of balance sheet date. Inventory Food inventory is stated at the lower of cost or net realizable value. Net realizable value is the estimated selling price in the ordinary course of business. For financial reporting purposes, the company uses the first-in-first-out method in costing its inventory.

Prepayments and advances Prepayments and advances are stated at its face amounts. Property and equipment Property and equipment are carried at cost less accumulated depreciation, and any impairment in value. The initial cost of property and equipment comprises its purchase price and any directly attributable costs of bringing the asset into working condition and locations of its intended use. Expenditures incurred after the fixed assets have been put into operation, such as repairs and maintenance, are normally charged to income in the period in which the cost are incurred. In situations where it can be clearly demonstrated that the expenditures have resulted in an increase in the future economic benefits expected to be obtained from the use of the item of property and equipment beyond its originally assessed standard of performance, the expenditures are capitalized as an additional cost of property and equipment. Depreciation is computed on a straight-line basis over the following estimated useful lives of the property and equipment. Leasehold improvements Transportation equipment Furnitures, fixtures and equipment 5 years 5 years 3-5 years

The useful lives and the method of depreciation are reviewed periodically to ensure that the periods and the method of depreciation are consistent with the expected pattern of economic benefits from items of property and equipment. When property and equipment are retired or otherwise disposed of, the cost and the related accumulated depreciation and any impairment in value are eliminated from the accounts and any resulting gain or loss from disposal is credited or charged to current operations. Impairment of Assets The carrying values of property and equipment are reviewed for impairment when events or changes in circumstances indicate the carrying values may not be recoverable. If any such indication exists and where the carrying values exceed the estimated recoverable amounts, the assets or cash generating units are written down to their recoverable amounts. The recoverable amount of these assets is greater of net selling price and value in use. The net selling price is the amount obtainable from the sale of an asset in the arms length transaction while value in use is the present value of estimated future cash flows expected to arise from the continuing use of an asset and from its disposal

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Analysis and Interpretation of Financial StatementsДокумент76 страницAnalysis and Interpretation of Financial StatementsSufyan Sadiq60% (5)

- Ias 12 TaxationДокумент15 страницIas 12 TaxationHải AnhОценок пока нет

- Performing Preliminary Engagement ActivitiesДокумент9 страницPerforming Preliminary Engagement ActivitiesMarnelli CatalanОценок пока нет

- A Exam SampleДокумент20 страницA Exam Sampledanchinh100% (1)

- 2016 ORION Consolidated Audit ReportДокумент112 страниц2016 ORION Consolidated Audit ReportJoachim VIALLONОценок пока нет

- End of Chapter 1 Exercises - Toralde, Ma - Kristine E.Документ7 страницEnd of Chapter 1 Exercises - Toralde, Ma - Kristine E.Kristine Esplana ToraldeОценок пока нет

- Meet The Standards - 16th NFJPIA MYC - Final RoundДокумент10 страницMeet The Standards - 16th NFJPIA MYC - Final RoundJoseph SalidoОценок пока нет

- Exercise Sheet For Financial Accounting - Answer IMBAДокумент53 страницыExercise Sheet For Financial Accounting - Answer IMBAHager Salah100% (1)

- Audit Program-MSBPLДокумент21 страницаAudit Program-MSBPLTasdik MahmudОценок пока нет

- Intermediate Accounting RTP May 20Документ44 страницыIntermediate Accounting RTP May 20Durgadevi BaskaranОценок пока нет

- Chapter-1 Accounting For NgoДокумент70 страницChapter-1 Accounting For Ngoshital_vyas1987100% (1)

- IFA Week 3 Tutorial Solutions Brockville SolutionsДокумент9 страницIFA Week 3 Tutorial Solutions Brockville SolutionskajsdkjqwelОценок пока нет

- CE On Quasi-ReorganizationДокумент1 страницаCE On Quasi-ReorganizationalyssaОценок пока нет

- CosAcc Unit 1 Introduction PDFДокумент13 страницCosAcc Unit 1 Introduction PDFKrisha NicoleОценок пока нет

- Chapter 4 4 4 4 4Документ7 страницChapter 4 4 4 4 4Rabie HarounОценок пока нет

- Group 2 Sec 1 Taco LabДокумент159 страницGroup 2 Sec 1 Taco LabSadAccountant100% (1)

- Module 4 - Business SustainabilityДокумент16 страницModule 4 - Business SustainabilityAbelОценок пока нет

- Acctg5 C15 Summary Error CorrectionДокумент2 страницыAcctg5 C15 Summary Error CorrectionJan Anthony Carlo GuevaraОценок пока нет

- Methodex - Sap FicoДокумент4 страницыMethodex - Sap Ficon_ashok_2020Оценок пока нет

- Tally Syllabus: 1. Basics of AccountingДокумент4 страницыTally Syllabus: 1. Basics of AccountingijrailОценок пока нет

- Selecta Group - Q1 2023 Financial StatementsДокумент22 страницыSelecta Group - Q1 2023 Financial StatementsJean Claude HechtОценок пока нет

- PO Setup and Defaulting of Accounts in A Purchasing EnvironmentДокумент5 страницPO Setup and Defaulting of Accounts in A Purchasing EnvironmentharishОценок пока нет

- Generally Accepted Accounting PrinciplesДокумент6 страницGenerally Accepted Accounting PrinciplesMuhammad RizwanОценок пока нет

- 3Year5Yearold - Time TableДокумент8 страниц3Year5Yearold - Time TableKarthikeyan RamasamyОценок пока нет

- IFRS Case Studies Handout PDFДокумент66 страницIFRS Case Studies Handout PDFPrince RyanОценок пока нет

- ACT 310 Chapter 01Документ55 страницACT 310 Chapter 01Sunny SunnyОценок пока нет

- Project Report Papad ManufacturingДокумент7 страницProject Report Papad ManufacturingPriyotosh DasОценок пока нет

- Curriculum Vitae Eko Wahyudi, S.T., M.M.: Working ExperienceДокумент3 страницыCurriculum Vitae Eko Wahyudi, S.T., M.M.: Working ExperienceGreen Sustain EnergyОценок пока нет

- Handbook - On - Professional - Opportunities in Internal AuditДокумент278 страницHandbook - On - Professional - Opportunities in Internal Auditahmed raoufОценок пока нет

- Pooling and Purchase - Accounting MethodsДокумент10 страницPooling and Purchase - Accounting MethodsNirav GosarОценок пока нет