Академический Документы

Профессиональный Документы

Культура Документы

Pseudo Trader's Unique Reference Number (TURN) Application

Загружено:

princessz_leoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Pseudo Trader's Unique Reference Number (TURN) Application

Загружено:

princessz_leoАвторское право:

Доступные форматы

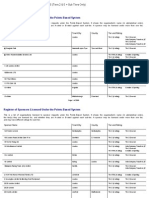

Pseudo Traders Unique Reference Number (TURN) Application Read the accompanying guidance notes before completing form

1. Are the goods for business/trading or starting a business? please tick Yes No

2. Please confirm the legal status (entity) of the importer please tick Sole Proprietor Partnership Limited Company Other

If other, please confirm status

3. If the importer is a Limited Company you must provide: Incorporation Number Country of Incorporation If the importer is a registered charity you must provide the registration number in the space provided. 4. Name of Importer Provide the full name of the importer (no initials) Limited Company (name) Sole Proprietor name Date of birth Partner name Date of birth Partner name Date of birth National Insurance number Nationality National Insurance number Nationality National Insurance number Nationality Date of Incorporation

Continue on separate sheet if necessary Other 5. Address of Importer If the importer is in business please confirm the Principal Place of Business. If the importer is not in business please confirm the home address.

Postcode Phone number Mobile number Fax E-mail address

C219

1 of 4

HMRC 11/06

6. Please list any other pseudo TURNs/VAT numbers the importer has had in the past. Pseudo TURN Pseudo TURN VAT number VAT number

7. Freight/Clearing Agent (if used) Provide the name, address, phone number and contact name of the freight agent used in the space provided.

Contact name

Phone

8. Provide a full description of the goods being imported in the space provided.

9. If importing motor vehicles/motorcycles, confirm make and model and vehicle identification number (VIN)/chassis/frame numbers

10. State the value of the goods being imported in one of the following currencies. GB pound Euro US dollar

11. Confirm where the goods are being imported from and provide suppliers details. Address

Country 12. Confirm the FULL address of goods destination following importation.

Postcode

C219

2 of 4

HMRC 11/06

13. Port of entry

Port of clearance (if different)

14. Confirm arrival date 15. Sea freight Bill of Lading Container number Vessel name Is the importation Drive on/Drive off? 16. Air freight Airway bill number Flight number Merchandise In Baggage (Hand carry) 17. By road transport Confirm trailer number Vehicle Registration number C.M.R./T1 (if applicable) 18. Coming out of Bonded Warehouse Warehouse approval number Warehouse address Yes No Yes No

Postcode 19. Is number required by the importer for further imports? please tick Number will be closed if not confirmed 20. Details of declarant Full name Signature Date Status of declarant please tick If other please specify Importer Agent Other Yes No

C219

3 of 4

HMRC 11/06

Guidance on completion of the Pseudo TURN Application form The onus is on the importer to ensure that applications are made in time. Customs take no responsibility for goods that cannot be cleared due to the importer or agent not requesting a Pseudo TURN in sufficient time Customs Tariff Vol. 3 All applications must be received in writing by post, fax or email as per the Customs Tariff, Vol 3, Pt. 3, 3.1.11. Many applications are held up because of missing or incomplete information. Here are pointers for some of the questions to help you complete the application enabling us to process as quickly as possible. Please complete in capitals letters and in black ink. If the business is a limited company, give the full name of the company, and supply the incorporation details. If the business is not a limited company, we will need the full name(s) (not initials), date(s) of birth and National Insurance (N.I) number(s) of the person or people running the business. Give full address, postcode and a contact phone number of importer. Freight/clearing agents: (if used) please give name, address, contact name and telephone number. We need to know the country from where the goods are being imported. Pseudo numbers are only for goods being imported from outside of the EU. We need to know which specific port the goods are coming into e.g. Heathrow, Gatwick. Freight details: if your goods are coming by ship (deep sea) we need a bill of - lading number, the vessel name, and container number (container number not always applicable if you are bringing in vehicles). - If your goods are coming by air, we need an airway bill number and flight number. If your goods are coming by road transport that arrives on a ferry to enter the UK (roll on/roll off), we need the trailer number and/or vehicle registration number. If goods are being cleared out of a bonded warehouse please provide the warehouse approval number and full address of the warehouse. If you wish to use the Pseudo TURN number again to clear further imports of goods, please tick Yes to the last question, otherwise the Pseudo TURN number will be closed. Declarant:- Full name and status of person completing application form. Return address for e-mail is turn@hmrc.gsi.gov.uk Guidance can be found on www.hmrc.gov.uk/forms/notices/jccc0345.htm or reference to Public Notice 553 on the above website. Pseudo TURNs may be closed without notification depending on risk assessment. Pseudo TURNs may be refused if false or misleading information is given.

Pseudo TURN applications take 48 hours (from receipt) to process. Applicants are advised not to contact the TURN Team within 48 hours of submission. Please note that these guidelines apply solely to correctly completed applications. Any queries not relating to the TURN Team should be directed to the National Advice Services (NAS) within UK 0845 010 9000. NAS outside UK 44 208 929 0152 Please note: the Pseudo Turn number is not a VAT registration number. Contact Details: TURN Team, HM Revenue & Customs, Custom House, Pier Head, Kings Dock, Swansea, SA1 8RY Phone: 01792 634004, 634005, 634007 & 634040 (Available 09:00 16:00 Mon - Fri) Fax: 01792 634022 Email: turn@hmrc.gsi.gov.uk (plain or rich text format only)

C219

4 of 4

HMRC 11/06

Вам также может понравиться

- Tax Return 2012 Guide EnclosedДокумент16 страницTax Return 2012 Guide EnclosedNatalia Ciocirlan100% (1)

- Application for UK VAT EORI NumberДокумент2 страницыApplication for UK VAT EORI Numberabdullaharshad100% (1)

- Ca 8454Документ4 страницыCa 8454bluerosedtu0% (1)

- P 85Документ5 страницP 85Fernando Mochales GutiérrezОценок пока нет

- Ca 3916Документ5 страницCa 3916GenovevaShtereva100% (1)

- Print VAT Registration - GOV - UkДокумент11 страницPrint VAT Registration - GOV - Uksiva kumarОценок пока нет

- IRDДокумент6 страницIRDKKОценок пока нет

- Value Added Tax (VAT) Number Registration / ApplicationДокумент4 страницыValue Added Tax (VAT) Number Registration / ApplicationLedger Domains LLCОценок пока нет

- Account Statement - : February 2014Документ2 страницыAccount Statement - : February 2014Fernando BatesОценок пока нет

- P21 Balancing Statement 2018 124615500017Документ2 страницыP21 Balancing Statement 2018 124615500017Aurimas AurisОценок пока нет

- p45 Tomasz Jureczko Diamonds Digital LTDДокумент3 страницыp45 Tomasz Jureczko Diamonds Digital LTDTomasz JureczkoОценок пока нет

- Ion Onl Y: Copy For HM Revenue & CustomsДокумент4 страницыIon Onl Y: Copy For HM Revenue & CustomsM Muneeb SaeedОценок пока нет

- Claim For Repayment of Tax Deducted From Savings and InvestmentsДокумент4 страницыClaim For Repayment of Tax Deducted From Savings and InvestmentsxzmangeshОценок пока нет

- Member Statement 68600048552Документ3 страницыMember Statement 68600048552Johnny Warhawk ONeillОценок пока нет

- 2015-03-02 00261073 Rekening PDFДокумент346 страниц2015-03-02 00261073 Rekening PDFAnonymous h0yGTDQWZОценок пока нет

- Agent Appointment FormДокумент2 страницыAgent Appointment FormSatyen ChikhliaОценок пока нет

- P 50Документ2 страницыP 50Emily DeerОценок пока нет

- Notice of Assessment Tax Ref No SXXXX913EДокумент1 страницаNotice of Assessment Tax Ref No SXXXX913EilamahizhОценок пока нет

- CA5403: Your National Insurance Number: About This FormДокумент4 страницыCA5403: Your National Insurance Number: About This FormluzipopОценок пока нет

- P45 68148Документ4 страницыP45 68148Эдварт АнтонОценок пока нет

- Contact Information: Mirosanu I Do Not Have A Middle Name / Initial ToniДокумент9 страницContact Information: Mirosanu I Do Not Have A Middle Name / Initial ToniToni MirosanuОценок пока нет

- Fatura 13006Документ1 страницаFatura 13006Devcon İPTVОценок пока нет

- 64-8 Form (Másolat)Документ2 страницы64-8 Form (Másolat)Molnar FerencneОценок пока нет

- Form 101 (See Rule 5) Application For Certificate of RegistrationДокумент5 страницForm 101 (See Rule 5) Application For Certificate of RegistrationLatisha MorrisonОценок пока нет

- R43 2019 PDFДокумент4 страницыR43 2019 PDFDavid Mark AldridgeОценок пока нет

- Application For Rental of Residential PremisesДокумент6 страницApplication For Rental of Residential PremisesMxolisi Bob ThabetheОценок пока нет

- View Completed FormsДокумент9 страницView Completed FormsAla CocpОценок пока нет

- P 85Документ5 страницP 85asheeshmОценок пока нет

- UK Visas & Immigration: Partially Completed ApplicationДокумент11 страницUK Visas & Immigration: Partially Completed ApplicationNorma RiepenhausenОценок пока нет

- QatarДокумент2 страницыQatarKelz YouknowmynameОценок пока нет

- Noa-Iit Ob2620150425142233zb4 PDFДокумент1 страницаNoa-Iit Ob2620150425142233zb4 PDFKanza KhanОценок пока нет

- Noa-Iit Ob2320170627071310ufp PDFДокумент1 страницаNoa-Iit Ob2320170627071310ufp PDFjasper haiОценок пока нет

- Inspired Sisters LTD Online) AUДокумент3 страницыInspired Sisters LTD Online) AUthankksОценок пока нет

- 2012 Ontario Tax FormДокумент2 страницы2012 Ontario Tax FormHassan MhОценок пока нет

- Customer Registration Form Airtel Final 23 10 2015Документ2 страницыCustomer Registration Form Airtel Final 23 10 2015ayОценок пока нет

- Tax Return 2018-19Документ18 страницTax Return 2018-19Kasam AОценок пока нет

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkДокумент3 страницыCopy For Employee: P45 Part 1A Details of Employee Leaving WorkSteve OrtonОценок пока нет

- Shipping Label 1313210411Документ8 страницShipping Label 1313210411Mauricio CastañónОценок пока нет

- File 2018 Tax Return ElectronicallyДокумент3 страницыFile 2018 Tax Return Electronicallymuhammad afiqОценок пока нет

- Tax Return Enclosures List: FEDERAL T1 2009Документ16 страницTax Return Enclosures List: FEDERAL T1 2009Christine TemplemanОценок пока нет

- Y3 and Personal Data Form 2Документ5 страницY3 and Personal Data Form 2Shakil AhmedОценок пока нет

- Royal Air Force Interest Form - Officer: Customer Id: 14911956 Request Id: 20273155Документ14 страницRoyal Air Force Interest Form - Officer: Customer Id: 14911956 Request Id: 20273155Jay SayОценок пока нет

- Starter Checklist: Instructions For EmployersДокумент2 страницыStarter Checklist: Instructions For EmployersTareqОценок пока нет

- Tax Back For Travellers-Trs Dl-Brochure-2010Документ2 страницыTax Back For Travellers-Trs Dl-Brochure-2010RuthОценок пока нет

- REPRG ES A79147518 1688865274 enДокумент5 страницREPRG ES A79147518 1688865274 enknonoОценок пока нет

- ItineraryДокумент2 страницыItineraryAditya VarmaОценок пока нет

- HMRC NRL1e Non Resident Landlord Application For An Individual 83G 62UW SOFДокумент3 страницыHMRC NRL1e Non Resident Landlord Application For An Individual 83G 62UW SOFDavid Gatt100% (1)

- Request For Taxpayer Identification Number and CertificationДокумент4 страницыRequest For Taxpayer Identification Number and CertificationAprilОценок пока нет

- 3169 1306enДокумент3 страницы3169 1306enmilitia14Оценок пока нет

- US Internal Revenue Service: f1040nr - 2005Документ5 страницUS Internal Revenue Service: f1040nr - 2005IRSОценок пока нет

- Nonimmigrant Visa - Confirmation PageДокумент2 страницыNonimmigrant Visa - Confirmation PageHemanth Kumar SОценок пока нет

- Tax Clearance Certificate NewДокумент1 страницаTax Clearance Certificate NewFranklin ShumbaОценок пока нет

- Chapter 1 Introduction To Uk Tax SystemДокумент3 страницыChapter 1 Introduction To Uk Tax Systemtans1100% (1)

- UK State Pension StatementДокумент7 страницUK State Pension StatementElmer LeonardОценок пока нет

- Federal Tax Return FormДокумент8 страницFederal Tax Return FormKING ZeusОценок пока нет

- Tax Credit Claim Form 2018: For Donation Claims OnlyДокумент2 страницыTax Credit Claim Form 2018: For Donation Claims OnlyasdfОценок пока нет

- E Tax 20200504201259Документ3 страницыE Tax 20200504201259monitganatra100% (1)

- LicenseДокумент6 страницLicenseRazvannusОценок пока нет

- Formvrtvpd1 PDFДокумент1 страницаFormvrtvpd1 PDFnirav16Оценок пока нет

- Bravia KDL 5100Документ119 страницBravia KDL 5100djdr0Оценок пока нет

- Drayton Lifestyle Time Switch User Manual For Model LP111, LP711, LP LP112, LP241, LP522, LP722Документ2 страницыDrayton Lifestyle Time Switch User Manual For Model LP111, LP711, LP LP112, LP241, LP522, LP722princessz_leo67% (3)

- Handbook Peugeot 107Документ140 страницHandbook Peugeot 107Bocage4xОценок пока нет

- Business Rates For Working From Home in UK (England & Wales) - Valuation Office AgencyДокумент2 страницыBusiness Rates For Working From Home in UK (England & Wales) - Valuation Office Agencyprincessz_leoОценок пока нет

- Inward Processing Relief How To Obtain Duty Relief On Goods Imported From Outside The EC For Re-ExportДокумент123 страницыInward Processing Relief How To Obtain Duty Relief On Goods Imported From Outside The EC For Re-Exportprincessz_leoОценок пока нет

- Guide To Business Names For UK Businesses - Department of Enterprise Trade and InvestmentДокумент28 страницGuide To Business Names For UK Businesses - Department of Enterprise Trade and Investmentprincessz_leoОценок пока нет

- Company ActДокумент761 страницаCompany ActNicquainCTОценок пока нет

- Guide To Incorporating A Company in The UK and Naming It - Companies HouseДокумент65 страницGuide To Incorporating A Company in The UK and Naming It - Companies Houseprincessz_leoОценок пока нет

- Guide To Incorporating A Company in The UK - Business LinkДокумент8 страницGuide To Incorporating A Company in The UK - Business Linkprincessz_leoОценок пока нет

- UK Border Agency Register of Sponsors Licensed Under The Points-Based System To Employee Foreign CitizensДокумент2 068 страницUK Border Agency Register of Sponsors Licensed Under The Points-Based System To Employee Foreign Citizensprincessz_leoОценок пока нет

- 2010 Statistics On Businesses in The UK - Office of National StatisticsДокумент410 страниц2010 Statistics On Businesses in The UK - Office of National Statisticsprincessz_leoОценок пока нет

- UK Trade Imports by Post - How To Complete Customs DocumentsДокумент11 страницUK Trade Imports by Post - How To Complete Customs Documentsprincessz_leoОценок пока нет

- UK Company - Short Tax Return Form - CT600Документ4 страницыUK Company - Short Tax Return Form - CT600princessz_leoОценок пока нет

- How To File Accounts To Companies House UK - A Guide BookДокумент36 страницHow To File Accounts To Companies House UK - A Guide Bookprincessz_leoОценок пока нет

- Importing To The UK Customs Procedures and Customs DebtДокумент24 страницыImporting To The UK Customs Procedures and Customs Debtprincessz_leoОценок пока нет

- What Is Share CapitalДокумент18 страницWhat Is Share Capitalprincessz_leoОценок пока нет

- Olympus Digital Voice Recorder WS-311M WS-321M Manual EnglishДокумент102 страницыOlympus Digital Voice Recorder WS-311M WS-321M Manual Englishprincessz_leoОценок пока нет

- Corporate Tax Self Assessment GuideДокумент36 страницCorporate Tax Self Assessment Guideprincessz_leoОценок пока нет

- UK Trade and Investment Department Forming A Company in UK LeafletДокумент7 страницUK Trade and Investment Department Forming A Company in UK Leafletprincessz_leoОценок пока нет

- Zanussi Washer Dryer Manual English WJS 55 W, WJS 1455 W, WJS 1655 WДокумент32 страницыZanussi Washer Dryer Manual English WJS 55 W, WJS 1455 W, WJS 1655 Wprincessz_leoОценок пока нет

- High Commission of India: Visa Application FormДокумент2 страницыHigh Commission of India: Visa Application FormShuhan Mohammad Ariful HoqueОценок пока нет

- Bagatsing V RamirezДокумент3 страницыBagatsing V RamirezAnonymous iOYkz0wОценок пока нет

- I Love GanzonДокумент22 страницыI Love Ganzonarnel tanggaroОценок пока нет

- DPC Cookie GuidanceДокумент17 страницDPC Cookie GuidanceshabiumerОценок пока нет

- 32A Registration LegalДокумент1 страница32A Registration LegalChaitram200925% (4)

- Responsibilities of Prophets: Alaihi Wasallam) Asked The People SayingДокумент3 страницыResponsibilities of Prophets: Alaihi Wasallam) Asked The People SayingSunain AliОценок пока нет

- Online Tax Payment PortalДокумент1 страницаOnline Tax Payment Portalashish rathoreОценок пока нет

- BSNL Payslip February 2019Документ1 страницаBSNL Payslip February 2019pankajОценок пока нет

- NOTIFICATION FOR GRAMIN DAK SEVAK POSTSДокумент68 страницNOTIFICATION FOR GRAMIN DAK SEVAK POSTSShubham VermaОценок пока нет

- The Period of Enlightenment 1872 1898Документ24 страницыThe Period of Enlightenment 1872 1898Myung KimОценок пока нет

- Sec - Governance ReviewerДокумент4 страницыSec - Governance ReviewerAngela Abrea MagdayaoОценок пока нет

- Transportation: Edit EditДокумент3 страницыTransportation: Edit EditRebecca JordanОценок пока нет

- Caoile EFT Authorization Form - EnglishДокумент2 страницыCaoile EFT Authorization Form - EnglishSaki DacaraОценок пока нет

- 13 GARCIA v. VILLARДокумент1 страница13 GARCIA v. VILLARGSSОценок пока нет

- Book 1Документ9 страницBook 1Samina HaiderОценок пока нет

- 2020 Dee - v. - Dee Reyes20210424 14 mjb83kДокумент4 страницы2020 Dee - v. - Dee Reyes20210424 14 mjb83kLynielle CrisologoОценок пока нет

- IBPS Clerk RecruitmentДокумент47 страницIBPS Clerk RecruitmentTopRankersОценок пока нет

- Jeff Gasaway Investigation Report From Plano ISD April 2010Документ21 страницаJeff Gasaway Investigation Report From Plano ISD April 2010The Dallas Morning NewsОценок пока нет

- Charles Taylor.Документ17 страницCharles Taylor.Will PalmerОценок пока нет

- PoliceLife April-2011 Issuu PDFДокумент32 страницыPoliceLife April-2011 Issuu PDFshane parrОценок пока нет

- Zeal Court Acid Attack AppealДокумент24 страницыZeal Court Acid Attack Appealshanika33% (3)

- (WWWДокумент5 страниц(WWWnosena1267Оценок пока нет

- Credit Bureau Development in The PhilippinesДокумент18 страницCredit Bureau Development in The PhilippinesRuben Carlo Asuncion100% (4)

- Chapter 1 Accounting For Business Combinations SolmanДокумент10 страницChapter 1 Accounting For Business Combinations SolmanKhen FajardoОценок пока нет

- 13-07-26 Microsoft-Motorola Agreed Jury InstructionsДокумент45 страниц13-07-26 Microsoft-Motorola Agreed Jury InstructionsFlorian MuellerОценок пока нет

- 2 Presentation On Supplemental Guidelines1Документ18 страниц2 Presentation On Supplemental Guidelines1Muhammad Alsharif Aming AlihОценок пока нет

- Expert committee review engineering projectsДокумент4 страницыExpert committee review engineering projectsSyed AhmedОценок пока нет

- B.Tech in Civil Engineering FIRST YEAR 2014-2015: I Semester Ii SemesterДокумент1 страницаB.Tech in Civil Engineering FIRST YEAR 2014-2015: I Semester Ii Semesterabhi bhelОценок пока нет

- Mutual Fund Industry Study - Final BEДокумент45 страницMutual Fund Industry Study - Final BEPrerna KhoslaОценок пока нет