Академический Документы

Профессиональный Документы

Культура Документы

Basel 1

Загружено:

vinni_30Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Basel 1

Загружено:

vinni_30Авторское право:

Доступные форматы

Feedback BASEL 1 EFFECTED BANKS

From 1965 to 1981 there were about eight bank failures (or bankruptcies) in the United States. Bank failures were particularly prominent during the '80s, a time which is usually referred to as the "savings and loan crisis." Banks throughout the world were lending extensively, while countries' external indebtedness was growing at an unsustainable rate. (For related reading, see Analyzing A Bank's Financial Statements.) As a result, the potential for the bankruptcy of the major international banks because grew as a result of low security. In order to prevent this risk, the Basel Committee on Banking Supervision, comprised of central banks and supervisory authorities of 10 countries, met in 1987 in Basel, Switzerland. The committee drafted a first document to set up an international 'minimum' amount of capital that banks should hold. This minimum is a percentage of the total capital of a bank, which is also called the minimum risk-based capital adequacy. In 1988, the Basel I Capital Accord (agreement) was created. The Basel II Capital Accord follows as an extension of the former, and was implemented in 2007. In this article, we'll take a look at Basel I and how it impacted the banking industry. The Purpose of Basel I In 1988, the Basel I Capital Accord was created. The general purpose was to: 1. Strengthen the stability of international banking system. 2. Set up a fair and a consistent international banking system in order to decrease competitive inequality among international banks. The basic achievement of Basel I has been to define bank capital and the so-called bank capital ratio. In order to set up a minimum risk-based capital adequacy applying to all banks and governments in the world, a general definition of capital was required. Indeed, before this international agreement, there was no single definition of bank capital. The first step of the agreement was thus to define it.

Two-Tiered Capital Basil I defines capital based on two tiers: 1. Tier 1 (Core Capital): Tier 1 capital includes stock issues (or share holders equity) and declared reserves, such as loan loss reserves set aside to cushion future losses or for smoothing out income variations. 2. Tier 2 (Supplementary Capital): Tier 2 capital includes all other capital such as gains on investment assets, long-term debt with maturity greater than five years and hidden reserves (i.e. excess allowance for losses on loans and leases). However, short-term unsecured debts (or debts without guarantees), are not included in the definition of capital. Credit Risk is defined as the risk weighted asset (RWA) of the bank, which are banks assets weighted in relation to their relative credit risk levels. According to Basel I, the total capital should represent at least 8% of the bank's credit risk (RWA). In addition, the Basel agreement identifies three types of credit risks: The on-balance sheet risk (see Figure 1 for example). The trading off-balance sheet risk. These are derivatives, namely interest rates, foreign exchange, equity derivatives and commodities. The non-trading off-balance sheet risk. These include general guarantees, such as forward purchase of assets or transaction-related debt assets. Let's take a look at some calculations related to RWA and capital requirement. Figure 1 displays predefined categories of on-balance sheet exposures, such as vulnerability to loss from an unexpected event, weighted according to four relative risk categories.

Figure 1: Basel's Classification of risk weights of on-balance sheet assets

Free Trading Guide - GFT

As shown in Figure 2, there is an unsecured loan of $1,000 to a non-bank, which requires a risk weight of 100%. The RWA is therefore calculated as RWA=$1,000 100%=$1,000. By using Formula 2, a minimum 8% capital requirement gives 8% RWA=8% $1,000=$80. In other words, the total capital holding of the firm must be $80 related to the unsecured loan of $1,000. Calculation under different risk weights for different types of assets are also presented in Table 2.

Figure 2: Calculation of RWA and capital requirement on-balance sheet assets

Market risk includes general market risk and specific risk. The general market risk refers to changes in the market values due to large market movements. Specific risk refers to changes in the value of an individual asset due to factors related to the issuer of the security. There are four types of economic variables that generate market risk. These are interest rates, foreign exchanges, equities and commodities. The market risk can be calculated in two different manners: either with the standardized Basel model or with internal value at risk (VaR) models of the banks. These internal models can only be used by the largest banks that satisfy qualitative and quantitative standards imposed by the Basel agreement. Moreover, the 1996 revision also adds the possibility of a third tier for the total capital, which includes short-term unsecured debts. This is at the discretion of the central banks. (For related reading, see Get To Know The Central Banks and What Are Central Banks?) Pitfalls of Basel I Basel I Capital Accord has been criticized on several grounds. The main criticisms include the following: Limited differentiation of credit risk There are four broad risk weightings (0%, 20%, 50% and 100%), as shown in Figure1, based on an 8% minimum capital ratio.

Static measure of default risk The assumption that a minimum 8% capital ratio is sufficient to protect banks from failure does not take into account the changing nature of default risk.

No recognition of term-structure of credit risk The capital charges are set at the same level regardless of the maturity of a credit exposure.

Simplified calculation of potential future counterparty risk The current capital requirements ignore the different level of risks associated with different currencies and macroeconomic risk. In other words, it assumes a common market to all actors, which is not true in reality.

Lack of recognition of portfolio diversification effects In reality, the sum of individual risk exposures is not the same as the risk reduction through portfolio diversification. Therefore, summing all risks might provide incorrect judgment of risk. A remedy would be to create an internal credit risk model - for example, one similar to the model as developed by the bank to calculate market risk. This remark is also valid for all other weaknesses.

Free Trading Guide - GFT

These listed criticisms have led to the creation of a new Basel Capital Accord, known as Basel II, which added operational risk and also defined new calculations of credit risk. Operational risk is the risk of loss arising from human error or management failure. Basel II Capital Accord was implemented in 2007. Conclusion The Basel I Capital Accord aimed to assess capital in relation to credit risk, or the risk that a loss will occur if a party does not fulfill its obligations. It launched the trend toward increasing risk modeling research; however, its over-simplified calculations, and classifications have simultaneously called for its disappearance, paving the way for the Basel II Capital Accord and further agreements as the symbol of the continuous refinement of risk and capital. Nevertheless, Basel I, as the first international instrument assessing the importance of risk in relation to capital, will remain a milestone in the finance and banking history.

Read more: http://www.investopedia.com/articles/07/BaselCapitalAccord.asp#ixzz1zx5qwBJv

Вам также может понравиться

- BASEL1Документ7 страницBASEL1Ritu SharmaОценок пока нет

- Basel Norms For BankingДокумент5 страницBasel Norms For BankingAkshat PrakashОценок пока нет

- Effect of Basel III On Indian BanksДокумент52 страницыEffect of Basel III On Indian BanksSargam Mehta50% (2)

- Basel 1Документ3 страницыBasel 1RanjitОценок пока нет

- Assignment On BASELДокумент4 страницыAssignment On BASELMahiTrisha100% (1)

- BASEL I, II, III-uДокумент43 страницыBASEL I, II, III-uMomil FatimaОценок пока нет

- "Bank of Crooks and Criminals" or Bank of Credit & Commerce InternationalДокумент6 страниц"Bank of Crooks and Criminals" or Bank of Credit & Commerce InternationalAli ShahОценок пока нет

- Legal and Regulatory Aspects of BankingДокумент216 страницLegal and Regulatory Aspects of Bankingeknath2000Оценок пока нет

- SME Financing in Bangladesh NewДокумент42 страницыSME Financing in Bangladesh NewDrubo Sobur100% (1)

- Predicting Financial Distress of Pharmaceutical Companies in India Using Altman Z Score ModelДокумент4 страницыPredicting Financial Distress of Pharmaceutical Companies in India Using Altman Z Score ModelInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- NABARDДокумент25 страницNABARDAmit KumarОценок пока нет

- The Role of Whistleblowers in Detecting and Preventing Employee Fraud in Licensed Commercial Banks in Sri Lanka: A Qualitative StudyДокумент7 страницThe Role of Whistleblowers in Detecting and Preventing Employee Fraud in Licensed Commercial Banks in Sri Lanka: A Qualitative StudyInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- ConclusionДокумент2 страницыConclusionMasud Khan Shakil0% (1)

- Chapter-8 Asset Liability Management in The Banks: An OverviewДокумент34 страницыChapter-8 Asset Liability Management in The Banks: An OverviewVASUDEVARAOОценок пока нет

- Chapter 1Документ27 страницChapter 1Nicole JoanОценок пока нет

- Dire Dawa University: College of Business and Economic Department of ManagementДокумент20 страницDire Dawa University: College of Business and Economic Department of ManagementEng-Mukhtaar CatooshОценок пока нет

- A Study of Capital Structure ManagementДокумент94 страницыA Study of Capital Structure ManagementBijaya DhakalОценок пока нет

- Satish Pradhan Dnyanasadhana College: Department of BMS Sample MCQ Questions Subject: Strategic Financial ManagementДокумент5 страницSatish Pradhan Dnyanasadhana College: Department of BMS Sample MCQ Questions Subject: Strategic Financial Managementshyam1985Оценок пока нет

- Credit Risk ManagementДокумент3 страницыCredit Risk Managementamrut_bОценок пока нет

- Internship Report On Departments and Subsidiaries Branches of ICBДокумент37 страницInternship Report On Departments and Subsidiaries Branches of ICBNafiz FahimОценок пока нет

- Emerging Challenges of International Financial ManagementДокумент17 страницEmerging Challenges of International Financial ManagementVineet Nair50% (4)

- Modes of Investment of IBBLДокумент53 страницыModes of Investment of IBBLMussa Ratul100% (2)

- HDFC Bank CAMELS AnalysisДокумент15 страницHDFC Bank CAMELS Analysisprasanthgeni22Оценок пока нет

- Basel NormsДокумент42 страницыBasel NormsBluehacksОценок пока нет

- 0 - Tybms If Sem 6 QBДокумент47 страниц0 - Tybms If Sem 6 QBMangesh GuptaОценок пока нет

- MBA Intership Report On Liquidity Management Process of The City Bank Ltd-LibreДокумент84 страницыMBA Intership Report On Liquidity Management Process of The City Bank Ltd-LibreGultekin Binte AzadОценок пока нет

- Caiib - BFM - Case Studies: Dedicated To The Young and Energetic Force of BankersДокумент2 страницыCaiib - BFM - Case Studies: Dedicated To The Young and Energetic Force of BankersssssОценок пока нет

- Js - Camels AnalysisДокумент7 страницJs - Camels AnalysisTammy DavisОценок пока нет

- BRM Final ProjectДокумент20 страницBRM Final ProjectRaja AhsanОценок пока нет

- Management of Funds Entire SubjectДокумент85 страницManagement of Funds Entire SubjectMir Wajahat Ali100% (1)

- Basel 3 PDFДокумент6 страницBasel 3 PDFNischal PatelОценок пока нет

- Central BankДокумент9 страницCentral BanksakibОценок пока нет

- Internship Report of NCCBLДокумент39 страницInternship Report of NCCBLaburayhanОценок пока нет

- Issue ManagementДокумент30 страницIssue Managementmohanbkp100% (2)

- ACC 1102 Case StudyДокумент1 страницаACC 1102 Case StudyMohammad Mosharof HossainОценок пока нет

- Banking & FinanceДокумент15 страницBanking & FinanceRiya ThakkarОценок пока нет

- Report On Wealth ManagementДокумент67 страницReport On Wealth ManagementanuboraОценок пока нет

- The Effects of Deposits Mobilization On Financial Performance in Commercial Banks in Rwanda. A Case of Equity Bank Rwanda Limited PDFДокумент28 страницThe Effects of Deposits Mobilization On Financial Performance in Commercial Banks in Rwanda. A Case of Equity Bank Rwanda Limited PDFJohn FrancisОценок пока нет

- Bank and Insurance RegulationДокумент2 страницыBank and Insurance Regulationভোরের কুয়াশাОценок пока нет

- Reasearch Proposal On Mutual FundДокумент8 страницReasearch Proposal On Mutual FundpalashmkhОценок пока нет

- HRM and Internationalization of BusinessДокумент3 страницыHRM and Internationalization of BusinessWasifОценок пока нет

- Basics of Bank LendingДокумент23 страницыBasics of Bank LendingRosestella PereiraОценок пока нет

- Term Paper by ImranДокумент14 страницTerm Paper by ImranImran KhanОценок пока нет

- Overview of Working Capital Management Overview of Working Capital ManagementДокумент25 страницOverview of Working Capital Management Overview of Working Capital ManagementFarzad Touhid100% (1)

- Chapter 1 Nature and Scope of International FinanceДокумент67 страницChapter 1 Nature and Scope of International FinanceRahul GhosaleОценок пока нет

- Future and Option Questions PDFДокумент6 страницFuture and Option Questions PDFAshok ReddyОценок пока нет

- FCCBДокумент8 страницFCCBRadha RampalliОценок пока нет

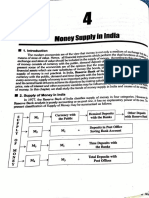

- Money Supply in India 1Документ9 страницMoney Supply in India 1Chaitanya ChoudharyОценок пока нет

- Bandhan Case Study: Prepared By: Bakshi Satpreet Singh (10MBI1005)Документ17 страницBandhan Case Study: Prepared By: Bakshi Satpreet Singh (10MBI1005)Sachit MalikОценок пока нет

- MGT 25 Challenges For Social Entrepreneurship PDFДокумент9 страницMGT 25 Challenges For Social Entrepreneurship PDFAneesh MalhotraОценок пока нет

- Bangladesh Infrastructure Finance Fund Limited (BIFFL) : BackgroundДокумент4 страницыBangladesh Infrastructure Finance Fund Limited (BIFFL) : Backgroundsakib mehediОценок пока нет

- 1.2 Doc-20180120-Wa0002Документ23 страницы1.2 Doc-20180120-Wa0002Prachet KulkarniОценок пока нет

- ICFAI University, Dehradun: Business Strategy and PoliciesДокумент4 страницыICFAI University, Dehradun: Business Strategy and PoliciesPankaj ShuklaОценок пока нет

- Basel AccordДокумент11 страницBasel AccordleojosephkiОценок пока нет

- Risk Management in Commercial BanksДокумент22 страницыRisk Management in Commercial BanksKarim FouadОценок пока нет

- Security Analysis & Portfolio Management Syllabus MBA III SemДокумент1 страницаSecurity Analysis & Portfolio Management Syllabus MBA III SemViraja GuruОценок пока нет

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019От EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019Оценок пока нет

- How Basel 1 Affected Banks: by Fadi ZaherДокумент3 страницыHow Basel 1 Affected Banks: by Fadi Zaherchris_clifford_2Оценок пока нет

- BFM-CH - 10 - Module BДокумент20 страницBFM-CH - 10 - Module BSantosh Saroj100% (1)

- BFM FormulaДокумент4 страницыBFM FormulathamiztОценок пока нет

- NPA in Allahabad Bank PDFДокумент68 страницNPA in Allahabad Bank PDFSachinОценок пока нет

- Bank Valuation Using Multiples in Us and EuropeДокумент24 страницыBank Valuation Using Multiples in Us and EuropeOleksiy KuntsevychОценок пока нет

- An Indepth Analysis of HDFC BankДокумент172 страницыAn Indepth Analysis of HDFC BankchakshyutguptaОценок пока нет

- BMO Annual Report 2020Документ218 страницBMO Annual Report 2020Bilal MustafaОценок пока нет

- Banking Data Warehouse and Basel II From IBMДокумент27 страницBanking Data Warehouse and Basel II From IBMKhoo Lee Sit Kong100% (1)

- Chapter 6 Bank Reports Commercial BankДокумент13 страницChapter 6 Bank Reports Commercial BankBoRaHaEОценок пока нет

- Camel Rating SystemДокумент47 страницCamel Rating SystemAli AlbaghdadiОценок пока нет

- Capita Adequacy of Himalayan BankДокумент23 страницыCapita Adequacy of Himalayan BankArjunОценок пока нет

- Branch Audit ChecklistДокумент96 страницBranch Audit ChecklistYugansh BholaОценок пока нет

- Prudential Regulation For Banks andДокумент57 страницPrudential Regulation For Banks andFarzad TouhidОценок пока нет

- Financial Analysis of A BankДокумент7 страницFinancial Analysis of A BankLourenz Mae AcainОценок пока нет

- Non-Banking Financial CompaniesДокумент18 страницNon-Banking Financial CompaniesBhushan GuptaОценок пока нет

- Executive Summary IEF Nov2020Документ6 страницExecutive Summary IEF Nov2020fredy coronelОценок пока нет

- THE AFRICAN REINSURER June 2010Документ52 страницыTHE AFRICAN REINSURER June 2010Obasi NgwutaОценок пока нет

- Challenges of International Financial ManagementДокумент17 страницChallenges of International Financial ManagementAkash Gowda C KОценок пока нет

- Financial Management 2Документ7 страницFinancial Management 2Rashmi RanjanaОценок пока нет

- Integrity Matters 4Документ84 страницыIntegrity Matters 4Robert Didier100% (1)

- Thesis - Sbi BankДокумент124 страницыThesis - Sbi BankRam Prasad Silwal100% (1)

- Relative Perfromance of Commercial Banks in India Using Camel ApproachДокумент21 страницаRelative Perfromance of Commercial Banks in India Using Camel ApproachAnkush GoyalОценок пока нет

- Basel Ii:: A Worldwide Challenge For The Banking BusinessДокумент32 страницыBasel Ii:: A Worldwide Challenge For The Banking BusinesshaffaОценок пока нет

- CAMEL Model With Detailed Explanations and Proper FormulasДокумент4 страницыCAMEL Model With Detailed Explanations and Proper FormulasHarsh AgarwalОценок пока нет

- 5 6138677592305172554Документ11 страниц5 6138677592305172554rajupetalokeshОценок пока нет

- Indian Banking IndustryДокумент25 страницIndian Banking IndustryAsim MahatoОценок пока нет

- Advanced Underwriting 2017Документ333 страницыAdvanced Underwriting 2017Tassy Nokuthanda Chipofya100% (1)

- Pillar 3 Disclosure RequirementsДокумент70 страницPillar 3 Disclosure Requirementsvandana005Оценок пока нет

- Risk MGMT in IB-Bank IslamДокумент51 страницаRisk MGMT in IB-Bank Islambint_bakri87Оценок пока нет

- International Journal of Economics, Commerce and Management, Ijecm - Co.ukДокумент17 страницInternational Journal of Economics, Commerce and Management, Ijecm - Co.ukMalcolm ChristopherОценок пока нет

- Camel ResearchДокумент62 страницыCamel ResearchPuja AwasthiОценок пока нет