Академический Документы

Профессиональный Документы

Культура Документы

Global Recession

Загружено:

n_joysudhirОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Global Recession

Загружено:

n_joysudhirАвторское право:

Доступные форматы

Global recession

A global recession is a period of global economic slowdown. The International Monetary Fund (IMF) takes many factors into account when defining a global recession, but it states that global economic growth of 3 percent or less is "equivalent to a global recession". Informally, a national recession is a period of declining productivity. To identify a recession, which included two successive quarterly declines in gross domestic product (GDP), a measure of the nations output. Whereas a national recession is identified by two quarters of decline, defining a global recession is more difficult, because developing nations are expected to have a higher GDP growth than developed nations. According to IMF, the real GDP growth of the emerging and developing countries is on an uptrend and that of advanced economies is on a downtrend since late 1980s. The world growth is projected to slow from 5% in 2007 to 3.75% in 2008 and to just over 2% in 2009. Downward revisions in GDP growth vary across regions. Among the most affected are commodity exporters, and countries with acute external financing and liquidity problems.

How is the Global Recession affecting developing countries like India?

The past year has seen a dramatic change in the prospects of developing countries due to the effects of the global recession. Declines in foreign direct investment, export revenue, remittances, tourism and other adverse impacts of the recession will reduce economic growth. International Monetary Fund forecasts released on 22 April 2009 indicate that global economic growth will contract by 1.3 per cent in 2009, compared to 3.2 per cent positive growth in 2008. According to the World Bank, developing countries' combined growth will fall to 2.1 per cent, or to zero per cent excluding China and India.

The IMF estimates that global recessions seem to occur over a cycle lasting between 8 and 10 years. During what the IMF terms the past three global recessions of the last three decades, global per capita output growth was zero or negative. The IMFs current forecast estimates a small per-capita GDP decline, when measured by market exchange rates, and a tiny increase when measured by purchasing power parity. By either of those measures the IMF didnt release forecasts for the other macroeconomic

indicators it used in this exercise the world will be hovering around recessionary territory next year too. Year per Capita Output (PPP Weighted) Industrial Production Jobless Rate** 1975 1982 1991 -0.13 -1.6-1.87 -0.89 -1.08-0.69 -0.18 -0.09-4.01 Total Trade Capital Flows* Oil Use Per Capita Consumption per Capita Investment 0.56 -0.9 1.19 0.41 -2.04

-0.76 -2.87 1.61 -2.07 0.01 0.72

-0.18 -4.72 0.62 2.56 -0.15 -1.11 -8.74 0.28 -2.3

2009, projected,-2.5

-6.23 -11.75 -6.18 -1.5 -0.4 -2.01 0.48

Average (75, 82, 91)

-0.76 -1.25 1.18

Economic Recession in India

India is facing the position of recession as globalization showing its negative scenario. As it was started in US and now it's touching the boundary of India also. Recession is a phase in which rupee depreciate, cash crunches, money market slowdown, inflation comes. All in all it's become difficult to bring money from the pocket of an individual. As we know price of the steel, iron goes up, we would like to postpone our purchasing but if we won't spend, how producer could makes his bread. If the producer starts reducing the price of the commodity with such belief that customer buy the product in all case. This will bring only when he starts cutting its cost of production. Cost cutting means reduction in variable cost. As price of steel, iron, equipments, machinery, are touching sky, only way to reduce the cost is the reduction in employees. Hence people fear of their job security. In fear of the job security, people are generally shifting their purchasing. All of them either producer, investor, customer, employee posing each other to create recession Negative Aspect of Recession on Indian Economy As recession have various negative effects on Indian economy. The capital market was facing the downfall; liquidity is dropping down, an individual...

What will be the effect of Global recession on Indian Economy?

Which sectors affecting badly & how to tackle it? Also what will be the effect of Union Budget? India has a big advantage in coping with an economic slowdown. It has all-too extensive experience in it; and it has a political system that can cope with disgruntlement without suffering existential doubts. Also, ownership of corporation will play a very important role in days to come. Organizations which are run by founders or owners will have better shelf life compared to those which are run by the so called corporate bodies. Indian Economy is fundamentally very strong. The mid range economy has always been in the hands of careful Indian investors who have invested carefully over the years. The Global recession word has hit India at the right time, this is when Indian Realty industry needed a correction. Then we see economy blooming and then follows the recession which is for getting us to the right Value. Indian companies which completely depend on US and European economy will suffer and they have to learn a lesson not to depend only on outside economy, no matter even if they look lucrative. Even in India where we are supposed to be 'fundamentally strong' in the economy, the way to reach those strong fundamentals is down. Export industry is the first one to bear the brunt. Real Estate...I definitely see the bubble bursting. It is one of those sectors currently putting up a 'presentation'. I am wondering which sector will follow after real estate goes down after this current floundering. I do not think I know how anybody can tackle this. I Guess Indian IT will be able to sustain the impact to a great extent ...with organic/inorganic growth moves .New markets; strong domestic market should help good bookings for IT Players.

Recession Impact on Logistics Industry

Global recession has had an impact almost on all areas of business all over the world. Logistics is a department that is mainly related to sourcing, supplying and delivering. It has everything to do with the transport. If the overall business is down, the logistics will also end up being slow. Global recession has had a major impact on logistics because every logistic department works on a specific pattern of demand and supply. Demand and supply can be very dynamic and they keep changing everyday. However, on an overall basis it is more or less standard if the big picture is taken into account. Nonetheless, global recession has caused huge deficits in the logistic cycle by decreasing the demand for products and increasing the demand for warehousing in the logistics area. What will the department do with having so many goods that are not being supplied? But, the production and manufacturing cycle has not stopped. During the recession cycle, the production cycle had no effect as the companies continue the manufacturing process. What the recession has typically done is it has put a full stop on the consumer goods sector where the consumers are not buying that much anymore. Everyone has been cutting back. This has actually created a surplus of goods and obviously this has given a need for more space to store the surplus. Even a small disruption to the cycle can cause heavy losses in the form of surplus goods and inventory. The best way to combat this for the logistics department is to liquidize and mobilize goods by spreading out the locations and by supplying goods to those locations.

Opinion of CEOS/MDS of companiesMy favorite investor and source of inspiration till 1 year back. But I lost total trust on him after his recent interviews. He completely lost the way in 2008. In stead of accepting failure and correct his way of thinking, he is now talking about 2012-14. Even a new investor can tell about stock market bounce back by 2012. Rakesh Jhunjhunwala CEO of Welspun Gujurat Stahl Rohren Ltd I am not that much bullish on our banking sector prospects. We are seeing decline in deposits means economy is slowing. Managing Director Corporation Bank

Conclusion:We know Recission affected many sectors of our India like IT sector,Banking Sector,Public Sectors etc.But we can say that it is not upto the worst level.But there is a lots of job cuts in private sectors specially in IT sectors. Due to fluctuation in demand and supply scenario and cuts in Automobile Industry Logistic Industries affected Little more in Global Recission. As there would be more export i.e. there would be more sales and production would rise,that will result in more employment oppurtinities. Although input cost has been high,but the financial institute has to play a major role.

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Personalitytraits AbstДокумент2 страницыPersonalitytraits Abstn_joysudhirОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Open and Closed QuestionsДокумент8 страницOpen and Closed Questionsn_joysudhirОценок пока нет

- Open and Closed QuestionsДокумент8 страницOpen and Closed Questionsn_joysudhirОценок пока нет

- What Is InventoryДокумент7 страницWhat Is Inventoryn_joysudhirОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Handicrafts and Handlooms Export Corporation of India Ltd. (HHEC)Документ5 страницHandicrafts and Handlooms Export Corporation of India Ltd. (HHEC)n_joysudhirОценок пока нет

- Organization Structure of Gati LTD.: Managed by 18 Express Distribution Centres (EDC)Документ8 страницOrganization Structure of Gati LTD.: Managed by 18 Express Distribution Centres (EDC)n_joysudhirОценок пока нет

- AlpaGasus: How To Train LLMs With Less Data and More AccuracyДокумент6 страницAlpaGasus: How To Train LLMs With Less Data and More AccuracyMy SocialОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Sba 2Документ29 страницSba 2api-377332228Оценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Doshas in A Nutshell - : Vata Pitta KaphaДокумент1 страницаThe Doshas in A Nutshell - : Vata Pitta KaphaCheryl LynnОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Construction of Optimal Portfolio Using Sharpe's Single Index Model - An Empirical Study On Nifty Metal IndexДокумент9 страницThe Construction of Optimal Portfolio Using Sharpe's Single Index Model - An Empirical Study On Nifty Metal IndexRevanKumarBattuОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Costbenefit Analysis 2015Документ459 страницCostbenefit Analysis 2015TRÂM NGUYỄN THỊ BÍCHОценок пока нет

- Dynamics of Machinery PDFДокумент18 страницDynamics of Machinery PDFThomas VictorОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Plaza 66 Tower 2 Structural Design ChallengesДокумент13 страницPlaza 66 Tower 2 Structural Design ChallengessrvshОценок пока нет

- Skills Redux (10929123)Документ23 страницыSkills Redux (10929123)AndrewCollas100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Appendix - Pcmc2Документ8 страницAppendix - Pcmc2Siva PОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

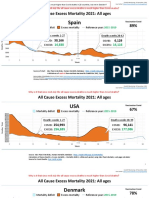

- Countries EXCESS DEATHS All Ages - 15nov2021Документ21 страницаCountries EXCESS DEATHS All Ages - 15nov2021robaksОценок пока нет

- Spesifikasi PM710Документ73 страницыSpesifikasi PM710Phan'iphan'Оценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Opc PPT FinalДокумент22 страницыOpc PPT FinalnischalaОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- (123doc) - Toefl-Reading-Comprehension-Test-41Документ8 страниц(123doc) - Toefl-Reading-Comprehension-Test-41Steve XОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- HirePro Video Proctored Online-Instruction Sheet - Bain IndiaДокумент1 страницаHirePro Video Proctored Online-Instruction Sheet - Bain Indiaapoorv sharmaОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Gods Omnipresence in The World On Possible MeaninДокумент20 страницGods Omnipresence in The World On Possible MeaninJoan Amanci Casas MuñozОценок пока нет

- Test Your Knowledge - Study Session 1Документ4 страницыTest Your Knowledge - Study Session 1My KhanhОценок пока нет

- 13 Adsorption of Congo Red A Basic Dye by ZnFe-CO3Документ10 страниц13 Adsorption of Congo Red A Basic Dye by ZnFe-CO3Jorellie PetalverОценок пока нет

- Carob-Tree As CO2 Sink in The Carbon MarketДокумент5 страницCarob-Tree As CO2 Sink in The Carbon MarketFayssal KartobiОценок пока нет

- My Personal Code of Ethics1Документ1 страницаMy Personal Code of Ethics1Princess Angel LucanasОценок пока нет

- Ob NotesДокумент8 страницOb NotesRahul RajputОценок пока нет

- School of Mathematics 2021 Semester 1 MAT1841 Continuous Mathematics For Computer Science Assignment 1Документ2 страницыSchool of Mathematics 2021 Semester 1 MAT1841 Continuous Mathematics For Computer Science Assignment 1STEM Education Vung TauОценок пока нет

- Vendor Information Sheet - LFPR-F-002b Rev. 04Документ6 страницVendor Information Sheet - LFPR-F-002b Rev. 04Chelsea EsparagozaОценок пока нет

- Wilcoxon Matched Pairs Signed Rank TestДокумент3 страницыWilcoxon Matched Pairs Signed Rank TestDawn Ilish Nicole DiezОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Fusion Implementing Offerings Using Functional Setup Manager PDFДокумент51 страницаFusion Implementing Offerings Using Functional Setup Manager PDFSrinivasa Rao Asuru0% (1)

- How Drugs Work - Basic Pharmacology For Healthcare ProfessionalsДокумент19 страницHow Drugs Work - Basic Pharmacology For Healthcare ProfessionalsSebastián Pérez GuerraОценок пока нет

- CX Programmer Operation ManualДокумент536 страницCX Programmer Operation ManualVefik KaraegeОценок пока нет

- Strucure Design and Multi - Objective Optimization of A Novel NPR Bumber SystemДокумент19 страницStrucure Design and Multi - Objective Optimization of A Novel NPR Bumber System施元Оценок пока нет

- Solved Simplex Problems PDFДокумент5 страницSolved Simplex Problems PDFTejasa MishraОценок пока нет

- SMR 13 Math 201 SyllabusДокумент2 страницыSMR 13 Math 201 SyllabusFurkan ErisОценок пока нет

- Mixed Up MonstersДокумент33 страницыMixed Up MonstersjaneОценок пока нет